Global Glass Door Merchandiser Market

Market Size in USD Billion

CAGR :

%

USD

7.85 Billion

USD

18.35 Billion

2024

2032

USD

7.85 Billion

USD

18.35 Billion

2024

2032

| 2025 –2032 | |

| USD 7.85 Billion | |

| USD 18.35 Billion | |

|

|

|

|

Glass Door Merchandiser Market Size

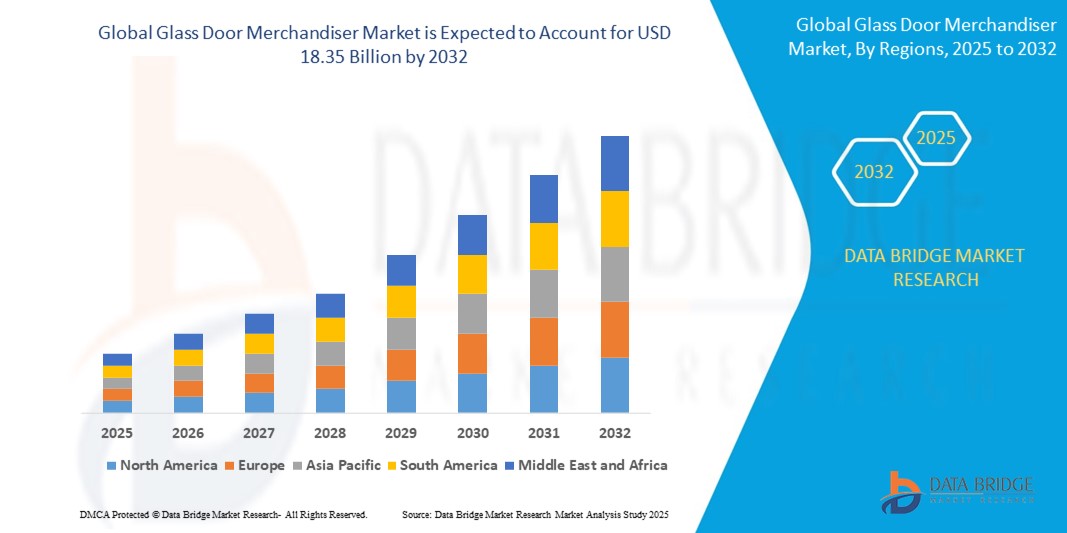

- The global glass door merchandiser market size was valued at USD 7.85 billion in 2024 and is expected to reach USD 18.35 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing demand for energy-efficient refrigeration in retail and foodservice sectors, alongside advancements in glass door technology that improve insulation, visibility, and product accessibility. These innovations are driving the replacement of traditional refrigeration units with modern, eco-friendly merchandisers across commercial settings

- Furthermore, rising emphasis on food safety, regulatory compliance, and sustainability is pushing retailers to adopt merchandisers with hydrocarbon refrigerants, smart sensors, and low-energy components. These factors are accelerating the adoption of advanced glass door merchandisers, significantly boosting the industry's growth

Glass Door Merchandiser Market Analysis

- Glass door merchandisers are commercial refrigeration units designed for chilled storage and visual display of perishable goods, typically used in supermarkets, convenience stores, and foodservice outlets. These units combine transparent doors with temperature control systems to ensure product freshness while enhancing shopper experience

- The rising popularity of organized retail, growing demand for cold storage visibility, and increasing focus on sustainable refrigeration solutions are key drivers of the market. Technological upgrades such as IoT-enabled controls, solar-assist features, and modular configurations are further fueling growth across global markets

- North America dominated the glass door merchandiser market with a share of 35.5% in 2024, due to strong demand from the retail and foodservice sectors for energy-efficient refrigeration and display solutions

- Asia-Pacific is expected to be the fastest growing region in the glass door merchandiser market during the forecast period due to rapid urbanization, expanding food retail chains, and rising cold storage needs across developing economies

- Hinged door type segment dominated the market with a market share of 61.8% in 2024, due to its widespread application in convenience stores, supermarkets, and grocery chains. Hinged doors are favored for their superior sealing capabilities, which minimize cold air leakage and contribute to improved energy efficiency. Their user-friendly opening mechanism and robust door closure systems support food safety standards while maintaining optimal product visibility and accessibility, making them a reliable choice for high-traffic retail environments

Report Scope and Glass Door Merchandiser Market Segmentation

|

Attributes |

Glass Door Merchandiser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Glass Door Merchandiser Market Trends

“Growth of Energy-Efficient Glass Door Merchandisers”

- The global glass door merchandiser market is expanding significantly due to rising demand for energy-efficient refrigeration solutions that reduce electricity consumption while maintaining product visibility and freshness

- For instance, industry leaders such as True Manufacturing, Frigoglass, Hussmann (Heat and Control, Inc.), Liebherr, and Arneg are innovating with low-E glass, LED lighting, inverter compressors, and natural refrigerants (such as R290) to develop eco-friendly merchandisers that meet stringent environmental regulations and reduce operational costs for retailers

- The growing consumer preference for grab-and-go and visually appealing refrigerated displays across supermarkets, convenience stores, and foodservice outlets is driving adoption of glass door merchandisers with advanced temperature controls and aesthetic designs

- Integration of smart technologies, including remote monitoring, IoT-enabled temperature management, and digital thermostats, enhances energy efficiency and operational reliability in retail refrigeration

- Market growth is supported by the global push for carbon footprint reduction and governmental incentives promoting energy-efficient equipment in commercial refrigeration sectors

- The shift toward environmentally conscious retail practices has increased product differentiation based on energy ratings, driving manufacturers to focus on sustainability without compromising cooling performance

Glass Door Merchandiser Market Dynamics

Driver

“Rising Trend of Home-Based Businesses”

- The increase in home-based food, beverage, and small retail business setups has expanded the demand for compact, efficient cooling and merchandising solutions suitable for smaller scale operations

- For instance, companies such as True Manufacturing and Hussmann offer versatile merchandisers in smaller sizes with energy-efficient features ideal for home-based entrepreneurs, food trucks, and local small retailers seeking professional-grade refrigeration for perishables

- Growing consumer preference for specialty and artisanal products encourages small food producers and home-based businesses to use glass door merchandisers for better product visibility and hygiene

- The rise of direct-to-consumer food delivery and subscription models is furthered supported by refrigerated merchandisers that maintain product integrity at the point of sale or storage in small commercial settings

- Increasing urbanization and concurrent growth in small-scale retail outlets drive demand for adaptable refrigeration units that balance energy use with space constraints

Restraint/Challenge

“Maintenance and Repair Costs”

- The operational lifetime costs of glass door merchandisers can be high due to regular maintenance needs such as glass door seal replacements, compressor servicing, and cleaning of refrigeration coils to maintain efficiency

- For instance, retail chains and convenience stores using merchandisers from manufacturers such as Frigoglass and Liebherr report significant expenditure on upkeep and repair, which may include periodic fault diagnostics and replacement of refrigeration components that raise total cost of ownership

- Technical complexity of energy-efficient units, including digital controls and inverter compressors, adds to maintenance challenges requiring skilled service personnel

- Inadequate repair infrastructure or delayed servicing can lead to product temperature inconsistencies, spoilage risks, and increased operational disruptions for retailers

- High repair expenses can discourage small businesses and independent retailers from investing in premium or advanced models despite their energy savings, affecting market penetration in some segments

Glass Door Merchandiser Market Scope

The market is segmented on the basis of design, configuration, and end use.

- By Design

On the basis of design, the glass door merchandiser market is segmented into hinged door type and sliding door type. The hinged door segment accounted for the largest market revenue share of 61.8% in 2024, driven by its widespread application in convenience stores, supermarkets, and grocery chains. Hinged doors are favored for their superior sealing capabilities, which minimize cold air leakage and contribute to improved energy efficiency. Their user-friendly opening mechanism and robust door closure systems support food safety standards while maintaining optimal product visibility and accessibility, making them a reliable choice for high-traffic retail environments.

The sliding door segment is projected to witness the fastest growth from 2025 to 2032, primarily due to its space-saving advantages and increasing adoption in compact commercial layouts. Sliding glass doors enhance ease of movement in narrow aisles and reduce the risk of obstructions or customer collisions in crowded spaces. Their sleek, modern appearance is also increasingly aligned with the design aesthetics of premium retail outlets and modern foodservice establishments, further driving their demand.

- By Configuration

On the basis of configuration, the market is segmented into endless remote, refrigeration system, and endless self-contained. The endless remote configuration held the largest market share in 2024, driven by its ability to support centralized refrigeration systems, which offer higher energy efficiency and better temperature control across large-scale retail operations. This configuration is commonly used in supermarkets and hypermarkets where multiple merchandiser units are connected to a remote compressor system, reducing maintenance complexity and allowing for optimized cooling performance.

The endless self-contained segment is anticipated to register the fastest growth rate during the forecast period. This is largely attributed to rising demand from smaller retail formats and convenience stores that prioritize flexible installation and mobility. Self-contained systems eliminate the need for external refrigeration lines, making them ideal for pop-up stores, seasonal outlets, and retailers seeking to expand refrigeration capacity without major infrastructure modifications. Their plug-and-play nature, combined with advancements in energy-efficient compressors and eco-friendly refrigerants, is enhancing their appeal in the market.

- By End Use

On the basis of end use, the market is segmented into retail outlets, commercial complexes, commercial kitchens, airports and stations, and institutional facilities and establishments. The retail outlets segment dominated the market in 2024, fueled by the expanding footprint of supermarkets, hypermarkets, and convenience stores globally. Glass door merchandisers serve as key point-of-sale solutions in these environments, supporting effective product presentation and temperature regulation for beverages, dairy, and ready-to-eat foods. The rise of organized retail and an emphasis on shopper engagement through transparent refrigeration units are further bolstering demand in this segment.

The airport and stations segment is projected to witness the fastest growth through 2032, driven by increasing investments in modernizing transportation hubs and enhancing food and beverage retail services. These high-footfall areas require merchandisers that combine visibility, durability, and minimal footprint. The growing trend of grab-and-go retail formats and 24/7 food kiosks at airports and railway stations is accelerating the deployment of energy-efficient, low-noise glass door merchandisers that can withstand continuous operation under heavy use conditions.

Glass Door Merchandiser Market Regional Analysis

- North America dominated the glass door merchandiser market with the largest revenue share of 35.5% in 2024, driven by strong demand from the retail and foodservice sectors for energy-efficient refrigeration and display solutions

- The region’s emphasis on food safety standards, eco-friendly cooling technologies, and aesthetically appealing refrigeration units fuels adoption across supermarkets, convenience stores, and commercial kitchens

- High levels of consumerism, the presence of major retail chains, and a focus on sustainability further contribute to the region's leadership in deploying modern, glass-door refrigeration systems

U.S. Glass Door Merchandiser Market Insight

The U.S. glass door merchandiser market captured the largest revenue share in 2024 within North America, supported by the presence of extensive food retail infrastructure and quick-service restaurants. Rising demand for visually appealing, energy-efficient refrigeration systems across supermarkets and grab-and-go retail formats is accelerating growth. Increasing regulatory pressure to reduce energy consumption and greenhouse gas emissions also promotes the adoption of high-efficiency merchandisers with LED lighting, R290 refrigerants, and ECM fan motors.

Europe Glass Door Merchandiser Market Insight

The Europe glass door merchandiser market is projected to grow at a strong CAGR during the forecast period, driven by increasing investments in food retail modernization and stricter energy-efficiency regulations. The region is witnessing high adoption across convenience stores, petrol stations, and commercial kitchens where display clarity, thermal performance, and compliance with environmental norms are essential. Growth is further supported by consumer preference for fresh, chilled products in well-lit and attractive merchandisers that promote transparent shopping experiences.

U.K. Glass Door Merchandiser Market Insight

The U.K. market is expected to expand steadily due to the increasing number of small-format retail outlets, cafes, and express food stores. Demand is driven by the need for compact, visually optimized display refrigeration in urban areas, along with regulations encouraging the use of low-GWP refrigerants and energy-labeled equipment. Merchandisers that offer a balance between space efficiency and product visibility are particularly favored in this evolving retail landscape.

Germany Glass Door Merchandiser Market Insight

Germany's glass door merchandiser market is advancing with rising demand from institutional facilities, bakeries, and premium food retailers. The country’s strong emphasis on environmental sustainability and energy conservation is promoting the use of remote and self-contained merchandisers with high energy ratings. The integration of smart temperature control systems and motion-sensor lighting is also gaining traction in line with Germany’s digitalization push.

Asia-Pacific Glass Door Merchandiser Market Insight

The Asia-Pacific market is expected to witness the fastest CAGR from 2025 to 2032, driven by rapid urbanization, expanding food retail chains, and rising cold storage needs across developing economies. Technological innovation, favorable government policies on food safety, and the growth of organized retail are stimulating the adoption of modern refrigeration equipment. Glass door merchandisers are increasingly in demand for their ability to enhance visual merchandising while maintaining consistent cooling.

Japan Glass Door Merchandiser Market Insight

Japan’s market is growing due to the proliferation of convenience stores (konbini), compact commercial spaces, and high standards in refrigeration. Merchandisers with ultra-low noise levels, space-saving designs, and touchless or automated access are becoming popular. Innovations in design and integration with building energy management systems reflect Japan’s focus on intelligent, efficient retail infrastructure.

China Glass Door Merchandiser Market Insight

China held the largest revenue share in Asia-Pacific in 2024, driven by the rapid expansion of hypermarkets, online-to-offline retail stores, and quick-service restaurants. With a growing focus on food preservation, presentation, and regulatory compliance, Chinese retailers are investing in glass door merchandisers with energy-saving features. Domestic manufacturing strength, availability of cost-effective solutions, and large-scale adoption in urban retail zones position China as a regional growth leader.

Glass Door Merchandiser Market Share

The glass door merchandiser industry is primarily led by well-established companies, including:

- Hobart (U.S.)

- Turbo Air Inc. (U.S.)

- ARNEG S.P.A. (Italy)

- Everest (India)

- Liebherr-International Deutschland GmbH (Germany)

- True Manufacturing Co., Inc. (U.S.)

- Migali (U.S.)

- ANTHONY INC. (U.S.)

- Procool Ltd (Ireland)

- TSSC Group (U.A.E)

- Traulsen (U.S.)

- UAB FEROR LT (Lithuania)

- HOSHIZAKI CORPORATION (Japan)

Latest Developments in Global Glass Door Merchandiser Market

- In 2025, Hussmann expanded its leadership in refrigerated display innovation by introducing intelligent energy-management features, including adaptive defrost and IoT-based door sensors. These advancements enhance operational efficiency by minimizing energy wastage and reducing product spoilage, positioning the company as a key player in driving the digital transformation of cold display systems across global food retail formats

- In 2025, True Manufacturing launched solar-assist merchandisers tailored for emerging markets with inconsistent power supply. This development aligns with global efforts to expand sustainable refrigeration access, especially in regions with energy infrastructure challenges. By offering off-grid capability, the company significantly strengthens its footprint in developing economies and supports resilience in cold chain logistics

- In 2024, True Manufacturing unveiled its Eco-Cool merchandiser line, featuring triple-pane, Low-E glass for superior insulation and reduced condensation. This product innovation directly responds to growing retailer demand for high-efficiency display solutions and contributes to energy conservation goals across foodservice and retail environments

- In March 2021, Frost-trol entered a strategic partnership with Bio Fresh Tech to co-develop a patented thermal storage technology for refrigerated cabinets. This breakthrough aims to improve temperature stability and energy efficiency in perishable goods storage, reinforcing Frost-trol’s role in next-generation cold chain innovation

- In November 2020, Hauser launched the Refino multi-deck merchandiser, distinguished by its transparent design that maximizes product visibility and accessibility. This advancement enhances the shopper experience and sets new standards in retail display aesthetics, supporting Hauser’s positioning as a premium solution provider in commercial refrigeration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Door Merchandiser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Door Merchandiser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Door Merchandiser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.