Global Gas Engine Oil Market

Market Size in USD Billion

CAGR :

%

USD

5.86 Billion

USD

8.53 Billion

2024

2032

USD

5.86 Billion

USD

8.53 Billion

2024

2032

| 2025 –2032 | |

| USD 5.86 Billion | |

| USD 8.53 Billion | |

|

|

|

|

Gas Engine Oil Market Size

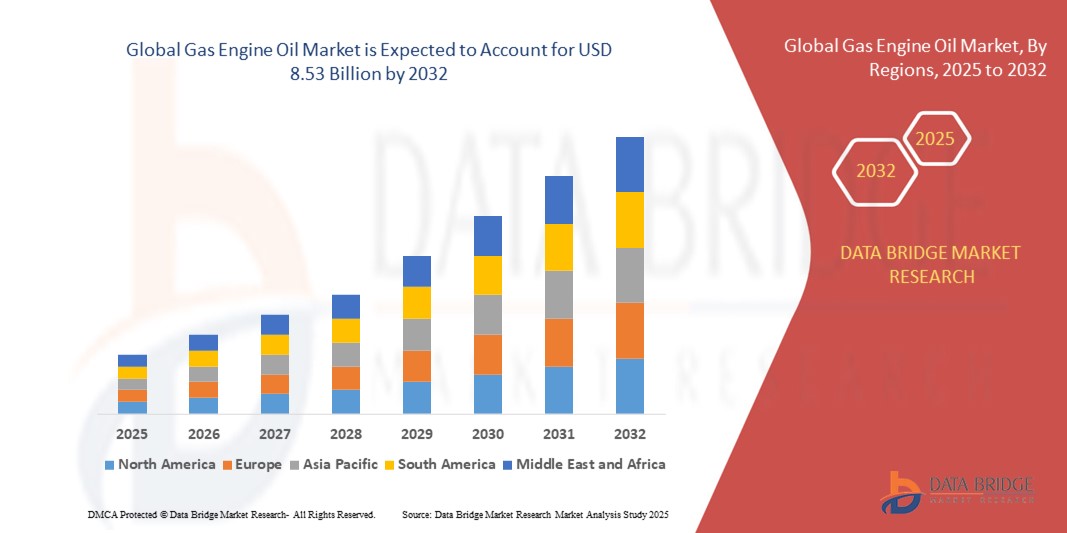

- The global gas engine oil market size was valued at USD 5.86 billion in 2024 and is expected to reach USD 8.53 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of natural gas-based power generation, rising demand for energy efficiency, and the growing emphasis on reducing carbon emissions across industrial and commercial applications

- In addition, the expanding use of gas engines in distributed power generation, combined heat and power (CHP) systems, and renewable energy integration is driving the need for high-performance lubricants that can operate under demanding conditions

Gas Engine Oil Market Analysis

- The global gas engine oil market is witnessing steady growth due to a combination of environmental regulations, advancements in gas engine technology, and the rising shift toward cleaner fuel alternatives

- Gas engine oil plays a critical role in ensuring optimal engine performance, reducing wear and tear, and extending maintenance intervals. Industrial sectors such as manufacturing, utilities, and oil and gas are major consumers, as they increasingly deploy gas engines for both primary and backup power needs

- North America dominated the gas engine oil market with the largest revenue share in 2024, driven by the region’s abundant natural gas resources, well-established energy infrastructure, and growing adoption of distributed power generation systems

- Asia-Pacific region is expected to witness the highest growth rate in the global gas engine oil market, driven by expanding manufacturing activities, rising energy demand, and government initiatives promoting cleaner fuel alternatives

- The synthetic gas engine oils segment dominated the market with the largest revenue share in 2024, driven by their superior thermal stability, oxidation resistance, and extended drain intervals, which make them ideal for high-load and continuous operation applications. Industries with critical power generation needs prefer synthetic variants for their ability to reduce wear and improve efficiency under extreme operating conditions

Report Scope and Gas Engine Oil Market Segmentation

|

Attributes |

Gas Engine Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion in Distributed Power Generation Projects • Rising Adoption of Renewable Energy Integrated Gas Engines |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gas Engine Oil Market Trends

Rising Demand For High-Performance Lubricants In Gas-Fired Power Generation

- The growing reliance on gas-fired power plants as a cleaner alternative to coal is driving the need for specialized high-performance lubricants that can withstand extreme operating conditions. Gas engine oils designed for high-load, high-temperature applications help enhance engine efficiency, reduce wear, and extend maintenance intervals, making them essential for continuous power generation

- The expansion of combined heat and power (CHP) systems in industrial and commercial facilities is further boosting demand for gas engine oils with superior oxidation stability and deposit control. These oils help optimize performance and reduce downtime in systems that operate for extended periods under varying loads

- The shift toward low-emission engines has also increased the requirement for lubricants compatible with advanced after-treatment systems, ensuring regulatory compliance without compromising engine performance. This is prompting manufacturers to innovate formulations with enhanced thermal stability and reduced ash content

- For instance, in 2023, several utilities in Europe upgraded their lubricant supply contracts to premium synthetic gas engine oils to meet stricter emission targets while achieving longer drain intervals, resulting in reduced operational costs and improved efficiency

- While the trend supports engine reliability and efficiency, continuous product innovation and customized lubricant solutions will be key to meeting the diverse demands of modern gas engine applications across different industries and geographies

Gas Engine Oil Market Dynamics

Driver

Increasing Adoption Of Natural Gas Engines In Industrial And Power Generation Applications

• The rising adoption of natural gas engines for distributed power generation and industrial operations is significantly driving lubricant demand. Industries are opting for gas engines due to their lower emissions, cost-effectiveness, and fuel efficiency, creating a steady need for oils that enhance engine life and reliability

• Operators are increasingly aware of the role lubricants play in reducing maintenance costs, improving thermal stability, and preventing component wear, making premium gas engine oils a preferred choice for continuous and heavy-duty operations

• Government incentives promoting the use of cleaner fuels and the installation of gas-based power plants are accelerating the deployment of gas engines, thereby increasing the market potential for high-quality lubricants

• For instance, in 2022, several Asia-Pacific countries announced subsidies for gas-based distributed energy projects, resulting in a surge in lubricant demand for newly installed engines

• While adoption is expanding, lubricant suppliers must align product offerings with region-specific engine technologies, emission regulations, and operational conditions to sustain growth in this competitive market

Restraint/Challenge

High Cost Of Premium Synthetic Lubricants And Limited Awareness In Emerging Markets

• The high cost of advanced synthetic gas engine oils compared to conventional lubricants is a barrier for cost-sensitive end-users, particularly in developing economies where operational budgets are limited. This restricts the shift toward premium formulations despite their performance benefits

• Limited awareness among operators about the long-term cost savings and efficiency improvements offered by high-quality lubricants further hampers adoption, leading many to continue using lower-grade oils with shorter service life

• Supply chain constraints in remote industrial regions can also delay access to specialized lubricants, forcing operators to rely on locally available but less suitable alternatives, potentially impacting engine performance and longevity

• For instance, in 2023, several small-scale power producers in parts of Africa and South Asia reported reliance on standard automotive oils for gas engines due to availability and pricing issues, resulting in higher maintenance frequency

• Addressing these challenges will require targeted awareness campaigns, cost-effective product variants, and stronger distribution networks to ensure consistent supply and adoption in underserved markets

Gas Engine Oil Market Scope

The market is segmented on the basis of product type, grade, additive percentage, and end-use industry.

- By Product Type

On the basis of product type, the gas engine oil market is segmented into conventional gas engine oils, synthetic gas engine oils, and semi-synthetic gas engine oils. The synthetic gas engine oils segment dominated the market with the largest revenue share in 2024, driven by their superior thermal stability, oxidation resistance, and extended drain intervals, which make them ideal for high-load and continuous operation applications. Industries with critical power generation needs prefer synthetic variants for their ability to reduce wear and improve efficiency under extreme operating conditions.

The semi-synthetic gas engine oils segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their balanced performance and cost-effectiveness. These oils combine the durability of synthetic formulations with the affordability of conventional oils, making them attractive for mid-range applications in both industrial and automotive sectors.

- By Grade

On the basis of grade, the gas engine oil market is segmented into monograde oils and multigrade oils. The multigrade oils segment held the largest market revenue share in 2024, owing to their versatility and ability to perform effectively across a wide temperature range. This makes them particularly suitable for regions experiencing seasonal temperature variations and applications requiring operational flexibility.

The monograde oils segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their cost advantages and suitability for engines operating in stable temperature environments, particularly in dedicated industrial or marine applications where conditions are consistent.

- By Additive Percentage

On the basis of additive percentage, the gas engine oil market is segmented into less than 0.10%, 0.10–0.50%, 0.50–1.00%, and more than 1%. The 0.10–0.50% segment accounted for the largest share in 2024, supported by its optimal balance between performance enhancement and compliance with emission standards. Oils in this range effectively reduce wear, control deposits, and maintain engine cleanliness without excessive ash content.

The more than 1% segment is expected to witness the fastest growth rate from 2025 to 2032, driven by heavy-duty industrial applications that demand enhanced protection, higher detergent levels, and superior load-carrying capabilities for extended engine life in high-stress conditions.

- By End-Use Industry

On the basis of end-use industry, the gas engine oil market is segmented into power generation, automotive, industrial, marine, and others. The power generation segment dominated the market in 2024, owing to the increasing global reliance on natural gas-fired plants and combined heat and power (CHP) systems. Gas engine oils are essential in ensuring uninterrupted operation and efficiency in these critical installations.

The automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the expanding adoption of gas-powered vehicles in select markets and the rising demand for low-emission, fuel-efficient engine solutions.

Gas Engine Oil Market Regional Analysis

• North America dominated the gas engine oil market with the largest revenue share in 2024, driven by the region’s abundant natural gas resources, well-established energy infrastructure, and growing adoption of distributed power generation systems.

• The demand is further supported by the replacement of aging coal plants with cleaner natural gas alternatives, increased investment in combined heat and power (CHP) projects, and the widespread use of gas engines in industrial, utility, and commercial applications.

• High awareness of the benefits of premium lubricants, coupled with the presence of leading lubricant manufacturers and robust distribution networks, reinforces North America’s leading position in the global market.

U.S. Gas Engine Oil Market Insight

The U.S. gas engine oil market captured the largest revenue share within North America in 2024, propelled by its large-scale deployment of gas-fired power plants, industrial facilities, and decentralized energy systems. Abundant shale gas production, supportive regulatory policies, and the need for reliable, efficient power generation are accelerating lubricant demand. The increasing adoption of synthetic and semi-synthetic oils for extended service life, improved oxidation stability, and reduced maintenance downtime is further driving market growth. In addition, strong domestic manufacturing and research capabilities allow for continuous innovation in lubricant formulations tailored to advanced gas engine technologies.

Europe Gas Engine Oil Market Insight

The Europe gas engine oil market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent emission regulations, the ongoing transition from coal to natural gas, and the expansion of renewable energy-integrated power systems. The region’s emphasis on sustainability and operational efficiency is boosting the adoption of high-performance synthetic lubricants capable of meeting both environmental and operational requirements. Growth is particularly notable in combined heat and power (CHP) plants, district heating networks, and biogas-based power generation.

Germany Gas Engine Oil Market Insight

The Germany gas engine oil market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s energy transition policies, strong industrial sector, and increasing use of biogas-powered engines. The demand for lubricants with high oxidation resistance, low ash content, and compatibility with variable fuel qualities is on the rise. Manufacturers are focusing on bio-gas compatible formulations and offering extended-drain products to meet the evolving needs of CHP plants and municipal energy projects.

U.K. Gas Engine Oil Market Insight

The U.K. gas engine oil market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s commitment to reducing carbon emissions and its transition toward cleaner energy sources. The increasing installation of gas-fired power plants, combined heat and power (CHP) systems, and biogas facilities is creating consistent demand for high-performance lubricants. The U.K.’s focus on operational efficiency, coupled with strict environmental compliance requirements, is encouraging the adoption of synthetic and semi-synthetic oils that offer extended drain intervals, superior oxidation stability, and reduced deposit formation. In addition, the growing role of decentralized energy projects in supporting grid stability is further boosting lubricant consumption across industrial, utility, and commercial applications.

Asia-Pacific Gas Engine Oil Market Insight

The Asia-Pacific gas engine oil market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and rising electricity demand in countries such as China, India, and Japan. Government initiatives promoting clean energy adoption and the establishment of gas-based power plants are creating substantial opportunities for lubricant suppliers. The availability of competitively priced natural gas and the region’s emerging role as a manufacturing hub for gas engines and related components further support market expansion.

China Gas Engine Oil Market Insight

The China gas engine oil market held the largest revenue share in Asia-Pacific in 2024, driven by extensive investments in natural gas infrastructure, a growing industrial base, and the rapid shift toward cleaner energy sources. The country’s strong manufacturing capabilities, combined with domestic lubricant production and innovation, are meeting the needs of large-scale gas-fired power projects and industrial facilities. In addition, the expansion of smart city initiatives and distributed energy projects is fueling demand for high-quality lubricants optimized for efficiency and longevity.

Japan Gas Engine Oil Market Insight

The Japan gas engine oil market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on energy efficiency, reliable power supply, and stringent environmental regulations. The integration of CHP systems and hybrid renewable-gas energy setups is increasing demand for synthetic lubricants with superior thermal stability and low maintenance requirements. Japan’s mature infrastructure and high-tech orientation also drive the adoption of advanced formulations compatible with modern engine designs.

Gas Engine Oil Market Share

The Gas Engine Oil industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- Shell plc (U.K.)

- Chevron Corporation (U.S.)

- TotalEnergies (France)

- BP p.l.c. (U.K.)

- Fuchs Petrolub SE (Germany)

- Valvoline Inc. (U.S.)

- PetroChina Company Limited (China)

- LUKOIL (Russia)

- Idemitsu Kosan Co., Ltd. (Japan)

- Indian Oil Corporation Ltd (India)

- SK Enmove Co., Ltd. (South Korea)

Latest Developments in Global Gas Engine Oil Market

- In August 2022, ExxonMobil Lubricants Pvt Ltd entered into a strategic partnership with Think Gas Distribution Pvt Ltd to expand the availability of its specialized compressed natural gas (CNG) engine oils for both passenger and commercial vehicles. Under this collaboration, Mobil’s advanced gas engine oil range will be distributed through Think Gas’s owned and operated stations across multiple states in India. This development is expected to enhance product accessibility for CNG vehicle owners, improve engine performance through high-quality lubrication solutions, and support the growing adoption of cleaner fuel technologies. The initiative also strengthens ExxonMobil’s presence in India’s alternative fuel lubricant segment, contributing to market growth in line with the country’s clean energy transition goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gas Engine Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gas Engine Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gas Engine Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.