Global Gastroretentive Drug Delivery Systems Market

Market Size in USD Billion

CAGR :

%

USD

16.10 Billion

USD

26.44 Billion

2024

2032

USD

16.10 Billion

USD

26.44 Billion

2024

2032

| 2025 –2032 | |

| USD 16.10 Billion | |

| USD 26.44 Billion | |

|

|

|

|

Gastroretentive Drug Delivery Systems Market Size

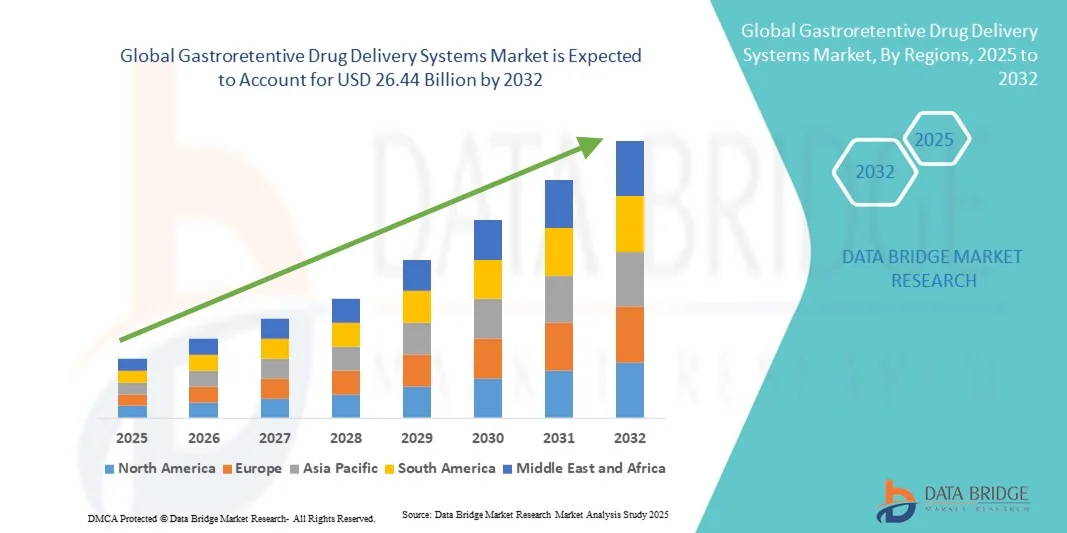

- The global gastroretentive drug delivery systems market size was valued at USD 16.10 billion in 2024 and is expected to reach USD 26.44 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely driven by the increasing prevalence of gastrointestinal disorders, coupled with advancements in targeted and controlled drug delivery technologies, enabling prolonged gastric retention and improved therapeutic efficacy

- Furthermore, rising demand for patient-centric formulations, enhanced bioavailability, and reduced dosing frequency is positioning gastroretentive systems as a preferred choice in modern pharmaceutical therapy. These converging trends are accelerating the adoption of innovative gastroretentive drug delivery solutions, thereby significantly boosting the industry’s growth

Gastroretentive Drug Delivery Systems Market Analysis

- Gastroretentive drug delivery systems (GRDDS), designed to prolong gastric residence time and improve the bioavailability of drugs, are increasingly critical in modern pharmaceutical therapy for enhancing treatment efficacy and patient compliance, particularly for drugs with narrow absorption windows in the upper gastrointestinal tract

- The growing demand for GRDDS is primarily driven by the rising prevalence of gastrointestinal disorders, increasing focus on controlled and targeted drug delivery, and the need for improved therapeutic outcomes with reduced dosing frequency

- North America dominated the gastroretentive drug delivery systems market with the largest revenue share of 41.8% in 2024, attributed to advanced pharmaceutical R&D infrastructure, high adoption of innovative drug delivery technologies, and strong presence of key industry players developing novel formulations with sustained-release and bioadhesive properties

- Asia-Pacific is expected to be the fastest-growing region in the GRDDS market during the forecast period, supported by increasing pharmaceutical manufacturing capabilities, rising healthcare expenditure, and growing awareness of advanced drug delivery systems

- Floating drug delivery systems segment dominated the gastroretentive drug delivery systems market with a market share of 47.5% in 2024, driven by their proven effectiveness in enhancing gastric retention and improving the absorption of drugs with limited solubility in the lower gastrointestinal tract

Report Scope and Gastroretentive Drug Delivery Systems Market Segmentation

|

Attributes |

Gastroretentive Drug Delivery Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gastroretentive Drug Delivery Systems Market Trends

Advancements in Targeted and Controlled Drug Delivery

- A significant and accelerating trend in the global gastroretentive drug delivery systems (GRDDS) market is the development of advanced formulations that enable precise, targeted, and sustained release of drugs within the stomach, improving therapeutic outcomes and patient compliance

- For Instance, the Floating Microsphere formulation allows controlled release of antibiotics over extended periods, ensuring higher drug bioavailability and reduced dosing frequency. Similarly, Mucoadhesive Tablets can adhere to gastric mucosa, prolonging residence time and enhancing absorption of drugs with narrow absorption windows

- Controlled-release technologies in GRDDS enable features such as pH-responsive drug release, site-specific targeting, and reduced gastrointestinal side effects. Instance, certain alginate-based GRDDS formulations release drugs selectively in acidic gastric conditions to improve efficacy and minimize irritation

- The integration of novel polymers, bioadhesive materials, and nanotechnology in GRDDS facilitates prolonged gastric retention and better pharmacokinetic profiles. Through these innovations, drug delivery can be optimized for both acute and chronic conditions, creating more effective therapy regimens

- This trend towards more sophisticated, patient-centric, and precise gastroretentive formulations is reshaping expectations in pharmaceutical therapy. Consequently, companies such as Lupin and Cipla are developing floating and bioadhesive systems with improved drug release profiles for better patient outcomes

- The demand for GRDDS that offer enhanced bioavailability, sustained release, and patient compliance is growing rapidly across both prescription and over-the-counter drug categories, as healthcare providers increasingly prioritize therapeutic efficiency and convenient

Gastroretentive Drug Delivery Systems Market Dynamics

Driver

Rising Prevalence of Gastrointestinal Disorders and Need for Enhanced Therapeutic Efficacy

- The increasing incidence of gastrointestinal disorders, coupled with the growing need for improved treatment efficacy, is a significant driver for the heightened demand for GRDDS

- For Instance, in 2024, Lupin Pharmaceuticals introduced an alginate-based floating system for H. pylori therapy, aiming to improve drug retention and absorption, which is expected to drive GRDDS adoption in the forecast period

- As patients and healthcare providers seek therapies that minimize dosing frequency while maximizing drug bioavailability, GRDDS offers controlled release, targeted delivery, and reduced side effects, providing a compelling advantage over conventional oral formulations

- Furthermore, the increasing focus on patient-centric therapies and advanced drug delivery solutions is making GRDDS an integral component of modern pharmaceutical innovation, offering solutions for drugs with narrow absorption windows or poor solubility

- Improved therapeutic outcomes, reduced dosing schedules, and better patient adherence are key factors propelling the adoption of GRDDS in both chronic and acute treatment regimens. The trend towards personalized medicine and targeted drug delivery further contributes to market growth

Restraint/Challenge

Formulation Complexity and Regulatory Compliance Hurdles

- Challenges associated with complex formulation requirements, stability issues, and rigorous regulatory standards pose significant barriers to broader market adoption of GRDDS. As GRDDS often involve bioadhesive polymers, floating systems, or multilayer tablets, achieving consistent performance can be technically demanding

- For Instance, reports of batch-to-batch variability in floating microsphere formulations have made some pharmaceutical companies cautious about large-scale production and commercialization

- Addressing these formulation challenges through optimized polymer selection, robust manufacturing processes, and strict quality control is crucial for ensuring reproducibility and therapeutic efficacy. In addition, obtaining regulatory approvals for innovative GRDDS formulations can be time-consuming and resource-intensive, affecting market entry timelines

- While technological advancements are gradually mitigating these issues, the high development cost of complex gastroretentive systems can still hinder adoption, particularly for small- and mid-sized pharmaceutical companies in developing regions

- Overcoming these challenges through formulation innovation, streamlined regulatory pathways, and cost-effective manufacturing solutions will be vital for sustained growth in the GRDDS market

Gastroretentive Drug Delivery Systems Market Scope

The market is segmented on the basis of system type, dosage form, and distribution channel.

- By System Type

On the basis of system type, the gastroretentive drug delivery systems market is segmented into high density system, expandable drug delivery system, bioadhesive drug delivery systems, floating drug delivery systems, and others. The floating drug delivery systems segment dominated the market with the largest revenue share of 47.5% in 2024, driven by its ability to prolong gastric retention and enhance the bioavailability of drugs with narrow absorption windows. These systems are widely preferred for antibiotics, anti-diabetic drugs, and cardiovascular medications due to their predictable release profile and compatibility with various oral formulations. The strong demand is also supported by technological advancements in floating microspheres and hydrodynamically balanced systems that ensure better therapeutic efficacy. Regulatory approvals and extensive clinical studies further validate the effectiveness of floating systems, bolstering their adoption among pharmaceutical manufacturers.

The bioadhesive drug delivery systems segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by the rising need for localized gastric drug delivery and enhanced patient compliance. Bioadhesive systems can adhere to gastric mucosa, prolonging residence time, and improving absorption of drugs that are otherwise poorly absorbed in the lower gastrointestinal tract. Their versatility in incorporating a variety of drug molecules, including peptides and proteins, makes them highly attractive for novel therapeutic applications. Growing R&D activities and increasing focus on personalized medicine are also accelerating the adoption of bioadhesive systems. These systems are particularly suitable for drugs requiring controlled release and reduced dosing frequency, which enhances patient adherence. The expanding portfolio of bioadhesive formulations by key pharmaceutical players is expected to further drive market growth.

- By Dosage Form

On the basis of dosage form, the gastroretentive drug delivery systems market is segmented into tablets, liquid, microspheres, capsules, and others. The tablet segment dominated the market in 2024 due to its ease of manufacturing, cost-effectiveness, and patient familiarity. Tablets can be engineered into floating, bioadhesive, or expandable forms, making them versatile for a wide range of drug molecules. The availability of enteric-coated and multilayered tablets further enhances their efficacy in gastric retention and controlled drug release. In addition, regulatory acceptance and extensive clinical validation of tablet-based GRDDS contribute to their strong market presence. Tablets are often preferred by healthcare providers for their convenience in prescribing and patient adherence.

The microspheres segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their unique ability to provide uniform drug release, improved stability, and higher surface area for gastric adhesion. Microspheres are particularly useful for drugs with narrow absorption windows or poor solubility, enabling better bioavailability and prolonged therapeutic effect. Advancements in polymer technology and microencapsulation techniques are enhancing the performance and safety of microsphere-based GRDDS. Microspheres are also increasingly used in combination with other gastroretentive strategies, such as floating or bioadhesive systems, further expanding their market potential. Rising investment in research and development and growing adoption in chronic disease management are expected to fuel this segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the gastroretentive drug delivery systems market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2024, driven by the preference of healthcare providers to dispense advanced drug delivery systems directly to patients under supervision. Hospitals often handle chronic and complex therapies requiring GRDDS, ensuring proper administration, monitoring, and patient adherence. The presence of specialized healthcare professionals and clinical guidance enhances the reliability and acceptance of these systems, supporting their sustained use. Regulatory and quality compliance standards in hospitals also ensure the safe use of gastroretentive formulations.

The online pharmacies segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing e-commerce penetration, growing patient awareness, and the convenience of home delivery for prescription and over-the-counter gastroretentive medications. Online platforms provide easy access to a wide range of GRDDS formulations and enable patients to compare products, read reviews, and manage recurring orders. The growth is further supported by digital healthcare initiatives, telemedicine consultations, and rising smartphone penetration, especially in emerging markets. Online pharmacies also offer subscription services and doorstep delivery, enhancing patient convenience and compliance with complex dosing schedules.

Gastroretentive Drug Delivery Systems Market Regional Analysis

- North America dominated the gastroretentive drug delivery systems market with the largest revenue share of 41.8% in 2024, attributed to advanced pharmaceutical R&D infrastructure, high adoption of innovative drug delivery technologies, and strong presence of key industry players developing novel formulations with sustained-release and bioadhesive properties

- Healthcare providers and pharmaceutical companies in the region prioritize the development and use of GRDDS to improve drug bioavailability, reduce dosing frequency, and enhance patient compliance, particularly for chronic and complex therapies

- This widespread adoption is further supported by high healthcare expenditure, regulatory support for innovative drug delivery systems, and the presence of leading pharmaceutical players, establishing gastroretentive drug delivery systems as a preferred solution for effective oral therapy in both hospital and outpatient settings

U.S. Gastroretentive Drug Delivery Systems Market Insight

The U.S. gastroretentive drug delivery systems (GRDDS) market captured the largest revenue share of 82.2% in 2024 within North America, fueled by the growing focus on advanced drug delivery technologies and patient-centric therapies. Healthcare providers and pharmaceutical companies are increasingly prioritizing gastroretentive systems for drugs with narrow absorption windows to improve bioavailability and therapeutic outcomes. The growing prevalence of chronic gastrointestinal disorders and rising adoption of controlled-release oral formulations further propel the market. Moreover, ongoing R&D initiatives and the presence of leading pharmaceutical manufacturers developing innovative floating, bioadhesive, and high-density systems significantly contribute to market expansion.

Europe Gastroretentive Drug Delivery Systems Market Insight

The Europe gastroretentive drug delivery systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of gastrointestinal diseases and the rising demand for novel oral drug delivery solutions. The region’s stringent regulatory framework ensures high-quality GRDDS formulations, which fosters trust among healthcare providers and patients. The adoption of these systems is growing across hospitals, specialty clinics, and pharmaceutical manufacturing applications. European consumers and healthcare providers also prefer formulations that enhance therapeutic efficacy and patient compliance, driving the uptake of floating and bioadhesive systems.

U.K. Gastroretentive Drug Delivery Systems Market Insight

The U.K. gastroretentive drug delivery systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising incidence of gastrointestinal disorders and demand for sustained-release oral medications. Pharmaceutical companies are increasingly focusing on innovative GRDDS formulations to improve bioavailability, reduce dosing frequency, and enhance patient adherence. The U.K.’s advanced healthcare infrastructure, supportive reimbursement policies, and growing awareness of controlled-release therapies continue to stimulate market growth. In addition, hospitals and retail pharmacies are expanding their adoption of these systems for both chronic and acute treatment regimens.

Germany Gastroretentive Drug Delivery Systems Market Insight

The Germany gastroretentive drug delivery systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investment in pharmaceutical R&D and demand for innovative oral drug delivery technologies. Germany’s focus on high-quality manufacturing standards, regulatory compliance, and advanced healthcare infrastructure promotes the adoption of GRDDS across hospitals and outpatient settings. The integration of floating, bioadhesive, and high-density systems in treatment regimens is becoming increasingly prevalent, with healthcare providers favoring formulations that enhance drug retention and absorption. The emphasis on patient-centric therapies aligns with local expectations for efficacy and safety.

Asia-Pacific Gastroretentive Drug Delivery Systems Market Insight

The Asia-Pacific gastroretentive drug delivery systems market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising prevalence of gastrointestinal disorders, rapid urbanization, and increasing healthcare expenditure in countries such as China, India, and Japan. The growing adoption of advanced oral drug delivery systems, supported by government initiatives promoting healthcare innovation, is driving market growth. Furthermore, APAC’s expanding pharmaceutical manufacturing capabilities and increasing presence of contract research organizations are enhancing the availability and affordability of GRDDS, broadening access to patients across the region.

Japan Gastroretentive Drug Delivery Systems Market Insight

The Japan gastroretentive drug delivery systems market is gaining momentum due to the country’s focus on advanced pharmaceutical technologies, high healthcare standards, and increasing prevalence of gastrointestinal and chronic diseases. The market adoption is driven by the rising number of elderly patients requiring controlled-release oral therapies. Integration of GRDDS with innovative drug formulations and adherence to stringent regulatory standards is fueling growth. Moreover, Japan’s emphasis on improving patient compliance and therapeutic outcomes is increasing the utilization of floating, bioadhesive, and high-density drug delivery systems across hospitals and pharmacies.

India Gastroretentive Drug Delivery Systems Market Insight

The India gastroretentive drug delivery systems market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding pharmaceutical manufacturing base, increasing healthcare awareness, and growing prevalence of gastrointestinal disorders. GRDDS are increasingly adopted in hospitals, retail pharmacies, and outpatient care due to their effectiveness in improving drug bioavailability and patient adherence. The push towards affordable, innovative oral drug delivery systems, along with supportive government healthcare initiatives and rising disposable income, are key factors propelling market growth in India.

Gastroretentive Drug Delivery Systems Market Share

The Gastroretentive Drug Delivery Systems industry is primarily led by well-established companies, including:

- Catalent, Inc. (U.S.)

- Lonza (Switzerland)

- Evonik Industries AG (Germany)

- Colorcon, Inc. (U.S.)

- AptarGroup, Inc. (U.S.)

- Aenova Group (Germany)

- Evotec SE (Germany)

- F. Hoffmann-La Roche AG (Switzerland)

- GSK plc (U.K.)

- Oramed Pharmaceuticals Inc. (Israel)

- Camurus AB (Sweden)

- mc2 therapeutics 2 (Denmark)

- Assertio Holdings, Inc. (U.S.)

- BASF SE (Germany)

- AbbVie Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

What are the Recent Developments in Global Gastroretentive Drug Delivery Systems Market?

- In February 2025, Evonik entered into collaborations with several biotechnology firms to develop innovative gastroretentive drug delivery systems. These partnerships focus on utilizing advanced materials and technologies to create GRDDS that enhance drug stability and release profiles

- In April 2024. Catalent announced the development of dual-mechanism gastroretentive tablets that combine floating and swelling technologies. These tablets are designed to prolong gastric residence time and provide controlled drug release, improving the bioavailability of drugs with narrow absorption windows

- In September 2024, Thermo Fisher Scientific invested USD 22 million to expand its oral solid dose (OSD) development and manufacturing capabilities at its Cincinnati, Ohio, and Bend, Oregon sites. This expansion aims to provide flexible and innovative solutions for early development challenges commonly faced by biotech and pharmaceutical companies, enhancing their ability to accelerate pre-clinical oral drug product innovation and advanced drug delivery

- In February 2024, Novo Holdings, the parent company of Novo Nordisk, announced plans to acquire Catalent's drug delivery business for USD 6.5 billion. This acquisition aims to enhance Novo Nordisk's manufacturing capabilities, particularly for its GLP-1 injectable drugs such as Wegovy and Ozempic. The deal includes the purchase of Catalent's fill-finish manufacturing sites in Italy, Belgium, and the U.S., which are crucial for the production of injection pens

- In November 2023, Lonza introduced the Capsugel Enprotect capsule platform, designed to provide enteric protection for drugs sensitive to stomach acid. These capsules are ready-to-use and eliminate the need for post-filling coating, simplifying the manufacturing process. The Enprotect capsules are particularly beneficial for delivering drugs that require targeted release in the small intestine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.