Global Gallium Arsenide Germanium Solar Cell Gaas Market

Market Size in USD Billion

CAGR :

%

USD

17.08 Billion

USD

32.57 Billion

2024

2032

USD

17.08 Billion

USD

32.57 Billion

2024

2032

| 2025 –2032 | |

| USD 17.08 Billion | |

| USD 32.57 Billion | |

|

|

|

|

Gallium Arsenide Germanium Solar Cell (Gaas) Market Size

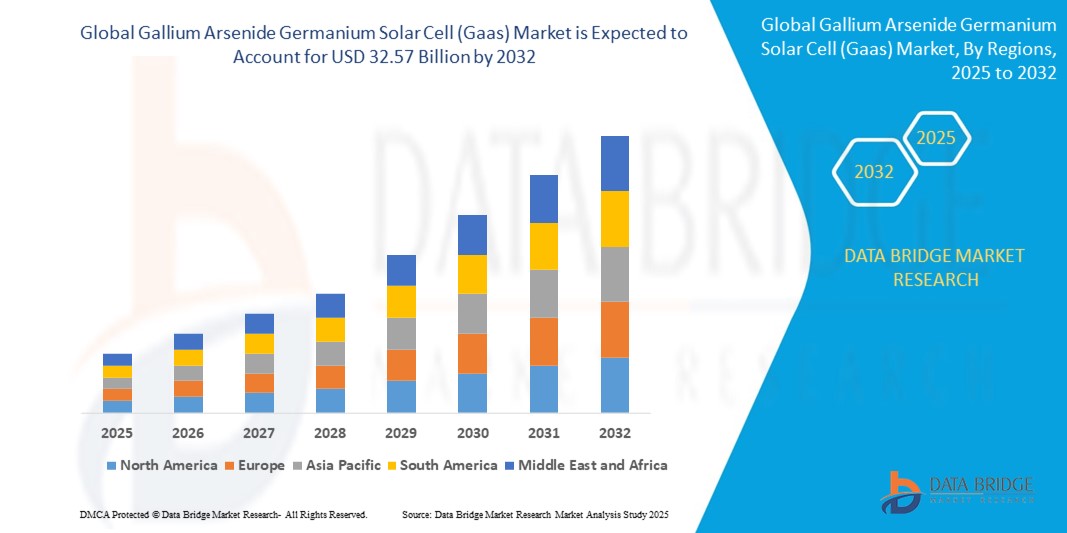

- The global Gallium Arsenide Germanium Solar Cell (Gaas) market size was valued at USD 17.08 billion in 2024 and is expected to reach USD 32.57 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the increasing deployment of high-efficiency solar technologies in space, defense, and communication sectors, driven by GaAs solar cells' superior performance under extreme environmental conditions, including high radiation and temperature variability

- Furthermore, the rising demand for lightweight, compact, and highly efficient photovoltaic solutions in satellites, unmanned systems, and advanced wireless communication infrastructure is accelerating the integration of GaAs-based solar cells, thereby significantly boosting the industry's growth

Gallium Arsenide Germanium Solar Cell (Gaas) Market Analysis

- GaAs solar cells are compound semiconductor devices known for their high conversion efficiency, radiation resistance, and power-to-weight ratio, making them ideal for aerospace, defense, and concentrator photovoltaic applications

- The escalating demand is primarily fueled by increased space exploration missions, expanding 5G and IoT networks, and the growing need for resilient and high-performance energy sources in both terrestrial and orbital environments

- Asia-Pacific dominated the Gallium Arsenide Germanium Solar Cell (Gaas) market with a share of 49% in 2024, due to strong demand across satellite communications, military electronics, and high-efficiency photovoltaic applications

- North America is expected to be the fastest growing region in the Gallium Arsenide Germanium Solar Cell (Gaas) market during the forecast period due to increasing demand in aerospace, defense, and high-speed communication sectors

- LEC Grown GaAs segment dominated the market with a market share of 68.9% in 2024, due to its superior crystal quality, lower defect density, and high efficiency, which make it ideal for demanding applications such as aerospace and military-grade photovoltaics. LEC growth technology is well-established and facilitates better uniformity in crystal structure, which is crucial for high-performance solar cells. Its compatibility with multi-junction architectures and better thermal and radiation resistance further contributes to its broad adoption in space-based and satellite applications

Report Scope and Gallium Arsenide Germanium Solar Cell (Gaas) Market Segmentation

|

Attributes |

Gallium Arsenide Germanium Solar Cell (Gaas) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Gallium Arsenide Germanium Solar Cell (Gaas) Market Trends

“Growing Demand for Renewable Energy Sources”

- A significant and accelerating trend in the Gallium Arsenide Germanium Solar Cell (GaAs) market is the surging demand for renewable energy, driven by global sustainability goals and stricter carbon emission regulations

- For instance, ompanies such as AZUR SPACE Solar Power GmbH, SolAero Technologies (now part of Rocket Lab), and Alta Devices are at the forefront of advancing GaAs solar cell technology, targeting high-efficiency applications in both terrestrial and space sectors

- These solar cells are particularly valued in specialized markets—such as satellite power systems, space exploration, and high-altitude solar panels—where their efficiency often exceeds 30%, outperforming traditional silicon-based cells

- The International Energy Agency (IEA) reports a 50% surge in renewable energy capacity in 2023, with advanced solar technologies such as GaAs-Ge cells playing a crucial role in supporting this expansion

- Advancements in multi-junction and thin-film technologies, along with increased investments from companies such as Boeing Spectrolab and Sharp Corporation, are further enhancing the performance and durability of GaAs solar cells for demanding environments

- In conclusion, as the global energy landscape shifts toward renewables, the high efficiency and reliability of GaAs-Ge solar cells are positioning them as essential components in the next generation of solar power systems, supporting both terrestrial and space-based energy needs

Gallium Arsenide Germanium Solar Cell (Gaas) Market Dynamics

Driver

“Rise in the Installation of Solar System”

- The global push for renewable energy is driving a significant increase in solar system installations, directly boosting demand for high-efficiency GaAs solar cells

- For instance, companies such as SolAero Technologies and AZUR SPACE Solar Power GmbH are expanding production to supply both terrestrial and space-based solar projects, leveraging the superior efficiency and radiation resistance of GaAs technology

- Government incentives, subsidies, and ambitious solar targets in regions such as the EU, US, and Asia-Pacific are encouraging utilities and private sectors to adopt advanced solar technologies, including GaAs-Ge cells

- The miniaturization of electronics and the need for lightweight, high-output power sources in aerospace, telecommunications, and military applications are further fueling adoption of GaAs solar cells

- Growing investments in research and development by industry leaders such as Boeing Spectrolab and Sharp Corporation are resulting in improved multi-junction and thin-film GaAs solar cell technologies, supporting broader market penetration

Restraint/Challenge

“Limited Availability of Gallium and Germanium”

- The supply of gallium and germanium is inherently limited, as these elements are byproducts of other metal refining processes, making their availability volatile and subject to disruptions

- For instance, companies such as Alta Devices and Boeing Spectrolab face challenges in securing consistent, high-purity sources of these materials, which can impact production schedules and costs

- Price fluctuations driven by geopolitical factors, trade restrictions, and mining output variability can increase the cost structure for manufacturers and limit scalability

- Competition for these critical materials from other high-tech sectors, such as semiconductors and LED manufacturing, further strains supply and drives up prices

- Addressing these supply chain challenges requires ongoing investment in recycling technologies, alternative sourcing strategies, and material recovery efforts to ensure long-term sustainability and growth for the GaAs-Ge solar cell market

Gallium Arsenide Germanium Solar Cell (Gaas) Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Gallium Arsenide Germanium (GaAs) solar cell market is segmented into LEC Grown GaAs and VGF Grown GaAs. The LEC Grown GaAs segment accounted for the largest market revenue share of 68.9% in 2024, driven by its superior crystal quality, lower defect density, and high efficiency, which make it ideal for demanding applications such as aerospace and military-grade photovoltaics. LEC growth technology is well-established and facilitates better uniformity in crystal structure, which is crucial for high-performance solar cells. Its compatibility with multi-junction architectures and better thermal and radiation resistance further contributes to its broad adoption in space-based and satellite applications.

The VGF Grown GaAs segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its scalability, cost-effectiveness, and potential to support larger wafer sizes. VGF methods offer better control over stoichiometry and doping profiles, making it suitable for high-volume commercial manufacturing. The growing shift toward terrestrial solar applications and optoelectronic devices is fostering interest in VGF Grown GaAs due to its balance of performance and production efficiency.

- By Application

On the basis of application, the market is segmented into Radio Frequency Electronics, Light Emitting Diodes, Photovoltaic Devices, Photonic Devices, Wireless Communication, Optoelectronic Devices, and Other Applications. The Photovoltaic Devices segment held the largest revenue share in 2024, attributed to the growing demand for high-efficiency solar cells in space missions, unmanned aerial vehicles, and high-altitude platforms. GaAs solar cells offer superior power-to-weight ratio, high energy conversion efficiency, and enhanced resistance to radiation and high temperatures, making them indispensable in aerospace and defense sectors. Their usage in concentrator photovoltaic (CPV) systems is also rising due to their ability to maintain performance under high irradiance levels.

The Wireless Communication segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing deployment of 5G infrastructure and the rising need for high-frequency, low-noise, and high-speed electronic components. GaAs-based components are critical in RF front-end modules, offering faster signal transmission and reduced power consumption. With growing reliance on wireless connectivity in smartphones, satellites, and IoT networks, the demand for GaAs solar cell technology in communication applications is rapidly expanding.

Gallium Arsenide Germanium Solar Cell (Gaas) Market Regional Analysis

- Asia-Pacific dominated the Gallium Arsenide Germanium Solar Cell (Gaas) market with the largest revenue share of 49% in 2024, driven by strong demand across satellite communications, military electronics, and high-efficiency photovoltaic applications

- The region’s thriving semiconductor manufacturing ecosystem, government support for space and defense sectors, and expanding telecommunications infrastructure are key factors propelling growth

- In addition, increasing investment in renewable energy and the development of smart cities are accelerating the adoption of GaAs-based solar and optoelectronic technologies across both industrial and consumer markets

Japan GaAs Solar Cell Market Insight

The Japan market is expanding steadily due to the nation’s emphasis on technological advancement, energy efficiency, and space exploration. Japan’s mature electronics sector and demand for compact, lightweight, and radiation-resistant solar solutions support widespread adoption in satellites and unmanned systems. Integration of GaAs solar cells into IoT-based energy modules and the aging population’s need for reliable communication systems are also contributing to growth.

China GaAs Solar Cell Market Insight

The China GaAs solar cell market held the largest share in Asia-Pacific in 2024, supported by the country’s leadership in electronics manufacturing and high-volume satellite launches. The rising deployment of 5G and IoT infrastructure is spurring demand for GaAs components in RF and photonic devices. In addition, China’s aggressive push into the global solar and defense sectors, along with strategic investments in compound semiconductor production, are cementing its dominance in the market.

Europe GaAs Solar Cell Market Insight

The Europe market is projected to grow at a significant CAGR over the forecast period, driven by growing investments in space missions, sustainable energy solutions, and defense technologies. The EU’s strong research base in advanced materials, coupled with funding for low-carbon technologies and secure communication systems, is encouraging adoption of GaAs-based solar and RF solutions. The region’s interest in next-generation satellite systems and electronic warfare capabilities is further accelerating growth.

U.K. GaAs Solar Cell Market Insight

The U.K. market is anticipated to grow steadily, driven by increased focus on national space initiatives, telecommunications advancements, and innovation in defense systems. The rise of domestic satellite programs and partnerships with private space firms are promoting GaAs cell integration. Moreover, research institutions and startups in the U.K. are exploring novel applications in optoelectronics and photonics, supporting long-term market expansion.

Germany GaAs Solar Cell Market Insight

Germany’s GaAs solar cell market is expected to witness notable growth, underpinned by its robust engineering sector and commitment to renewable energy and smart defense. The country’s emphasis on sustainability and digital innovation is promoting the use of high-efficiency GaAs cells in both terrestrial and aerospace applications. Government-backed R&D programs and partnerships with European space agencies are also enhancing the market outlook.

North America GaAs Solar Cell Market Insight

The North American market is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand in aerospace, defense, and high-speed communication sectors. The U.S. government’s space programs and the need for radiation-hardened solar cells in satellites are major growth drivers. Rising investments in 5G and next-gen wireless technologies, coupled with a mature semiconductor ecosystem, are further expanding opportunities for GaAs-based solar and RF applications.

U.S. GaAs Solar Cell Market Insight

The U.S. captured the largest revenue share in North America in 2024, fueled by strong military and space research budgets, along with robust demand for high-performance energy solutions. The widespread use of GaAs in defense-grade communication systems, unmanned vehicles, and surveillance technologies underpins its market dominance. In addition, the presence of leading aerospace firms and compound semiconductor manufacturers supports rapid technological development and commercialization.

Gallium Arsenide Germanium Solar Cell (Gaas) Market Share

The Gallium Arsenide Germanium Solar Cell (Gaas) industry is primarily led by well-established companies, including:

- Semiconductor Wafer Inc (Taiwan)

- AXT, Inc. (U.S.)

- Freiberger Compound Materials GmbH (Germany)

- Xiamen Powerway Advanced Material Co., Ltd. (China)

- Sumitomo Electric Industries, Ltd. (Japan)

- Wafer Technology Ltd. (U.K.)

- MTI Corporation (U.S.)

- Vital Materials Co., Limited. (China)

- DOWA Electronics Materials Co., Ltd. (Japan)

- II-VI Incorporated (U.S.)

- IQE PLC (U.K.)

- Wafer Technology (U.S.)

- Advanced Wireless Semiconductor Company (Taiwan)

- Hanergy Mobile Energy Holding Group Limited. (Beijing)

- Qorvo, Inc. (U.S.)

Latest Developments in Global Gallium Arsenide Germanium Solar Cell (Gaas) Market

- In January 2024, Caltech's Space Solar Power Project achieved a milestone. SSPD-1 tested wireless power transmission, assessed solar cell durability in space, and trialed lightweight structure deployment vital for space solar power. Despite deployment challenges, the mission provided valuable insights for future space solar power system design and development, supported by philanthropist Donald Bren and Northrop Grumman Corporation

- In March 2024, An article revealed China's strategic move, designating gallium as its primary resource for weaponizing critical minerals. This decision underscores China's focus on securing vital materials for military applications, potentially reshaping global mineral dynamics. Such strategic selection of gallium suggests a calculated approach to bolstering national defense capabilities through control over key resources

- In October 2023, Flexwave, a Taiwanese PV solutions company, introduced a solar PV unit guaranteeing 10 years of autonomous power for remote small-scale electronic devices. Target applications include wildfire detectors, gas monitors, and Internet of Things (IoT) devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gallium Arsenide Germanium Solar Cell Gaas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gallium Arsenide Germanium Solar Cell Gaas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gallium Arsenide Germanium Solar Cell Gaas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.