Global Garment Steamer Market

Market Size in USD Billion

CAGR :

%

USD

3.77 Billion

USD

5.75 Billion

2025

2033

USD

3.77 Billion

USD

5.75 Billion

2025

2033

| 2026 –2033 | |

| USD 3.77 Billion | |

| USD 5.75 Billion | |

|

|

|

|

Garment Steamer Market Size

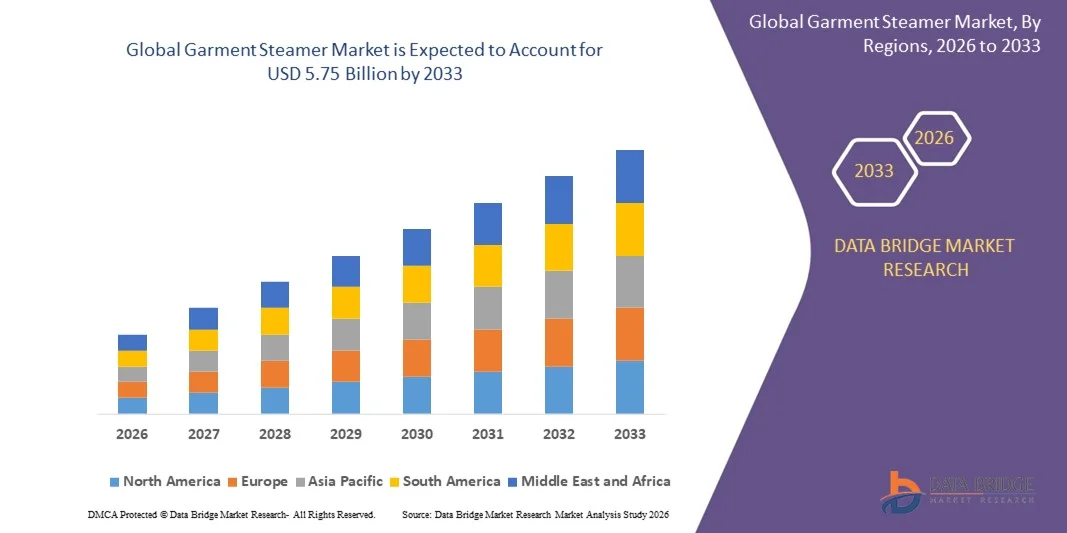

- The global garment steamer market size was valued at USD 3.77 billion in 2025 and is expected to reach USD 5.75 billion by 2033, at a CAGR of 5.41% during the forecast period

- The market growth is largely fueled by increasing consumer focus on garment care, convenience, and time-saving solutions, driving higher adoption of both handheld and upright steamers in residential and commercial settings

- Furthermore, rising demand for advanced, durable, and hygienic garment care appliances, capable of removing wrinkles, odors, and bacteria efficiently, is establishing modern steamers as essential household and professional tools. These factors are accelerating the adoption of garment steamers, thereby significantly boosting the industry’s growth

Garment Steamer Market Analysis

- Garment steamers, offering quick wrinkle removal, fabric sanitization, and gentle care for delicate textiles, are becoming increasingly important appliances in both households and commercial establishments due to their efficiency, portability, and ease of use

- The escalating demand for garment steamers is primarily driven by growing urbanization, rising disposable incomes, increasing awareness of fabric care, and a preference for convenient and hygienic garment maintenance solutions across diverse consumer segments

- Europe dominated garment steamer market with a share of 35% in 2025, due to rising consumer focus on garment care, increasing disposable incomes, and a growing preference for high-quality, energy-efficient home appliances

- Asia-Pacific is expected to be the fastest growing region in the garment steamer market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing awareness of personal and professional garment care in countries such as China, Japan, and India

- Handheld/ portable garment steamer segment dominated the market with a market share of 57.9% in 2025, due to its compact design, ease of use, and portability for everyday household use. Consumers prefer handheld steamers for quick touch-ups and their ability to handle delicate fabrics without requiring an ironing board. The strong demand is also fueled by increasing travel and work-from-home trends where portability and convenience are highly valued. Handheld steamers’ compatibility with various garment types and lightweight construction further reinforce their popularity among users

Report Scope and Garment Steamer Market Segmentation

|

Attributes |

Garment Steamer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Garment Steamer Market Trends

Growing Use of Handheld and Portable Garment Steamers

- A significant trend in the garment steamer market is the increasing adoption of handheld and portable steamers for home, travel, and small commercial applications, driven by rising consumer preference for convenience, mobility, and time-saving garment care solutions. This shift is positioning handheld and portable steamers as essential appliances for quick wrinkle removal and fabric maintenance across multiple settings

- For instance, Philips and Conair offer high-performance portable steamers that are lightweight, ergonomically designed, and capable of handling delicate fabrics. These models enhance user experience and broaden the market appeal for consumers seeking efficient and versatile garment care solutions

- The adoption of portable steamers is also growing in hospitality and retail sectors, where quick touch-ups and easy mobility are critical for maintaining professional garment presentation. This trend is expanding the use of steamers beyond households and into commercial and semi-professional environments

- In emerging markets, rising urbanization and increasing disposable incomes are fueling the preference for compact and portable steamers that are easy to store and operate. This is creating opportunities for manufacturers to target households seeking practical, space-saving garment care solutions

- Consumers are also increasingly drawn to handheld steamers for their multifunctionality, such as wrinkle removal, sanitization, and odor elimination, which provides added value and convenience. This is strengthening the role of portable steamers as versatile solutions for modern fabric care

- The market is witnessing strong growth in upright steamers designed for larger garments and continuous steaming needs. The combined rise of portable and upright steamers is reinforcing the overall expansion of the garment steamer market, catering to diverse user requirements and driving innovation in appliance design

Garment Steamer Market Dynamics

Driver

Rising Demand for Convenient and Hygienic Garment Care

- The growing consumer focus on hygiene, fabric care, and time efficiency is driving demand for garment steamers that can remove wrinkles, odors, and bacteria effectively. Consumers are increasingly seeking appliances that deliver convenience, portability, and reliable performance for everyday use

- For instance, the Philips 7000 series handheld steamer with OptimalTEMP technology allows safe use on all fabrics while eliminating up to 99.99% of bacteria. Such innovations strengthen adoption by combining efficiency, safety, and hygiene in a single appliance

- The trend toward remote work, travel, and fast-paced urban lifestyles is increasing reliance on handheld and compact steamers, as they offer quick solutions for garment maintenance without requiring ironing boards or extensive setup

- Rising awareness of fabric care and maintenance is encouraging consumers to invest in steamers that extend garment life and improve appearance. This is establishing steamers as a preferred alternative to traditional ironing in households and commercial establishments

- The market is also benefiting from growing interest in multifunctional appliances that provide wrinkle removal, sanitization, and fabric refreshing in one device, which enhances value for consumers and strengthens overall demand for garment steamers

Restraint/Challenge

High Cost of Premium Steamers

- The garment steamer market faces challenges due to the high cost of advanced and premium models, which incorporate multifunctional features, rapid heating, and hygiene-focused technologies. These elevated price points limit affordability for some consumer segments and can slow widespread adoption

- For instance, premium handheld steamers with antibacterial features and extended durability, such as those from Philips and Panasonic, are priced significantly higher than basic models. This price gap can constrain market penetration, especially in cost-sensitive regions

- Manufacturers must balance innovation, performance, and affordability while maintaining product quality, which increases production complexity and operational costs. This adds pressure on brands to optimize supply chains and manufacturing processes

- The reliance on high-performance materials and advanced technologies increases overall production expenses, creating a barrier for smaller players and new entrants in the market. This challenge requires careful pricing strategies to ensure competitive positioning

- The market continues to face limitations in scaling high-end product offerings to mass-market consumers without compromising design, performance, or safety. These factors collectively influence market growth dynamics and adoption rates across different consumer segments

Garment Steamer Market Scope

The market is segmented on the basis of product type, power, water tank capacity, material, price range, end-user, and sales channel.

- By Product Type

On the basis of product type, the garment steamer market is segmented into handheld/portable garment steamer and upright/non-portable garment steamer. The handheld/portable segment dominated the market with the largest revenue share of 57.9% in 2025, driven by its compact design, ease of use, and portability for everyday household use. Consumers prefer handheld steamers for quick touch-ups and their ability to handle delicate fabrics without requiring an ironing board. The strong demand is also fueled by increasing travel and work-from-home trends where portability and convenience are highly valued. Handheld steamers’ compatibility with various garment types and lightweight construction further reinforce their popularity among users.

The upright/non-portable segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising adoption in commercial settings such as hotels, laundries, and fashion boutiques. Upright steamers provide larger steaming capacity, higher efficiency, and continuous operation, which makes them suitable for high-volume usage. Their ergonomic design and professional-grade performance are increasingly attracting commercial buyers seeking reliable, time-saving garment care solutions.

- By Power

On the basis of power, the garment steamer market is segmented into below 750 watt, 750–1000 watt, 1000–1500 watt, 1500–2500 watt, and 2500 watt & above. The 1000–1500 watt segment dominated the market with the largest revenue share in 2025, driven by its optimal balance of energy efficiency and effective steaming performance. Consumers prefer this segment as it delivers sufficient heat and steam output for both domestic and semi-professional applications without excessive power consumption. Steamer models in this power range often support quick heating and consistent steam output, increasing user convenience and satisfaction. For instance, Philips offers several models within this range that combine safety features with reliable performance, further boosting adoption.

The 1500–2500 watt segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand in commercial applications requiring rapid and continuous steaming. Higher-powered steamers allow faster wrinkle removal and improved efficiency, which is critical for hotels, retail, and fashion sectors. Their advanced features, such as adjustable steam settings and large water reservoirs, make them appealing for high-volume garment care, driving market expansion.

- By Water Tank Capacity

On the basis of water tank capacity, the market is segmented into below 500 ml, 500 ml–1 litre, 1–2 litre, 2–3 litre, 3–4 litre, and 4 litre & above. The 1–2 litre segment dominated the market with the largest revenue share in 2025, driven by its ideal capacity for moderate-duration steaming sessions without frequent refills. Consumers value this segment for balancing portability with sufficient water supply for household use. Steamers with this capacity often offer uninterrupted performance for multiple garments, making them suitable for families and small-scale commercial use. For instance, Conair’s 1.5-litre portable steamers are widely preferred due to their consistent output and ease of handling.

The 2–3 litre segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in commercial and professional settings. Larger water tanks reduce downtime, allowing uninterrupted operation for extended steaming requirements. The demand is further reinforced by features such as rapid heating, adjustable steam flow, and ergonomic design, which enhance user convenience and operational efficiency.

- By Material

On the basis of material, the garment steamer market is segmented into plastic, ABS, metal, aluminium, stainless steel, cast iron, and ceramic. The plastic segment dominated the market with the largest revenue share in 2025, driven by its lightweight construction, affordability, and ease of maintenance. Plastic steamers are preferred by households due to their portability and safe handling for daily use. Their widespread availability and variety in design and color further attract consumers seeking both functionality and aesthetics. For instance, Rowenta’s plastic-bodied steamers are popular for home use due to their reliability and ergonomic design.

The stainless steel segment is expected to witness the fastest growth from 2026 to 2033, fueled by its durability, corrosion resistance, and premium appeal. Stainless steel construction allows higher heating capacity and prolonged usage, making it suitable for commercial and professional environments. Its robust design, combined with advanced features, drives adoption among buyers seeking long-lasting and high-performance garment care solutions.

- By Price Range

On the basis of price range, the market is segmented into economy/mid-range and premium. The economy/mid-range segment dominated the market with the largest revenue share in 2025, driven by affordability and suitability for everyday household use. Consumers prefer this segment as it balances cost with adequate steaming performance and convenience features. The strong demand is reinforced by increasing awareness of garment care benefits and accessibility of models across retail and e-commerce channels. For instance, Philips and Panasonic offer mid-range steamers that combine performance with budget-friendly pricing, driving significant sales.

The premium segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for high-performance, durable, and feature-rich steamers in commercial and luxury household settings. Premium models often include advanced steam control, rapid heat-up times, and ergonomic designs, appealing to professional users and affluent households. Their long-term reliability and enhanced features drive market expansion in both residential and professional segments.

- By End-User

On the basis of end-user, the market is segmented into households, commercial, and others. The household segment dominated the market with the largest revenue share in 2025, driven by rising consumer focus on garment maintenance, convenience, and time-saving solutions. Homeowners prefer steamers for their ease of use, quick operation, and gentle care for delicate fabrics. Increasing online availability and home appliance awareness further boost adoption. For instance, Conair and Rowenta offer household steamers that combine affordability with reliable performance, reinforcing the segment’s dominance.

The commercial segment is expected to witness the fastest growth from 2026 to 2033, fueled by demand from hotels, laundries, and fashion retailers seeking high-capacity, durable, and efficient steamers. Commercial users require steamers with large water tanks, high power output, and professional-grade features for consistent performance. The adoption is further supported by advanced functionalities such as adjustable steam flow and long-life construction, enhancing productivity and operational efficiency.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct and indirect channels. The indirect segment dominated the market with the largest revenue share in 2025, driven by the widespread presence of retail stores, e-commerce platforms, and distributors providing easy access to diverse product offerings. Consumers prefer indirect channels due to convenience, product comparison, and promotional offers available both online and offline. For instance, Amazon and Walmart offer a variety of garment steamers with home delivery options, driving higher adoption.

The direct segment is expected to witness the fastest growth from 2026 to 2033, fueled by manufacturers’ efforts to engage consumers through online brand stores and exclusive outlets. Direct channels allow better customer engagement, customization options, and competitive pricing, increasing consumer trust and loyalty. Growing digitalization and manufacturer-led marketing campaigns further reinforce the growth of direct sales channels in the garment steamer market.

Garment Steamer Market Regional Analysis

- Europe dominated the garment steamer market with the largest revenue share of 35% in 2025, driven by rising consumer focus on garment care, increasing disposable incomes, and a growing preference for high-quality, energy-efficient home appliances

- Consumers in the region highly value convenience, time-saving solutions, and ergonomic designs offered by modern garment steamers, which are suitable for both household and semi-professional use

- This widespread adoption is further supported by the availability of advanced features such as rapid heating, adjustable steam settings, and large water tanks, establishing garment steamers as a favored solution for residential and commercial applications

Germany Garment Steamer Market Insight

The Germany garment steamer market dominated the European market with the largest share, fueled by increasing awareness of fabric care and demand for technologically advanced, durable, and eco-conscious appliances. German consumers are drawn to energy-efficient steamers with high performance, and the integration of advanced safety features is enhancing adoption. The market growth is supported by the country’s strong retail infrastructure and high penetration of e-commerce platforms, facilitating convenient access to diverse product offerings.

U.K. Garment Steamer Market Insight

The U.K. garment steamer market is projected to grow at a noteworthy CAGR throughout the forecast period, driven by a rising trend toward home grooming and personal care appliances. Consumers increasingly prefer handheld and portable steamers for quick touch-ups and delicate fabric handling. In addition, concerns regarding fabric maintenance, convenience, and efficiency are encouraging both households and small commercial establishments to adopt garment steamers.

North America Garment Steamer Market Insight

The North America garment steamer market is poised for steady growth, driven by increasing awareness of fabric care, urban lifestyles, and high disposable incomes. U.S. consumers in particular are adopting handheld and upright steamers for residential and commercial use, valuing ease of use, quick operation, and multifunctional features. For instance, Philips and Rowenta offer models that cater to both households and small businesses, enhancing market penetration.

U.S. Garment Steamer Market Insight

The U.S. garment steamer market captured the largest revenue share within North America in 2025, fueled by rising consumer demand for convenient and efficient garment care solutions. The adoption of portable and high-capacity steamers is supported by the growing trend of work-from-home setups, travel, and professional cleaning services. Increasing availability through online platforms and retail stores further drives market growth.

Asia-Pacific Garment Steamer Market Insight

The Asia-Pacific garment steamer market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing awareness of personal and professional garment care in countries such as China, Japan, and India. Growing interest in modern household appliances, coupled with government initiatives promoting digitalization and smart home adoption, is boosting demand for both handheld and upright steamers.

China Garment Steamer Market Insight

The China garment steamer market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, increasing urbanization, and strong domestic manufacturing base for home appliances. Consumers are adopting steamers for their convenience, quick wrinkle removal, and suitability for multiple garment types. The availability of affordable options and advanced models from domestic and international brands is further driving adoption.

Japan Garment Steamer Market Insight

The Japan garment steamer market is gaining momentum due to high consumer focus on convenience, precision fabric care, and technologically advanced home appliances. Japanese consumers favor steamers with ergonomic designs, rapid heating, and energy-efficient operation. Rising interest in professional garment maintenance for households and small businesses is contributing to the market’s growth in both residential and commercial sectors.

Garment Steamer Market Share

The garment steamer industry is primarily led by well-established companies, including:

- Candy Hoover Group Srl (Italy)

- Morphy Richards India (India)

- Kenwood Limited (U.K.)

- Robert Bosch GmbH (Germany)

- Pursteam.us (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- Dyson (U.K.)

- Groupe SEB (France)

- Koninklijke Philips N.V. (Netherlands)

- Gryphon Appliances Ltd. (U.K.)

- Whirlpool Corporation (U.S.)

- PARI Robotics Inc. (U.S.)

- Hettich Holding GmbH & Co. (Germany)

- Sulzer Ltd. (Switzerland)

- Shanghai Shininess (China)

- Marel (Iceland)

- ANKO FOOD MACHINE CO., LTD (Taiwan)

- AB Electrolux (Sweden)

- Jiffy (U.S.)

Latest Developments in Global Garment Steamer Market

- In April 2025, Panasonic unveiled the NI‑GWG090GTH Garment Steamer, featuring an innovative expandable hanger adjustable from 43 cm to 83 cm along with a powerful 2400 W output and a wider steam head that delivers high steam intensity for efficient wrinkle removal. This launch is significant as it targets both wide garments and diverse fabric types, enhancing user convenience and performance, thereby strengthening Panasonic’s competitive positioning in the garment care segment and expanding product appeal to households with larger or sensitive clothing items

- In January 2025, LG introduced an upgraded LG Styler® solution with a built‑in handheld high‑pressure steamer, Dual TrueSteam™ technology, and a Dynamic Moving Hanger™ system, offering deeper steam penetration, improved dust removal, and enhanced deodorization. This development advances the market by integrating multifunctional garment care features into a single appliance, driving demand for premium steam‑based solutions that deliver both sanitization and wrinkle reduction in one cycle

- In October 2024, Panasonic launched new handheld garment steamers (NI‑GHF025WSK and NI‑GHD015WSK) with rapid heat‑up, lightweight design, and high steam output that can eliminate 99.99 % of mites and bacteria. The introduction of these models broadens accessibility for everyday consumers seeking quick, hygienic garment care, reinforcing handheld steamers’ role as essential household appliances and expanding the market footprint in emerging and established regions

- In December 2023, Philips introduced the 7000 series handheld steamer (STH7040/80) with a moving steam head, equipped with OptimalTEMP technology, allowing safe use on any ironable fabric without risk of burns. The steamer is designed to last up to 70% longer than standard models and can kill up to 99.99% of bacteria, helping refresh clothes and remove odors. This launch strengthened Philips’ presence in the premium handheld segment, appealing to consumers seeking safety, durability, and hygiene

- In April 2023, Conair launched the Steam & Press with Turbo, featuring a turbo boost function for enhanced steam output, allowing users to tackle tough wrinkles efficiently. The device is compact and easy to use, suitable for home use or travel, and refreshes garments while being gentle on fabrics. This innovation boosted the market by offering a convenient and effective solution for household consumers, enhancing adoption of portable garment care appliances

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.