Global Geosynthetic Clay Liner Market

Market Size in USD Million

CAGR :

%

USD

402.02 Million

USD

593.96 Million

2025

2033

USD

402.02 Million

USD

593.96 Million

2025

2033

| 2026 –2033 | |

| USD 402.02 Million | |

| USD 593.96 Million | |

|

|

|

|

What is the Global Geosynthetic Clay Liner Market Size and Growth Rate?

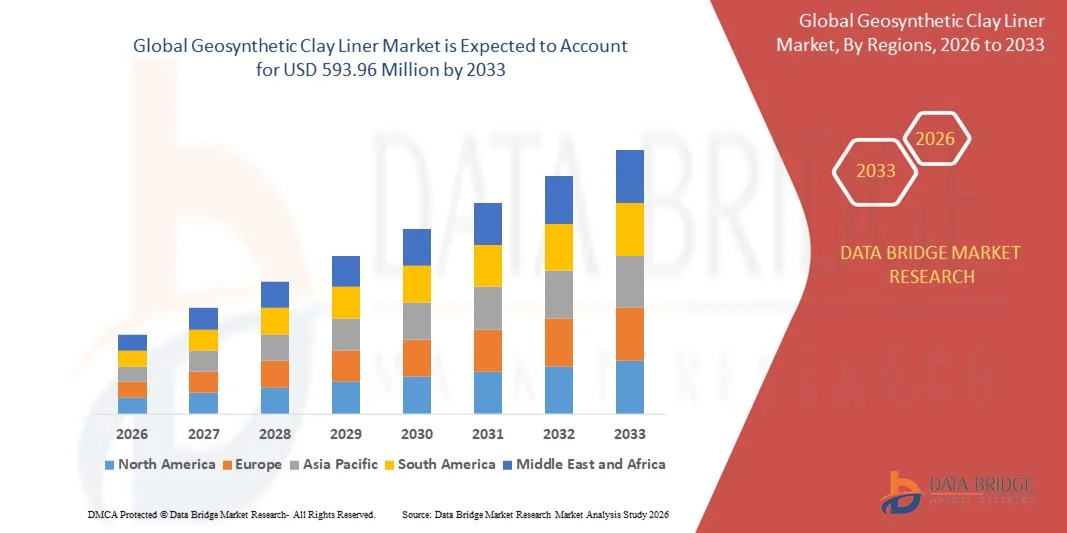

- The global geosynthetic clay liner market size was valued at USD 402.02 million in 2025 and is expected to reach USD 593.96 million by 2033, at a CAGR of 5.00% during the forecast period

- The surge in expenditure on infrastructure development across the globe acts as one of the major factors driving the growth of geosynthetic clay liner market. The initiatives taken by government for boosting the domestic production increasing the investments in the construction sector and infrastructure development activities, especially in developing nations such as China, India, and Middle East & Africa, and growth in awareness regarding landfill protection in the construction and mining sectors accelerate the market growth

What are the Major Takeaways of Geosynthetic Clay Liner Market?

- The increase in the number of shale gas production activities worldwide and supportive norms across various regions further influence the market

- In addition, rapid urbanization and industrialization, expansion of end use industries, and high investment by private and public organizations positively affect the geosynthetic clay liner market. Furthermore, use of bio-based polymers led by concerns about GHG emissions extends profitable opportunities to the market players

- Asia-Pacific dominated the geosynthetic clay liner market with a 41.8% revenue share in 2025, driven by rapid infrastructure development, large-scale mining activities, expanding landfill construction, and increasing environmental protection initiatives across China, India, Japan, South Korea, and Southeast Asia

- North America is expected to register the fastest CAGR of 9.25% from 2026 to 2033, driven by stringent environmental regulations, growing landfill upgrades, and rising focus on sustainable containment solutions

- The Natural Sodium Bentonite segment dominated the market with a 48.6% share in 2025, owing to its superior swelling capacity, low hydraulic conductivity, and wide acceptance in landfill liners, mining containment, and water barrier application

Report Scope and Geosynthetic Clay Liner Market Segmentation

|

Attributes |

Geosynthetic Clay Liner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Geosynthetic Clay Liner Market?

Increasing Shift Toward High-Performance, Composite, and Environmentally Sustainable Geosynthetic Clay Liners

- The geosynthetic clay liner market is witnessing a strong shift toward composite and reinforced GCLs that combine bentonite with advanced geotextiles and geomembranes to enhance hydraulic performance and durability

- Manufacturers are increasingly focusing on needle-punched, polymer-enhanced, and multilayer GCL designs that offer superior shear strength, low permeability, and long-term containment reliability

- Rising emphasis on environmental protection, landfill safety, and water resource management is driving demand for high-performance GCLs across mining, waste containment, and civil infrastructure projects

- For instance, companies such as NAUE, HUESKER, AGRU, CETCO (Minerals Technologies), and Layfield have expanded their GCL portfolios with improved bonding technologies, chemical resistance, and installation efficiency

- Growing adoption of prefabricated, factory-controlled GCL systems is reducing installation time, labor costs, and project risks, especially in large-scale infrastructure developments

- As regulatory standards for containment and environmental compliance become more stringent, advanced Geosynthetic Clay Liners will remain critical for long-term sealing and barrier applications

What are the Key Drivers of Geosynthetic Clay Liner Market?

- Rising demand for effective containment solutions in landfills, mining operations, wastewater treatment facilities, and hazardous waste management

- For instance, in 2024–2025, major infrastructure and mining projects across Asia-Pacific, North America, and Europe increasingly adopted GCLs to meet stricter environmental and groundwater protection regulations

- Growing investments in transportation infrastructure, tunnels, canals, and dams are boosting the use of GCLs for seepage control and structural stability

- Advancements in bentonite processing, polymer modification, and geotextile reinforcement have improved GCL performance under high load and aggressive chemical environments

- Increasing preference for cost-effective and space-saving alternatives to traditional compacted clay liners is accelerating GCL adoption

- Supported by expanding construction activities, environmental regulations, and sustainability initiatives, the Geosynthetic Clay Liner market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Geosynthetic Clay Liner Market?

- Higher initial costs of premium and reinforced GCL products can limit adoption in cost-sensitive projects and emerging economies

- For instance, during 2024–2025, fluctuations in bentonite prices, geotextile raw material costs, and logistics expenses impacted overall GCL manufacturing and project budgets

- Performance variability due to improper installation, hydration issues, or subgrade conditions can affect liner effectiveness if not handled correctly

- Limited technical awareness and skilled labor availability in certain regions restrict optimal GCL deployment

- Competition from geomembranes, compacted clay liners, and hybrid containment systems creates pricing pressure and project-level substitution risks

- To overcome these challenges, manufacturers are focusing on installer training programs, product standardization, and performance-certified GCL systems to strengthen global adoption

How is the Geosynthetic Clay Liner Market Segmented?

The market is segmented on the basis of raw material and application.

- By Raw Material

On the basis of raw material, the geosynthetic clay liner market is segmented into Natural Sodium Bentonite, Calcium Bentonite, and Polymer-Enhanced Bentonite. The Natural Sodium Bentonite segment dominated the market with a 48.6% share in 2025, owing to its superior swelling capacity, low hydraulic conductivity, and wide acceptance in landfill liners, mining containment, and water barrier applications. Sodium bentonite-based GCLs offer reliable self-sealing performance, ease of installation, and compliance with environmental regulations, making them the preferred choice across large-scale infrastructure and waste management projects.

The Polymer-Enhanced Bentonite segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for enhanced chemical resistance, performance under aggressive leachates, and durability in saline or contaminated environments. Increasing adoption in hazardous waste containment, mining, and industrial projects is accelerating the shift toward polymer-modified GCL solutions.

- By Application

On the basis of application, the geosynthetic clay liner market is segmented into Landfills, Mining, Water Management & Containment, and Infrastructure Projects. The Landfills segment dominated the market with a 41.2% share in 2025, supported by strict environmental regulations, growing municipal solid waste generation, and the need for effective groundwater protection. GCLs are extensively used in base liners, capping systems, and side-slope containment due to their low permeability, space efficiency, and cost advantages over compacted clay liners.

The Mining segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing mineral extraction activities, tailings dam construction, and heightened focus on environmental safety in mining operations. Rising investments in mining projects across Asia-Pacific, Latin America, and Africa, along with stricter containment norms, are accelerating the adoption of high-performance GCLs in mining applications.

Which Region Holds the Largest Share of the Geosynthetic Clay Liner Market?

- Asia-Pacific dominated the geosynthetic clay liner market with a 41.8% revenue share in 2025, driven by rapid infrastructure development, large-scale mining activities, expanding landfill construction, and increasing environmental protection initiatives across China, India, Japan, South Korea, and Southeast Asia

- Strong growth in urbanization, transportation infrastructure, water management projects, and industrial development is fueling widespread adoption of GCLs for containment, seepage control, and environmental safety

- Governments across the region are enforcing stricter regulations related to groundwater protection, waste disposal, and mining tailings management, significantly boosting demand for high-performance geosynthetic clay liners

China Geosynthetic Clay Liner Market Insight

China is the largest contributor within Asia-Pacific, supported by massive investments in infrastructure, mining operations, landfill construction, and industrial waste containment. Rapid urban expansion, large-scale transportation projects, and strict environmental compliance requirements are driving extensive use of GCLs in landfills, canals, and tailings facilities. Strong domestic manufacturing capacity and cost-competitive production further support market dominance.

India Geosynthetic Clay Liner Market Insight

India is witnessing strong growth due to increasing investments in smart cities, highways, rail corridors, mining, and municipal waste management. Government initiatives focused on environmental sustainability, water conservation, and industrial development are accelerating the adoption of GCLs across infrastructure and containment applications.

North America Geosynthetic Clay Liner Market

North America is expected to register the fastest CAGR of 9.25% from 2026 to 2033, driven by stringent environmental regulations, growing landfill upgrades, and rising focus on sustainable containment solutions. Increasing rehabilitation of aging waste disposal sites, mining tailings facilities, and water management systems is strengthening demand for advanced GCL products. Strong presence of leading geosynthetics manufacturers, technological advancements in polymer-enhanced GCLs, and high awareness of long-term environmental protection support rapid market expansion

U.S. Geosynthetic Clay Liner Market Insight

The U.S. leads regional growth due to strict EPA regulations, high landfill closure activities, and extensive use of GCLs in mining, hazardous waste containment, and infrastructure projects. Increasing adoption of composite liner systems and polymer-modified bentonite solutions further drives market demand.

Canada Geosynthetic Clay Liner Market Insight

Canada contributes significantly through expanding mining activities, oil & gas containment projects, and growing focus on environmental remediation. Investments in sustainable infrastructure and water protection initiatives are accelerating GCL adoption across the country.

Which are the Top Companies in Geosynthetic Clay Liner Market?

The geosynthetic clay liner industry is primarily led by well-established companies, including:

- Nilex Inc. (Canada)

- GSE Holdings (U.S.)

- Minerals Technologies Inc. (U.S.)

- LAYFIELD GROUP LTD. (Canada)

- terrafix (U.S.)

- Geofabrics (Australia)

- Global Synthetics (Australia)

- Geotech Systems & Solutions (P) Ltd. (India)

- HUESKER (Germany)

- Wall Tag Pte Ltd. (Singapore)

- Laviosa Chemica Mineria (Italy)

- AGRU AMERICA, INC (U.S.)

- NAUE GmbH & Co. KG (Germany)

- ABG Ltd (U.K.)

What are the Recent Developments in Global Geosynthetic Clay Liner Market?

- In June 2025, the Geosynthetic Institute (GSI) announced its planned relocation from Folsom, Pa., to the Georgia Institute of Technology campus in Atlanta, Ga., by the end of 2025, aiming to expand multidisciplinary research activities, strengthen educational programs, and host major geosynthetics events, thereby reinforcing long-term innovation and academic collaboration in the geosynthetics sector

- In November 2024, the Canadian Geotechnical Society (CGS), in partnership with the Canadian National Chapter of the International Association of Hydrogeologists (IAH-CNC), organized GeoMontréal 2024 in Montréal, Quebec, featuring advancements in geosynthetic clay liners, stress crack resistance of HDPE geomembranes, drainage geocomposites, and thermos-hydro-mechanical performance studies, highlighting continuous technical progress and knowledge sharing within the industry

- In October 2024, White Cap completed an agreement to acquire Triumph Geo-Synthetics Inc., a California-based distributor of geosynthetics and erosion control products, to expand its infrastructure and non-residential market offerings, strengthening product availability and service capabilities across regional construction markets

- In July 2024, the city of Ballarat launched its first geosynthetic cell capping project at the Ballarat Regional Landfill, utilizing advanced geosynthetic materials to control leachate and gas emissions, demonstrating a strong commitment to sustainable waste management and regulatory compliance

- In July 2024, Geosynthetics Magazine emphasized the growing importance of geosynthetic solutions that meet stringent landfill leachate management requirements, highlighting material advancements that improve containment performance and environmental protection, underscoring the industry’s focus on sustainability-driven innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Geosynthetic Clay Liner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Geosynthetic Clay Liner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Geosynthetic Clay Liner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.