Global Frozen Pet Food Market

Market Size in USD Million

CAGR :

%

USD

24.26 Million

USD

39.96 Million

2025

2033

USD

24.26 Million

USD

39.96 Million

2025

2033

| 2026 –2033 | |

| USD 24.26 Million | |

| USD 39.96 Million | |

|

|

|

|

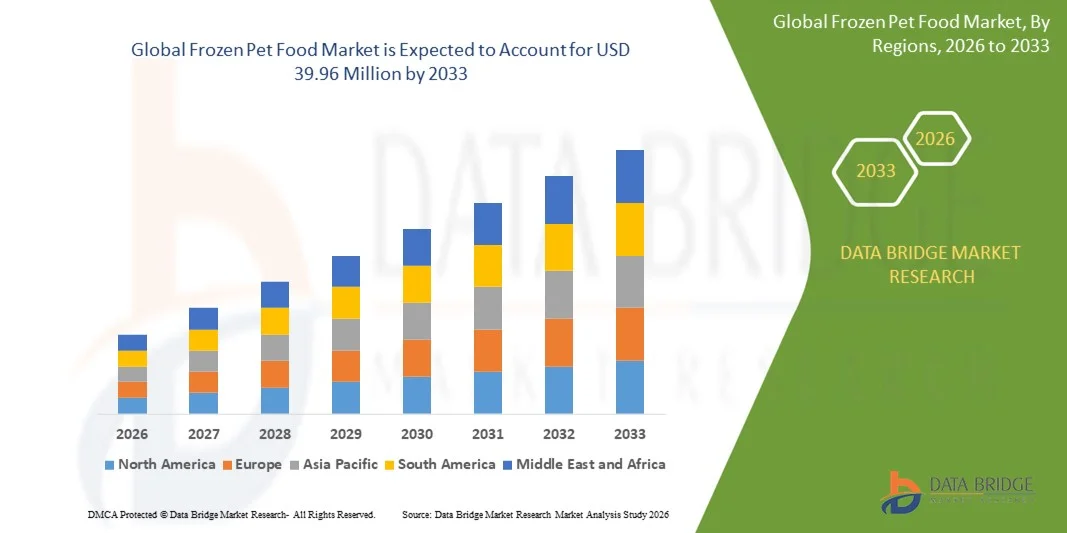

What is the Global Frozen Pet Food Market Size and Growth Rate?

- The global frozen pet food market size was valued at USD 24.26 million in 2025 and is expected to reach USD 39.96 million by 2033, at a CAGR of 5.70% during the forecast period

- Rising consumer preference for high-quality, minimally processed, and nutrient-rich pet food products is one of the primary drivers boosting market expansion. Growing awareness regarding pet health, digestive wellness, and immunity enhancement is increasing demand for raw, freeze-preserved, and natural pet diets

- Increasing adoption of premium, grain-free, and additive-free pet nutrition, coupled with rising pet humanization and higher spending on companion animal wellbeing, further accelerates market growth

- In addition, the shift toward clean-label, protein-rich, and veterinarian-recommended frozen formulations supports strong demand across developed and emerging markets. As urban pet ownership rises globally, the frozen pet food market continues to gain traction due to its superior nutritional value and freshness retention

What are the Major Takeaways of Frozen Pet Food Market?

- Growing awareness of health benefits, including improved digestion, better skin and coat health, and stronger immunity, is significantly driving consumer adoption of frozen pet diets. Rising disposable income, preference for premium feeding formats, and rapid expansion of specialty pet retail channels further contribute to market growth.

- Ongoing product innovations, such as species-specific blends, organic-certified recipes, high-protein raw formulations, and functional additions such as probiotics and omega-3s, are creating new revenue opportunities for manufacturers

- North America dominated the frozen pet food market with a 41.2% revenue share in 2025, supported by strong consumer demand for premium, natural, and minimally processed pet nutrition across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.85% from 2026 to 2033, driven by rising pet ownership in China, Japan, India, and South Korea, along with increasing demand for premium, natural, and fresh pet nutrition

- The Dogs segment dominated the market with a revenue share of 61.8% in 2025, driven by the high adoption of premium raw diets, growing pet humanization, and increasing demand for high-protein, biologically appropriate meals

Report Scope and Frozen Pet Food Market Segmentation

|

Attributes |

Frozen Pet Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Frozen Pet Food Market?

Rising Demand for Nutrient-Enriched and Multi-Functional Frozen Pet Foods

- The frozen pet food market is witnessing strong growth toward nutrient-dense, multifunctional, and clean-label pet nutrition, incorporating superfoods, probiotics, omega-fatty acids, and high-quality proteins to enhance pet health, digestion, and immunity

- Manufacturers are increasingly developing multi-purpose frozen formulations that support digestive wellness, weight management, skin health, and allergy control, catering to rising demand for functional, human-grade pet diets

- Consumers are shifting toward natural, minimally processed, preservative-free pet foods, replacing traditional kibble with safer, more nutritious frozen options that align with premium pet-parenting trends

- For instance, brands such as Wellness, Primal Pet Foods, Full Moon Pet, and The Crump Group have expanded their portfolios with gently cooked, raw, and air-dried frozen formats enriched with functional ingredients

- Growing awareness of pet obesity prevention, digestive health, longevity, and clean-label nutrition continues to boost adoption globally

- As pet owners prioritize health-focused, high-protein, and biologically appropriate diets, Frozen Pet Foods are becoming a central innovation area within the premium pet nutrition industry

What are the Key Drivers of Frozen Pet Food Market?

- Rising consumer shift toward natural, minimally processed, high-protein, and functional pet diets is driving rapid adoption of frozen pet foods globally

- In 2025, companies such as Primal Pet Foods, Full Moon Pet, and We Feed Raw expanded frozen and freeze-dried product lines targeting digestive health, muscle development, and overall vitality

- Increasing awareness of pet obesity, allergies, digestive disorders, and the need for high-quality animal proteins is accelerating growth across North America, Europe, and Asia-Pacific

- Advancements in cold-chain logistics, flash-freezing technology, and gently cooked processes have improved product safety, nutrient retention, and palatability

- Rising demand for organic, human-grade, grain-free, and non-GMO pet foods is further fueling market expansion, supported by premiumization trends and rising pet ownership

- With ongoing investments in R&D, sustainability-focused packaging, retail expansion, and subscription-based frozen delivery services, the frozen pet food market is set to maintain strong momentum in the coming years

Which Factor is Challenging the Growth of the Frozen Pet Food Market?

- High costs associated with raw material sourcing, cold-chain storage, refrigeration, and transportation make Frozen Pet Foods less affordable in price-sensitive markets

- For instance, during 2024–2025, fluctuations in meat prices, supply chain disruptions, and increased energy costs impacted production and distribution for multiple manufacturers

- Stringent regulations concerning food safety, pathogen control, and raw diet compliance add operational complexity and raise production timelines

- Limited consumer awareness in developing regions about the nutritional benefits of frozen pet diets restricts broader adoption

- Strong competition from freeze-dried, air-dried, dehydrated, and premium kibble alternatives creates pricing pressure and challenges product differentiation

- To address these challenges, companies are focusing on scalable production, cost-efficient sourcing, improved cold-chain capabilities, and consumer education to strengthen global acceptance of Frozen Pet Foods

How is the Frozen Pet Food Market Segmented?

The market is segmented on the basis of pet type, product type, retail channel, flavor, and packaging type.

- By Pet Type

On the basis of pet type, the frozen pet food market is segmented into Dogs, Cats, Fish, Birds, and Small Animals. The Dogs segment dominated the market with a revenue share of 61.8% in 2025, driven by the high adoption of premium raw diets, growing pet humanization, and increasing demand for high-protein, biologically appropriate meals. Dog owners prefer frozen raw and cooked formats due to perceived digestive benefits, improved skin health, and better energy levels.

The Cats segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising ownership of indoor cats, higher spending on feline nutrition, and increasing demand for minimally processed, grain-free, and high-meat-content diets. Premiumization trends, veterinarian recommendations, and growth in freeze-thawed formulations continue to support rapid adoption. The remaining categories—Fish, Birds, and Small Animals—maintain niche demand driven by specialty pet owners.

- By Product Type

On the basis of product type, the frozen pet food market is segmented into Frozen Raw Food, Frozen Cooked Food, and Frozen Treats. The Frozen Raw Food segment dominated the market with a revenue share of 54.3% in 2025, attributed to the growing popularity of biologically appropriate raw diets (BARF), rising awareness of minimally processed nutrition, and strong acceptance across North America and Europe. Raw blends containing organ meats, bones, and natural enzymes are preferred for digestive and immune health support.

The Frozen Treats segment is projected to grow at the fastest CAGR from 2026 to 2033 due to increasing demand for functional treats, clean-label ingredients, and seasonal frozen snacks for cooling and enrichment. Rising premiumization in pet snacking categories and innovation in flavors such as pumpkin, yogurt, and meat-based popsicles is accelerating adoption. Frozen Cooked Food provides a balanced middle ground, appealing to owners seeking safety along with home-style nutrition.

- By Retail Channel

The frozen pet food market is segmented into Pet Specialty Stores, Mass Merchandisers, Grocery Stores, Online Retailers, and Veterinarians. Pet Specialty Stores dominated the market with a revenue share of 46.9% in 2025, driven by higher availability of premium frozen diets, temperature-controlled storage, expert guidance, and strong customer loyalty. These stores often carry raw frozen blends, customized diets, and exclusive premium brands, making them the preferred offline channel.

The Online Retailers segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by expanding e-commerce platforms, home-delivery convenience, and rising adoption of subscription models for frozen pet meals. Consumers increasingly prefer online ordering due to bulk-pack options, frozen-specific logistics improvements, better assortment, and price transparency.

- By Flavor

On the basis of flavor, the frozen pet food market is segmented into Chicken, Beef, Fish, Lamb, Duck, Rabbit, and Venison. The Chicken segment dominated the market with a revenue share of 39.7% in 2025, owing to its wide availability, high digestibility, cost-effectiveness, and suitability for pets with sensitive stomachs. Chicken-based frozen diets are favored for their balanced protein-fat ratio, palatability, and compatibility with mixed raw or cooked feeding programs.

The Fish segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for omega-rich formulations, hypoallergenic diets, and the growing preference for sustainable seafood-based pet nutrition. Fish-based frozen food is increasingly used in both dogs and cats with skin allergies or protein sensitivities.

- By Packaging Type

The frozen pet food market is segmented into pouches, tubs, bags, and boxes. the pouches segment dominated the market with a revenue share of 44.2% in 2025, supported by their convenience, leak-proof structure, portion-controlled packaging, and suitability for frozen storage. Pouches help retain freshness, reduce freezer space usage, and provide easy thaw-and-serve functionality, making them highly preferred among urban pet owners.

The Tubs segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for reusable packaging, premium cooked meals, and family-sized frozen portions. Tubs offer durability, product visibility, and better sealing for maintaining texture and moisture.

Which Region Holds the Largest Share of the Frozen Pet Food Market?

- North America dominated the frozen pet food market with a 41.2% revenue share in 2025, supported by strong consumer demand for premium, natural, and minimally processed pet nutrition across the U.S. and Canada

- Rising adoption of raw and cooked frozen diets, pet humanization trends, and willingness to spend on high-quality foods fuel market leadership. Growing preference for grain-free, high-protein, and species-appropriate diets strengthens regional growth, along with robust cold-chain infrastructure and strong penetration of specialty pet retailers

- Leading manufacturers are expanding frozen product portfolios through innovations in raw blends, single-protein recipes, freeze–thaw stability, and pathogen-control technologies. Increased focus on clean-label claims, organic ingredients, and veterinarian-endorsed formulations further supports the region’s dominance

U.S. Frozen Pet Food Market Insight

The U.S. is the largest contributor in North America, driven by high demand for premium raw diets, fresh-cooked frozen meals, and functional formulations targeting digestion, skin health, and immunity. Manufacturers are investing in advanced cold-chain logistics, high-pressure processing (HPP), and single-serve frozen meal packs to enhance safety and convenience. Strong presence of pet specialty stores, rising subscription-based deliveries, and widespread consumer preference for clean-label, preservative-free pet foods further support market expansion across the country.

Canada Frozen Pet Food Market Insight

Canada contributes significantly to regional growth, fueled by rising preference for natural, organic, and human-grade frozen pet foods. Increasing consumer awareness regarding high-protein diets, allergen-free formulations, and raw feeding benefits is driving adoption across both dogs and cats. Manufacturers and retailers are expanding frozen product lines, including cooked meals, blends, and freeze–thaw variants, supported by growing penetration of specialty pet stores and e-commerce platforms.

Asia-Pacific Frozen Pet Food Market Insight

Asia-Pacific is projected to register the fastest CAGR of 8.85% from 2026 to 2033, driven by rising pet ownership in China, Japan, India, and South Korea, along with increasing demand for premium, natural, and fresh pet nutrition. Rapid urbanization, growing disposable incomes, and the popularity of Western-style pet care trends are boosting adoption of frozen raw and cooked diets. Expansion of online retail, cold-chain logistics, and premium imported brands is improving accessibility and accelerating regional growth.

China Frozen Pet Food Market Insight

China is the largest contributor within Asia-Pacific, supported by rising spending on premium pet nutrition, growing popularity of raw feeding, and rapid expansion of domestic and international frozen pet food brands. Investments in cold-chain infrastructure, high-quality proteins, and HPP technology are strengthening product quality and safety. Increasing online retail penetration further boosts market reach across urban centers.

Japan Frozen Pet Food Market Insight

Japan shows steady growth, driven by high consumer focus on quality, safety, and functional nutrition for aging pets. Frozen raw and gently-cooked meals are gaining traction due to rising preference for minimally processed foods. Strong retail networks, premium product positioning, and innovations in small-portion frozen packs continue to support adoption.

India Frozen Pet Food Market Insight

India is emerging as a key growth market due to rapid growth in pet ownership, rising income levels, and increasing awareness of fresh and natural pet diets. Urban consumers are showing higher interest in frozen raw and cooked products for digestive health and overall wellness. Expansion of e-commerce platforms and premium retail outlets is boosting market penetration in metropolitan cities.

South Korea Frozen Pet Food Market Insight

South Korea contributes significantly due to strong preference for premium, human-grade pet foods, rising influence of wellness trends, and growing popularity of functional frozen diets. Social media, pet cafés, and K-lifestyle trends are accelerating demand for high-quality, species-appropriate meals. Innovations in flavors, packaging, and nutritional blends support rapid category expansion.

Which are the Top Companies in Frozen Pet Food Market?

The frozen pet food industry is primarily led by well-established companies, including:

- PetSmart LLC (U.S.)

- Stella & Chewy’s LLC (U.S.)

- Primal Pet Foods Inc. (U.S.)

- K9 Natural (New Zealand)

- Champion Petfoods (Canada)

- Canvasback Pet Supplies (U.S.)

- Carnivore Meat Company LLC (U.S.)

- Steve’s Real Food (U.S.)

- Kiezebrink (Netherlands)

- Northwest Naturals (U.S.)

- Raw Paws Pet Food (U.S.)

- Bravo (U.S.)

- Tucker’s (U.S.)

- Stewart Brand Dog Food (U.S.)

- Wisconsin Freeze Dried (U.S.)

- Canature Processing Ltd. (Canada)

- Vital Essentials (U.S.)

- Fresh Is Best (U.S.)

- Petfoods (Mars Petcare US, Inc.) (U.S.)

- Carnivora (Canada)

What are the Recent Developments in Global Frozen Pet Food Market?

- In November 2025, The Crump Group Inc. brand Caledon Farms introduced a new gently cooked range of Fresh Frozen dog food, marking the company’s first foray into the pet food category and strengthening its presence in the premium nutrition segment, concluding that this launch will significantly enhance its competitiveness in the frozen pet food market

- In June 2025, Japanese seafood company Maruha Nichiro Corporation (MNC) established a new pet food business promotional office, enabling the company to expand its innovation capabilities while simultaneously launching frozen pet food for dogs, concluding that this strategic move will elevate MNC’s footprint in the global pet nutrition industry

- In June 2025, Full Moon Pet rolled out a human-grade, air-dried dog food line named Pure Protein, designed as a minimally processed, high-protein, shelf-stable substitute for traditional kibble and positioned as a safer option than freeze-dried or raw formats, concluding that this product line is expected to attract pet owners seeking premium and convenient feeding solutions

- In March 2025, We Feed Raw launched its new Freeze-Dried Raw Food for Dogs, aiming to make raw feeding more accessible while preserving high nutritional value and convenience for pet owners, concluding that this launch will broaden its appeal among consumers seeking raw, nutrient-rich alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Frozen Pet Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Frozen Pet Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Frozen Pet Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.