Global Gamma Irradiated Human Tissue Packaging Solutions Market

Market Size in USD Million

CAGR :

%

USD

85.00 Million

USD

224.85 Million

2024

2032

USD

85.00 Million

USD

224.85 Million

2024

2032

| 2025 –2032 | |

| USD 85.00 Million | |

| USD 224.85 Million | |

|

|

|

|

Gamma-Irradiated Human Tissue Packaging Solutions Market Size

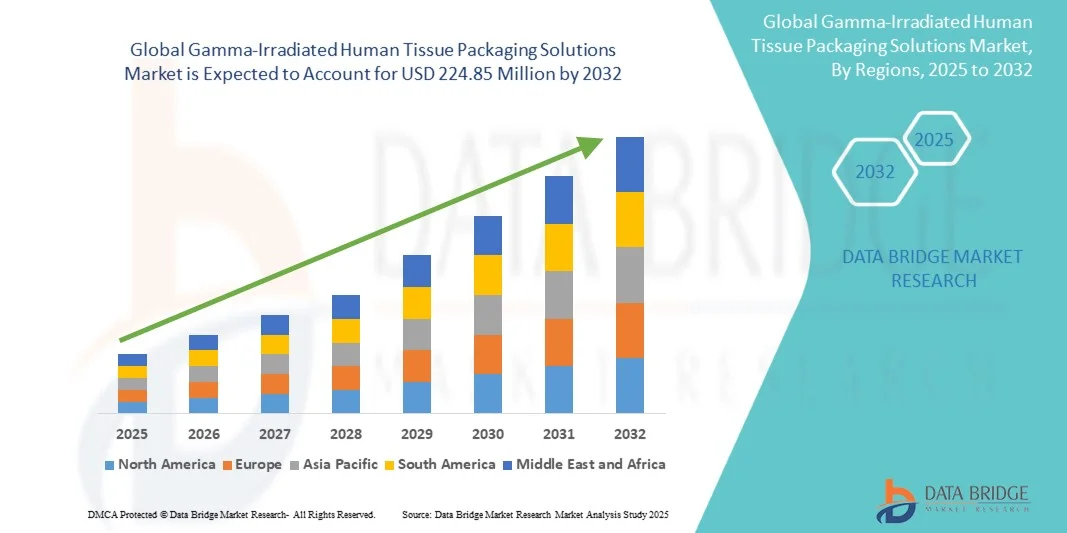

- The global gamma-irradiated human tissue packaging solutions market size was valued at USD 85.00 million in 2024 and is expected to reach USD 224.85 million by 2032, at a CAGR of 12.93% during the forecast period

- The market growth is largely driven by the increasing demand for sterile, validated packaging systems to ensure the safety and integrity of human tissue allografts, supported by advancements in sterilization technologies and compliance with stringent regulatory standards

- Furthermore, the rising volume of transplant procedures, expanding tissue banking networks, and growing emphasis on cold-chain validated, ISO 11607-compliant packaging solutions are establishing gamma-irradiated packaging as a critical enabler of safe tissue distribution worldwide. These converging factors are accelerating adoption, thereby significantly boosting the industry’s growth

Gamma-Irradiated Human Tissue Packaging Solutions Market Analysis

- Gamma-irradiated human tissue packaging solutions, designed to ensure sterility and integrity of allografts during processing, storage, and distribution, are increasingly vital to tissue banks, hospitals, and surgical centers due to their role in preventing contamination, preserving biological properties, and meeting stringent regulatory compliance standards

- The escalating demand for these packaging systems is primarily fueled by the rising volume of tissue transplant procedures worldwide, growth in tissue banking infrastructure, and the need for ISO 11607-compliant, cold-chain validated sterile barrier systems capable of withstanding gamma sterilization

- North America dominated the gamma-irradiated human tissue packaging solutions market with the largest revenue share of 41.8% in 2024, supported by a mature transplantation ecosystem, strong presence of certified tissue banks, and strict FDA and AATB guidelines that mandate validated packaging for human tissue distribution

- Asia-Pacific is expected to be the fastest growing region in the market during the forecast period, driven by increasing healthcare investments, rapid expansion of tissue banking facilities, and rising awareness of safe and standardized transplantation practices

- Sterile pouches segment dominated the market with a share of 45.1% in 2024, owing to their proven compatibility with gamma irradiation, robust barrier protection, and widespread adoption across tissue types including musculoskeletal, skin, cardiovascular, and amniotic grafts

Report Scope and Gamma-Irradiated Human Tissue Packaging Solutions Market Segmentation

|

Attributes |

Gamma-Irradiated Human Tissue Packaging Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gamma-Irradiated Human Tissue Packaging Solutions Market Trends

“Rising Adoption of ISO-Compliant Sterile Barrier Systems”

- A significant and accelerating trend in the global gamma-irradiated human tissue packaging solutions market is the increasing adoption of ISO 11607-compliant sterile barrier systems, ensuring validated sterility and barrier integrity throughout processing, storage, and transplantation

- For instance, tissue banks are increasingly using Tyvek–polyethylene laminates and multilayer barrier pouches that maintain performance after gamma irradiation, providing enhanced sterility assurance and compliance with international standards

- The integration of advanced materials enables packaging to withstand higher radiation doses without compromising barrier properties, thereby extending product shelf life and ensuring safe tissue distribution

- For instance, multilayer laminates designed for musculoskeletal and skin allografts are being validated to retain tensile strength and seal integrity post-irradiation, supporting their reliability in clinical use

- The seamless incorporation of validated packaging systems into tissue banking operations facilitates efficient processing, regulatory compliance, and reliable global distribution, thereby driving broader adoption

- This trend towards standardization and robust sterile packaging solutions is fundamentally reshaping expectations for tissue safety, encouraging companies to invest in advanced, validated packaging technologies

- The demand for sterile barrier packaging with proven gamma compatibility is growing rapidly across tissue banks and healthcare facilities, as stakeholders increasingly prioritize safety, compliance, and operational efficiency

Gamma-Irradiated Human Tissue Packaging Solutions Market Dynamics

Driver

“Growing Demand Due to Rising Tissue Transplant Procedures and Regulatory Compliance”

- The increasing global volume of tissue transplant procedures, coupled with stricter regulatory guidelines from agencies such as the FDA and AATB, is a significant driver for the heightened demand for gamma-irradiated packaging solutions

- For instance, in March 2024, several North American tissue banks expanded their processing capabilities, mandating validated sterile packaging to meet new regulatory requirements for safety and traceability

- As healthcare providers and tissue banks focus on minimizing contamination risks, gamma-compatible sterile packaging ensures barrier integrity, sterility maintenance, and validated protection during distribution

- Furthermore, the rising number of musculoskeletal, skin, cardiovascular, and amniotic grafts being transplanted globally highlights the critical role of advanced sterile packaging systems in supporting medical demand

- The convenience of standardized, validated packaging solutions streamlines tissue processing, improves supply chain efficiency, and reduces the risk of recalls due to noncompliance with sterility regulations

- The trend towards tissue banking expansion and the need for traceable, compliant packaging solutions are further propelling market growth across both developed and emerging regions worldwide

Restraint/Challenge

“Material Compatibility Issues and High Validation Costs”

- Concerns surrounding the compatibility of certain packaging materials with gamma irradiation pose a significant challenge to broader market penetration, as radiation may cause brittleness or loss of barrier integrity

- For instance, reports of material degradation in non-validated pouches have raised concerns among tissue banks about the long-term reliability of packaging exposed to sterilization doses

- Addressing these challenges through the development of radiation-stable materials, robust sealing technologies, and advanced testing methods is crucial for maintaining sterility and performance

- For instance, companies are investing in research to create multilayer laminates and Tyvek-based solutions that retain mechanical and barrier properties even after repeated sterilization validation

- In addition, the high costs of packaging validation, including dose mapping, sterility assurance testing, and regulatory certification, can be a barrier for smaller tissue banks and processors

- While larger players are able to absorb these costs, the perceived expense of validated gamma-irradiated packaging systems can hinder adoption in cost-sensitive markets with limited budgets

- Overcoming these challenges through material innovation, cost-effective validation strategies, and wider industry collaboration will be vital for sustained growth of the market

Gamma-Irradiated Human Tissue Packaging Solutions Market Scope

The market is segmented on the basis of tissue type, packaging material, product state and end user.

- By Tissue Type

On the basis of tissue type, the gamma-irradiated human tissue packaging solutions market is segmented into musculoskeletal, soft tissue allografts, cardiovascular, amniotic membrane & placental tissues, and cellularized. The musculoskeletal segment dominated the market with the largest market revenue share in 2024, driven by the high volume of bone grafts, tendons, and demineralized bone matrix used in orthopedic and spinal surgeries. Tissue banks and surgical centers heavily rely on validated sterile barrier systems capable of withstanding gamma irradiation while preserving tissue integrity. Growing demand for musculoskeletal allografts in trauma, sports medicine, and reconstructive procedures further fuels this dominance. Regulatory bodies place strong emphasis on validated packaging for musculoskeletal tissues, which represent the majority of global transplants. In addition, the established clinical trust and widespread availability of musculoskeletal grafts in hospitals support the segment’s leading position.

The amniotic membrane & placental tissues segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising applications in ophthalmology, wound healing, and regenerative medicine. These tissues are delicate, biologically active, and require advanced multilayer laminates and sterile pouches that preserve hydration and sterility post-irradiation. Increased awareness of amniotic membrane’s therapeutic benefits is driving adoption in both developed and emerging regions. Tissue banks and research institutes are investing in specialized packaging to improve storage stability. Furthermore, the expansion of regenerative therapy programs and biobanks specializing in placental tissues accelerates growth in this sub-segment.

- By Packaging Material

On the basis of packaging material, the gamma-irradiated human tissue packaging solutions market is segmented into sterile pouches, multi-layer medical laminates, rigid trays, nonwoven wraps, and insulated shippers & phase-change materials. The sterile pouches segment dominated the market with the largest revenue share of 45.1% in 2024, as they are widely validated for gamma irradiation and ensure barrier integrity across multiple tissue types. Their flexibility, cost-effectiveness, and compatibility with ISO 11607 sterile barrier standards make them the preferred packaging choice for tissue banks globally. Tissue processors rely heavily on sterile pouches for musculoskeletal and skin grafts, where maintaining sterility and usability at the point of care is critical. The dominance of this segment is reinforced by the ease of sealing, broad supplier availability, and established clinical trust in sterile pouch systems. In addition, hospitals and distributors prefer these pouches for their adaptability to frozen, refrigerated, and ambient tissue storage.

The multi-layer medical laminates segment is expected to record the fastest growth rate during the forecast period, driven by their superior barrier protection against oxygen, moisture, and microbial ingress. These laminates are especially valuable for cardiovascular and amniotic tissues, where long-term storage stability is critical. The increasing demand for packaging materials that maintain mechanical strength and sterility after gamma doses of up to 25–35 kGy is boosting adoption. Tissue banks and research institutes are increasingly choosing multilayer laminates to improve operational efficiency. Continuous innovations in multilayer designs tailored for biocompatibility and irradiation resilience are opening lucrative opportunities in this segment.

- By Product State

On the basis of product state, the gamma-irradiated human tissue packaging solutions market is segmented into frozen (≤ −20°C), refrigerated (2–8°C), and ambient. The frozen tissue packaging segment dominated the market in 2024, as the majority of musculoskeletal and cardiovascular tissues are stored and transported under deep-freeze conditions. Packaging solutions for frozen tissues must withstand gamma irradiation and preserve barrier integrity under sub-zero temperatures and during transit with dry ice or other phase-change materials. This segment’s dominance is strengthened by the high global demand for orthopedic and spinal grafts, which are primarily stored frozen for long-term viability. Stringent cold-chain compliance in North America and Europe also sustains the lead of frozen packaging systems. Hospitals, distributors, and tissue banks prioritize these packages to ensure safe handling and regulatory compliance.

The ambient segment is anticipated to grow at the fastest pace from 2025 to 2032, driven by rising demand for lyophilized and dehydrated tissues, particularly in skin and amniotic applications. Ambient packaging significantly reduces logistical complexity by eliminating cold-chain requirements, making it attractive for hospitals, distributors, and emerging markets with limited infrastructure. Validated sterile pouches and laminates enable long shelf life at room temperature, supporting efficient global distribution. Tissue processors benefit from reduced storage costs and simplified inventory management. Increasing adoption of ambient-stable grafts in wound care and ophthalmology is a key driver of this segment’s growth.

- By End User

On the basis of application, the gamma-irradiated human tissue packaging solutions market is segmented into tissue banks, hospitals & surgical centres, distributors, and research institutes & biobanks. The tissue banks segment dominated the market in 2024 with the largest revenue share, as they serve as the primary processors and distributors of human tissue grafts globally. Packaging demand in this segment is driven by the need for validated sterile barrier systems that ensure compliance with FDA, AATB, and ISO 11607 standards. Tissue banks invest significantly in packaging that can withstand gamma irradiation and provide traceability through labelling and barcoding systems. The central role of tissue banks in transplantation ecosystems cements their position as the largest consumer of gamma-irradiated packaging solutions. Their procurement policies often favor standardized, high-volume packaging systems to streamline operations and reduce errors.

The hospitals & surgical centres segment is projected to grow at the fastest rate during the forecast period, as the final point of tissue use increasingly demands OR-ready, user-friendly sterile packages. Surgeons and operating room staff prioritize packaging that is easy to open, sterile at point-of-care, and compatible with diverse tissue types. The trend toward on-demand transplantation and shorter procedure turnaround times enhances reliance on pre-validated sterile packages. In addition, hospital procurement policies in both developed and emerging regions are shifting toward suppliers offering standardized, compliant, and easily handled packaging solutions. Adoption of ambient and refrigerated packaging for OR readiness further fuels growth in this sub-segment.

Gamma-Irradiated Human Tissue Packaging Solutions Market Regional Analysis

- North America dominated the gamma-irradiated human tissue packaging solutions market with the largest revenue share of 41.8% in 2024, supported by a mature transplantation ecosystem, strong presence of certified tissue banks, and strict FDA and AATB guidelines that mandate validated packaging for human tissue distribution

- Tissue banks, hospitals, and distributors in the region prioritize validated packaging solutions that ensure sterility, maintain tissue integrity during gamma irradiation, and support traceability and compliance with FDA and AATB guidelines

- This dominance is further supported by advanced healthcare infrastructure, extensive transplantation networks, and the growing demand for standardized packaging solutions that simplify tissue processing, storage, and distribution, establishing gamma-irradiated packaging as the preferred solution for both commercial and clinical applications

U.S. Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The U.S. market captured the largest revenue share of 82% in 2024 within North America, fueled by the well-established tissue banking ecosystem and stringent FDA and AATB regulatory standards. Tissue banks, hospitals, and distributors are increasingly prioritizing ISO 11607-compliant sterile barrier systems to ensure sterility, tissue integrity, and traceability. The growing preference for validated, gamma-compatible packaging, combined with rising volumes of musculoskeletal, skin, and cardiovascular allografts, further propels the market. Moreover, the integration of advanced sterile pouches, multilayer laminates, and insulated transport solutions is significantly contributing to the market’s expansion.

Europe Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict tissue banking regulations and the escalating need for safe, validated packaging in hospitals and research facilities. Increasing urbanization, rising surgical procedures, and the adoption of connected and standardized healthcare infrastructure foster the use of gamma-irradiated packaging solutions. European tissue banks also value the convenience and reliability of pre-validated sterile barrier systems. The region is experiencing significant growth across hospitals, tissue banks, and biobanks, with advanced packaging increasingly incorporated into both new and existing tissue processing workflows.

U.K. Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expansion of tissue banks and heightened focus on patient safety and regulatory compliance. Concerns regarding tissue contamination and graft integrity encourage both hospitals and distributors to adopt validated gamma-irradiated packaging solutions. The U.K.’s established healthcare infrastructure, coupled with advanced biobanking practices, is expected to continue to stimulate market growth. The increasing use of sterile pouches, laminates, and cold-chain validated solutions aligns with local regulatory expectations, promoting widespread adoption.

Germany Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of safe tissue handling and the demand for technologically advanced, compliant packaging solutions. Germany’s well-developed healthcare and biobanking infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of gamma-irradiated packaging, particularly for musculoskeletal, cardiovascular, and dermal grafts. The integration of packaging with traceability, cold-chain management, and ISO 11607-compliant processes is becoming increasingly prevalent, with a strong preference for reliable, validated sterile barrier systems aligning with local requirements.

Asia-Pacific Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 25% during 2025–2032, driven by increasing healthcare infrastructure, rising surgical volumes, and expanding tissue banking networks in countries such as China, Japan, and India. Growing government initiatives supporting transplantation safety, coupled with higher adoption of standardized sterile barrier systems, are driving market growth. Moreover, as APAC emerges as a manufacturing hub for advanced packaging materials such as multilayer laminates and insulated shippers, the affordability and accessibility of gamma-irradiated tissue packaging solutions are expanding to a wider healthcare network.

Japan Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The Japan market is gaining momentum due to the country’s advanced healthcare system, increasing surgical procedures, and demand for safe, reliable tissue packaging. Japanese tissue banks emphasize regulatory compliance and traceability, fueling adoption of gamma-irradiated sterile barrier systems. Integration of packaging solutions with cold-chain monitoring, barcoding, and OR-ready sterile packs is contributing to growth. Furthermore, the aging population and rising demand for orthopedic, cardiovascular, and dermal grafts are such asly to spur further adoption of validated packaging in both hospitals and research institutes.

India Gamma-Irradiated Human Tissue Packaging Solutions Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding healthcare infrastructure, growing tissue banking networks, and increasing surgical volumes. India is becoming a major hub for tissue processing and transplantation, and gamma-irradiated sterile packaging solutions are increasingly adopted across hospitals, distributors, and biobanks. Government initiatives promoting healthcare safety, availability of cost-effective packaging solutions, and strong domestic manufacturing capabilities are key factors propelling market growth in India.

Gamma-Irradiated Human Tissue Packaging Solutions Market Share

The gamma-irradiated human tissue packaging solutions industry is primarily led by well-established companies, including:

- Sterigenics U.S., LLC (U.S.)

- Life Science Outsourcing, Inc. (U.S.)

- STERIS (U.S.)

- Ionisos (France)

- OLIVER (U.S.)

- Toray Plastics (America), Inc. (U.S.)

- Nordion (Canada) Inc. (Canada)

- BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

- PAXXUS (U.S.)

- Gamma-Pak Sterilization Ind. & Trd. Inc. (Turkey)

- Eagle Medical Inc. (U.S.)

- Symec Engineers (India) Pvt. Ltd. (India)

- Neenah Inc. (U.S.)

- UFP Technologies, Inc. (U.S.)

- Shine Company. (U.S.)

- Mativ Holdings, Inc. (U.S.)

- Sotera Health (U.S.)

- Medtronic (Ireland)

What are the Recent Developments in Gamma-Irradiated Human Tissue Packaging Solutions Market?

- In December 2024, the U.S. Food and Drug Administration (FDA) hosted the final session of its Medical Device Sterilization Town Hall Series, focusing on advancements in sterilization technologies, including gamma irradiation. The session addressed regulatory updates, best practices, and emerging trends in sterilization methods for medical devices and tissue products. This initiative underscores the FDA's commitment to ensuring the safety and efficacy of sterilization processes in the medical field

- In September 2024, Sterigenics, a global leader in gamma sterilization services, hosted a webinar titled "Gamma: Sustainable Sterilization for the Long Term." The session delved into the sustainability of gamma irradiation as a sterilization modality, discussing the global supply chain for Cobalt-60 and its long-term viability in medical device sterilization. This event highlighted the industry's focus on sustainable practices in sterilization technologies

- In March 2024, researchers at Fermilab developed an electron beam accelerator aimed at sterilizing medical equipment. While primarily focused on electron beam sterilization, the research contributes to the broader field of radiation-based sterilization technologies, including gamma irradiation, by enhancing understanding and capabilities in sterilization processes

- In February 2024, Indafor launched a versatile paper-based medical packaging capable of withstanding all three widely used sterilization processes, including radiation, autoclave, and ethylene oxide. This innovative product allows customers to serve multiple markets and explore new opportunities by providing a unique alternative to polymer-based or kraft medical packaging traditionally used for nasal swabs, syringes, bandages, and other single-use applications

- In April 2023, the U.S. Food and Drug Administration (FDA) announced a voluntary pilot program for its Radiation Sterilization Master File. This initiative aimed to support medical device manufacturers by facilitating the regulatory approval process for products sterilized using radiation methods, including gamma irradiation. The program was designed to streamline the submission process for companies, thereby expediting the availability of sterile medical devices to the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.