Global Geographic Information System Gis Software Market

Market Size in USD Billion

CAGR :

%

USD

10.67 Billion

USD

21.11 Billion

2024

2032

USD

10.67 Billion

USD

21.11 Billion

2024

2032

| 2025 –2032 | |

| USD 10.67 Billion | |

| USD 21.11 Billion | |

|

|

|

|

Geographic Information System (GIS) Software Market Size

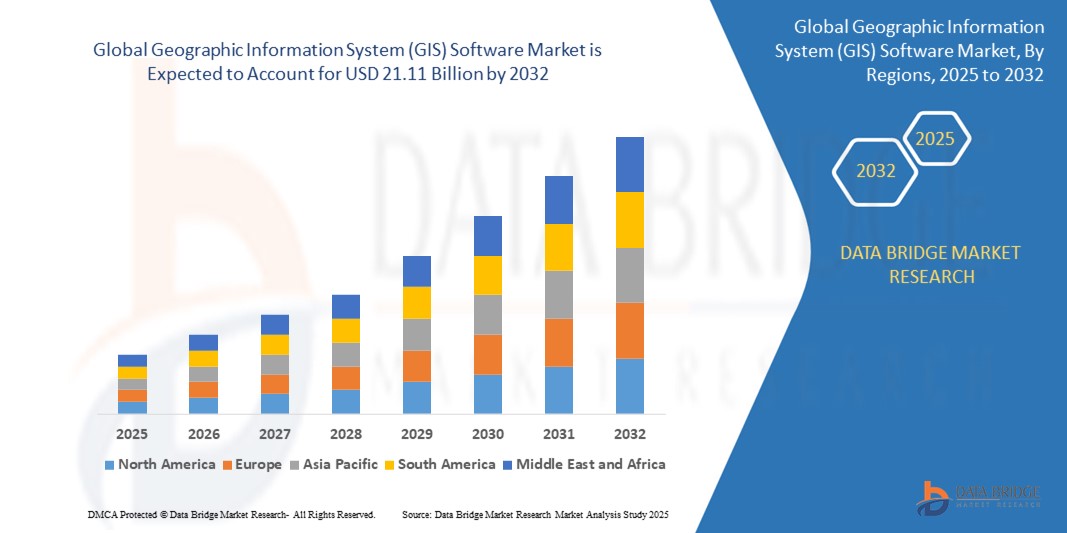

- The global Geographic Information System (GIS) Software market size was valued at USD 10.67 Billion in 2024 and is expected to reach USD 21.11 Billion by 2032 at a CAGR of 8.9% during the forecast period

- The process of site selection land acquisition planning designing visualizing building project management operations and reporting are all aided by geographic information system (GIS) software for smart cities. The geographic information system (GIS) solutions are used in urban planning by experts to better properly analyze model and visualize places. By processing geospatial data from satellite imaging aerial photography and remote sensors geographic information system (GIS) software systems offer a comprehensive perspective of the land and infrastructure.

Geographic Information System (GIS) Software Market Analysis

- A software application called geographic information is used to evaluate produce maintain and map various sorts of data. By combining location data with various descriptive data types such as demographic data it also connects to the map. Analyzing interpreting and visualizing geographic data to identify trends patterns and relevant investments is now possible thanks to technology. Users can better understand relationships trends and spatial context via GIS. Recently mapping has become this technology's most significant role.

- The process of site selection land acquisition planning designing visualizing building project management operations and reporting are all aided by geographic information system (GIS) software for smart cities. The geographic information system (GIS) solutions are used in urban planning by experts to better properly analyze model and visualize places.

- North America dominates the Geographic Information System (GIS) Software market with the largest revenue share of 46.01% in 2025 driven by its advanced technological infrastructure widespread adoption of GIS applications in urban planning defense and environmental management and strong government support.

- Asia-Pacific is expected to be the fastest growing region in the Geographic Information System (GIS) Software market during the forecast period fueled by rapid urbanization increased investments in smart city projects and growing demand for location-based services across sectors like agriculture and transportation.

- The Software segment is expected to dominate the market with a market share of 74.6% owing to the rising adoption of cloud-based GIS solutions increasing integration with AI and IoT technologies and growing demand for spatial data analytics across industries..

Report Scope and Geographic Information System (GIS) Software Market Segmentation

|

Attributes |

Geographic Information System (GIS) Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value growth rate segmentation geographical coverage and major players the market reports curated by the Data Bridge Market Research also include import export analysis production capacity overview production consumption analysis price trend analysis climate change scenario supply chain analysis value chain analysis raw material/consumables overview vendor selection criteria PESTLE Analysis Porter Analysis and regulatory framework. |

Geographic Information System (GIS) Software Market Trends

“Increasing Integration of Artificial Intelligence in GIS”

- The integration of artificial intelligence (AI) in GIS software is transforming geospatial data analysis by enabling real-time processing, predictive modeling, and automated mapping. AI enhances spatial decision-making by identifying patterns, anomalies, and trends that would be difficult to detect manually.

- Companies like Esri and Trimble are leveraging AI in their GIS platforms to deliver smarter, more efficient geospatial solutions. For instance, Esri’s AI-enabled ArcGIS tools allow real-time object detection in satellite imagery, improving disaster response and urban planning accuracy.

- AI technologies are also enabling dynamic, real-time customization of GIS applications to suit specific user needs. This is particularly beneficial in urban development and infrastructure projects, where tailored mapping and simulations help planners make informed, data-driven decisions.

- Machine learning algorithms are increasingly being embedded in GIS software to analyze massive geospatial datasets and predict land-use changes, traffic congestion, or environmental risks. This predictive capability reduces manual data processing and enhances the precision of decision-making processes.

Geographic Information System (GIS) Software Market Dynamics

Driver

““Increasing Demand for Automation in Spatial Data Management”

- A major driver of the GIS software market is the rising demand for automation in spatial data collection, management, and analysis. Industries across sectors are investing in GIS to improve operational efficiency, accuracy, and data-driven decision-making.

- The integration of automation, AI, and machine learning with GIS platforms is revolutionizing how organizations visualize and analyze spatial information. For example, Hexagon AB uses automated GIS mapping for real-time infrastructure monitoring and urban development planning.

- GIS-based automation enables quicker environmental assessments, infrastructure modeling, and land-use planning. Municipal governments and transport authorities are automating these tasks to save time and improve accuracy in public service delivery.

- The increasing complexity of spatial data and the need for high-resolution analytics are boosting demand for advanced GIS platforms. Sectors like utilities and agriculture use GIS for precision asset tracking and resource allocation, reducing costs and improving service delivery.

- GIS solutions also contribute to sustainability goals by minimizing environmental impacts through efficient land and resource management. For instance, Trimble’s GIS solutions support smart irrigation and crop monitoring systems to reduce water waste and enhance agricultural productivity.

Restraint/Challenge

““High Upfront Cost and Integration Complexity”

- A significant restraint in the GIS software market is the high initial investment required for software licenses, specialized hardware, and skilled personnel. This barrier is particularly challenging for small and mid-sized organizations with limited IT budgets.

- For instance, small municipalities or local planning offices often struggle to afford the latest GIS platforms and ongoing software updates. Without sufficient funding, they may rely on outdated tools, reducing the accuracy and efficiency of spatial analysis.

- Integration with legacy IT systems remains a challenge, as many organizations face difficulties aligning GIS platforms with their existing data structures. This complexity can delay implementation and raise operational costs.

- The steep learning curve for GIS tools further complicates adoption. Organizations often need to invest in workforce training, which can temporarily affect productivity. For example, government departments implementing advanced GIS systems have reported delays due to extensive staff onboarding requirements.

- Additionally, data accuracy and standardization remain challenges. Disparate data sources and varying spatial formats often require significant preprocessing, which adds time and cost to GIS projects, especially in resource-constrained environments.

Geographic Information System (GIS) Software Market Scope

The market is segmented on the battery type component, function and end-user..

|

Segmentation |

Sub-Segmentation |

|

By Components |

|

|

By Function |

|

|

By End-User |

|

Geographic Information System (GIS) Software Market Scope

The market is segmented on the components organization size deployment type and industry vertical.

- By Components

On the basis of components, the Geographic Information System (GIS) Software market is segmented into Software, Hardware. The Software segment dominates the largest market revenue share of 74.6% in 2025. The software segment leads GIS market growth due to rising adoption of cloud-based GIS platforms, AI-driven geospatial analytics, and real-time data processing capabilities. Industries leverage these tools for smarter decision-making, infrastructure planning, and environmental monitoring, boosting efficiency and accuracy in spatial operations.

The Hardware segment is anticipated to witness the fastest growth rate of 18.7% from 2025 to 2032. GIS hardware, including GPS receivers, scanners, and drones, is essential for collecting high-quality geospatial data. Increasing use of mobile GIS devices and aerial mapping tools across sectors like defense, construction, and agriculture is driving demand for precise, durable, and field-ready hardware solutions.

- By Function

On the basis of function the Geographic Information System (GIS) Software market is segmented into mapping, surveying, telematics navigation, location based services. The mapping held the largest market revenue share in 2025.Mapping applications drive GIS market adoption by enabling detailed visual representation of spatial data for urban planning, disaster management, and environmental assessment. Governments and enterprises rely on GIS-based maps to optimize resource allocation, improve infrastructure, and make data-backed policy and business decisions.

The surveying segment is expected to witness the fastest CAGR from 2025 to 2032. Surveying remains a core GIS function, vital for land management, infrastructure development, and construction. Technological advancements like LiDAR integration and drone-based surveying are improving accuracy and reducing manual effort, expanding GIS adoption across engineering, real estate, and public works projects worldwide.

- By End User

On the basis of end user the Geographic Information System (GIS) Software market is segmented into agriculture, oil and gas, construction, mining, transportation, utilities, others. The agriculture held the largest market revenue share in 2025 and it is expected to witness the fastest CAGR from 2025 to 2032.. GIS in agriculture is revolutionizing precision farming by enabling real-time monitoring of soil health, crop patterns, and irrigation systems. Farmers use spatial data to optimize inputs, reduce waste, and boost yield, driving adoption of GIS tools in both commercial and small-scale farming.

Geographic Information System (GIS) Software Market Regional Analysis

- North America dominates the Geographic Information System (GIS) Software market with the largest revenue share of 46.01% in 2024 North America leads the GIS software market due to widespread adoption across government, environmental, and utility sectors. Investments in smart infrastructure, disaster management, and defense applications, along with robust tech ecosystems, drive continuous innovation and expansion in GIS technology deployment.

U.S. Geographic Information System (GIS) Software Market Insight

The U.S. Geographic Information System (GIS) Software market captured the largest revenue share of 71.2% within North America in 2025 The U.S. dominates the GIS market through federal investments in smart city programs, national security, and environmental monitoring. Agencies like FEMA and the USGS heavily rely on GIS, while private sectors use it for logistics, utilities, and real estate development.

Europe Geographic Information System (GIS) Software Market Insight

The Europe Geographic Information System (GIS) Software market is projected to expand at a substantial CAGR throughout the forecast period Europe’s GIS market is driven by urban digitization, transportation planning, and stringent environmental regulations. Integration of GIS in climate change modeling, energy efficiency projects, and public health initiatives supports regional demand, particularly in sustainability-focused infrastructure development and resource management.

Germany Geographic Information System (GIS) Software Market Insight

Germany is rapidly adopting GIS for urban mobility, utility planning, and environmental engineering. As a technology-driven economy, Germany emphasizes smart manufacturing and industrial mapping, integrating GIS with IoT and automation systems to enhance planning, monitoring, and operational efficiency.

France Geographic Information System (GIS) Software Market Insight

The France Geographic Information System (GIS) Software market is expected to expand at a considerable CAGR during the forecast period France’s GIS software market is growing due to investments in regional planning, smart city initiatives, and renewable energy management. Government support and academic collaborations promote spatial data.

Asia-Pacific Geographic Information System (GIS) Software Market Insight

The Asia-Pacific Geographic Information System (GIS) Software market is poised to grow at the fastest CAGR of over 25.1% in 2025 Asia-Pacific is the fastest-growing GIS market, fueled by rapid urbanization, infrastructure expansion, and increased demand for spatial intelligence. Government smart city initiatives, growing agriculture modernization, and technology integration in transportation and utilities boost regional GIS software adoption and innovation.

Japan Geographic Information System (GIS) Software Market Insight

Japan leverages GIS for earthquake preparedness, infrastructure monitoring, and population management. High urban density and aging infrastructure drive demand for geospatial analytics. GIS also supports precision agriculture and efficient logistics planning in Japan’s technologically advanced but resource-constrained environments.

China Geographic Information System (GIS) Software Market Insight

The China Geographic Information System (GIS) Software market accounted for the largest market revenue share in Asia Pacific in 2025 China’s GIS market is expanding due to large-scale investments in smart cities, environmental management, and national infrastructure projects. Government-led digital initiatives and rising private sector usage in agriculture, energy, and urban planning are accelerating adoption of domestic and international GIS platforms.

Geographic Information System (GIS) Software Market Share

The Geographic Information System (GIS) Software industry is primarily led by well-established companies including:

- Environmental Systems Research Institute Inc. (Esri) (U.S.)

- Hexagon (Sweden)

- Pitney Bowes Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Trimble Inc. (U.S.)

- Topcon (Japan)

- Hi-Target. (China)

- BENTLEY SYSTEMS INCORPORATED (U.S.)

- Caliper Corporation (U.S.)

- Computer Aided Development Corporation Limited (Cadcorp) (U.K.)

- SuperMap Software Co. Ltd. (China)

- L3Harris Technologies Inc. (U.S.) and

- Maxar Technologies (U.S.).

Latest Developments in Global Geographic Information System (GIS) Software Market

- In July 2024, Esri and Trimble deepened their collaboration to enhance GIS and infrastructure management solutions. This initiative integrates Trimble's high-accuracy geospatial field systems with Esri's ArcGIS software, aiming to improve asset lifecycle management and support sustainable infrastructure planning.

- On October 15, 2024, Esri and Autodesk announced an enhanced integration, incorporating Esri's geospatial reference data into Autodesk Forma. This collaboration aims to transform early design and planning stages for architecture, engineering, construction, and operations professionals by providing cohesive spatial data and analytics

- In June 2022, Hexagon, a multibillion-dollar market leader in sensor, software, and digital reality solutions, is supporting start-ups to boost productivity and ESG. Hexagon Manufacturing Intelligence Division awarded SmartParts and RIIICO recognition. The manufacturing sector's efficiency and sustainability will rise thanks to the open innovation platform's assistance in scaling startups and expanding connectivity with top-tier businesses.

- In June 2022, Construct Helix was introduced by Bentley Acceleration Initiatives, the company's internal incubator for strategic investments. Bentley Systems is a provider of infrastructure engineering software. By offering SaaS solutions that will enable a connected data environment, it is specifically designed to digitalize the flow of construction project workflows.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW AND INDUSTRY TRENDS

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 TECHNOLOGICAL TRENDS

5.2 CASE STUDIES

5.3 PORTER ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.5 REGULATORY IMPLICATIONS

6 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY FUNCTION

6.1 OVERVIEW

6.2 DATA IMPORT AND EXPORT

6.3 DATA VISUALIZATION

6.4 DATA MANAGEMENT

6.5 3D MODELLING

6.6 MAP CREATION

6.7 DATA ANALYSIS

6.7.1 BY TYPE

6.7.1.1. SPATIAL QUERYING

6.7.1.2. SPATIAL STATISTICS

6.7.1.3. NETWORK ANALYSIS

6.7.1.4. TERRAIN ANALYSIS

6.7.1.5. IMAGE ANALYSIS

6.7.1.6. 3D ANALYSIS

6.7.1.7. TEMPORAL ANALYSIS

6.8 GEOCODING

6.9 OTHERS

7 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY DEPLOYMENT TYPE

7.1 OVERVIEW

7.2 DESKTOP GIS

7.3 MOBILE GIS

7.4 SERVER GIS

7.5 DEVELOPER GIS

7.6 ENTERPRISE GIS

7.7 OTHERS

8 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY MODEL

8.1 OVERVIEW

8.2 STANDALONE

8.2.1 BY DEPLOYMENT TYPE

8.2.1.1. DESKTOP GIS

8.2.1.2. MOBILE GIS

8.2.1.3. SERVER GIS

8.2.1.4. DEVELOPER GIS

8.2.1.5. ENTERPRISE GIS

8.2.1.6. OTHERS

8.3 INTEGRATED

8.3.1 BY DEPLOYMENT TYPE

8.3.1.1. DESKTOP GIS

8.3.1.2. MOBILE GIS

8.3.1.3. SERVER GIS

8.3.1.4. DEVELOPER GIS

8.3.1.5. ENTERPRISE GIS

8.3.1.6. OTHERS

9 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY DATA TYPE

9.1 OVERVIEW

9.2 VECTOR DATA

9.3 RASTER DATA

9.4 TABULAR DATA

9.5 3D DATA

9.6 TEMPORAL DATA

9.7 OTHERS

10 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 URBAN PLANNING

10.3 ENVIRONMENTAL MANAGEMENT

10.4 NATURAL RESOURCE MANAGEMENT

10.5 EMERGENCY RESPONSE

10.6 TRANSPORTATION PLANNING

10.7 MARKET ANALYSIS

11 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 IT & TELECOM

11.2.1 BY FUNCTION

11.2.1.1. DATA IMPORT AND EXPORT

11.2.1.2. DATA VISUALIZATION

11.2.1.3. DATA MANAGEMENT

11.2.1.4. 3D MODELLING

11.2.1.5. MAP CREATION

11.2.1.6. DATA ANALYSIS

11.2.1.7. GEOCODING

11.2.1.8. OTHERS

11.3 ENERGY & UTILITIES

11.3.1 BY FUNCTION

11.3.1.1. DATA IMPORT AND EXPORT

11.3.1.2. DATA VISUALIZATION

11.3.1.3. DATA MANAGEMENT

11.3.1.4. 3D MODELLING

11.3.1.5. MAP CREATION

11.3.1.6. DATA ANALYSIS

11.3.1.7. GEOCODING

11.3.1.8. OTHERS

11.4 AEROSPACE & DEFENCE

11.4.1 BY FUNCTION

11.4.1.1. DATA IMPORT AND EXPORT

11.4.1.2. DATA VISUALIZATION

11.4.1.3. DATA MANAGEMENT

11.4.1.4. 3D MODELLING

11.4.1.5. MAP CREATION

11.4.1.6. DATA ANALYSIS

11.4.1.7. GEOCODING

11.4.1.8. OTHERS

11.5 OIL & GAS

11.5.1 BY FUNCTION

11.5.1.1. DATA IMPORT AND EXPORT

11.5.1.2. DATA VISUALIZATION

11.5.1.3. DATA MANAGEMENT

11.5.1.4. 3D MODELLING

11.5.1.5. MAP CREATION

11.5.1.6. DATA ANALYSIS

11.5.1.7. GEOCODING

11.5.1.8. OTHERS

11.6 GOVERNMENT

11.6.1 BY FUNCTION

11.6.1.1. DATA IMPORT AND EXPORT

11.6.1.2. DATA VISUALIZATION

11.6.1.3. DATA MANAGEMENT

11.6.1.4. 3D MODELLING

11.6.1.5. MAP CREATION

11.6.1.6. DATA ANALYSIS

11.6.1.7. GEOCODING

11.6.1.8. OTHERS

11.7 CONSTRUCTION & REAL ESTATE

11.7.1 BY FUNCTION

11.7.1.1. DATA IMPORT AND EXPORT

11.7.1.2. DATA VISUALIZATION

11.7.1.3. DATA MANAGEMENT

11.7.1.4. 3D MODELLING

11.7.1.5. MAP CREATION

11.7.1.6. DATA ANALYSIS

11.7.1.7. GEOCODING

11.7.1.8. OTHERS

11.8 MINING

11.8.1 BY FUNCTION

11.8.1.1. DATA IMPORT AND EXPORT

11.8.1.2. DATA VISUALIZATION

11.8.1.3. DATA MANAGEMENT

11.8.1.4. 3D MODELLING

11.8.1.5. MAP CREATION

11.8.1.6. DATA ANALYSIS

11.8.1.7. GEOCODING

11.8.1.8. OTHERS

11.9 AGRICULTURE

11.9.1 BY FUNCTION

11.9.1.1. DATA IMPORT AND EXPORT

11.9.1.2. DATA VISUALIZATION

11.9.1.3. DATA MANAGEMENT

11.9.1.4. 3D MODELLING

11.9.1.5. MAP CREATION

11.9.1.6. DATA ANALYSIS

11.9.1.7. GEOCODING

11.9.1.8. OTHERS

11.1 TRANSPORTATION

11.10.1 BY FUNCTION

11.10.1.1. DATA IMPORT AND EXPORT

11.10.1.2. DATA VISUALIZATION

11.10.1.3. DATA MANAGEMENT

11.10.1.4. 3D MODELLING

11.10.1.5. MAP CREATION

11.10.1.6. DATA ANALYSIS

11.10.1.7. GEOCODING

11.10.1.8. OTHERS

11.11 HEALTHCARE

11.11.1 BY FUNCTION

11.11.1.1. DATA IMPORT AND EXPORT

11.11.1.2. DATA VISUALIZATION

11.11.1.3. DATA MANAGEMENT

11.11.1.4. 3D MODELLING

11.11.1.5. MAP CREATION

11.11.1.6. DATA ANALYSIS

11.11.1.7. GEOCODING

11.11.1.8. OTHERS

11.12 RETAIL & ECOMMERCE

11.12.1 BY FUNCTION

11.12.1.1. DATA IMPORT AND EXPORT

11.12.1.2. DATA VISUALIZATION

11.12.1.3. DATA MANAGEMENT

11.12.1.4. 3D MODELLING

11.12.1.5. MAP CREATION

11.12.1.6. DATA ANALYSIS

11.12.1.7. GEOCODING

11.12.1.8. OTHERS

11.13 OTHERS

12 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, BY GEOGRAPHY

12.1 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 NORTH AMERICA

12.1.1.1. U.S.

12.1.1.2. CANADA

12.1.1.3. MEXICO

12.1.2 EUROPE

12.1.2.1. GERMANY

12.1.2.2. U.K.

12.1.2.3. ITALY

12.1.2.4. FRANCE

12.1.2.5. SPAIN

12.1.2.6. SWITZERLAND

12.1.2.7. NETHERLANDS

12.1.2.8. BELGIUM

12.1.2.9. RUSSIA

12.1.2.10. DENMARK

12.1.2.11. SWEDEN

12.1.2.12. POLAND

12.1.2.13. TURKEY

12.1.2.14. FINLAND

12.1.2.15. NORWAY

12.1.2.16. REST OF EUROPE

12.1.3 ASIA PACIFIC

12.1.3.1. JAPAN

12.1.3.2. CHINA

12.1.3.3. SOUTH KOREA

12.1.3.4. INDIA

12.1.3.5. AUSTRALIA

12.1.3.6. SINGAPORE

12.1.3.7. THAILAND

12.1.3.8. INDONESIA

12.1.3.9. MALAYSIA

12.1.3.10. PHILIPPINES

12.1.3.11. NEW ZEALAND

12.1.3.12. VIETNAM

12.1.3.13. TAIWAN

12.1.3.14. REST OF ASIA-PACIFIC

12.1.4 SOUTH AMERICA

12.1.4.1. BRAZIL

12.1.4.2. ARGENTINA

12.1.4.3. REST OF SOUTH AMERICA

12.1.5 MIDDLE EAST AND AFRICA

12.1.5.1. SOUTH AFRICA

12.1.5.2. UAE

12.1.5.3. SAUDI ARABIA

12.1.5.4. EGYPT

12.1.5.5. OMAN

12.1.5.6. QATAR

12.1.5.7. KUWAIT

12.1.5.8. BAHRAIN

12.1.5.9. ISRAEL

12.1.5.10. REST OF MIDDLE EAST AND AFRICA

13 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET , SWOT & DBMR ANALYSIS

15 GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) SOFTWARE MARKET, COMPANY PROFILE

15.1 AUTODESK

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ESRI

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ARCGIS ONLINE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 QGIS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BENTLEY MAP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 INTERGRAPH GIS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 GLOBAL MAPPER

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 SAFE SOFTWARE

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 MANIFOLD SYSTEM

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENT

15.1 GEOMEDIA

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 SUPERGIS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 CITYENGINE

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OPENMAPTITLES

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 ENVI

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 HEXAGON GEOSPATIAL

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.16 ARCGIS PRO

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 GEODA

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.18 MAPINFO PROFESSIONAL

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.19 GRASS GIS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.2 GEOSERVER

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.21 GVSIG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 GEOMEDIA SMART CLIENT

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 GEOPANDAS

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 MAPBOX

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 GOOGLE EARTH PRO

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.26 GEODJANGO

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENTS

15.27 ARC2EARTH

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 GEOGRAPHIC PRESENCE

15.27.4 PRODUCT PORTFOLIO

15.28 GEONETWORK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 GEOGRAPHIC PRESENCE

15.28.4 PRODUCT PORTFOLIO

15.29 CARTO

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 GEOGRAPHIC PRESENCE

15.29.4 PRODUCT PORTFOLIO

15.3 FME

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 GEOGRAPHIC PRESENCE

15.30.4 PRODUCT PORTFOLIO

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.