Global Gige Camera Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

6.11 Billion

2025

2033

USD

2.20 Billion

USD

6.11 Billion

2025

2033

| 2026 –2033 | |

| USD 2.20 Billion | |

| USD 6.11 Billion | |

|

|

|

|

GigE Camera Market Size

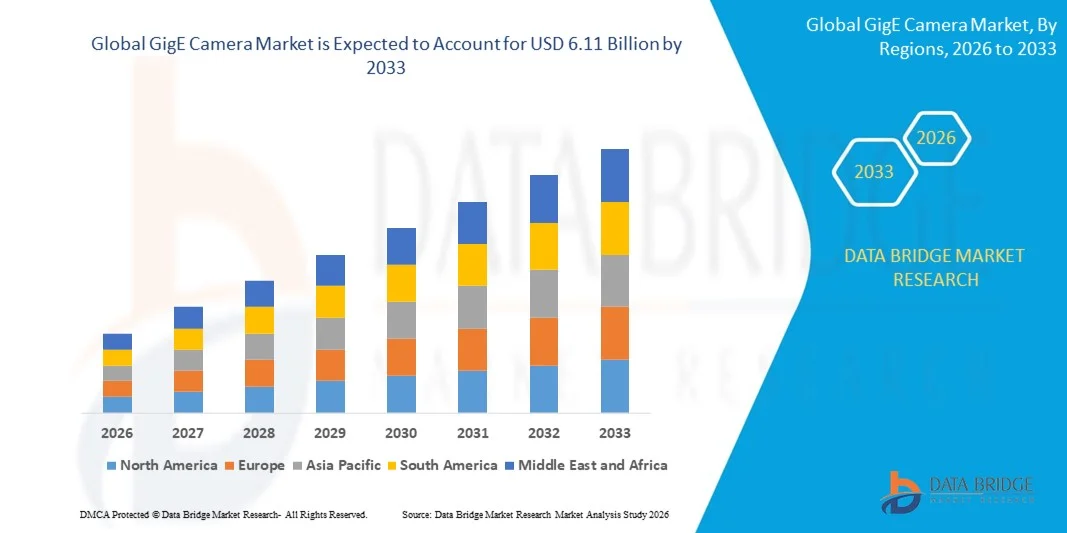

- The global GigE camera market size was valued at USD 2.20 billion in 2025 and is expected to reach USD 6.11 billion by 2033, at a CAGR of 13.60% during the forecast period

- The market growth is largely fuelled by the rising adoption of machine vision systems across industrial automation and smart manufacturing environments

- Increasing demand for high-speed, long-distance image transmission in applications such as factory automation, quality inspection, and traffic monitoring is supporting market expansion

GigE Camera Market Analysis

- The market is witnessing strong momentum due to its ability to deliver high-resolution imaging with reliable data transfer over extended cable lengths, making it suitable for complex industrial setups

- Continuous technological advancements, along with increasing integration of GigE cameras in emerging applications such as robotics, logistics automation, and intelligent surveillance systems, are shaping the overall market landscape

- North America dominated the GigE camera market with the largest revenue share in 2025, driven by strong adoption of industrial automation, machine vision systems, and advanced manufacturing technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global GigE camera market, driven by expanding manufacturing bases, rising adoption of automation technologies, strong growth in electronics and semiconductor industries, and increasing government initiatives supporting smart manufacturing and digital transformation

- The area scan camera segment held the largest market revenue share in 2025 driven by its widespread use in industrial inspection, automation, and machine vision applications where full-frame image capture is required. Area scan GigE cameras offer high flexibility, ease of integration, and compatibility with a wide range of lenses, making them a preferred choice across manufacturing and quality control operations

Report Scope and GigE Camera Market Segmentation

|

Attributes |

GigE Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

GigE Camera Market Trends

Rising Adoption Of High-Speed Imaging In Industrial Automation

- The increasing demand for high-resolution and real-time image acquisition is significantly shaping the GigE camera market, as industries such as manufacturing, logistics, and electronics increasingly rely on advanced vision systems for quality inspection, process automation, and defect detection. GigE cameras are gaining traction due to their ability to deliver high-speed data transmission over long distances with stable connectivity, supporting precise and continuous monitoring in complex industrial environments

- Growing investments in industrial automation, robotics, and machine vision systems are accelerating the adoption of GigE cameras across assembly lines, packaging units, and inspection stations. Manufacturers prefer GigE cameras for their scalability, ease of integration with existing Ethernet infrastructure, and support for high frame rates, which enhances productivity and reduces downtime in automated operations

- The trend toward smart factories and Industry 4.0 is reinforcing the demand for GigE cameras, as they enable seamless integration with AI-based analytics, edge computing, and centralized control systems. These cameras support real-time data processing and remote monitoring, helping manufacturers optimize workflows, improve operational efficiency, and ensure consistent product quality

- For instance, in 2024, key industrial automation players in Germany and Japan integrated GigE cameras into robotic inspection and machine vision solutions used in automotive and electronics manufacturing. These deployments improved inspection accuracy, reduced manual intervention, and supported predictive maintenance initiatives, strengthening overall production efficiency

- While demand continues to rise, sustained market growth depends on advancements in sensor technology, bandwidth optimization, and compatibility with evolving industrial software platforms. Manufacturers are focusing on developing compact, energy-efficient, and high-performance GigE cameras to meet the growing requirements of next-generation industrial applications

GigE Camera Market Dynamics

Driver

Growing Demand For Machine Vision And Industrial Automation

- The expanding use of machine vision systems in manufacturing, automotive, and electronics industries is a major driver for the GigE camera market. GigE cameras offer reliable high-speed image transfer, making them ideal for applications such as quality inspection, robotic guidance, and automated measurement. Their ability to operate over long cable lengths without signal loss further supports widespread adoption

- Increasing emphasis on precision, productivity, and cost reduction is driving manufacturers to invest in advanced vision technologies. GigE cameras enable real-time monitoring and automated decision-making, helping industries minimize errors, reduce waste, and enhance overall production efficiency. This is particularly important in high-volume and high-precision manufacturing environments

- The integration of GigE cameras with AI and deep learning-based image processing solutions is further boosting market growth. These combined systems support advanced applications such as defect classification, object recognition, and predictive maintenance, encouraging adoption across diverse industrial sectors

- For instance, in 2023, leading automotive and electronics manufacturers in the U.S. and South Korea expanded their use of GigE camera-based vision systems to support automated inspection and robotic assembly processes. These implementations improved throughput, reduced quality-related costs, and strengthened competitive positioning

- Despite strong growth drivers, continued expansion will rely on ongoing innovation in camera resolution, frame rates, and interoperability with industrial networks. Investments in R&D and collaboration between camera manufacturers and automation solution providers will be critical to sustaining long-term market growth

Restraint/Challenge

High Initial Costs And Technical Integration Complexity

- The relatively high initial cost of GigE camera systems compared to basic imaging solutions remains a key challenge, particularly for small and medium-sized enterprises. Expenses related to high-performance sensors, lenses, and supporting hardware can limit adoption among cost-sensitive users

- Technical complexity associated with system integration and network configuration also restrains market growth. Implementing GigE cameras requires expertise in Ethernet networking, bandwidth management, and software compatibility, which can increase deployment time and operational costs

- Bandwidth limitations and data management challenges may arise in high-resolution and high-frame-rate applications, especially when multiple cameras are deployed simultaneously. These issues necessitate investments in advanced network infrastructure and data processing capabilities

- For instance, in 2024, manufacturing SMEs in Southeast Asia reported slower adoption of GigE camera systems due to higher setup costs and limited in-house technical expertise. Challenges related to network optimization and system calibration further delayed implementation in some facilities

- Addressing these challenges will require cost-effective camera designs, simplified integration tools, and enhanced technical support. Training initiatives, modular system architectures, and advancements in Ethernet standards are expected to improve accessibility and support broader adoption of GigE cameras across global markets

GigE Camera Market Scope

The market is segmented on the basis of type, colour sensor type, imaging technology, and application.

- By Type

On the basis of type, the GigE camera market is segmented into line scan cameras and area scan cameras. The area scan camera segment held the largest market revenue share in 2025 driven by its widespread use in industrial inspection, automation, and machine vision applications where full-frame image capture is required. Area scan GigE cameras offer high flexibility, ease of integration, and compatibility with a wide range of lenses, making them a preferred choice across manufacturing and quality control operations.

The line scan camera segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption in high-speed and continuous inspection applications such as web inspection, printing, and conveyor-based systems. Line scan GigE cameras enable precise imaging of moving objects with high resolution and consistency, supporting advanced defect detection and measurement requirements.

- By Colour Sensor Type

On the basis of colour sensor type, the GigE camera market is segmented into monochrome and colour. The monochrome segment accounted for the largest revenue share in 2025 due to its higher sensitivity, better contrast, and superior performance in low-light conditions, making it ideal for industrial inspection, robotics, and measurement tasks.

The colour segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing demand for applications requiring colour differentiation such as food inspection, packaging, electronics assembly, and surveillance. Colour GigE cameras enhance visual detail and accuracy in classification and sorting processes, driving their adoption across diverse industries.

- By Imaging Technology

On the basis of imaging technology, the market is segmented into charge coupled device (CCD) technology based cameras, complementary metal oxide semiconductor (CMOS) technology based cameras, and smart cameras. The CMOS technology based camera segment dominated the market in 2025, attributed to lower power consumption, faster processing speeds, and continuous advancements in sensor performance.

The smart camera segment is expected to register the fastest growth rate from 2026 to 2033, driven by the integration of onboard processing, AI-based analytics, and edge computing capabilities. Smart GigE cameras reduce system complexity and enable real-time decision-making, supporting the growing adoption of intelligent vision systems in industrial automation.

- By Application

On the basis of application, the GigE camera market is segmented into manufacturing operations and non-manufacturing operations. The manufacturing operations segment held the largest market share in 2025 due to extensive use of GigE cameras in quality inspection, robotic guidance, and process automation across automotive, electronics, and industrial manufacturing sectors

The non-manufacturing operations segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption in sectors such as logistics, healthcare, research, and security. Increasing use of machine vision and imaging technologies beyond traditional manufacturing environments is expanding the application scope of GigE cameras globally.

GigE Camera Market Regional Analysis

- North America dominated the GigE camera market with the largest revenue share in 2025, driven by strong adoption of industrial automation, machine vision systems, and advanced manufacturing technologies

- End users in the region place high value on high-speed data transmission, reliable image quality, and seamless integration of GigE cameras with existing Ethernet-based infrastructure

- This strong adoption is further supported by high capital investment, a technologically advanced industrial base, and increasing deployment of vision systems across manufacturing, logistics, and inspection applications

U.S. GigE Camera Market Insight

The U.S. GigE camera market captured the largest revenue share in 2025 within North America, supported by the rapid expansion of smart factories, robotics, and quality inspection systems. Manufacturers are increasingly prioritizing high-resolution imaging and real-time data transfer to improve productivity and reduce operational errors. The growing use of GigE cameras in automotive, electronics, and semiconductor industries, along with rising investments in AI-enabled vision systems, continues to propel market growth.

Europe GigE Camera Market Insight

The Europe GigE camera market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent quality control standards and rising demand for automation across manufacturing and industrial operations. Increasing adoption of Industry 4.0 practices, coupled with the need for precise inspection and monitoring systems, is accelerating the use of GigE cameras. The region is witnessing growing deployment across automotive, packaging, and pharmaceutical industries.

U.K. GigE Camera Market Insight

The U.K. GigE camera market is expected to witness steady growth from 2026 to 2033, driven by increasing investments in industrial automation and smart manufacturing initiatives. The growing focus on improving production efficiency, quality assurance, and process monitoring is encouraging the adoption of GigE cameras across manufacturing and research applications. Strong technological infrastructure and rising use of machine vision systems further support market expansion.

Germany GigE Camera Market Insight

The Germany GigE camera market is expected to witness robust growth from 2026 to 2033, fueled by the country’s strong manufacturing base and leadership in industrial automation. Germany’s emphasis on precision engineering, quality control, and advanced production technologies promotes the widespread adoption of GigE cameras. Integration of machine vision systems in automotive, machinery, and electronics manufacturing is a key growth contributor.

Asia-Pacific GigE Camera Market Insight

The Asia-Pacific GigE camera market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, expanding manufacturing capacity, and increasing adoption of automation technologies in countries such as China, Japan, and South Korea. Government initiatives supporting smart manufacturing and rising demand for cost-effective vision systems are accelerating market growth.

Japan GigE Camera Market Insight

The Japan GigE camera market is expected to witness strong growth from 2026 to 2033 due to the country’s advanced robotics industry, high-tech manufacturing environment, and focus on precision inspection. Japanese manufacturers emphasize reliability, accuracy, and high-speed imaging, driving the adoption of GigE cameras across electronics, automotive, and semiconductor applications. Integration with AI and machine vision solutions further supports market expansion.

China GigE Camera Market Insight

The China GigE camera market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid industrial expansion, large-scale manufacturing activities, and high adoption of machine vision technologies. China’s role as a global manufacturing hub, combined with increasing investments in smart factories and quality inspection systems, is driving strong demand for GigE cameras across multiple industrial sectors.

GigE Camera Market Share

The GigE Camera industry is primarily led by well-established companies, including:

- Sony Corporation (Japan)

- Teledyne Technologies Incorporated (U.S.)

- Basler AG (Germany)

- Allied Vision Technologies GmbH (Germany)

- JAI (Japan)

- Point Grey Research Inc. (Canada)

- Toshiba Teli Corporation (Japan)

- Baumer (Switzerland)

- Matrox Electronic Systems Ltd (Canada)

- Qualitas Technologies Pvt Ltd (India)

- Adimec Advanced Image Systems B.V. (Netherlands)

- Atmel Corporation (U.S.)

- Alrad (U.K.)

- Bytronic.com (U.K.)

- FLIR Systems, Inc. (U.S.)

- IMPERX, Inc. (U.S.)

- Sensor Technologies America Inc. (U.S.)

- MATRIX VISION GmbH (Germany)

- Multipix Imaging (U.S.)

Latest Developments in Global GigE Camera Market

- In November 2025, FLIR Systems, Inc. (U.S.) announced a product launch with the introduction of a new GigE camera series designed for harsh and demanding environments. The development focuses on delivering high durability, stable performance, and reliable imaging in extreme outdoor and industrial conditions. These cameras are intended for applications such as outdoor surveillance, factory automation, and industrial monitoring. The launch enables FLIR to broaden its product portfolio and address niche, high-value use cases. This move is expected to strengthen FLIR’s competitive positioning and increase adoption of ruggedized GigE cameras across industrial sectors

- In October 2025, Sony Corporation (Japan) unveiled a new GigE camera model featuring integrated AI-based real-time image processing capabilities. This product innovation is aimed at supporting automation, smart manufacturing, and intelligent inspection systems. By embedding AI at the camera level, Sony enhances processing speed, reduces system complexity, and improves decision-making accuracy for end users. The development offers significant benefits for industries adopting Industry 4.0 and machine vision solutions. This advancement reinforces Sony’s technology leadership and accelerates the shift toward intelligent and autonomous imaging systems in the GigE camera market

- In December 2025, JAI A/S (Denmark) entered into a strategic partnership with a leading robotics company to co-develop integrated imaging solutions for automated systems. This collaboration focuses on combining GigE camera technology with advanced robotic platforms for applications in manufacturing, logistics, and warehouse automation. The partnership enables seamless hardware-software integration, improving precision, speed, and operational efficiency. It also allows JAI to expand its reach within the rapidly growing robotics ecosystem. This development highlights increasing convergence between vision systems and robotics, positively influencing innovation and long-term growth in the GigE camera market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gige Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gige Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gige Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.