Global Fungal Infections Market

Market Size in USD Billion

CAGR :

%

USD

14.42 Billion

USD

19.73 Billion

2021

2029

USD

14.42 Billion

USD

19.73 Billion

2021

2029

| 2022 –2029 | |

| USD 14.42 Billion | |

| USD 19.73 Billion | |

|

|

|

|

Fungal Infections Market Analysis and Size

The global fungal infections market is expected to witness significant growth during the forecast period. The symptoms of fungal infections depend on the type of fungal infection. The common symptoms include itching and skin changes, including red and possibly peeling or cracking skin. This type of infection can be treated with antifungal medications. These medications can kill fungi directly or prevent them from thriving and growing. Antifungal drugs are available in several formulations, including powder, pills, sprays, shampoos, and creams or ointments.

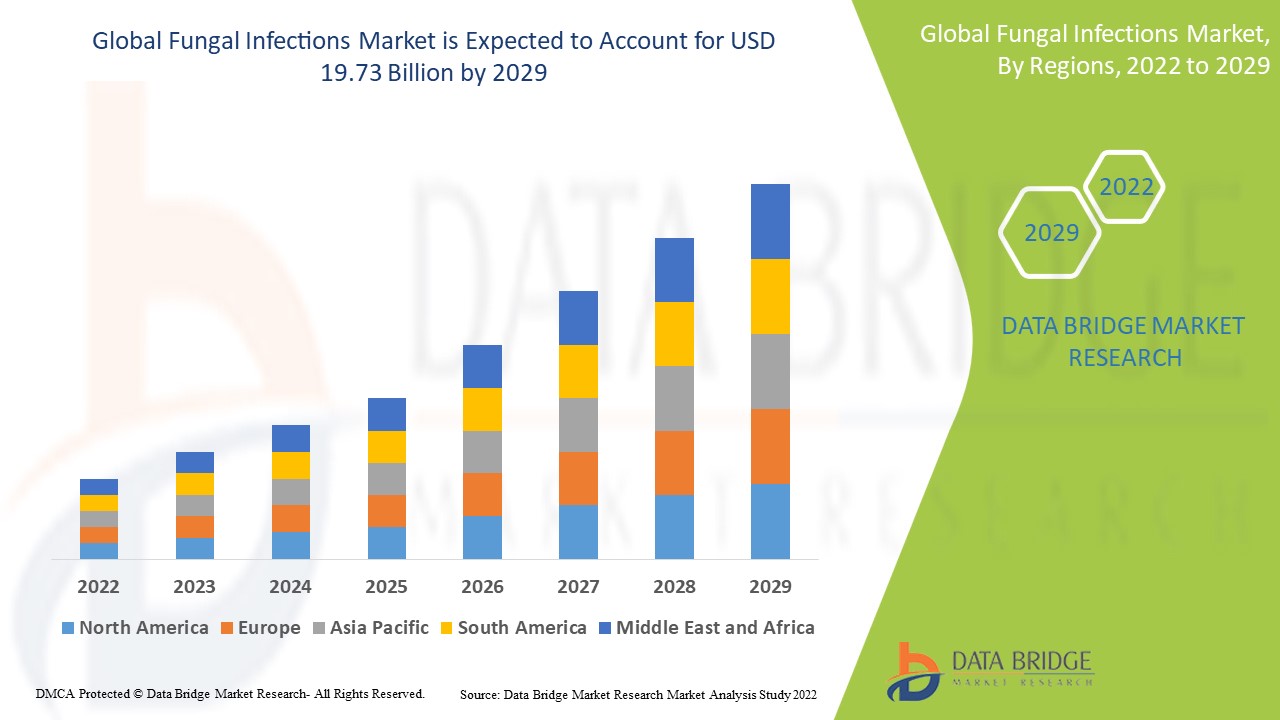

Data Bridge Market Research analyses a growth rate in the global fungal infections market in the forecast period 2022-2029. The expected CAGR of the global candida infections drugs market tends to be around 4.00% in the mentioned forecast period. The market was valued at USD 14.42 billion in 2021, and it would grow up to USD 19.73 billion by 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Fungal Infections Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Types (Aspergillosis, Blastomycosis, Candidiasis, Candida auris, Coccidioidomycosis, Cryptococcus gattii Infection, Fungal Eyes Infection, Fungal Nail Infection, Histoplasmosis, Ringworm, Others), Drugs (Corticosteroids, Corticosteroid-Sparing Agents, Immunosuppressive, Immunomodulator, Antifungals and Others), Treatment (Antifungal, Others), Route of Administration (Oral, Parenteral, Topical, Vaginal, Others), Dosage Form (Creams, Gels, Ointment, Solution, Lotions, Others), End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, online Pharmacies and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd. (Switzerland), Mylan N.V. (U.S.), Teva Pharmaceutical Industries Ltd. (Israel), Sanofi (France), Pfizer Inc. (U.S.), GSK plc (U.K.), Novartis AG (Switzerland), AstraZeneca (U.K.), Johnson & Johnson Private Limited (U.S.), Sun Pharmaceutical Industries Ltd. (India), Merck & Co., Inc. (U.S.), Bristol-Myers Squibb Company (U.S.), Lilly (U.S.), Amgen Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Fungal infections are common in the natural world. Infection occurs when an invading fungus enters the body, and the immune system becomes too weak to handle the abnormalities. Fungal infections can occur anywhere on the body. The most common fungal infections are ringworm, jock itch, athlete's foot, and yeast. This disease prevalence is rising, and important diagnostic procedures and treatments will boost the market's growth.

Global Fungal Infections Market Dynamics

Drivers

- Increased Demand for Diagnostic Tests

Diagnostic tests, such as medical imaging, including C.T. scans and X-rays, are usually performed to detect pneumocystis pneumonia. In addition, biopsy involves extracting a small part of the infected tissue and is examined under the microscope for the presence of a specific fungus. It is generally performed for the diagnosis of aspergillosis, pneumocytosis pneumonia, and sporotrichosis. Thus, it acts as a major driver in market growth.

- The rise in Cryptococcal Meningitis

As per the Centers for Disease Control and Prevention, an estimated 220,000 new cases of cryptococcal meningitis occur globally every year, and around 181,000 deaths occur because of cryptococcal meningitis. Cryptococcal meningitis is a deadly brain infection caused by the soil-dwelling fungus Cryptococcus.

Opportunities

- Rising Existence of Several Fungal Infections

Several fungal infections are helping in boosting the growth of the market. Pneumocystis pneumonia is the most severe and commonly occurring fungal infection that is caused by the fungus Pneumocystis jirovecii. It is most widespread in individuals with weakened immune systems, such as those with AIDS. Other than these, Dermatophytes and Candidiasis are two other types of commonly occurring fungal infections. Candidiasis majorly affects soft, moist areas or skin around the nails. For instance, vaginal yeast infection in women and baby diaper rash occurs because of candidiasis. All these factors are also contributing to the growth of the market.

- Increasing Demand for Retail Pharmacies

The rise in the number of drugs used for the global fungal infections market delivered through retail pharmacies and the surge in the number of retail pharmacies in developed countries create opportunities for market growth. In addition, patients prefer retail pharmacies for purchasing drugs, as these are easily accessible.

Restraints/Challenges

- Lack of skilled professionals

The lack of qualified personnel unable to perform these treatments could reduce the growth of the global fungal infections market over a forecast period.

- Unavailability of Appropriate Treatments

To treat conditions that are rare, many times, all treatments are not available, especially in underdeveloped countries. Severe patients need to be treated with advanced techniques, but these are sometimes unavailable in hospitals and clinics. Thus, it hampers market growth.

This global fungal infections market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global fungal infections market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Fungal Infections Market

Even though in the COVID-19 pandemic, the shift was on eliminating the infection and vaccine production, the fungal infections were hit, and the link between the two was established. Currently, fungal infection cases are increasing among people because of the ideal environment in COVID-19 patients, low oxygen, acidic medium (diabetic ketoacidosis and others), high iron levels, high glucose, and suppressed immune system, along with other comorbidities. Government authorities are spreading more and more awareness for the early detection and management of fungal infections in COVID-19 patients. For instance, guidelines have been released by the Indian Council of Medical Research (ICMR), i.e., Do's and Don'ts for the COVID – 19 patients.

Global Fungal Infections Market Scope

The global fungal infections market is segmented on the basis of types, drugs, treatment, dosage form, route of administration, end-user, distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Types

- Aspergillosis

- Blastomycosis

- Candidiasis

- Candida auris

- Coccidioidomycosis

- Cryptococcus gattii infection

- Fungal Eyes Infection

- Fungal Nail Infection

- Histoplasmosis

- Ringworm

- Others

Drugs

- Corticosteroids

- Corticosteroid-Sparing Agents

- Immunosuppressive

- Immunomodulator

- Antifungals

- Others

Treatment

- Antifungal

- Others

Dosage Form

- Creams

- Gels

- Ointment

- Solution

- Lotions

- Others

Route of Administration

- Oral

- Parenteral

- Topical

- Vaginal

- Others

End-Users

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacies

- Others

Fungal Infections Market Regional Analysis/Insights

The global fungal infections market is analysed and market size insights and trends are provided by drugs, treatment, dosage form, route of administration, end-user, distribution channel as referenced above.

The major countries covered in the global fungal infections market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the market due to the highest number of patients diagnosed with a skin infections and increased R&D and healthcare expenditure.

Asia-Pacific is considered to have the most lucrative period due to increased campaign programs for skincare products, favorable environmental conditions for manufacturing, and number of generic drugs.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Fungal Infections Market Share Analysis

The global fungal infections market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global fungal infections market.

Key players operating in the global fungal infections market include:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Johnson & Johnson Private Limited (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Merck & Co., Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Lilly (U.S.)

- Amgen Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FUNGAL INFECTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FUNGAL INFECTIONS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL FUNGAL INFECTIONS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

4.3 COMPETITIVE INTELLIGENCE

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR FUNGAL INFECTIONS MARKET

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FUNGAL INFECTIONS MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FUNGAL INFECTIONS MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FUNGAL INFECTIONS MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR FUNGAL INFECTIONS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.13.4 CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13 MARKET OVERVIEW

13.1 DRIVERS

13.2 RESTRAINTS

13.3 OPPORTUNITIES

13.4 CHALLENGES

14 GLOBAL FUNGAL INFECTIONS MARKET, BY AREA OF INFECTION

14.1 OVERVIEW

14.2 SKIN AND SOFT TISSUES

14.2.1 SUPERFICIAL INFECTIONS

14.2.1.1. DERMATOPHYTOSIS

14.2.1.1.1. RINGWORM

14.2.1.1.2. ATHLETE’S FOOT

14.2.1.1.3. JOCK ITCH

14.2.1.2. TINEA CAPITIS

14.2.1.3. TINEA PEDIS

14.2.1.4. TINEA VERSICOLO

14.2.2 HARD-TO-TREAT CASES

14.2.2.1. CHRONIC AND RECURRENT DERMATOPHYTOSIS

14.2.2.2. DEEP TISSUE MYCOSES

14.3 MUCOSAL AREAS

14.3.1 ORAL CAVITY

14.3.1.1. ORAL CANDIDIASIS

14.3.1.2. ESOPHAGEAL CANDIDIASIS

14.3.2 GENITAL AREA

14.3.2.1. VAGINAL CANDIDIASIS

14.3.2.2. PENILE CANDIDIASIS

14.4 RESPIRATORY SYSTEM

14.4.1 LUNG INFECTIONS

14.4.1.1. ASPERGILLOSIS

14.4.1.2. HISTOPLASMOSIS

14.4.1.3. CRYPTOCOCCOSIS

14.4.1.4. MUCORMYCOSIS

14.5 CENTRAL NERVOUS SYSTEM (CNS)

14.5.1 CRYPTOCOCCAL MENINGITIS

14.5.2 CANDIDAL BRAIN ABSCESSES

14.5.3 FUNGAL ENCEPHALITIS

14.6 BLOODSTREAM INFECTIONS

14.6.1 CANDIDEMIA

14.6.2 DISSEMINATED HISTOPLASMOSIS

14.6.3 INVASIVE ASPERGILLOSIS

14.6.4 FUSARIOSIS

14.7 OTHERS

15 GLOBAL FUNGAL INFECTIONS MARKET, BY SPECIES

15.1 OVERVIEW

15.2 CANDIDA SPP.

15.2.1 MULTIDRUG-RESISTANT CANDIDA AURIS

15.2.2 FLUCONAZOLE-RESISTANT CANDIDA GLABRATA

15.3 ASPERGILLUS SPP.

15.4 CRYPTOCOCCUS SPP.

15.5 MUCORALES SPP.

15.6 FUSARIUM SPP.

16 GLOBAL FUNGAL INFECTIONS MARKET, BY PATIENT GROUP

16.1 OVERVIEW

16.2 NON-IMMUNOCOMPROMISED PATIENTS

16.3 IMMUNOCOMPROMISED PATIENTS

17 GLOBAL FUNGAL INFECTIONS MARKET, BY END USER

17.1 OVERVIEW

17.2 HOSPITALS

17.3 CLINICS

17.4 HOMECARE SETTINGS

17.5 AMBULATORY SURGICAL CENTERS (ASCS)

17.6 ACADEMIC AND RESEARCH INSTITUTES

18 GLOBAL FUNGAL INFECTIONS MARKET, BY DRUG CLASS

18.1 OVERVIEW

18.2 AZOLES

18.2.1 FLUCONAZOLE

18.2.2 ITRACONAZOLE

18.2.3 VORICONAZOLE

18.2.4 POSACONAZOLE

18.2.5 ISAVUCONAZOLE

18.3 ECHINOCANDINS

18.3.1 CASPOFUNGIN

18.3.2 MICAFUNGIN

18.3.3 ANIDULAFUNGIN

18.4 POLYENES

18.4.1 AMPHOTERICIN B

18.4.2 NYSTATIN

18.5 ALLYLAMINES

18.6 OTHER

19 GLOBAL FUNGAL INFECTIONS MARKET, BY ROUTE OF ADMINISTRATION

19.1 OVERVIEW

19.2 ORAL

19.3 TOPICAL

19.4 INTRAVENOUS (IV)

19.5 INTRATHECAL

20 GLOBAL FUNGAL INFECTIONS MARKET, BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 HOSPITAL PHARMACIES

20.3 RETAIL PHARMACIES

20.4 ONLINE PHARMACIES

20.5 DRUG STORES

21 GLOBAL FUNGAL INFECTIONS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS

21.8 REGULATORY CHANGES

21.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL FUNGAL INFECTIONS MARKET, BY GEOGRAPHY

22.1 GLOBAL FUNGAL INFECTIONS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1.1 NORTH AMERICA

22.1.2 U.S.

22.1.3 CANADA

22.1.4 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 ITALY

22.2.5 SPAIN

22.2.6 RUSSIA

22.2.7 TURKEY

22.2.8 NETHERLANDS

22.2.9 SWITZERLAND

22.2.10 AUSTRIA

22.2.11 IRELAND

22.2.12 NORWAY

22.2.13 POLAND

22.2.14 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 TAIWAN

22.3.4 SOUTH KOREA

22.3.5 INDIA

22.3.6 AUSTRALIA

22.3.7 SINGAPORE

22.3.8 THAILAND

22.3.9 MALAYSIA

22.3.10 INDONESIA

22.3.11 PHILIPPINES

22.3.12 VIETNAM

22.3.13 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 CHILE

22.4.4 PERU

22.4.5 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 ISRAEL

22.5.7 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL FUNGAL INFECTIONS MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL FUNGAL INFECTIONS MARKET, COMPANY PROFILE

24.1 PFIZER INC.

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 GILEAD SCIENCES, INC.

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 NOVARTIS AG

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 MERCK & CO., INC.

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 ASTELLAS PHARMA INC.

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 SCYNEXIS, INC.

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 BASILEA PHARMACEUTICA

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 MICURX PHARMACEUTICALS

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 SPERO THERAPEUTICS

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 ADAGIO THERAPEUTICS

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 SUN PHARMACEUTICAL INDUSTRIES LTD.

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 CIPLA LIMITED

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 GLENMARK PHARMACEUTICALS LTD.

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.14 BAYER AG

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 BAYER AG

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 ABBVIE INC.

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 TAKEDA PHARMACEUTICAL COMPANY LIMITED

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 GLAXOSMITHKLINE

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 SANOFI

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 MUNDIPHARMA INTERNATIONAL

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 DR. REDDY’S LABORATORIES

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 TORRENT PHARMACEUTICALS

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 GEOGRAPHIC PRESENCE

24.22.4 PRODUCT PORTFOLIO

24.22.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.