Global Furfuryl Alcohol Market

Market Size in USD Million

CAGR :

%

USD

686.41 Million

USD

1,136.01 Million

2024

2032

USD

686.41 Million

USD

1,136.01 Million

2024

2032

| 2025 –2032 | |

| USD 686.41 Million | |

| USD 1,136.01 Million | |

|

|

|

|

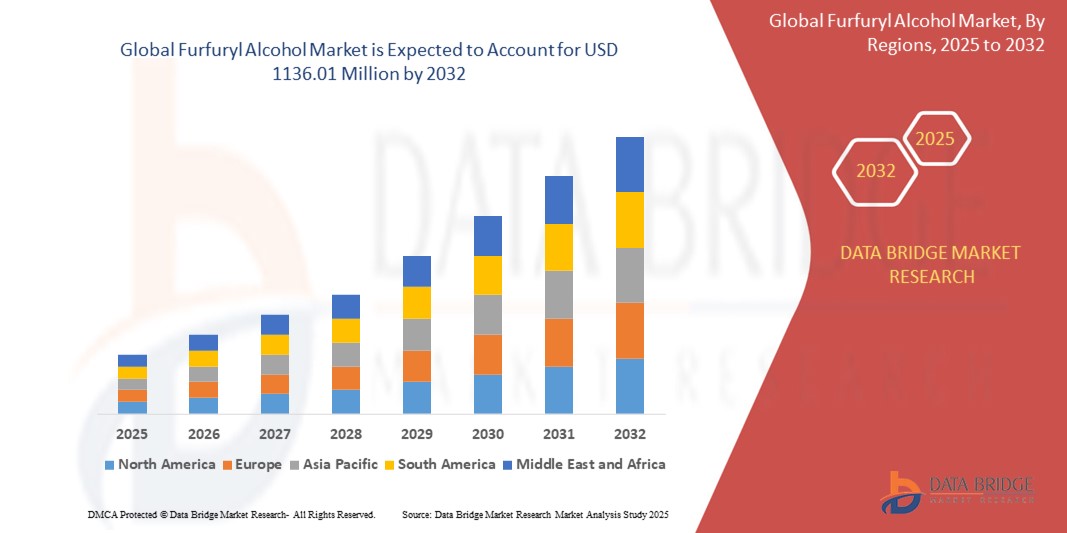

What is the Global Furfuryl Alcohol Market Size and Growth Rate?

- The global furfuryl alcohol market size was valued at USD 686.41 million in 2024 and is expected to reach USD 1136.01 million by 2032, at a CAGR of 6.50% during the forecast period

- The furfuryl alcohol market is experiencing steady growth, driven primarily by its widespread use in the foundry industry for the production of furan resins, which are essential in manufacturing foundry molds and cores

- Furfuryl alcohol is primarily used in the production of resins, particularly furan resins, which are employed in the manufacture of foundry molds and cores. It is also used as a solvent and as an intermediate in the synthesis of various chemicals. The rising demand for metal casting in automotive, aerospace, and construction industries has further fueled the need for furfuryl alcohol-based resins

- In addition, the increasing focus on sustainability and the use of bio-based chemicals has further supported market growth, as furfuryl alcohol is derived from renewable agricultural by products

What are the Major Takeaways of Furfuryl Alcohol Market?

- Furfuryl alcohol is essential in the production of high-performance furan resins, which are widely used for creating foundry molds and cores. These molds are crucial for the precision casting of metals, ensuring quality and strength in the final products

- As industries such as automotive and aerospace continue to expand, the need for lightweight, durable metal components rises, further driving demand for furfuryl alcohol-based furan resins. This growing application in critical industries positions furfuryl alcohol as a valuable material in the global market

- The increasing use of furfuryl alcohol in furan resins for metal casting applications, particularly in the automotive and aerospace sectors, is a key driver for market growth

- Asia-Pacific dominated the furfuryl alcohol market with the largest revenue share of 36.96% in 2024, driven by abundant raw material availability, expanding foundry and resin manufacturing industries, and supportive government policies for green chemistry adoption

- North America is projected to grow at the fastest CAGR of 7.15% from 2025 to 2032, driven by rising demand for eco-friendly resins, industrial adhesives, and corrosion inhibitors across multiple end-use sectors

- The Corncobs segment dominated the market with the largest revenue share of 53.1% in 2024, owing to its high cellulose content, cost-effectiveness, and easy availability across major furfural-producing regions

Report Scope and Furfuryl Alcohol Market Segmentation

|

Attributes |

Furfuryl Alcohol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Furfuryl Alcohol Market?

“Rising Demand for Eco-Friendly Binders in Foundry and Bio-Based Resins”

- A major trend shaping the global furfuryl alcohol market is the increasing shift toward eco-friendly foundry binders and bio-based thermosetting resins, driven by sustainability goals and regulatory pressures

- Furfuryl alcohol, derived from renewable biomass (primarily agricultural waste such as corn cobs), is gaining popularity as a green alternative to petroleum-based chemicals in metal casting and industrial resin formulations

- For instance, companies such as TransFurans Chemicals and Silvateam are actively scaling bio-based resin solutions using furfuryl alcohol to meet growing demand in Europe and Asia-Pacific foundry markets

- The material’s low VOC emission profile, excellent binding properties, and curing efficiency under acidic conditions make it highly suitable for core and mold making in iron and steel foundries

- In addition, furfuryl alcohol is increasingly used in wood modification, adhesives, and corrosion-resistant coatings, further reinforcing its versatility across industrial applications

- As industries seek sustainable material replacements, furfuryl alcohol’s dual benefit renewability and high performance are expected to unlock new innovation paths in green chemistry and industrial sustainability efforts

What are the Key Drivers of Furfuryl Alcohol Market?

- One of the primary drivers of the furfuryl alcohol market is the expanding foundry industry, especially in India, China, and Eastern Europe, where demand for efficient, low-emission binder systems is accelerating

- For instance, in May 2024, DynaChem South Africa launched a new line of furfuryl alcohol-based binders aimed at replacing synthetic resins in automotive and heavy equipment casting, reflecting a shift to cleaner technologies

- Growing awareness of bio-based chemicals and tightening environmental regulations are encouraging manufacturers to adopt furfuryl alcohol in coatings, plastics, and rubber additives

- Increasing demand for Furan resins in wood treatment and building applications due to their excellent water resistance and long-term durability is further propelling market growth

- Moreover, the rise of green procurement policies in public infrastructure projects and industrial sectors is expected to support long-term adoption of furfuryl alcohol across geographies

Which Factor is challenging the Growth of the Furfuryl Alcohol Market?

- A key challenge facing the furfuryl alcohol market is price volatility of raw materials, especially furfural, which is extracted from agricultural residues and subject to supply fluctuations based on crop yield and processing capacity

- For instance, inconsistent supply chains in China and India the largest furfural-producing countries have led to rising costs and availability issues for downstream furfuryl alcohol producers

- In addition, furfuryl alcohol poses certain toxicity concerns during handling and manufacturing, which limits its adoption in some consumer-facing applications without proper safety measures

- Market penetration is also hindered by the presence of synthetic alternatives with lower upfront costs, particularly in emerging economies where price sensitivity dominates procurement decision

- Overcoming these barriers will require a combination of investment in localized furfural production, advancement in low-toxicity formulations, and regulatory harmonization to support safe and widespread industrial use

- As sustainability continues to drive material choices, addressing these challenges is essential to fully realize the commercial potential of furfuryl alcohol as a next-gen green industrial input

How is the Furfuryl Alcohol Market Segmented?

The market is segmented on the basis of raw material, application, and end user industry.

- By Raw Material

On the basis of raw material, the furfuryl alcohol market is segmented into Corncobs, Rice Hulls, Cotton Hulls, Sugarcane Bagasse, and Others. The Corncobs segment dominated the market with the largest revenue share of 53.1% in 2024, owing to its high cellulose content, cost-effectiveness, and easy availability across major furfural-producing regions. Corncobs serve as the primary source for furfural production, making them a cornerstone raw material for furfuryl alcohol synthesis.

The Sugarcane Bagasse segment is expected to witness the fastest growth rate from 2025 to 2032 due to its increasing use as a sustainable alternative and strong alignment with bio-based production strategies, particularly in Latin America and Asia-Pacific.

- By Application

On the basis of application, the furfuryl alcohol market is segmented into Resins, Solvents, Plastics, Adhesives, Corrosion Inhibitors, Polymers, Wetting Agent, and Others. The Resins segment held the largest revenue share of 46.8% in 2024, attributed to the widespread use of furfuryl alcohol in manufacturing furan resins, especially for core and mold production in foundries. The superior binding properties and thermal resistance of these resins support their dominance in industrial applications.

The Corrosion Inhibitors segment is projected to grow at the highest CAGR during the forecast period, driven by the growing demand for eco-friendly and biodegradable inhibitors in petrochemical, marine, and water treatment industries.

- By End User Industry

On the basis of end user industry, the market is segmented into Foundry, Paint and Coatings, Pharmaceuticals, Agriculture, Food and Beverages, and Others. The Foundry segment dominated the market with a revenue share of 42.5% in 2024, supported by the heavy reliance on furan resins for metal casting and sand core applications. This dominance is particularly strong in countries with large automotive and heavy machinery manufacturing bases.

The Pharmaceuticals segment is anticipated to witness the highest growth rate between 2025 and 2032, propelled by the increasing use of furfuryl alcohol derivatives in drug formulation, synthesis of bioactive compounds, and as a green solvent in production processes.

Which Region Holds the Largest Share of the Furfuryl Alcohol Market?

- Asia-Pacific dominated the furfuryl alcohol market with the largest revenue share of 36.96% in 2024, driven by abundant raw material availability, expanding foundry and resin manufacturing industries, and supportive government policies for green chemistry adoption

- The region benefits from low-cost biomass sources such as corncobs and bagasse, making production more economical and sustainable

- Rapid industrialization in countries such as China and India, along with strong domestic consumption and export potential, continues to strengthen Asia-Pacific’s position as a global production hub for furfuryl alcohol

China Furfuryl Alcohol Market Insight

China captured the largest revenue share within Asia-Pacific in 2024, fueled by strong demand from the foundry, coatings, and adhesive sectors. High investments in infrastructure, growing exports of resin products, and technological advances in biomass processing are key contributors. Government support for eco-friendly chemicals and the presence of leading domestic manufacturers further reinforce China’s market dominance.

Japan Furfuryl Alcohol Market Insight

Japan’s market shows steady growth, underpinned by its advanced industrial base, strict environmental regulations, and demand for high-purity furfuryl alcohol in electronics and pharmaceuticals. The country's focus on sustainable manufacturing practices and innovation in bio-based solvents contributes to its regional competitiveness.

India Furfuryl Alcohol Market Insight

India is experiencing robust growth in the furfuryl alcohol market, supported by rising industrial output, increasing agricultural residue availability, and government initiatives promoting bio-based chemicals. The emergence of local producers and rising demand from foundry and agricultural sectors position India as a key growth engine within Asia-Pacific.

Which Region is the Fastest Growing in the Furfuryl Alcohol Market?

North America is projected to grow at the fastest CAGR of 7.15% from 2025 to 2032, driven by rising demand for eco-friendly resins, industrial adhesives, and corrosion inhibitors across multiple end-use sectors. The region's strong emphasis on sustainability, along with investments in biochemicals and green materials, creates favorable conditions for furfuryl alcohol expansion. Technological innovation, supportive regulatory frameworks, and increased research in bio-based applications further accelerate adoption.

U.S. Furfuryl Alcohol Market Insight

The U.S. accounted for the largest market share in North America in 2024, driven by expanding applications in foundries, coatings, and pharmaceuticals. A strong push for sustainable sourcing, advanced R&D capabilities, and growing consumer awareness around bio-based chemicals bolster market demand across industries.

Canada Furfuryl Alcohol Market Insight

Canada’s market is growing steadily, propelled by government incentives for green manufacturing and the rise of eco-conscious industries. Increasing use of furfuryl alcohol in corrosion-resistant coatings, polymer modification, and chemical synthesis is helping establish a resilient market base.

Mexico Furfuryl Alcohol Market Insight

Mexico is witnessing rising demand for furfuryl alcohol, especially in the resin and agricultural sectors. The availability of agricultural waste, increasing foundry output, and growing collaborations with U.S.-based suppliers enhance market access and adoption in the region.

Which are the Top Companies in Furfuryl Alcohol Market?

The furfuryl alcohol industry is primarily led by well-established companies, including:

- DynaChem South Africa (Pty) Ltd. (South Africa)

- The Chemical Company (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Pennakem, LLC (U.S.)

- Nova Molecular Technologies (U.S.)

- Continental Industries Group, Inc. (U.S.)

- TransFurans Chemicals bvba (Belgium)

- Silvateam S.p.a. (Italy)

- Shandong Crownchem Industries Co., Ltd (China)

- Furnova Polymers Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Furfuryl Alcohol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Furfuryl Alcohol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Furfuryl Alcohol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.