Global Furfural Market

Market Size in USD Million

CAGR :

%

USD

627.91 Million

USD

1,016.01 Million

2024

2032

USD

627.91 Million

USD

1,016.01 Million

2024

2032

| 2025 –2032 | |

| USD 627.91 Million | |

| USD 1,016.01 Million | |

|

|

|

|

What is the Global Furfural Market Size and Growth Rate?

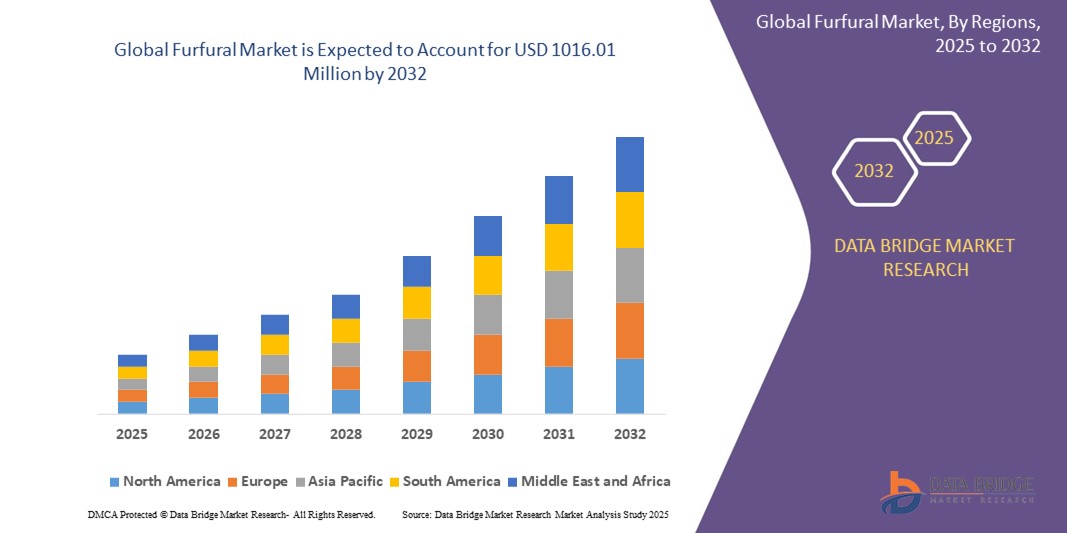

- The global furfural market size was valued at USD 627.91 million in 2024 and is expected to reach USD 1016.01 million by 2032, at a CAGR of 6.20% during the forecast period

- Market growth is primarily driven by the rising demand for renewable and bio-based chemicals, alongside increased interest in eco-friendly alternatives across industries such as agriculture, pharmaceuticals, and chemicals

- In addition, advancements in biomass processing technologies and an expanding focus on sustainable raw materials are propelling the market forward, positioning Furfural as a crucial component in the global shift toward green chemistry

What are the Major Takeaways of Furfural Market?

- Furfural, a chemical derived from agricultural biomass, is gaining traction as a sustainable feedstock in the production of resins, solvents, and plastics, offering a bio-based alternative to petroleum-derived chemicals

- The market is witnessing increased demand due to growing environmental regulations, a surge in green industrial applications, and the availability of low-cost agricultural residues such as corn cobs, oat hulls, and sugarcane bagasse

- As industries continue to adopt circular economy models, Furfural's role as a biodegradable and renewable chemical is becoming increasingly vital in supporting low-emission manufacturing and eco-friendly product development

- Asia-Pacific dominated the furfural market with the largest revenue share of 48.76% in 2024, driven by abundant raw material availability, low production costs, and a strong presence of furfural manufacturers, particularly in China and India

- North America is projected to grow at the fastest CAGR of 10.4% from 2025 to 2032, driven by a rising shift toward sustainable and bio-based chemicals across industries such as automotive, oil & gas, and pharmaceuticals

- The corncobs segment dominated the furfural market with the largest market revenue share of 52.8% in 2024, owing to their high pentosan content and abundant availability in key furfural-producing regions

Report Scope and Furfural Market Segmentation

|

Attributes |

Furfural Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Furfural Market?

“Green Chemistry and Bio-Based Innovation”

- A major trend shaping the global Furfural market is the increasing shift toward green chemistry and the adoption of bio-based production methods. As industries and governments strive for more sustainable practices, furfural derived from agricultural residues such as corn cobs and sugarcane bagasse is emerging as a preferred eco-friendly alternative to petrochemicals

- Furfural’s utility in producing furan-based biofuels, resins, and solvents aligns with growing efforts to reduce carbon footprints and transition to renewable resources. Key players are investing in bio-refinery models and integrating circular economy practices to enhance yield and minimize waste

- For instance, in January 2024, Lenzing AG announced a collaboration with Chemiepark Linz to develop a pilot bio-refinery aimed at sustainable furfural production from wood-based feedstock. This reflects a growing trend of industrial-scale bio-based chemical projects

- In addition, research into enzyme-based conversion technologies is enabling more efficient furfural extraction processes, further promoting its scalability and commercial viability

- As global demand for clean-label and environmentally responsible raw materials grows across pharmaceuticals, food, and agrochemical sectors, furfural’s sustainable sourcing and low toxicity are increasing its market desirability

- This emphasis on renewable chemistry, carbon-neutral production, and regulatory compliance is positioning furfural as a cornerstone in the future of sustainable industrial materials

What are the Key Drivers of Furfural Market?

- The rising demand for bio-based chemicals in industries such as agriculture, pharmaceuticals, and plastics is a core driver behind the increasing adoption of furfural. Its use in producing furfuryl alcohol, resins, and solvents makes it a critical ingredient for eco-friendly manufacturing

- For instance, in April 2024, Pennakem LLC expanded its furfural capacity at its Memphis facility to cater to the rising demand in bioplastics and resin industries, illustrating how supply chain investments are backing this trend

- In addition, furfural’s value as a sustainable platform chemical is reinforced by growing pressure from governments and global organizations to phase out petroleum-based inputs

- Agricultural waste valorization—converting waste into valuable chemicals—is another key driver, especially in developing nations seeking both economic and environmental gains

- Increased R&D investment and technological advancements in biomass hydrolysis and catalytic conversion processes are improving yields and making furfural production more cost-effective, attracting industry players and investors

- As global industries move toward carbon neutrality and waste reduction, furfural’s renewable origin, biodegradability, and lower environmental impact are reinforcing its market relevance and expansion

Which Factor is challenging the Growth of the Furfural Market?

- One of the significant challenges facing the furfural market is the lack of cost-efficient, large-scale production infrastructure in many regions. Traditional production methods are energy-intensive and involve the use of corrosive chemicals, leading to high operational costs and environmental concerns

- For instance, many small-scale producers in Asia and Africa face difficulties in maintaining quality consistency and emissions standards, limiting their ability to scale operations or enter global markets

- In addition, competition from synthetic alternatives and fluctuating raw material prices—especially for agricultural biomass—can impact production planning and profitability

- Another challenge is the limited awareness and commercial acceptance of furfural-based products in some industrial sectors, where established petrochemical inputs dominate due to familiarity and lower cost

- To address these hurdles, innovations such as continuous production systems, greener catalysts, and partnerships between chemical producers and agribusinesses are essential. Companies such as Illovo Sugar Africa are experimenting with integrating furfural production into existing sugar operations to lower costs and maximize biomass use

- Overcoming these obstacles through technological innovation, policy support, and market education will be crucial to unlocking the full growth potential of the furfural industry globally

How is the Furfural Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Raw Material

On the basis of raw material, the Furfural market is segmented into corncobs, rice hulls, cotton hulls, sugarcane bagasse, and others. The corncobs segment dominated the Furfural market with the largest market revenue share of 52.8% in 2024, owing to their high pentosan content and abundant availability in key furfural-producing regions. Corncobs are widely used due to their efficient conversion rate and cost-effectiveness, making them a primary feedstock in both batch and continuous processes.

The sugarcane bagasse segment is anticipated to witness the fastest growth rate of 7.9% from 2025 to 2032, supported by increasing production in Latin America and Asia-Pacific. Sugarcane bagasse is a byproduct of sugar refining, offering sustainability and circular economy benefits, which make it attractive for large-scale furfural production projects.

• By Process

On the basis of process, the Furfural market is segmented into Quaker Batch, Chinese Batch, Rosenlew Continuous, and others. The Chinese Batch process held the largest market share in 2024 at 47.6%, due to its dominance in Asia—especially China—where this method is cost-effective and well-established. Its relatively low capital investment and adaptability to varied feedstocks continue to support its prevalence.

The Rosenlew Continuous process is projected to grow at the fastest CAGR of 8.3% from 2025 to 2032, driven by increasing demand for automation, efficiency, and reduced labor requirements. This method also offers better yield and consistency, which makes it suitable for high-volume production in industrialized regions.

• By Catalyst

On the basis of catalyst, the market is segmented into solid acid type and liquid acid type. The liquid acid type segment accounted for the largest market revenue share of 59.1% in 2024, as it is widely used in conventional furfural production for its high reactivity and lower cost. Sulfuric acid remains the most commonly used catalyst for hydrolysis in batch processes.

The solid acid type is expected to witness the fastest CAGR of 9.4% from 2025 to 2032, owing to its environmental advantages, reusability, and ease of separation. With increasing regulatory scrutiny on waste disposal and emissions, manufacturers are shifting toward solid acid catalysts to align with green chemistry practices.

• By Application

On the basis of application, the Furfural market is segmented into solvents, flavour enhancers, fungicides, gasoline additives, decolorizing agents, and intermediates in adhesives and sealants. The solvents segment held the dominant position with the largest market share of 38.6% in 2024, as furfural-based solvents are widely used in refining lubricants and extracting dienes due to their strong solvency and eco-friendliness.

The fungicides segment is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, with increased use in sustainable agricultural practices. Furfural's biodegradability and effectiveness as a natural pesticide substitute are encouraging adoption in organic and eco-conscious farming.

• By End User

On the basis of end user, the Furfural market is segmented into chemical, agrochemical, pharmaceutical and medical, oil and gas, automotive and transportation, manufacturing, furfurals and polymer, food and beverages, fertilizer, and others. The chemical segment dominated the market with the highest revenue share of 35.9% in 2024, driven by extensive usage in producing furfuryl alcohol, solvents, and resin precursors across industrial applications.

The pharmaceutical and medical segment is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, due to furfural's growing relevance in the synthesis of active pharmaceutical ingredients (APIs) and intermediates. Its ability to serve as a renewable, low-toxicity compound supports rising demand in the healthcare sector.

Which Region Holds the Largest Share of the Furfural Market?

- Asia-Pacific dominated the Furfural market with the largest revenue share of 48.76% in 2024, driven by abundant raw material availability, low production costs, and a strong presence of furfural manufacturers, particularly in China and India

- The region’s dominance is further supported by its large-scale agricultural activities, which generate high volumes of feedstock such as corncobs and bagasse, ideal for furfural production

- In addition, favorable government policies, expanding chemical and pharmaceutical industries, and increasing investment in bio-based chemicals are key factors accelerating regional market growth

China Furfural Market Insight

China Furfural market dominated the Asia-Pacific market revenue share in 2024, supported by vast feedstock resources, strong export potential, and government emphasis on green chemical production. China hosts numerous furfural manufacturing facilities that benefit from economies of scale and integrated production systems. The country's rising demand for bio-based solvents and resins further fuels the market.

India Furfural Market Insight

The India Furfural market is poised to grow at a robust CAGR during the forecast period, driven by the growing agrochemical and pharmaceutical industries. India’s agricultural sector provides an abundant supply of corncobs and sugarcane bagasse, offering sustainable raw material sources. Increasing focus on renewable chemicals and government initiatives supporting bio-based industries further stimulate growth.

Japan Furfural Market Insight

The Japan Furfural market is expected to expand steadily, driven by its emphasis on environmental sustainability, high-tech innovation, and growing applications in resin and pharmaceutical production. With a mature manufacturing sector and demand for green solvents, Japan is focusing on importing and refining high-quality furfural for domestic industrial applications.

Which Region is the Fastest Growing Region in the Furfural Market?

North America is projected to grow at the fastest CAGR of 10.4% from 2025 to 2032, driven by a rising shift toward sustainable and bio-based chemicals across industries such as automotive, oil & gas, and pharmaceuticals. The region’s furfural demand is supported by increasing research into eco-friendly alternatives to petroleum-based solvents and strong interest from green technology investors. Regulatory encouragement for reducing carbon footprints and the growing integration of furfural in adhesives, lubricants, and agrochemical formulations are also boosting market expansion.

U.S. Furfural Market Insight

The U.S. Furfural market captured the largest revenue share in North America in 2024, owing to its advanced R&D ecosystem, supportive environmental policies, and strong presence of chemical processing industries. The U.S. is witnessing increasing interest in furfural-based resins and renewable solvents, supported by collaborations between research institutions and commercial manufacturers.

Canada Furfural Market Insight

The Canada Furfural market is expected to grow steadily due to increasing awareness of sustainable industrial practices and investment in biomass conversion technologies. Canada's abundant agricultural residue and its strategic push toward circular economy models are opening new avenues for furfural production and utilization.

Mexico Furfural Market Insight

The Mexico Furfural market is gaining momentum as agro-industrial companies explore value-added uses for crop residues such as sugarcane bagasse. Government-led initiatives to promote bio-based manufacturing and interest in export-oriented production are driving regional development.

Which are the Top Companies in Furfural Market?

The furfural industry is primarily led by well-established companies, including:

- ILLOVO SUGAR AFRICA (South Africa)

- TransFurans Chemicals bvba (Belgium)

- hebeichem (China)

- KRBL (India)

- Silvateam S.p.a. (China)

- LENZING AG (Austria)

- Hongye Holding Group Corporation Limited (China)

- Tanin d.d. (U.S.)

- Pennakem, LLC (U.S.)

- Hefei Tnj Chemical Industry Co., Ltd. (China)

- TCI Chemicals (India) Pvt. Ltd. (India)

- BEIJING LYS CHEMICALS CO., LTD. (China)

- Laxmi Furals Pvt Ltd (India)

What are the Recent Developments in Global Furfural Market?

- In June 2023, Origin Materials announced the launch of Origin 1, marking the startup of the world’s first commercial chloromethyl furfural (CMF) production facility. This milestone signifies a major advancement in the commercialization of sustainable, carbon-negative chemicals

- In January 2023, the Chinese government unveiled plans to significantly invest in the furfural industry as part of its broader strategy to promote renewable energy and reduce carbon emissions. This initiative positions China as a key player in the global shift toward green chemical manufacturing

- In September 2022, Mitsui Chemicals, a prominent Japanese chemical firm, introduced a newly developed thermoplastic resin derived from furfural, aimed at applications in automotive parts and electronic devices. This innovation highlights the growing potential of furfural in high-performance and sustainable material solutions

- In July 2022, CFF GmbH & Co. KG, a Germany-based specialty chemical company, announced the creation of a new furfural-based resin system tailored for the construction sector. This development demonstrates the increasing integration of bio-based materials in infrastructure and building applications

- In May 2021, the Kilombero Sugar Company, majority-owned by Illovo Sugar Africa (75% stake), announced a significant expansion project to raise sugar production from 127,000 tons to 271,000 tons annually. This expansion is expected to enhance the supply of sugarcane by-products, including those used in furfural production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.