Global Gasoline Direct Injection Market

Market Size in USD Billion

CAGR :

%

USD

7.56 Billion

USD

15.60 Billion

2024

2032

USD

7.56 Billion

USD

15.60 Billion

2024

2032

| 2025 –2032 | |

| USD 7.56 Billion | |

| USD 15.60 Billion | |

|

|

|

|

Gasoline direct injection Market Size

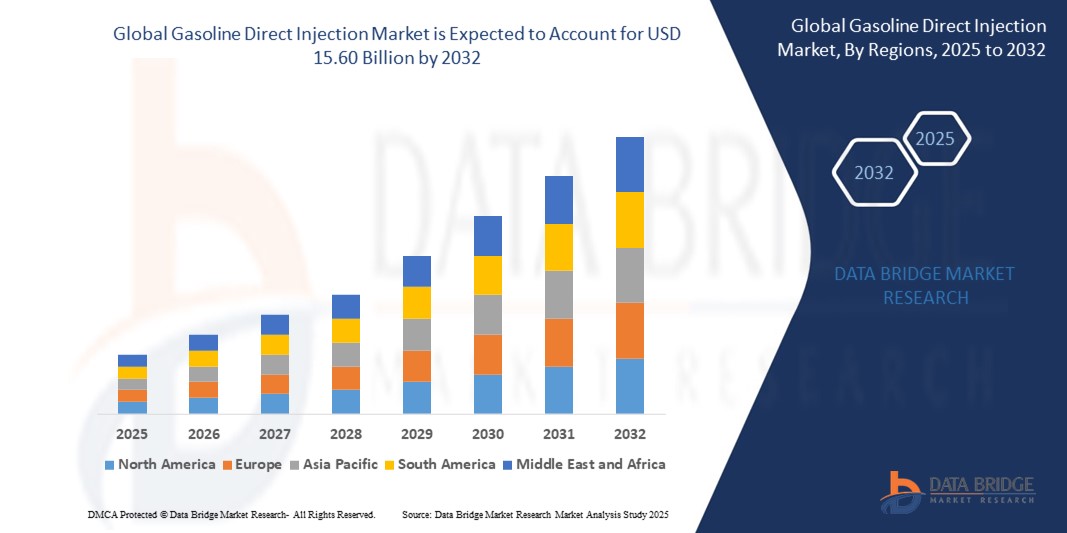

- The Global Gasoline direct injection Market size was valued at USD 7.56 billion in 2024 and is expected to reach USD 15.60 billion by 2032, at a CAGR of 9.48% during the forecast period

- The market growth is largely fueled by increasing use of battery electric vehicles (BEV)

Gasoline direct injection Market Analysis

- Gasoline direct injection (GASOLINE DIRECT INJECTION) systems have become essential for modern internal combustion engines, enabling precise fuel delivery directly into the combustion chamber. This technology improves engine efficiency, enhances power output, and reduces harmful emissions, making it a preferred choice among automakers striving to meet global fuel economy and emission standards.

- Market growth is fueled by stringent emission regulations, rising demand for fuel-efficient vehicles, and growing penetration of turbocharged gasoline engines. GASOLINE DIRECT INJECTION systems offer superior combustion control, supporting automakers in achieving higher thermal efficiency and compliance with evolving environmental norms such as Euro 6 and China VI.

- North America is expected to dominate the Global Gasoline direct injection Market with 60.03% in 2024, driven by strong demand for high-performance vehicles, stringent fuel efficiency standards by the U.S. EPA, and a well-established automotive manufacturing base. OEMs in the region are rapidly shifting from port fuel injection to GASOLINE DIRECT INJECTION systems for their light-duty vehicle fleets.

- Asia-Pacific is anticipated to witness the fastest market growth, owing to increasing automotive production in China, India, and Southeast Asia. Rising consumer demand for powerful yet fuel-efficient vehicles and government incentives for cleaner engine technologies are accelerating GASOLINE DIRECT INJECTION adoption in the region.

- The I4 engine segment dominated the market with 51.90% in 2024 with the largest revenue share, attributed to its widespread use in compact and mid-sized vehicles. I4 engines offer an optimal balance of power, fuel efficiency, and cost, making them the preferred choice for GASOLINE DIRECT INJECTION integration by major OEMs across both developed and emerging markets. Their compatibility with GASOLINE DIRECT INJECTION systems helps automakers meet stringent emission standards without compromising on performance.

Report Scope and Gasoline direct injection Market Segmentation

|

Attributes |

Gasoline direct injection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gasoline direct injection Market Trends

“Integration of Advanced Fuel Pressure Control and Turbocharging Technologies”

- A key trend reshaping the global GASOLINE DIRECT INJECTION market is the increasing integration of high-pressure fuel injection systems with turbocharged engines to improve power output, fuel economy, and emissions control.

- Automakers are pairing GASOLINE DIRECT INJECTION systems with downsized turbocharged engines to meet stringent fuel efficiency and emission norms without compromising engine performance.

For instance,

- In April 2024, Hyundai Motor Group introduced a new turbo-GASOLINE DIRECT INJECTION engine platform featuring variable fuel pressure control and dual-injection strategies to meet Euro 7 standards. The engine achieved a 9% improvement in fuel efficiency and 12% lower NOx emissions, highlighting the growing role of advanced GASOLINE DIRECT INJECTION in meeting regulatory targets.

- The adoption of multi-hole injectors, cylinder pressure sensors, and electronic control units (ECUs) is further enhancing combustion precision, contributing to reduced carbon emissions and improved throttle response.

Gasoline direct injection Market Dynamics

Driver

“Tightening Emission Regulations Driving OEM Shift Toward GASOLINE DIRECT INJECTION Technology”

- Stringent global emission standards or 3 regulations are pushing automakers to adopt Gasoline direct injection as a primary strategy for reducing CO2 and particulate emissions.

- GASOLINE DIRECT INJECTION systems offer superior fuel atomization and targeted injection, leading to more efficient combustion and lower hydrocarbon and CO2 emissions.

For Instance,

- In July 2024, Volkswagen AG accelerated the adoption of GASOLINE DIRECT INJECTION engines across its sedan and hatchback platforms in Europe to meet upcoming Euro 7 targets. The company reported a 14% reduction in fleet-wide CO2 emissions in part due to widespread GASOLINE DIRECT INJECTION deployment.

- The technology also supports compliance without fully transitioning to hybrid or electric powertrains, allowing OEMs to extend the life of internal combustion platforms during the EV transition period.

Restraint/Challenge

“Higher Particulate Emissions and Cost Sensitivity in Entry-Level Segments”

- While GASOLINE DIRECT INJECTION engines improve fuel efficiency, they tend to generate higher particulate emissions, especially in low-load or cold-start conditions, requiring additional components like gasoline particulate filters (GPFs).

- The cost associated with GASOLINE DIRECT INJECTION system components—such as high-pressure injectors, pumps, and control units makes it less attractive for low-cost vehicle segments, particularly in price-sensitive markets.

For Instance,

- In March 2024, several Chinese automakers postponed GASOLINE DIRECT INJECTION rollout in budget hatchback models due to rising raw material costs and the added expense of GPF integration. These concerns slowed OEM adoption in the sub USD 10,000 segment.

- This creates a challenge for widespread penetration unless suppliers innovate with low-cost, compact GASOLINE DIRECT INJECTION solutions that meet performance and emission targets without significantly raising vehicle prices.

Gasoline direct injection Market Scope

The market is segmented on the basis of engine configuration, component, and vehicle type.

- By Type

On the basis of engine type, the Gasoline direct injection Market is segmented into I3, I4, V6, and V8 engines. The I4 engine segment dominated the market with the largest revenue share of 51.90% in 2024, attributed to its widespread use in compact and mid-sized vehicles. I4 engines offer an optimal balance of power, fuel efficiency, and cost, making them the preferred choice for GASOLINE DIRECT INJECTION integration by major OEMs across both developed and emerging markets. Their compatibility with GASOLINE DIRECT INJECTION systems helps automakers meet stringent emission standards without compromising on performance

The V6 segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for high-performance and premium vehicles. Automakers are increasingly deploying GASOLINE DIRECT INJECTION technology in V6 configurations to enhance fuel combustion efficiency and power delivery, especially in SUVs and performance sedans. Additionally, advancements in turbocharging paired with GASOLINE DIRECT INJECTION are pushing the performance capabilities of V6 engines further, attracting consumer attention.

- By Component

On the basis of component, the market is segmented into fuel injector, rail, pump, sensor, and electronic control unit (ECU).The fuel injector segment held the highest market revenue share in 2024, as it is the core component in a GASOLINE DIRECT INJECTION system, directly responsible for delivering pressurized fuel into the combustion chamber. The growing trend toward precision fuel delivery to improve fuel efficiency and reduce carbon emissions has made high-performance injectors essential for modern engines. Technological advancements in multi-hole and high-pressure injectors are further supporting segment growth.

The electronic control unit (ECU) segment is projected to witness the fastest CAGR during the forecast period. ECUs manage the fuel injection timing and quantity with high precision, and their evolving role in real-time data analytics and integration with other vehicle control systems (like turbocharging or hybrid drive systems) is increasing their relevance.

- By Vehicle Type

Based on vehicle type, the market is segmented into hatchback, sedan, and SUV/MPV.

The SUV/MPV segment accounted for the largest market share in 2024, supported by the global boom in SUV sales. GASOLINE DIRECT INJECTION technology enhances power and efficiency, making it ideal for larger vehicles with higher fuel consumption. Consumer preference for SUVs in both developed (U.S., Europe) and developing (China, India) markets is pushing automakers to integrate GASOLINE DIRECT INJECTION across their utility vehicle lineups to meet stricter emissions regulations while maintaining performance.

The sedan segment is expected to record the fastest growth rate from 2025 to 2032, driven by a resurgence in compact and mid-sized sedans with turbocharged GASOLINE DIRECT INJECTION engines. Many OEMs are revamping their sedan portfolios with fuel-efficient, low-emission powertrains, with GASOLINE DIRECT INJECTION playing a central role in achieving these targets. Increasing affordability and the reintroduction of fuel-efficient sedans, especially in Asia-Pacific, are accelerating segment momentum.

Gasoline direct injection Market Regional Analysis

- North America is expected to dominate the Global Gasoline direct injection Market with 60.03% in 2024, driven by strong demand for high-performance vehicles, stringent fuel efficiency standards by the U.S. EPA, and a well-established automotive manufacturing base. OEMs in the region are rapidly shifting from port fuel injection to GASOLINE DIRECT INJECTION systems for their light-duty vehicle fleets.

- Additionally, the preference for SUVs and pickup trucks equipped with GASOLINE DIRECT INJECTION systems supports market expansion

U.S. Gasoline direct injection Market Insight

The U.S. captures over 80% of North America’s revenue share in 2024, bolstered by a strong push from automakers to meet Corporate Average Fuel Economy (CAFE) standards. Increasing production of hybrid and turbocharged gasoline vehicles with GASOLINE DIRECT INJECTION engines enhances fuel efficiency and reduces CO2 emissions. The rising consumer focus on performance combined with fuel savings is stimulating the uptake of GASOLINE DIRECT INJECTION technology. Moreover, government incentives for cleaner vehicles and technological investments by leading OEMs contribute to the market’s growth.

Europe Gasoline direct injection Market Insight

Europe is expected to witness steady growth throughout the forecast period, supported by increasingly strict EU CO2 emission. The shift towards downsized engines with GASOLINE DIRECT INJECTION technology to improve fuel economy and reduce emissions is a key driver. European consumers’ growing environmental awareness and demand for low-emission vehicles also fuel GASOLINE DIRECT INJECTION adoption, especially in passenger cars and luxury vehicles.

Germany Gasoline direct injection Market Insight

Germany leads the European GASOLINE DIRECT INJECTION market due to its robust automotive industry and emphasis on high-performance, eco-friendly vehicles. OEMs like Volkswagen, BMW, and Mercedes-Benz continue to invest heavily in GASOLINE DIRECT INJECTION engine development to balance power and efficiency. The growing focus on meeting stringent emissions standards and government initiatives promoting green technology support market growth.

Asia-Pacific Gasoline direct injection Market Insight

The Asia-Pacific Gasoline direct injection Market is poised to grow at the fastest CAGR of 21.04% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising vehicle production, and increasing consumer demand for fuel-efficient and performance-oriented vehicles. Countries such as China, Japan, South Korea, and India are investing heavily in GASOLINE DIRECT INJECTION technology adoption, aided by tightening emission norms and subsidies for cleaner engines.

China Gasoline direct injection Market Insight

China represents the largest market share in Asia-Pacific in 2024, fueled by the country’s massive automotive production and sales volumes. The Chinese government’s focus on reducing urban air pollution and carbon emissions accelerates the adoption of GASOLINE DIRECT INJECTION engines in passenger cars. Local manufacturers are expanding R&D efforts to enhance GASOLINE DIRECT INJECTION performance and lower costs, further driving market growth. Additionally, rising middle-class income levels are increasing consumer preference for technologically advanced vehicles.

India Gasoline direct injection Market Insight

India’s GASOLINE DIRECT INJECTION market is expanding rapidly due to tightening Bharat Stage VI (BS-VI) emission norms and growing production of petrol-powered vehicles with improved fuel efficiency. Increasing fuel prices and government incentives encourage OEMs and consumers to shift towards vehicles with GASOLINE DIRECT INJECTION technology. Rising urbanization and awareness about environmental pollution are also driving demand for cleaner and more efficient engines.

Gasoline direct injection Market Share

The Gasoline direct injection industry is primarily led by well-established companies, including:

- Marelli Holdings Co., Ltd. (Japan)

- Robert Bosch GmbH (Germany)

- Denso (Japan)

- Continental AG (Germany)

- Delphi Technologies (UK)

- Hitachi Astemo, Ltd. (Japan)

- Stanadyne Holdings (US)

- Keihin (Japan)

- Infineon Technologies (Germany)

- GP Performance (Italy)

Latest Developments in Global Gasoline direct injection Market

- In April 2025, Bosch introduced its latest gasoline direct injection fuel injector designed to enhance fuel atomization and combustion efficiency. This new product incorporates improved piezoelectric control technology, allowing for more precise fuel delivery and reduced emissions. The launch aims to help automakers meet increasingly stringent global emission norms while boosting engine performance and fuel economy in gasoline-powered vehicles.

- In March 2025, Denso announced the opening of a new manufacturing plant in Mexico dedicated to producing high-precision GASOLINE DIRECT INJECTION components. This expansion is part of Denso’s strategy to increase supply capacity to North American and Latin American automotive OEMs amid rising demand for gasoline direct injection systems. The new facility is equipped with advanced automation to ensure product quality and scalability.

- In February 2025, BorgWarner completed the acquisition of Delphi Technologies, a leader in fuel injection and powertrain solutions, for USD 4.2 billion. This acquisition significantly enhances BorgWarner’s gasoline direct injection offerings and consolidates its position as a key supplier to global OEMs. The combined expertise enables the development of next-gen GASOLINE DIRECT INJECTION systems that address tighter emission standards and evolving consumer preferences.

- In January 2025, Magneti Marelli signed a strategic partnership with Hyundai Motor Group to co-develop cutting-edge GASOLINE DIRECT INJECTION technology featuring integrated turbocharging and advanced injection timing control. The collaboration aims to optimize engine power output and fuel efficiency while reducing particulate emissions, supporting Hyundai’s commitment to sustainable mobility and compliance with future environmental regulations.

- In April 2025, Delphi Technologies launched a new high-pressure fuel pump designed for gasoline direct injection engines that enhances fuel delivery precision at higher pressures. This innovation improves combustion efficiency, reduces emissions, and supports downsized, turbocharged engine designs popular in modern vehicles. The product launch strengthens Delphi’s position as a supplier of critical GASOLINE DIRECT INJECTION components to major global automotive manufacturers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.