Global Fuel Cell Power Train Market

Market Size in USD Million

CAGR :

%

USD

774.52 Million

USD

54,028.64 Million

2024

2032

USD

774.52 Million

USD

54,028.64 Million

2024

2032

| 2025 –2032 | |

| USD 774.52 Million | |

| USD 54,028.64 Million | |

|

|

|

|

What is the Global Fuel Cell Power Train Market Size and Growth Rate?

- The global fuel cell power train market size was valued at USD 774.52 million in 2024 and is expected to reach USD 54028.64 million by 2032, at a CAGR of70.00% during the forecast period

- The fuel cell powertrain market is experiencing significant growth, driven by increasing environmental regulations and a rising demand for clean energy solutions. Fuel cell powertrains, which use hydrogen to generate electricity, are emerging as a promising alternative to conventional internal combustion engines due to their zero-emission benefits and high efficiency

What are the Major Takeaways of Fuel Cell Power Train Market?

- The market is expanding as both government initiatives and corporate investments focus on advancing hydrogen infrastructure and fuel cell technologies

- Key factors propelling market growth include stringent emission standards, advancements in hydrogen storage and fuel cell technology, and growing investments in research and development. Governments worldwide are implementing policies and providing incentives to promote the adoption of hydrogen fuel cell vehicles, contributing to market expansion

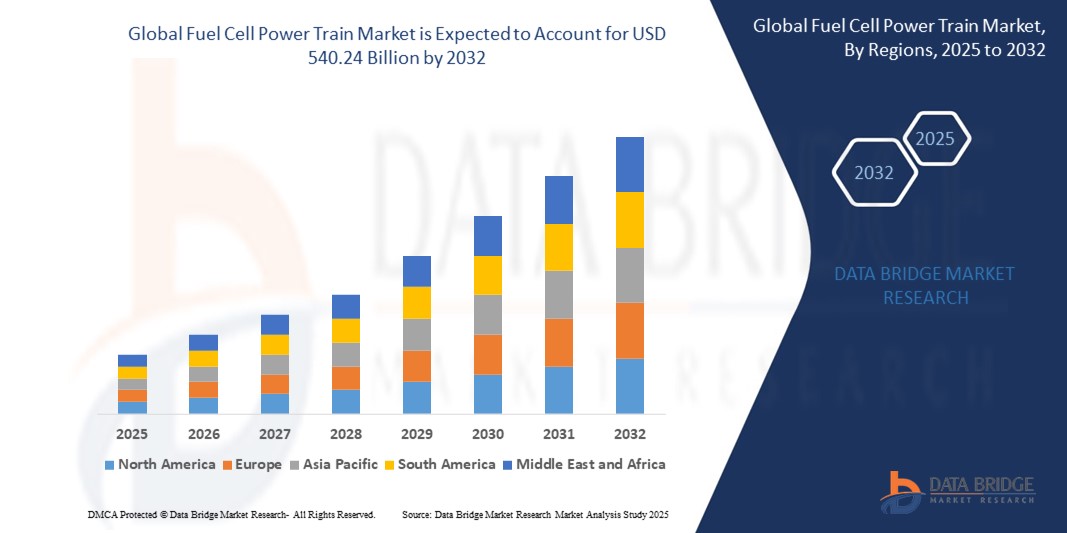

- Asia-Pacific dominated the fuel cell power train market with the largest revenue share of 46.5% in 2024, driven by rising investments in clean mobility, favorable government policies for hydrogen infrastructure, and increasing production of fuel cell vehicles across countries such as China, Japan, and South Korea

- North America fuel cell power train market is poised to grow at the fastest CAGR of 18.7% from 2025 to 2032, fueled by increasing investments in clean energy, growing demand for zero-emission vehicles, and the development of robust hydrogen refueling infrastructure across the U.S. and Canada

- The Fuel Cell System segment dominated the fuel cell power train market with the largest market revenue share of 47.5% in 2024, driven by the critical role of fuel cell stacks in generating electricity from hydrogen to power the vehicle

Report Scope and Fuel Cell Power Train Market Segmentation

|

Attributes |

Fuel Cell Power Train Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fuel Cell Power Train Market?

“Rising Integration of Hydrogen Technologies with Advanced AI for Efficiency Optimization”

- A significant and rapidly emerging trend in the global fuel cell power train market is the growing integration of Artificial Intelligence (AI) and advanced data analytics to optimize system performance, fuel efficiency, and real-time diagnostics. AI-powered solutions are enabling better monitoring and control of fuel cell operations, driving efficiency, durability, and operational cost savings

- For instance, companies are developing AI platforms that analyze vehicle performance data to predict fuel cell health, suggest maintenance schedules, and optimize hydrogen consumption based on driving patterns and environmental conditions. This predictive maintenance approach helps reduce downtime and improves system longevity

- AI integration also enhances vehicle control systems, ensuring optimal energy management by balancing fuel cell output with battery and power electronics in hybrid configurations. This technology is especially relevant in heavy-duty commercial vehicles where efficiency and range are critical

- Moreover, AI-powered digital twins are being implemented by leading manufacturers to simulate fuel cell system behavior under different operating scenarios, allowing for continuous improvement and faster troubleshooting

- Companies such as Bosch, Cummins, and Plug Power are investing in smart Fuel Cell Power Train solutions that combine AI with hydrogen technologies to boost vehicle range, reduce emissions, and enhance reliability

- As the global mobility sector transitions toward zero-emission solutions, the demand for AI-enhanced fuel cell power trains is expected to surge, particularly in commercial fleets, public transportation, and long-haul trucking applications

What are the Key Drivers of Fuel Cell Power Train Market?

- The rising global demand for clean mobility solutions, coupled with stringent emission regulations and government initiatives supporting hydrogen infrastructure, is significantly driving the fuel cell power train market

- For instance, in March 2024, Ballard Power Systems announced an expanded partnership to supply fuel cell modules for zero-emission buses across Europe, reflecting strong market momentum toward decarbonizing transportation

- The superior energy efficiency, longer driving range, and faster refueling times of fuel cell vehicles, compared to battery-electric alternatives, are making them an attractive solution for sectors such as heavy-duty transport, commercial logistics, and public transit

- Growing investments by automakers and governments in hydrogen production, storage, and refueling infrastructure are creating favorable conditions for scaling fuel cell power train adoption

- In addition, advancements in fuel cell technology, including increased power density, reduced system costs, and enhanced durability, are accelerating their integration into passenger vehicles, trucks, buses, and rail systems

Which Factor is challenging the Growth of the Fuel Cell Power Train Market?

- Despite growing interest, the limited availability of hydrogen refueling infrastructure remains a significant challenge restricting the mass adoption of fuel cell power trains, especially in emerging markets and rural regions

- For instance, while countries such as Japan, Germany, and South Korea have made considerable progress in building hydrogen refueling networks, other regions still face gaps in infrastructure, affecting vehicle deployment at scale

- High production and deployment costs, particularly for green hydrogen and advanced fuel cell components, add to the economic challenges for end-users and fleet operators

- Moreover, technical challenges related to hydrogen storage, system complexity, and the need for specialized maintenance also pose barriers to widespread adoption

- Addressing these concerns through strategic public-private partnerships, policy incentives, technological advancements, and investments in hydrogen infrastructure will be crucial to unlocking the full potential of the fuel cell power train market and enabling a zero-emission future for transportation

How is the Fuel Cell Power Train Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Component

On the basis of component, the fuel cell power train market is segmented into Fuel Cell System, Battery System, Drive System, Hydrogen Storage System, and Others. The Fuel Cell System segment dominated the fuel cell power train market with the largest market revenue share of 47.5% in 2024, driven by the critical role of fuel cell stacks in generating electricity from hydrogen to power the vehicle. Continuous advancements in fuel cell technology, such as increased power density and extended lifespan, further fuel the demand for this segment across both passenger and commercial vehicles.

The Hydrogen Storage System segment is anticipated to witness the fastest growth rate of 24.1% from 2025 to 2032, attributed to rising investments in hydrogen refueling infrastructure and innovations in lightweight, high-pressure storage tanks. The need for efficient, safe, and compact hydrogen storage solutions is growing significantly, especially in long-range trucks and buses.

• By Drive Type

On the basis of drive type, the fuel cell power train market is segmented into Rear Wheel Drive (RWD), Front Wheel Drive (FWD), and All-Wheel Drive (AWD). The Rear Wheel Drive (RWD) segment held the largest market revenue share in 2024, driven by its widespread adoption in heavy-duty trucks, commercial vehicles, and performance vehicles where improved traction and torque distribution are essential.

The All-Wheel Drive (AWD) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for enhanced vehicle stability, off-road capabilities, and improved handling across different terrains. The integration of AWD with Fuel Cell Power Trains provides superior performance, making them ideal for both passenger and commercial applications.

• By Vehicle Type

On the basis of vehicle type, the fuel cell power train market is segmented into Passenger Cars, Light Commercial Vehicles (LCV), Buses, and Trucks. The Passenger Cars segment accounted for the largest market revenue share of 52.3% in 2024, supported by growing consumer demand for zero-emission personal vehicles and increasing availability of fuel cell car models from leading automakers such as Toyota, Hyundai, and Honda.

The Trucks segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the urgent need to decarbonize freight transport and the superior range and refueling advantages offered by hydrogen-powered trucks. The growing deployment of fuel cell trucks for long-haul and heavy-duty applications further propels this segment.

• By Power Output

On the basis of power output, the fuel cell power train market is segmented into Less than 150 kW, 150–250 kW, and More than 250 kW. The 150–250 kW segment dominated the market with the largest market revenue share of 46.8% in 2024, owing to its suitability for a wide range of applications, including passenger cars, light commercial vehicles, and public transport buses. These powertrains offer an optimal balance between performance, efficiency, and cost, driving widespread adoption.

The More than 250 kW segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the expansion of heavy-duty vehicles and commercial fleets requiring higher power outputs for long-distance, high-load transport operations. This segment is critical in enabling the deployment of zero-emission trucks and buses for demanding routes.

Which Region Holds the Largest Share of the Fuel Cell Power Train Market?

- Asia-Pacific dominated the fuel cell power train market with the largest revenue share of 46.5% in 2024, driven by rising investments in clean mobility, favorable government policies for hydrogen infrastructure, and increasing production of fuel cell vehicles across countries such as China, Japan, and South Korea

- The region's rapid urbanization, expanding automotive manufacturing base, and initiatives to decarbonize the transport sector are accelerating the adoption of fuel cell power trains. Growing concerns over air pollution and energy security are further propelling market growth, especially in commercial vehicles and public transport fleets

- In addition, advancements in hydrogen storage, improved fuel cell system efficiency, and strong support for green energy transitions position Asia-Pacific as the leading market for fuel cell power trains, with significant demand emerging from both passenger and commercial vehicle segments

China Fuel Cell Power Train Market Insight

The China fuel cell power train market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by the country's ambitious hydrogen development plans, strong domestic manufacturing capabilities, and government subsidies promoting fuel cell vehicles. China's aggressive push for clean transportation, expanding hydrogen refueling networks, and technological leadership in fuel cell stack production contribute significantly to market growth.

Japan Fuel Cell Power Train Market Insight

The Japan fuel cell power train market continues to grow steadily, supported by the country's long-standing focus on hydrogen economy development, technological innovation, and demand for zero-emission mobility solutions. Japan's automotive giants are actively investing in fuel cell vehicle production, with strong adoption expected across both passenger and commercial fleets. Government-backed initiatives for hydrogen infrastructure and energy security further boost market expansion.

Which Region is the Fastest Growing Region in the Fuel Cell Power Train Market?

North America fuel cell power train market is poised to grow at the fastest CAGR of 18.7% from 2025 to 2032, fueled by increasing investments in clean energy, growing demand for zero-emission vehicles, and the development of robust hydrogen refueling infrastructure across the U.S. and Canada. Rising environmental regulations, tax incentives for fuel cell vehicle adoption, and technological advancements in fuel cell and hydrogen storage systems are driving strong market growth. In particular, the push for decarbonizing heavy-duty transport and logistics sectors is creating substantial demand for fuel cell power trains in North America.

U.S. Fuel Cell Power Train Market Insight

The U.S. fuel cell power train market captured the largest revenue share within North America in 2024, driven by large-scale deployment of fuel cell trucks, buses, and passenger vehicles, alongside government initiatives supporting clean mobility. The presence of major fuel cell technology providers, coupled with expanding hydrogen infrastructure projects, is accelerating market growth across key states such as California and Texas.

Canada Fuel Cell Power Train Market Insight

The Canada fuel cell power train market is projected to witness steady growth, supported by favorable policies for green energy, increasing demand for sustainable transport solutions, and ongoing investments in hydrogen production and refueling stations. Canada's strong focus on reducing greenhouse gas emissions and leveraging hydrogen as part of its energy transition strategy is boosting the adoption of Fuel Cell Power Trains across both urban and long-haul applications.

Which are the Top Companies in Fuel Cell Power Train Market?

The fuel cell power train industry is primarily led by well-established companies, including:

- Cummins Inc. (U.S.)

- Ballard Power Systems (Canada)

- Robert Bosch GmbH (Germany)

- DENSO CORPORATION (Japan)

- FEV Group GmbH (Germany)

- FCP FUEL CELL POWERTRAIN GMBH (Germany)

- ITM Power PLC (U.K.)

- Ceres (U.K.)

- Continental AG (Germany)

- BorgWarner Inc. (U.S.)

- AVL (Austria)

- Plug Power Inc. (U.S.)

- NUVERA FUEL CELLS, LLC (U.S.)

- Nedstack Fuel Cell Technology (Netherlands)

- Dana Limited (U.S.)

What are the Recent Developments in Global Fuel Cell Power Train Market?

- In March 2024, Intelligent Energy launched its new 'IE-DRIVE' hydrogen fuel cell system, claiming it to be the most compact and high-powered solution currently available for passenger vehicles. The company states that this innovative system overcomes the limitations of Battery Electric Vehicles (BEVs) and advances the adoption of zero-emission mobility through hydrogen technology, further reinforcing its market competitiveness

- In March 2024, Viritech, a prominent developer of hydrogen powertrain technologies, introduced its 60kW VPT60N Ready to Run Vehicle Powertrain as part of the Viritech Powertrain family. This product is the outcome of extensive research and integrates Viritech’s full range of powertrain solutions and enabling technologies into a comprehensive system, positioning the company as a key player in next-generation hydrogen mobility

- In April 2022, Plug Power and Olin Corporation announced the formation of a joint venture (JV) to produce and distribute green hydrogen, supporting the rising global demand for fuel cell applications. Their first production facility, located in St. Gabriel, Louisiana, will manufacture 15 tons per day of green hydrogen, marking a significant step toward accelerating the global hydrogen economy

- In April 2022, Nuvera Fuel Cells secured a purchase order and signed a memorandum of understanding with Hytech AS for the deployment of Nuvera® E-45 Fuel Cell Engines for stationary power generation. This collaboration reflects Nuvera's strategic expansion into stationary energy solutions, broadening its hydrogen fuel cell applications beyond transportation

- In September 2021, Ballard Power Systems revealed its latest innovation, the FCmove™-HD+ fuel cell system with a 100kW power output, engineered to be smaller, lighter, more efficient, and cost-effective than previous models. Designed for flexible installation in both engine bay and rooftop configurations, this development enhances Ballard's ability to meet the growing demand for fuel cell technology in truck and bus markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.