Global Gaur Gum Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

2.79 Billion

2025

2033

USD

1.53 Billion

USD

2.79 Billion

2025

2033

| 2026 –2033 | |

| USD 1.53 Billion | |

| USD 2.79 Billion | |

|

|

|

|

Guar Gum Market Size

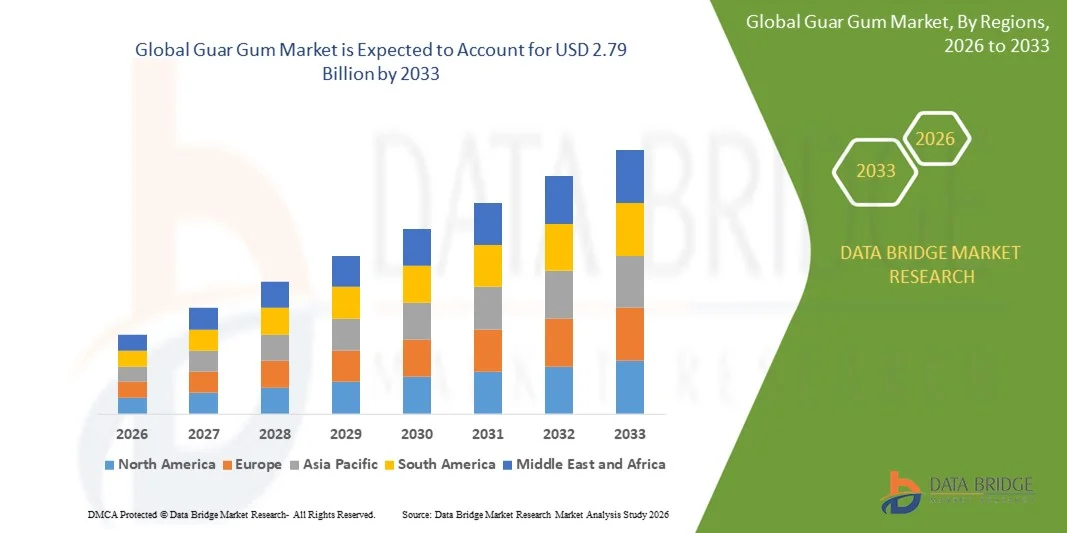

- The global guar gum market size was valued at USD 1.53 billion in 2025 and is expected to reach USD 2.79 billion by 2033, at a CAGR of 7.80% during the forecast period

- The market growth is largely fuelled by rising demand from the food and beverage industry for natural thickeners, stabilizers, and emulsifiers

- Expanding application of guar gum in oil and gas drilling activities, particularly in hydraulic fracturing, is significantly supporting market expansion

Guar Gum Market Analysis

- The market is witnessing steady growth due to its biodegradable, cost-effective, and multifunctional properties across diverse end-use industries

- Increasing preference for plant-based and clean-label ingredients is enhancing the adoption of guar gum as a natural additive in global markets

- North America dominated the guar gum market with the largest revenue share in 2025, driven by strong demand from the food processing and oil & gas industries, along with rising preference for natural and clean-label ingredients

- Asia-Pacific region is expected to witness the highest growth rate in the global guar gum market, driven by rapid growth in food processing industries, increasing industrial applications, and rising demand for natural and plant-based hydrocolloids

- The food grade segment held the largest market revenue share in 2025, driven by the extensive use of guar gum as a natural thickener, stabilizer, and emulsifier in processed foods, bakery products, and beverages. Its clean-label appeal and compatibility with gluten-free and low-fat formulations make food grade guar gum a preferred choice among food manufacturers

Report Scope and Guar Gum Market Segmentation

|

Attributes |

Guar Gum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Guar Gum Market Trends

Rise of Natural and Multi-Functional Hydrocolloids in Food and Industrial Applications

- The increasing preference for natural, plant-based hydrocolloids is transforming the guar gum market by driving its adoption as a thickener, stabilizer, and emulsifier across food, beverage, and processed food applications. Its strong water-binding capacity improves texture, viscosity, and shelf life across diverse formulations. This functional versatility helps manufacturers maintain consistent product quality while optimizing formulation efficiency

- Growing demand for clean-label and gluten-free food products is accelerating the use of guar gum as a natural alternative to synthetic additives. This trend is especially evident in bakery, dairy, sauces, and convenience foods where ingredient transparency is critical. Manufacturers benefit from simplified labeling, improved consumer trust, and compliance with evolving food safety regulations

- The versatility and cost-effectiveness of guar gum are making it attractive across industrial sectors such as oil and gas, pharmaceuticals, and personal care. Its ability to perform under varying temperature and pressure conditions enhances application flexibility. End users gain improved performance characteristics, reduced formulation costs, and alignment with sustainable production practices

- For instance, in 2023, several food processing companies in Europe reported improved texture stability and reduced formulation costs after replacing synthetic stabilizers with guar gum in ready-to-eat products. This shift supported better mouthfeel, longer shelf life, and improved processing efficiency. As a result, manufacturers also observed higher consumer acceptance and repeat demand

- While demand for guar gum is expanding, long-term growth depends on consistent raw material supply, quality standardization, and innovation in value-added guar derivatives. Continued R&D is essential to enhance solubility, viscosity control, and application-specific performance. Manufacturers focusing on customized guar solutions are better positioned to meet evolving industry requirements

Guar Gum Market Dynamics

Driver

Rising Demand From Food Processing and Oil & Gas Industries

- The growing use of guar gum in food processing as a thickening, binding, and moisture-retention agent is a major driver of market growth. Its natural origin aligns well with global trends toward healthier and minimally processed foods. In addition, its compatibility with a wide range of formulations supports consistent demand across food categories

- In the oil and gas sector, increasing drilling and hydraulic fracturing activities are driving demand for guar gum as a critical component in drilling fluids. Its superior viscosity enhancement and fluid loss control improve drilling efficiency. This results in better well performance, reduced downtime, and optimized operational costs

- Technological advancements in guar processing and modified guar gum formulations are expanding its application scope across industrial uses. Improved performance under extreme temperature and pressure conditions increases reliability in demanding environments. These advancements also support higher adoption in technically complex oilfield operations

- For instance, in 2022, oilfield service providers in North America increased guar gum consumption to improve drilling efficiency and operational stability. Enhanced fluid performance helped reduce equipment stress and improve overall productivity. This trend reinforced steady demand from the energy sector despite market volatility

- While food and energy sector demand continues to propel the market, maintaining supply stability and managing price volatility remain essential. Strategic sourcing, long-term contracts, and processing efficiencies play a key role in sustaining growth. Companies investing in supply chain resilience are better positioned for long-term expansion

Restraint/Challenge

Raw Material Price Volatility and Supply Dependence

- The guar gum market is highly dependent on agricultural output, particularly guar crop production concentrated in limited geographies. Seasonal variations and unpredictable weather conditions directly impact crop yields. This dependence creates uncertainty in raw material availability and pricing stability

- Price volatility poses challenges for manufacturers and end users, making long-term procurement planning difficult. Sudden cost fluctuations can disrupt budgeting and contract negotiations. Smaller buyers are especially affected, often delaying purchases or reducing usage during price spikes

- Supply chain disruptions and export restrictions from key producing countries can further constrain market growth. Industries requiring large and consistent guar gum volumes face risks of delayed deliveries and inconsistent quality. These challenges can limit production continuity across food and industrial sectors

- For instance, in 2023, fluctuations in guar seed production in India led to significant price instability in global markets. Food manufacturers and oilfield service companies faced increased input costs and renegotiated supply contracts. This volatility highlighted the market’s sensitivity to regional agricultural conditions

- While demand fundamentals remain strong, addressing supply risks is critical for long-term market resilience. Improved farming practices, diversification of sourcing regions, and strategic inventory management can reduce dependency risks. Stakeholders adopting integrated supply strategies are better equipped to navigate market uncertainties

Guar Gum Market Scope

The market is segmented on the basis of grade, function, and application.

- By Grade

On the basis of grade, the guar gum market is segmented into food grade, industrial grade, and pharmaceutical grade. The food grade segment held the largest market revenue share in 2025, driven by the extensive use of guar gum as a natural thickener, stabilizer, and emulsifier in processed foods, bakery products, and beverages. Its clean-label appeal and compatibility with gluten-free and low-fat formulations make food grade guar gum a preferred choice among food manufacturers.

The industrial grade segment is expected to witness steady growth from 2026 to 2033, supported by strong demand from the oil and gas sector, particularly in drilling and hydraulic fracturing applications. Industrial grade guar gum is valued for its viscosity control and friction-reducing properties, which enhance drilling efficiency and operational performance.

- By Function

On the basis of function, the guar gum market is segmented into stabilizer & emulsifier, thickening & gelling agent, binder, friction reducer, and others. The thickening & gelling agent segment accounted for the largest share in 2025, owing to guar gum’s superior water-binding capacity and ability to improve texture and consistency across food and industrial formulations.

The friction reducer segment is expected to witness steady growth from 2026 to 2033, driven by its critical role in oilfield applications. Guar gum-based friction reducers help lower pumping pressure, improve fluid flow, and enhance overall drilling efficiency, supporting increased adoption in energy operations.

- By Application

On the basis of application, the guar gum market is segmented into oil & gas, food & beverage, pharmaceuticals & cosmetics, and others. The oil & gas segment dominated the market in 2025, fuelled by the extensive use of guar gum in drilling fluids for hydraulic fracturing and well stimulation activities. Its effectiveness in viscosity enhancement and fluid loss control makes it indispensable in upstream energy operations.

The food & beverage segment is expected to witness significant growth from 2026 to 2033, driven by rising demand for natural, clean-label ingredients. Guar gum’s multifunctional benefits in improving mouthfeel, shelf life, and product stability are accelerating its adoption across processed food, dairy, and convenience food categories.

Guar Gum Market Regional Analysis

- North America dominated the guar gum market with the largest revenue share in 2025, driven by strong demand from the food processing and oil & gas industries, along with rising preference for natural and clean-label ingredients

- Manufacturers in the region highly value guar gum for its thickening, stabilizing, and friction-reducing properties, supporting its widespread use across processed foods, pharmaceuticals, and drilling applications

- This strong adoption is further supported by advanced industrial infrastructure, high consumption of convenience foods, and steady energy sector activity, positioning guar gum as a key functional ingredient across multiple end-use sectors

U.S. Guar Gum Market Insight

The U.S. guar gum market captured the largest revenue share in 2025 within North America, fueled by robust demand from food manufacturers and sustained oilfield activities. The growing focus on clean-label food formulations and gluten-free products is increasing the use of guar gum as a natural hydrocolloid. In addition, steady drilling and hydraulic fracturing operations continue to support consumption of guar gum in oilfield applications, reinforcing market growth.

Europe Guar Gum Market Insight

The Europe guar gum market is expected to witness steady growth from 2026 to 2033, driven by rising demand for natural food additives and stringent regulations limiting synthetic ingredients. Increasing consumption of processed and ready-to-eat foods is supporting guar gum usage as a stabilizer and thickener. The pharmaceutical and cosmetics industries are also contributing to demand due to its binding and texture-enhancing properties.

U.K. Guar Gum Market Insight

The U.K. guar gum market is expected to grow at a notable pace from 2026 to 2033, supported by increasing adoption of clean-label and plant-based food products. Food manufacturers are increasingly incorporating guar gum to improve texture and shelf life while maintaining simple ingredient labels. Demand from the pharmaceutical and personal care sectors further supports market expansion.

Germany Guar Gum Market Insight

The Germany guar gum market is expected to register consistent growth from 2026 to 2033, driven by strong food processing activities and a growing preference for natural functional ingredients. Germany’s advanced manufacturing base and focus on high-quality formulations promote the use of guar gum in food, pharmaceutical, and industrial applications. The emphasis on product performance and sustainability continues to support market adoption.

Asia-Pacific Guar Gum Market Insight

The Asia-Pacific guar gum market is expected to witness the fastest growth rate from 2026 to 2033, driven by expanding food processing industries, rising population, and increasing industrial applications. Growing demand for processed foods and rising oil & gas exploration activities are accelerating guar gum consumption. The region also benefits from proximity to major guar-producing countries, supporting supply availability.

Japan Guar Gum Market Insight

The Japan guar gum market is expected to witness steady growth from 2026 to 2033 due to rising demand for functional food ingredients and pharmaceutical excipients. Japanese manufacturers emphasize quality, consistency, and functionality, driving the use of guar gum in food, healthcare, and specialty applications. Increasing demand for texture-modified and health-oriented foods further supports market growth.

China Guar Gum Market Insight

The China guar gum market accounted for a significant revenue share in Asia Pacific in 2025, attributed to rapid growth in food processing, pharmaceuticals, and industrial applications. China’s expanding manufacturing sector and increasing consumption of processed foods are boosting guar gum demand. In addition, rising oilfield activities and growing focus on natural additives continue to propel market expansion.

Guar Gum Market Share

The Guar Gum industry is primarily led by well-established companies, including:

• Cemoi Chocolatier (France)

• Republica del Cacao (Ecuador)

• Nestlé S.A. (Switzerland)

• Mars Incorporated (U.S.)

• Fuji Oil Holdings Inc. (Japan)

• Guittard Chocolate Co. (U.S.)

• Ghirardelli Chocolate Co. (U.S.)

• Valrhona Inc. (France)

• Barry Callebaut AG (Switzerland)

• Alpezzi Chocolate SA de CV (Mexico)

• Kerry Group Plc (Ireland)

Latest Developments in Global Guar Gum Market

- In December 2022, Nexira introduced a new product launch under its ‘Naltive’ brand, expanding its portfolio of natural texturizers. The development focuses on offering efficient hydrocolloid solutions such as tara gum, locust bean gum, and guar specialties tailored for plant-based and dairy applications. This launch is aimed at supporting clean-label formulations and improving texture and stability in food products. The initiative strengthens Nexira’s positioning in the natural ingredients segment. It also supports growing demand for multifunctional hydrocolloids in food innovation. Overall, the launch enhances competition and innovation within the guar gum and hydrocolloids market

- In April 2022, Solvay entered into a strategic partnership with Procter & Gamble as part of its sustainable guar farming initiative. This collaboration is designed to expand farmer education programs, with a strong focus on empowering women farmers through training in good agricultural practices. The initiative aims to improve guar crop quality, yield consistency, and supply chain transparency. By strengthening sustainable sourcing, Solvay enhances long-term raw material availability. The partnership also reinforces sustainability standards across the guar gum value chain. This development positively impacts market stability and responsible sourcing practices

- In July 2021, TechnoServe received industry recognition from the American Chemistry Council for its sustainable guar initiative. The development highlights TechnoServe’s role in promoting responsible farming practices across the guar supply chain. The initiative focuses on improving farmer livelihoods, enhancing crop productivity, and ensuring sustainable raw material sourcing. Recognition from a leading industry body strengthens credibility and adoption of sustainable guar programs. This acknowledgment encourages broader industry participation in sustainable sourcing models. As a result, it supports long-term supply resilience and positive market perception of guar-based products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gaur Gum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gaur Gum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gaur Gum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.