Global Gantry Robot Market

Market Size in USD Billion

CAGR :

%

USD

3.35 Billion

USD

6.30 Billion

2024

2032

USD

3.35 Billion

USD

6.30 Billion

2024

2032

| 2025 –2032 | |

| USD 3.35 Billion | |

| USD 6.30 Billion | |

|

|

|

|

Gantry Robot Market Size

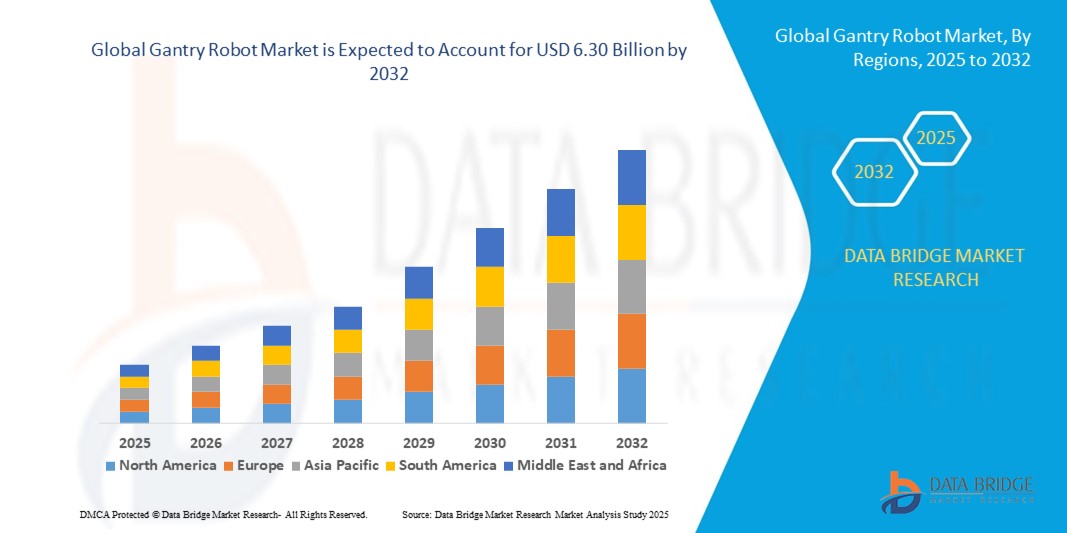

- The global gantry robot market size was valued at USD 3.35 billion in 2024 and is expected to reach USD 6.30 billion by 2032, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by the increasing adoption of industrial automation and advanced manufacturing technologies, leading to higher demand for precision, efficiency, and productivity across various sectors such as automotive, electronics, aerospace, and logistics

- Furthermore, rising industrial requirements for flexible, high-speed, and heavy-duty material handling and assembly solutions are establishing gantry robots as a preferred automation system. These converging factors are accelerating the deployment of gantry robots, thereby significantly boosting the market’s expansion

Gantry Robot Market Analysis

- Gantry robots are automated mechanical systems that move along multiple axes to perform tasks such as material handling, assembly, palletizing, welding, and packaging. They offer high precision, repeatability, and scalability, making them suitable for complex industrial operations

- The escalating demand for gantry robots is primarily driven by the need to enhance operational efficiency, reduce labor costs, and maintain consistent quality. In addition, integration with AI, IoT, and smart factory systems is further enabling autonomous operations and real-time process optimization, propelling the market growth across regions and end-use industries

- North America dominated the gantry robot market with a share of 40.5% in 2024, due to the growing adoption of automation in manufacturing, logistics, and warehouse operations

- Asia-Pacific is expected to be the fastest growing region in the gantry robot market during the forecast period due to rising industrial automation, rapid urbanization, and expansion of manufacturing hubs in countries such as China, Japan, and India

- 3-axis gantry robots segment dominated the market with a market share of 39% in 2024, due to their widespread adoption in industrial automation for tasks requiring precise linear motion along three axes. Their popularity stems from an ideal balance between functionality, cost-effectiveness, and ease of integration into existing production lines. Industries favor 3-axis systems for high-speed operations, repeatability, and compatibility with various tooling and end-effectors. The segment’s growth is further supported by robust demand in material handling, packaging, and assembly processes where moderate complexity and accuracy are sufficient. Manufacturers also prefer 3-axis configurations due to their reduced maintenance requirements and proven reliability

Report Scope and Gantry Robot Market Segmentation

|

Attributes |

Gantry Robot Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Gantry Robot Market Trends

Increasing Labor Shortages

- The rising labor shortages across manufacturing, logistics, and processing industries are significantly driving the demand for gantry robots. As industries struggle with workforce scarcity, particularly in repetitive, hazardous, and precision-demanding tasks, gantry robots are emerging as a reliable solution to maintain productivity and operational efficiency

- For instance, ABB and Güdel Group have developed advanced gantry robot systems that are being deployed in automotive manufacturing facilities where labor shortages and growing demand for consistent quality are pushing automation adoption. These systems help manufacturers meet production timelines while reducing dependency on manual intervention

- The structural ability of gantry robots to perform heavy-duty material handling, palletizing, and packaging tasks makes them essential in sectors such as automotive, electronics, and e-commerce. In regions facing acute labor constraints, these robots fill the skill gap by ensuring speed, precision, and safety in production lines

- The global rise in e-commerce and logistics activities has heightened the reliance on automated systems as warehouses and distribution centers face significant labor constraints. Gantry robots reduce delivery backlogs by executing repetitive sorting and handling tasks at higher efficiency than manual labor

- In addition, aging populations in developed regions such as Europe and Japan are intensifying labor shortages in industrial sectors, accelerating the adoption of automated alternatives. Gantry robots are becoming strategic investments to mitigate workforce gaps and sustain competitiveness in global supply chains

- Overall, increasing labor shortages are positioning gantry robots as indispensable tools for industrial resilience. This trend reflects a structural shift in how companies view automation—not just as a cost reducer but as a long-term necessity to address workforce challenges and ensure consistent output

Gantry Robot Market Dynamics

Driver

Increasing Demand for Automation Across Various Industries

- The intensifying demand for automation in industries such as manufacturing, automotive, electronics, logistics, and food processing is a key driver of the gantry robot market. Companies are turning to automated solutions to handle precision tasks, reduce operational costs, and improve productivity in competitive global markets

- For instance, FANUC Corporation has expanded its gantry robot portfolio to serve high-volume automotive assembly lines, where automated handling and welding have become critical due to rising global production volumes. Such deployments highlight how automation is vital to achieving cost efficiency and consistency across industries

- The drive toward automation is further reinforced by the need to minimize human error, enhance quality, and maintain safe working environments. Gantry robots excel in repetitive and heavy-duty tasks such as machine tending, palletizing, packaging, and material transfer, aligning with industry requirements for accuracy and speed

- Industries facing fluctuating demand patterns and shorter product lifecycles rely on gantry robots for flexibility. Their modular structure allows for integration with CNC machines, conveyors, and automated storage systems, making them valuable components of Industry 4.0 initiatives and smart factories

- In conclusion, the rapid shift toward industrial automation across multiple sectors strongly supports the adoption of gantry robots. This driver illustrates how businesses are increasingly dependent on robotics solutions to sustain efficiency, competitiveness, and resilience against operational challenges

Restraint/Challenge

Need of Technical Expertise

- A major challenge in the gantry robot market is the high level of technical expertise required for deployment, operation, and maintenance of these systems. Unlike conventional automation, gantry robots demand skilled professionals for programming, calibration, and integration into existing workflows, which creates barriers for adoption

- For instance, KUKA and Güdel Group emphasize training and service support for their gantry robot installations, as many client companies face difficulties in developing in-house expertise. The lack of skilled operators and engineers often delays project timelines and increases overall deployment costs for end users

- The complexity of integrating gantry robots with production lines, conveyor systems, or smart factory platforms adds to the technical burden. Any misconfiguration or lack of expertise can lead to inefficiencies, downtime, and increased maintenance requirements over time

- Furthermore, small and medium-sized enterprises (SMEs) often find it difficult to invest in specialized workforce training or retain skilled technicians, creating dependency on third-party service providers. This reliance increases costs and reduces control over long-term maintenance strategies

- As a result, the need for technical expertise continues to hinder the widespread adoption of gantry robots, particularly in SME-dominated markets. Addressing this challenge will require simplified programming interfaces, increased automation in configuration, and broader workforce training initiatives to ensure sustainable adoption across industries

Gantry Robot Market Scope

The market is segmented on the basis of type, payload capacity, application, and end user.

- By Type

On the basis of type, the gantry robot market is segmented into 2-Axis Gantry Robots, 3-Axis Gantry Robots, 4-Axis Gantry Robots, and Multi-Axis Gantry Robots. The 3-Axis Gantry Robots segment dominated the largest market revenue share of 39% in 2024, driven by their widespread adoption in industrial automation for tasks requiring precise linear motion along three axes. Their popularity stems from an ideal balance between functionality, cost-effectiveness, and ease of integration into existing production lines. Industries favor 3-axis systems for high-speed operations, repeatability, and compatibility with various tooling and end-effectors. The segment’s growth is further supported by robust demand in material handling, packaging, and assembly processes where moderate complexity and accuracy are sufficient. Manufacturers also prefer 3-axis configurations due to their reduced maintenance requirements and proven reliability.

The Multi-Axis Gantry Robots segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing automation requirements in complex manufacturing processes. Multi-axis systems provide enhanced flexibility, allowing simultaneous multi-directional movements for intricate tasks in assembly, welding, and electronics production. The growing adoption of Industry 4.0 practices and collaborative robotics is encouraging manufacturers to deploy multi-axis gantry robots for higher efficiency and precision. Their ability to handle diverse operations while reducing labor costs makes them highly attractive across automotive, aerospace, and electronics sectors.

- By Payload Capacity

On the basis of payload capacity, the gantry robot market is segmented into up to 50 kg, 50–200 kg, and above 200 kg. The 50–200 kg segment dominated the market in 2024, driven by the versatility of mid-range payload robots across multiple industrial applications. This segment offers an optimal combination of load-handling capability and operational speed, making it suitable for material handling, palletizing, and assembly operations. Industries increasingly rely on mid-payload gantry robots for moderate to heavy-duty operations without requiring the high investment associated with ultra-heavy payload systems. The segment benefits from consistent demand in sectors such as automotive, electronics, and food and beverage, where production efficiency and precision are critical.

The above 200 kg payload segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising automation in heavy industries and logistics. Robots with higher payload capacities are essential for handling bulky components in automotive assembly, aerospace manufacturing, and large-scale packaging operations. Technological advancements enabling robust, durable, and precise high-capacity gantry robots are encouraging manufacturers to adopt these solutions. The need for faster throughput, reduced manual labor, and improved workplace safety is further driving demand for above 200 kg payload systems.

- By Application

On the basis of application, the gantry robot market is segmented into material handling, palletizing and depalletizing, welding and soldering, assembly, packaging, and others. The material handling segment dominated the market in 2024, driven by its extensive use across industries to move raw materials, components, and finished products efficiently. Material handling gantry robots improve workflow automation, reduce human intervention, and enhance workplace safety, making them critical for modern production facilities. Their adaptability to various payloads and integration with conveyor systems and warehouse management solutions contribute to strong demand. Industries benefit from reduced cycle times, higher productivity, and precise positioning of goods, reinforcing the segment’s leading position.

The welding and soldering segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in automotive, electronics, and heavy equipment manufacturing. Gantry robots in welding and soldering applications provide high precision, consistent weld quality, and accelerated production speeds. The integration of advanced sensors and adaptive control systems enhances efficiency and reduces material wastage. Increasing investments in automated fabrication processes, along with the need for high-quality, repeatable welds, are driving rapid deployment of gantry robots for these operations.

- By End User

On the basis of end user, the gantry robot market is segmented into automotive, electronics, food and beverage, aerospace, pharmaceuticals, logistics and warehousing, and others. The automotive segment dominated the market in 2024, driven by extensive use of gantry robots in assembly, material handling, and welding operations. Automotive manufacturers are increasingly deploying gantry robots to enhance production speed, ensure consistent quality, and support large-scale manufacturing demands. The segment benefits from high automation investments, strong demand for electric vehicles, and the need for precise handling of heavy components such as engines and chassis.

The electronics segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing production of consumer electronics, semiconductors, and high-precision components. Gantry robots in electronics manufacturing provide compact, precise, and automated solutions for assembly, soldering, and testing processes. Rising demand for miniaturized devices, higher production accuracy, and faster turnaround times is driving the rapid adoption of gantry robotics in this sector.

Gantry Robot Market Regional Analysis

- North America dominated the gantry robot market with the largest revenue share of 40.5% in 2024, driven by the growing adoption of automation in manufacturing, logistics, and warehouse operations

- Companies in the region are increasingly investing in robotics to enhance productivity, reduce labor costs, and maintain high precision in production

- The widespread adoption is further supported by advanced technological infrastructure, high capital expenditure capabilities, and a strong focus on Industry 4.0 implementation

U.S. Gantry Robot Market Insight

The U.S. gantry robot market captured the largest revenue share in North America in 2024, fueled by rapid industrial automation and modernization trends. Companies are increasingly deploying gantry robots to enhance manufacturing precision, improve operational efficiency, and support high-volume production lines. The strong presence of automotive, electronics, and logistics sectors, coupled with the rising demand for robotics-driven material handling solutions, continues to drive market growth. In addition, the integration of robots with IoT-enabled manufacturing systems and smart warehouse setups is significantly expanding their application scope.

Europe Gantry Robot Market Insight

The Europe gantry robot market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent efficiency standards, increasing industrial automation, and growing adoption of robotics in manufacturing and warehousing. Countries such as Germany, France, and Italy are witnessing rising deployment of gantry robots in automotive, aerospace, and electronics manufacturing. European companies are focusing on precision, energy efficiency, and automation integration, which are fostering higher demand for gantry robotics across production facilities and logistics operations.

U.K. Gantry Robot Market Insight

The U.K. gantry robot market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing automation in manufacturing and logistics sectors. Companies are adopting gantry robots to improve throughput, ensure consistent product quality, and optimize space utilization in warehouses. The market growth is further supported by government initiatives promoting Industry 4.0 practices and robotics adoption in SMEs and large-scale manufacturing units, alongside rising investments in smart factory infrastructure.

Germany Gantry Robot Market Insight

The Germany gantry robot market is expected to expand at a considerable CAGR during the forecast period, fueled by strong industrial automation practices and a high demand for precision engineering. Germany’s automotive, electronics, and aerospace sectors are increasingly deploying gantry robots to enhance operational efficiency and maintain competitive advantages. The emphasis on innovation, smart manufacturing, and integration with digital factory systems is driving adoption, while sustainability-focused solutions and energy-efficient robotics are increasingly favored in both commercial and industrial applications.

Asia-Pacific Gantry Robot Market Insight

The Asia-Pacific gantry robot market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising industrial automation, rapid urbanization, and expansion of manufacturing hubs in countries such as China, Japan, and India. The region’s growing focus on smart factories, government initiatives promoting robotics adoption, and increasing availability of cost-effective robotic solutions are key growth factors. In addition, APAC’s role as a production hub for robotics components and systems is improving affordability and accessibility, boosting the adoption of gantry robots across manufacturing, logistics, and assembly operations.

Japan Gantry Robot Market Insight

The Japan gantry robot market is gaining momentum due to the country’s advanced manufacturing sector, emphasis on automation, and demand for high-precision robotics. Japanese companies are adopting gantry robots for material handling, assembly, and packaging processes to improve productivity and quality. The integration of robots with IoT-enabled production systems and smart factory initiatives is accelerating adoption. Furthermore, Japan’s aging workforce is encouraging automation to ensure operational continuity and maintain production efficiency across industrial sectors.

China Gantry Robot Market Insight

The China gantry robot market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s robust manufacturing base, rapid urbanization, and government support for automation and smart manufacturing. The adoption of gantry robots is driven by high-volume production needs in automotive, electronics, and logistics industries. The push for smart factories, domestic robotics manufacturing capabilities, and the availability of cost-effective solutions are further propelling the market. Strong industrial investments and rapid integration of automation technologies across production lines are solidifying China’s position as a key market for gantry robots.

Gantry Robot Market Share

The gantry robot industry is primarily led by well-established companies, including:

- KUKA AG (Germany)

- ABB Ltd. (Switzerland)

- Yaskawa Electric Corporation (Japan)

- FANUC Corporation (Japan)

- Siemens AG (Germany)

- Parker Hannifin Corporation (U.S.)

- Thomson Industries, Inc. (U.S.)

- Schneider Electric SE (France)

- Zollern GmbH & Co. KG (Germany)

- IAI Industrial Robots (Japan)

- Festo AG & Co. KG (Germany)

- Bosch Rexroth AG (Germany)

- Bürobotec GmbH (Germany)

Latest Developments in Global Gantry Robot Market

- In October 2023, Neuromeka, a leading collaborative robotics firm, and KEBA, a global provider of robotics and industrial automation solutions, entered into a Memorandum of Understanding (MOU) to jointly develop advanced industrial robots. This strategic partnership is expected to accelerate innovation in the gantry robot market by combining their expertise in automation and collaborative robotics. The collaboration aims to enhance the flexibility, precision, and efficiency of industrial robotic systems, thereby supporting the growing demand for smart factory solutions and high-performance automation across manufacturing sectors

- In 2023, ABB introduced the IRB 6700, a high-performance gantry robot specifically designed for heavy-duty applications in the automotive and aerospace industries. The robot’s robust design, coupled with integration of artificial intelligence (AI) and machine learning (ML) capabilities, enhances autonomous decision-making and operational efficiency. This launch strengthens ABB’s position in the gantry robot market and caters to industries requiring high precision, heavy payload handling, and optimized production cycles, driving overall market growth

- In July 2022, FANUC launched an upgraded line of gantry robots with enhanced payload capacity and extended reach for assembly and material handling applications. These upgrades cater to industries such as automotive, electronics, and logistics, where high throughput and precision are critical. By improving operational flexibility and reducing cycle times, FANUC’s enhanced gantry robots are expected to drive increased adoption in both existing and emerging industrial sectors

- In May 2021, Yaskawa Motoman introduced a modular gantry robot system with scalable axes and payload options, aimed at optimizing production efficiency in automotive and electronics manufacturing. The modular design allows manufacturers to customize robotic setups based on specific application requirements, improving workflow automation and reducing capital expenditure. This development has contributed to expanding the versatility and market penetration of gantry robots, particularly in regions investing heavily in Industry 4.0 initiatives

- In February 2020, Bosch Rexroth, a prominent provider of automation solutions, launched a new e-commerce portal to offer streamlined access to a wide range of Rexroth hydraulic and factory automation components. This initiative improves convenience and efficiency in procurement, enabling manufacturers to quickly source gantry robot components and related automation products. The portal facilitates faster deployment of industrial automation solutions, supporting the expansion of gantry robot adoption in manufacturing and logistics operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gantry Robot Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gantry Robot Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gantry Robot Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.