Global Garage Equipment Market

Market Size in USD Billion

CAGR :

%

USD

11.33 Billion

USD

30.55 Billion

2024

2032

USD

11.33 Billion

USD

30.55 Billion

2024

2032

| 2025 –2032 | |

| USD 11.33 Billion | |

| USD 30.55 Billion | |

|

|

|

|

Garage Equipment Market Size

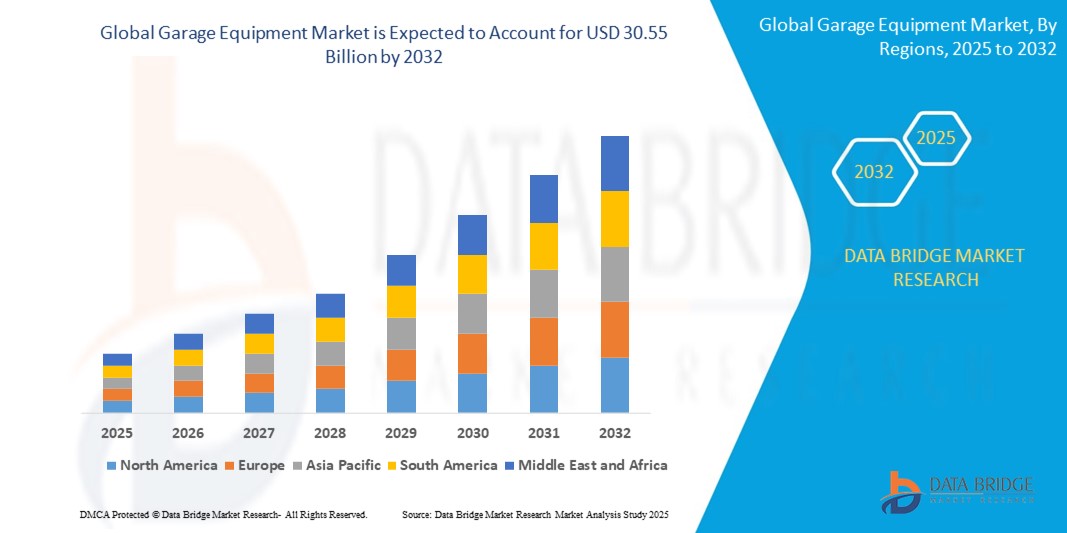

- The global garage equipment market size was valued at USD 11.33 billion in 2024 and is expected to reach USD 30.55 billion by 2032, at a CAGR of 13.20% during the forecast period

- The market growth is driven by the increasing demand for advanced automotive repair and maintenance solutions, spurred by the rising number of vehicles globally and technological advancements in diagnostic and repair equipment

- Growing consumer awareness of vehicle safety, coupled with stringent government regulations on emissions and vehicle performance, is boosting the adoption of sophisticated garage equipment across various garage types

Garage Equipment Market Analysis

- Garage equipment, encompassing tools and systems for vehicle repair, maintenance, and diagnostics, is a critical component of the automotive aftermarket, catering to both passenger and commercial vehicles

- The market is propelled by the increasing complexity of modern vehicles, necessitating advanced diagnostic and repair tools, as well as the growing trend of predictive maintenance enabled by electronic equipment

- North America dominated the garage equipment market with a revenue share of 38.5% in 2024, driven by a mature automotive industry, high vehicle ownership rates, and the presence of leading equipment manufacturers

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing vehicle sales, and expanding automotive repair infrastructure in countries such as China and India

- The independent garage segment dominated the largest market revenue share of 45.0% in 2024, driven by its flexibility, cost-effective services, and widespread adoption for routine maintenance and repairs, particularly post-warranty

Report Scope and Garage Equipment Market Segmentation

|

Attributes |

Garage Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Garage Equipment Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global garage equipment market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced data processing, enabling detailed insights into equipment performance, maintenance schedules, and operational efficiency

- AI-driven garage equipment solutions support predictive maintenance, identifying potential equipment failures before they result in costly downtime or repair delays

- For instances, companies are developing AI-powered diagnostic tools that analyze vehicle data to provide precise repair recommendations or optimize workshop workflows based on real-time demand and resource availability

- This trend enhances the efficiency and value of garage equipment, making it increasingly appealing to OEM authorized garages, independent garages, and franchise garages

- AI algorithms can process extensive data sets, including vehicle diagnostics, equipment usage patterns, and technician performance, to improve service accuracy and operational productivity

Garage Equipment Market Dynamics

Driver

“Rising Demand for Advanced Vehicle Maintenance and Safety Compliance”

- Growing consumer and regulatory demand for vehicle safety and performance is a key driver for the global garage equipment market, particularly for passenger vehicles and commercial vehicles

- Garage equipment, such as diagnostic and test equipment, emission equipment, and lifting equipment, supports critical safety features such as precise alignment, brake testing, and emissions compliance

- Government regulations, especially in North America and Europe, mandating stringent vehicle safety and emission standards, are accelerating the adoption of advanced garage equipment

- The rise of electric vehicles (EVs) and connected vehicle technologies, supported by IoT and 5G advancements, is expanding the need for specialized equipment such as EV diagnostic tools and automated lifts, offering faster and more accurate maintenance services

- Manufacturers are increasingly equipping OEM authorized garages and franchise garages with factory-fitted advanced equipment to meet consumer expectations and enhance service quality

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant upfront costs for acquiring, installing, and integrating advanced garage equipment, such as electronic diagnostic systems and automated body shop equipment, pose a barrier, particularly for independent garages in emerging markets

- Retrofitting fixed or mobile garage setups with modern equipment can be complex and expensive, limiting adoption in cost-sensitive regions

- Data security and privacy issues are a major challenge, as electronic garage equipment collects sensitive vehicle and customer data, raising concerns about breaches, misuse, or non-compliance with data protection laws

- The varied regulatory frameworks across countries for data handling and equipment standards create operational challenges for global manufacturers and service providers

- These factors may discourage adoption, especially in regions such as Asia-Pacific, where cost sensitivity is high, or in North America, where data privacy awareness is significant, potentially slowing market growth

Garage Equipment market Scope

The market is segmented on the basis of garage type, installation type, function type, equipment type, and vehicle type.

- By Garage Type

On the basis of garage type, the global garage equipment market is segmented into OEM Authorized Garage, Independent Garage, and Franchise Garages. The independent garage segment dominated the largest market revenue share of 45.0% in 2024, driven by its flexibility, cost-effective services, and widespread adoption for routine maintenance and repairs, particularly post-warranty. Independent garages leverage affordable labor costs and authorized products, catering to diverse customer needs across passenger and commercial vehicles.

The Franchise Garages segment is expected to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by increasing brand recognition, standardized service protocols, and consumer preference for reliable, branded repair experiences. The expansion of automotive service networks and partnerships with OEMs further accelerates the adoption of franchise garages.

- By Installation Type

On the basis of installation type, the global garage equipment market is segmented into Mobile and Fixed. The Mobile segment accounted for the largest market revenue share of 52.5% in 2024, driven by its flexibility and ability to provide on-site repair and maintenance services, particularly for commercial fleets and roadside assistance. Mobile equipment enhances operational efficiency and customer convenience, especially in remote or underserved areas.

The Fixed segment is anticipated to experience the fastest growth rate of 7.8% from 2025 to 2032. Fixed installations, such as vehicle lifts and diagnostic machines in permanent garage setups, are critical for high-volume service centers. The increasing number of OEM-authorized and franchise garages investing in advanced fixed equipment to meet stringent safety and performance standards drives this growth.

- By Function Type

On the basis of function type, the global garage equipment market is segmented into Electronic and Mechanical. The Electronic segment held the largest market revenue share of 58.0% in 2024, propelled by the rising demand for advanced diagnostic tools, such as scanners, electronic wheel alignment systems, and ECU programmers, to service modern vehicles with complex electronic systems. The integration of IoT and AI in electronic equipment enhances diagnostic accuracy and efficiency.

The Mechanical segment is expected to witness significant growth from 2025 to 2032, driven by the continued need for traditional tools such as vehicle lifts, tire changers, and hydraulic systems for physical repair tasks. The growth of commercial vehicle maintenance and the expansion of independent garages in emerging markets support the demand for mechanical equipment.

- By Equipment Type

On the basis of equipment type, the global garage equipment market is segmented into Body Shop Equipment, Diagnostic and Test Equipment, Emission Equipment, Lifting Equipment, Washing Equipment, Wheel and Tire Equipment, and Others. The Body Shop Equipment segment dominated the market with a revenue share of 35.0% in 2024, driven by the increasing demand for collision repair and vehicle restoration, particularly for passenger vehicles. Tools such as paint booths and frame straighteners are essential for addressing dents, scratches, and structural damage.

The Diagnostic and Test Equipment segment is anticipated to witness the fastest growth rate of 10.2% from 2025 to 2032, fueled by the rising complexity of vehicles, including electrified and connected systems. The need for advanced diagnostic scanners, emission analyzers, and ADAS calibration tools in OEM-authorized and independent garages drives this segment’s growth.

- By Vehicle Type

On the basis of vehicle type, the global garage equipment market is segmented into Passenger Vehicles and Commercial Vehicles. The Passenger Vehicles segment held the largest market revenue share of 68.5% in 2024, attributed to the high global volume of passenger cars and consumer emphasis on safety, maintenance, and aesthetics. Both factory-installed and aftermarket equipment cater to the diverse needs of passenger vehicle owners.

The Commercial Vehicles segment is expected to witness rapid growth of 9.6% from 2025 to 2032, driven by the increasing adoption of garage equipment for heavy-duty vehicles such as trucks and buses. The demand for location tracking, diagnostics, and maintenance tools in commercial fleets, coupled with stringent emission and safety regulations, fuels this segment’s expansion.

Garage Equipment Market Regional Analysis

- North America dominated the garage equipment market with a revenue share of 38.5% in 2024, driven by a mature automotive industry, high vehicle ownership rates, and the presence of leading equipment manufacturers

- Consumers prioritize garage equipment for enhancing vehicle safety, performance, and longevity, especially in regions with high vehicle ownership and diverse climatic conditions

- Growth is supported by advancements in equipment technology, including connected diagnostic tools and automated systems, alongside rising adoption in both OEM and aftermarket segments

U.S. Garage Equipment Market Insight

The U.S. garage equipment market captured the largest revenue share of 76.7% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of vehicle safety and maintenance benefits. The trend towards vehicle customization and increasing regulations promoting stricter emission and safety standards further boost market expansion. Automakers’ growing incorporation of advanced diagnostic and repair equipment in OEM-authorized garages complements aftermarket sales, creating a diverse product ecosystem.

Europe Garage Equipment Market Insight

The Europe garage equipment market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety, emissions compliance, and operational efficiency. Consumers seek equipment that enhances diagnostic accuracy and service speed while ensuring environmental compliance. The growth is prominent in both new garage installations and retrofit projects, with countries such as Germany and France showing significant uptake due to stringent emission regulations and urban traffic conditions.

U.K. Garage Equipment Market Insight

The U.K. market for garage equipment is expected to witness rapid growth, driven by demand for advanced diagnostic and repair tools in urban and suburban settings. Increased interest in vehicle safety and rising awareness of emission control benefits encourage adoption. In addition, evolving vehicle safety and environmental regulations influence consumer choices, balancing equipment functionality with compliance.

Germany Garage Equipment Market Insight

Germany is expected to witness rapid growth in the garage equipment market, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle safety and efficiency. German consumers prefer technologically advanced equipment, such as electronic diagnostic tools and precision lifts that enhance service quality and contribute to operational efficiency. The integration of these tools in premium service centers and aftermarket options supports sustained market growth.

Asia-Pacific Garage Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of vehicle maintenance, safety, and environmental compliance is boosting demand. Government initiatives promoting vehicle safety and emission standards further encourage the use of advanced garage equipment.

Japan Garage Equipment Market Insight

Japan’s garage equipment market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced equipment that enhances vehicle maintenance and safety. The presence of major automotive manufacturers and integration of advanced tools in OEM-authorized garages accelerate market penetration. Rising interest in aftermarket service upgrades also contributes to growth.

China Garage Equipment Market Insight

China holds the largest share of the Asia-Pacific garage equipment market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for advanced maintenance and repair solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced equipment. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Garage Equipment Market Share

The garage equipment industry is primarily led by well-established companies, including:

- Oil Lube Systems Pvt Ltd. (India)

- MAHA Maschinenbau Haldenwang GmbH & Co. KG (Germany)

- Istobal S.A. (Spain)

- Nussbaum Automotive Solutions Lp (U.S.)

- Symach SRL (Italy)

- Robert Bosch GmbH (Germany)

- Guangzhou Jingjia Auto Equipment Co., Ltd. (China)

- Aro Equipments Pvt. Ltd (India)

- Snap-on Incorporated (U.S.)

- VisiCon Automatisierungstechnik GmbH (Germany)

- Standard Tools and Equipment Co.

- Samvit Garage Equipments (India)

- Vehicle Service Group (U.S.)

- Boston Garage Equipment Ltd (U.K.)

What are the Recent Developments in Global Garage Equipment Market?

- In May 2025, Madhus Garage Equipment officially launched the Hunter HawkEye XL in India, hailed as the world’s most advanced wheel alignment system. Developed in collaboration with Hunter Engineering Company, this cutting-edge solution is designed to align a wide range of vehicles—from compact cars to heavy-duty commercial trucks. The launch marks a significant milestone in Madhus’ 20-year partnership with Hunter, aiming to close the technology gap in India’s automotive service sector. With enhanced precision, speed, and versatility, the HawkEye XL sets a new benchmark for alignment systems in the country

- In May 2025, TEXA unveiled its latest innovations at Autopromotec 2025, showcasing cutting-edge solutions for garage equipment and vehicle diagnostics. Among the highlights were the NAVIGATOR NANO SERVICE, a compact VCI for car diagnostics, and the E-DIAG CHARGER, a dual-purpose station for charging and diagnosing electric and hybrid vehicle batteries. TEXA also introduced advancements in ADAS calibration, secure gateway access, and software updates, reinforcing its commitment to supporting the evolving needs of workshops and OEMs in the era of electrification and smart diagnostics

- In March 2023, Alliance Automotive Group (AAG), a leading UK-based automotive aftermarket distributor, acquired Direct Auto Parts Ltd. (DAP)—a single-branch motor factor business based in Barking, Essex, with annual sales of approximately £2.6 million and 13 employees. This strategic acquisition aimed to expand AAG’s regional footprint, strengthen its customer base, and support operational consolidation within the garage equipment and vehicle parts sector. DAP had been a long-standing member of the PDP buying group, and its integration reflects AAG’s continued growth strategy across the UK and Ireland

- In September 2022, Continental AG expanded its workshop equipment portfolio by launching two advanced exhaust emissions testers—the DX280 DC and CCP800—at Automechanika 2022 in Frankfurt. The DX280 DC uses diffusion-charging (DC) technology to measure exhaust particles, meeting the stricter Euro 6 diesel regulations. The CCP800 is a mobile, all-in-one emissions system equipped with a gas analyzer and modules for smoke, oil temperature, and RPM measurement. This launch positions Continental to support workshops and testing centers across Europe in complying with evolving particulate emission standards

- In December 2021, Ravaglioli, a leading garage equipment manufacturer under Vehicle Service Group (VSG), entered into a strategic partnership with TEXA, a specialist in diagnostic and remote vehicle technologies. This collaboration focuses on integrating mechanical and electronic expertise to develop next-generation workshop solutions, particularly in areas like ADAS calibration and vehicle alignment. By combining their complementary strengths, the two companies aim to equip automotive workshops with innovative, future-ready tools that address the evolving challenges posed by modern vehicle technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Garage Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Garage Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Garage Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.