Global Geospatial Intelligence Geoai Market

Market Size in USD Billion

CAGR :

%

USD

37.18 Billion

USD

85.51 Billion

2025

2033

USD

37.18 Billion

USD

85.51 Billion

2025

2033

| 2026 –2033 | |

| USD 37.18 Billion | |

| USD 85.51 Billion | |

|

|

|

|

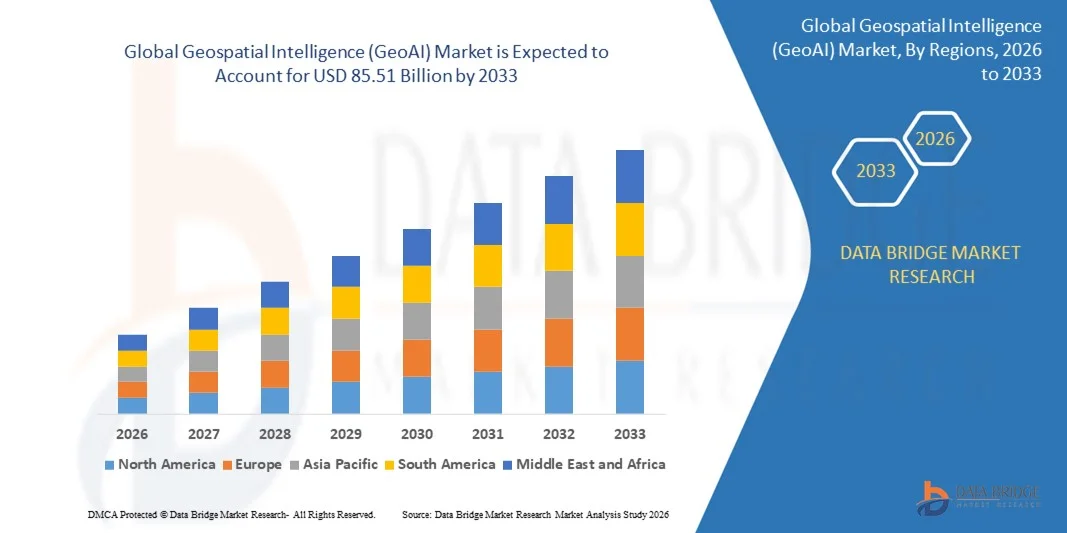

What is the Global Geospatial Intelligence (GeoAI) Market Size and Growth Rate?

- The global Geospatial Intelligence (GeoAI) market size was valued at USD 37.18 billion in 2025 and is expected to reach USD 85.51 billion by 2033, at a CAGR of 10.97% during the forecast period

- Increasing adoption of AI-powered geospatial analytics, rising deployment of IoT and satellite-based sensors, growing demand for real-time location intelligence in urban planning, defense, and disaster management, proliferation of cloud-based GIS platforms, and rising integration of GeoAI with big data and machine learning technologies are some of the key factors likely to drive the growth of the Geospatial Intelligence (GeoAI) market

What are the Major Takeaways of Geospatial Intelligence (GeoAI) Market?

- Rising demand for actionable geospatial insights in energy, agriculture, transportation, and government sectors, along with expanding investments in smart city initiatives and precision mapping solutions, is creating significant growth opportunities for the GeoAI market

- Limited availability of skilled GeoAI professionals, high implementation costs, and complexity in integrating multi-source geospatial data may act as potential restraints for market growth

- North America dominated the geospatial intelligence (GeoAI) market with a 40.12% revenue share in 2025, driven by strong adoption of AI-enabled geospatial platforms, advanced satellite imaging, and GIS analytics across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.19% from 2026 to 2033, driven by rising investments in satellite infrastructure, IoT-enabled geospatial devices, and AI-driven analytics across China, Japan, India, South Korea, and Southeast Asia

- The Software segment dominated the market with a 46.2% share in 2025, driven by increasing adoption of AI-powered geospatial analytics platforms, cloud-enabled GIS software, and advanced visualization tools

Report Scope and Geospatial Intelligence (GeoAI) Market Segmentation

|

Attributes |

Geospatial Intelligence (GeoAI) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Geospatial Intelligence (GeoAI) Market?

Increasing Shift Toward Advanced, Real-Time, and Cloud-Enabled GeoAI Solutions

- The geospatial intelligence (GeoAI) market is witnessing strong adoption of cloud-based, high-speed, and AI-powered platforms designed to support real-time geospatial analytics, satellite imagery processing, and large-scale IoT data integration

- Manufacturers are introducing multi-layered, AI-integrated analytics systems that offer real-time data fusion, predictive modeling, and visualization tools compatible with modern GIS platforms

- Growing demand for cost-efficient, scalable, and field-deployable GeoAI solutions is driving usage across defense, urban planning, agriculture, and disaster management sectors

- For instance, companies such as ESRI, Hexagon, Google, and IBM have enhanced their GeoAI platforms with real-time geospatial processing, multi-source data fusion, and cloud-enabled collaboration features

- Increasing need for rapid decision-making, high-resolution mapping, and predictive analytics is accelerating the shift toward portable and cloud-integrated GeoAI solutions

- As geospatial datasets grow larger and analytics more complex, GeoAI platforms remain vital for environmental monitoring, smart city development, and resource optimization

What are the Key Drivers of Geospatial Intelligence (GeoAI) Market?

- Rising demand for AI-driven, real-time geospatial analytics to support predictive modeling, environmental monitoring, and urban planning

- For instance, in 2025, leading providers such as Google, ESRI, Hexagon, IBM, and Trimble upgraded their platforms to enable cloud integration, AI-assisted analytics, and enhanced multi-source data fusion

- Growing adoption of IoT, satellite imaging, drones, autonomous vehicles, and smart agriculture is boosting demand for high-accuracy geospatial analytics across North America, Europe, and Asia-Pacific

- Advancements in cloud computing, GPU acceleration, data fusion algorithms, and visualization platforms have strengthened performance, scalability, and efficiency of GeoAI solutions

- Increasing need for real-time disaster management, resource allocation, and predictive risk assessment is driving adoption of advanced geospatial analytics tools

- Supported by continuous investments in AI research, remote sensing technology, and digital infrastructure, the GeoAI market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Geospatial Intelligence (GeoAI) Market?

- High costs associated with premium AI-powered geospatial platforms and cloud infrastructure restrict adoption among SMEs and emerging markets

- For instance, during 2024–2025, infrastructure expenses, high licensing fees, and data acquisition costs increased overall deployment costs for several global vendors

- Complexity in integrating multi-source geospatial datasets, advanced AI algorithms, and predictive analytics requires specialized expertise and training

- Limited awareness in developing regions regarding GeoAI applications, data interoperability, and analytics potential slows adoption

- Competition from traditional GIS platforms, open-source analytics software, and basic remote sensing tools creates pricing pressure and reduces product differentiation

- To address these issues, companies are focusing on scalable cloud solutions, AI-enabled automation, cost-efficient deployment models, and enhanced training resources to increase global adoption of Geospatial Intelligence (GeoAI) solutions

How is the Geospatial Intelligence (GeoAI) Market Segmented?

The market is segmented on the basis of offering, core technology architecture, application, and vertical.

- By Offering

On the basis of offering, the geospatial intelligence (GeoAI) market is segmented into Software, Geospatial Acquisition Systems, and Services. The Software segment dominated the market with a 46.2% share in 2025, driven by increasing adoption of AI-powered geospatial analytics platforms, cloud-enabled GIS software, and advanced visualization tools. Software solutions provide real-time data integration, predictive modeling, and multi-source data analytics, making them essential for government, defense, smart city planning, and precision agriculture applications. Their scalability, accessibility via cloud platforms, and compatibility with IoT and satellite data accelerate deployment across enterprises, research institutions, and municipal organizations.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to rising demand for consulting, data acquisition, integration, and customized analytics solutions. Increasing complexity in geospatial workflows, requirement for expert interpretation of satellite imagery, and expanding adoption of outsourced geospatial intelligence solutions are driving strong growth in the services segment globally.

- By Core Technology Architecture

On the basis of core technology architecture, the geospatial intelligence (GeoAI) market is segmented into Vector & GIS Analytics, Raster & Imagery Analytics, Streaming & Real-time Analytics, and Geovisualization. The Raster & Imagery Analytics segment dominated the market with a 44.8% share in 2025, as it supports satellite imagery, drone data, and remote sensing applications essential for urban planning, disaster management, and environmental monitoring. These platforms allow accurate pixel-based analysis, pattern recognition, and temporal monitoring for large geospatial datasets, making them crucial for government agencies, energy firms, and environmental organizations.

The Streaming & Real-time Analytics segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of IoT sensors, UAVs, and autonomous vehicle data streams. The need for real-time monitoring, predictive decision-making, and high-frequency data processing in applications such as smart cities, precision agriculture, and transportation logistics is accelerating deployment of real-time geospatial analytics globally.

- By Application

On the basis of application, the geospatial intelligence (GeoAI) market is segmented into Automotive and Transportation, Aerospace and Defence, IT and Telecommunications, Education and Government, Electronics and Semiconductor, Industrial, and Healthcare. The Automotive and Transportation segment dominated the market with a 41.5% share in 2025, driven by the need for autonomous vehicle navigation, route optimization, traffic management, and connected mobility systems. GeoAI solutions enable real-time mapping, predictive analytics, and vehicle-to-infrastructure intelligence, making them indispensable for OEMs, logistics providers, and smart transportation projects.

The Aerospace and Defence segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to rising demand for advanced situational awareness, surveillance, and military mapping solutions. Increasing government spending on defense modernization, space exploration programs, and drone-based reconnaissance is accelerating adoption of AI-enabled geospatial intelligence in aerospace and defense sectors.

- By Vertical

On the basis of vertical, the geospatial intelligence (GeoAI) market is segmented into Energy & Utilities, Government & Defense, Telecommunication, Insurance & Financial Services, Real Estate & Construction, Automotive & Transportation, Healthcare & Life Sciences, Mining, Agriculture, and Other Verticals. The Government & Defense segment dominated the market with a 38.7% share in 2025, supported by the extensive use of geospatial intelligence for defense planning, border security, disaster response, and urban development initiatives. GeoAI platforms allow high-resolution satellite imagery analysis, predictive threat modeling, and infrastructure monitoring, making them crucial for national security and public administration.

The Agriculture segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by the adoption of precision farming, crop health monitoring, soil analysis, and climate adaptation strategies. Increasing investment in AI-driven agricultural analytics, drones, and IoT-enabled field sensors is boosting demand for geospatial intelligence solutions across global farming ecosystems.

Which Region Holds the Largest Share of the Geospatial Intelligence (GeoAI) Market?

- North America dominated the geospatial intelligence (GeoAI) market with a 40.12% revenue share in 2025, driven by strong adoption of AI-enabled geospatial platforms, advanced satellite imaging, and GIS analytics across the U.S. and Canada

- Rapid expansion of smart city projects, autonomous vehicle infrastructure, defense mapping, and precision agriculture programs has further strengthened demand. Leading companies are introducing cloud-integrated GeoAI platforms, multi-layer data analytics, real-time monitoring solutions, and AI-powered predictive models, enhancing the region’s technological advantage

- High concentration of skilled data scientists, strong innovation ecosystems, and sustained government and private-sector investment in geospatial research reinforce market leadership

U.S. Geospatial Intelligence (GeoAI) Market Insight

The U.S. is the largest contributor in North America, supported by extensive R&D in AI-powered geospatial analytics, satellite imaging, autonomous navigation, and defense applications. Adoption of advanced geospatial software, real-time GIS monitoring, and predictive urban planning tools drives market growth. Strong startup ecosystems, government-funded innovation programs, and demand for location-based intelligence further accelerate adoption of GeoAI solutions.

Canada Geospatial Intelligence (GeoAI) Market Insight

Canada contributes significantly to regional growth, propelled by investments in satellite technology, AI analytics for environmental monitoring, and smart infrastructure projects. Universities, research labs, and government agencies increasingly adopt GeoAI for resource management, disaster monitoring, and urban planning. Government-backed innovation initiatives and a skilled workforce enhance regional adoption and market penetration.

Asia-Pacific Geospatial Intelligence (GeoAI) Market

Asia-Pacific is projected to register the fastest CAGR of 8.19% from 2026 to 2033, driven by rising investments in satellite infrastructure, IoT-enabled geospatial devices, and AI-driven analytics across China, Japan, India, South Korea, and Southeast Asia. Expanding smart city initiatives, autonomous vehicle deployment, industrial automation, and environmental monitoring are fueling demand for high-performance GeoAI platforms. High-volume production of geospatial sensors, UAVs, and imaging systems supports widespread adoption of real-time analytics and predictive modeling solutions.

China Geospatial Intelligence (GeoAI) Market Insight

China is the largest contributor in Asia-Pacific due to massive investments in AI-powered satellite imaging, GIS platforms, and smart city deployments. Rising adoption of precision agriculture, transportation analytics, and defense mapping drives demand for advanced GeoAI solutions with multi-source data integration and real-time processing capabilities. Competitive local manufacturing and government support further enhance regional adoption.

Japan Geospatial Intelligence (GeoAI) Market Insight

Japan shows steady growth, supported by precision mapping technologies, advanced robotics, and urban infrastructure modernization. High focus on quality engineering, low-latency analytics, and AI-enabled geospatial platforms drives adoption among government agencies, automotive OEMs, and industrial enterprises.

India Geospatial Intelligence (GeoAI) Market Insight

India is emerging as a key growth hub, fueled by government-backed geospatial initiatives, satellite programs, and rising adoption of AI and IoT technologies. Demand for smart city planning, precision agriculture, and disaster management accelerates the use of GeoAI platforms.

South Korea Geospatial Intelligence (GeoAI) Market Insight

South Korea contributes strongly, driven by advanced semiconductor infrastructure, autonomous vehicle navigation systems, and industrial automation. Adoption of high-resolution satellite imagery, AI-based analytics, and geospatial monitoring tools is supporting market expansion.

Which are the Top Companies in Geospatial Intelligence (GeoAI) Market?

The geospatial intelligence (GeoAI) industry is primarily led by well-established companies, including:

- Google (U.S.)

- IBM (U.S.)

- Alteryx (U.S.)

- ESRI (U.S.)

- Hexagon AB (Sweden)

- TomTom (Netherlands)

- Trimble (U.S.)

- Ouster (U.S.)

- Vantor (U.S.)

- Lanteris Space Systems (U.S.)

- Precisely (U.S.)

- Caliper Corporation (U.S.)

- RMSI (India)

- MapLarge (U.S.)

- General Electric (U.S.)

- Airbus (France)

- Fugro (Netherlands)

- Planet Labs (U.S.)

- Microsoft (U.S.)

- CGI (Canada)

- Teledyne Technologies (Canada)

What are the Recent Developments in Global Geospatial Intelligence (GeoAI) Market?

- In November 2025, TomTom expanded its collaboration with Geotab to enhance fleet tracking, route optimization, driver behavior analysis, and real-time traffic services across Africa, strengthening its presence in the continent and improving fleet management efficiency

- In October 2025, Airbus and Thales partnered with Leonardo to integrate space-related assets and expertise into a unified European space platform, focusing on Earth observation and satellite systems, driving innovation in the European aerospace and defense sector

- In June 2025, Hexagon AB acquired Aero Photo Europe to expand aerial mapping capabilities across Europe and Africa, enabling more comprehensive geospatial data collection and enhancing its global mapping services

- In April 2025, Bentley Systems partnered with Google to enhance iTwin analytics by integrating Street View imagery, AI, and Vertex AI for roadway asset detection and infrastructure assessment, strengthening digital infrastructure management capabilities

- In March 2025, Esri integrated Google Maps Platform’s photorealistic 3D tiles into ArcGIS, enabling high-resolution 3D mapping across more than 2,500 cities, expanding GIS visualization and urban planning applications globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.