Global Functional Juices Market

Market Size in USD Billion

CAGR :

%

USD

207.51 Billion

USD

281.82 Billion

2024

2032

USD

207.51 Billion

USD

281.82 Billion

2024

2032

| 2025 –2032 | |

| USD 207.51 Billion | |

| USD 281.82 Billion | |

|

|

|

|

Functional Juices Market Size

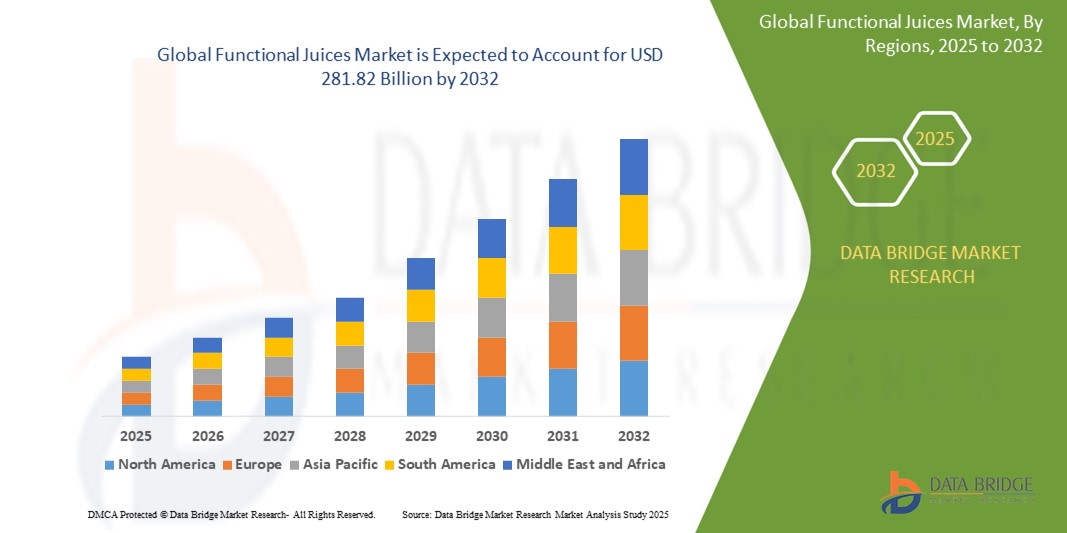

- The global functional juices market size was valued at USD 207.51 billion in 2024 and is expected to reach USD 281.82 billion by 2032, at a CAGR of 3.9% during the forecast period

- The market growth is largely fueled by rising health consciousness and increasing consumer preference for functional beverages that offer nutritional benefits beyond basic hydration, including support for immunity, digestion, energy, and mental alertness

- Furthermore, the surge in demand for clean-label, low-sugar, and plant-based drink options is prompting manufacturers to innovate with natural ingredients, superfoods, and fortified formulations. These converging factors are significantly accelerating the adoption of functional juices, thereby boosting the market’s overall expansion

Functional Juices Market Analysis

- Functional juices are beverages formulated with added ingredients such as vitamins, minerals, probiotics, botanical extracts, and antioxidants designed to deliver targeted health benefits. These products appeal to consumers seeking convenient, on-the-go wellness solutions without compromising on taste or quality

- The growing popularity of preventive healthcare, coupled with evolving dietary habits and an increase in fitness-oriented lifestyles, is driving the demand for functional juices globally. The market is further supported by advancements in cold-pressed and natural processing techniques, along with broader distribution through both physical retail and digital platforms

- North America dominated the functional juices market with a share of 38.1% in 2024, due to a heightened focus on preventive healthcare, clean-label trends, and strong demand for functional beverages rich in vitamins, antioxidants, and probiotics

- Asia-Pacific is expected to be the fastest growing region in the functional juices market during the forecast period due to rising urbanization, an expanding health-conscious middle class, and increasing disposable incomes

- Bottle segment dominated the market with a market share of 42% in 2024, due to its widespread consumer preference, ease of portability, and higher volume capacity suitable for regular use. Bottles are favored for both single-serve and family-size packaging, offering versatility across retail formats. Their compatibility with both glass and PET materials also aligns with sustainability trends and brand preferences for premium presentation

Report Scope and Functional Juices Market Segmentation

|

Attributes |

Functional Juices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Functional Juices Market Trends

“Rising Consumer Preference for Health-Enhancing Ingredients”

- The functional juices market is expanding as health-conscious consumers increasingly seek beverages infused with ingredients that offer tangible wellness benefits, such as probiotics, adaptogens, and antioxidants

- For instance, brands such as Suja and Naked Juice are capturing market share by emphasizing organic, cold-pressed juices featuring minimally processed, natural ingredients, catering to demand for both nutrition and transparency

- Innovations such as cold-pressed technology preserve more nutrients and improve shelf life, while new juice formats—incorporating superfoods, fiber, and functional botanicals—allow manufacturers to address specific consumer goals such as digestion, immunity, and energy

- Fitness and lifestyle trends are fueling demand for juices designed for rapid hydration, enhanced sports recovery, and metabolic support, with leading brands innovating with electrolytes, vitamins, and micronutrients

- Product lines encompassing kombucha-based and probiotic-rich juices have gained popularity for their digestive health benefits, pointing to a broader shift toward functional, not just flavorful, beverage choices

- The rise of clean-label and “free-from” positioning—such as no added sugar or preservatives—further propels growth, especially among millennials and Gen Z seeking authentic, nutrient-dense refreshment options

Functional Juices Market Dynamics

Driver

“Growing Demand for Natural Ingredients”

- Consumers are favoring natural and organic juice products over those containing synthetic additives or artificial sweeteners, supporting growth for brands prioritizing clean, simple ingredient lists

- For instance, the success of cold-pressed offerings by Suja and Naked Juice demonstrates that consumers are willing to pay a premium for juice perceived as fresher, healthier, and more transparent in sourcing

- The surge in chronic health issues—such as diabetes, obesity, and heart disease—drives demand for juices formulated with turmeric, ginger, and other health-promoting botanicals for targeted benefits

- Manufacturers are responding with innovative formulations that blend traditional fruit bases with functional components, tapping into preferences for natural fortification rather than synthetic enrichment

- The trend is reinforced by regulatory and nutrition guidance encouraging increased intake of natural foods and beverages, boosting category legitimacy and supporting new product development

Restraint/Challenge

“High Production Costs”

- Functional juices, especially those featuring premium raw ingredients such as superfruits, probiotics, and adaptogens, incur higher production costs than traditional juices due to ingredient pricing and advanced processing technologies

- For instance, industry reports highlight that the need for specialized equipment (e.g., cold-press, non-thermal pasteurization) and superior raw materials can raise manufacturing expenses and, consequently, retail prices, narrowing the consumer base in price-sensitive segments

- Shorter shelf life due to the absence of preservatives and the presence of active functional components complicates logistics, requiring efficient cold chains that further add to operational costs

- Regulatory compliance, quality assurance for health claims, and sourcing challenges for consistent, high-quality natural ingredients also contribute to elevated production and go-to-market costs

- These cumulative expenses can limit broader adoption and profitability, particularly for smaller manufacturers or in emerging markets less able to absorb or pass along higher costs to consumers

Functional Juices Market Scope

The market is segmented on the basis of packaging, components, functions, and distribution channel.

- By Packaging

On the basis of packaging, the functional juices market is segmented into bottle, sachet, tin can, tetra pack, and others. The bottle segment dominated the largest market revenue share of 42% in 2024, attributed to its widespread consumer preference, ease of portability, and higher volume capacity suitable for regular use. Bottles are favored for both single-serve and family-size packaging, offering versatility across retail formats. Their compatibility with both glass and PET materials also aligns with sustainability trends and brand preferences for premium presentation.

The tetra pack segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for lightweight, eco-friendly, and shelf-stable packaging. Tetra packs provide excellent protection against light and oxygen, preserving the nutritional value and freshness of functional juices without the need for preservatives. Their recyclability and convenience make them increasingly popular, especially in urban households and on-the-go consumption scenarios.

- By Components

On the basis of components, the functional juices market is segmented into carotenoids, phenolic acids, flavonoids, fatty acids, probiotics, prebiotics, minerals, and vitamins. The vitamins segment held the largest market share in 2024, primarily due to the widespread use of vitamin-enriched juices in addressing common nutritional deficiencies. Vitamin C, D, and B-complex enriched beverages are highly demanded for immunity, energy, and metabolic support, making them a staple among health-conscious consumers.

The probiotics segment is anticipated to grow at the fastest pace from 2025 to 2032, owing to increased awareness of gut health and microbiome benefits. Functional juices fortified with probiotics are gaining traction as consumers seek non-dairy alternatives to support digestion and immunity. The appeal of probiotics in juice form lies in their ability to deliver health benefits without altering taste or texture, making them ideal for daily consumption across age groups.

- By Functions

On the basis of function, the market is segmented into weight management, hydration, health and wellness, energy and rejuvenation, and others. The health and wellness segment accounted for the highest revenue share in 2024, supported by growing preventive healthcare trends and consumer inclination toward natural, functional beverages. Juices enriched with antioxidants, vitamins, and plant-based nutrients are widely recognized for supporting immunity, heart health, and detoxification.

The energy and rejuvenation segment is projected to register the highest growth from 2025 to 2032, as consumers increasingly turn to natural energy boosters over synthetic stimulants. Functional juices with adaptogens, electrolytes, and botanical extracts are gaining favor for their ability to provide sustained vitality, especially among fitness enthusiasts and busy professionals seeking clean-label energy sources.

- By Distribution Channel

On the basis of distribution channel, the functional juices market is segmented into supermarkets/hypermarkets, drug stores and pharmacies, convenience stores, online retail stores, and others. The supermarkets/hypermarkets segment dominated the market in 2024, driven by wide product availability, in-store promotions, and consumer trust in brick-and-mortar retail. These retail chains offer a diverse selection of functional juices, enabling shoppers to compare brands, ingredients, and pricing conveniently.

The online retail stores segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the rapid expansion of e-commerce platforms and shifting consumer behavior toward digital shopping. Online channels offer benefits such as doorstep delivery, subscription models, and access to niche or premium functional juice brands that may not be readily available offline. The surge in health-focused online communities and influencers also plays a role in driving e-commerce growth in this category.

Functional Juices Market Regional Analysis

- North America dominated the functional juices market with the largest revenue share of 38.1% in 2024, driven by a heightened focus on preventive healthcare, clean-label trends, and strong demand for functional beverages rich in vitamins, antioxidants, and probiotics

- Consumers in the region are increasingly shifting from carbonated drinks to nutrient-dense alternatives that support immunity, energy, and digestive health

- The presence of well-established health beverage brands, high disposable incomes, and widespread retail distribution further strengthens the market, especially across the U.S. and Canada

U.S. Functional Juices Market Insight

The U.S. functional juices market captured the largest revenue share within North America in 2024, owing to a rapidly growing demand for clean-label, fortified beverages that target specific wellness needs such as detoxification, cognitive function, and gut health. The country's robust health and fitness culture, combined with increasing awareness of the long-term benefits of functional nutrition, has fueled demand for nutrient-dense juices. Innovation in ingredients—such as cold-pressed fruits, adaptogens, and fermented blends—has further expanded the product range, with strong support from e-commerce platforms, supermarket chains, and health-focused retail outlets.

Europe Functional Juices Market Insight

Europe is projected to register a substantial CAGR in the functional juices market over the forecast period, supported by growing health consciousness and an aging population with a strong inclination toward natural wellness solutions. Consumers across the region are increasingly drawn to juices enriched with plant-based ingredients, antioxidants, and micronutrients that support immune health, digestion, and energy. Stringent regulations around food and health claims have enhanced consumer trust in functional products, while sustainability trends and demand for organic, low-sugar options are influencing purchasing behavior. Both Western and Eastern European countries are experiencing rising adoption across retail and specialty health channels.

U.K. Functional Juices Market Insight

The U.K. functional juices market is expected to grow at a healthy CAGR, driven by the country's rising demand for low-sugar, natural health beverages tailored to specific functional needs. Post-pandemic, consumers have maintained a heightened awareness of immune support and overall wellness, driving demand for juices fortified with vitamins, botanicals, and superfoods. Functional juices are increasingly positioned as convenient meal complements or replacements, especially among health-conscious urban consumers. The U.K.’s strong retail infrastructure and consumer openness to innovation have enabled the rapid expansion of both domestic and international brands in the segment.

Germany Functional Juices Market Insight

Germany’s functional juices market is expanding steadily, fueled by the population’s growing interest in organic, plant-based, and science-backed wellness products. German consumers value transparency, quality, and the integration of nutrition into daily routines, making functional juices a natural choice for those seeking convenience and health benefits in one. The market is witnessing demand for probiotic, vitamin-enriched, and antioxidant-infused formulations, particularly in urban centers and among older consumers. Germany’s well-established organic sector and strong presence of health food stores further support the segment’s consistent growth.

Asia-Pacific Functional Juices Market Insight

Asia-Pacific is poised to grow at the fastest CAGR from 2025 to 2032, making it a critical region for the functional juices market. The growth is driven by rising urbanization, an expanding health-conscious middle class, and increasing disposable incomes across countries such as China, India, Japan, and South Korea. Government-backed initiatives promoting wellness and digital health education are accelerating consumer awareness and adoption. The availability of locally sourced superfoods, herbal ingredients, and innovative blends tailored to regional health needs is fostering rapid product diversification. Enhanced retail penetration and growing e-commerce infrastructure are further enabling access to functional juices across a broader demographic.

Japan Functional Juices Market Insight

Japan’s functional juices market is gaining traction due to the nation’s advanced health awareness, rapid urbanization, and cultural preference for food-based wellness solutions. Consumers are seeking functional juices that provide specific benefits such as improved digestion, energy, and cardiovascular support—especially those formulated with traditional ingredients such as yuzu, matcha, and fermented botanicals. Japan’s aging population is also a key driver of demand for convenient, easy-to-consume health beverages. The integration of functionality with flavor and packaging innovation has positioned functional juices as a staple in both supermarkets and convenience stores.

China Functional Juices Market Insight

China accounted for the largest revenue share in the Asia-Pacific functional juices market in 2024, propelled by the country’s expanding urban population, rising disposable income, and strong interest in health-enhancing beverages. Functional juices are gaining popularity in both residential and commercial consumption settings, particularly among young professionals and families focused on long-term wellness. Domestic manufacturers are driving innovation with herbal infusions, collagen-based formulations, and immunity-boosting blends tailored to local health trends. The rapid growth of e-commerce platforms and social media-driven health campaigns further amplify market visibility and product accessibility.

Functional Juices Market Share

The functional juices industry is primarily led by well-established companies, including:

- Red Bull (Austria)

- PepsiCo, Inc. (U.S.)

- Nestlé (Switzerland)

- Kraft Foods (U.S.)

- General Mills (U.S.)

- Campbell Soup Company (U.S.)

- Monster Beverage Corporation (U.S.)

- The Coca-Cola Company (U.S.)

- ADM (U.S.)

- DuPont (U.S.)

- BASF SE (Germany)

- Glanbia PLC (Ireland)

- Mondelez International group (U.S.)

- Dr Pepper Snapple Group Inc. (U.S.)

- GSK plc. (U.K.)

Latest Developments in Global Functional Juices Market

- In January 2025, Reliance Consumer Products Limited (RCPL) entered the Indian rehydration and energy beverage segment with the launch of RasKik Gluco Energy, a drink enriched with glucose, electrolytes, and real lemon juice. Priced affordably at Rs. 10 per single-serve SKU, this launch positions RCPL to disrupt the hydration category by targeting mass-market consumers seeking accessible, functional refreshment. The move signals RCPL’s intent to compete in a high-volume, value-driven segment, strengthening its foothold in the functional beverage space and expanding its reach across rural and urban India

- In October 2023, Tropicana expanded its product offerings in India by launching two new smoothie flavors—Pineapple & Mango and Strawberry & Banana—fortified with Vitamin C. This product innovation enhances Tropicana’s presence in the functional juice segment by addressing the growing consumer preference for nutrient-rich, ready-to-drink beverages. The nationwide rollout through diverse retail channels also reflects the brand’s strategy to solidify its market share by appealing to health-conscious consumers seeking immunity-boosting and flavorful options

- In May 2023, Reliance Consumer Products Limited (RCPL) reaffirmed its strategic push into the hydration market by reiterating the availability of RasKik Gluco Energy. This continued focus on promoting the product underlines the brand’s commitment to penetrating the Indian functional drink space with a product that combines affordability and rehydration benefits. Its emphasis on convenience and nutritional value is expected to create significant traction in tier-2 and tier-3 markets

- In March 2023, Dole launched a diverse portfolio of functional fruit juices, including 100% Pineapple Juice, Pineapple Mango Juice, and Dole Digestive Bliss Fruit Juice, emphasizing clean-label ingredients and digestive health. These products cater directly to the growing demand for natural, nutrient-rich beverages among wellness-focused consumers. Dole’s emphasis on transparency and real fruit content enhances its credibility in the functional beverage segment and strengthens its position in global health-conscious markets

- In July 2021, Dole Packaged Foods expanded into functional beverage territory with the introduction of Dole Fruitify juices and Dole Essentials fruit bowls. The Fruitify range—infused with ingredients such as turmeric, green tea extract, and coconut water—was designed to offer functional benefits such as anti-inflammatory support and hydration, all with fewer than 100 calories per can. This innovation marked a strategic shift for Dole, aligning the brand with evolving consumer trends favoring low-calorie, benefit-driven beverages and signaling its intention to compete more aggressively in the premium functional drink category

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Functional Juices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Functional Juices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Functional Juices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.