Global Frozen Cocktails Market

Market Size in USD Million

CAGR :

%

USD

954.70 Million

USD

1,591.94 Million

2024

2032

USD

954.70 Million

USD

1,591.94 Million

2024

2032

| 2025 –2032 | |

| USD 954.70 Million | |

| USD 1,591.94 Million | |

|

|

|

|

Frozen Cocktails Market Size

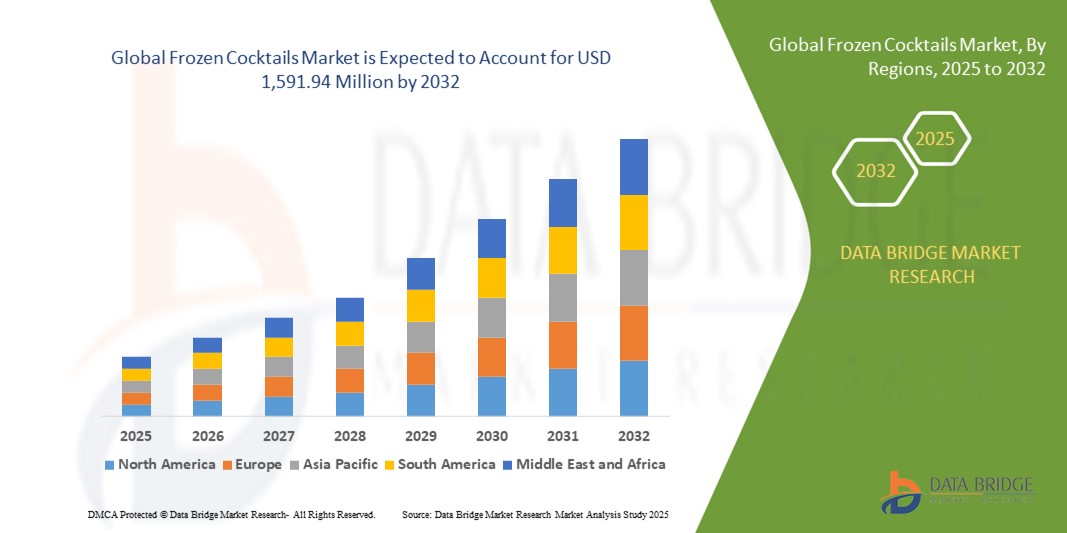

- The global frozen cocktails market size was valued at USD 954.70 million in 2024 and is expected to reach USD 1,591.94 million by 2032, at a CAGR of 6.6% during the forecast period

- The market growth is largely fuelled by the increasing popularity of ready-to-drink beverages, rising consumer preference for convenient and innovative alcoholic options, and the expansion of flavored frozen cocktail varieties

- Growing demand from younger demographics seeking unique and premium drinking experiences is further boosting market growth

Frozen Cocktails Market Analysis

- The market is witnessing significant traction due to the convenience, portability, and variety offered by frozen cocktails, making them an attractive choice for social gatherings, outdoor events, and casual consumption

- Innovations in packaging, along with the introduction of healthier and low-calorie options, are further widening the consumer base and supporting long-term market expansion

- Europe dominated the frozen cocktails market with the largest revenue share of 40.6% in 2024, driven by rising consumer preference for ready-to-drink alcoholic beverages, growing nightlife culture, and strong presence of bars, restaurants, and specialty stores offering frozen cocktails

- Asia-Pacific region is expected to witness the highest growth rate in the global frozen cocktails market, driven by expanding hospitality and tourism sectors, increased presence of international beverage brands, and rising consumer awareness of innovative and convenient cocktail options

- The Margarita segment held the largest market revenue share in 2024 driven by its global popularity, refreshing citrus profile, and versatility across both premium and mass-market offerings. The wide availability of ready-to-drink frozen margaritas in various retail formats has boosted adoption, especially during summer seasons and outdoor events.

Report Scope and Frozen Cocktails Market Segmentation

|

Attributes |

Frozen Cocktails Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Into Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Frozen Cocktails Market Trends

Growing Popularity of Ready-to-Drink (RTD) Frozen Alcoholic Beverages

• The rising consumer preference for convenient and innovative alcoholic options is driving demand for ready-to-drink (RTD) frozen cocktails, offering a blend of portability, variety, and indulgence. These beverages cater to both at-home entertainment and outdoor leisure activities, making them an attractive choice for a wide demographic seeking hassle-free cocktail experiences

• The increasing appeal of premiumization in the alcoholic beverages sector is boosting demand for high-quality frozen cocktails made with natural ingredients, craft spirits, and exotic flavors. This trend is further enhanced by the influence of social media and digital marketing, where visually appealing, ready-to-serve frozen cocktails attract younger consumers and trend-focused audiences

• Seasonal and event-based consumption patterns are contributing to strong sales spikes during summer months, festivals, and sports events. The frozen format not only enhances the drinking experience but also provides a novelty factor that encourages repeat purchases and brand loyalty among consumers

• For instance, in 2023, several U.S.-based beverage brands launched frozen margarita and daiquiri pouches in partnership with major retail chains, resulting in rapid sell-outs during the summer season. These products targeted both casual drinkers and premium buyers by offering single-serve, mess-free options with consistent taste and quality

• While RTD frozen cocktails are rapidly penetrating the mainstream beverage market, their growth relies on continuous flavor innovation, sustainable packaging solutions, and regulatory compliance in different regions. Brands that can combine convenience with authenticity are best positioned to capture long-term market share

Frozen Cocktails Market Dynamics

Driver

Increasing Demand for Convenient and On-the-Go Alcoholic Beverage Solutions

• The shift in consumer lifestyles toward faster, more flexible consumption patterns is fueling interest in portable alcoholic options such as frozen cocktails. These products eliminate the need for complex preparation while delivering a bar-quality experience, appealing to both frequent travelers and urban professionals with limited leisure time

• Younger demographics, particularly millennials and Gen Z, are embracing single-serve and ready-to-consume alcoholic beverages for social gatherings, outdoor activities, and home parties. The appeal lies in their versatility, reduced waste, and ability to cater to spontaneous occasions without sacrificing taste or quality

• Growth in the convenience retail sector, along with increased penetration of e-commerce platforms, is expanding product accessibility and encouraging trial purchases. The ability to order frozen cocktails online for direct-to-door delivery is further accelerating adoption rates across multiple regions

• For instance, in 2024, a leading European beverage company reported a 35% year-over-year increase in frozen cocktail sales after introducing subscription-based home delivery services, enabling customers to receive seasonal flavor assortments regularly

• While convenience is a strong driver, maintaining product freshness, ensuring consistent freezing during transport, and catering to diverse taste preferences will be key to sustaining demand in competitive markets

Restraint/Challenge

Cold Chain Logistics and Seasonal Demand Fluctuations

• Frozen cocktails require strict temperature control throughout the supply chain to maintain product integrity, which increases logistics costs and limits distribution in regions lacking adequate cold storage infrastructure. This poses a significant challenge for brands aiming to expand into new or remote markets

• The seasonal nature of frozen cocktail consumption, heavily tied to warmer months and outdoor events, creates uneven revenue patterns for manufacturers and retailers. Managing inventory to balance peak demand with off-season slowdowns is a persistent operational hurdle

• Distribution challenges are compounded by the need for specialized packaging to preserve the frozen format, adding to both production expenses and environmental concerns. Without efficient and sustainable solutions, scaling operations can be difficult for emerging brands

• For instance, in 2023, several small-scale frozen cocktail producers in Southeast Asia reported revenue drops of over 40% during monsoon months, citing reduced outdoor gatherings and logistical constraints in maintaining cold storage during transport

• While demand is strong during high-consumption periods, addressing logistical inefficiencies, developing year-round product variants, and expanding into climate-independent consumption channels will be essential to mitigate seasonality risks

Frozen Cocktails Market Scope

The market is segmented on the basis of product type, form, distribution channel, pricing, packaging, flavour, and end-user.

- By Product Type

On the basis of product type, the frozen cocktails market is segmented into Cosmopolitan, Martini, Mojito, Margarita, Strawberry Daiquiri, and Sangria. The Margarita segment held the largest market revenue share in 2024 driven by its global popularity, refreshing citrus profile, and versatility across both premium and mass-market offerings. The wide availability of ready-to-drink frozen margaritas in various retail formats has boosted adoption, especially during summer seasons and outdoor events.

The Strawberry Daiquiri segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for fruit-forward and visually appealing alcoholic beverages. Its sweet flavour profile and vibrant color make it a preferred choice for social gatherings, festivals, and younger demographics seeking novelty in cocktail experiences.

- By Form

On the basis of form, the frozen cocktails market is segmented into Ice Popsicles and Freezer Pouch Drinks. The Freezer Pouch Drinks segment held the largest market revenue share in 2024 driven by its portability, mess-free consumption, and suitability for retail distribution. The format is favored by both consumers and retailers for its extended shelf life and ease of storage.

The Ice Popsicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its unique frozen snack appeal that combines indulgence and refreshment. Innovative flavor blends and alcohol-infused dessert concepts are fueling demand for this playful format in both domestic and commercial settings.

- By Distribution Channel

On the basis of distribution channel, the frozen cocktails market is segmented into Specialty Stores, HORECA, Liquor Stores, and Others. The Liquor Stores segment held the largest market revenue share in 2024 driven by strong consumer reliance on specialized alcohol retailers for variety and premium product access. These outlets also facilitate impulse buying through in-store promotions and seasonal displays.

The HORECA segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of frozen cocktail offerings in bars, restaurants, and hotels as part of experiential dining and themed beverage menus.

- By Pricing

On the basis of pricing, the frozen cocktails market is segmented into Premium, Middle, and Low. The Middle segment held the largest market revenue share in 2024 driven by its balance between quality and affordability, attracting a wide consumer base across various demographics. It is especially popular in supermarkets and retail chains targeting everyday indulgence.

The Premium segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer interest in craft beverages, natural ingredients, and artisanal cocktail experiences. Premium positioning is further boosted by high-end packaging and exclusive flavour innovations.

- By Packaging

On the basis of packaging, the frozen cocktails market is segmented into Glass, Plastic, and Metal. The Plastic segment held the largest market revenue share in 2024 driven by its lightweight nature, cost-effectiveness, and suitability for single-use formats such as pouches and cups. It supports large-scale distribution and enhances portability for outdoor events.

The Glass segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its premium appeal, recyclability, and ability to preserve flavour integrity. Glass packaging is increasingly used by high-end brands seeking to differentiate their offerings in competitive markets.

- By Flavour

On the basis of flavour, the frozen cocktails market is segmented into Fruit Flavour, Spices Flavour, and Herbs Flavour. The Fruit Flavour segment held the largest market revenue share in 2024 driven by consumer preference for familiar, refreshing, and naturally sweet taste profiles. It remains a versatile base for seasonal and exotic variations, supporting high repeat purchase rates.

The Herbs Flavour segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing interest in botanical-infused beverages and mixology-inspired creations that offer a sophisticated drinking experience.

- By End-User

On the basis of end-user, the frozen cocktails market is segmented into Residential and Commercial. The Residential segment held the largest market revenue share in 2024 driven by increased at-home consumption trends, especially in the post-pandemic era where home entertaining has surged. Consumers value the convenience and variety of frozen cocktails for casual gatherings and celebrations.

The Commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising inclusion of frozen cocktails in the menus of bars, restaurants, and event catering services seeking to diversify beverage offerings and attract younger clientele.

Frozen Cocktails Market Regional Analysis

• Europe dominated the frozen cocktails market with the largest revenue share of 40.6% in 2024, driven by rising consumer preference for ready-to-drink alcoholic beverages, growing nightlife culture, and strong presence of bars, restaurants, and specialty stores offering frozen cocktails

• Consumers in the region highly value unique flavors, premium offerings, and convenient consumption formats, encouraging widespread adoption across both retail and on-premise channels

• This adoption is further reinforced by high disposable incomes, urbanization, and lifestyle trends favoring social gatherings, outdoor events, and premium beverage experiences, establishing frozen cocktails as a favored alcoholic drink in Europe

U.K. Frozen Cocktails Market Insight

The U.K. frozen cocktails market captured the largest revenue share in 2024 within Europe, fueled by growing cocktail culture, increasing demand in bars, restaurants, and pubs, and strong consumer interest in ready-to-drink beverage options. The rising popularity of themed events, parties, and outdoor dining experiences is boosting adoption of frozen cocktails in both commercial and residential settings. Moreover, innovations in flavors, packaging formats, and premium offerings are significantly contributing to market expansion across the U.K.

Germany Frozen Cocktails Market Insight

The Germany frozen cocktails market is expected to witness the fastest growth rate from 2025 to 2032, driven by urbanization, increasing disposable income, and rising consumption of ready-to-drink alcoholic beverages. Specialty bars, restaurants, and clubs are increasingly offering frozen cocktails, supported by new flavor launches and seasonal promotions. In addition, consumer preference for fruit-based and premium cocktails is further driving market growth in Germany.

Asia-Pacific Frozen Cocktails Market Insight

The Asia-Pacific frozen cocktails market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urban populations, increasing disposable incomes, and growing adoption of Western-style beverage culture in countries such as China, Japan, India, and Australia. The region’s growing preference for on-the-go and ready-to-drink alcoholic beverages, along with expanding bar and nightlife culture, is fueling adoption of frozen cocktails. In addition, APAC is witnessing product innovations, localized flavors, and convenient packaging options that are making frozen cocktails more accessible and appealing to a wider consumer base.

Japan Frozen Cocktails Market Insight

The Japan frozen cocktails market is expected to witness the fastest growth rate from 2025 to 2032 due to increasing demand for convenience, interest in Western-style drinks, and availability in both on-premise and off-premise channels. Consumers are showing strong preference for fruit-flavored, ready-to-drink frozen cocktails during social events and seasonal occasions. Moreover, introduction of limited-edition flavors and compact packaging formats is supporting adoption across both residential and commercial sectors.

China Frozen Cocktails Market Insight

The China frozen cocktails market a is expected to witness the fastest growth rate from 2025 to 2032, attributed to growing disposable incomes, rapid urbanization, and rising consumption of ready-to-drink alcoholic beverages. Frozen cocktails are gaining popularity in bars, restaurants, and homes, driven by younger consumers and expanding nightlife culture. The push towards premiumization, innovative flavors, and convenient packaging, along with strong distribution networks, is accelerating market growth in China.

U.S. Frozen Cocktails Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for ready-to-drink alcoholic beverages, growing bar and nightlife culture, and increasing consumer preference for premium and flavored cocktails. Consumers in the region value convenience, variety of flavors, and innovative packaging formats, which encourage adoption across retail and on-premise channels. High disposable incomes, urban lifestyles, and trends favoring outdoor gatherings and social events further support widespread adoption, making frozen cocktails a popular choice for both residential and commercial consumption

U.S. Frozen Cocktails Market Insight

The U.S. frozen cocktails market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strong cocktail culture, demand in bars, restaurants, and cafes, and growing popularity of ready-to-drink alcoholic beverages. The trend of premiumization, innovative flavors, and seasonal launches is driving consumer interest, while convenient packaging formats are boosting off-premise sales in retail channels. Moreover, marketing campaigns, social media influence, and expanding distribution networks are accelerating market growth, making frozen cocktails a mainstream choice in the U.S.

Frozen Cocktails Market Share

The Frozen Cocktails industry is primarily led by well-established companies, including:

- Manchester Drinks (U.K.)

- Harvest Hill Beverage Company (U.S.)

- LIC Craft Cocktails (London)

- SMART ICE TRADING B.V (Noord-Holland)

- Snobar Cocktails (U.S.)

- Constellation Brands Inc. (U.S.)

- J Marr Group (U.K.)

- The Absolut Group (Sweden)

- Arbor Mist Winery (U.S.)

- NICE Drinks (Sweden)

Latest Developments in Global Frozen Cocktails Market

- In April 2022, Dailys, a ready-to-enjoy frozen adult beverage company, launched a range of new frozen cocktails in diverse flavors, including cone pouch flavors and red, white, and blue Poptails, making the products available globally at major supermarkets, mass merchandisers, and liquor stores, enhancing product variety and increasing market reach

- In July 2021, Cooloo introduced a limited-time variety cocktail pack featuring four new flavors—mojito, strawberry daiquiri, happy bay twist, and paradise island—launched in New York to expand its product portfolio and attract seasonal demand

- In May 2021, American Beverage Corporation launched ready-to-drink frozen cocktail pouches under the “Daily Cocktails” brand, offering strawberry, watermelon, and green apple flavors with 6.8% ABV and 90 calories, providing portability and flavor appeal while strengthening its market presence

- In March 2021, Cutwater Spirits launched two new frozen margarita offerings, including frozen margarita pops and canned mango margaritas, crafted with 100% blue agave tequila blanco, available in a 12-pack variety with flavors such as strawberry, mango, pineapple, and lime, expanding its product lineup and maintaining competitive advantage in the frozen cocktails market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frozen Cocktails Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Cocktails Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Cocktails Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.