Global Fumaric Acid Market

Market Size in USD Million

CAGR :

%

USD

666.06 Million

USD

984.07 Million

2024

2032

USD

666.06 Million

USD

984.07 Million

2024

2032

| 2025 –2032 | |

| USD 666.06 Million | |

| USD 984.07 Million | |

|

|

|

|

Fumaric Acid Market Size

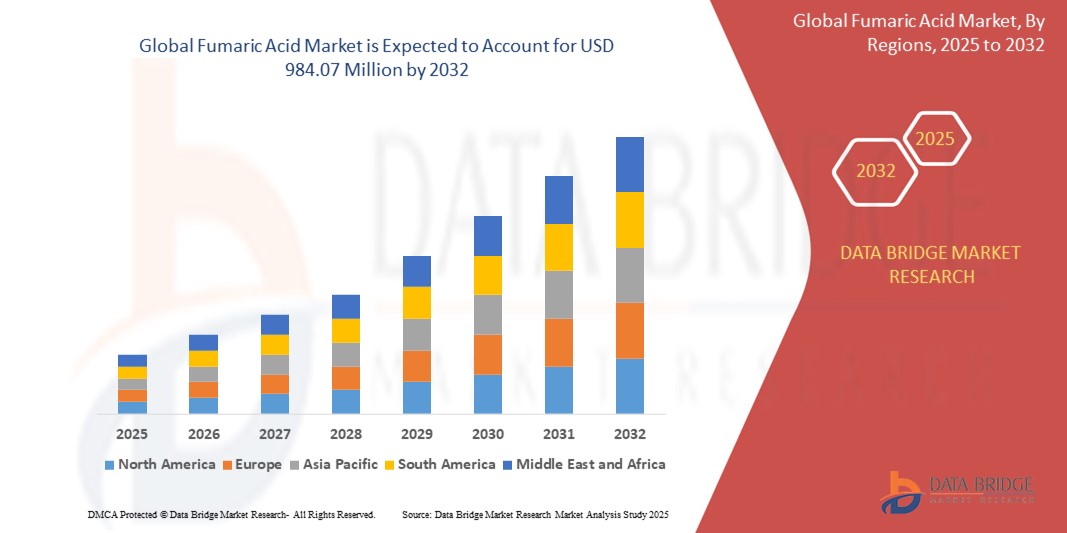

- The global fumaric acid market size was valued at USD 666.06 million in 2024 and is expected to reach USD 984.07 million by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by the increasing demand for fumaric acid in the food and beverage industry as an acidulant and preservative, driven by population growth and changing consumer preferences for processed and convenience foods, leading to greater utilization in various food formulations

- Furthermore, rising demand for fumaric acid in industrial applications such as unsaturated polyester resins, alkyd resins, and in the pharmaceutical industry is establishing it as a key ingredient across multiple sectors. These converging factors are accelerating the consumption of fumaric acid, thereby significantly boosting the industry's growth

Fumaric Acid Market Analysis

- Fumaric acid, an organic compound also known as trans-butene-dioic acid, is an increasingly vital component in various industrial applications, primarily in the food and beverage industry as an acidulant and preservative, as well as in the production of unsaturated polyester resins and in pharmaceutical applications, due to its versatile properties and cost-effectiveness

- The escalating demand for fumaric acid is primarily fueled by the rising consumption of processed and convenience foods globally, the growing need for it in the construction and automotive industries for manufacturing resins and coatings, and its expanding applications in the pharmaceutical sector for treating certain medical conditions

- Asia-Pacific dominated the fumaric acid market with a share of 45.4% in 2024, due to rapid industrialization, a growing population, and rising demand for processed foods, beverages, and resins across emerging economies

- North America is expected to be the fastest growing region in the fumaric acid market during the forecast period due to increased consumption of processed food, dietary supplements, and sustainable polymer resins

- Food Additive dominated the market with a market share of 65.5% in 2024, due to fumaric acid’s widespread use as an acidity regulator, flavor enhancer, and preservative in processed food and beverages. It offers high acidulant properties with a longer shelf life compared to other acids, making it an essential ingredient in soft drinks, bakery products, and confectionery. Its GRAS (Generally Recognized As Safe) status by regulatory agencies further promotes its adoption in the food and beverage industry

Report Scope and Fumaric Acid Market Segmentation

|

Attributes |

Fumaric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fumaric Acid Market Trends

“Rising Need for Processed Food And Beverages”

- A significant and accelerating trend in the global fumaric acid market is the rising need for its use in processed food and beverages, driven by changing consumer lifestyles and an increasing demand for convenience and ready-to-eat products. This trend is significantly boosting the market for fumaric acid as it acts as an effective acidulant, flavor enhancer, and preservative

- For instance, Bartek Ingredients, a major global producer of food-grade fumaric acid, has seen increased demand for their product due to its wide application in various processed foods and beverages to enhance tartness and extend shelf life. Similarly, companies such as Prinova LLC supply fumaric acid to the food industry, catering to the growing need for acidulants in products ranging from bakery items to beverages

- The rising consumption of processed foods and beverages, due to factors such as urbanization and busier lifestyles, has led to a greater reliance on ingredients such as fumaric acid to maintain quality and palatability. Fumaric acid is used in a variety of products, including soft drinks, fruit juices, confectionery, bakery goods, and even processed meats, where it helps regulate pH, enhance flavor profiles, and inhibit microbial growth, thus extending the shelf life – a crucial aspect for processed food manufacturers

- The seamless integration of fumaric acid into existing food and beverage manufacturing processes makes it a preferred choice for many companies looking to meet the growing demand for processed goods. Its effectiveness at lower concentrations compared to other food acids, such as citric acid, also makes it an economically viable option. Companies such as Thirumalai Chemicals and Polynt S.P.A., key players in the fumaric acid market, cater to this increasing demand from the processed food and beverage sector

- This trend towards increased consumption of processed foods and beverages is fundamentally reshaping the demand for food additives such as fumaric acid. Consequently, companies are focusing on ensuring a stable supply and exploring innovations to meet the specific requirements of the food and beverage industry

- The demand for fumaric acid from the processed food and beverage industry is growing rapidly across the globe, as consumer preferences continue to lean towards convenient and ready-to-consume options, making this sector a major driving force for the overall fumaric acid market

Fumaric Acid Market Dynamics

Driver

“Increase in Changing Consumer Preferences”

- The increasing prevalence of changing consumer preferences, particularly the growing demand for processed and convenience foods coupled with a rising inclination towards natural and clean-label ingredients, is a significant driver for the heightened demand for fumaric acid

- For instance, Bartek Ingredients, recognizing this shift in consumer preferences, emphasizes the natural occurrence of fumaric acid and its role as a clean-label acidulant in various food applications, aligning their product offerings with these evolving demands

- As consumers increasingly seek out convenient, ready-to-eat options due to busier lifestyles, the demand for processed foods and beverages has grown. Fumaric acid plays a crucial role in these products as an acidulant, flavor enhancer, and preservative, contributing to the desired taste, texture, and extended shelf life that consumers now expect. This makes it an essential ingredient for food manufacturers aiming to cater to these preferences

- The convenience of using fumaric acid to achieve specific food properties and its acceptance as a generally safe ingredient by regulatory bodies further propel its adoption by food and beverage manufacturers catering to changing consumer tastes. The trend towards longer shelf life and enhanced flavor profiles in packaged foods, driven by consumer demand, directly contributes to the increased use of fumaric acid

- The demand for fumaric acid, driven by these evolving consumer preferences for convenience, taste, and natural ingredients in their food and beverages, is steadily growing and continues to be a key driver for the overall fumaric acid market

Restraint/Challenge

“High Production Costs”

- Concerns surrounding the high production costs associated with manufacturing fumaric acid pose a significant challenge to broader market competitiveness and affordability. As the production process involves specific raw materials and chemical processes, fluctuations in these costs can impact the final price of fumaric acid, potentially hindering its wider application

- For instance, variations in the price of maleic anhydride, a key raw material in fumaric acid production for some manufacturers, can directly influence the production costs for companies such as Polynt S.P.A. and Thirumalai Chemicals, impacting their pricing strategies and profit margins

- Addressing these cost concerns often requires manufacturers to invest in efficient production technologies and explore alternative, more cost-effective raw material sources. In addition, adhering to stringent quality control measures, while essential, can also contribute to higher operational costs. Companies in the fumaric acid market continuously strive to optimize their production processes to mitigate these expenses. The relatively higher cost of fumaric acid compared to some other food acids can sometimes limit its use in very price-sensitive applications or regions

- While economies of scale and technological advancements have helped in gradually reducing production costs over time, the inherent complexities of chemical manufacturing and the reliance on specific feedstocks mean that significant cost reductions can be challenging to achieve consistently. This can particularly affect smaller players in the market who may not have the same negotiating power or technological capabilities as larger corporations

- Overcoming these challenges through innovation in production processes, securing stable and cost-effective raw material supplies, and optimizing supply chain logistics will be vital for ensuring fumaric acid remains a competitive and widely adopted ingredient across its various applications

Fumaric Acid Market Scope

The market is segmented on the basis of application, end-user, and extraction type.

- By Application

On the basis of application, the fumaric acid market is segmented into Food Additive, Rosin Paper Sizes, UPR (Unsaturated Polyester Resins), Alkyd Resins, Animal Feed, and Others. The Food Additive segment held the largest market revenue share 65.5% in 2024, primarily due to fumaric acid’s widespread use as an acidity regulator, flavor enhancer, and preservative in processed food and beverages. It offers high acidulant properties with a longer shelf life compared to other acids, making it an essential ingredient in soft drinks, bakery products, and confectionery. Its GRAS (Generally Recognized As Safe) status by regulatory agencies further promotes its adoption in the food and beverage industry.

The UPR (Unsaturated Polyester Resins) segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising demand in automotive, construction, and marine applications. Fumaric acid enhances the mechanical strength, corrosion resistance, and durability of resins. The global shift towards lightweight, fuel-efficient vehicles and sustainable construction materials further fuels the demand for UPR-grade fumaric acid.

- By End-User

On the basis of end-user, the fumaric acid market is categorized into the Food and Beverages Industry, Cosmetics Industry, Pharmaceutical Industry, and Chemical Industry. The Food and Beverages Industry dominated the market with a share of 45.4% in 2024, supported by the increasing consumption of processed and packaged foods worldwide. Consumers' preference for longer-lasting, shelf-stable food products, along with evolving dietary preferences, has intensified the use of fumaric acid in various edible formulations. Moreover, the clean-label trend and demand for natural acidulants bolster its growth in this sector

The Pharmaceutical Industry is anticipated to experience the fastest CAGR from 2025 to 2032, attributed to the growing use of fumaric acid in the synthesis of active pharmaceutical ingredients (APIs), particularly in the treatment of conditions such as multiple sclerosis and psoriasis. Its anti-inflammatory properties and favorable pharmacokinetic profile make it a key ingredient in several drug formulations, with increasing clinical research likely to drive future expansion.

- By Extraction Type

On the basis of extraction type, the fumaric acid market is segmented into Fumaria Officinalis, Maleic Anhydride, and Fermentation. The Maleic Anhydride segment accounted for the largest revenue share in 2024, largely due to its established industrial process, scalability, and cost-efficiency. This synthetic method allows for the bulk production of high-purity fumaric acid, supporting its use across large-volume applications such as resins, coatings, and polymers. Its widespread industrial integration ensures a steady supply chain and broad application versatility.

Meanwhile, the Fermentation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising environmental concerns and the growing shift towards bio-based, sustainable chemicals. Fermentation using carbohydrates or renewable biomass presents a low-carbon, eco-friendly production method. As green chemistry initiatives gain traction across industries, bio-based fumaric acid via fermentation is increasingly seen as a sustainable alternative to petroleum-derived sources.

Fumaric Acid Market Regional Analysis

- Asia-Pacific dominated the fumaric acid market with the largest revenue share of 45.4% in 2024, driven by rapid industrialization, a growing population, and rising demand for processed foods, beverages, and resins across emerging economies

- The region’s expanding middle class, increasing disposable incomes, and evolving dietary habits are major contributors to market growth

- In addition, supportive government policies on food safety and industrial development, along with strong local manufacturing capacities and advancements in chemical processing technologies, are accelerating adoption of fumaric acid across both domestic industries and international markets

Japan Fumaric Acid Market Insight

The Japan market is expanding due to increased demand for functional foods, nutraceuticals, and high-performance industrial resins. Japanese consumers favor food-grade ingredients with clean-label profiles, which has elevated the use of fumaric acid in acidulant roles. Manufacturers in Japan are also investing in sustainable production techniques and innovative polymer applications to support demand across food, pharmaceutical, and materials science sectors.

China Fumaric Acid Market Insight

The China fumaric acid market leads in Asia-Pacific, supported by its position as a global manufacturing hub and the large-scale consumption of food additives and industrial chemicals. Government initiatives focused on food safety, combined with surging demand for processed foods and beverage acidulants, are driving market expansion. Chinese producers are increasingly investing in eco-friendly extraction methods and fermentation-based technologies to serve both domestic and export markets.

Europe Fumaric Acid Market Insight

The Europe fumaric acid market is projected to grow steadily, fueled by stringent regulatory frameworks supporting clean-label food ingredients and bio-based chemical production. The region is at the forefront of sustainability initiatives and circular economy goals, encouraging the use of fumaric acid in environmentally responsible food, resin, and pharmaceutical applications. Rising consumer preference for organic food products and the shift toward low-emission manufacturing are further driving market penetration across Europe.

U.K. Fumaric Acid Market Insight

The U.K. market is experiencing steady growth, driven by demand for clean, natural additives in food and beverages, as well as sustainable resins in industrial manufacturing. Government initiatives promoting plastic alternatives and low-toxicity chemicals are supporting the use of fumaric acid in coatings, polymers, and eco-friendly food products. Local producers are also adopting fermentation-based production techniques to align with consumer and regulatory sustainability goals.

Germany Fumaric Acid Market Insight

The Germany fumaric acid market is expanding, underpinned by strong environmental policies and high industrial standards. German manufacturers emphasize biodegradable and non-toxic materials, which has led to greater adoption of fumaric acid in food, pharma, and resin applications. Advanced production technologies and high demand for minimally processed food products are reinforcing fumaric acid’s role across multiple sectors.

North America Fumaric Acid Market Insight

The North America market is expected to grow rapidly, driven by increased consumption of processed food, dietary supplements, and sustainable polymer resins. Rising health awareness, demand for natural acidulants, and a growing interest in clean-label products are influencing adoption in the food and beverage industry. Supportive regulatory frameworks, expanding pharmaceutical research, and growing applications in resins and coatings are also contributing to regional market growth.

U.S. Fumaric Acid Market Insight

The U.S. market leads in North America, supported by high demand for food-grade acids in bakery, beverages, and nutritional supplements. The presence of major food processing companies, along with growing consumer interest in plant-based and preservative-free products, is boosting market uptake. In addition, investment in advanced chemical synthesis and fermentation technologies is enhancing the availability and sustainability of fumaric acid products.

Fumaric Acid Market Share

The fumaric acid industry is primarily led by well-established companies, including:

- FUSO CHEMICAL CO., LTD. (Japan)

- Polynt (Italy)

- Bartek Ingredients Inc. (Canada)

- Tate & Lyle (U.K.)

- TCI Chemicals (India) Pvt. Ltd. (India)

- Huntsman International LLC (U.S.)

- Merck KGaA (Germany)

- The Chemical Company (U.S.)

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- DuPont (U.S.)

- Thermo Fischer Scientific, Inc. (U.S.)

- Thirumalai Chemicals (India)

- Khusheim Holding (Saudi Arabia)

- Sip Chemical Industries (India)

Latest Developments in Global Fumaric Acid Market

- In April 2022, Bartek Ingredients initiated the construction of a state-of-the-art facility aimed at becoming the world's largest producer of malic and food-grade fumaric acid. With an investment of USD 160 million, this expansion project, set to conclude by 2023, demonstrates Bartek's proactive stance in meeting rising market demand and exploring new product avenues. WSP Global's involvement underscores the project's strategic significance and underscores Bartek's dedication to enhancing its global leadership position

- In March 2020, Bartek Ingredients announced plans for a significant expansion, aiming to increase malic acid capacity by 10,000 Mt by the first quarter of 2021. As the world's leading malic acid and food-grade fumaric acid producer, this expansion initiative underscores Bartek's commitment to meeting escalating market demands and consolidating its position as a key player in the industry's growth trajectory

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FUMARIC ACID MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FUMARIC ACID MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FUMARIC ACID MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL FUMARIC ACID MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 FOOD ADDITIVE

10.3 ROSIN PAPER SIZES

10.4 UPR

10.5 ALKYD RESINS

10.6 ANIMAL FEED

10.7 OTHERS

11 GLOBAL FUMARIC ACID MARKET, BY EXTRACTION TYPE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 FUMARIA OFFICINALIS

11.3 MALEIC ANHYDRIDE

11.4 FERMENTATION

12 GLOBAL FUMARIC ACID MARKET, BY END USER, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 FOOD AND BEVERAGES INDUSTRY

12.2.1 FOOD AND BEVERAGES INDUSTRY, BY EXTRACTION TYPE

12.2.1.1. FUMARIA OFFICINALIS

12.2.1.2. MALEIC ANHYDRIDE

12.2.1.3. FERMENTATION

12.3 COSMETICS INDUSTRY

12.3.1 COSMETICS INDUSTRY, BY EXTRACTION TYPE

12.3.1.1. FUMARIA OFFICINALIS

12.3.1.2. MALEIC ANHYDRIDE

12.3.1.3. FERMENTATION

12.4 PHARMACEUTICAL INDUSTRY

12.4.1 PHARMACEUTICAL INDUSTRY, BY EXTRACTION TYPE

12.4.1.1. FUMARIA OFFICINALIS

12.4.1.2. MALEIC ANHYDRIDE

12.4.1.3. FERMENTATION

12.5 CHEMICAL INDUSTRY

12.5.1 CHEMICAL INDUSTRY, BY EXTRACTION TYPE

12.5.1.1. FUMARIA OFFICINALIS

12.5.1.2. MALEIC ANHYDRIDE

12.5.1.3. FERMENTATION

13 GLOBAL FUMARIC ACID MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT & APPROVALS

13.7 EXPANSIONS & PARTNERSHIP

13.8 REGULATORY CHANGES

14 GLOBAL FUMARIC ACID MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

14.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 SWITZERLAND

14.3.7 NETHERLANDS

14.3.8 BELGIUM

14.3.9 RUSSIA

14.3.10 DENMARK

14.3.11 SWEDEN

14.3.12 POLAND

14.3.13 TURKEY

14.3.14 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 AUSTRALIA

14.4.6 SINGAPORE

14.4.7 THAILAND

14.4.8 INDONESIA

14.4.9 MALAYSIA

14.4.10 PHILIPPINES

14.4.11 NEW ZEALAND

14.4.12 VIETNAM

14.4.13 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 UAE

14.6.3 SAUDI ARABIA

14.6.4 OMAN

14.6.5 QATAR

14.6.6 KUWAIT

14.6.7 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL FUMARIC ACID MARKET, SWOT & DBMR ANALYSIS

16 GLOBAL FUMARIC ACID MARKET, COMPANY PROFILE

16.1 FUSO CHEMICAL CO., LTD.

16.1.1 COMPANY OVERVIEW

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 POLYNT

16.2.1 COMPANY OVERVIEW

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 BARTEK INGREDIENTS INC.

16.3.1 COMPANY OVERVIEW

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 TATE & LYLE

16.4.1 COMPANY OVERVIEW

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TCI CHEMICALS (INDIA) PVT. LTD.

16.5.1 COMPANY OVERVIEW

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 HUNTSMAN INTERNATIONAL LLC

16.6.1 COMPANY OVERVIEW

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 MERCK KGAA

16.7.1 COMPANY OVERVIEW

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 THE CHEMICAL COMPANY

16.8.1 COMPANY OVERVIEW

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BASF SE

16.9.1 COMPANY OVERVIEW

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 AKZO NOBEL N.V.

16.10.1 COMPANY OVERVIEW

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DUPONT

16.11.1 COMPANY OVERVIEW

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 THIRUMALAI CHEMICALS

16.12.1 COMPANY OVERVIEW

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 KHUSHEIM HOLDING

16.13.1 COMPANY OVERVIEW

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SIP CHEMICAL INDUSTRIES

16.14.1 COMPANY OVERVIEW

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 THIRUMALAI CHEMICALS LTD

16.15.1 COMPANY OVERVIEW

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 VIZAG CHEMICAL

16.16.1 COMPANY OVERVIEW

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 FERRO CHEM INDUSTRIES

16.17.1 COMPANY OVERVIEW

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 BARTEK INGREDIENTS INC.

16.18.1 COMPANY OVERVIEW

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 MUBYGROUP COMPANY

16.19.1 COMPANY OVERVIEW

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 CONCLUSION

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Fumaric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fumaric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fumaric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.