Global Frozen Mango Market

Market Size in USD Million

CAGR :

%

USD

693.89 Million

USD

1,040.93 Million

2024

2032

USD

693.89 Million

USD

1,040.93 Million

2024

2032

| 2025 –2032 | |

| USD 693.89 Million | |

| USD 1,040.93 Million | |

|

|

|

|

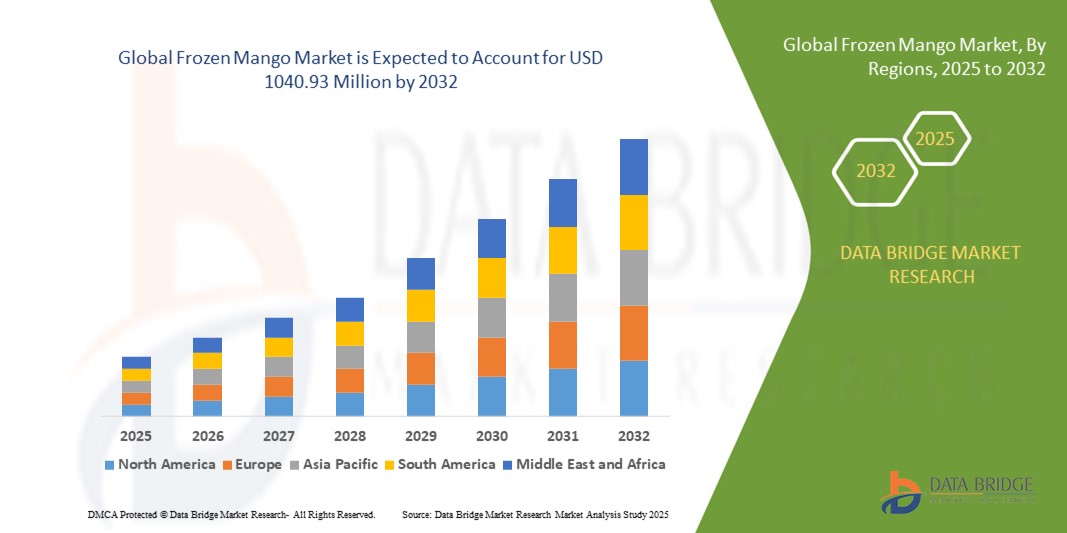

What is the Global Frozen Mango Market Size and Growth Rate?

- The global frozen mango market size was valued at USD 693.89 million in 2024 and is expected to reach USD 1040.93 million by 2032, at a CAGR of 5.20% during the forecast period

- The growth of the frozen mango market can be attributed to several factors as there is increasing demand for convenience foods, and frozen mango offers a convenient food option, they offer a convenient solution for consumers who want to enjoy mangoes without the hassle of peeling and cutting, which propel the market growth in the forecast period

What are the Major Takeaways of Frozen Mango Market?

- With busy lifestyles and growing urbanization, there is a rising demand for convenient food options. Frozen mango offers a convenient solution for consumers looking to incorporate fruits into their diet without the hassle of peeling, cutting, and preparing fresh mangoes

- Frozen mangoes have a longer shelf life compared to fresh mangoes, allowing consumers to enjoy mangoes even during off-seasons or in regions where fresh mangoes are not readily available. This extended shelf life contributes to the market growth, especially in regions with seasonal fluctuations in mango supply

- North America dominated the frozen mango market with the largest revenue share of 41.85% in 2024, driven by rising demand for convenient, ready-to-eat fruits and increasing consumer preference for healthy snacking options

- Asia-Pacific frozen mango market is poised to grow at the fastest CAGR of 4.36% during 2025–2032, driven by rapid urbanization, increasing disposable incomes, and rising adoption of convenient food products

- The Diced Frozen Mango segment dominated the market with a revenue share of 38.6% in 2024, primarily due to its extensive use in smoothies, desserts, yogurts, and bakery products

Report Scope and Frozen Mango Market Segmentation

|

Attributes |

Frozen Mango Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Frozen Mango Market?

Rising Demand for Convenience and Ready-to-Eat Product

- A significant and accelerating trend in the global frozen mango market is the increasing preference for convenience-oriented, ready-to-eat fruit solutions. This shift is driven by busy lifestyles, urbanization, and rising health awareness, with frozen mangoes offering year-round availability and longer shelf life compared to fresh produce

- For instance, companies are launching pre-cut, diced, and smoothie-ready frozen mango packs to meet consumer demand for quick meal preparation. Major brands are also focusing on resealable packaging and portion-controlled packs for enhanced convenience

- Innovation in cold chain logistics and advanced freezing technologies helps retain mango’s natural taste, texture, and nutrients, making frozen variants more appealing. Retailers and e-commerce platforms are expanding their frozen fruit assortments, including organic and premium mango options, to attract health-conscious consumers

- The trend is also supported by the rising popularity of smoothies, desserts, and functional beverages, where frozen mango serves as a key ingredient

- This growing demand for convenience and year-round supply is reshaping the frozen fruit industry, prompting companies such as Dole, Ardo, and SunOpta to expand their frozen mango product portfolios

- The integration of frozen mangoes into global foodservice menus and home cooking underscores their evolving role as a staple in the frozen fruit category

What are the Key Drivers of Frozen Mango Market?

- Increasing health consciousness and rising demand for natural, nutrient-rich food products are major drivers, with frozen mangoes offering a wholesome alternative to sugary snacks and processed foods

- For instance, in March 2024, Del Monte Foods expanded its frozen fruit range by introducing tropical fruit blends including frozen mango chunks, targeting smoothie lovers and health-focused consumers

- The growing penetration of supermarkets, hypermarkets, and online grocery platforms is boosting accessibility of frozen mangoes to a wider audience. Attractive retail promotions and wider cold storage networks are accelerating product adoption

- Rising disposable incomes, urban lifestyles, and exposure to international cuisines are pushing demand for frozen fruits across emerging economies. The foodservice industry is also incorporating frozen mangoes into bakery, confectionery, and beverage recipes, further fueling growth

- In addition, sustainability-driven consumers are increasingly opting for frozen mangoes due to reduced food wastage and better portion control, which strengthens their appeal in both residential and commercial applications

Which Factor is Challenging the Growth of the Frozen Mango Market?

- Supply chain limitations and dependency on seasonal mango harvests pose challenges to consistent year-round availability, especially in regions lacking strong cold storage infrastructure

- For instance, fluctuations in mango yields due to climate change, unpredictable rainfall, and rising temperatures have disrupted exports from key producers such as India and Vietnam, affecting supply stability

- Another major challenge lies in maintaining consistent quality during storage and transportation, as inadequate cold chain facilities can lead to texture loss and reduced shelf life

- High production and logistics costs for frozen mangoes make them relatively more expensive than fresh alternatives in some markets, limiting adoption among price-sensitive consumers

- Furthermore, competition from other tropical frozen fruits and growing consumer preference for locally sourced produce in developed economies can restrain market growth

- Addressing these challenges through investments in cold chain infrastructure, innovative preservation technologies, and sustainable sourcing will be vital for ensuring long-term growth in the frozen mango market

How is the Frozen Mango Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product Type

On the basis of product type, the frozen mango market is segmented into Whole Frozen Mango, Mango Slices, Diced Frozen Mango, Puree or Pulp, and Others. The Diced Frozen Mango segment dominated the market with a revenue share of 38.6% in 2024, primarily due to its extensive use in smoothies, desserts, yogurts, and bakery products. Food processors and households prefer diced mangoes as they are ready-to-use, portion-controlled, and reduce preparation time while maintaining nutritional quality.

The Puree or Pulp segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by growing demand from the beverage industry for juices, nectars, baby foods, and functional drinks. Its versatility as an ingredient for both industrial applications and direct consumption enhances its appeal. Increasing adoption in packaged beverage production and rising popularity of mango-flavored dairy products are expected to significantly boost the puree/pulp category over the forecast period.

- By End Use

On the basis of end use, the frozen mango market is segmented into Food Processing, Beverages, Foodservice, and Others. The Food Processing segment accounted for the largest revenue share of 41.2% in 2024, supported by strong demand from manufacturers of bakery, confectionery, dairy, and packaged foods. Frozen mangoes are widely used as raw materials in jams, sauces, yogurts, and ice creams due to their year-round availability and quality consistency.

The Beverages segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by rising consumption of smoothies, juices, and flavored drinks globally. Frozen mango puree and chunks are increasingly integrated into ready-to-drink beverages and wellness-focused product lines. The growing popularity of mango-based cocktails, functional beverages, and plant-based formulations across cafes, restaurants, and packaged drink companies is accelerating growth in this category, particularly in North America, Europe, and Asia-Pacific markets.

- By Distribution Channel

On the basis of distribution channel, the frozen mango market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, and Others. The Supermarkets/Hypermarkets segment dominated the market with the largest revenue share of 46.5% in 2024, owing to their wide product assortment, attractive promotions, and ability to maintain strong cold-chain storage for frozen goods. Consumers prefer these outlets for bulk purchases, discounts, and access to both domestic and international frozen fruit brands.

The Online Retail segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing internet penetration, the rise of e-commerce grocery platforms, and growing consumer preference for doorstep delivery of frozen products. Online channels also enable wider access to premium and imported frozen mango products, supported by subscription models and promotional bundles. The convenience of 24/7 availability, coupled with expanding cold logistics in last-mile delivery, is set to boost online sales growth significantly.

Which Region Holds the Largest Share of the Frozen Mango Market?

- North America dominated the frozen mango market with the largest revenue share of 41.85% in 2024, driven by rising demand for convenient, ready-to-eat fruits and increasing consumer preference for healthy snacking options

- Consumers in the region value the availability of mangoes year-round in frozen form, as well as their versatility in smoothies, desserts, and functional beverages

- The strong presence of leading players such as Dole Food Company, Del Monte, and SunOpta, combined with advanced cold chain infrastructure, supports widespread adoption. Higher disposable incomes and growing health awareness further reinforce the market’s growth, making frozen mangoes a staple in both retail and foodservice sectors

U.S. Frozen Mango Market Insight

The U.S. frozen mango market captured the largest revenue share in 2024 within North America, fueled by the country’s strong demand for smoothie ingredients, desserts, and natural snacks. The trend toward clean-label and plant-based diets is also accelerating frozen mango consumption. The U.S. benefits from a robust retail and e-commerce distribution network, ensuring easy access to diverse product forms such as diced mangoes, puree, and blends. Increasing use of frozen mangoes in foodservice outlets, cafés, and restaurants, alongside home consumption, is driving steady growth.

Europe Frozen Mango Market Insight

The Europe frozen mango market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising demand for exotic fruits, increasing urbanization, and consumer focus on healthy diets. European consumers are embracing frozen mangoes due to their convenience, consistent quality, and year-round availability. Countries in the region are seeing frozen mangoes incorporated into bakery, confectionery, and dairy recipes. Strong cold chain infrastructure and the presence of major retailers in Western Europe are fostering adoption, while growing vegan and smoothie culture is further boosting demand.

U.K. Frozen Mango Market Insight

The U.K. frozen mango market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the growing popularity of smoothies, juices, and tropical fruit-based snacks. Rising consumer health awareness, coupled with a preference for easy-to-prepare food, has significantly boosted demand. The U.K.’s strong e-commerce grocery sector and retail presence have made frozen mangoes widely available to households. Foodservice outlets and restaurants are also incorporating frozen mangoes into innovative recipes, further stimulating market expansion.

Germany Frozen Mango Market Insight

The Germany frozen mango market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s focus on sustainability, nutrition, and convenience. German consumers are increasingly adopting frozen fruits as part of healthy lifestyles, with frozen mangoes gaining traction in the preparation of smoothies, yogurts, and desserts. The well-developed retail sector and emphasis on organic and clean-label frozen products are fueling demand. Moreover, the food processing industry is utilizing frozen mango puree and dices in bakery and dairy applications, further strengthening market growth.

Which Region is the Fastest Growing Region in the Frozen Mango Market?

Asia-Pacific frozen mango market is poised to grow at the fastest CAGR of 4.36% during 2025–2032, driven by rapid urbanization, increasing disposable incomes, and rising adoption of convenient food products. The region’s strong mango cultivation base, particularly in India, Vietnam, and Thailand, ensures abundant supply for frozen processing and exports. Growing middle-class populations and the expansion of supermarkets and online grocery channels are broadening consumer access. The rising popularity of smoothies, tropical fruit beverages, and desserts across APAC further supports demand, making it the fastest growing market.

Japan Frozen Mango Market Insight

The Japan frozen mango market is gaining momentum due to rising health awareness, urban lifestyles, and the preference for convenience in meal preparation. Japanese consumers are increasingly incorporating frozen mangoes into smoothies, desserts, and functional beverages. The country’s aging population is also contributing to demand for easy-to-use, ready-to-eat fruit products. In addition, premium and imported frozen mango offerings are appealing to health-conscious consumers, while foodservice outlets are expanding their use of mango-based menu items.

China Frozen Mango Market Insight

The China frozen mango market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s large consumer base, expanding middle class, and rapid urbanization. The market is growing strongly in both retail and foodservice sectors, with frozen mangoes widely used in juices, dairy products, and desserts. China’s domestic production, combined with imports from Southeast Asian countries, ensures steady supply. Government-backed initiatives to strengthen cold chain logistics, along with growing adoption of frozen fruits in e-commerce platforms, are further driving growth in the market.

Which are the Top Companies in Frozen Mango Market?

The frozen mango industry is primarily led by well-established companies, including:

- Ardo (Belgium)

- SunOpta Inc. (Canada)

- Dole Food Company, Inc. (U.S.)

- Capricorn Food Products India Ltd. (India)

- Sunkist Growers, Inc. (U.S.)

- Kanegrade (U.K.)

- Xiamen Sinofrost (China)

- Kiril Mischeff (U.K.)

- Dole Food Company Inc. (U.S.)

- Ardo (Belgium)

- SunOpta Inc. (Canada)

- Nafoods Group (Vietnam)

- SICOLY (France)

- Capricorn Food Products India Ltd. (India)

- A Sunkist Growers Inc. (U.S.)

- Tropicool Foods Pvt. Ltd. (India)

- Del Monte Foods (U.S.)

- Doveco (Vietnam)

- Agro Products & Agencies (India)

- Kanegrade (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frozen Mango Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Mango Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Mango Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.