Global Furniture Polish Market

Market Size in USD Billion

CAGR :

%

USD

13.10 Billion

USD

19.28 Billion

2025

2033

USD

13.10 Billion

USD

19.28 Billion

2025

2033

| 2026 –2033 | |

| USD 13.10 Billion | |

| USD 19.28 Billion | |

|

|

|

|

Furniture Polish Market Size

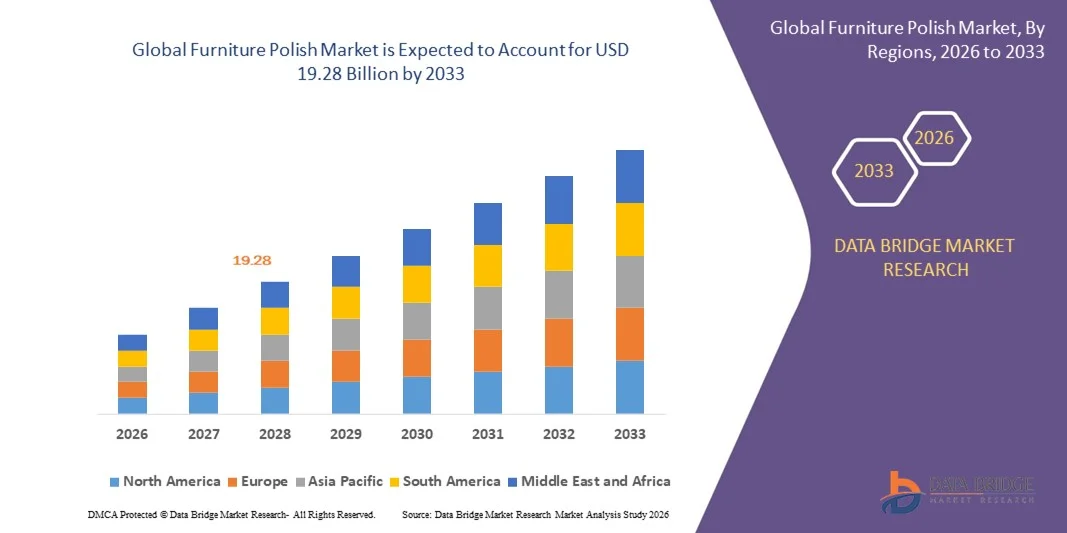

- The global furniture polish market size was valued at USD 13.1 billion in 2025 and is expected to reach USD 19.28 billion by 2033, at a CAGR of 4.95% during the forecast period

- The market growth is largely fueled by increasing consumer awareness about furniture maintenance, rising investments in home décor, and the growing preference for preserving the aesthetic appeal and longevity of wooden furniture across households and commercial spaces

- Furthermore, the expanding adoption of eco-friendly, multipurpose, and easy-to-use furniture polish products is driving demand, as consumers increasingly seek convenient solutions that combine cleaning, polishing, and surface protection. These converging factors are accelerating the uptake of furniture polish products, thereby significantly boosting the industry's growth

Furniture Polish Market Analysis

- Furniture polish products, designed to clean, protect, and enhance the appearance of wooden surfaces, are becoming essential in both residential and commercial settings due to their ability to maintain durability, shine, and aesthetic appeal

- The escalating demand for furniture polish is primarily fueled by rising disposable incomes, increasing investments in premium furniture, and the growing availability of innovative and eco-friendly polish formulations that cater to both household and professional maintenance needs

- Asia-Pacific dominated furniture polish market with a share of 39.2% in 2025, due to rapid urbanization, rising disposable incomes, and increasing consumer focus on home décor and furniture maintenance

- North America is expected to be the fastest growing region in the furniture polish market during the forecast period due to rising consumer awareness about furniture protection, increasing premium furniture ownership, and growth of organized retail and e-commerce channels

- Liquid segment dominated the market with a market share of 47% in 2025, due to its ease of application, streak-free finish, and suitability for a wide variety of wooden surfaces. Consumers often prefer liquid furniture polish for its ability to provide deep cleaning and long-lasting shine while preserving the wood’s natural texture. The segment benefits from strong adoption in both household and commercial settings, as it can be applied using simple cloths or microfiber pads

Report Scope and Furniture Polish Market Segmentation

|

Attributes |

Furniture Polish Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Furniture Polish Market Trends

Growing Adoption of Eco-Friendly and Multipurpose Furniture Polishes

- A significant trend in the furniture polish market is the rising preference for eco-friendly and multipurpose formulations that clean, protect, and shine wood surfaces while reducing chemical exposure. This trend is being driven by increasing consumer awareness of sustainable products and the desire for convenient solutions that maintain furniture aesthetics

- For instance, Pledge, a brand by S.C. Johnson, offers multi-surface and eco-conscious furniture polishes that are widely adopted in both residential and commercial settings. These products combine cleaning, dusting, and protective properties, promoting longer furniture lifespan and safer household use

- The demand for natural and biodegradable ingredients is influencing product development, with companies incorporating plant-based oils and waxes. This approach aligns with global sustainability goals and positions furniture polishes as environmentally responsible cleaning solutions

- Consumers are increasingly seeking products that deliver high shine and scratch protection without requiring multiple steps. This is encouraging brands to innovate concentrated formulas that simplify furniture care while enhancing durability

- The integration of fragrance and conditioning properties in polishes is gaining traction as households prefer products that simultaneously refresh interiors and maintain wood quality. This enhances user experience and strengthens brand loyalty in the competitive furniture care segment

- Overall, the market is witnessing sustained growth driven by the convergence of eco-friendly formulations, multipurpose functionality, and increased consumer focus on furniture longevity. This trend is expected to continue as sustainability and convenience remain key purchase motivators

Furniture Polish Market Dynamics

Driver

Rising Consumer Awareness and Preference for Furniture Maintenance

- The growing understanding of proper furniture care and the benefits of regular maintenance is driving demand for furniture polishes that protect and extend the life of wood surfaces. Consumers are increasingly investing in products that maintain aesthetics and prevent wear over time

- For instance, Minwax provides wood care solutions that include polishes and conditioners designed to preserve finishes and prevent damage. Their offerings educate users on proper application techniques and the importance of regular upkeep, reinforcing long-term furniture value

- The increasing trend of premium and antique furniture purchases is boosting demand for specialized polishes that safeguard delicate finishes. High-value furniture motivates consumers to adopt routine maintenance practices supported by quality products

- Rising urbanization and growing disposable income levels are creating larger consumer bases that invest in furniture longevity. This economic shift is further supporting market expansion and encouraging diversified product offerings

- Retailers and online platforms are promoting awareness campaigns about wood care, demonstrating polish benefits and ease of use. Such initiatives are driving adoption, particularly among first-time homeowners and millennial buyers who prioritize home aesthetics

Restraint/Challenge

High Competition from Low-Cost Unbranded Alternatives

- The furniture polish market faces significant competition from inexpensive unbranded and generic alternatives, which can undercut pricing for established brands. These low-cost products often appeal to budget-conscious consumers despite lacking the same quality or long-term protective benefits

- For instance, many local retail chains in the U.S. and U.K. stock generic wood polishes at prices significantly lower than branded products such as Pledge or Minwax. This price pressure challenges market players to differentiate through quality, performance, and sustainability messaging

- Brand loyalty is affected as consumers may experiment with cheaper options, reducing repeat purchases of premium polishes. This makes maintaining consistent revenue and market share more difficult for established companies

- Limited consumer awareness regarding product performance differences increases the risk of brand substitution. New entrants and unbranded alternatives can leverage price advantage without significant marketing expenditure

- The need for continuous product innovation and marketing investment to counter low-cost alternatives increases operational costs for major players. Companies must balance affordability, quality, and differentiation to remain competitive while sustaining profitability

Furniture Polish Market Scope

The market is segmented on the basis of product type, source, end-use, and sales channel.

- By Product Type

On the basis of product type, the furniture polish market is segmented into solvent, liquid, and aerosols. The liquid segment dominated the market with the largest market revenue share of 47% in 2025, driven by its ease of application, streak-free finish, and suitability for a wide variety of wooden surfaces. Consumers often prefer liquid furniture polish for its ability to provide deep cleaning and long-lasting shine while preserving the wood’s natural texture. The segment benefits from strong adoption in both household and commercial settings, as it can be applied using simple cloths or microfiber pads. Liquid polishes also offer enhanced protection against moisture, dust, and scratches, further reinforcing their market dominance. Its compatibility with eco-friendly and natural formulations has encouraged manufacturers to innovate in this category, attracting environmentally conscious buyers. Overall, the versatility and effectiveness of liquid furniture polish make it the preferred choice across multiple end-use sectors.

The aerosol segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for convenient, ready-to-use formats and rapid application. For instance, companies such as SC Johnson have introduced aerosol-based polishes that combine cleaning, polishing, and protective functions in a single spray, appealing to busy households and commercial spaces. Aerosols provide a uniform coating, reach difficult corners, and reduce application effort, making them attractive for time-sensitive cleaning tasks. Their portability and compact packaging encourage adoption in offices, restaurants, and hospitality sectors. The segment is further supported by rising awareness about quick-touch maintenance solutions that maintain furniture aesthetics with minimal effort. In addition, new innovations in eco-friendly aerosol propellants are expected to drive further acceptance. The ease of storage and long shelf life add to their growing popularity among consumers.

- By Source

On the basis of source, the furniture polish market is segmented into alkyd, melamine, polyester, lacquer, and others. The lacquer segment dominated the market in 2025 due to its superior protective properties, high gloss finish, and compatibility with a wide range of wood types. Lacquer-based polishes are favored in premium furniture and corporate office settings for their durability, resistance to scratches, and ability to maintain the original texture of wood surfaces. The segment also benefits from the growing trend of high-end interior décor where aesthetic appeal and long-lasting finishes are crucial. Consumers value lacquer polishes for their fast-drying properties and ease of application, which enhances their overall user experience. Manufacturers continue to innovate with water-based lacquer formulations that are environmentally friendly, further reinforcing their market dominance. The versatility and reliability of lacquer-based furniture polishes make them the leading choice in both household and professional applications.

The polyester segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for durable and high-gloss finishes suitable for modern furniture designs. For instance, companies such as Minwax have launched polyester-based polishes that offer superior scratch resistance and chemical protection, appealing to residential and commercial users. Polyester polishes are increasingly adopted in hospitality and restaurant sectors due to their robust surface protection and minimal maintenance requirements. The segment benefits from growing interest in furniture pieces with contemporary designs, requiring finishes that enhance aesthetics while maintaining durability. Ease of application with improved formulations has further boosted consumer confidence. In addition, innovations targeting environmentally friendly and low-VOC polyester polishes are expected to accelerate market growth. Their long-term protective qualities and visual appeal make them attractive across multiple end-use categories.

- By End-Use

On the basis of end-use, the furniture polish market is segmented into household, corporate offices, hospitality, educational institutes, restaurants & cafes, furniture manufacturers, and others. The household segment dominated the market in 2025, driven by increasing consumer preference for maintaining and enhancing home interiors. Homeowners prioritize furniture polish to protect valuable wood surfaces, retain natural shine, and prevent damage from daily wear and tear. The segment benefits from rising awareness about easy maintenance solutions and the availability of multipurpose products that combine cleaning, polishing, and protection. In addition, the growing trend of home décor and interior design investments has encouraged frequent use of furniture polish. The convenience of at-home application and availability through various retail channels further support its market dominance. The household segment remains a key revenue contributor for both local and international manufacturers.

The corporate offices segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing investments in maintaining professional and aesthetically pleasing workspaces. For instance, companies such as 3M provide specialized furniture polish products tailored for office desks, conference tables, and cabinets, ensuring a consistent polished look. Offices seek easy-to-use solutions that maintain high-traffic furniture without requiring frequent replacements. The demand is further supported by the rise of corporate sustainability initiatives, leading to the adoption of eco-friendly polish variants. The segment also benefits from bulk purchases and long-term maintenance contracts with cleaning service providers. In addition, corporate offices value furniture polish products that enhance both aesthetics and durability, contributing to brand image and employee satisfaction. The integration of maintenance protocols and professional cleaning standards is expected to sustain rapid growth in this segment.

- By Sales Channel

On the basis of sales channel, the furniture polish market is segmented into wholesaler/distributors, supermarket/hypermarkets, and online stores. The supermarket/hypermarket segment dominated the market in 2025 due to its extensive reach, product visibility, and convenient purchase experience. Consumers often prefer purchasing furniture polish from supermarkets and hypermarkets as they offer a variety of brands, packaging options, and promotional offers under one roof. The segment benefits from strong brand presence, in-store promotions, and customer trust associated with established retail chains. Easy access to new product launches and the ability to physically evaluate product quality further support market dominance. In addition, supermarkets provide dedicated household care aisles that encourage impulse purchases and bulk buying, boosting sales revenue. The segment continues to attract both individual buyers and institutional buyers seeking reliable sources for furniture maintenance products.

The online stores segment is expected to witness the fastest growth from 2026 to 2033, driven by rising e-commerce adoption, convenience of doorstep delivery, and availability of a wide variety of niche and premium polish products. For instance, Amazon and Flipkart offer furniture polish products with detailed descriptions, reviews, and comparison options, attracting tech-savvy consumers. Online channels also support subscription services and bulk purchases, catering to both households and businesses. The growth is further accelerated by targeted online marketing, product recommendations, and exclusive launches on digital platforms. In addition, increasing internet penetration and smartphone usage are driving consumers to explore online shopping for home care solutions. The convenience, variety, and competitive pricing contribute to rapid adoption of online channels as a preferred sales route.

Furniture Polish Market Regional Analysis

- Asia-Pacific dominated the furniture polish market with the largest revenue share of 39.2% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing consumer focus on home décor and furniture maintenance

- The region’s cost-effective manufacturing capabilities, growing presence of regional furniture manufacturers, and expanding retail networks are accelerating market growth

- The availability of skilled labor, supportive government initiatives for homecare and consumer goods industries, and rising adoption of eco-friendly and multipurpose furniture polish products are further contributing to increased demand across both household and commercial sectors

China Furniture Polish Market Insight

China held the largest share in the Asia-Pacific furniture polish market in 2025, owing to its strong industrial base in furniture production and high consumer awareness about homecare products. The country’s expanding urban population, increasing investment in premium home furnishings, and extensive distribution networks are major growth drivers. Demand is also supported by rising exports of furniture products, growing presence of international furniture polish brands, and ongoing innovations in eco-friendly and water-based formulations.

India Furniture Polish Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing urban middle-class population, rising homeownership, and growing investments in retail infrastructure. For instance, companies such as Pidilite and Kiwi are introducing innovative, easy-to-use furniture polish solutions tailored for households and small businesses. Rising awareness of furniture maintenance, adoption of modern wooden furniture, and growing penetration of organized retail and e-commerce platforms are further boosting market expansion. The “Make in India” initiative and increasing local manufacturing capacity are strengthening domestic supply and consumption.

Europe Furniture Polish Market Insight

The Europe furniture polish market is expanding steadily, supported by strong demand for high-quality and sustainable homecare products, stringent quality regulations, and growing investments in eco-friendly formulations. The region places emphasis on premium furniture care solutions that combine protection, aesthetic enhancement, and ease of use. Increasing consumer preference for long-lasting finishes and low-VOC products is driving adoption across households, offices, and hospitality sectors.

Germany Furniture Polish Market Insight

Germany’s furniture polish market is driven by high-quality furniture production, growing interest in wood maintenance, and strong retail and e-commerce channels. The country benefits from a well-established distribution network, high consumer awareness regarding furniture care, and continuous product innovations by key players. Demand is particularly strong in urban centers, where modern wooden furniture and high-end home interiors require specialized polish solutions.

U.K. Furniture Polish Market Insight

The U.K. market is supported by a mature homecare and retail sector, rising interest in DIY furniture maintenance, and growing availability of eco-friendly and multi-functional polish products. Increased focus on sustainable living, rising adoption of premium furniture, and strong presence of established international and local brands are encouraging market growth. Consumers are increasingly opting for ready-to-use and easy-to-apply formulations suitable for household and corporate applications.

North America Furniture Polish Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer awareness about furniture protection, increasing premium furniture ownership, and growth of organized retail and e-commerce channels. The region also sees strong demand from commercial offices, hospitality, and furniture manufacturers seeking efficient maintenance solutions. Innovations in sustainable and multipurpose furniture polish formulations are further supporting market expansion.

U.S. Furniture Polish Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by high household spending on furniture care, strong retail penetration, and growing adoption of premium and eco-friendly furniture polish products. The country’s focus on home aesthetics, increasing use of wooden and designer furniture, and presence of major international and domestic polish brands are key growth drivers. Rising consumer preference for convenient, ready-to-use solutions and strong e-commerce channels further consolidate the U.S.'s leading position in the region.

Furniture Polish Market Share

The furniture polish industry is primarily led by well-established companies, including:

- Cleenol Group Ltd (U.K.)

- Liberon Limited (U.K.)

- Reckitt Benckiser Group PLC (U.K.)

- PPG Industries Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- S.C. Johnson & Sons Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- Wood Finishes Group (U.K.)

- Golden Star Inc. (U.S.)

- Blanchon (France)

- Chestnut Products (U.S.)

- Teknos Group (Finland)

- Bona US (U.S.)

Latest Developments in Global Furniture Polish Market

- In May 2024, PPG Industries announced a $300 million investment to expand its North American manufacturing footprint by building a 250,000-square-foot facility in Tennessee. This expansion is expected to significantly enhance the company’s production capacity to 11 million gallons annually, strengthening its ability to meet growing demand from both household and commercial furniture sectors. The investment positions PPG to better serve the rising North American market for high-performance and specialty furniture polishes, ensuring faster supply, improved product availability, and a stronger competitive presence

- In April 2024, Sherwin-Williams launched the Sher-Wood Polyester Topcoat, a waterborne, high-performance coating designed for furniture manufacturers. The product offers quick build, excellent clarity, deep-fill shine, and superior polishability, directly catering to the industry’s demand for efficient, durable, and aesthetically appealing finishes. This launch is expected to drive adoption among commercial furniture producers seeking sustainable and premium coating solutions, reinforcing Sherwin-Williams’ position in the professional segment of the furniture polish and coatings market

- In early 2024, SC Johnson expanded its VOC-compliant spray polish line across Europe, following a 2023 reformulation with plant-based solvents and biodegradable surfactants. Starting in Germany and extending to France and Scandinavia, this rollout addresses the growing consumer demand for environmentally friendly and safe furniture maintenance solutions. The initiative is expected to strengthen SC Johnson’s market share in Europe, appealing to eco-conscious consumers while supporting regulatory compliance and sustainability trends in household care products

- In 2024, Godrej Consumer Products introduced a new citrus-scented polish range in India, specifically targeting younger urban homeowners. The line includes refill pouches and QR code-linked DIY care guides, enhancing convenience and engagement for consumers. This launch is anticipated to drive market growth in India by appealing to modern lifestyle preferences, boosting adoption among first-time buyers, and reinforcing Godrej’s presence in the rapidly expanding household furniture care segment

- In late 2023, Howard Products released an enhanced “Feed-N-Wax Plus” polish, combining UV blockers with deeper conditioning oils, aimed at the antique restoration and premium furniture segment. This product addresses the need for specialized maintenance solutions that provide both protection and nourishment for delicate wooden surfaces. The launch is expected to strengthen Howard Products’ position among niche, high-value consumers, and support growth in specialized furniture care markets where preservation and aesthetic enhancement are key priorities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.