Global Freight Matching Market

Market Size in USD Billion

CAGR :

%

USD

27.24 Billion

USD

118.73 Billion

2024

2032

USD

27.24 Billion

USD

118.73 Billion

2024

2032

| 2025 –2032 | |

| USD 27.24 Billion | |

| USD 118.73 Billion | |

|

|

|

|

Freight Matching Market Size

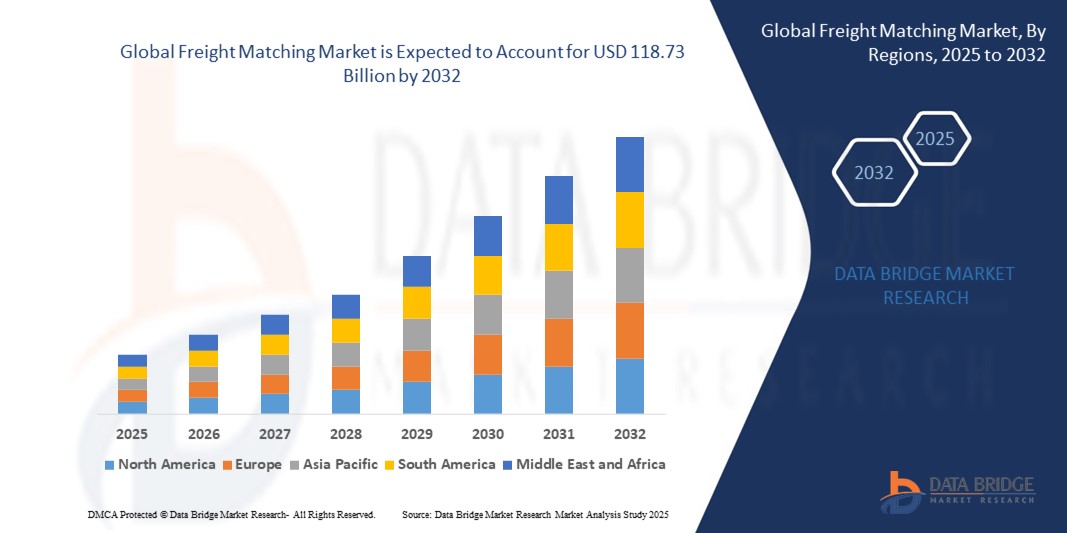

- The global freight matching market size was valued at USD 27.24 billion in 2024 and is expected to reach USD 118.73 billion by 2032, at a CAGR of 20.2% during the forecast period

- The market growth is largely fuelled by the rising adoption of digital freight platforms that enhance operational efficiency and reduce empty miles

- Increasing demand for real-time freight tracking and visibility solutions, driven by the growth of e-commerce and just-in-time delivery models

Freight Matching Market Analysis

- The market growth is largely fuelled by the rising adoption of digital freight platforms that enhance operational efficiency and reduce empty miles

- Increasing demand for real-time freight tracking and visibility solutions, driven by the growth of e-commerce and just-in-time delivery models

- North America dominated the freight matching market with the largest revenue share in 2024, driven by the high penetration of digital freight platforms, strong transportation infrastructure, and the rapid adoption of AI-powered logistics solutions for improved operational efficiency

- The Asia-Pacific region is expected to witness the highest growth rate in the global freight matching market, driven by rising cross-border trade, expanding manufacturing hubs, and growing investments in smart logistics solutions

- The road freight segment held the largest market revenue share in 2024, driven by the dominance of trucking in short- and medium-distance cargo transportation and the flexibility it offers in terms of delivery schedules and last-mile connectivity. The segment also benefits from increasing adoption of digital freight platforms and telematics for route optimization and load consolidation

Report Scope and Freight Matching Market Segmentation

|

Attributes |

Freight Matching Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Of AI-Driven Freight Optimization Solutions |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Freight Matching Market Trends

Integration of Artificial Intelligence and Predictive Analytics in Freight Matching

- The use of AI and predictive analytics in freight matching is enabling carriers and shippers to connect faster, optimize routes, and reduce empty miles while improving asset utilization by analyzing historical freight data and forecasting demand patterns in real time, leading to reduced fuel consumption and enhanced operational efficiency

- Predictive freight algorithms are increasingly being adopted by large logistics operators to anticipate seasonal demand spikes and optimize load allocation strategies, helping minimize downtime for trucks while ensuring higher profitability and better turnaround times for shipments across multiple regions

- Small and mid-sized carriers are also leveraging AI-powered freight platforms to compete with larger players by accessing instant load opportunities, transparent pricing, and route optimization tools, which improve delivery consistency and customer satisfaction without the need for heavy manual coordination

- For instance, in 2024, a U.S.-based freight tech startup deployed an AI-driven matching system that cut average load matching time by over 60 percent, resulting in improved carrier earnings per mile and significantly reducing CO₂ emissions through optimized trip planning across interstate routes

- Overall, the integration of AI and predictive analytics in freight matching is set to transform operational models, creating a more connected, data-driven, and sustainable logistics ecosystem that benefits shippers, carriers, and customers alike

Freight Matching Market Dynamics

Driver

Growing Demand for Real-Time Load Visibility and Optimization

- The demand for real-time load visibility is growing rapidly as shippers and carriers seek greater transparency and control over shipments, with advanced freight matching systems integrating GPS tracking and dynamic allocation tools to enhance service reliability and operational agility

- E-commerce growth and just-in-time manufacturing are pushing logistics providers to invest in platforms that can automatically adjust routes, reduce idle time, and ensure on-time deliveries, thereby minimizing penalties and improving customer satisfaction across industries

- Carriers are benefiting from reduced fuel costs and better vehicle utilization through continuous load optimization, while shippers enjoy predictable delivery windows and lower transportation expenses, strengthening long-term partnerships within the logistics chain

- For instance, in 2024, leading European freight operators integrated telematics-enabled matching platforms that allowed real-time route adjustments based on traffic and weather conditions, improving on-time performance by nearly 20 percent and lowering total operational expenses

- The rising need for real-time load tracking and dynamic optimization is expected to remain a primary market driver, fostering wider adoption of digital freight platforms and reshaping how goods move globally

Restraint/Challenge

High Implementation Costs and Technology Adoption Barriers Among Small Carriers

- The high cost of integrating freight matching platforms, purchasing telematics devices, and training staff poses a significant hurdle for small carriers and owner-operators, many of whom continue to rely on traditional manual load booking processes through phone brokers

- Limited internet coverage, low digital literacy, and inconsistent technology infrastructure in rural and remote transport hubs hinder the use of advanced freight solutions, leaving a large portion of the global carrier base underserved and reliant on inefficient methods

- Subscription fees for premium freight management tools and the ongoing maintenance costs discourage small operators from adopting these platforms, despite the potential operational gains and cost savings in the long term

- For instance, a 2023 survey in Southeast Asia revealed that more than 65 percent of small fleet operators had not implemented digital freight tools due to high subscription costs and insufficient training resources, leading to slower digital transformation in the sector

- Ultimately, unless affordable, scalable, and user-friendly freight matching solutions are introduced along with strong training programs, small carriers will continue to face barriers to entry, limiting the market’s full growth potential

Freight Matching Market Scope

The market is segmented on the basis of mode and end user.

- By Mode

On the basis of mode, the freight matching market is segmented into rail freight, road freight, ocean freight, and air freight. The road freight segment held the largest market revenue share in 2024, driven by the dominance of trucking in short- and medium-distance cargo transportation and the flexibility it offers in terms of delivery schedules and last-mile connectivity. The segment also benefits from increasing adoption of digital freight platforms and telematics for route optimization and load consolidation.

The air freight segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the growing demand for time-sensitive deliveries, e-commerce expansion, and global trade in high-value goods. Digital freight matching solutions in air cargo are enhancing booking efficiency, tracking accuracy, and space utilization, making it a preferred choice for urgent shipments.

- By End User

On the basis of end user, the freight matching market is segmented into 3PLs, brokers, shippers, and carriers. The 3PLs segment held the largest market share in 2024, driven by their expanding role in offering integrated logistics solutions and adopting advanced freight matching platforms to streamline operations, reduce costs, and improve service delivery for diverse industries.

The carriers segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing adoption of real-time load matching technologies that help reduce empty miles, optimize vehicle utilization, and enhance profitability, particularly among small and mid-sized fleet operators seeking competitive advantages in a dynamic market environment.

Freight Matching Market Regional Analysis

• North America dominated the freight matching market with the largest revenue share in 2024, driven by the high penetration of digital freight platforms, strong transportation infrastructure, and the rapid adoption of AI-powered logistics solutions for improved operational efficiency

• Shippers and carriers in the region increasingly value the real-time visibility, route optimization, and cost savings offered by advanced freight matching systems, leading to greater platform adoption across various freight modes

• This growth is further supported by the presence of leading logistics technology providers, a mature e-commerce sector, and the rising demand for faster, more flexible delivery services, making freight matching a critical enabler of supply chain competitiveness in North America

U.S. Freight Matching Market Insight

The U.S. freight matching market captured the largest revenue share within North America in 2024, fueled by the country’s high freight volumes, strong domestic trucking sector, and widespread adoption of cloud-based logistics management tools. Carriers and brokers are increasingly leveraging AI-driven load boards and predictive analytics to enhance efficiency, reduce empty miles, and increase asset utilization. In addition, the expansion of e-commerce, just-in-time delivery models, and cross-border trade with Canada and Mexico is further accelerating the adoption of freight matching platforms in the U.S.

Europe Freight Matching Market Insight

The Europe freight matching market is expected to witness the fastest growth rate from 2025 to 2032, supported by the region’s commitment to sustainable transportation and efficient freight operations. The push for reducing carbon emissions is encouraging shippers to use digital freight platforms that improve load consolidation and reduce empty trips. Moreover, the region’s complex cross-border logistics requirements, combined with strong government support for digitalization in transportation, are driving the adoption of advanced freight matching solutions across road, rail, and intermodal networks.

U.K. Freight Matching Market Insight

The U.K. freight matching market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for cost-efficient logistics solutions and the growth of e-commerce-driven deliveries. Freight operators are adopting technology-based matching platforms to address driver shortages, optimize routes, and ensure timely deliveries amidst urban congestion and changing trade patterns post-Brexit. In addition, the integration of telematics and freight matching software is helping carriers improve productivity and meet evolving customer service expectations.

Germany Freight Matching Market Insight

The Germany freight matching market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s position as a central logistics hub in Europe and its strong manufacturing base. The focus on digital transformation, combined with government initiatives to modernize freight infrastructure, is boosting the use of freight matching platforms. German logistics companies are increasingly adopting AI and IoT-based solutions to optimize multimodal freight movements, reduce costs, and enhance operational transparency for both domestic and cross-border trade.

Asia-Pacific Freight Matching Market Insight

The Asia-Pacific freight matching market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, expanding trade activities, and the digitalization of logistics in countries such as China, India, and Japan. The booming e-commerce industry, coupled with infrastructure investments and government-led smart logistics initiatives, is significantly increasing demand for freight matching solutions. Moreover, the region’s growing network of small and mid-sized carriers is increasingly relying on digital platforms to access more loads, improve fleet utilization, and remain competitive.

Japan Freight Matching Market Insight

The Japan freight matching market is expected to witness the fastest growth rate from 2025 to 2032 due to its advanced transportation network, high adoption of technology, and growing need to address labor shortages in the logistics sector. Japanese freight companies are increasingly integrating AI-enabled freight matching with telematics and autonomous delivery solutions to improve operational efficiency. Furthermore, the country’s strong focus on urban freight optimization and sustainability is driving the adoption of these platforms across both domestic and international freight routes.

China Freight Matching Market Insight

The China freight matching market accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by the country’s massive freight volumes, rapid logistics digitalization, and dominance in e-commerce. China’s extensive road and rail networks, combined with the rise of tech-driven logistics startups, are enabling fast adoption of freight matching systems among carriers, brokers, and shippers. The push toward smart city development, along with supportive government policies promoting intelligent transportation systems, continues to accelerate market growth in China.

Freight Matching Market Share

The Freight Matching industry is primarily led by well-established companies, including:

- Waymo (U.S.)

- Kodiak Robotics, Inc. (U.S.)

- Manbang Group (China)

- Convoy (U.S.)

- Flock Freight (U.S.)

- Uber Freight (U.S.)

- Loadsmart (U.S.)

- Cargomatic (U.S.)

- Transfix (U.S.)

- Sennder (Germany)

- Shipwell (U.S.)

- Flexport (U.S.)

- Zencargo (U.K.)

- Ontruck (Spain)

- Freightos (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.