Global Front End Production Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.90 Billion

USD

9.16 Billion

2024

2032

USD

4.90 Billion

USD

9.16 Billion

2024

2032

| 2025 –2032 | |

| USD 4.90 Billion | |

| USD 9.16 Billion | |

|

|

|

|

What is the Global Front End Production Equipment Market Size and Growth Rate?

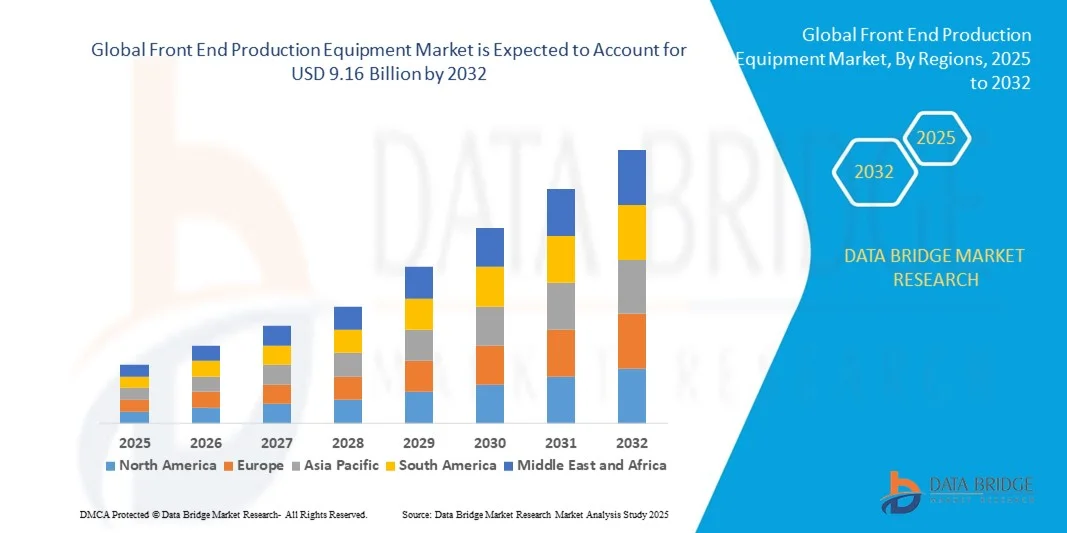

- The global front end production equipment market size was valued at USD 4.90 billion in 2024 and is expected to reach USD 9.16 billion by 2032, at a CAGR of 8.12% during the forecast period

- Increasing growth of the consumer electronics market and increasing number of foundries, rising demand for electric and hybrid vehicles, surging levels of investment in research and development activities, growing trends of miniaturization and technology migration, rising demand for chips to provide computation power and connectivity for artificial intelligence applications are some of the major as well as vital factors which will ,likely to boost the growth of the front end production equipment market

What are the Major Takeaways of Front End Production Equipment Market?

- Increasing number of data centers and servers, along with rising demand for silicon-based sensors for internet of things devices which will further create lucrative opportunities that will lead to the growth of the front end production equipment market in the above mentioned projected timeframe

- Increasing maintenance cost along with complexity of patterns and functional defects in manufacturing process which will, likely to act as market restraints factor for the growth of the front end production equipment

- North America dominated the front end production equipment market with the largest revenue share of 43.36% in 2024, driven by strong industrial development, advanced semiconductor manufacturing infrastructure, and early adoption of cutting-edge production technologies

- The Asia-Pacific market is poised to grow at the fastest CAGR of 7.36% during 2025–2032, driven by rapid industrialization, increasing semiconductor fab expansions, and government initiatives supporting local chip manufacturing in China, Japan, South Korea, and India

- The lithography segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its critical role in defining circuit patterns on silicon wafers and supporting advanced nodes below 5nm

Report Scope and Front End Production Equipment Market Segmentation

|

Attributes |

Front End Production Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Front End Production Equipment Market?

Automation and AI Integration in Semiconductor Manufacturing

- A key trend in the global front end production equipment market is the increasing integration of artificial intelligence (AI), machine learning (ML), and automation to enhance manufacturing precision, yield, and throughput efficiency. These technologies enable predictive maintenance, defect detection, and process optimization, reducing downtime and operational costs.

- For instance, Applied Materials, Inc. and ASML are leveraging AI-driven analytics to enhance wafer inspection, metrology, and lithography accuracy, improving production efficiency and device performance.

- AI-enabled systems are capable of real-time monitoring and adaptive control, ensuring consistent quality and minimizing material wastage. This shift toward smart manufacturing aligns with the industry’s push for advanced nodes below 5nm and greater chip complexity.

- The trend is reshaping the semiconductor manufacturing ecosystem, driving demand for highly automated, data-driven production tools that support Industry 4.0 and the growing requirement for intelligent fabrication environments

What are the Key Drivers of Front End Production Equipment Market?

- The global front end production equipment market is being propelled by the growing demand for advanced semiconductor devices across industries such as AI, automotive, consumer electronics, and telecommunications

- The shift toward miniaturization, energy efficiency, and performance enhancement is fueling investments in next-generation wafer fabrication technologies

- For instance, in April 2024, LAM RESEARCH CORPORATION introduced upgraded etch and deposition systems optimized for gate-all-around (GAA) and 3D NAND architectures, supporting high-density and energy-efficient chip manufacturing.

- In addiition, the increasing adoption of 5G, IoT, and autonomous systems has amplified the need for high-performance semiconductor components, boosting equipment sales

- Rising government initiatives supporting domestic semiconductor manufacturing—such as the U.S. CHIPS Act and Europe’s Chips Joint Undertaking—are further accelerating market expansion by encouraging capital investments and new fabrication facility development

Which Factor is Challenging the Growth of the Front End Production Equipment Market?

- The high capital investment required for semiconductor fabrication equipment and facilities remains a major barrier to entry for new players, restricting market participation to established giants. Setting up a modern fab can cost over USD 10 billion, limiting the scalability of smaller manufacturers

- Moreover, supply chain disruptions and material shortages, particularly for silicon wafers and rare gases, have impacted production timelines and increased operational costs across the industry

- Cybersecurity and data integrity concerns also pose challenges as fabs become increasingly automated and connected. For instance, recent reports of cyber intrusions in semiconductor production systems have highlighted the need for robust digital security frameworks

- To overcome these challenges, manufacturers are focusing on supply chain diversification, collaborative partnerships, and cost-efficient process innovations. Enhanced data protection protocols and automation resilience will be crucial for ensuring stability and sustaining long-term growth in the market

How is the Front End Production Equipment Market Segmented?

The market is segmented on the basis of equipment type, fab facility, dimension, product type, and supply chain participant.

- By Equipment Type

On the basis of equipment type, the Front End Production Equipment market is segmented into lithography, wafer surface conditioning equipment, deposition, cleaning process, and other equipment. The lithography segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its critical role in defining circuit patterns on silicon wafers and supporting advanced nodes below 5nm. Lithography systems remain the backbone of semiconductor fabrication, with manufacturers prioritizing precision, throughput, and yield optimization.

The wafer surface conditioning equipment segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by increasing adoption of advanced inspection, polishing, and planarization processes. The rising complexity of semiconductor devices, especially 3D structures ,such as FinFETs and GAA architectures, is driving demand for highly reliable conditioning tools, making them essential for maintaining wafer quality and production efficiency.

- By Fab Facility

On the basis of fab facility, the market is segmented into automation, chemical control equipment, gas control equipment, and others. The automation segment dominated with a 38% revenue share in 2024, attributed to the growing reliance on fully automated production lines to reduce human error, improve safety, and optimize process consistency across semiconductor fabs. Automation systems include wafer handling robots, transport systems, and integrated fab monitoring solutions, enabling precise coordination of complex fabrication steps.

The chemical control equipment segment is expected to witness the fastest growth at a CAGR of 21.5% from 2025 to 2032, driven by the need to precisely regulate chemical concentrations, pH levels, and fluid flows during etch, deposition, and cleaning processes. As advanced nodes demand tighter process controls, the adoption of sophisticated chemical control systems is accelerating globally, particularly in Asia-Pacific fabs expanding capacity.

- By Dimension

On the basis of dimension, the market is segmented into 2D, 2.5D, and 3D. The 2D segment dominated with a 44% revenue share in 2024, as traditional planar architectures continue to constitute the bulk of mature semiconductor production, particularly in memory and standard logic devices. 2D fabrication processes benefit from established workflows, equipment availability, and cost efficiency.

The 3D segment is projected to grow at the fastest CAGR of 23.8% from 2025 to 2032, reflecting the rising adoption of 3D NAND, FinFET, and GAA devices. Increasing demand for high-density, high-performance chips for AI, 5G, and autonomous applications is fueling the adoption of 3D architectures, necessitating advanced lithography, deposition, and inspection equipment capable of handling complex vertical structures.

- By Product Type

On the basis of product type, the market is segmented into memory, foundry, logic, MPU, discrete, analog, MEMS, and others. The memory segment dominated with a 40% revenue share in 2024, owing to massive demand for DRAM, NAND, and emerging storage solutions powering cloud data centers, smartphones, and AI applications. Memory fabrication requires high-precision deposition, etching, and inspection equipment, driving significant investment in front-end tools.

The foundry segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, driven by increasing outsourcing of advanced chip production to major foundries in Taiwan, South Korea, and China. Foundries’ adoption of cutting-edge process technologies and higher wafer volumes ensures strong growth in equipment demand across lithography, deposition, and cleaning systems.

- By Supply Chain Participant

On the basis of supply chain participant, the market is segmented into IDM firms, OSAT companies, and foundries. The IDM (Integrated Device Manufacturer) segment dominated with a 45% revenue share in 2024, due to in-house control over design, production, and quality for high-value logic, memory, and MPU products. IDMs prioritize investment in advanced front-end equipment to maintain technological leadership and yield advantage.

The foundry segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, driven by increasing global demand for outsourced semiconductor manufacturing. Foundries’ expansion in Asia-Pacific and adoption of advanced process nodes is boosting procurement of lithography, deposition, and inspection tools, while OSATs are gradually integrating front-end services to complement back-end packaging, further strengthening the market.

Which Region Holds the Largest Share of the Front End Production Equipment Market?

- North America dominated the front end production equipment market with the largest revenue share of 43.36% in 2024, driven by strong industrial development, advanced semiconductor manufacturing infrastructure, and early adoption of cutting-edge production technologies

- Companies in the region highly value precision, automation, and integration with digital systems, enhancing the efficiency and yield of semiconductor fabs.

- This widespread adoption is further supported by high R&D investment, a skilled technical workforce, and a concentration of major semiconductor equipment manufacturers, establishing Front End Production Equipment as a critical enabler of advanced chip production

U.S. Front End Production Equipment Market Insight

The U.S. market captured the largest revenue share of 81% within North America in 2024, fueled by rapid expansion of advanced semiconductor fabrication and high investment in R&D. Leading fabs are increasingly adopting AI-enabled equipment, automated process control, and next-generation lithography systems. The growing focus on domestic semiconductor manufacturing, along with government incentives, further propels market growth. Integration of advanced metrology, deposition, and cleaning tools enhances wafer yield and productivity, consolidating the U.S. as a leader in front-end semiconductor equipment adoption.

Europe Front End Production Equipment Market Insight

The Europe market is projected to grow at a substantial CAGR during the forecast period, driven by increasing semiconductor demand, technological innovation, and industrial automation adoption. Stringent quality and safety standards, along with the region’s emphasis on sustainable manufacturing, are boosting the use of high-precision front-end tools. Germany, France, and the Netherlands are emerging as hubs for advanced chip fabrication, with equipment adoption in lithography, deposition, and wafer surface conditioning gaining momentum.

U.K. Front End Production Equipment Market Insight

The U.K. market is expected to grow steadily during the forecast period, supported by increasing semiconductor research initiatives, smart manufacturing adoption, and growing investment in high-tech fabs. Focus on digitalization, workforce training, and collaboration with leading semiconductor equipment suppliers is facilitating the adoption of automation, chemical control, and deposition equipment in both commercial and R&D facilities.

Germany Front End Production Equipment Market Insight

Germany is witnessing significant growth due to strong industrial infrastructure, increasing fab automation, and emphasis on high-precision manufacturing. Investments in energy-efficient and sustainable equipment, combined with growing semiconductor demand across automotive and industrial sectors, are supporting adoption. Advanced front-end tools for lithography, cleaning, and deposition processes are increasingly integrated with smart factory solutions, driving overall market expansion.

Which Region is the Fastest Growing Region in the Front End Production Equipment Market?

The Asia-Pacific market is poised to grow at the fastest CAGR of 7.36% during 2025–2032, driven by rapid industrialization, increasing semiconductor fab expansions, and government initiatives supporting local chip manufacturing in China, Japan, South Korea, and India. Rising investments in next-generation semiconductor technologies, including 3D packaging and AI chips, are propelling demand for advanced front-end production equipment.

Japan Front End Production Equipment Market Insight

Japan’s market growth is driven by high-tech manufacturing capabilities, increasing adoption of automation, and demand for high-precision equipment in logic and memory fabrication. Integration with IoT-enabled process monitoring and advanced lithography systems enhances fab efficiency. The aging workforce is also encouraging automation and AI integration to maintain productivity and yield.

China Front End Production Equipment Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s expanding semiconductor ecosystem, government-backed fab construction projects, and increasing domestic equipment manufacturers. Adoption of cost-effective, high-throughput front-end tools, including deposition, lithography, and cleaning systems, is accelerating across memory, foundry, and logic fabs, making China a key driver for regional growth.

Which are the Top Companies in Front End Production Equipment Market?

The front end production equipment industry is primarily led by well-established companies, including:

- Tokyo Electron Limited (Japan)

- LAM RESEARCH CORPORATION (U.S.)

- ASML (Netherlands)

- Applied Materials, Inc. (U.S.)

- KLA Corporation (U.S.)

- SCREEN Holdings Co., Ltd. (Japan)

- Teradyne Inc. (U.S.)

- ADVANTEST CORPORATION (Japan)

- Hitachi High-Tech Corporation (Japan)

- Plasma-Therm (U.S.)

- Onto Innovation (U.S.)

- Veeco Instruments Inc. (U.S.)

- EV Group (EVG) (Austria)

- Nordson Corporation (U.S.)

- ADT (Advanced Dicing Technologies) (Israel)

- Evatec AG (Switzerland)

- Modutek Corporation (U.S.)

- Semiconductor Equipment Corp. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

What are the Recent Developments in Global Front End Production Equipment Market?

- In October 2025, Tokyo Electron Limited, a Japanese manufacturer of semiconductor production equipment, inaugurated a large-scale research and development (R&D) facility. This initiative aims to strengthen collaborations with TSMC and other key clients to advance the development of cutting-edge 1-nanometer semiconductors, reinforcing the company’s position in next-generation chip manufacturing

- In October 2025, Applied Materials, Inc. launched new semiconductor manufacturing systems designed to boost the performance of advanced logic and memory chips, which are critical for AI computing. These systems focus on Gate-All-Around (GAA) transistors for logic, high-bandwidth memory (HBM) for DRAM, and sophisticated packaging for system-in-a-package designs, ultimately enhancing chip performance, energy efficiency, and cost-effectiveness for AI applications

- In November 2024, Tata Electronics announced plans to establish India’s first semiconductor production plant in Dholera, Gujarat, in partnership with Taiwan’s Powerchip Semiconductor Manufacturing Corporation. Supporting this venture, Lam Research India, the regional subsidiary of the U.S.-based wafer equipment giant, will open a local office to provide advanced front-end wafer processing technology, a crucial step in producing transistors and interconnects, strengthening India’s semiconductor ecosystem

- In October 2024, KLA Corporation introduced a comprehensive suite of process control and enabling solutions specifically tailored for IC substrate (ICS) manufacturing. Leveraging expertise in front-end semiconductors, packaging, and IC substrates, KLA’s offerings aim to enhance packaging interconnect density for high-performance chips, empowering customers to optimize chip performance and reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Front End Production Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Front End Production Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Front End Production Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.