Global Full Body Scanner Market

Market Size in USD Billion

CAGR :

%

USD

432.65 Billion

USD

982.78 Billion

2024

2032

USD

432.65 Billion

USD

982.78 Billion

2024

2032

| 2025 –2032 | |

| USD 432.65 Billion | |

| USD 982.78 Billion | |

|

|

|

|

Full Body Scanner Market Size

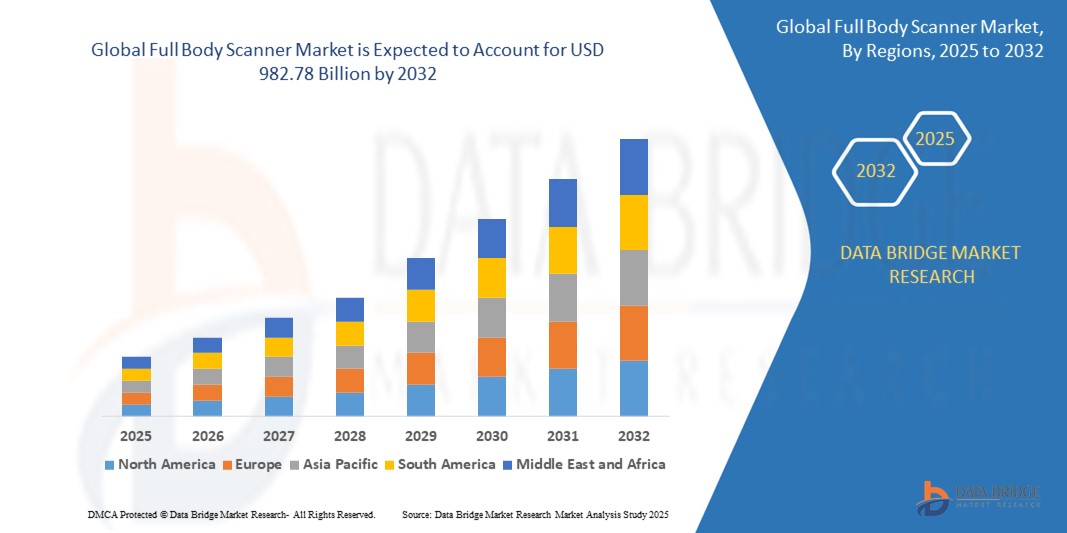

- The global full body scanner market size was valued at USD 432.65 billion in 2024 and is expected to reach USD 982.78 billion by 2032, at a CAGR of 10.8% during the forecast period

- The market growth is largely fueled by increasing global security concerns, rising incidences of terrorism and smuggling, and expanding infrastructure across transportation, correctional, and critical government facilities, leading to higher demand for advanced threat detection systems such as full body scanners

- Furthermore, the integration of AI-driven image analysis, non-invasive scanning technologies, and privacy-compliant software is establishing full body scanners as essential components in modern security frameworks. These advancements, along with growing regulatory support and public safety mandates, are accelerating the deployment of full body scanners worldwide, thereby significantly boosting the industry's growth

Full Body Scanner Market Analysis

- Full body scanners are security devices that use technologies such as X-ray backscatter, millimetre wave, and transmission X-ray to detect concealed threats, including weapons, explosives, and contraband, without physical contact. These systems are widely deployed in airports, prisons, border checkpoints, and public venues to enhance screening efficiency and security

- The rising demand for full body scanners is primarily driven by increasing government investments in transportation security, the need for faster and more accurate threat detection, and growing adoption of AI-enabled, automated screening solutions that ensure both safety and privacy

- North America dominated the full body scanner market with a share of 32.5% in 2024, due to increased security concerns, heightened threat detection needs, and strong investments in transportation and critical infrastructure protection

- Asia-Pacific is expected to be the fastest growing region in the full body scanner market during the forecast period due to expanding aviation networks, rising urbanization, and heightened geopolitical tensions

- Millimetre wave segment dominated the market with a market share of 65.5% in 2024, due to its non-ionizing radiation and high detection capabilities for both metallic and non-metallic threats. These scanners are increasingly deployed in high-security zones such as airports and government buildings due to their enhanced safety for human scanning and rapid image acquisition. The preference for millimetre wave technology is also fueled by regulatory approvals and its alignment with privacy-preserving software that automatically blurs sensitive body features, making it more acceptable to the general public

Report Scope and Full Body Scanner Market Segmentation

|

Attributes |

Full Body Scanner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Full Body Scanner Market Trends

“Increasing Technological Advancements”

- The full body scanner market is witnessing rapid growth fueled by continuous innovation in imaging and detection technologies, such as millimeter-wave and X-ray-based systems, which offer higher accuracy and faster throughput

- For instance, leading companies such as OSI Systems, Smiths Group, L3Harris Technologies, and Analogic Corporation are integrating artificial intelligence, automated target recognition, and biometric systems into their scanners to enhance threat detection and streamline screening processes

- The adoption of portable and less invasive scanner designs is on the rise, enabling flexible deployment at airports, government buildings, correctional facilities, and event venues

- Public and regulatory focus on privacy and safety is driving the development of solutions with minimal radiation exposure and automated image analysis to protect personal data

- The demand for touchless and automated screening systems has grown, especially in response to health and hygiene concerns in high-traffic environments

- In conclusion, the convergence of AI, automation, and user-centric design is positioning full body scanners as a critical tool for modern security infrastructure, with strong growth prospects in both public and private sectors

Full Body Scanner Market Dynamics

Driver

“Increasing Security Threats”

- Escalating global security threats, including terrorism, smuggling, and criminal activities, are driving the adoption of advanced full body scanners across airports, borders, and public venues

- For instance, the implementation of full body scanners by airport authorities and government agencies in North America and Europe has become standard practice to address rising concerns about concealed weapons and contraband

- Growing passenger volumes and infrastructure development in transportation hubs require efficient, non-intrusive screening solutions to maintain public safety and operational efficiency

- Regulatory mandates and government investments in security infrastructure are further accelerating market growth, particularly in regions with heightened risk profiles

- The integration of AI and real-time analytics is enhancing the effectiveness of threat detection and enabling faster response to evolving security challenges

Restraint/Challenge

“Maintenance and Operational Costs”

- The high initial investment, ongoing maintenance, and operational costs associated with advanced full body scanners can be a significant barrier for some organizations, particularly in developing regions

- For instance, airports and government facilities often face budget constraints related to the upkeep of sophisticated imaging units, software updates, and staff training, which can impact the pace of adoption and replacement cycles

- The need for regular calibration, preventive maintenance, and compliance with evolving safety standards adds to the total cost of ownership for end users

- Balancing the demand for high-throughput, reliable screening with cost-effective operations remains a challenge, especially for smaller transit hubs and public venues

- Concerns about system downtime, repair lead times, and the availability of technical support can also affect the reliability and perceived value of full body scanner deployments

Full Body Scanner Market Scope

The market is segmented on the basis of technology, product type, system, and application.

- By Technology

On the basis of technology, the full body scanner market is segmented into backscatter, millimetre wave, and transmission X-ray. The millimetre wave segment dominated the largest market revenue share of 65.5% in 2024, attributed to its non-ionizing radiation and high detection capabilities for both metallic and non-metallic threats. These scanners are increasingly deployed in high-security zones such as airports and government buildings due to their enhanced safety for human scanning and rapid image acquisition. The preference for millimetre wave technology is also fueled by regulatory approvals and its alignment with privacy-preserving software that automatically blurs sensitive body features, making it more acceptable to the general public.

The transmission X-ray segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior penetration capabilities, particularly for concealed objects inside body cavities or dense materials. This segment sees increasing demand from correctional facilities, border security agencies, and high-risk checkpoints where comprehensive screening is critical. Advancements in image resolution and software integration are also enhancing the detection efficiency of transmission X-ray systems, supporting their growing adoption.

- By Product Type

On the basis of product type, the full body scanner market is segmented into ground-mounted scanner and vehicle-mounted scanner. The ground-mounted scanner segment held the largest market share in 2024 due to its widespread deployment in airport security checkpoints, courthouses, and international border crossings. These scanners are favored for their stability, high throughput, and ability to integrate with biometric systems and automated screening protocols. Their fixed installation enables robust infrastructure for frequent, high-volume scanning, making them indispensable in high-security environments.

The vehicle-mounted scanner segment is anticipated to register the fastest CAGR during the forecast period, propelled by the need for flexible and mobile scanning solutions across remote border posts, temporary event security, and military field operations. These systems allow for rapid deployment, easy relocation, and on-the-go threat detection, which is increasingly important for responding to dynamic security needs. Their ability to scan both individuals and vehicles further supports their expanding role in multi-functional security applications.

- By System

On the basis of system, the market is segmented into image processing and modelling, 3D body scanner, and others. The image processing and modelling segment dominated the market in 2024, driven by growing integration of AI and machine learning algorithms that enable automated threat detection and advanced anomaly recognition. These systems enhance security personnel’s efficiency by reducing human error and providing real-time analysis with visual overlays and alerts. The rapid improvement in software capabilities, such as real-time image enhancement and predictive analytics, is also increasing their deployment across large-scale facilities.

The 3D body scanner segment is expected to exhibit the fastest growth through 2032, owing to rising adoption in both security and non-security applications, including virtual fitting rooms in retail, biometric analysis in healthcare, and ergonomic assessment in industrial design. In the security domain, 3D scanners are becoming popular for their high-resolution, three-dimensional imaging, allowing for more accurate detection of hidden objects and body shape profiling. The fusion of 3D scanning with biometric verification and access control is further boosting its adoption across high-security environments.

- By Application

On the basis of application, the full body scanner market is segmented into public, critical infrastructure, industrial, and others. The public segment accounted for the largest revenue share in 2024, largely due to consistent deployment across transportation hubs such as airports, metro stations, and public event venues. The growing emphasis on passenger safety, terrorism threat mitigation, and regulatory mandates has made full body scanners a core part of public safety infrastructure. High throughput capacity and real-time threat identification also support the dominance of this segment.

The critical infrastructure segment is projected to grow at the fastest rate from 2025 to 2032, driven by increasing concerns over sabotage, espionage, and unauthorized access in sectors such as nuclear power plants, data centers, and government facilities. Full body scanners in these settings are increasingly integrated with multilayered security systems, including biometric authentication and AI-driven monitoring. As these infrastructures face escalating security challenges, investments in advanced, automated scanning systems are expected to surge.

Full Body Scanner Market Regional Analysis

- North America dominated the full body scanner market with the largest revenue share of 32.5% in 2024, driven by increased security concerns, heightened threat detection needs, and strong investments in transportation and critical infrastructure protection

- The region exhibits widespread deployment of full body scanners across airports, government buildings, and correctional facilities, supported by regulatory mandates and public safety initiatives

- Robust technological adoption, combined with a high emphasis on national security, positions North America as the leading region for full body scanner installations across both fixed and mobile platforms

U.S. Full Body Scanner Market Insight

The U.S. full body scanner market captured the largest revenue share in 2024 within North America, primarily fueled by federal investments in aviation security and homeland defense. The Transportation Security Administration (TSA) has been instrumental in expanding the use of millimetre wave and backscatter scanners across major airports, enabling high-throughput, non-invasive passenger screening. In addition, the increasing use of AI-powered image processing in public safety and correctional facilities is enhancing operational efficiency. The market also benefits from robust R&D activity, integration of smart surveillance systems, and growing emphasis on privacy-preserving solutions for civilian scanning.

Europe Body Scanner Market Insight

The Europe full body scanner market is projected to grow at a substantial CAGR over the forecast period, driven by increasing adoption of security scanners in transportation hubs, border checkpoints, and government institutions. Heightened concerns over terrorism, illegal migration, and smuggling are prompting several European nations to deploy advanced scanning solutions that ensure both safety and compliance with strict privacy laws. The EU’s coordinated security policies and funding for public safety infrastructure upgrades are further stimulating demand. Full body scanners are increasingly being incorporated into new transportation projects, urban surveillance systems, and high-risk commercial settings, reflecting a broadening application base across the region.

U.K. Full Body Scanner Market Insight

The U.K. full body scanner market is expected to witness steady growth, supported by ongoing efforts to modernize airport and railway station security infrastructure. Rising concerns over national security and public safety, combined with a proactive approach to counter-terrorism, are driving demand for non-invasive, fast-scanning systems. The deployment of portable and vehicle-mounted scanners for temporary checkpoints and major public events is gaining popularity. Furthermore, the integration of full body scanners with biometric access and surveillance systems is advancing across public venues, with growing acceptance due to improved privacy controls and system transparency.

Germany Full Body Scanner Market Insight

The Germany full body scanner market is anticipated to experience strong growth during the forecast period, bolstered by a technologically advanced infrastructure and a high emphasis on data protection and privacy. Germany’s security agencies and critical infrastructure operators are increasingly adopting AI-powered scanning systems that comply with the country's strict data protection frameworks. The market is also seeing growing interest from industrial and commercial sectors, where secure employee access and theft prevention are key priorities. With a national focus on sustainability and innovation, Germany is investing in energy-efficient and compact scanner solutions integrated with smart building technologies.

Asia-Pacific Body Scanner Market Insight

The Asia-Pacific full body scanner market is set to grow at the fastest CAGR of 17.5% from 2025 to 2032, driven by expanding aviation networks, rising urbanization, and heightened geopolitical tensions. Rapid infrastructure development in countries such as China, India, and Japan is leading to widespread adoption of advanced scanning systems across airports, metro systems, and government facilities. The region’s governments are also promoting digitalization and smart city initiatives, which include integrated surveillance and security technologies. As a major manufacturing hub for security equipment, Asia-Pacific benefits from low production costs and increasing domestic deployment, making full body scanners more accessible to a broad consumer and institutional base.

Japan Full Body Scanner Market Insight

The Japan full body scanner market is expanding steadily, driven by the country’s high technology adoption rate and its commitment to public safety. Full body scanners are increasingly deployed in public transportation systems, especially ahead of global events and in preparation for emergencies such as natural disasters. Japan's aging population is also influencing demand for scanners that provide non-invasive, rapid, and user-friendly screening in both public and healthcare environments. Integration with facial recognition, access control, and IoT systems is advancing, with a strong focus on compact design, low radiation, and user privacy.

China Full Body Scanner Market Insight

The China full body scanner market held the largest revenue share in Asia-Pacific in 2024, supported by rapid infrastructure development and a strong domestic manufacturing ecosystem. Full body scanners are widely used across airports, subways, customs checkpoints, and correctional facilities, driven by the government’s aggressive investments in public safety and surveillance technology. As part of its smart city and digital security initiatives, China is integrating full body scanners into broader AI-powered monitoring systems. The availability of affordable, high-performance systems from local manufacturers is enabling mass deployment and making China a major exporter of full body scanning technologies across Asia and beyond.

Full Body Scanner Market Share

The full body scanner industry is primarily led by well-established companies, including:

- NUCTECH COMPANY LIMITED (China)

- Autoclear (U.S.)

- Brijot (U.S.)

- TEK84, INC. (U.S.)

- Westminster Group Plc (U.K.)

- QinetiQ (U.K.)

- ODSecurity (Netherlands)

- Rohde & Schwarz (Germany)

- VITRONIC (Germany)

- Evolv Technologies, Inc. (U.S.)

- ADANI GROUP (India)

- Metrasens (U.K.)

- Canon U.S.A., Inc. (U.S.)

- 3F Advanced System (Israel)

- Artec Europe (Luxembourg)

- Leidos (U.S.)

- Braun & Co. Limited (U.K.)

- Smiths Detection Group Ltd. (U.K.)

- American Science and Engineering, Inc. (U.S.)

Latest Developments in Global Full Body Scanner Market

- In March 2023, Tek84 Inc. expanded its presence in the full body scanner market by acquiring Integrated Defense and Security Solutions (IDSS) Corp., a company specializing in airport scanner technologies. This strategic acquisition merged leading-edge X-ray scanning capabilities aimed at addressing critical security challenges such as contraband detection, human trafficking, and terrorism, thereby strengthening Tek84's position in the global security screening space

- In December 2022, Tek84 Inc. further advanced its market reach when the LaSalle County Jail approved the installation of its X-ray full-body scanner. The deployment was intended to enhance inmate screening and prevent the smuggling of prohibited items, highlighting the growing adoption of full body scanners in correctional facilities

- In March 2022, Smiths Detection announced that its HI-SCAN 10080 XCT, an advanced X-ray computed tomography Explosive Detection System (EDS) for checked baggage and air cargo, had been approved for inclusion on the U.S. Transportation Security Administration’s (TSA) Air Cargo Screening Technology List (ACSTL). This approval reinforced the company's presence in the U.S. security screening market and emphasized the increasing regulatory alignment of full body and baggage scanner solutions

- In January 2022, LINEV Group strengthened its foothold in the MENA region’s full body scanner and X-ray systems market by launching LINEV Systems Equipment Trading in Dubai, United Arab Emirates. This expansion enabled the company to deliver its innovative X-ray-based technologies across security, medical, non-destructive testing (NDT), and analytical sectors, tapping into the region’s growing demand for advanced screening solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.