Global Gas Turbine Services Market

Market Size in USD Billion

CAGR :

%

USD

11.95 Billion

USD

20.89 Billion

2025

2033

USD

11.95 Billion

USD

20.89 Billion

2025

2033

| 2026 –2033 | |

| USD 11.95 Billion | |

| USD 20.89 Billion | |

|

|

|

|

Global Gas Turbine Services Market Size

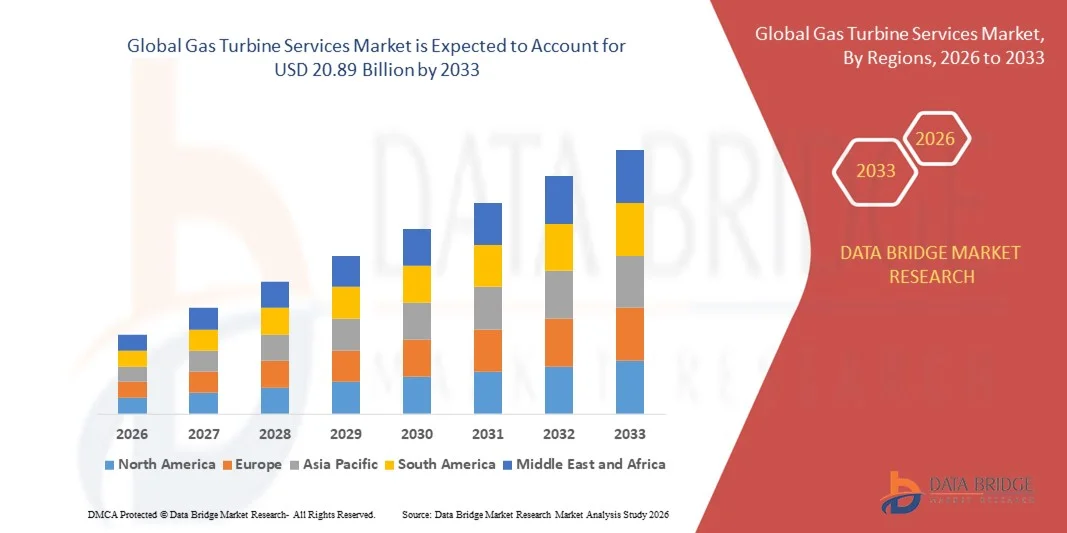

- The global Gas Turbine Services Market size was valued at USD 11.95 billion in 2025 and is projected to reach USD 20.89 billion by 2033, growing at a CAGR of 7.23% during the forecast period.

- The market expansion is primarily driven by the rising demand for efficient and reliable power generation, coupled with increasing investments in the upgradation and maintenance of existing gas turbine infrastructure across industrial and utility sectors.

- Additionally, the integration of digital technologies, predictive maintenance, and remote monitoring solutions is enhancing operational efficiency and service delivery, further propelling the growth of the global gas turbine services industry.

Global Gas Turbine Services Market Analysis

- Gas turbine services, encompassing maintenance, repair, and overhaul (MRO) solutions for industrial and utility gas turbines, are increasingly critical for ensuring operational efficiency, reliability, and optimized performance across power generation and oil & gas sectors, driven by the global shift toward cleaner and more efficient energy systems.

- The growing demand for uninterrupted power supply, coupled with the aging fleet of gas turbines and the increasing focus on reducing carbon emissions, is fueling the adoption of advanced turbine servicing technologies and long-term service agreements (LTSAs).

- North America dominated the Global Gas Turbine Services Market with the largest revenue share of 34.3% in 2025, supported by a well-established power infrastructure, high energy demand, and the strong presence of major service providers such as GE, Siemens Energy, and Mitsubishi Power. The U.S. leads the market with extensive turbine refurbishment projects and the adoption of digital monitoring systems to enhance operational efficiency.

- Asia-Pacific is expected to be the fastest-growing region in the Global Gas Turbine Services Market during the forecast period, driven by rapid industrialization, expanding energy infrastructure, and rising investments in combined-cycle power plants, particularly across China, India, and Southeast Asia.

- The Heavy Duty segment dominated the market with the largest revenue share of 48.6% in 2025, attributed to its extensive deployment in large-scale power generation and combined-cycle plants

Report Scope and Global Gas Turbine Services Market Segmentation

|

Attributes |

Gas Turbine Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Gas Turbine Services Market Trends

Enhanced Efficiency Through Digitalization and Predictive Maintenance

- A significant and accelerating trend in the Global Gas Turbine Services Market is the deepening integration of digital technologies, artificial intelligence (AI), and predictive analytics to optimize turbine performance and maintenance operations. This technological convergence is enhancing efficiency, reliability, and operational control across power generation and industrial applications.

- For instance, General Electric’s Predix platform and Siemens Energy’s Omnivise solutions utilize AI-driven analytics to monitor turbine health in real time, predict potential component failures, and optimize maintenance schedules. Similarly, Mitsubishi Power’s TOMONI intelligent digital platform leverages AI and cloud computing to enhance asset performance and reduce downtime.

- AI integration in gas turbine services enables advanced condition monitoring, automated diagnostics, and data-driven decision-making, allowing operators to detect anomalies early and improve maintenance precision. For example, AI-powered algorithms can analyze vibration, temperature, and exhaust data to predict wear and tear, ensuring optimal turbine lifespan and performance.

- The adoption of digital twin technology allows service providers to simulate turbine behavior under different operational scenarios, helping to fine-tune performance and reduce unplanned outages. Through centralized digital platforms, operators can manage multiple assets, monitor energy output, and execute predictive maintenance remotely.

- This shift toward smart, connected, and automated service ecosystems is transforming traditional maintenance models, setting new benchmarks for efficiency and reliability. Leading companies such as GE, Siemens Energy, and Ansaldo Energia are investing heavily in AI-powered solutions to deliver proactive service offerings and optimize lifecycle management.

- The growing demand for digitalized and predictive maintenance solutions is rapidly increasing across both developed and emerging markets, as utilities and industries prioritize operational excellence, cost efficiency, and sustainable power generation.

Global Gas Turbine Services Market Dynamics

Driver

Growing Need Due to Rising Energy Demand and Aging Infrastructure

- The increasing global demand for reliable and efficient power generation, combined with the aging infrastructure of existing gas turbines, is a major driver for the growing need for gas turbine services across industrial, utility, and oil & gas sectors.

- For instance, in March 2025, Siemens Energy announced the expansion of its service network in North America with advanced diagnostic and maintenance capabilities to support aging combined-cycle plants, emphasizing the industry's shift toward lifecycle management and modernization. Such strategic developments by leading players are expected to fuel the gas turbine services market during the forecast period.

- As operators face increasing pressure to enhance efficiency, reduce emissions, and minimize downtime, service providers are offering advanced maintenance, repair, and overhaul (MRO) solutions powered by digital and AI-based technologies. These solutions enable real-time monitoring, predictive analytics, and remote troubleshooting, significantly improving operational reliability.

- Furthermore, the rising focus on sustainable energy transitions and the growing integration of combined heat and power (CHP) systems are strengthening the role of gas turbines as a flexible and cleaner energy source, driving continuous demand for specialized service contracts and performance optimization.

- The emphasis on extending the operational life of existing turbines, optimizing fuel efficiency, and adhering to environmental compliance standards is propelling the adoption of long-term service agreements (LTSAs) and performance-based maintenance programs, especially across developing markets.

Restraint/Challenge

High Operational Costs and Technical Complexity

- The high costs associated with turbine maintenance, component replacement, and overhauls, along with the technical complexity of service operations, pose significant challenges to market growth. Older turbines often require expensive retrofitting or part upgrades, which can strain budgets for smaller power producers and industrial users.

- For instance, extensive maintenance projects involving rotor replacement or combustor overhauls can lead to prolonged downtime and substantial operational expenses, deterring frequent servicing, particularly in cost-sensitive markets.

- Additionally, the shortage of skilled technicians and the need for high-precision tools and specialized expertise can further limit service efficiency and increase turnaround times, impacting plant performance. Companies such as GE and Mitsubishi Power are investing in digital service platforms and remote diagnostics to mitigate these challenges by improving predictive maintenance and optimizing resource allocation.

- Another significant restraint is the volatility of natural gas prices and fluctuations in power demand, which can delay maintenance schedules or reduce investment in turbine upgrades.

- Addressing these challenges through digital transformation, workforce training, cost-efficient service models, and the adoption of modular maintenance strategies will be essential to ensuring sustainable growth in the global gas turbine services market.

Global Gas Turbine Services Market Scope

Gas turbine services market is segmented on the basis of type, capacity outlook, services, end user and service provider.

- By Type

On the basis of type, the Global Gas Turbine Services Market is segmented into Heavy Duty, Industrial, and Aero-Derivative. The Heavy Duty segment dominated the market with the largest revenue share of 48.6% in 2025, attributed to its extensive deployment in large-scale power generation and combined-cycle plants. Heavy-duty gas turbines are favored for their high efficiency, durability, and ability to operate under demanding conditions, making them a preferred choice among utility providers.

The Aero-Derivative segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing demand for flexible, lightweight, and mobile power generation solutions. Their quick start-up capability and suitability for distributed energy systems make them ideal for offshore, defense, and remote industrial applications. The increasing use of aero-derivative turbines in the oil & gas sector for mechanical drive and power generation further supports their market growth.

- By Capacity Outlook

on the basis of capacity, the Global Gas Turbine Services Market is categorized into <100 MW, 100 to 200 MW, and >200 MW. The >200 MW segment dominated the market in 2025 with a revenue share of 45.3%, owing to its extensive application in utility-scale power plants requiring high output and efficiency. These turbines are often used in large combined-cycle and cogeneration plants for base-load electricity generation.

The 100 to 200 MW segment is projected to record the fastest CAGR from 2026 to 2033, driven by its increasing adoption in mid-scale power projects and industrial applications where balanced efficiency and flexibility are critical. Growth in decentralized energy systems and grid modernization projects worldwide is expected to further boost demand across this capacity range, as utilities and industries seek optimized turbine solutions for variable power needs.

- By Services

On the basis of services, the market is segmented into Maintenance, Repair, Spare Parts Supply, and Overhaul. The Maintenance segment held the largest revenue share of 43.2% in 2025, as ongoing maintenance services are essential for ensuring turbine efficiency, minimizing downtime, and extending operational lifespan. The increasing preference for long-term service agreements (LTSAs) and performance-based maintenance contracts also supports segment dominance.

The Repair segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by the rising need to restore aging turbine components and reduce replacement costs. Advancements in on-site and modular repair technologies, along with digital predictive maintenance solutions, are enabling quicker service turnaround and cost savings, making repair services a crucial growth driver in the evolving gas turbine services landscape.

- By End User

On the basis of end user, the Global Gas Turbine Services Market is segmented into Power Generation, Oil & Gas, and Other Industrial sectors. The Power Generation segment dominated the market with a 52.4% revenue share in 2025, owing to the high reliance on gas turbines for electricity production across both base-load and peak-load applications. The shift toward cleaner energy and the modernization of existing power plants are driving substantial investments in turbine maintenance and performance optimization.

The Oil & Gas segment is forecasted to exhibit the fastest CAGR from 2026 to 2033, driven by the expanding use of turbines in offshore and onshore operations for mechanical drive, compression, and auxiliary power generation. Increasing exploration activities and the growing demand for efficient turbine-based solutions in refineries are expected to further propel service requirements in this segment.

- By Service Provider

on the basis of service provider, the market is bifurcated into OEM and Non-OEM. The OEM (Original Equipment Manufacturer) segment dominated the market with a revenue share of 61.5% in 2025, owing to the trust and reliability associated with branded service solutions, proprietary parts, and advanced diagnostic capabilities. OEMs such as GE, Siemens Energy, and Mitsubishi Power benefit from established service networks and long-term contracts with major power producers.

The Non-OEM segment is projected to record the fastest CAGR from 2026 to 2033, driven by the increasing preference for cost-effective and flexible service solutions offered by independent providers. Non-OEM companies are gaining traction due to their competitive pricing, regional presence, and ability to service multi-brand turbine fleets, thereby diversifying the global gas turbine service ecosystem.

Global Gas Turbine Services Market Regional Analysis

- North America dominated the Global Gas Turbine Services Market with the largest revenue share of 34.3% in 2025, driven by the region’s extensive power generation capacity, modernization of existing turbine fleets, and increasing investments in energy infrastructure. The strong presence of major service providers such as General Electric, Siemens Energy, and Mitsubishi Power further strengthens the region’s market dominance.

- Utilities and industrial operators across North America are prioritizing efficient turbine performance, reduced emissions, and digital service integration, leading to widespread adoption of predictive maintenance, remote monitoring, and performance optimization technologies.

- This growth is further supported by high energy demand, aging turbine installations, and a strong regulatory focus on cleaner energy solutions, establishing North America as a key hub for advanced gas turbine servicing across both power generation and oil & gas sectors.

U.S. Gas Turbine Services Market Insight

The U.S. gas turbine services market captured the largest revenue share of 78% in 2025 within North America, driven by the extensive use of gas turbines across power generation and oil & gas sectors. The country’s focus on modernizing aging turbine fleets, improving operational efficiency, and adopting digital predictive maintenance systems is fueling market growth. The integration of AI-based diagnostics, IoT-enabled monitoring, and long-term service agreements (LTSAs) further enhances operational reliability and reduces downtime. Moreover, the strong presence of industry leaders such as General Electric, Siemens Energy, and Mitsubishi Power continues to support advancements in performance optimization and lifecycle management.

Europe Gas Turbine Services Market Insight

The Europe gas turbine services market is projected to grow at a substantial CAGR throughout the forecast period, supported by the region’s transition toward cleaner energy sources and the refurbishment of existing gas-fired power plants. Strict EU emission regulations and the increasing adoption of combined heat and power (CHP) systems are driving service demand. Additionally, the rising need for high-efficiency and low-emission turbines across industrial and utility sectors is encouraging modernization projects. European countries are also witnessing strong growth in digital service solutions, with AI and data analytics becoming integral to predictive maintenance and real-time performance tracking.

U.K. Gas Turbine Services Market Insight

The U.K. gas turbine services market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by efforts to decarbonize the power sector and the rising importance of flexible, gas-based power generation to support renewable integration. The country’s expanding focus on combined-cycle power plants and efficient turbine retrofits is creating steady demand for advanced maintenance and overhaul services. Furthermore, the presence of major OEMs and partnerships with independent service providers is promoting technological upgrades and enhancing the efficiency of existing turbine assets across the region.

Germany Gas Turbine Services Market Insight

The Germany gas turbine services market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s industrial modernization efforts and the shift from coal to cleaner gas-based power generation. Germany’s strong engineering base and commitment to sustainable energy are driving the adoption of digitalized turbine maintenance solutions. The integration of remote monitoring, digital twins, and predictive analytics is increasingly prevalent, enabling operators to improve performance and minimize emissions. Growing investments in industrial CHP systems and distributed energy projects further support market expansion in Germany.

Asia-Pacific Gas Turbine Services Market Insight

The Asia-Pacific gas turbine services market is poised to grow at the fastest CAGR of 22% from 2026 to 2033, driven by rapid industrialization, increasing energy demand, and rising investments in gas-based power infrastructure across China, India, and Japan. Governments across the region are prioritizing cleaner and more reliable energy generation, boosting the installation and servicing of advanced gas turbines. Furthermore, APAC’s emergence as a manufacturing hub for turbine components and the expansion of non-OEM service providers are enhancing affordability and accessibility. The integration of digital platforms for monitoring and predictive maintenance is also contributing significantly to regional market growth.

Japan Gas Turbine Services Market Insight

The Japan gas turbine services market is gaining momentum due to the country’s focus on energy efficiency, reliability, and emissions reduction. With limited natural resources, Japan relies heavily on gas-fired power generation, driving demand for turbine optimization and maintenance services. The market is further strengthened by digital transformation initiatives, including AI-driven diagnostics and IoT-based asset monitoring. Japan’s emphasis on sustainability and advanced technology adoption continues to promote service innovation and efficiency improvements across the energy and industrial sectors.

China Gas Turbine Services Market Insight

The China gas turbine services market accounted for the largest market share in Asia-Pacific in 2025, propelled by the nation’s rapid urbanization, industrial growth, and extensive deployment of gas-fired power plants. China’s strong manufacturing capabilities and domestic OEM presence, including Dongfang Electric and Harbin Electric, contribute to the country’s growing dominance. Additionally, government initiatives promoting low-emission energy systems and smart plant digitization are boosting demand for advanced maintenance, repair, and overhaul services. The increasing adoption of digital twin technologies and predictive maintenance platforms is further transforming the country’s gas turbine service landscape.

Global Gas Turbine Services Market Share

The Gas Turbine Services industry is primarily led by well-established companies, including:

• General Electric (U.S.)

• Siemens Energy (Germany)

• Mitsubishi Power (Japan)

• Rolls-Royce Holdings plc (U.K.)

• Ansaldo Energia (Italy)

• Solar Turbines (U.S.)

• Doosan Enerbility (South Korea)

• Alstom Power (France)

• Baker Hughes (U.S.)

• Hitachi Energy (Switzerland)

• Power Machines (Russia)

• Safran Power Units (France)

• Shanghai Electric (China)

• Cummins Inc. (U.S.)

• Wärtsilä (Finland)

• Envision Group (China)

• Hafslund Eco AS (Norway)

• Caterpillar Energy Solutions (U.S.)

• TECO-Westinghouse (U.S.)

• Doosan Heavy Industries & Construction (South Korea)

What are the Recent Developments in Global Gas Turbine Services Market?

- In April 2024, General Electric (GE) Vernova announced the launch of its Digital Services Optimization Program in the Middle East, aimed at improving operational efficiency and reducing emissions in gas-fired power plants. The initiative leverages AI-driven predictive maintenance and digital twin technologies to enhance asset performance, optimize fuel efficiency, and minimize downtime. This program highlights GE’s ongoing commitment to supporting the region’s transition toward cleaner and more efficient power generation while reinforcing its leadership position in the Global Gas Turbine Services Market.

- In March 2024, Siemens Energy introduced its Omnivise Fleet Management Platform, a next-generation digital solution designed to enable power plant operators to monitor and optimize turbine performance across multiple sites. The platform integrates real-time analytics, AI-powered diagnostics, and remote service capabilities, allowing operators to extend turbine lifecycles and lower maintenance costs. This development underscores Siemens Energy’s focus on digital transformation within the service sector, enhancing reliability and sustainability across global turbine operations.

- In March 2024, Mitsubishi Power successfully launched its Advanced Service Center in Texas, U.S., dedicated to delivering comprehensive gas turbine maintenance, repair, and upgrade solutions. The facility features state-of-the-art diagnostic and component refurbishment capabilities to support both heavy-duty and aero-derivative turbines. This expansion demonstrates Mitsubishi Power’s strategic investment in localizing service operations, providing faster turnaround times, and strengthening its customer support network across North America.

- In February 2024, Ansaldo Energia announced a strategic partnership with Doosan Enerbility to jointly develop high-efficiency turbine service solutions and component upgrades for aging gas turbine fleets in Europe and Asia. The collaboration focuses on performance improvement, emissions reduction, and lifecycle cost optimization, aligning with global sustainability goals. This partnership reinforces Ansaldo Energia’s commitment to advancing service innovation and expanding its global footprint in turbine maintenance and overhaul solutions.

- In January 2024, Rolls-Royce Holdings plc unveiled its R^2 Data Labs Turbine Insight Program, a digital analytics platform designed to provide customers with deep operational insights into turbine health and performance. The system uses machine learning and IoT sensors to predict failures before they occur and optimize servicing schedules. This innovation demonstrates Rolls-Royce’s dedication to data-driven service enhancement, empowering operators with smarter decision-making tools and contributing to the growing digitalization trend in the Global Gas Turbine Services Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gas Turbine Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gas Turbine Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gas Turbine Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.