Global Gcc Air Purifiers Market

Market Size in USD Million

CAGR :

%

USD

302.35 Million

USD

1,087.40 Million

2025

2033

USD

302.35 Million

USD

1,087.40 Million

2025

2033

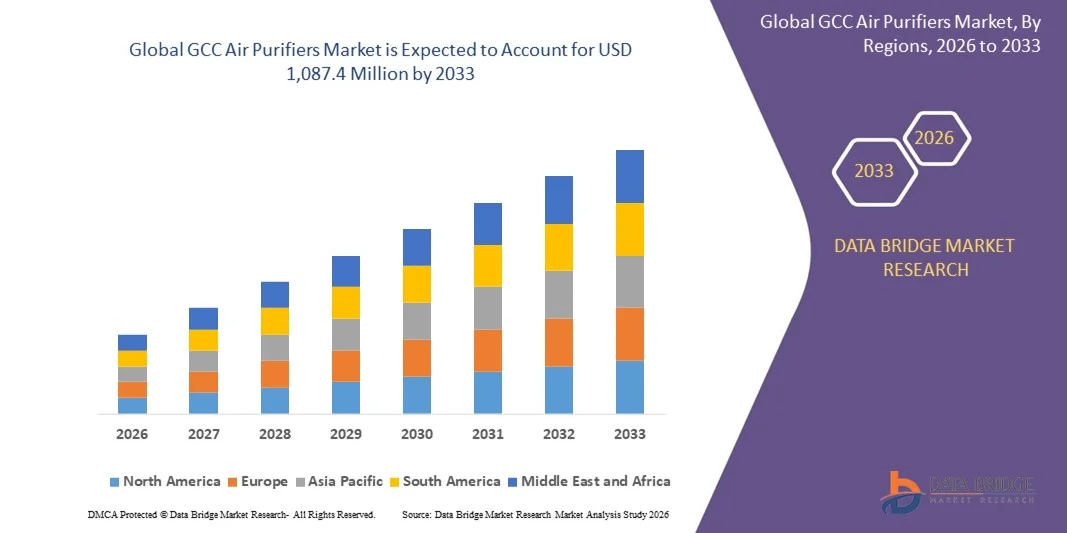

| 2026 –2033 | |

| USD 302.35 Million | |

| USD 1,087.40 Million | |

|

|

|

|

GCC Air Purifiers Market Size

- The GCC air purifiers market size was valued at USD 302.35 million in 2025 and is expected to reach USD 1,087.4 million by 2033, at a CAGR of 17.35% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of air pollution and dust in urban areas, rising awareness regarding indoor air quality, and growing demand for smart and energy-efficient air purification solutions

- The expanding residential and commercial construction sectors, combined with higher disposable incomes and lifestyle changes, are also driving the adoption of air purifiers across the GCC region

GCC Air Purifiers Market Analysis

- The market is witnessing strong demand from both residential and commercial segments, driven by health-conscious consumers and regulatory emphasis on air quality standards

- Increasing adoption of smart and connected air purifiers, integrated with mobile applications and voice-controlled systems, is enhancing user convenience and boosting market penetration

- Saudi Arabia dominated the GCC air purifiers market with the largest revenue share in 2025, driven by rising awareness of indoor air quality and increasing prevalence of respiratory ailments. Consumers are increasingly prioritizing air purification systems for both residential and commercial applications

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the GCC air purifiers market due to rising disposable incomes, increasing health consciousness, rapid urbanization, and strong demand for advanced smart air purifiers with IoT connectivity and multi-stage filtration systems

- The residential segment held the largest market revenue share in 2025 driven by increasing awareness among homeowners regarding indoor air quality and health benefits. Residential air purifiers are widely used to reduce allergens, dust, smoke, and VOCs, making them a preferred choice for families and individuals in urban areas

Report Scope and GCC Air Purifiers Market Segmentation

|

Attributes |

GCC Air Purifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

• Alhokair Fashion Retail (Saudi Arabia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

GCC Air Purifiers Market Trends

Rise of Smart and Advanced Air Purifiers

- The growing adoption of smart and advanced air purifiers is transforming the GCC air purifiers market by enabling real-time monitoring and filtration of indoor air pollutants. The portability, connectivity, and efficiency of these devices allow for immediate air quality improvement in homes, offices, and commercial spaces, resulting in healthier indoor environments and reduced respiratory risks. These systems are increasingly integrated with sensors that detect particulate matter, VOCs, and humidity, providing automatic adjustment of filtration levels for optimal performance

- The high demand for energy-efficient and IoT-enabled air purifiers is accelerating the adoption of connected devices with mobile app control and voice assistant integration. These systems are particularly effective in urban areas with high pollution levels, helping reduce exposure to allergens, dust, and VOCs. Manufacturers are also developing multi-functional units that combine air purification with humidification and cooling, enhancing overall indoor comfort

- The affordability and ease of use of modern air purifiers are making them attractive for both residential and commercial applications. Users benefit from enhanced air filtration without complex installation or maintenance, which ultimately improves comfort and wellbeing. Regular filter replacement notifications, compact designs, and low-noise operation further encourage frequent use and sustained adoption

- For instance, in 2023, several offices and residential complexes in major GCC cities reported significant improvement in indoor air quality after deploying HEPA and activated carbon-based air purifiers. These systems helped reduce airborne allergens and pollutants while lowering the incidence of respiratory complaints. Users also reported improved sleep quality, reduced allergy symptoms, and enhanced productivity in office environments

- While smart and advanced air purifiers are driving adoption, their impact depends on continued innovation, energy efficiency, and affordability. Manufacturers must focus on localized product development and deployment strategies to fully capitalize on this growing demand. Collaboration with health organizations, inclusion of real-time air quality alerts, and integration with smart home ecosystems can further strengthen market penetration

GCC Air Purifiers Market Dynamics

Driver

Rising Awareness About Indoor Air Quality and Health Concerns

- Increasing concerns about indoor air pollution and its impact on health are driving both consumers and businesses to adopt air purifiers as a primary defense mechanism. Pollutants such as dust, smoke, allergens, and VOCs are prompting a strong focus on air quality management and preventive health. The rising prevalence of respiratory diseases and seasonal allergies is reinforcing the urgency for clean indoor air solutions

- Residents and commercial operators are becoming aware of the benefits of clean indoor air, including reduced respiratory issues, improved productivity, and enhanced comfort. This awareness has led to regular use of air purifiers in homes, offices, and healthcare facilities. Consumers are also showing interest in devices with air quality indicators, smart alerts, and energy-efficient operations to balance performance with sustainability

- Government initiatives and public awareness campaigns have further strengthened market growth. From air quality monitoring programs to health advisory campaigns, supportive measures are helping consumers adopt high-performance air purifiers. Collaboration between municipalities, schools, and businesses is encouraging wider acceptance and educational outreach on indoor air quality management

- For instance, in 2022, several GCC cities introduced air quality alert systems and recommended indoor air purifiers for homes and offices, boosting demand for advanced filtration and smart devices. Adoption has increased in corporate offices, hospitals, and educational institutions, driven by regulatory compliance and workplace safety programs

- While awareness and supportive frameworks are driving market growth, there is still a need to improve affordability, enhance energy efficiency, and ensure product availability to sustain adoption. Companies focusing on cost-effective solutions, smart connectivity, and robust after-sales services are more likely to capture a larger market share

Restraint/Challenge

High Cost of Advanced Air Purifiers and Limited Adoption in Certain Segments

- The high price point of advanced air purifiers such as HEPA, activated carbon, and smart IoT-enabled systems makes them less accessible for small households and budget-conscious consumers. Premium devices are often preferred in commercial spaces or high-income residential segments, limiting widespread usage. The upfront investment, coupled with periodic filter replacement costs, continues to be a barrier for mid-income consumers

- In some areas, there is a lack of consumer knowledge regarding device maintenance, filter replacement, and proper usage, which can reduce effectiveness and adoption. The absence of reliable after-sales support further restricts market penetration. Users may abandon or underutilize devices if they are unaware of optimal operating conditions or maintenance schedules

- Supply chain challenges and limited availability of high-end models in certain urban and suburban areas also hamper adoption. Consumers often rely on basic or low-cost purifiers, which may not provide optimal air filtration. Seasonal demand fluctuations and logistical constraints during peak pollution periods further exacerbate accessibility issues

- For instance, in 2023, market surveys revealed that over 60% of households in mid-income urban regions did not use advanced air purifiers, citing high costs and maintenance requirements as primary barriers. Commercial buyers also reported delays in procuring smart devices due to limited local inventory and distribution bottlenecks

- While product technologies continue to advance, addressing cost, awareness, and accessibility challenges remains crucial. Market stakeholders must focus on affordable solutions, energy-efficient designs, and localized distribution to unlock the full potential of the GCC air purifiers market. Partnerships with local retailers, financing options, and educational campaigns can help increase adoption across broader segments

GCC Air Purifiers Market Scope

The market is segmented on the basis of end-user and technology

- By End-User

On the basis of end-user, the GCC air purifiers market is segmented into commercial and residential. The residential segment held the largest market revenue share in 2025 driven by increasing awareness among homeowners regarding indoor air quality and health benefits. Residential air purifiers are widely used to reduce allergens, dust, smoke, and VOCs, making them a preferred choice for families and individuals in urban areas.

The commercial segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption in offices, hospitals, schools, and hospitality sectors. Commercial air purifiers offer higher capacity filtration, multi-functional units, and IoT-enabled monitoring, making them suitable for large spaces and ensuring healthier environments for employees, visitors, and patients.

- By Technology

On the basis of technology, the GCC air purifiers market is segmented into High-Efficiency Particulate Air (HEPA), electrostatic precipitator, ion & ozone generators, activated carbon, and other technologies. The HEPA segment held the largest market share in 2025 due to its superior ability to remove fine particles, allergens, and airborne pathogens from indoor air, making it highly effective for both residential and commercial applications.

The activated carbon segment is expected to register the fastest growth from 2026 to 2033, driven by its efficiency in removing odors, VOCs, and gaseous pollutants. Increasing concerns about chemical emissions from furniture, paints, and cleaning agents are boosting demand for activated carbon-based purification systems across homes and commercial spaces.

GCC Air Purifiers Market Regional Analysis

- Saudi Arabia dominated the GCC air purifiers market with the largest revenue share in 2025, driven by rising awareness of indoor air quality and increasing prevalence of respiratory ailments. Consumers are increasingly prioritizing air purification systems for both residential and commercial applications

- The growing demand for smart, energy-efficient, and low-maintenance purifiers further propels market growth

- Moreover, government initiatives aimed at improving urban air quality and public health are boosting adoption across households and institutions

U.A.E. Air Purifiers Market Insight

The U.A.E. air purifiers market is expected to witness the fastest growth rate from 2026 to 2033, fueled by a combination of high disposable incomes, technological advancements, and rising health consciousness. Urban populations are increasingly investing in smart air purification devices equipped with HEPA and activated carbon filters. The market is also witnessing significant adoption in commercial spaces, hospitals, and educational institutions, contributing to overall market expansion.

Qatar Air Purifiers Market Insight

The Qatar air purifiers market is expected to grow rapidly from 2026 to 2033, driven by government initiatives promoting sustainable and healthy living environments. Increasing awareness about allergens, dust, and air pollutants is encouraging households and businesses to invest in high-performance air purifiers. The adoption of smart, connected devices integrated with mobile apps and IoT platforms is further stimulating market growth.

Kuwait Air Purifiers Market Insight

The Kuwait air purifiers market is projected to witness strong growth from 2026 to 2033, supported by rising urbanization, frequent dust storms, and growing concern for indoor air quality. Consumers are increasingly seeking purifiers with multi-stage filtration, air quality sensors, and low energy consumption. The market is also witnessing adoption in commercial and hospitality sectors to provide healthier indoor environments.

Oman Air Purifiers Market Insight

The Oman air purifiers market is expected to grow steadily from 2026 to 2033, driven by increasing awareness of respiratory health and rising disposable incomes. The adoption of energy-efficient and smart air purifiers, capable of monitoring air quality and automatically adjusting performance, is boosting consumer preference. Both residential and commercial segments are contributing to market expansion.

Bahrain Air Purifiers Market Insight

The Bahrain air purifiers market is projected to witness a robust growth rate from 2026 to 2033, owing to the rising demand for advanced indoor air quality solutions. Consumers are increasingly prioritizing purifiers with HEPA filters, low noise levels, and compact designs suitable for homes and offices. Increasing public awareness campaigns about air pollution and health impacts are further enhancing market penetration across the region.

GCC Air Purifiers Market Share

The GCC Air Purifiers industry is primarily led by well-established companies, including:

• Alhokair Fashion Retail (Saudi Arabia)

• Nayomi (Saudi Arabia)

• RedTag Fashion (Saudi Arabia)

• Landmark Group (Max / Centrepoint) (U.A.E.)

• Apparel Group (U.A.E.)

• Chalhoub Group (U.A.E.)

• Splash Fashions (U.A.E.)

• Alshaya Group (Kuwait)

• Debenhams Kuwait (Kuwait)

• Liwa Trading Enterprises (U.A.E.)

• Lulu Group International (U.A.E.)

• Al Meera Consumer Goods Company (Qatar)

• Al Nasser Group (Qatar)

• Khimji Ramdas (Oman)

• Jawad Business Group (Bahrain)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.