Global Fruit Flavors Market

Market Size in USD Billion

CAGR :

%

USD

34.30 Billion

USD

69.88 Billion

2025

2033

USD

34.30 Billion

USD

69.88 Billion

2025

2033

| 2026 –2033 | |

| USD 34.30 Billion | |

| USD 69.88 Billion | |

|

|

|

|

Fruit Flavors Market Size

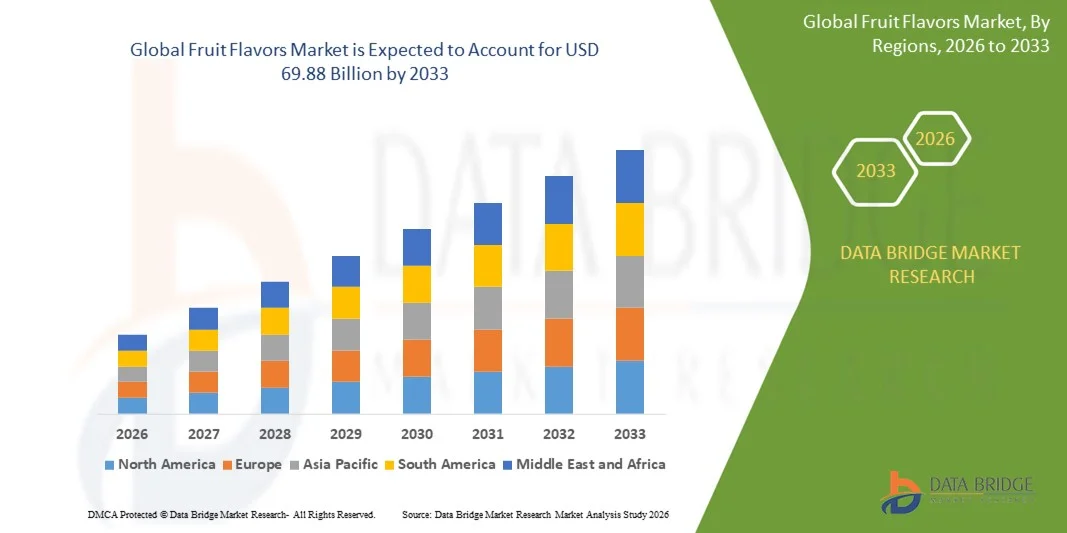

- The global fruit flavors market size was valued at USD 34.30 billion in 2025 and is expected to reach USD 69.88 billion by 2033, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by rising consumer preference for flavorful and clean-label food and beverage products, driven by growing demand for natural, fruit-based ingredients across categories such as beverages, confectionery, dairy, and bakery. Increasing product innovation focused on exotic and functional fruit flavors is further accelerating adoption among manufacturers seeking to enhance sensory appeal and meet evolving taste preferences

- Furthermore, the expanding processed and packaged food industry, supported by urbanization, higher disposable incomes, and shifting dietary habits, is boosting the integration of fruit flavors in ready-to-drink beverages, snacks, nutritional products, and flavored dairy formulations. These converging factors are amplifying the use of both natural and synthetic fruit flavors, thereby strengthening overall market growth

Fruit Flavors Market Analysis

- Fruit flavors, used to enhance taste, aroma, and product identity across a wide range of food, beverage, pharmaceutical, and personal care applications, are becoming increasingly essential due to rising consumer expectations for authentic, refreshing, and diverse flavor profiles. Their ability to improve sensory experience while supporting product differentiation makes them a critical component for manufacturers

- The escalating demand for fruit flavors is primarily fueled by shifting consumer inclination toward natural flavors, premiumization trends in beverages, and strong innovation in flavor blending technologies that enable more stable, intense, and authentic fruit notes. The growing popularity of tropical and exotic fruit flavors and the rising use of flavor systems in functional and health-focused products are further enhancing market expansion

- Asia-Pacific dominated the fruit flavors market with a share of 36.6% in 2025, due to expanding food and beverage production, rising consumption of flavored beverages, and a strong presence of flavor manufacturing hubs

- North America is expected to be the fastest growing region in the fruit flavors market during the forecast period due to strong demand for flavored ready-to-drink beverages, rising innovation in functional foods, and increasing reliance on high-purity natural flavors

- Natural segment dominated the market with a market share of 59.2% in 2025, due to rising consumer preference for clean-label, plant-derived, and transparently sourced ingredients across food, beverage, and health categories. Brands continue reformulating legacy products using natural fruit concentrates, organic flavor extracts, and solvent-free distillates to strengthen safety perception and regulatory compliance. Increasing awareness of additive-free diets enhances demand for natural flavor solutions with minimal processing and high fruit authenticity. The segment benefits from government guidelines encouraging natural ingredient adoption in nutritional products, creating steady utilization across mass and premium segments. Growing innovation in natural extraction technologies also supports enhanced stability, aroma retention, and flavor intensity, reinforcing its market leadership

Report Scope and Fruit Flavors Market Segmentation

|

Attributes |

Fruit Flavors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fruit Flavors Market Trends

Rising Demand for Natural and Clean-Label Fruit Flavors

- The prevailing trend is the pronounced consumer migration toward natural and authentic fruit flavors, moving away from synthetic alternatives due to increased health consciousness and a desire for transparency. This shift is driving flavor manufacturers to invest heavily in advanced extraction technologies to capture the true, delicate profiles of natural fruits without using artificial additives

- For instance, Symrise AG, a global leader in the flavor industry, has made significant commitments to its natural flavor portfolio by utilizing cutting-edge techniques such as bio-fermentation to create highly authentic fruit flavors that meet stringent clean-label standards. This innovation allows the company to deliver complex, clean-tasting flavors such as natural yuzu and cold-pressed citrus extracts, which resonate strongly with ingredient-savvy consumers

- There is a noticeable acceleration in the demand for exotic and tropical fruit flavor profiles such as passion fruit, yuzu, lychee, and mango. Consumers are seeking adventurous and unique taste experiences that go beyond the traditional apple, orange, or strawberry, which encourages brands to differentiate their product offerings with novel taste combinations

- The market is observing a significant movement toward flavor pairing and complexity, where fruit notes are often blended with complementary non-fruit flavors such as botanicals, herbs, or spices. This strategy creates sophisticated and layered taste experiences in final products, such as incorporating cucumber with lime or basil with strawberry in craft beverages and yogurts

- The integration of fruit flavors into functional products is increasing, positioning these flavors as essential components in the growth of the nutraceutical and wellness segments. Fruit flavors are vital for improving the palatability of functional ingredients such as protein, collagen, and vitamins in supplements, health shots, and meal replacement powders

- Ultimately, the confluence of consumer preference for natural ingredients, a demand for unique taste profiles, and the necessity for clean labeling is compelling the entire flavor industry to prioritize sustainable sourcing and technological innovation in fruit flavor creation. This ensures that the authentic taste, color, and aroma of real fruit can be consistently and economically delivered across a diverse range of food and beverage applications

Fruit Flavors Market Dynamics

Driver

Growing Consumption of Flavored Beverages and Processed Foods

- The massive and sustained growth in the consumption of flavored beverages, in addition to the ever-increasing market for convenience and processed foods, acts as a fundamental and powerful driver for the fruit flavors market. The food and beverage industry constantly requires new and appealing fruit flavors to satisfy consumer demand for variety and product differentiation in crowded categories such as soft drinks, juices, and snacks

- For instance, PepsiCo, Inc. consistently drives demand for fruit flavors by launching new variants of its flavored carbonated soft drinks, sports drinks such as Gatorade, and enhanced water beverages with exotic and familiar fruit profiles such as watermelon and mixed berries. The strategic use of innovative fruit flavors is crucial for the company to capture market share among consumers who are transitioning from traditional sugary drinks to more complex and naturally flavored options

- The expansion of the dairy and confectionery sectors globally is another key factor fueling the demand for fruit flavors, as these tastes are essential for a vast array of products such as yogurts, ice creams, candies, and baked goods. Fruit flavors provide the necessary profile for product lines that cater to indulgence, as well as those that target healthier segments such as low-fat or high-protein dairy alternatives

- The global trend of urbanization and increasing disposable incomes in emerging economies is directly correlated with a rise in the consumption of processed and packaged food products, which universally rely on added fruit flavors for consistent taste and appeal. This demographic shift is creating huge, new markets for fruit-flavored instant meals, ready-to-eat snacks, and convenient dessert preparations

- The inherent versatility and broad consumer acceptance of fruit flavors allow them to be used effectively across almost every food and beverage matrix, ranging from savory sauces and marinades to infant formulas and alcoholic beverages. This wide applicability ensures that the fruit flavor segment remains indispensable to manufacturers looking to innovate or maintain existing product lines

Restraint/Challenge

Fluctuating Availability and High Cost of Natural Raw Materials

- The inherent volatility in the supply chain for natural fruit raw materials poses a significant and ongoing challenge to the fruit flavors market, particularly concerning the natural and clean-label segment. Global climate change, unpredictable weather patterns, and plant diseases can severely impact fruit harvests, leading to reduced availability and sharp price spikes for key raw materials such as citrus peels or tropical fruit extracts

- For instance, high-profile reports of crop failures or severe weather events in specific regions, such as frost affecting vanilla bean crops or hurricanes damaging citrus groves, have directly resulted in immediate and substantial cost increases for flavor houses and their downstream clients. This high-cost structure makes it difficult for flavor manufacturers to offer natural fruit flavor solutions at a price point competitive with widely available, cost-stable synthetic options

- The complexity and capital intensity of the natural extraction process itself further contribute to the higher production costs of natural fruit flavors compared to chemically synthesized alternatives. Obtaining concentrated flavor extracts from natural fruit sources often requires specialized, high-tech equipment and energy-intensive processes such as solvent extraction or steam distillation, which involve significant overhead expenses

- The sustainability and ethical sourcing requirements increasingly demanded by consumers add a layer of financial and logistical burden to flavor manufacturers who must invest in certified fair-trade or organic raw materials. This need to trace and verify the ethical origin of fruits such as berries or exotic extracts limits the pool of potential suppliers and drives up the procurement costs for compliant ingredients

- The combined effect of unpredictable supply from agricultural sources, high processing technology costs, and increasing ethical sourcing demands creates a significant barrier to entry and expansion for natural fruit flavor manufacturers. These factors ultimately limit the affordability of clean-label products for a broader consumer base, especially when compared to the readily available and consistently priced synthetic fruit flavorings

Fruit Flavors Market Scope

The market is segmented on the basis of flavor type, nature, form, and application.

- By Flavor Type

On the basis of flavor type, the fruit flavors market is segmented into berries flavors, stone fruit flavors, tropical and exotic flavors, citrus flavors, apple and pears flavors, and others. The citrus flavors segment dominated the market in 2025 due to its extensive usage across beverages, confectionery, dairy, and nutritional products, supported by its strong global familiarity and consumer preference for refreshing taste profiles. Manufacturers increasingly rely on citrus bases since they offer versatile formulation properties suitable for both high-acid beverages and fortified food items. The demand is further strengthened by rising health consciousness as citrus associations with freshness and vitamin-rich profiles improve product appeal across categories. Brands also benefit from the availability of cost-effective citrus extracts and concentrates that ensure flavor consistency in large-scale production. The dominance continues as citrus flavors serve as foundational components in multilayer flavor blends used by beverage and bakery manufacturers aiming for balanced sensory experiences.

The tropical and exotic flavors segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising consumer inclination toward innovative, bold, and globally inspired tastes. Increasing popularity of flavors such as mango, passionfruit, guava, lychee, and pineapple is supported by premium beverage launches and cross-cultural snacking trends that elevate demand in mainstream markets. Foodservice chains and beverage brands continue to introduce exotic flavor combinations in smoothies, sparkling drinks, yogurts, and frozen desserts, boosting commercial adoption. Consumers increasingly associate tropical flavors with naturalness and indulgence, strengthening their presence in health-centric categories such as vitamin drinks and functional snacks. The segment’s rapid expansion is further fueled by improved supply chain access for tropical fruit extracts and advanced flavor encapsulation technologies enabling longer shelf life.

- By Nature

On the basis of nature, the fruit flavors market is segmented into natural and synthetic flavors. The natural segment dominated the market with the largest share of 59.2% in 2025 due to rising consumer preference for clean-label, plant-derived, and transparently sourced ingredients across food, beverage, and health categories. Brands continue reformulating legacy products using natural fruit concentrates, organic flavor extracts, and solvent-free distillates to strengthen safety perception and regulatory compliance. Increasing awareness of additive-free diets enhances demand for natural flavor solutions with minimal processing and high fruit authenticity. The segment benefits from government guidelines encouraging natural ingredient adoption in nutritional products, creating steady utilization across mass and premium segments. Growing innovation in natural extraction technologies also supports enhanced stability, aroma retention, and flavor intensity, reinforcing its market leadership.

The synthetic segment is expected to witness the fastest CAGR from 2026 to 2033, driven by strong demand from high-volume food and beverage manufacturers requiring consistent, cost-efficient, and long-lasting flavor solutions. Synthetic flavors offer enhanced stability under heat and processing conditions, making them suitable for confectionery, baked goods, carbonated beverages, and shelf-stable snacks. The segment benefits from the ability to replicate a wide range of fruit profiles with high accuracy while maintaining uniformity across batches and geographies. Cost-effectiveness plays a major role as brands optimize flavor expenses while maintaining desired taste intensity for mass-market products. Ongoing development in advanced flavor chemistry supports improved aroma accuracy and reduced off-notes, contributing to the segment’s rapid expansion.

- By Form

On the basis of form, the fruit flavors market is segmented into liquid, powder, and syrup. The liquid segment dominated the market in 2025 due to its high compatibility with beverage formulations, dairy products, sauces, and bakery fillings that require fast-dissolving and easily blendable flavor systems. Liquid fruit flavors offer superior dispersion in both hot and cold processing environments, which strengthens their adoption in large-scale industrial applications. Manufacturers prefer liquid formats for product consistency and the ability to achieve precise dosing during production. Increasing demand for flavored water, functional drinks, and energy beverages reinforces the dominance of liquid fruit flavors due to strong solubility and stability. Continuous development of water-soluble natural extracts further expands utilization of liquid flavor bases across wellness and nutraceutical applications.

The powder segment is anticipated to witness the fastest growth rate from 2026 to 2033, propelled by rising demand for dry beverage mixes, bakery premixes, instant snacks, and confectionery coatings requiring stable and shelf-resilient flavor formats. Powdered fruit flavors offer extended storage life and improved transportation efficiency, making them cost-effective for manufacturers across global and regional supply chains. The segment benefits from increasing consumption of sports nutrition products, flavored supplements, and fortified powders that depend on encapsulated fruit flavors for aroma protection. Advancements in spray-drying and microencapsulation technologies enhance flavor retention and protect volatile compounds, supporting growing adoption. Rising demand for convenience foods and ready-to-mix drinks further accelerates the expansion of powdered fruit flavor solutions.

- By Application

On the basis of application, the fruit flavors market is segmented into food and beverage, pet food, pharmaceutical, personal care and cosmetic, and others. The food and beverage segment dominated the market in 2025 due to high utilization of fruit flavors across soft drinks, juices, confectionery, dairy products, frozen desserts, and bakery items. Manufacturers rely heavily on fruit bases for enhancing taste familiarity and delivering natural sweetness profiles aligned with evolving health trends. Product launches in flavored yogurts, low-sugar beverages, and plant-based snacks continue to increase the segment size. The wide range of fruit flavors enables brands to experiment with seasonal, regional, and functional variants that strengthen product differentiation. Strong R&D investments toward clean-label and natural formulations further solidify the dominance of the food and beverage segment.

The personal care and cosmetic segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing use of fruit-derived aromatic compounds in skincare, lip care, hair care, and bath products. Consumers increasingly prefer refreshing and naturally inspired fruity profiles that elevate sensory experiences in daily grooming routines. Manufacturers incorporate fruit flavors in lip balms, face masks, shampoos, and body washes to improve product acceptance and create signature aromatic identities. Growth in premium personal care categories supports higher consumption of natural fruit extracts and fruit-inspired fragrance blends. Rising interest in clean beauty and fruit-based actives further expands the adoption of fruit flavors within personal care product formulations.

Fruit Flavors Market Regional Analysis

- Asia-Pacific dominated the fruit flavors market with the largest revenue share of 36.6% in 2025, driven by expanding food and beverage production, rising consumption of flavored beverages, and a strong presence of flavor manufacturing hubs

- The region’s cost-effective manufacturing ecosystem, growing investments in flavor innovation, and increasing exports of fruit-based flavor blends are accelerating market expansion

- The availability of skilled labor, supportive regulatory frameworks, and rapid urbanization across developing economies are contributing to increased utilization of fruit flavors in packaged foods and beverages

China Fruit Flavors Market Insight

China held the largest share in the Asia-Pacific fruit flavors market in 2025 owing to its strong dominance in beverage manufacturing, large-scale fruit processing capabilities, and extensive demand for ready-to-drink products. The country's advanced production facilities, expanding functional beverage segment, and high consumption of flavored snacks are major growth drivers. Rising investments in natural and clean-label flavor development further support increasing adoption across food categories.

India Fruit Flavors Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion in the packaged food sector, increasing demand for flavored dairy and beverage products, and rising influence of Western flavor trends. The growing presence of global beverage brands, in addition to strong domestic production of fruit-based snacks and juices, is strengthening market growth. Increasing investment in flavor R&D facilities and ongoing diversification of regional taste profiles are contributing to strong market expansion.

Europe Fruit Flavors Market Insight

The Europe fruit flavors market is expanding steadily, supported by stringent quality regulations, rising demand for high-purity natural flavors, and growing investments in sustainable and premium food production. The region emphasizes clean-label ingredients, flavor authenticity, and advanced formulation technologies, especially in dairy, confectionery, and beverages. Increasing use of specialty fruit flavors in plant-based food products is further enhancing market growth.

Germany Fruit Flavors Market Insight

Germany’s fruit flavors market is driven by its strong processed food and beverage manufacturing base, high demand for premium and natural flavor systems, and a well-established network of flavor technology innovators. The country’s emphasis on quality, advanced R&D partnerships, and preference for sustainable flavor solutions supports continuous innovation. Demand remains strong in confectionery, bakery, dairy, and functional beverages segments.

U.K. Fruit Flavors Market Insight

The U.K. market is supported by a mature food processing sector, growing demand for flavored wellness beverages, and rising focus on reformulation of products using natural fruit flavors. With increasing investments in R&D, expanding private-label food brands, and strong consumer interest in exotic and seasonal flavor profiles, the U.K. continues to play an important role in the region’s flavor innovation landscape.

North America Fruit Flavors Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for flavored ready-to-drink beverages, rising innovation in functional foods, and increasing reliance on high-purity natural flavors. Growing investments in product reformulation, advancements in encapsulated flavor technologies, and increasing collaboration between food manufacturers and flavor houses are contributing to rapid market expansion.

U.S. Fruit Flavors Market Insight

The U.S. accounted for the largest share in the North America fruit flavors market in 2025, supported by its expansive packaged food industry, strong beverage innovation pipeline, and extensive adoption of fruit flavors in snacks, dairy, and wellness drinks. The country’s focus on natural ingredients, flavor diversification, and premium formulation capabilities strengthens market leadership. Presence of leading flavor manufacturers and advanced distribution networks further solidifies the U.S.’s dominant position in the region.

Fruit Flavors Market Share

The fruit flavors industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- ADM (U.S.)

- Givaudan (Switzerland)

- Kerry Group (Ireland)

- International Flavors & Fragrances, Inc. (U.S.)

- Firmenich SA (Switzerland)

- Symrise (Germany)

- MANE (France)

- Taiyo International (U.S.)

- T. Hasegawa Inc. (Japan)

- Synergy Flavors (U.S.)

- Sensient Technologies Corporation (U.S.)

- Bell Flavors & Fragrances (U.S.)

- Flavorchem (U.S.)

- Takasago International Corporation (Japan)

- Keva Flavours Pvt. Ltd. (India)

- Huabao International Holdings Limited (China)

- Tate & Lyle (U.K.)

- Robertet (France)

- McCormick & Company, Inc. (U.S.)

- Wanxiang International Ltd. (China)

- TREATT (U.K.)

- China Flavors & Fragrances Co. Ltd. (China)

- Lucta (Spain)

- Solvay (Belgium)

Latest Developments in Global Fruit Flavors Market

- In October 2024, Symrise AG expanded its tropical flavor range with new clean-label fruit variants, strengthening its capability to support brands focusing on natural, traceable ingredients. This development enhances Symrise’s influence in the fruit flavors market by enabling manufacturers to create differentiated products with richer sensory profiles, improved formulation flexibility, and a stronger appeal to health-conscious consumers seeking authentic taste experiences

- In September 2024, Givaudan SA entered a partnership with a leading beverage manufacturer to co-develop advanced citrus flavor systems tailored for low-sugar and functional drink formulations. This collaboration reinforces Givaudan’s leadership in flavor innovation by combining its R&D expertise with real-time market insights, accelerating the rollout of next-generation fruit flavor solutions designed to meet evolving consumer preferences for refreshing, better-for-you beverages

- In July 2024, Sensient Technologies launched a new line of natural berry concentrates engineered to deliver superior color stability, high flavor retention, and clean-label compatibility. This launch strengthens Sensient’s market position by addressing key technical challenges in beverage and nutrition applications, allowing brands to maintain product consistency, enhance visual appeal, and respond to rising demand for naturally sourced fruit components

- In March 2024, Firmenich SA expanded its citrus processing facility to improve extraction efficiency, increase production capacity, and ensure consistent supply of high-purity citrus ingredients. This investment supports Firmenich’s long-term strategy to meet the accelerating global demand for natural fruit flavors while helping manufacturers reduce sourcing risks, streamline operations, and develop more stable and high-impact citrus-based formulations

- In January 2024, Kerry Group plc acquired a specialized natural flavor producer to strengthen its portfolio of fruit-derived flavor solutions across food, beverage, and nutritional segments. This acquisition enhances Kerry’s ability to deliver more customized, health-aligned formulations and positions the company more competitively by expanding its technical capabilities, broadening its customer reach, and accelerating innovation in the natural fruit flavors market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fruit Flavors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fruit Flavors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fruit Flavors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.