Global Gas Equipment Market

Market Size in USD Billion

CAGR :

%

USD

82.47 Billion

USD

132.24 Billion

2025

2033

USD

82.47 Billion

USD

132.24 Billion

2025

2033

| 2026 –2033 | |

| USD 82.47 Billion | |

| USD 132.24 Billion | |

|

|

|

|

Gas Equipment Market Size

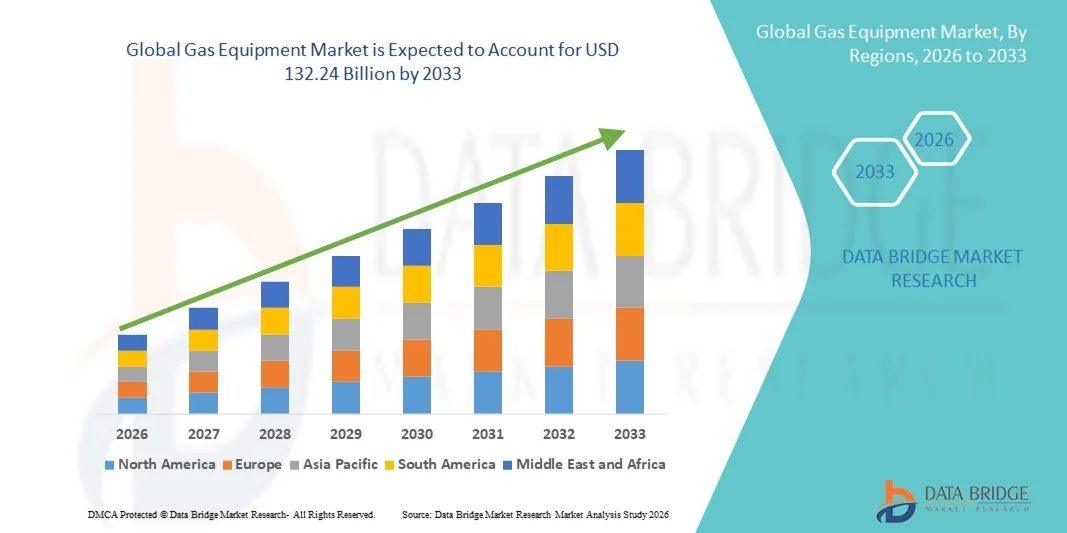

- The global gas equipment market size was valued at USD 82.47 billion in 2025 and is expected to reach USD 132.24 billion by 2033, at a CAGR of 6.08% during the forecast period

- The market growth is largely driven by the increasing demand for industrial gases across key sectors such as energy, healthcare, and manufacturing, coupled with advancements in gas storage, transportation, and detection technologies

- Furthermore, stringent safety regulations and the rising need for reliable and efficient gas handling solutions in both industrial and commercial applications are encouraging the adoption of advanced gas equipment. These combined factors are accelerating the deployment of innovative gas solutions, thereby substantially propelling the market's growth

Gas Equipment Market Analysis

- Gas equipment, including gas delivery systems, regulators, flow devices, and detection systems, is increasingly critical for industrial, medical, and commercial applications due to its role in ensuring safe, efficient, and reliable handling of various gases

- The rising demand for gas equipment is primarily driven by the expanding use of industrial gases in manufacturing, healthcare, energy, and chemical processing, coupled with stringent safety regulations and the need for precise gas monitoring and control

- North America dominated the gas equipment market with the largest revenue share of 39.8% in 2025, supported by advanced industrial infrastructure, strict safety standards, and a strong presence of key manufacturers, with the U.S. witnessing significant adoption of advanced gas delivery and detection systems across industries

- Asia-Pacific is expected to be the fastest growing region in the gas equipment market during the forecast period due to rapid industrialization, growing energy demand, and increasing investments in chemical, healthcare, and semiconductor sectors

- Gas delivery systems segment dominated the gas equipment market with a market share of 42.8% in 2025, driven by their essential role in the safe and efficient storage, distribution, and transport of industrial and specialty gases

Report Scope and Gas Equipment Market Segmentation

|

Attributes |

Gas Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Gas Equipment Market Trends

Advanced Automation and IoT-Enabled Gas Systems

- A significant and accelerating trend in the global gas equipment market is the integration of IoT and automation technologies into gas storage, delivery, and detection systems, enabling real-time monitoring, predictive maintenance, and improved operational efficiency

- For instance, modern gas regulators and flow devices equipped with IoT sensors can provide continuous pressure, flow, and leakage data to centralized control systems, allowing operators to detect anomalies early and prevent disruptions

- Smart gas detection systems now utilize AI algorithms to predict potential gas leaks and optimize safety protocols, while cloud-based platforms allow centralized tracking and automated alerts for industrial, healthcare, and commercial applications

- The integration of gas equipment with industrial IoT platforms enables seamless management of multiple devices, improving process reliability, safety compliance, and overall efficiency across large-scale operations

- This trend towards more intelligent, connected, and automated gas solutions is driving innovation, with companies such as Air Products developing IoT-enabled monitoring systems that integrate with industrial control networks for proactive safety management

- The demand for advanced, automated, and IoT-enabled gas equipment is growing rapidly across industrial, healthcare, and energy sectors, as organizations increasingly prioritize operational efficiency, safety, and predictive maintenance

Gas Equipment Market Dynamics

Driver

Increasing Industrial Gas Demand and Stringent Safety Regulations

- The rising consumption of industrial gases across sectors such as healthcare, chemicals, metal fabrication, and energy, combined with strict safety standards, is a significant driver of demand for advanced gas equipment

- For instance, in March 2025, Linde plc launched next-generation gas detection and delivery solutions for healthcare and industrial facilities, focusing on compliance with global safety regulations

- As industries expand and production volumes increase, reliable and precise gas delivery and monitoring systems are essential to ensure operational efficiency, safety, and regulatory compliance

- Furthermore, the growing emphasis on reducing workplace hazards and environmental risks is pushing organizations to adopt advanced gas storage, purification, and detection solutions to meet compliance requirements

- Technological innovations that enhance monitoring, control, and safety, coupled with increasing awareness of occupational safety standards, are driving widespread adoption of modern gas equipment across diverse end-use sectors

- Expansion of industrial infrastructure in emerging economies is boosting demand for gas equipment for manufacturing, energy, and healthcare applications, creating significant growth opportunities

- Rising investment in automation and smart manufacturing technologies is encouraging integration of intelligent gas equipment into broader industrial IoT frameworks, driving operational efficiency and safety compliance

Restraint/Challenge

High Capital Costs and Technical Complexity

- The high initial investment required for advanced gas equipment, including automated delivery systems, purifiers, and detection solutions, poses a challenge for smaller enterprises and price-sensitive end-users

- For instance, sophisticated IoT-enabled gas monitoring systems with integrated safety protocols can cost significantly more than conventional equipment, limiting adoption in cost-constrained industrial setups

- In addition, the technical complexity involved in installing, operating, and maintaining advanced gas equipment can hinder deployment, particularly in regions with limited skilled workforce or technical support infrastructure

- The need for regular calibration, compliance checks, and adherence to international safety standards adds operational overhead and increases the total cost of ownership, making adoption slower in some markets

- Overcoming these challenges through modular, user-friendly equipment designs, financing options, and technical training programs is essential for broader market penetration and sustained growth

- Limited standardization across different types of gas equipment and regional safety norms can create integration challenges and slow adoption in multinational operations

- Supply chain disruptions and raw material price volatility can increase production costs and lead to delayed deployments, posing additional challenges to market expansion

Gas Equipment Market Scope

The market is segmented on the basis of equipment type, process, gas type, and end-user.

- By Equipment Type

On the basis of equipment type, the gas equipment market is segmented into gas delivery systems, gas regulators, flow devices, purifiers and filters, gas generating systems, gas detection systems, cryogenic products, and accessories. The gas delivery systems segment dominated the market with the largest market revenue share of 42.8% in 2025, driven by their essential role in safe storage, controlled distribution, and efficient transport of industrial and specialty gases. Industries such as healthcare, chemicals, and metal fabrication prioritize gas delivery systems due to their reliability and regulatory compliance. In addition, advancements in automation and IoT-enabled monitoring in gas delivery systems enhance safety, efficiency, and predictive maintenance, further driving adoption. Their widespread compatibility with various gas types and operational scalability also strengthens their market dominance.

The gas detection systems segment is anticipated to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by increasing industrial safety regulations, awareness of occupational hazards, and the growing adoption of smart monitoring technologies. Gas detection systems provide real-time alerts, leak detection, and integration with centralized safety platforms, making them critical for hazardous and high-value operations. The rising demand for workplace safety in industries such as oil and gas, healthcare, and semiconductor manufacturing is accelerating the uptake of advanced gas detection solutions. Furthermore, technological innovations such as AI-enabled predictive analytics and wireless connectivity are driving market expansion.

- By Process

On the basis of process, the gas equipment market is segmented into gas generation, gas storage, gas detection, and gas transportation. The gas storage segment dominated the market with the largest revenue share in 2025 due to the critical need for safe, reliable storage solutions for industrial and specialty gases. Advanced storage systems ensure controlled pressure, purity maintenance, and compliance with safety standards, making them indispensable for healthcare, chemical, and metal fabrication industries. Companies are increasingly integrating automated monitoring and leak prevention technologies to enhance operational safety and efficiency. The segment’s growth is further supported by the rising global demand for industrial gases and expanding industrial infrastructure.

The gas generation segment is expected to witness the fastest growth during the forecast period, driven by the increasing adoption of on-site gas production technologies for nitrogen, oxygen, and hydrogen. On-site gas generation reduces dependency on cylinder deliveries, lowers operational costs, and ensures a consistent supply for critical industrial processes. Growing applications in healthcare, electronics manufacturing, and renewable energy sectors are propelling the adoption of gas generating systems. Technological advancements, including energy-efficient generation and modular designs, further support rapid market growth.

- By Gas Type

On the basis of gas type, the market is segmented into nitrogen, hydrogen, helium, oxygen, carbon dioxide, and others. The nitrogen segment dominated the market with the largest share in 2025 due to its extensive use across multiple industries such as chemical processing, metal fabrication, and food packaging. Nitrogen is valued for its inert properties and is critical for applications such as blanketing, purging, and cooling. The dominance is reinforced by well-established supply chains, storage infrastructure, and widespread industrial usage. Advanced nitrogen supply systems integrated with smart monitoring also enhance safety and operational efficiency.

The hydrogen segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its rising adoption in clean energy, fuel cells, and industrial applications. Governments’ push toward renewable energy and low-carbon solutions is accelerating demand for hydrogen production, storage, and handling equipment. Technological innovations in high-purity hydrogen generation, storage, and safety systems are attracting investments and supporting market expansion. Hydrogen’s critical role in decarbonization strategies further positions it as a high-growth segment.

- By End-User

On the basis of end-user, the gas equipment market is segmented into metal fabrication, chemicals, healthcare, oil and gas, food and beverage, and others. The chemicals segment dominated the market with the largest revenue share in 2025 due to the essential use of industrial gases in chemical synthesis, processing, and storage. Chemical manufacturers require precise, safe, and reliable gas handling solutions for large-scale operations, driving adoption of advanced gas delivery, purification, and monitoring systems. Regulatory compliance and operational safety remain key drivers in this segment.

The healthcare segment is expected to witness the fastest growth during the forecast period, fueled by increasing demand for medical gases, oxygen therapy, anesthesia applications, and diagnostic equipment. Hospitals and clinics are investing in sophisticated gas equipment such as generators, regulators, and detection systems to ensure patient safety and uninterrupted supply. Technological integration, including IoT-enabled monitoring and automated control, enhances operational efficiency and safety, supporting rapid adoption in healthcare facilities worldwide.

Gas Equipment Market Regional Analysis

- North America dominated the gas equipment market with the largest revenue share of 39.8% in 2025, supported by advanced industrial infrastructure, strict safety standards, and a strong presence of key manufacturers, with the U.S. witnessing significant adoption of advanced gas delivery and detection systems across industries

- Industries in the region, including healthcare, chemicals, metal fabrication, and energy, prioritize reliable, precise, and safe gas storage, delivery, and detection systems, fueling widespread adoption of advanced gas equipment

- This dominance is further supported by strong R&D capabilities, well-established supply chains, and the presence of leading gas equipment manufacturers, enabling rapid deployment of innovative solutions for both industrial and commercial applications

U.S. Gas Equipment Market Insight

The U.S. gas equipment market captured the largest revenue share of 79% in 2025 within North America, driven by the high adoption of advanced industrial infrastructure and strict safety regulations. Industries such as healthcare, chemicals, metal fabrication, and energy are increasingly prioritizing reliable, automated, and IoT-enabled gas storage, delivery, and detection systems. The growing focus on operational efficiency, workplace safety, and regulatory compliance is further propelling market expansion. In addition, technological innovations in smart gas monitoring and control systems are supporting adoption across both industrial and commercial applications.

Europe Gas Equipment Market Insight

The Europe gas equipment market is projected to grow at a significant CAGR throughout the forecast period, primarily driven by stringent industrial safety standards and increasing demand for advanced gas solutions in healthcare, chemical, and manufacturing sectors. Rising urbanization and the shift towards automated industrial processes are fostering the adoption of gas delivery, detection, and purification systems. European companies are also emphasizing energy efficiency, safety, and compliance, encouraging widespread deployment across residential, commercial, and industrial facilities.

U.K. Gas Equipment Market Insight

The U.K. gas equipment market is expected to expand at a notable CAGR during the forecast period, driven by the rising trend of industrial automation and the need for precise and safe gas handling. Healthcare facilities, chemical plants, and metal fabrication units are increasingly adopting advanced gas regulators, storage systems, and detection solutions. In addition, stringent local safety regulations, growing awareness of operational hazards, and a robust industrial infrastructure are supporting market growth in the country.

Germany Gas Equipment Market Insight

The Germany gas equipment market is anticipated to grow at a considerable CAGR, fueled by the country’s focus on industrial safety, technological innovation, and energy-efficient solutions. The demand for automated gas delivery systems, purifiers, and detection equipment is rising in chemical, healthcare, and manufacturing sectors. Germany’s well-developed infrastructure, emphasis on compliance, and preference for advanced, environmentally conscious technologies are promoting widespread adoption of modern gas equipment solutions.

Asia-Pacific Gas Equipment Market Insight

The Asia-Pacific gas equipment market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by rapid industrialization, increasing energy demand, and rising adoption of advanced gas technologies in countries such as China, Japan, and India. Expanding manufacturing facilities, healthcare infrastructure, and chemical industries are accelerating the deployment of gas storage, delivery, and detection systems. Government initiatives promoting industrial automation, workplace safety, and smart manufacturing are further boosting market growth across the region.

Japan Gas Equipment Market Insight

The Japan gas equipment market is gaining traction due to the country’s high-tech industrial environment, focus on operational safety, and adoption of automated manufacturing and healthcare solutions. The market is driven by the growing use of advanced gas detection systems, purifiers, and delivery equipment across hospitals, chemical plants, and manufacturing facilities. Integration of smart monitoring and IoT-enabled solutions is enhancing efficiency, reliability, and safety, contributing to rapid market growth in both industrial and commercial sectors.

India Gas Equipment Market Insight

The India gas equipment market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding industrial base, rapid urbanization, and increasing adoption of modern gas technologies. The healthcare, chemical, and metal fabrication industries are driving demand for gas storage, delivery, purification, and detection systems. Government initiatives supporting industrial safety, smart manufacturing, and energy-efficient operations, alongside the presence of domestic manufacturers, are key factors propelling market growth in India.

Gas Equipment Market Share

The Gas Equipment industry is primarily led by well-established companies, including:

- Rexarc International, Inc. (U.S.)

- Hannay Reels Inc. (U.S.)

- Filtration Group (U.S.)

- Donaldson Company, Inc. (U.S.)

- Messer SE & Co. KGaA (Germany)

- Colfax Corporation (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- John Wood Group PLC (U.K.)

- Air Liquide (France)

- GCE Group (Sweden)

- Camfil (Sweden)

- Linde plc (Ireland)

- Johnson Thermal Systems (U.S.)

- Aerzen (Germany)

- ENOTEC GmbH (Germany)

- Freudenberg Filtration Technologies SE & Co. KG (Germany)

- Universal Industrial Gases, Inc. (U.S.)

- Gas Equipment Inc. (U.S.)

- Bry-Air (India)

- MATHESON TRI-GAS, INC. (U.S.)

What are the Recent Developments in Global Gas Equipment Market?

- In June 2025, Teledyne GFD launched the PS DUO portable dual‑gas detector, which can simultaneously sense two gases (e.g., CO + H₂S, H₂ + O₂) using passive diffusion, and alerts via bright LED, vibration, and sound. The device is rugged (IP67), lightweight, and designed for industrial safety applications; its flexibility to choose gas pairings makes it ideal for diverse hazardous environments

- In June 2025, Teledyne GFD partnered with Industrial Detection Solutions (IDS) to localize sensor manufacturing in Saudi Arabia. A 699 m² plant was established in Dammam to produce high‑precision gas sensors (toxic and combustible) such as the DM‑700, FP‑700, and IR‑700. This move aligns with Saudi Arabia’s IKTVA programme to boost local value-add, reduce lead times, and strengthen regional safety infrastructure

- In May 2025, Honeywell introduced a new Hydrogen Leak Detector (HLD) sensor based on Thermal Conductivity Detection (TCD) technology. This sensor can detect hydrogen leaks as low as 50 ppm in real time, with a fast response time (< 2 seconds), and is designed to operate for up to 10 years without recalibration a big advantage for hydrogen-powered systems

- In May 2025, BWR Innovations’ Oncore Energy system was recognized as an early adopter of Honeywell’s HLD sensor. Their hydrogen fuel-cell generator integrates the HLD sensor to continuously monitor for leaks, reinforcing operational safety. This adoption signals growing commercial use of hydrogen safety technology in practical deployments

- In September 2022, Dräger launched its X-am 2800 connected multi‑gas detector, capable of measuring up to four gases simultaneously. The device features Bluetooth connectivity that streams real-time readings and alerts to Dräger’s Gas Detection Connect cloud platform, enabling remote monitoring and fleet management. Its rugged construction (drop-tested >2 m, IP68) and modular sensor options make it suitable for diverse industries, including emergency services and confined space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.