Global Garage Body Shop Equipment Market

Market Size in USD Billion

CAGR :

%

USD

6.29 Billion

USD

13.86 Billion

2024

2032

USD

6.29 Billion

USD

13.86 Billion

2024

2032

| 2025 –2032 | |

| USD 6.29 Billion | |

| USD 13.86 Billion | |

|

|

|

|

Garage Body Shop Equipment Market Size

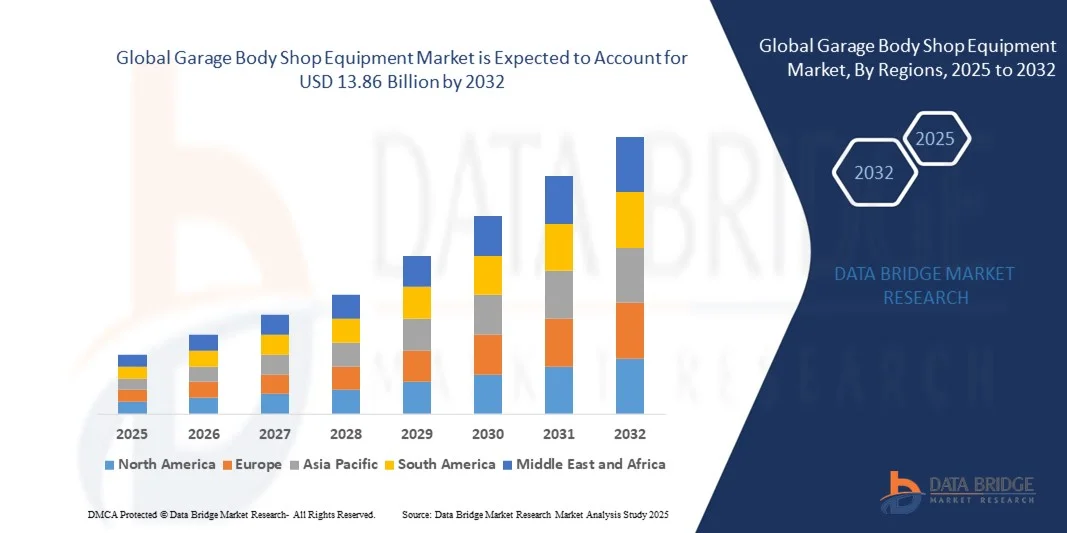

- The global garage body shop equipment market size was valued at USD 6.29 billion in 2024 and is expected to reach USD 13.86 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fuelled by the increasing number of vehicles on the road, rising demand for automotive maintenance and repair services, and growing adoption of advanced body shop equipment for efficiency and precision

- Growing focus on automotive safety, repair quality, and faster turnaround times is further driving the adoption of modern equipment in garages and body shops globally

Garage Body Shop Equipment Market Analysis

- The market is witnessing steady growth due to the expansion of automotive service centers, increasing disposable incomes, and the rising preference for professional maintenance services over DIY repairs

- Adoption of automation and smart equipment is enhancing operational efficiency, reducing repair time, and improving customer satisfaction, which further stimulates market demand

- North America dominated the garage body shop equipment market with the largest revenue share in 2024, driven by increasing vehicle parc, growing demand for automotive maintenance, and the adoption of advanced repair and diagnostic equipment

- Asia-Pacific region is expected to witness the highest growth rate in the global garage body shop equipment market, driven by urbanization, expanding automotive sales, government initiatives promoting professional repair services, and the emergence of APAC as a manufacturing hub for cost-effective garage equipment

- The Lifting Equipment segment held the largest market revenue share in 2024, driven by the growing demand for efficient vehicle servicing, faster repair turnaround, and workplace safety in garages. Lifting equipment such as hydraulic lifts, jacks, and hoists are widely used across commercial and independent workshops for their reliability and operational efficiency

Report Scope and Garage Body Shop Equipment Market Segmentation

|

Attributes |

Garage Body Shop Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Garage Body Shop Equipment Market Trends

Increasing Adoption of Advanced and Automated Garage Equipment

- The growing shift toward advanced and automated garage body shop equipment is transforming the automotive repair landscape by enabling faster, precise, and safer vehicle maintenance. Modern equipment such as automated lifts, paint booths, and computerized diagnostic tools allow garages to complete repairs more efficiently while reducing human error and workplace hazards. This results in improved service quality and higher customer satisfaction

- Rising demand for rapid repair and maintenance services in commercial fleets and urban automotive centers is accelerating the adoption of modern equipment. Tools such as computerized frame alignment systems, wheel balancers, and robotic spray systems are particularly effective in high-volume workshops, helping reduce repair turnaround times and enhance operational efficiency

- The affordability and modular design of new garage body shop equipment are making them attractive for small and mid-sized repair shops, enabling upgrades without significant capital expenditure. Workshops benefit from improved workflow and productivity, which ultimately enhances profitability and service reliability

- For instance, in 2023, several automotive service chains in North America reported faster vehicle turnaround and higher repair accuracy after deploying automated paint booths and digital alignment machines. These upgrades reduced operational errors, minimized material wastage, and improved overall service efficiency

- While advanced garage equipment is driving operational efficiency, its impact depends on continuous technological innovation, training for workshop staff, and cost-effective deployment strategies. Manufacturers must focus on localized solutions and service support to fully capitalize on growing demand

Garage Body Shop Equipment Market Dynamics

Driver

Rising Vehicle Parc and Growing Demand for Efficient Repair Services

- The increase in the global vehicle parc is pushing both commercial and independent garages to adopt modern body shop equipment to meet rising repair and maintenance demand. Vehicles require precise tools for bodywork, painting, and alignment, which has accelerated investment in advanced equipment. Growing vehicle ownership in emerging markets is further driving demand for upgraded garage solutions to handle diverse vehicle types efficiently

- Vehicle owners and fleet operators are increasingly prioritizing quality repairs and faster service turnaround times, encouraging workshops to upgrade their equipment. Enhanced repair quality ensures customer satisfaction, repeat business, and compliance with safety standards. The trend is reinforced by growing competition among workshops to offer premium, reliable, and faster service to retain clientele

- Regulatory mandates and safety standards for automotive repairs are supporting the adoption of advanced garage equipment. Workshops must comply with emission regulations, safety inspections, and vehicle repair quality requirements, driving consistent demand for modern tools. In addition, government initiatives promoting road safety and environmental compliance are motivating garages to invest in precise and certified equipment

- For instance, in 2022, several European countries introduced stricter automotive repair compliance standards, boosting demand for automated lifts, precision alignment systems, and computerized diagnostics across commercial and independent garages. This regulatory push has also encouraged workshops to adopt advanced diagnostic tools and automated processes to minimize errors and meet inspection protocols

- While demand is growing, continuous innovation, affordability, and workforce training are essential to ensure sustained adoption and operational efficiency in garage workshops. Workshops are increasingly seeking modular and scalable equipment solutions to manage costs while keeping pace with technological advancements and evolving customer expectations

Restraint/Challenge

High Cost of Advanced Equipment and Limited Access for Small Workshops

- The high price point of advanced garage body shop equipment such as automated lifts, robotic spray booths, and diagnostic machines makes them inaccessible for small and mid-sized workshops. These systems are often adopted only by large commercial garages or chain service centers. High initial investment and maintenance costs prevent smaller operators from modernizing, limiting their operational efficiency and competitiveness

- In many regions, there is a lack of trained personnel capable of using or maintaining complex equipment. The absence of technical expertise and support infrastructure reduces operational efficiency and limits adoption, particularly in rural or underdeveloped markets. Workshops often require additional training programs or vendor support, which adds to operational costs and delays effective utilization of equipment

- Supply chain challenges for equipment and spare parts can delay installation and maintenance in remote areas, affecting overall market penetration. Smaller workshops often rely on older manual tools, which can reduce repair quality and efficiency. Delays in delivery of key components or consumables also increase downtime and reduce service capacity, impacting revenue potential

- For instance, in 2023, automotive service providers in Southeast Asia reported that limited access to modern garage equipment and high capital costs prevented many small-scale workshops from upgrading, constraining market growth. Workshops in rural and semi-urban areas particularly struggled with delayed deliveries and a lack of financing options for high-cost tools, limiting expansion opportunities

- While technological advancements continue to improve garage equipment, addressing cost, accessibility, and training challenges is critical. Market stakeholders are focusing on modular, scalable, and mobile solutions to enable wider adoption and long-term market potential. Strategic collaborations between manufacturers and financing providers are also emerging to make equipment more affordable and accessible for smaller workshops

Garage Body Shop Equipment Market Scope

The market is segmented on the basis of product type, garage type, vehicle type, sales channel, installation, and function type.

- By Product Type

On the basis of product type, the garage body shop equipment market is segmented into Lifting Equipment, Dent & Damage Removal, Surface Finish, and Others. The Lifting Equipment segment held the largest market revenue share in 2024, driven by the growing demand for efficient vehicle servicing, faster repair turnaround, and workplace safety in garages. Lifting equipment such as hydraulic lifts, jacks, and hoists are widely used across commercial and independent workshops for their reliability and operational efficiency.

The Dent & Damage Removal segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of advanced dent repair systems, pullers, and frame straightening equipment. These tools enable precision repairs, reduce labor time, and enhance service quality, particularly in urban automotive centers and high-volume workshops.

- By Garage Type

On the basis of garage type, the market is segmented into Automotive OEM Dealerships, Franchise Stores, and Independent Garages. Independent Garages held a significant market share in 2024, supported by the increasing number of small and mid-sized repair workshops seeking modern, cost-effective body shop equipment.

The Franchise Stores segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising chain-based service centers adopting standardized equipment to ensure consistent quality and faster service.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Two-Wheeler, PCV and LCV, and HCV. PCV and LCV dominated the market in 2024, owing to the high demand for commercial vehicle maintenance and fleet repair services across logistics, delivery, and transportation sectors.

The HCV segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing heavy vehicle usage and stricter regulatory safety and maintenance standards.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM (Original Equipment Manufacturer) and Aftermarket. The Aftermarket segment held the largest revenue share in 2024, driven by repair shops upgrading their equipment and replacement demand for worn-out tools in garages.

The OEM segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising partnerships with vehicle manufacturers and dealerships, ensuring the deployment of high-quality equipment in service centers.

- By Installation

On the basis of installation, the market is segmented into Mobile and Fixed. Fixed installations accounted for the largest share in 2024, supported by the setup of permanent workshop infrastructure and dedicated body shop facilities.

The Mobile segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by on-site repair services, roadside assistance, and emerging mobile workshops in urban and semi-urban regions.

- By Function Type

On the basis of function type, the market is segmented into Electronic and Mechanical. Mechanical equipment dominated in 2024, owing to its reliability, ease of use, and widespread adoption across both independent and commercial garages.

The Electronic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by automation, digital diagnostics, and smart garage equipment that enhances precision, safety, and operational efficiency.

Garage Body Shop Equipment Market Regional Analysis

- North America dominated the garage body shop equipment market with the largest revenue share in 2024, driven by increasing vehicle parc, growing demand for automotive maintenance, and the adoption of advanced repair and diagnostic equipment

- Garages in the region highly value efficiency, precision, and safety, leading to widespread deployment of automated lifts, frame alignment systems, and computerized paint booths

- This growth is further supported by strong industrial infrastructure, high disposable incomes, and the preference for modernized repair services across commercial and independent garages

U.S. Garage Body Shop Equipment Market Insight

The U.S. garage body shop equipment market captured the largest share in North America in 2024, fueled by rapid vehicle growth, increasing fleet operations, and the trend toward automation in repair workshops. Workshops are increasingly prioritizing faster turnaround times, operational efficiency, and high-quality repairs, which drives demand for advanced equipment. The rising adoption of OEM and aftermarket equipment, combined with technological advancements in lifts, diagnostics, and paint booths, is further propelling the market.

Europe Garage Body Shop Equipment Market Insight

The Europe garage body shop equipment market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent automotive repair standards, safety regulations, and growing demand for modernized repair services. Increasing urbanization and the presence of well-established automotive service networks are fostering adoption. European workshops are also investing in environmentally friendly, energy-efficient equipment to comply with regulations and reduce operational costs.

U.K. Garage Body Shop Equipment Market Insight

The U.K. garage body shop equipment market is expected to witness rapid growth from 2025 to 2032, fueled by rising vehicle ownership, the trend of home-grown and independent garages adopting modern tools, and a focus on faster repair services. Concerns about vehicle safety, insurance compliance, and service quality are encouraging both commercial and independent garages to upgrade to advanced equipment.

Germany Garage Body Shop Equipment Market Insight

The Germany garage body shop equipment market is expected to witness significant growth from 2025 to 2032, driven by high awareness of vehicle maintenance standards, stringent safety and environmental regulations, and the adoption of advanced repair and diagnostic tools. Workshops in Germany increasingly integrate automated and electronic equipment, emphasizing operational efficiency, precision, and eco-conscious solutions.

Asia-Pacific Garage Body Shop Equipment Market Insight

The Asia-Pacific garage body shop equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, expanding automotive sales, and growing industrialization in countries such as China, Japan, and India. Increasing vehicle parc and government initiatives promoting professional automotive repair services are accelerating equipment adoption. Furthermore, APAC is emerging as a manufacturing hub for garage equipment, making tools more affordable and accessible to a wider workshop base.

Japan Garage Body Shop Equipment Market Insight

The Japan garage body shop equipment market is expected to witness substantial growth from 2025 to 2032, due to the country’s high automotive standards, advanced technology adoption, and demand for precision repair services. Workshops are increasingly integrating electronic and automated equipment for diagnostics, alignment, and painting, enhancing service efficiency. Japan’s focus on innovation and high-quality automotive maintenance is driving growth across commercial and independent garages.

China Garage Body Shop Equipment Market Insight

The China garage body shop equipment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s growing middle class, rapid urbanization, and rising vehicle ownership. China’s focus on professional automotive services, smart repair solutions, and affordable aftermarket and OEM equipment is boosting adoption across residential, commercial, and fleet service workshops. The government’s push toward automotive standardization and the availability of cost-effective modern equipment are key factors propelling market growth.

Garage Body Shop Equipment Market Share

The Garage Body Shop Equipment industry is primarily led by well-established companies, including:

- MAHA Maschinenbau Haldenwang GmbH & Co. KG (Germany)

- Snap-on Incorporated (U.S.)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Vehicle Service Group (U.S.)

- VisiCon Automatisierungstechnik GmbH (Germany)

- Standard Tools and Equipment Co. (U.K.)

- Symach s.r.l. (Italy)

- Otto Nußbaum GmbH & Co. KG (Germany)

- M/s Samvit Garage Equipments (India)

- Sarveshwari Engineers (India)

- Guangzhou Jingjia Auto Equipment Co., Ltd. (China)

- Boston Garage Equipment Ltd (U.K.)

- Arex Test Systems bv (Netherlands)

- Euro Car Parts Ltd T/A LKQ Coatings (U.K.)

- Aro Equipments Pvt. Ltd (India)

- ISTOBAL (Spain)

- Con Air Equipments Private Limited (India)

- Oil Lube Systems Pvt Ltd. (India)

- Gray Manufacturing (U.S.)

- AUTEC Car Wash Systems (Italy)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.