Global Full Spectrum Cannabidiol Cbd Oils Market

Market Size in USD Billion

CAGR :

%

USD

2.01 Billion

USD

3.64 Billion

2024

2032

USD

2.01 Billion

USD

3.64 Billion

2024

2032

| 2025 –2032 | |

| USD 2.01 Billion | |

| USD 3.64 Billion | |

|

|

|

|

Full Spectrum Cannabidiol (CBD) Oils Market Size

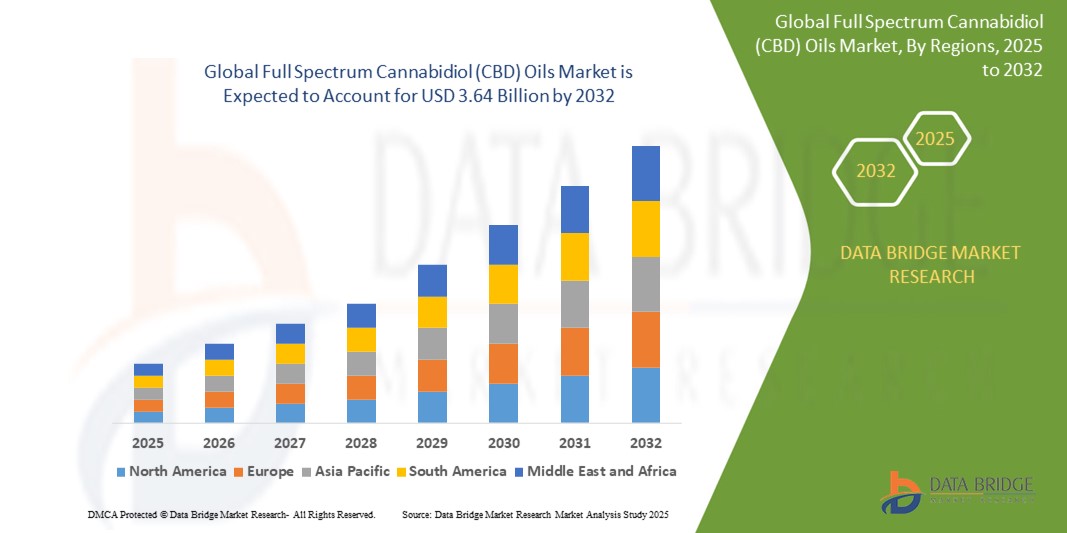

- The global full spectrum cannabidiol (CBD) oils market size was valued at USD 2.01 billion in 2024 and is expected to reach USD 3.64 billion by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is largely fuelled by the rising awareness of the health benefits associated with CBD products, including stress relief, pain management, and anti-inflammatory properties, particularly among aging populations and individuals with chronic conditions

- In addition, the increasing legalization of cannabis-derived products across various regions, coupled with growing consumer acceptance of natural wellness supplements, is contributing to the expansion of the full spectrum CBD oils market

Full Spectrum Cannabidiol (CBD) Oils Market Analysis

- The market is witnessing significant innovation in formulation and extraction methods, leading to more potent, bioavailable, and consumer-friendly oil products

- E-commerce and digital retailing are playing a crucial role in boosting product accessibility, helping brands reach niche health-conscious audiences across both developed and emerging economies

- North America dominated the full spectrum cannabidiol (CBD) oils market with the largest revenue share of 41.56% in 2024, driven by growing consumer acceptance of CBD products and favorable regulatory developments supporting hemp-derived formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global full spectrum cannabidiol (CBD) oils market, driven by improving regulatory conditions, expanding e-commerce penetration, and rising demand for natural and plant-based healthcare solutions across countries such as China, Japan, India, and South Korea

- The cannabinoids segment accounted for the largest market revenue share of 47.9% in 2024, primarily driven by the increasing awareness of therapeutic benefits offered by compounds such as cannabidiol (CBD) and cannabigerol (CBG). Consumers are increasingly drawn to full spectrum products due to the combined impact of multiple cannabinoids, which are believed to provide greater efficacy through the entourage effect. The segment also benefits from expanding research initiatives and a rising demand for alternative wellness solutions

Report Scope and Full Spectrum Cannabidiol (CBD) Oils Market Segmentation

|

Attributes |

Full Spectrum Cannabidiol (CBD) Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expanding Legalization of Cannabis-Derived Products Across New Markets • Rising Demand for Natural and Plant-Based Wellness Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Full Spectrum Cannabidiol (CBD) Oils Market Trends

“Growing Consumer Preference for Natural and Full Spectrum Wellness Products”

- Consumers are increasingly shifting towards plant-based wellness solutions, with full spectrum CBD oils gaining popularity due to their natural origin and broad therapeutic benefits without synthetic ingredients. This shift reflects a broader health-conscious movement embracing clean-label and organic products. As wellness becomes more personalized, CBD oils fit seamlessly into preventative routines

- The perceived synergy of cannabinoids and terpenes in full spectrum formulations is creating higher demand over isolated CBD, as users believe it offers enhanced benefits via the entourage effect. Consumers are beginning to differentiate between broad-spectrum, isolate, and full spectrum with growing awareness. Brands that educate buyers on this distinction are gaining competitive advantage

- Wellness influencers and lifestyle coaches actively promote daily use of full spectrum CBD oils for sleep, anxiety, and stress relief, amplifying visibility and mainstream acceptance. Digital platforms are playing a key role in normalizing CBD in daily wellness. As a result, market penetration is increasing beyond traditional medicinal use

- For instance, Charlotte’s Web launched new full spectrum CBD tinctures in 2024 aimed at mood and relaxation, driving higher consumer engagement and validating its utility in wellness regimens. Their product line expansion is strategically targeted at holistic wellness seekers, reinforcing CBD’s preventive appeal. The move also influenced competitors to follow suit

- With consumers seeking natural alternatives that align with wellness goals, full spectrum CBD oils are positioned to become an integral part of holistic health practices, supported by growing trust, digital education, and expanded retail presence

Full Spectrum Cannabidiol (CBD) Oils Market Dynamics

Driver

“Expansion of Legal Frameworks and Medical Endorsements for CBD Products”

- Evolving cannabis legalization and regulatory reforms across North America and Europe are boosting accessibility and legitimizing the use of full spectrum CBD oils for health and wellness applications. This legal clarity encourages product development and expands the potential consumer base. Regulatory updates are paving the way for global expansion

- Medical professionals are increasingly endorsing CBD for non-intoxicating relief from chronic pain, anxiety, and sleep disorders, encouraging patients to consider natural therapies. These endorsements are enhancing credibility and integrating CBD into broader healthcare conversations. Demand is expected to grow with increased physician participation

- Widespread consumer testimonials, clinical trials, and published research are influencing public perception, shifting CBD from a niche alternative remedy to a validated wellness aid. With scientific support, users are more confident in the product’s benefits and safety. This is helping reduce resistance among skeptical consumers

- For instance, in 2023, the U.S. Food and Drug Administration granted research clearance to multiple CBD clinical studies, validating its potential in managing conditions such as epilepsy and generalized anxiety disorder. This has further strengthened institutional interest and public confidence in regulated CBD use. Regulatory support often leads to wider insurance discussions and inclusion in health policies

- As more countries implement clear CBD legislation and medical professionals continue to endorse its therapeutic applications, the market is poised for long-term growth driven by increased accessibility, credibility, and acceptance

Restraint/Challenge

“Regulatory Inconsistencies and Quality Concerns Impacting Market Trust”

- The lack of uniform global regulations on CBD classification, dosage standards, and labeling practices is creating confusion among manufacturers and consumers alike. This discrepancy often leads to compliance issues and mistrust in product legitimacy. The regulatory patchwork hinders cross-border growth and scaling

- Reports of product mislabeling, such as incorrect CBD concentrations or the presence of unauthorized THC levels, have raised red flags for health-conscious consumers and government bodies. This undermines brand trust and makes consumers hesitant to try CBD for the first time. Transparency is critical in this sector

- Limited third-party verification, testing inconsistencies, and absence of standardized certifications are challenging the credibility of products in both online and offline channels. Without regulation, counterfeit or diluted products can enter the market, affecting consumer experience. Reputable brands must work harder to earn consumer trust

- For instance, a 2023 FDA review of 50 CBD oil products in the U.S. found that nearly 40% were inaccurately labeled, prompting safety concerns and legal warnings to several retailers. Such incidents reinforce the need for stricter quality controls. The situation also underscores how poor regulation can damage industry reputation

- Unless cohesive regulatory frameworks and mandatory quality assurance mechanisms are implemented globally, the growth of full spectrum CBD oils may be hampered by consumer hesitation, product recalls, and legal uncertainties across key regions

Full Spectrum Cannabidiol (CBD) Oils Market Scope

The market is segmented on the basis of compound, type, and application.

- By Compound

On the basis of compound, the full spectrum cannabidiol (CBD) oils market is segmented into terpenes, tetrahydrocannabinol (THC), flavonoids, and cannabinoids. The cannabinoids segment accounted for the largest market revenue share of 47.9% in 2024, primarily driven by the increasing awareness of therapeutic benefits offered by compounds such as cannabidiol (CBD) and cannabigerol (CBG). Consumers are increasingly drawn to full spectrum products due to the combined impact of multiple cannabinoids, which are believed to provide greater efficacy through the entourage effect. The segment also benefits from expanding research initiatives and a rising demand for alternative wellness solutions.

The terpenes segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing consumer preference for natural aroma, flavor, and enhanced therapeutic synergy. Terpenes are gaining traction for their anti-inflammatory and mood-enhancing properties, making them desirable additions to full spectrum oils. Their increased use in topical applications and premium CBD blends is further boosting demand across health-conscious demographics.

- By Type

On the basis of type, the full spectrum cannabidiol (CBD) oils market is segmented into hemp-derived and marijuana-derived. The hemp-derived segment dominated the market in 2024 with the largest revenue share, supported by regulatory approvals and broader acceptance due to its low THC content. Products in this segment align well with international compliance standards, making them favorable for import/export across multiple countries. Widespread availability in wellness stores and online platforms is accelerating segment expansion.

The marijuana-derived segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing legalization in medical and recreational sectors. This segment appeals to consumers seeking stronger effects and is often used in therapeutic applications under prescription. Expansion of legal dispensaries and shifting public attitudes toward marijuana are supporting the segment’s rising adoption.

- By Application

On the basis of application, the full spectrum cannabidiol (CBD) oils market is segmented into cosmetics industry, food industry, pharmaceuticals industry, and others. The pharmaceuticals industry segment led the market with the largest share in 2024, attributed to the increasing incorporation of CBD oils in the treatment of chronic pain, anxiety, epilepsy, and sleep disorders. Pharmaceutical players are investing in clinical trials and research studies to validate efficacy and safety, driving segment growth. Government approvals of CBD-based medications are further accelerating adoption.

The cosmetics industry segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising demand for natural and functional beauty products. Full spectrum CBD oils are being increasingly used in skincare formulations for their anti-inflammatory and antioxidant properties. The clean beauty trend and consumer preference for holistic wellness are fueling demand in facial serums, balms, and topical treatments.

Full Spectrum Cannabidiol (CBD) Oils Market Regional Analysis

- North America dominated the full spectrum cannabidiol (CBD) oils market with the largest revenue share of 41.56% in 2024, driven by growing consumer acceptance of CBD products and favorable regulatory developments supporting hemp-derived formulations

- Consumers in the region are increasingly adopting full spectrum CBD oils for wellness, skincare, and therapeutic use, backed by rising awareness of plant-based health alternatives

- The presence of established manufacturers, combined with innovative retail strategies and strong e-commerce penetration, supports the widespread availability and consumption of full spectrum CBD oils in the region

U.S. Full Spectrum Cannabidiol (CBD) Oils Market Insight

The U.S. full spectrum CBD oils market captured the largest revenue share in 2024 within North America, supported by increasing legalization and consumer interest in natural and holistic health products. The market is bolstered by an expanding base of users relying on CBD for pain management, anxiety relief, and sleep disorders. Moreover, the surge in health-conscious lifestyles, along with celebrity endorsements and mainstream retail availability, continues to drive growth across various end-use categories, including personal care and food supplements.

Europe Full Spectrum Cannabidiol (CBD) Oils Market Insight

The Europe full spectrum CBD oils market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising regulatory clarity and growing acceptance of CBD as a functional ingredient. European consumers are turning to CBD-infused oils for wellness and personal care, with demand strengthening in countries such as Germany, Switzerland, and the Netherlands. The region is witnessing an expansion in domestic production and retail channels, helping improve accessibility and normalize usage among both older and younger demographics.

U.K. Full Spectrum Cannabidiol (CBD) Oils Market Insight

The U.K. full spectrum CBD oils market is expected to witness the fastest growth rate from 2025 to 2032, backed by strong consumer awareness and the increasing use of CBD in cosmetics and food items. The introduction of the Novel Foods regulation by the Food Standards Agency (FSA) is expected to streamline the market and encourage product standardization and safety. The growing preference for clean-label, natural wellness products continues to attract new users to full spectrum CBD oils in the country.

Germany Full Spectrum Cannabidiol (CBD) Oils Market Insight

The Germany full spectrum CBD oils market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s evolving medical cannabis framework and rising demand for natural pain management solutions. As regulatory frameworks mature and public education increases, CBD oils are gaining traction for applications ranging from skincare to mental wellness. Germany’s role as a major European hub for CBD research and innovation is further strengthening the presence of premium product offerings tailored to local consumer expectations.

Asia-Pacific Full Spectrum Cannabidiol (CBD) Oils Market Insight

The Asia-Pacific full spectrum CBD oils market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing health and wellness trends, growing middle-class populations, and emerging cannabis legalization in countries such as Thailand, South Korea, and Australia. Government pilot programs, favorable policy shifts, and rising awareness of natural health alternatives are catalyzing demand for full spectrum CBD oils across the region. In addition, regional investments in hemp cultivation and processing are expected to enhance domestic production and reduce import dependence.

China Full Spectrum Cannabidiol (CBD) Oils Market Insight

The China full spectrum CBD oils market is witnessing growing momentum, particularly in the cosmetics and personal care sectors, driven by demand for anti-aging and skin-soothing products. Although strict regulations limit ingestible CBD formats, the acceptance of hemp-derived skincare is expanding among consumers and brands alike. China’s robust hemp cultivation infrastructure, particularly in Yunnan and Heilongjiang provinces, is positioning the country as a potential supply leader in the global CBD value chain.

Japan Full Spectrum Cannabidiol (CBD) Oils Market Insight

The Japan full spectrum CBD oils market is expected to witness the fastest growth rate from 2025 to 2032, supported by a strong consumer preference for wellness products and a rising awareness of cannabidiol’s potential health benefits. While current regulations restrict THC content, the market for hemp-derived, low-THC CBD oils continues to expand across cosmetics, supplements, and therapeutic segments. Japanese consumers are showing growing trust in high-quality, imported CBD products, while domestic brands are beginning to emerge in response to increasing local demand.

Full Spectrum Cannabidiol (CBD) Oils Market Share

The Full Spectrum Cannabidiol (CBD) Oils industry is primarily led by well-established companies, including:

- Gaia Herbs Hemp (U.S.)

- ENDOCA (Denmark)

- Diamond CBD (U.S.)

- NuLeaf Naturals, LLC (U.S.)

- CV Sciences, Inc. (U.S.)

- ConnOils LLC (U.S.)

- Medical Marijuana, Inc. (U.S.)

- FOLIUM BIOSCIENCES (U.S.)

- PureKana LLC (U.S.)

- CBD American Shaman (U.S.)

- Canopy Growth USA, LLC (U.S.)

- Elixinol Global Limited (Australia)

- KAZMIRA (U.S.)

- Emblem Cannabis (Canada)

- Aphria (Canada)

- Curaleaf Hemp (U.S.)

- Joy Organics (U.S.)

- Isodiol International Inc. (Canada)

- MM Enterprises USA, LLC (U.S.)

- Aurora Cannabis Inc. (Canada)

Latest Developments in Global Full Spectrum Cannabidiol (CBD) Oils Market

- In November 2022, British Cannabis launched an advanced product under its CBD Rescue Cream range by introducing the Synergy CBG and CBD Rescue Cream. This product development builds upon the original award-winning CBD formula that debuted in 2019. The new cream aims to enhance skin health by combining Cannabigerol (CBG) and Cannabidiol (CBD) for synergistic therapeutic effects. The original formulation was notably the first cannabis-based cosmetic in the U.K. to be clinically tested for dermatological benefits. With this innovation, British Cannabis reinforces its leadership in the cannabinoid skincare segment, boosting consumer trust and expanding market presence in the wellness and personal care industries.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Full Spectrum Cannabidiol Cbd Oils Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Full Spectrum Cannabidiol Cbd Oils Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Full Spectrum Cannabidiol Cbd Oils Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.