Global Fusion Protein Market

Market Size in USD Billion

CAGR :

%

USD

36.80 Billion

USD

73.05 Billion

2025

2033

USD

36.80 Billion

USD

73.05 Billion

2025

2033

| 2026 –2033 | |

| USD 36.80 Billion | |

| USD 73.05 Billion | |

|

|

|

|

Fusion Protein Market Size

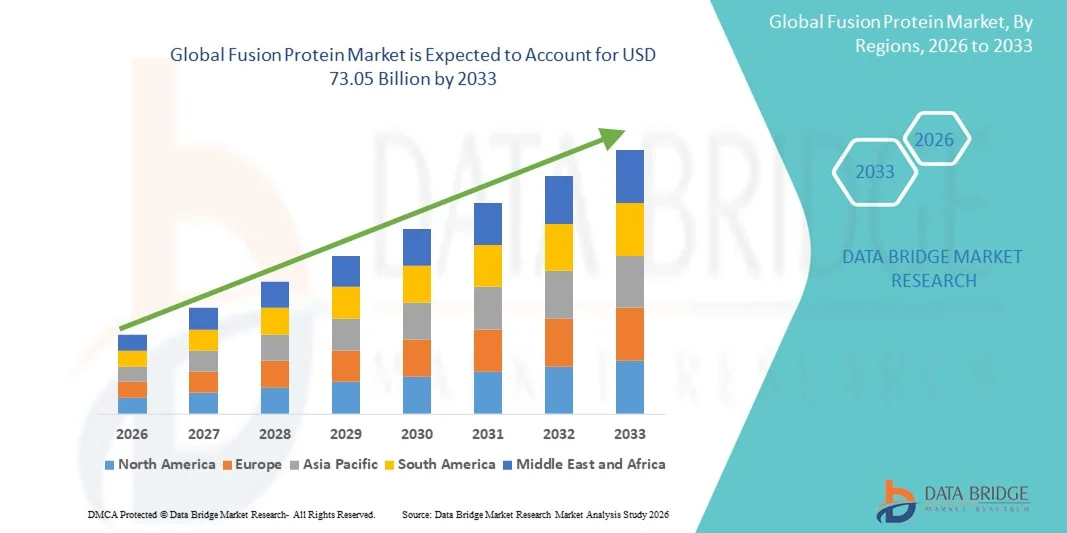

- The global fusion protein market size was valued at USD 36.8 billion in 2025 and is expected to reach USD 73.05 billion by 2033, at a CAGR of 8.95% during the forecast period

- The market growth is largely fueled by the rising adoption of biopharmaceuticals and advancements in genetic engineering technologies, enabling the development of targeted therapies and enhanced biologics

- Furthermore, increasing research and development activities in therapeutic proteins and growing demand for personalized medicine are positioning fusion proteins as key components in modern drug development. These converging factors are accelerating the adoption of fusion protein solutions, thereby significantly boosting the industry's growth

Fusion Protein Market Analysis

- Fusion proteins, engineered by combining two or more distinct protein sequences, are increasingly vital components in modern biopharmaceuticals and therapeutic applications due to their enhanced specificity, improved efficacy, and ability to target multiple disease pathways simultaneously

- The escalating demand for fusion proteins is primarily fueled by the growing prevalence of chronic diseases, rising adoption of biologics, and increasing focus on personalized medicine and targeted therapies

- North America dominated the fusion protein market with the largest revenue share of 42.5% in 2025, characterized by advanced biotechnology infrastructure, high R&D investments, and a strong presence of key industry players, with the U.S. leading in clinical trials and commercialization of innovative fusion protein therapeutics

- Asia-Pacific is expected to be the fastest growing region in the fusion protein market during the forecast period due to expanding biotechnology research, increasing healthcare expenditure, and growing adoption of advanced therapeutics in emerging economies

- Immunoglobulin (Ig) fusion protein segment dominated the fusion protein market with a market share of 44.3% in 2025, driven by its widespread use in chimeric protein drugs and biologics, coupled with continuous advancements in therapeutic protein engineering

Report Scope and Fusion Protein Market Segmentation

|

Attributes |

Fusion Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Fusion Protein Market Trends

Advancements in Targeted Therapeutics and Protein Engineering

- A significant and accelerating trend in the global fusion protein market is the increasing development of next-generation fusion proteins with enhanced targeting capabilities and improved pharmacokinetic profiles, enabling more effective therapies for complex diseases

- For instance, Biogen’s experimental fusion protein candidates combine monoclonal antibodies with cytokines to enhance immune response while minimizing off-target effects in oncology treatments

- Innovations in protein engineering techniques, such as site-specific conjugation and modular fusion designs, allow researchers to optimize stability, half-life, and efficacy of fusion proteins, meeting the growing demand for precision therapeutics

- The integration of fusion proteins with advanced delivery systems, including nanoparticle carriers and sustained-release formulations, is further expanding their therapeutic potential across multiple disease areas

- This trend towards more sophisticated, multifunctional, and targeted fusion protein therapies is fundamentally reshaping drug development pipelines, encouraging companies such as Amgen and Roche to invest heavily in fusion protein R&D

- The adoption of engineered fusion proteins is growing rapidly across both biopharmaceutical and clinical research sectors, as stakeholders increasingly prioritize efficacy, specificity, and reduced immunogenicity in therapeutic solutions

- Growing collaborations between biotech startups and established pharmaceutical companies are accelerating the development and commercialization of innovative fusion protein candidates, enhancing market competitiveness

- Increasing use of AI and computational modeling for fusion protein design is optimizing molecule properties, reducing development timelines, and enabling the creation of highly customized therapeutics

Fusion Protein Market Dynamics

Driver

Rising Prevalence of Chronic Diseases and Demand for Biologics

- The increasing incidence of chronic and rare diseases, coupled with the rising adoption of biologics, is a significant driver for the heightened demand for fusion protein therapeutics

- For instance, in March 2025, Pfizer announced expansion in its biologics pipeline targeting autoimmune and oncology indications using novel fusion protein candidates, aiming to improve patient outcomes

- As healthcare providers seek more effective treatments with targeted mechanisms of action, fusion proteins offer enhanced specificity, reduced side effects, and improved patient adherence compared to conventional therapies

- Furthermore, growing awareness of personalized medicine and targeted treatment approaches is positioning fusion proteins as critical components of modern therapeutic strategies, integrating seamlessly with emerging biologic platforms

- The increasing investment in biopharmaceutical R&D and clinical trials for fusion protein-based drugs is accelerating their adoption across oncology, autoimmune, and metabolic disease segments, further fueling market growth

- Expansion of healthcare infrastructure and rising government support for advanced therapies in emerging economies is driving adoption and availability of fusion protein therapeutics

- Rising patient preference for advanced biologics over conventional treatments due to better efficacy and reduced side effects is further boosting market demand

Restraint/Challenge

High Manufacturing Complexity and Regulatory Barriers

- The complex manufacturing processes involved in fusion protein production, including expression, purification, and quality control, pose a significant challenge to broader market expansion

- For instance, high-profile delays in clinical trials for fusion proteins due to production inconsistencies have made some developers cautious about scaling up operations rapidly

- Maintaining consistent protein quality, ensuring proper folding and bioactivity, and complying with stringent regulatory standards are critical yet resource-intensive steps that can limit new entrants

- Furthermore, high costs associated with R&D, specialized manufacturing facilities, and regulatory approvals can hinder the accessibility of fusion protein therapeutics, particularly in emerging markets or for smaller biotech firms

- Addressing these challenges through process optimization, advanced bioprocessing technologies, and streamlined regulatory pathways is essential for sustaining long-term growth and broader adoption in the global fusion protein market

- Potential immunogenic reactions and safety concerns among patients can restrict usage and necessitate extensive clinical testing before approval

- Limited awareness among healthcare providers in certain regions about fusion protein applications can slow adoption, requiring targeted educational and marketing initiatives

Fusion Protein Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the global fusion protein market is segmented into Immunoglobulin (Ig) Fusion Protein, Parathyroid Hormone (PTH) Fusion Protein, Cytokines Recombinant Fusion Protein, and Others. The Immunoglobulin (Ig) Fusion Protein segment dominated the market with the largest revenue share of 44.3% in 2025, driven by its extensive application in chimeric protein drugs and biologics. Ig fusion proteins are widely utilized due to their high stability, long half-life, and strong therapeutic potential in oncology, autoimmune, and infectious diseases. The segment benefits from continuous R&D advancements in protein engineering and conjugation techniques, enhancing efficacy and reducing side effects. Pharmaceutical companies prefer Ig fusion proteins for their established safety profiles and compatibility with various delivery systems. In addition, the segment’s dominance is reinforced by increasing clinical trials and approvals of Ig fusion protein therapeutics globally. The growing adoption of personalized medicine further boosts demand for this subsegment, making it a cornerstone in modern biopharmaceutical development.

The Parathyroid Hormone (PTH) Fusion Protein segment is expected to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by rising demand in osteoporosis and metabolic disorder treatments. PTH fusion proteins enhance bone regeneration and mineral metabolism, offering superior therapeutic outcomes compared to traditional therapies. The segment is supported by advancements in recombinant protein technology and targeted delivery systems that improve patient adherence and treatment efficacy. Increased healthcare expenditure and awareness of bone health, particularly in aging populations, are driving adoption in both developed and emerging markets. Pharmaceutical companies are actively investing in clinical trials for novel PTH fusion proteins to expand their indications and market potential. In addition, the segment benefits from partnerships and collaborations between biotech firms and academic research institutes, accelerating innovation and commercialization of new therapeutics.

- By Application

On the basis of application, the global fusion protein market is segmented into chimeric protein drugs, biological technology, and others. The Chimeric Protein Drugs segment dominated the market with the largest revenue share of 46.2% in 2025, driven by its effectiveness in treating cancer, autoimmune disorders, and rare diseases. These drugs combine the functional properties of multiple proteins to enhance specificity, reduce immunogenicity, and improve therapeutic outcomes. The dominance is supported by increasing regulatory approvals, extensive R&D investments, and the growing prevalence of chronic diseases that require advanced biologic therapies. Companies are leveraging chimeric protein drugs to develop personalized treatment solutions, increasing market penetration and adoption. Moreover, continuous technological innovations in fusion protein engineering, such as modular design and site-specific conjugation, are strengthening this segment’s position. The segment’s integration into combination therapies also expands its clinical relevance and commercial potential.

The Biological Technology segment is anticipated to witness the fastest growth rate of 22.5% from 2026 to 2033, driven by advancements in synthetic biology, protein engineering, and bioprocessing technologies. This segment includes applications in research, diagnostics, and therapeutic development, providing versatile tools for designing and producing novel fusion proteins. The growing demand for innovative biologics in emerging markets and increased funding for biotechnology research are key factors accelerating adoption. Companies are increasingly focusing on biologics platforms to optimize production, reduce costs, and develop highly customized fusion proteins for specific therapeutic needs. In addition, the convergence of AI, computational modeling, and high-throughput screening technologies is enhancing efficiency and enabling faster development cycles in this segment. The expanding use of fusion proteins in experimental therapies and preclinical studies also supports its rapid growth trajectory.

Fusion Protein Market Regional Analysis

- North America dominated the fusion protein market with the largest revenue share of 42.5% in 2025, characterized by advanced biotechnology infrastructure, high R&D investments, and a strong presence of key industry players, with the U.S. leading in clinical trials and commercialization of innovative fusion protein therapeutics

- The region benefits from well-established pharmaceutical and biopharmaceutical ecosystems, enabling faster clinical trials, regulatory approvals, and commercialization of innovative fusion protein therapeutics

- High healthcare expenditure, growing prevalence of chronic and rare diseases, and increasing adoption of biologics are supporting market growth, while the U.S. leads in developing and manufacturing next-generation fusion proteins for oncology, autoimmune, and metabolic disorders

U.S. Fusion Protein Market Insight

The U.S. fusion protein market captured the largest revenue share of 78% in 2025 within North America, fueled by the country’s advanced biotechnology infrastructure and extensive R&D investments. Pharmaceutical and biopharmaceutical companies are increasingly prioritizing the development of novel fusion protein therapeutics targeting oncology, autoimmune, and metabolic disorders. The growing prevalence of chronic diseases, coupled with rising adoption of biologics and personalized medicine, is further propelling market growth. Moreover, collaborations between biotech startups and established pharma companies are accelerating innovation and commercialization of fusion protein drugs. Strong regulatory support and streamlined clinical trial processes also contribute significantly to market expansion. The U.S. continues to lead in global fusion protein research, development, and production, making it a key market hub.

Europe Fusion Protein Market Insight

The Europe fusion protein market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare expenditure, growing prevalence of chronic and rare diseases, and increased adoption of biologics. Government support for advanced therapeutics and strong biopharmaceutical infrastructure are fostering fusion protein development and commercialization. European pharmaceutical companies are leveraging research collaborations and technology transfers to accelerate innovation. The market is experiencing significant growth across oncology, autoimmune, and metabolic disease applications, with fusion proteins being integrated into both clinical treatments and experimental therapeutics. Continuous investment in R&D and regulatory frameworks favoring biologics further strengthen market expansion. Europe’s emphasis on personalized medicine and targeted therapies positions it as a key region for fusion protein adoption.

U.K. Fusion Protein Market Insight

The U.K. fusion protein market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of biologics, rising prevalence of chronic diseases, and robust pharmaceutical research infrastructure. Rising awareness of targeted therapies and the integration of fusion proteins into personalized treatment plans are encouraging adoption among healthcare providers. The U.K.’s strong regulatory framework, alongside investments in clinical trials and biotech collaborations, is expected to continue stimulating market growth. Academic and industry partnerships are fostering the development of novel fusion protein therapeutics. The demand for innovative biologics, combined with the U.K.’s position as a hub for biotech innovation, is driving expansion across both research and commercial applications.

Germany Fusion Protein Market Insight

The Germany fusion protein market is expected to expand at a considerable CAGR during the forecast period, fueled by strong biopharmaceutical R&D infrastructure and increasing demand for advanced therapeutics. Germany’s focus on innovation, combined with well-established manufacturing capabilities, promotes the adoption of fusion proteins for oncology, autoimmune, and metabolic disorders. The integration of fusion proteins into clinical research and commercial therapeutics is becoming increasingly prevalent. Growing awareness among healthcare providers about targeted therapies and personalized medicine supports market growth. Regulatory support and incentives for biotech innovations further enhance adoption. The country’s emphasis on sustainable and high-quality biologics manufacturing strengthens Germany’s position in the global fusion protein market.

Asia-Pacific Fusion Protein Market Insight

The Asia-Pacific fusion protein market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by increasing healthcare investments, rising prevalence of chronic diseases, and expanding biopharmaceutical R&D in countries such as China, Japan, and India. Government initiatives promoting biotechnology innovation and healthcare infrastructure development are driving adoption. The region is emerging as a manufacturing hub for fusion protein therapeutics, enhancing accessibility and affordability. Moreover, growing awareness among healthcare providers and patients regarding advanced biologics is accelerating market penetration. Expansion of clinical research facilities and collaborations with global biotech firms further support growth. Asia-Pacific’s large patient population and increasing adoption of personalized medicine make it a key growth region for fusion proteins.

Japan Fusion Protein Market Insight

The Japan fusion protein market is gaining momentum due to the country’s advanced biotechnology ecosystem, aging population, and high adoption of innovative therapeutics. The Japanese market emphasizes precision medicine, driving demand for fusion proteins in oncology, autoimmune, and metabolic disorder treatments. Integration of fusion proteins into hospital and research-based clinical applications is fueling growth. Moreover, strong collaborations between pharmaceutical companies and research institutes are accelerating R&D and commercialization of new therapeutics. Government support for biotechnology innovation and healthcare modernization further enhances market expansion. Japan’s focus on high-quality biologics and patient-centric therapies positions it as a key market within the Asia-Pacific region.

India Fusion Protein Market Insight

The India fusion protein market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing biotechnology sector, expanding healthcare infrastructure, and increasing adoption of advanced therapeutics. Rising prevalence of chronic and lifestyle diseases is driving demand for fusion protein-based treatments. India’s emergence as a cost-effective manufacturing hub for biologics, including fusion proteins, is boosting market accessibility. Government initiatives promoting biotechnology innovation and healthcare modernization are further propelling growth. The availability of skilled workforce and growing R&D investments support the development of novel fusion protein therapeutics. Increasing awareness among healthcare providers and patients regarding targeted biologics is enhancing adoption across both clinical and commercial applications.

Fusion Protein Market Share

The Fusion Protein industry is primarily led by well-established companies, including:

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- F. Hoffmann La Roche (Switzerland)

- Novartis AG (Switzerland)

- Bristol Myers Squibb Company (U.S.)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

- GSK plc (U.K.)

- Takeda Pharmaceutical Company Ltd. (Japan)

- Biogen Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Samsung Bioepis Co., Ltd. (South Korea)

- Celgen Biopharma (China)

- 3SBIO Inc. (China)

- Innovent Biologics (China)

What are the Recent Developments in Global Fusion Protein Market?

- In July 2025, Pfizer Oncology announced termination of the mid-stage Phase II trial of Maplirpacept in diffuse large B‑cell lymphoma (DLBCL) citing insufficient patient recruitment highlighting challenges even for high‑profile fusion‑protein candidates targeting CD47 in hematologic cancers

- In February 2025, IBI363 (the same PD‑1/IL‑2α bispecific fusion protein) received a second Fast Track Designation by FDA this time for certain patients with squamous non‑small cell lung cancer (sqNSCLC) whose disease progressed after prior anti–PD‑(L)1 therapy and chemotherapy, demonstrating the broadening clinical push for fusion‑protein immunotherapies beyond melanoma

- In September 2024, Innovent Biologics announced that its bispecific antibody fusion protein IBI363 (PD‑1/IL‑2α) received Fast Track Designation from the U.S. Food and Drug Administration (FDA) for treatment of advanced/metastatic melanoma

- In June 2024, Fapon Biopharma announced the development of a novel fusion‑protein immunotherapy candidate, code‑named FP008, which fuses an attenuated IL‑10 monomer (IL‑10M) with an anti‑PD‑1 antibody designed to treat solid tumours that are resistant to conventional anti‑PD‑1 therapy, potentially offering enhanced efficacy with reduced toxicity

- In November 2021, Pfizer completed its acquisition of Trillium Therapeutics for about USD 2.26 billion, gaining access to Trillium’s SIRPα‑Fc fusion‑protein candidates which target the

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.