Global Full Service Carrier Market

Market Size in USD Billion

CAGR :

%

USD

3.54 Billion

USD

5.44 Billion

2024

2032

USD

3.54 Billion

USD

5.44 Billion

2024

2032

| 2025 –2032 | |

| USD 3.54 Billion | |

| USD 5.44 Billion | |

|

|

|

|

Full Service Carrier Market Size

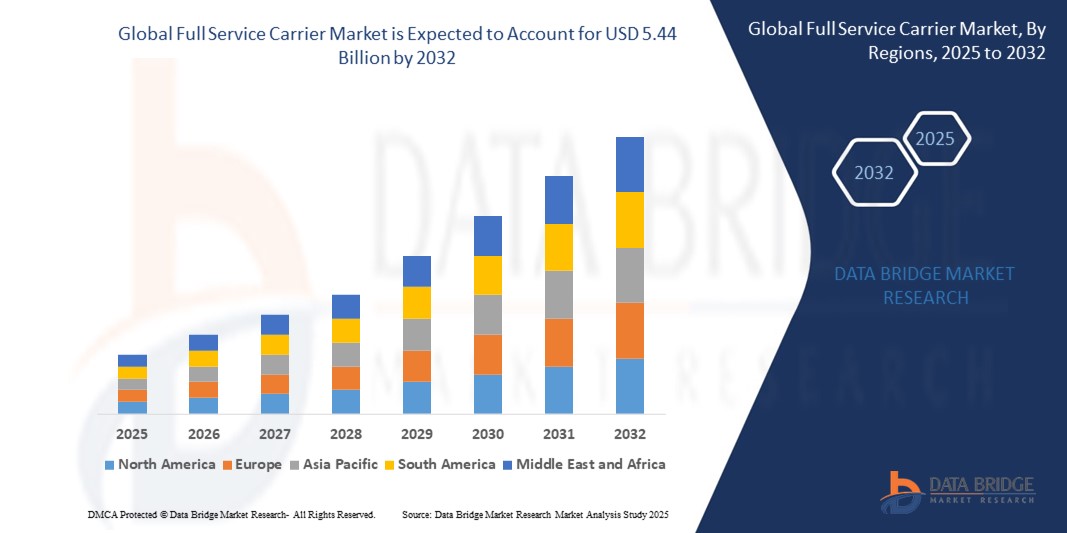

- The global full service carrier market size was valued at USD 3.54 billion in 2024 and is expected to reach USD 5.44 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by rising global air travel demand, expanding international tourism, and growing business travel, especially in emerging economies. Full service carriers are increasingly investing in fleet expansion, premium services, and route connectivity to meet the evolving expectations of modern travelers seeking comfort and convenience

- Furthermore, increasing consumer preference for value-added onboard services such as meals, entertainment, and flexible baggage policies is reinforcing the appeal of full service carriers over low-cost alternatives. These converging factors are accelerating passenger loyalty and long-haul traffic, thereby significantly boosting the industry's growth

Full Service Carrier Market Analysis

- Full service carriers are airlines that offer comprehensive in-flight and ground services, including checked baggage, meals, seat selection, in-flight entertainment, and multiple cabin classes. They operate both domestic and international routes, focusing on passenger comfort, connectivity, and service differentiation

- The growth of this market is driven by rising middle-class incomes, improving air travel infrastructure, and increased airline alliances and code-sharing agreements. Passengers are drawn to the seamless travel experience and higher service standards provided by FSCs, supporting strong market expansion across both developed and emerging regions

- North America dominated the full service carrier market with a share of 34.5% in 2024, due to a high concentration of major carriers, strong business travel demand, and a well-established air travel infrastructure

- Asia-Pacific is expected to be the fastest growing region in the full service carrier market during the forecast period due to rapid urbanization, growing disposable incomes, and a surge in regional and international air traffic

- Fixed-wing aircraft segment dominated the market with a market share of 89.8% in 2024, due to its widespread use in commercial passenger aviation and its superior efficiency in long-distance travel. Full service carriers primarily operate fleets of narrow-body and wide-body fixed-wing aircraft for both domestic and international routes, leveraging their high passenger capacity, longer range, and advanced in-flight features. The continuous investment by airlines in next-generation fuel-efficient aircraft such as the Airbus A350 and Boeing 787 further consolidates the dominance of this segment

Report Scope and Full Service Carrier Market Segmentation

|

Attributes |

Full Service Carrier Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Full Service Carrier Market Trends

“Increasing Trend of Business Travel”

- The full service carrier (FSC) market is growing steadily as business travel demand rises driven by global economic growth, corporate globalization, and increased international trade, prompting airlines to enhance premium offerings and connectivity

- For instance, American Airlines reported strong business travel revenue growth in 2024, investing in expanded business class seating, lounges, and flexible ticketing options to cater to frequent corporate travelers

- Growing emphasis on passenger experience is fueling upgrades in in-flight entertainment, Wi-Fi connectivity, and personalized services that appeal especially to business travelers seeking comfort and productivity during flights

- Increasing corporate travel budgets and demand for nonstop international flights are motivating FSCs to expand route networks and form strategic alliances to offer seamless global connectivity

- Technological advancements such as biometric boarding, AI-driven customer service, and better mobile apps are streamlining travel for business passengers, reducing friction in airport and boarding processes

- Sustainability efforts such as fuel-efficient aircraft adoption and carbon offset programs are part of FSCs’ strategies to attract environmentally conscious corporate clients, aligning travel policies with corporate social responsibility goals

Full Service Carrier Market Dynamics

Driver

“Rising Disposable Income”

- The rising disposable income worldwide, especially in emerging economies, is increasing demand for premium air travel options provided by FSCs, as more consumers and businesses afford enhanced travel experiences

- For instance, Delta Air Lines has expanded its premium economy and first-class cabins targeting affluent travelers from countries such as China and India where disposable income has grown substantially

- Growing middle-class populations globally are driving increased demand for international and business-class travel, encouraging airlines to invest in fleet modernization and service enhancements

- Higher disposable income enables leisure travelers to upgrade to full-service carrier options for better comfort, meal services, and loyalty program benefits, thereby expanding FSC market share

- Consumer willingness to pay for convenience, safety, and better in-flight amenities supports sustained growth in full-service carrier revenue streams across multiple regions

Restraint/Challenge

“Lack of Proper Capacity Management”

- One key challenge for the FSC market is managing capacity effectively to balance demand fluctuations and avoid overcapacity or underutilization, which can lead to reduced profitability and operational inefficiencies

- For instance, major carriers such as British Airways have struggled intermittently with cabin crew shortages and fleet availability mismatches, resulting in flight cancellations and delays that impact customer satisfaction and financial performance

- Demand volatility caused by geopolitical tensions, pandemics, and economic cycles complicates capacity planning and route optimization for FSCs, requiring advanced forecasting and flexible network strategies

- Inefficient capacity management can lead to higher unit costs, reduced load factors, and increased fuel consumption, limiting airlines’ competitive positioning against low-cost carriers

- Addressing these challenges calls for investments in data analytics, flexible fleet deployment, and dynamic pricing models to adapt capacity quickly according to market demand

Full Service Carrier Market Scope

The market is segmented on the basis of connectivity, aircraft type, and services.

- By Connectivity

On the basis of connectivity, the full service carrier market is segmented into regional and global. The global segment accounted for the largest market revenue share in 2024, primarily due to the extensive international route networks operated by major full service carriers and their ability to offer long-haul travel with premium services. These airlines often serve as national flag carriers and play a key role in international business and tourism travel. The appeal of global FSCs is further strengthened by their established partnerships with global airline alliances, enabling seamless intercontinental connections, integrated loyalty programs, and coordinated scheduling.

The regional segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for efficient intra-regional connectivity and the increasing affluence of middle-class travelers in emerging markets. Regional FSCs are gaining momentum by offering premium service levels on shorter routes, appealing to both business and leisure travelers seeking comfort and convenience without sacrificing time. Fleet modernization and network expansion in Asia-Pacific and Latin America further support the growth trajectory of this segment.

- By Aircraft Type

On the basis of aircraft type, the market is categorized into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment dominated the market with a share of 89.8% in 2024, backed by its widespread use in commercial passenger aviation and its superior efficiency in long-distance travel. Full service carriers primarily operate fleets of narrow-body and wide-body fixed-wing aircraft for both domestic and international routes, leveraging their high passenger capacity, longer range, and advanced in-flight features. The continuous investment by airlines in next-generation fuel-efficient aircraft such as the Airbus A350 and Boeing 787 further consolidates the dominance of this segment.

The rotary-wing aircraft segment is expected to register the fastest CAGR from 2025 to 2032, driven by the rising adoption of helicopter services for premium, point-to-point urban and regional air mobility. In select metropolitan regions, FSCs and affiliated operators are increasingly deploying rotary-wing aircraft to offer luxury, time-saving connections from airports to city centers or between high-value destinations. Growth in tourism, offshore energy transport, and VIP travel are also contributing to rising demand in this niche segment.

- By Services

On the basis of services, the market is segmented into in-flight entertainment, checked baggage, comfort, meals, beverages, and others. The meals segment held the largest revenue share in 2024, underpinned by its central role in defining the FSC premium experience. Full service carriers differentiate themselves through high-quality onboard dining, often curated by renowned chefs and tailored to regional tastes, which significantly enhances customer satisfaction and loyalty. Long-haul and business class passengers particularly value this aspect as part of a premium, all-inclusive offering.

The in-flight entertainment segment is poised to witness the highest growth rate from 2025 to 2032, driven by passengers' increasing demand for personalized, on-demand digital content during flights. FSCs are investing heavily in advanced IFE systems offering touchscreen displays, streaming services, and Wi-Fi connectivity, creating immersive onboard experiences. The evolution of seatback screens with high-definition visuals, gamification, and real-time connectivity further propels this segment as a key differentiator in competitive long-haul travel markets.

Full Service Carrier Market Regional Analysis

- North America dominated the full service carrier market with the largest revenue share of 34.5% in 2024, driven by a high concentration of major carriers, strong business travel demand, and a well-established air travel infrastructure

- The region benefits from extensive international and domestic route networks, frequent flyer programs, and high expectations for premium in-flight services among consumers

- Market growth is further supported by rising passenger traffic, increasing fleet modernization efforts, and continued investments in enhancing passenger comfort and connectivity

U.S. Full Service Carrier Market Insight

The U.S. accounted for the largest revenue share in the North American full service carrier market in 2024. This dominance is fueled by the country’s high air travel frequency, expansive route networks, and strong consumer demand for luxury travel options. Leading U.S. FSCs are actively investing in new-generation aircraft and technology to improve operational efficiency and passenger comfort. The resurgence in corporate travel, combined with rising expectations for personalized onboard experiences and loyalty-driven incentives, further strengthens the U.S. market's position as a global FSC leader.

Europe Full Service Carrier Market Insight

Europe held a significant share of the full service carrier market in 2024, supported by a dense network of cross-border flights, high tourism volumes, and growing preference for enhanced in-flight services. European FSCs benefit from strong international demand and intra-regional travel across business and leisure segments. The market is also being shaped by increased focus on environmental sustainability, with many airlines transitioning to more fuel-efficient aircraft and adopting carbon-reduction strategies. Rising consumer expectations for comfort, premium dining, and seamless digital services are also contributing to the expansion of the FSC model across the region.

U.K. Full Service Carrier Market Insight

The U.K. full service carrier market is expected to grow steadily over the forecast period, supported by its strategic location as a transatlantic and European air travel hub. Leading U.K.-based FSCs are focusing on improving passenger experiences through enhanced onboard services, digital integration, and premium cabin upgrades. Rising outbound tourism, corporate travel demand, and competitive long-haul service offerings are key factors driving market growth. The presence of advanced airport infrastructure and a well-connected global route network further reinforces the U.K.'s position in the FSC landscape.

Germany Full Service Carrier Market Insight

Germany’s full service carrier market continues to expand, propelled by high passenger volumes, strong demand for quality service, and a focus on reliability and safety. As a major European economy and travel destination, Germany supports a mix of long-haul and intra-European flights operated by its national carriers. Investments in modernizing aircraft fleets and improving passenger amenities, such as inflight connectivity and upgraded business class cabins, are enhancing the competitiveness of German FSCs. Furthermore, sustainability efforts and innovation in digital booking and service platforms are supporting long-term growth.

Asia-Pacific Full Service Carrier Market Insight

Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, owing to rapid urbanization, growing disposable incomes, and a surge in regional and international air traffic. The expansion of aviation infrastructure and increasing middle-class aspirations are driving demand for premium air travel across countries such as China, India, and Japan. Governments across the region are supporting air connectivity through new airport developments, regulatory reforms, and initiatives promoting regional tourism. Full service carriers are leveraging these trends by expanding fleets, enhancing service offerings, and forming strategic partnerships to capture rising demand.

Japan Full Service Carrier Market Insight

Japan’s full service carrier market is experiencing steady growth, backed by the country’s high service standards, technological innovation, and rising inbound tourism. Japanese FSCs are known for their attention to detail, punctuality, and quality of onboard services, which appeal strongly to both domestic and international travelers. The growing adoption of digital platforms for ticketing, entertainment, and real-time updates is improving the overall travel experience. With increasing demand for integrated, secure, and convenient travel options, Japan’s FSCs are well-positioned to capture a larger share of premium passenger traffic.

China Full Service Carrier Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its vast domestic air travel demand, strong economic growth, and expanding international connectivity. Chinese full service carriers are rapidly scaling operations, supported by substantial government investment in airport infrastructure and aviation technology. The increasing popularity of smart travel solutions, loyalty programs, and enhanced cabin services is contributing to market growth. In addition, the presence of competitive domestic FSCs offering quality service at accessible pricing is making full service air travel more widely available across China’s tier-1 and tier-2 cities.

Full Service Carrier Market Share

The full service carrier industry is primarily led by well-established companies, including:

- China Eastern Airlines Ltd. (China)

- China Southern Airlines Company Limited (China)

- Delta Air Lines, Inc. (U.S.)

- United Airlines, Inc. (U.S.)

- Air China (China)

- ANA (Japan)

- British Airways (U.K.)

- The Emirates Group (Emirates Airlines) (U.A.E.)

- Turkish Airlines (Turkey)

- Deutsche Lufthansa AG (Germany)

- American Airlines, Inc. (U.S.)

- Air France (France)

- ANA (Japan)

- Qatar Airways (Qatar)

- Etihad Airways (U.A.E.)

- IAG International Airlines Group (U.K.)

- Japan Airlines (Japan)

- SINGAPORE AIRLINES GROUP (Singapore)

Latest Developments in Global Full Service Carrier Market

- In September 2021, Delta Airlines and Northwest Airlines were anticipated to form a major alliance, aiming to create one of the world’s largest airline networks. The partnership was expected to integrate routes, fleets, and services, enhancing global connectivity and operational efficiency. Passengers would benefit from improved flight options, streamlined bookings, and aligned loyalty programs across North America, Europe, and Asia

- In September 2021, Delta Airlines announced the launch of a next-generation in-flight entertainment system to elevate passenger experience. Featuring HD touchscreens, expanded media libraries, real-time tracking, and faster Wi-Fi, the system underscored Delta’s commitment to innovation and comfort through enhanced digital engagement on board

- In June 2020, American Airlines and British Airways entered a joint venture to strengthen transatlantic operations. By aligning schedules, fares, and loyalty benefits, the partnership offered passengers better connectivity between North America and Europe, more coordinated travel services, and shared premium lounge access

- In June 2020, American Airlines and US Airways finalized a merger, forming the world’s largest airline. The consolidation integrated their fleets, networks, and services under the American Airlines brand. This move improved operational scale, broadened destination offerings, and enhanced customer experiences across domestic and international routes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.