Global Gas Phase Filtration Market

Market Size in USD Billion

CAGR :

%

USD

2.19 Billion

USD

3.20 Billion

2024

2032

USD

2.19 Billion

USD

3.20 Billion

2024

2032

| 2025 –2032 | |

| USD 2.19 Billion | |

| USD 3.20 Billion | |

|

|

|

|

Gas Phase Filtration Market Size

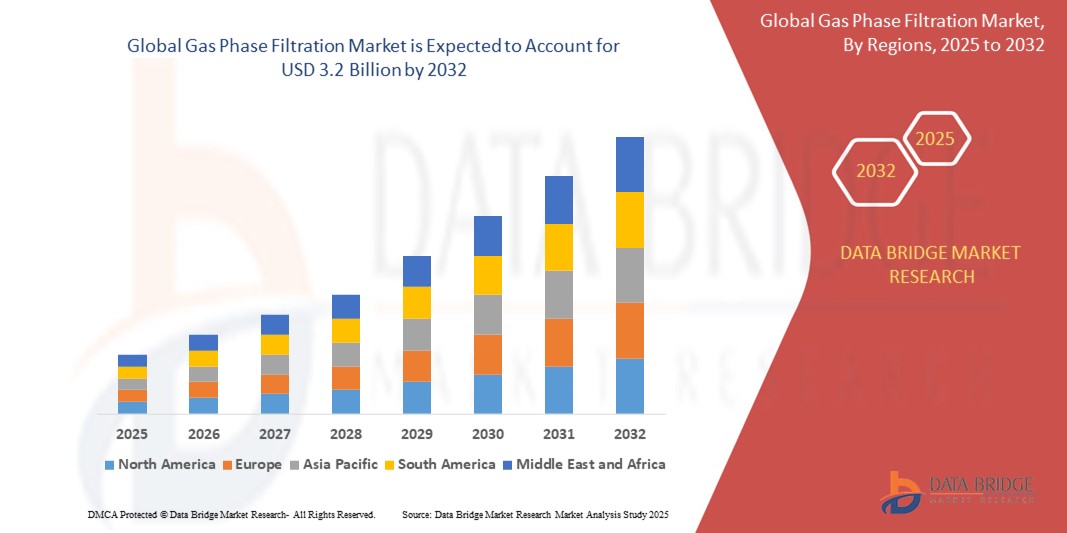

- The Global Gas Phase Filtration Market size was valued at USD 2.19 billion in 2024 and is expected to reach USD 3.2 billion by 2032, at a CAGR of 4.55% during the forecast period

- The rise in awareness regarding the impact of poor indoor and outdoor air quality on human health is escalating the growth of gas phase filtration market.

- The U.S.ge gas phase filtration using specialized filter media and chemical substrate to remove gaseous pollutants from the air, and high utilization of the filtration system in various industries including chemical, oil and gas, wastewater and sewage treatment for effective clean indoor air of chemicals, odors and other intangible materials are the major factors driving the gas phase filtration market.

Gas Phase Filtration Market Analysis

- Gas phase filtration refers to a method of purifying the air present in the surroundings of the filter. Filter media are known to be installed inside these filters which are made up of activated carbon or sodium permanganates and are considered as the most widely accepted filters among consumers.

- The implementation of stringent environment regulations, the adoption of the system by business and commercial environments such as computer clean rooms, data centers, museums and libraries and rise in the acceptance of these filters as air quality checks in various industries accelerate the gas phase filtration market growth.

- North America is expected to hold a 35% market share in 2024, driven by stringent air quality standards, strong demand from data centers, and widespread use in semiconductor and healthcare sectors.

- Asia-Pacific is the fastest-growing region with a CAGR of 7.2% through 2032, fueled by rapid industrialization, stringent air quality norms, and urbanization in countries like China, India, and Southeast Asia, with market share projected to reach 32%.

- In 2025, the gas phase filtration market is segmented into packed bed and combination. Packed Bed filters dominate the gas phase filtration market with over 60% market share due to their widespread use in industrial facilities, chemical processing, and wastewater treatment for effectively removing high concentrations of gaseous contaminants.

Report Scope and Gas Phase Filtration Market Segmentation

|

Attributes |

Gas Phase Filtration Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gas Phase Filtration Market Trends

“Emphasis on Energy-Efficient and Sustainable Filtration Solutions”

- A prominent trend in the Global Gas Phase Filtration Market is the shift toward energy-efficient and environmentally sustainable filtration technologies across commercial, industrial, and institutional sectors.

- Manufacturers are developing filters that reduce pressure drop and extend service life, minimizing energy consumption and maintenance frequency.

For Instance,

- Advanced activated carbon filters with optimized pore structure enhance adsorption efficiency while lowering HVAC energy usage.

- The drive is strongly influenced by stricter indoor air quality (IAQ) regulations and green building certifications (e.g., LEED, WELL).

- Custom solutions for specific contaminant removal—like VOCs, sulfur compounds, and ammonia—are gaining traction in semiconductor, food processing, and wastewater treatment industries.

Gas Phase Filtration Market Dynamics

Driver

“Stringent Indoor Air Quality Regulations and Occupational Safety Standards”

- Growing global awareness of air pollution and its health impacts is driving demand for advanced gas phase filtration in commercial buildings, hospitals, laboratories, and cleanrooms.

- Filtration systems play a vital role in removing harmful gases such as ozone, VOCs, and sulfur compounds, meeting IAQ standards and protecting worker health.

For instance,

- Facilities in sectors like semiconductor manufacturing and pharmaceuticals require precise contaminant control to maintain product integrity and workplace safety.

- Regulations like ASHRAE 62.1 and ISO 10121 are spurring upgrades in HVAC filtration systems, especially in North America and Europe.

- Urbanization and increased construction of high-occupancy buildings in Asia-Pacific further support market growth for high-efficiency gas phase filters.

- Government-led green building initiatives and energy efficiency incentives are accelerating adoption in both new and retrofitted infrastructure projects.

Restraint/Challenge

“High Initial Costs and Limited Awareness in Developing Economies”

- Despite long-term savings and performance benefits, the upfront cost of advanced gas phase filtration systems can be a deterrent—particularly in price-sensitive markets.

- Limited awareness of the technology’s role in mitigating gaseous pollutants and improving IAQ restricts adoption outside of regulated industries.

For instance,

- Many small- to mid-sized facilities in Latin America and Southeast Asia still rely on basic particulate filters due to budget constraints and knowledge gaps.

- Training gaps and lack of standardized implementation practices also hinder broader market penetration.

- While cost reductions and education efforts are underway, adoption in emerging regions remains slow compared to industrialized economies.

- Industry players are addressing this through bundled HVAC solutions, localized distribution, and end-user education campaigns.

Gas Phase Filtration Market Scope

The market is segmented on the basis of type, filter, application and end-user.

- By type

On the basis of type, the gas phase filtration market is segmented into packed bed and combination. Packed Bed filters dominate the gas phase filtration market with over 60% market share in 2025 due to their widespread use in industrial facilities, chemical processing, and wastewater treatment for effectively removing high concentrations of gaseous contaminants.

Combination Filters are the fastest-growing segment, projected to expand at a CAGR of 9.2% from 2025 to 2032, driven by demand for integrated particulate and gas filtration in cleanrooms, commercial buildings, and high-tech manufacturing environments.

- By filter

On the basis of filter, the gas phase filtration market is segmented into granular activated carbon, potassium permanganate, impregnated activated carbon and blend. Granular Activated Carbon dominates with the largest market share in 2024 due to its high adsorption efficiency, cost-effectiveness, and widespread use across industrial and commercial settings for removing VOCs, odors, and harmful gases.

Impregnated Activated Carbon is the fastest-growing segment, expected to grow at a CAGR of 9.4%, driven by demand for targeted removal of specific contaminants like sulfur compounds and ammonia in sensitive environments such as cleanrooms and semiconductor facilities.

- By application

On the basis of application, the gas phase filtration market is segmented into corrosion and toxic gas control and odor control. Corrosion and Toxic Gas Control leads the market owing to its critical role in protecting sensitive electronics, control rooms, and industrial equipment from corrosive gases in industries like oil & gas, data centers, and wastewater treatment.

Odor Control is the fastest-growing segment, expanding rapidly due to rising environmental concerns, urban waste management needs, and increased adoption in hospitality and commercial buildings, particularly in densely populated urban regions.

- By end-user

On the basis of end-user, the gas phase filtration market is segmented into pulp and paper, chemicals and petrochemicals, metals and mining, food and beverages, hospitality, healthcare, utilities, semiconductor manufacturing, water and wastewater and others. Semiconductor Manufacturing is the leading end-user segment due to its stringent air purity requirements and heavy reliance on advanced gas phase filtration systems to prevent contamination during fabrication processes, contributing the highest revenue share in 2024.

Healthcare is the fastest-growing segment with a projected CAGR of 10.1%, fueled by increasing investments in hospital infrastructure, infection control measures, and regulatory focus on maintaining sterile environments in ICUs, labs, and surgical areas.

Gas Phase Filtration Market Regional Analysis

- North America is expected to hold a 35% market share in 2024, driven by stringent air quality standards, strong demand from data centers, and widespread use in semiconductor and healthcare sectors.

- Regulatory frameworks like ASHRAE and EPA guidelines promote the adoption of energy-efficient and high-performance filtration systems.

- Government-backed R&D, along with industry-academia partnerships, accelerates innovation in gas adsorption materials and filter designs for critical environments including laboratories, pharmaceuticals, and high-tech manufacturing.

U.S. Gas Phase Filtration Market Insight

The U.S. leads with a 22.3% share in 2025, driven by stringent IAQ standards and widespread use in data centers, healthcare, and semiconductor sectors. Continued innovation in adsorbent media and HVAC integration reinforces its dominance in the North American market.

Canada Gas Phase Filtration Market Insight

Canada's market is growing due to increased adoption in hospitals, green buildings, and public infrastructure. Government initiatives promoting energy efficiency and clean air technologies support demand for advanced, eco-friendly gas phase filtration systems.

Europe Gas Phase Filtration Market Insight

Europe represents 27.9% of the global market in 2024, supported by strong regulatory mandates on VOCs and gaseous emissions. Industries like pharmaceuticals, food processing, and electronics fuel adoption of multi-stage, high-efficiency filtration systems.

U.K. Gas Phase Filtration Market Insight

The U.K. sees growth from increased focus on indoor air quality in healthcare, public transport, and commercial spaces. Demand for compact, high-capacity filters and hybrid systems is expanding in urban infrastructure and retrofitting projects.

Germany Gas Phase Filtration Market Insight

Germany drives European growth with major demand in automotive, cleanrooms, and industrial processing. Emphasis on precision manufacturing and environmental compliance propels investments in custom gas filtration technologies.

Asia Pacific Gas Phase Filtration Market Insight

Asia-Pacific is the fastest-growing region with a CAGR of 7.2% through 2032, fueled by rapid industrialization, stringent air quality norms, and urbanization in countries like China, India, and Southeast Asia, with market share projected to reach 32%.

China Gas Phase Filtration Market Insight

China holds a 21.1% share in 2025, driven by government policies supporting clean manufacturing, growing electronics and EV production, and adoption of high-efficiency filters in industrial and residential HVAC systems.

Gas Phase Filtration Market Share

The Sol-Gel Coatings industry is primarily led by well-established companies, including:

- Camfil (Sweden)

- American Air Filter Company Inc. (AAF International) (U.S.)

- Donaldson Company Inc. (U.S.)

- Freudenberg & Co. KG (Germany)

- CLARCOR Industrial Air (U.S.)

- Bry-Air Inc. (U.S.)

- PURAFIL INC. (U.S.)

- Circul-aire Inc. (Canada)

- KCWW (Kimberly-Clark Worldwide Inc.) (U.S.)

- ProMark Associates Inc. (U.S.)

- Tri-Dim Filter Corporation (U.S.)

- Koch Filter (U.S.)

- Filtration Group Corporation (U.S.)

- North American Filter Corporation (U.S.)

- Cosmos Air Purification (India)

- Troy Filters Ltd. (U.S.)

- Spectrum Filtration Pvt. Ltd. (India)

- Pure Air Filtration LLC (U.S.)

- MayAir Group (Malaysia)

Latest Developments in Global Gas Phase Filtration Market

- In June 2025, Chart Industries and Flowserve announced a $19 billion all-stock merger to form a global leader in gas and liquid handling technologies. Set to close in Q4 2025, the strategic union aims to deliver $300 million in cost synergies and bolster domestic manufacturing in response to complex supply chains.

- In May 2025, Major suppliers unveiled new filter media composed of stainless steel, aluminum mesh, and silica-free substrates, enhancing performance under high temperatures and extending service life in chemical processing and industrial air purification applications.

- In April 2025, Leading market player introduced smart gas-phase filters embedded with IoT sensors and AI analytics for real-time monitoring, predictive maintenance, and dynamic performance adjustments—significantly reducing operating costs and improving efficiency.

- In March 2025, In response to tougher environmental standards, manufacturers launched blended activated carbon filters optimized for VOC and odour removal. These eco-conscious filters balance performance and cost-effectiveness, targeting emerging markets and sustainable construction projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gas Phase Filtration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gas Phase Filtration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gas Phase Filtration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.