Global Gibberellins Market

Market Size in USD Billion

CAGR :

%

USD

3.48 Billion

USD

6.98 Billion

2024

2032

USD

3.48 Billion

USD

6.98 Billion

2024

2032

| 2025 –2032 | |

| USD 3.48 Billion | |

| USD 6.98 Billion | |

|

|

|

|

Global Gibberellins Market Size

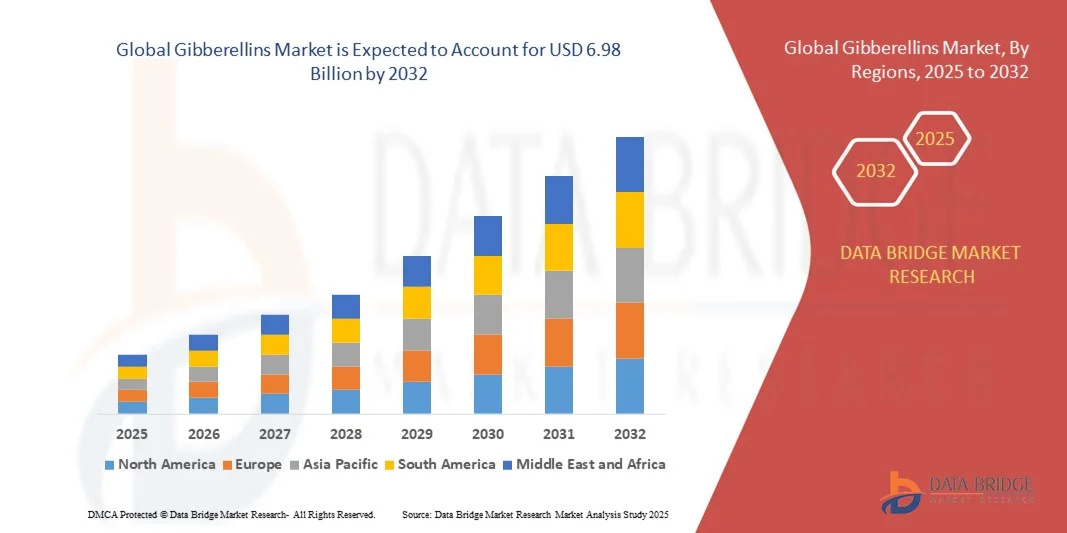

- The global Gibberellins Market size was valued at USD 3.48 billion in 2024 and is projected to reach USD 6.98 billion by 2032, growing at a CAGR of 9.10% during the forecast period

- Market expansion is primarily driven by increasing demand for higher agricultural yields, advancements in plant growth regulators, and the adoption of modern farming techniques across emerging economies

- Additionally, growing awareness of sustainable agriculture and the use of gibberellins to improve crop quality and productivity are key factors contributing to the market's rapid growth trajectory

Global Gibberellins Market Analysis

- Gibberellins, a class of plant hormones that regulate growth and influence various developmental processes, are becoming increasingly vital in modern agriculture due to their ability to enhance seed germination, stimulate stem elongation, and improve fruit development across a range of crops

- The rising demand for gibberellins is primarily fueled by the global need to increase crop yields, adoption of advanced agricultural practices, and the push for sustainable farming solutions in the face of climate change and growing food security concerns

- Asia-Pacific dominated the Global Gibberellins Market with the largest revenue share of 32.8% in 2024, driven by high awareness among farmers, strong agricultural R&D infrastructure, and early adoption of plant growth regulators, particularly in the U.S., where fruit and vegetable producers are increasingly relying on gibberellins to meet quality standards and maximize harvests

- North America Asia-Pacific is expected to be the fastest growing region in the Global Gibberellins Market during the forecast period due to rapid expansion of the agriculture sector, government support for high-efficiency fertilizers, and increasing demand for high-value crops in countries like China and India

- The 19-Carbon Gibberellins segment held the dominant market share of 61.4% in 2024, owing to their high biological activity and widespread use in commercial agriculture.

Report Scope and Global Gibberellins Market Segmentation

|

Attributes |

Gibberellins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Gibberellins Market Trends

Enhanced Crop Performance Through Biotechnology and Precision Agriculture

- A significant and accelerating trend in the global Gibberellins Market is the growing integration of biotechnology and precision agriculture techniques to optimize the application of plant growth regulators. This synergy is enhancing the efficiency, precision, and outcome of gibberellin use in modern farming systems.

- For instance, smart farming technologies now enable precise monitoring of crop health, soil conditions, and weather data to determine the optimal timing and dosage of gibberellin application. Companies like Bayer and Syngenta are leveraging digital platforms and biotechnology tools to maximize the effectiveness of plant growth regulators, including gibberellins, in improving yields and crop quality.

- The integration of biotechnology allows for the development of crop varieties with improved responsiveness to gibberellins, leading to better stem elongation, fruit development, and flowering. Furthermore, precision agriculture systems, powered by AI and satellite imagery, can analyze large-scale field data to identify specific zones where gibberellin application can be most beneficial, reducing waste and environmental impact.

- The adoption of digital farming platforms facilitates centralized crop management, where farmers can schedule, monitor, and adjust gibberellin use through a single interface that integrates with sensors, drones, and automated sprayers. This enables data-driven decision-making and real-time adjustments, improving both productivity and sustainability.

- This trend toward data-enabled, targeted use of gibberellins is redefining agricultural practices, making them more efficient and environmentally responsible. Companies such as Corteva Agriscience and BASF are investing heavily in R&D to create advanced formulations compatible with precision farming tools.

- The demand for technologically enhanced gibberellin solutions is growing rapidly across both developed and emerging agricultural markets, as producers increasingly prioritize sustainable growth, resource efficiency, and higher crop returns through integrated agricultural technologies.

Global Gibberellins Market Dynamics

Driver

Growing Need Due to Rising Food Demand and Agricultural Productivity Pressures

- The increasing global population and rising demand for food are placing immense pressure on agricultural productivity, driving significant growth in the use of plant growth regulators like gibberellins. Farmers and agribusinesses are turning to these solutions to improve crop quality, yield, and overall efficiency in both staple and high-value crops.

- For instance, in May 2024, Corteva Agriscience announced a strategic collaboration with leading agri-tech startups in India to optimize the use of gibberellins in hybrid rice and fruit production through AI-driven application models. Such partnerships are accelerating the adoption of advanced agricultural inputs in developing economies.

- Gibberellins offer targeted physiological benefits, such as enhancing fruit size, improving seed germination, and promoting uniform flowering—critical advantages in meeting growing food demand under constrained arable land availability.

- Additionally, the shift towards sustainable and precision agriculture is boosting gibberellin usage, as these regulators enable more efficient crop management with minimal environmental impact. The move away from excessive fertilizer and pesticide use has also highlighted gibberellins as a viable alternative for improving plant growth without harmful residues.

- The adoption of controlled-environment agriculture (CEA), such as greenhouses and vertical farming, is further supporting market growth. Gibberellins play a key role in these systems by optimizing growth cycles and enabling year-round production of fruits and vegetables, meeting the rising consumer preference for fresh, high-quality produce.

Restraint/Challenge

Regulatory Constraints and Limited Farmer Awareness in Developing Regions

- Despite the growing demand, the Gibberellins Market faces significant challenges, particularly in the form of regulatory constraints and limited awareness among smallholder farmers in developing regions. Regulatory approvals for plant growth regulators can be slow and vary widely between countries, creating barriers to market entry for manufacturers and limiting product availability in key agricultural areas.

- For instance, inconsistent guidelines for allowable residues and application rates across regions such as Latin America and Africa complicate international trade and discourage broader usage of gibberellins, especially in export-oriented agricultural sectors.

- Another major challenge is the lack of awareness and education about gibberellins among farmers in less-developed agricultural economies. Many growers are still reliant on traditional farming methods and are hesitant to adopt new technologies due to limited access to training, technical support, or proven use-case data.

- The relatively high cost of branded gibberellin formulations can also deter adoption in price-sensitive markets, where farmers may prioritize cheaper alternatives or be unfamiliar with the return on investment these products can offer.

- Overcoming these challenges will require increased investment in farmer education programs, public-private partnerships to streamline regulatory approvals, and more affordable, localized gibberellin solutions that are tailored to the needs of small and medium-scale producers. Companies such as BASF and Nufarm are already expanding outreach programs and pilot projects in rural areas to address these barriers and unlock new growth opportunities.

Global Gibberellins Market Scope

The gibberellins market is segmented on the basis of application, type, method and distribution channel.

- By Application

On the basis of application, the Global Gibberellins Market is segmented into malting of barley, increasing sugarcane yield, fruit production, and seed production. The fruit production segment dominated the market with the largest revenue share of 38.7% in 2024, owing to the wide use of gibberellins in enhancing fruit size, improving ripening, and promoting uniform flowering in crops such as grapes, apples, and citrus. As consumers demand higher-quality produce and exporters require visual appeal and consistency, gibberellin application is becoming critical in the fruit industry.

The sugarcane yield enhancement segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for sugar and ethanol, particularly in Asia-Pacific and Latin America. Gibberellins promote internode elongation and early maturity in sugarcane, boosting tonnage per hectare. Governments supporting bioethanol policies are also contributing to greater adoption of gibberellins in sugarcane agriculture.

- By Type

On the basis of type, the market is segmented into 19-Carbon Gibberellins and 20-Carbon Gibberellins. The 19-Carbon Gibberellins segment held the dominant market share of 61.4% in 2024, owing to their high biological activity and widespread use in commercial agriculture. Gibberellic acid (GA₃), the most commonly used gibberellin and part of the 19-carbon group, is extensively applied in seed treatment, fruit setting, and stem elongation processes.

The 20-Carbon Gibberellins segment is expected to register the fastest growth rate (CAGR) during the forecast period from 2025 to 2032. Though less commonly used today, this segment is gaining traction due to increased R&D into their unique roles in plant development and potential for stress tolerance. As biotechnology advances and niche crop applications expand, interest in 20-carbon gibberellins is projected to rise steadily in coming years.

- By Method

On the basis of biosynthesis method, the Global Gibberellins Market is segmented into Methylerythritol Phosphate (MEP) Pathway and Trans-Geranylgeranyl Diphosphate (GGDP) Pathway. The MEP Pathway segment dominated the market in 2024 with a market share of 55.8%, as it is the most widely studied and efficient method of gibberellin production in both natural and synthetic environments. This method is widely used in microbial fermentation processes, especially involving Gibberella fujikuroi, to produce commercial-grade gibberellins.

The GGDP Pathway segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increased biotechnological interest in optimizing metabolic pathways for high-yield and cost-efficient gibberellin production. With advances in metabolic engineering and synthetic biology, researchers and manufacturers are exploring GGDP pathway manipulation to enhance production yields and reduce process costs, particularly in controlled fermentation environments.

- By Distribution Channel

On the basis of distribution channel, the Global Gibberellins Market is segmented into online and offline channels. The offline segment held the largest revenue share of 69.3% in 2024, as agrochemical distributors, local agri-input shops, and direct-to-farm sales still dominate product access in most agricultural regions. Farmers often prefer offline purchases due to in-person consultation, bulk discounts, and product reliability, especially in developing economies where internet access is limited.

The online segment is projected to be the fastest-growing distribution channel during the forecast period, with the highest CAGR from 2025 to 2032. Digital agriculture platforms, growing internet penetration, and the rise of B2B e-commerce in the agrochemical sector are contributing to this trend. Major players are launching online portals and partnering with digital agri-marketplaces to expand their reach, particularly targeting tech-savvy farmers and larger agricultural enterprises in North America, Europe, and Asia-Pacific.

Global Gibberellins Market Regional Analysis

- Asia-Pacific dominated the Global Gibberellins Market with the largest revenue share of 32.8% in 2024, driven by advanced agricultural practices, high adoption of plant growth regulators, and strong government support for sustainable farming initiatives.

- Farmers and agribusinesses in the region increasingly utilize gibberellins to boost crop yields, improve fruit quality, and enhance overall plant growth, particularly in high-value crops such as grapes, apples, and citrus.

- This widespread usage is further supported by well-established distribution networks, a high level of awareness regarding modern agrochemicals, and robust investments in agri-tech innovation, positioning gibberellins as a key input for both conventional and precision farming systems across the U.S. and Canada.

U.S. Gibberellins Market Insight

The U.S. gibberellins market captured the largest revenue share of 81% in 2024 within North America, driven by advanced agricultural practices and a strong focus on maximizing crop yields through plant growth regulators. The increasing adoption of gibberellins in fruit production, seed treatment, and cereal crops is fueling demand. Additionally, the rise of precision agriculture technologies and government incentives for sustainable farming contribute to market expansion. The integration of AI and data-driven agronomy tools to optimize gibberellin application rates is also accelerating growth, alongside strong distribution networks and robust R&D investments from key players.

Europe Gibberellins Market Insight

The Europe gibberellins market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent agricultural regulations and a growing focus on environmentally friendly crop enhancement solutions. The demand for improved crop quality and yield in countries such as France, Italy, and Spain is driving increased use of gibberellins, particularly in vineyards and fruit orchards. The region’s emphasis on sustainable agriculture and organic farming is encouraging the adoption of plant growth regulators with lower environmental impact, further boosting the market across both commercial farming and specialty crop segments.

U.K. Gibberellins Market Insight

The U.K. gibberellins market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising demand for high-quality produce and efficient farming techniques. Increased awareness of plant growth regulators among farmers, along with government support for agricultural innovation, is stimulating growth. The expansion of greenhouse farming and controlled-environment agriculture is also fostering gibberellin use in seed production and fruit cultivation. Additionally, the U.K.’s strong research base and collaboration between academia and industry are accelerating product development and adoption.

Germany Gibberellins Market Insight

The Germany gibberellins market is forecasted to expand at a considerable CAGR during the forecast period, propelled by technological advancements in crop management and the country’s commitment to sustainable farming practices. German farmers are increasingly incorporating gibberellins to improve the yield and quality of cereals, fruits, and vegetables while minimizing chemical inputs. The presence of key agrochemical manufacturers and a well-established distribution infrastructure support market growth. The integration of gibberellins into precision agriculture systems aligns with the country’s emphasis on innovation and environmental stewardship.

Asia-Pacific Gibberellins Market Insight

The Asia-Pacific gibberellins market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding agricultural modernization efforts in countries like China, India, and Japan. The region’s increasing focus on enhancing crop productivity to meet food security demands is boosting gibberellin adoption. Government initiatives promoting agrochemical use and digital agriculture platforms facilitate market penetration. Furthermore, the emergence of Asia-Pacific as a manufacturing and export hub for gibberellin products is improving affordability and accessibility across the region.

Japan Gibberellins Market Insight

The Japan gibberellins market is gaining momentum due to the country’s advanced agricultural technology and high focus on improving crop quality and yield. Japan’s aging farming population and labor shortages are driving demand for plant growth regulators that can optimize production efficiency. The adoption of greenhouse farming and vertical agriculture further supports gibberellin use in specialty crops. Integration with smart farming technologies and the country’s emphasis on sustainability and precision agriculture are key factors accelerating market growth in both commercial and research sectors.

China Gibberellins Market Insight

The China gibberellins market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding agricultural sector, rapid urbanization, and strong government support for modern farming techniques. China is one of the largest consumers of plant growth regulators globally, with widespread usage across fruit production, seed treatment, and cereal crops. The government’s “Smart Agriculture” initiatives and push towards high-value crop production further propel market demand. Additionally, local manufacturing capabilities and competitive pricing of gibberellin products contribute to strong domestic consumption and export potential.

Global Gibberellins Market Share

The Gibberellins industry is primarily led by well-established companies, including:

• Aroxa Crop Science Private Limited (India)

• Fine Americas, Inc. (U.S.)

• Hubei Yuancheng Saichuang Technology (China)

• Jiangsu Fengyuan Bioengineering Co., Ltd. (China)

• Nufarm Ltd. (Australia)

• Shanghai Fuang Agrochemical Co., Ltd. (China)

• Shanghai Pengteng Fine Chemical Co., Ltd. (China)

• Sichuan Guoguang Agrochemical Co. Ltd. (China)

• Valent U.S.A. Corporation (U.S.)

• Xinyi (H.K.) Industrial Co., Ltd. (China/Hong Kong)

• Zhejiang Qianjiang Biochemical Co., Ltd. (China)

• Zodiac Brand Space Pvt. Ltd. (India)

• BASF SE (Germany)

• Corteva Agriscience (U.S.)

• Syngenta Group (Switzerland)

• FMC Corporation (U.S.)

• Bayer AG (Germany)

• Tata Chemicals Ltd. (India)

What are the Recent Developments in Global Gibberellins Market?

- In April 2023, BASF SE, a global leader in agricultural solutions, launched a strategic initiative in South Africa focused on enhancing crop productivity through advanced gibberellin formulations tailored to local farming conditions. This initiative demonstrates BASF’s commitment to delivering innovative, effective plant growth regulators that address regional agricultural challenges, strengthening its position in the rapidly expanding Global Gibberellins Market.

- In March 2023, Nufarm Ltd., an established agrochemical company headquartered in Australia, introduced a new high-efficiency gibberellin product specifically designed to improve sugarcane yields and quality. The innovative formulation underscores Nufarm’s dedication to supporting sustainable farming practices while boosting crop output, providing growers with reliable solutions to meet increasing demand.

- In March 2023, Syngenta Group successfully deployed a large-scale agricultural enhancement program in India aimed at optimizing fruit production through the use of precision gibberellin application technologies. This project highlights Syngenta’s expertise in integrating advanced agrochemical solutions to improve crop growth, contributing to increased food security and farmer profitability in key emerging markets.

- In February 2023, Jiangsu Fengyuan Bioengineering Co., Ltd., a leading Chinese manufacturer of plant growth regulators, announced a strategic partnership with regional agricultural cooperatives to promote the adoption of gibberellins for seed production and malting barley crops. This collaboration is designed to enhance crop quality and yield, streamlining processes for farmers and agribusinesses alike, reinforcing Fengyuan’s role as a key market innovator.

- In January 2023, Corteva Agriscience unveiled a new line of gibberellin-based products at the World Agri-Tech Innovation Summit, featuring enhanced bioavailability and environmentally friendly formulations. These products enable farmers to achieve superior crop performance with reduced environmental impact, reflecting Corteva’s commitment to sustainable agriculture and cutting-edge biotechnologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gibberellins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gibberellins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gibberellins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.