Global Gaskets And Seals Market

Market Size in USD Billion

CAGR :

%

USD

74.00 Billion

USD

117.06 Billion

2024

2032

USD

74.00 Billion

USD

117.06 Billion

2024

2032

| 2025 –2032 | |

| USD 74.00 Billion | |

| USD 117.06 Billion | |

|

|

|

|

Gaskets and Seals Market Size

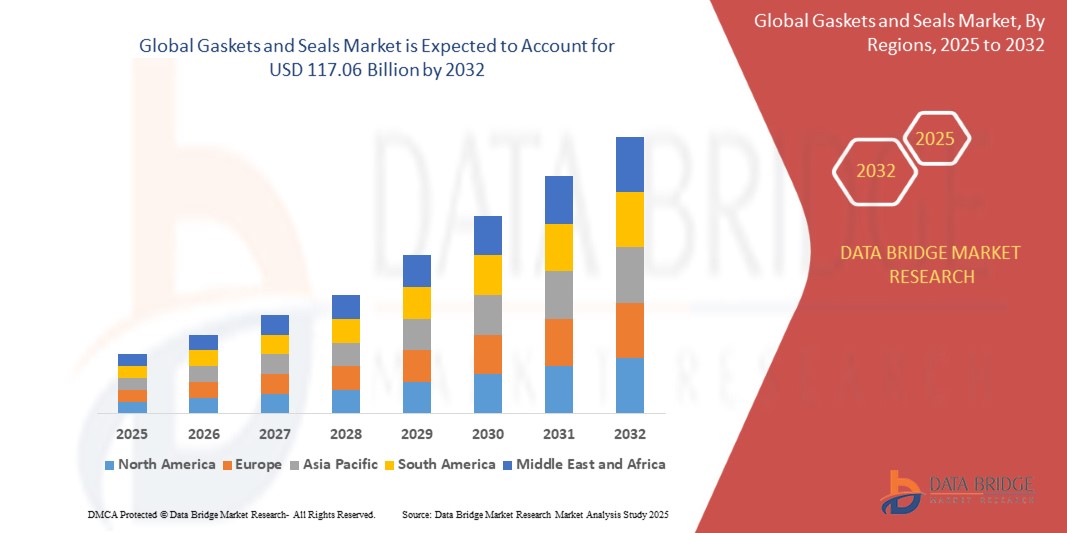

- The global gaskets and seals market size was valued at USD 74.00 billion in 2024 and is expected to reach USD 117.06 billion by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is largely fuelled by the increasing demand from the automotive, aerospace, electronics, and oil and gas industries, where sealing solutions are critical for safety, efficiency, and emissions control

- Rising investments in industrial infrastructure and ongoing technological advancements in sealing materials and designs are also contributing to the expansion of the market

Gaskets and Seals Market Analysis

- The market is witnessing strong demand due to the need for enhanced leakage protection, extended equipment life, and compliance with stringent emission and safety regulations across various industrial sectors

- Innovations such as non-metallic gaskets, advanced elastomers, and high-temperature sealing solutions are gaining traction, particularly in the automotive and energy industries

- North America region is expected to witness the highest growth rate in the global gaskets and seals market, driven by strict regulatory standards for emission control, technological advancements in sealing materials, and increased adoption in the oil and gas and chemical processing industries

- Asia-Pacific is expected to be the fastest growing region in the gaskets and seals market during the forecast period due to

- Gaskets dominate the market with a significant revenue share in 2024, driven by their widespread use in sealing applications to prevent leaks in pipelines, valves, and flanges. The demand for gaskets is fueled by their ability to withstand high pressure and temperature, providing reliable sealing in various industrial environments

Report Scope and Gaskets and Seals Market Segmentation

|

Attributes |

Gaskets and Seals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gaskets and Seals Market Trends

“Shift Toward Environmentally Sustainable and Low-Emission Materials”

- Stringent global regulations such as REACH and the Clean Air Act are prompting companies to adopt eco-friendly elastomers and polymers, reducing emissions and hazardous waste

- Industries are increasingly favoring gaskets made from renewable materials such as natural rubber, hemp fiber, and thermoplastic elastomers, which lower environmental impact

- The demand for low-VOC (Volatile Organic Compounds) adhesives and sealants is increasing, particularly in the automotive and construction sectors aiming for green certifications

- Sustainable gaskets and seals not only improve environmental performance but also enhance thermal efficiency and durability, benefiting end-users in long-term cost savings

- In 2024, Freudenberg Sealing Technologies launched a new series of eco-friendly seals for electric vehicles using partially bio-based materials, aligning with carbon neutrality goals in the European Union

Gaskets and Seals Market Dynamics

Driver

“Rising Demand from Automotive and Aerospace Industries”

- In the automotive industry, gaskets and seals ensure leak-proof operation in engines, transmissions, and battery packs, especially important in electric vehicles where temperature control is vital

- Aerospace applications demand high-precision, lightweight seals that withstand extreme temperatures, pressure variations, and fuel exposure, increasing the value of specialized sealing solutions

- OEMs are increasingly integrating smart sealing technologies embedded with sensors to monitor leakage, heat, or pressure, enhancing system reliability and maintenance planning

- The push for fuel efficiency and emission reduction has led to a preference for high-temperature-resistant and low-friction gaskets that boost engine performance

- For instance, Boeing has expanded its sourcing of aerospace-grade silicone seals for new-generation aircraft engines, contributing to the durability and performance efficiency of critical components in commercial aviation

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Disruptions”

- Key materials like nitrile rubber, PTFE, and silicone experience frequent price fluctuations tied to crude oil prices, directly affecting manufacturing budgets

- Trade restrictions, port congestion, and shipping delays have caused unpredictable lead times and limited inventory availability for both suppliers and buyers

- Small and mid-sized enterprises face greater risks, as they lack the buying power and storage capacity to buffer against cost surges or shipment delays

- Manufacturers are compelled to explore alternate sourcing strategies or localize supply chains to mitigate risks, often at the expense of increased production complexity

- For instance, During 2023, gasket manufacturers in North America reported a 20% increase in raw material procurement costs due to the combined impact of rubber supply shortages and increased freight tariffs from Asia

Gaskets and Seals Market Scope

The gaskets and seals market is segmented on the basis of type, material, application, distribution channel, and industry.

• By Type

On the basis of type, the market is segmented into gaskets and seals. Gaskets dominate the market with a significant revenue share in 2024, driven by their widespread use in sealing applications to prevent leaks in pipelines, valves, and flanges. The demand for gaskets is fueled by their ability to withstand high pressure and temperature, providing reliable sealing in various industrial environments.

Seals is expected to witness the fastest growth rate from 2025 to 2032, due to their essential role in dynamic sealing applications, including rotating shafts and hydraulic systems, contributing to overall equipment efficiency and safety.

• By Material

On the basis of material, the market is segmented into fiber, graphite, polytetrafluoroethylene (PTFE), rubber, and others. Fiber materials held the largest revenue share in 2024, favored for their excellent sealing performance and chemical resistance in harsh conditions. Graphite is expected to witness the fastest growth rate during the forecast period, owing to its high thermal stability and resilience in high-temperature industrial processes.

PTFE and rubber materials is expected to witness the fastest growth rate from 2025 to 2032, across automotive and aerospace applications due to their flexibility and resistance to corrosion and wear.

• By Application

On the basis of application, the market is segmented into heat exchangers, pressure vessels, manhole covers, handhole, valve bonnets, pipe flanges, power generation, and others. Pipe flanges and valve bonnets accounted for the largest market revenue share in 2024, driven by extensive use in oil and gas, chemical, and power generation industries requiring leak-proof sealing solutions.

The heat exchangers segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing demand in HVAC and industrial cooling systems, where efficient heat transfer and sealing integrity are critical.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into original equipment manufacturers (OEMs) and aftermarket. OEMs dominate the market in 2024, as they supply gaskets and seals integrated within new equipment and machinery.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising need for maintenance, repair, and replacement across various end-use industries to ensure operational safety and reduce downtime.

• By Industry

On the basis of industry, the market is segmented into paper and pulp industry, oil and gas, electrical, automotive, aerospace, industrial manufacturing, marine and rail, chemicals and petrochemicals, and others. The oil and gas industry held the largest revenue share in 2024 due to the critical need for reliable sealing in pipelines and processing equipment.

The automotive sector is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing production of electric vehicles and stringent emission regulations requiring advanced sealing technologies. Aerospace and chemical industries also contribute significantly, focusing on high-performance materials capable of withstanding extreme operational conditions.

Gaskets and Seals Market Regional Analysis

- Asia-Pacific dominated the gaskets and seals market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, expanding manufacturing sectors, and increasing investments in oil and gas and automotive industries

- The region benefits from a growing demand for advanced sealing solutions across power generation, chemical, and marine sectors, supported by increasing infrastructure projects and government initiatives aimed at industrial growth

- Rising urbanization and improving standards of manufacturing quality are boosting the adoption of high-performance gaskets and seals in countries such as China, India, and Japan, establishing Asia-Pacific as a key market for both OEM and aftermarket sales

China Gaskets and Seals Market Insight

China accounted for the largest revenue share in the Asia-Pacific gaskets and seals market in 2024, driven by rapid urbanization, industrial expansion, and high demand from automotive, chemical, and oil and gas sectors. The country’s growing middle-class population, coupled with government support for manufacturing and energy infrastructure, propels market growth. Moreover, domestic manufacturers’ ability to offer cost-effective and technologically advanced products is strengthening China’s position as a market leader in the region.

Japan Gaskets and Seals Market Insight

The Japan gaskets and seals market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s strong automotive and electronics manufacturing sectors. Emphasis on precision engineering and high-quality materials supports demand for advanced sealing solutions. Additionally, Japan’s focus on energy efficiency and environmental regulations drives the adoption of sustainable gasket and seal products, particularly in industrial manufacturing and power generation. The aging population and growing need for reliable infrastructure maintenance also contribute to market growth in both commercial and industrial applications.

Europe Gaskets and Seals Market Insight

The Europe gaskets and seals market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent environmental regulations and the need for sustainable sealing solutions. Increasing investments in renewable energy and stringent safety standards in automotive and industrial sectors drive adoption. European countries are witnessing growth across chemical processing, power generation, and aerospace industries, emphasizing high-quality and innovative sealing products.

Germany Gaskets and Seals Market Insight

Germany holds a significant share in the European gaskets and seals market, supported by its strong automotive and industrial manufacturing base. The country’s emphasis on research and development and adoption of eco-friendly sealing materials promotes market expansion. Germany’s well-established infrastructure and stringent regulatory framework encourage the integration of advanced sealing technologies, especially in sectors like automotive, aerospace, and chemicals.

U.K. Gaskets and Seals Market Insight

The U.K. gaskets and seals market is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing industrial automation and stringent safety and environmental standards. The rise in renewable energy projects, chemical processing, and aerospace industries is fueling demand for high-performance and eco-friendly sealing solutions. Furthermore, the U.K.’s well-developed manufacturing base and strong aftermarket service industry support the adoption of advanced gasket and seal technologies across various sectors.

North America Gaskets and Seals Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by the presence of major automotive, aerospace, and oil and gas companies. The region’s focus on upgrading aging infrastructure and growing demand for high-performance sealing solutions in power generation and chemical industries are key growth factors. Furthermore, the adoption of advanced materials such as graphite and PTFE enhances product performance, catering to stringent safety and environmental standards.

U.S. Gaskets and Seals Market Insight

The U.S. gaskets and seals market is expected to witness the fastest growth rate from 2025 to 2032, fueled by continuous investments in oil and gas exploration, power generation, and automotive sectors. Increasing demand for durable, high-temperature-resistant sealing solutions and advancements in material technologies support market growth. Additionally, the trend toward aftermarket sales and maintenance in industrial sectors further bolsters the market expansion.

Gaskets and Seals Market Share

The Gaskets and Seals industry is primarily led by well-established companies, including:

- SKF (Sweden)

- Freudenberg FST GmbH (Germany)

- Flowserve Corporation (U.S.)

- John Crane (U.K.)

- BRUSS Sealing Systems GmbH (Germany)

- Trelleborg Group. (Sweden)

- ElringKlinger AG (Germany)

- Cooper Standard (U.S.)

- Garlock, an Enpro Industries, Inc. (U.S.)

- Dätwyler Holding Inc. (Switzerland)

- Lamons (U.S.)

- SSP Manufacturing Inc. (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Renesas Electronics Corporation. (Japan)

- A.J. Rubber & Sponge Ltd. (Canada)

Latest Developments in Global Gaskets and Seals Market

- In 2023, Trelleborg Sealing Solutions launched the H2Pro line, focusing on sustainable energy by catering to the growing hydrogen applications market. This development supports eco-friendly solutions and is expected to boost market growth as industries shift towards greener alternatives

- In 2023, John Crane introduced the Type SB2/SB2A USP seal, combining heavy-duty cartridge seal technology with Upstream Pumping innovations. This advancement enhances equipment performance and reliability, likely driving increased demand in the gaskets and seals market

- In 2022, Erith Group began producing industrial seals and gaskets in Ras Al Khaimah, aiming to supply high-quality engineering solutions globally. This expansion strengthens the company’s market presence and meets rising industrial demand

- In 2022, Dana launched Spicer off-highway transmission kits that include seals, gaskets, and o-rings, simplifying OEM maintenance and repairs. This initiative improves service efficiency and supports aftermarket growth in the transmission sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gaskets And Seals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gaskets And Seals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gaskets And Seals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.