Global Gastrointestinal Diseases Drug Development Market

Market Size in USD Billion

CAGR :

%

USD

39.60 Billion

USD

51.35 Billion

2024

2032

USD

39.60 Billion

USD

51.35 Billion

2024

2032

| 2025 –2032 | |

| USD 39.60 Billion | |

| USD 51.35 Billion | |

|

|

|

|

Gastrointestinal Diseases Drug Development Market Size

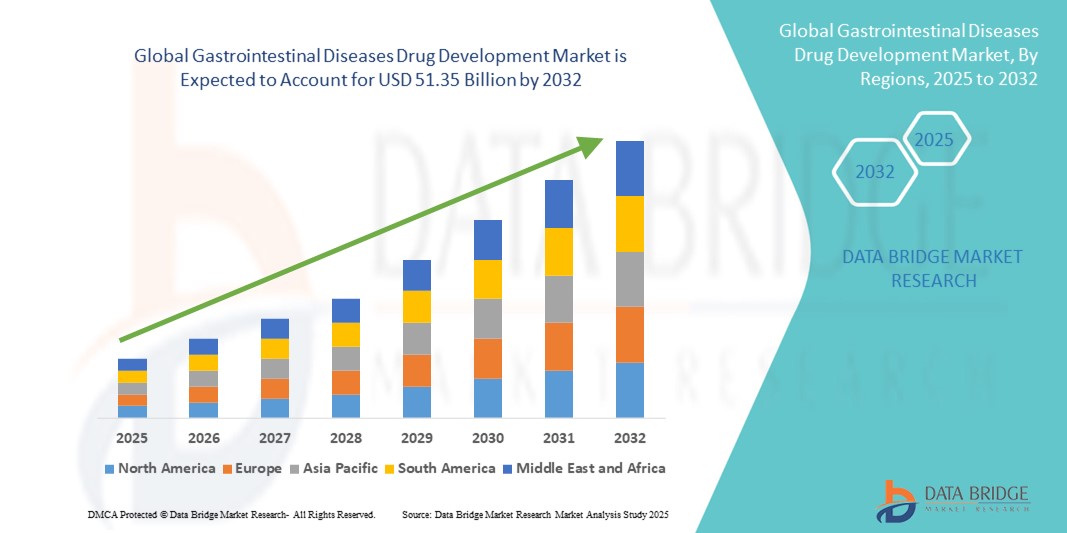

- The global gastrointestinal diseases drug development market size was valued at USD 39.60 billion in 2024 and is expected to reach USD 51.35 billion by 2032, at a CAGR of 3.30% during the forecast period

- The market growth is largely fueled by increasing research activities, rising prevalence of gastrointestinal disorders, and technological advancements in drug discovery and development

- Furthermore, the growing demand for targeted therapies, biologics, and novel treatment approaches is accelerating the uptake of gastrointestinal diseases drug development solutions, thereby significantly boosting the industry's growth

Gastrointestinal Diseases Drug Development Market Analysis

- Gastrointestinal Diseases Drug Development, encompassing innovative therapies and advanced treatment solutions, is increasingly vital in modern healthcare systems across both hospitals and specialty clinics due to its potential to improve patient outcomes, enhance disease management, and integrate seamlessly with diagnostic and monitoring services

- The escalating demand for gastrointestinal diseases drug development is fueled by rising disease prevalence, aging populations, unmet clinical needs, advances in biologics and microbiome therapies, increasing GI cancers, and supportive regulatory initiatives

- North America dominated the gastrointestinal diseases drug development market with the largest revenue share of 46.05% in 2024, supported by advanced healthcare infrastructure, strong presence of pharmaceutical companies, and widespread adoption of innovative therapies. The U.S. remains the major contributor, driven by extensive clinical trials, proactive pharmacovigilance programs, and early adoption of novel drugs for gastrointestinal disorders

- Asia-Pacific is expected to be the fastest-growing region in the gastrointestinal diseases drug development market during the forecast period, fueled by increasing urbanization, rising disposable incomes, expansion of healthcare facilities offering specialized gastrointestinal care, and growing awareness among physicians and patients regarding advanced treatment options

- Injectable drugs dominated the gastrointestinal diseases drug development market with a revenue share of 57.2% in 2024, primarily due to the prevalence of biologics and monoclonal antibodies that require parenteral delivery

Report Scope and Gastrointestinal Diseases Drug Development Market Segmentation

|

Attributes |

Gastrointestinal Diseases Drug Development Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gastrointestinal Diseases Drug Development Market Trends

Enhanced Convenience Through Advanced Therapeutics and Integrated Care

- A significant and accelerating trend in the global gastrointestinal diseases drug development market is the deepening integration of innovative drug therapies with advanced diagnostic and patient monitoring systems. This integration is significantly enhancing treatment precision and improving patient outcomes

- For instance, novel biologics and small-molecule therapies are being developed to target specific gastrointestinal pathways, allowing healthcare providers to offer more personalized and effective treatment regimens. Similarly, combination therapies are increasingly being explored to enhance efficacy and reduce adverse effects in patients with complex gastrointestinal conditions

- Advanced drug formulations are enabling improved delivery mechanisms, better bioavailability, and reduced dosing frequency, which contributes to higher patient adherence and overall treatment success. In addition, integration with digital health platforms allows physicians to track patient progress and adjust therapies in real time

- The seamless integration of new therapies with existing hospital protocols and clinical workflows facilitates coordinated care, enabling multidisciplinary teams to manage gastrointestinal diseases more effectively. Through centralized monitoring, treatment adjustments, and patient education, outcomes are optimized

- This trend towards more targeted, effective, and patient-centric therapies is fundamentally reshaping expectations for gastrointestinal disease management. Consequently, pharmaceutical companies are investing heavily in research and development of novel molecules, biologics, and therapy combinations to meet these evolving demands

- The demand for advanced gastrointestinal treatments is growing rapidly across hospitals, specialty clinics, and homecare settings, as healthcare providers increasingly prioritize efficacy, safety, and integrated disease management in treatment protocols

Gastrointestinal Diseases Drug Development Market Dynamics

Driver

Growing Need Due to Rising Incidence of Gastrointestinal Disorders and Advanced Therapeutics Adoption

- The increasing prevalence of gastrointestinal disorders worldwide, coupled with the expanding adoption of advanced therapeutics and diagnostic tools, is a significant driver for the growth of the Gastrointestinal Diseases Drug Development market

- For instance, in April 2024, Takeda Pharmaceutical Company announced the advancement of its novel pipeline targeting inflammatory bowel disease (IBD), focusing on precision medicine approaches and enhanced patient monitoring. Such strategies by leading pharmaceutical companies are expected to drive market growth over the forecast period

- As patients and healthcare providers become more aware of the need for effective gastrointestinal disease management, novel drug therapies offer targeted treatment options, reduced side effects, and improved clinical outcomes compared to traditional therapies

- Furthermore, the growing adoption of integrated treatment plans and combination therapies is enabling healthcare providers to offer more personalized care. Enhanced drug formulations, biologics, and molecularly targeted therapies are increasingly preferred in hospitals, specialty clinics, and homecare settings

- The convenience of therapies with improved administration methods, such as oral sustained-release formulations or less frequent dosing, along with expanding patient support programs, is boosting treatment adherence and market demand. The trend toward patient-centric care and greater accessibility of advanced gastrointestinal drugs further contributes to overall market expansion

Restraint/Challenge

Concerns Regarding High Costs and Regulatory Compliance

- High development costs and stringent regulatory requirements for gastrointestinal disease drugs pose significant challenges for market growth. Drug development involves extensive clinical trials, compliance with safety regulations, and substantial investment in research and development, which can slow the introduction of new therapies

- For instance, delays in clinical trial approvals or stringent efficacy and safety evaluation standards in key markets have made some pharmaceutical companies cautious in launching novel gastrointestinal drugs

- Addressing these challenges through optimized clinical trial designs, strong regulatory engagement, and cost-effective production methods is crucial for ensuring sustained market growth. Leading companies emphasize robust clinical evidence and patient safety to gain regulatory approval and market acceptance

- In addition, the relatively high price of advanced gastrointestinal drugs compared to traditional treatments can limit access for price-sensitive patients, particularly in developing regions or for underinsured populations

- While biosimilars and generic alternatives are gradually emerging, the perceived premium for innovative therapeutics can still hinder widespread adoption. Educating healthcare providers and patients on the benefits of advanced treatments is essential for overcoming these barriers

- Overcoming these challenges through cost reduction strategies, regulatory compliance, and patient education initiatives will be vital for continued growth in the Gastrointestinal Diseases Drug Development market

Gastrointestinal Diseases Drug Development Market Scope

The market is segmented on the basis of disease type, molecular targets, marketed drugs, clinical trials, route of administration, and end-users.

- By Disease Type

On the basis of disease type, the global gastrointestinal diseases drug development market is segmented into gastroenteritis, inflammatory bowel disease (IBD), irritable bowel syndrome, and others. The IBD segment dominated the largest market revenue share of 46.5% in 2024, driven by the high prevalence of Crohn’s disease and ulcerative colitis across major regions. This segment benefits from continuous advancements in biologics and targeted therapies that address the chronic and relapsing nature of IBD. Patient dependence on long-term treatment regimens further supports sustained market revenue. IBD therapies also enjoy robust clinical validation and established guidelines, increasing physician preference and prescription rates. Additionally, pharmaceutical investments in R&D pipelines for novel IBD treatments contribute to the dominance of this segment. The segment’s integration with personalized medicine approaches enhances patient outcomes and drives market demand.

The irritable bowel syndrome (IBS) segment is anticipated to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by rising awareness among patients and physicians about its impact on quality of life. Improved diagnostic capabilities and the identification of subtypes within IBS are facilitating targeted drug development. The increasing availability of symptom-specific therapies and lifestyle-focused interventions is supporting rapid adoption. Growing demand for safer and more effective treatment options also accelerates the segment’s growth. Pharmaceutical companies are investing in innovative drug formulations to improve efficacy and patient adherence. Overall, the combination of heightened disease recognition and novel therapeutic approaches drives the fastest growth of the IBS segment.

- By Molecular Targets

On the basis of molecular targets, the global gastrointestinal diseases drug development market is segmented into sodium transporter NHE3 inhibitors, sphingosine-1-phosphate receptor functional antagonists, tumor necrosis factor (TNF) blockers, and others. TNF blockers held the largest market revenue share of 44.3% in 2024, owing to their well-established efficacy in controlling inflammation in IBD patients. Their strong clinical track record and proven ability to reduce disease progression make them a preferred choice for physicians. TNF blockers are widely adopted across both adult and pediatric populations, offering a range of approved therapies for various gastrointestinal disorders. The extensive use of TNF inhibitors in both monotherapy and combination therapy strengthens their market position. Additionally, patient familiarity and physician confidence in TNF blockers contribute to their leading market share. Their ability to integrate with long-term disease management programs further reinforces market dominance.

The sphingosine-1-phosphate receptor functional antagonists segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by encouraging clinical trial outcomes and the potential to offer safer oral alternatives to injectable therapies. These drugs provide targeted immunomodulation, reducing inflammation with fewer side effects. The convenience of oral administration enhances patient adherence and treatment continuity. Pharmaceutical companies are actively pursuing global approvals, increasing market accessibility. As healthcare systems prioritize patient-friendly therapies, this segment sees rapid uptake. The innovative mechanism of action and strong therapeutic promise position this subsegment for sustained high growth.

- By Marketed Drugs

On the basis of marketed drugs, the global gastrointestinal diseases drug development market is segmented into infliximab, adalimumab, mesalazine, and others. Adalimumab dominated the largest market revenue share of 41.7% in 2024, due to its widespread use as a first-line biologic therapy for IBD. Its strong clinical efficacy and multiple approved indications make it a preferred therapy for moderate-to-severe disease. The availability of biosimilars in key markets has increased patient access while maintaining revenue growth. Physicians favor adalimumab due to its long-term safety profile and robust data supporting sustained remission. The drug’s global footprint and presence across outpatient and hospital settings further reinforce its market leadership. Continuous research into new indications strengthens its position and long-term revenue potential.

Mesalazine is anticipated to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by its effectiveness in treating mild-to-moderate IBD cases and favorable safety profile. Oral and rectal formulations offer flexibility in treatment approaches. Product innovations, such as extended-release formulations, improve patient adherence and convenience. Growing demand for safer maintenance therapies contributes to the segment’s rapid adoption. Mesalazine’s widespread availability and affordability make it a preferred choice in emerging markets. Increasing awareness among patients about early treatment benefits further supports strong growth in this segment.

- By Clinical Trials

On the basis of clinical trials, the global gastrointestinal diseases drug development market is segmented into etrolizumab, SHP647, ABX464, ASP3291, and others. Etrolizumab held the largest market revenue share of 38.6% in 2024, attributed to its advanced stage of development and promising results in moderate-to-severe ulcerative colitis. Its robust phase III trial data demonstrates efficacy in inducing and maintaining remission, creating strong interest among healthcare providers. Pharmaceutical investments and strategic collaborations have expanded its global presence. Etrolizumab’s mechanism targeting integrin pathways provides a differentiated treatment option for IBD. Patient enrollment in clinical trials and ongoing regulatory approvals drive continued momentum. Its potential to address unmet medical needs reinforces its market leadership.

ABX464 is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by its novel mechanism of action that modulates immune response and inflammation. Strong preclinical and clinical trial results are fueling optimism among clinicians and investors. Its oral formulation enhances patient adherence and preference. The growing pipeline of first-in-class therapies targeting IBD and related conditions accelerates adoption. Strategic partnerships and licensing agreements expand access to global markets. Overall, ABX464’s innovation and promising clinical profile position it as a high-growth subsegment in gastrointestinal drug development.

- By Route of Administration

On the basis of route of administration, the global gastrointestinal diseases drug development market is segmented into oral and injectable. Injectable drugs dominated the largest market revenue share of 57.2% in 2024, primarily due to the prevalence of biologics and monoclonal antibodies that require parenteral delivery. Injectable therapies are preferred in moderate-to-severe disease management for their high bioavailability and rapid therapeutic effect. Hospitals and specialized infusion centers facilitate administration, monitoring, and patient safety. The established efficacy of injectable biologics in controlling inflammation drives physician preference. Their use in combination therapies further reinforces market demand. Long-term clinical data supporting treatment outcomes strengthens adoption globally.

Oral drugs are expected to witness the fastest CAGR of 17.6% from 2025 to 2032, driven by patient preference for convenience, improved adherence, and reduced dependency on clinical settings. Innovative small-molecule therapies that can be administered orally are gaining traction. Pharmaceutical companies are investing in advanced drug delivery systems to enhance absorption and efficacy. Growing interest in home-based therapy options further accelerates growth. Oral therapies cater to early-stage disease management and maintenance therapy, broadening their applicability. These factors collectively contribute to the rapid expansion of the oral drug subsegment.

- By End-Users

On the basis of end-users, the global gastrointestinal diseases drug development market is segmented into hospitals, homecare, specialty clinics, and others. Hospitals accounted for the largest market revenue share of 48.4% in 2024, due to the concentration of severe and complex cases requiring specialized treatment and advanced therapies. Hospitals provide necessary infrastructure for biologic infusions, patient monitoring, and comprehensive disease management. Physician preference and patient trust in hospital-based care contribute to the dominance of this segment. The presence of multidisciplinary teams ensures coordinated treatment approaches. Hospitals also facilitate clinical trials and access to innovative therapies. Their ability to manage both inpatient and outpatient care supports sustained revenue growth.

Specialty clinics are expected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by increasing focus on targeted therapy management, outpatient infusion services, and personalized treatment plans. These clinics offer flexibility, reduced waiting times, and focused care for gastrointestinal disorders. Adoption of innovative treatment modalities and patient-centric approaches enhances their attractiveness. Expansion of specialized clinics in emerging markets is boosting accessibility. Strategic partnerships with pharmaceutical companies help integrate novel therapies efficiently. Overall, the combination of patient convenience, specialized care, and targeted treatment options accelerates the growth of this segment.

Gastrointestinal Diseases Drug Development Market Regional Analysis

- North America dominated the gastrointestinal diseases drug development market with the largest revenue share of 46.05% in 2024

- Supported by advanced healthcare infrastructure, strong presence of pharmaceutical companies, and widespread adoption of innovative therapies

- The region continues to lead due to its robust clinical research ecosystem, availability of cutting-edge treatment options, and proactive pharmacovigilance programs that ensure safety and efficacy of new drugs

U.S. Gastrointestinal Diseases Drug Development Market Insight

The U.S. gastrointestinal diseases drug development market captured the largest revenue share within North America in 2024, driven by extensive clinical trials, early adoption of novel drugs, and the proactive implementation of pharmacovigilance programs. Rising awareness campaigns about gastrointestinal disorders and the availability of advanced therapeutic solutions are further boosting market demand. Additionally, the presence of leading pharmaceutical companies focusing on targeted therapies and biologics is reinforcing the U.S.’s position as the key contributor to regional growth.

Europe Gastrointestinal Diseases Drug Development Market Insight

The Europe gastrointestinal diseases drug development market is expected to expand steadily throughout the forecast period, driven by increasing prevalence of gastrointestinal disorders and the region’s emphasis on evidence-based treatment approaches. Strong regulatory frameworks, coupled with well-established healthcare infrastructure, are facilitating the adoption of advanced therapies in hospitals and specialty clinics. Increased research collaborations and investments in novel drug development are further fueling market growth across countries such as Germany, France, and Italy.

U.K. Gastrointestinal Diseases Drug Development Market Insight

The U.K. gastrointestinal diseases drug development market is projected to witness notable growth, supported by rising awareness among physicians and patients regarding innovative gastrointestinal therapies. Government initiatives promoting research in gastroenterology, coupled with a strong presence of specialty healthcare providers, are contributing to the increasing uptake of novel drug therapies. Additionally, the U.K.’s well-developed healthcare ecosystem facilitates clinical trials and early adoption of advanced treatment options.

Germany Gastrointestinal Diseases Drug Development Market Insight

The Germany gastrointestinal diseases drug development market is expected to grow consistently, driven by increasing prevalence of gastrointestinal conditions and the demand for targeted therapeutic interventions. The country’s advanced healthcare infrastructure, emphasis on R&D, and focus on precision medicine contribute to the adoption of novel treatments in both hospital and specialty clinic settings. Patient awareness campaigns and the availability of specialized care centers further reinforce market growth.

Asia-Pacific Gastrointestinal Diseases Drug Development Market Insight

The Asia-Pacific gastrointestinal diseases drug development market is poised to be the fastest-growing region during the forecast period, fueled by increasing urbanization, rising disposable incomes, and expansion of healthcare facilities offering specialized gastrointestinal care. Countries such as China, Japan, and India are witnessing a surge in advanced treatment adoption, supported by growing awareness among physicians and patients regarding novel therapies. Investment in research infrastructure and expanding hospital networks are further propelling market growth.

Japan Gastrointestinal Diseases Drug Development Market Insight

The Japan gastrointestinal diseases drug development market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and strong focus on medical innovation. Rising incidence of gastrointestinal disorders and growing adoption of cutting-edge therapies in hospitals and specialty clinics are key factors driving market expansion. Additionally, ongoing clinical research and collaborations with global pharmaceutical companies are enhancing the availability of novel treatment options.

China Gastrointestinal Diseases Drug Development Market Insight

The China gastrointestinal diseases drug development market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, increasing healthcare awareness, and a growing middle-class population. The expanding network of hospitals and specialty clinics, coupled with government support for research and development in gastrointestinal therapeutics, is boosting the adoption of innovative drugs. Strong domestic pharmaceutical manufacturers and increasing investment in advanced therapies are further strengthening market growth in China.

Gastrointestinal Diseases Drug Development Market Share

The gastrointestinal diseases drug development industry is primarily led by well-established companies, including:

- GSK plc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- AstraZeneca (U.S.)

- Pfizer Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (U.S.)

- Amgen Inc. (U.S.)

- Daiichi Sankyo Company Limited (Japan)

- AB Sciences (France)

- Eisai Co., Ltd (Japan)

- Merck & Co., Inc. (U.S.)

Latest Developments in Global Gastrointestinal Diseases Drug Development Market

- In May 2021, Bristol Myers Squibb received U.S. FDA approval for Zeposia (ozanimod) for the treatment of moderately to severely active ulcerative colitis (UC). This oral medication is the first and only sphingosine 1-phosphate (S1P) receptor modulator approved for UC, offering a new treatment option for patients with this chronic inflammatory bowel disease

- In March 2022, AbbVie received U.S. FDA approval for RINVOQ (upadacitinib) for the treatment of adults with moderately to severely active ulcerative colitis who have had an inadequate response or intolerance to one or more tumor necrosis factor (TNF) blockers

- In December 2023, the U.S. Food and Drug Administration approved five new gastrointestinal targeted drugs, including treatments for gastroesophageal reflux disease (GERD), inflammatory bowel disease (IBD), and colonoscopy preparation. These approvals reflect ongoing innovation in the gastrointestinal therapeutic landscape, expanding treatment options for various GI conditions

- In April 2025, Intercept Pharmaceuticals announced that 11 submitted abstracts had been accepted for presentation at Digestive Disease Week 2025, including oral presentations of data from a Phase 2 study. This highlights the company's commitment to advancing research and development in gastrointestinal diseases, particularly in areas with high unmet medical need

- In August 2025, Takeda Pharmaceutical Company announced plans to conduct global clinical trials in India to accelerate the introduction of its innovative drugs, including those targeting gastrointestinal diseases. India’s diverse patient population and expanding healthcare infrastructure present a strategic opportunity for accelerating drug development and access to advanced treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.