Global Glass Fiber Reinforced Plastics Gfrp Market

Market Size in USD Billion

CAGR :

%

USD

50.72 Billion

USD

84.25 Billion

2024

2032

USD

50.72 Billion

USD

84.25 Billion

2024

2032

| 2025 –2032 | |

| USD 50.72 Billion | |

| USD 84.25 Billion | |

|

|

|

|

Glass Fiber-reinforced Plastics (GFRP) Market Size

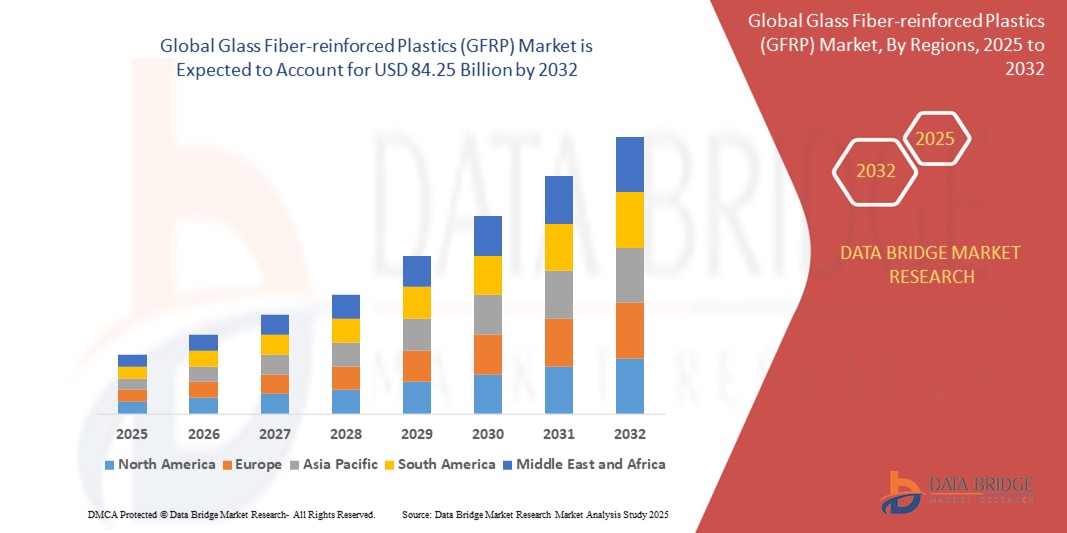

- The global Glass Fiber-reinforced Plastics (GFRP) market size was valued at USD 50.72 billion in 2024 and is expected to reach USD 84.25 billion by 2032, at a CAGR of 6.55% during the forecast period

- The market growth is largely fueled by increasing demand for lightweight, durable, and corrosion-resistant materials across industries such as construction, automotive, wind energy, and aerospace, where performance and longevity are critical

- Furthermore, the growing emphasis on sustainability and energy efficiency is encouraging the replacement of traditional materials with GFRP composites, which offer superior mechanical properties and design flexibility. These converging factors are accelerating the adoption of GFRP solutions, thereby significantly boosting the industry's growth

Glass Fiber-reinforced Plastics (GFRP) Market Analysis

- Glass Fiber-reinforced Plastics (GFRP), composed of glass fibers embedded in a polymer matrix, are increasingly vital materials across various industries due to their high strength-to-weight ratio, corrosion resistance, and durability, making them ideal for demanding applications in construction, transportation, wind energy, and aerospace sectors

- The escalating demand for GFRP is primarily fueled by the growing need for lightweight and high-performance materials, increased focus on energy efficiency and sustainability, and the expanding use of composites in structural and industrial applications

- North America dominated the Glass Fiber-reinforced Plastics (GFRP) market with a share of due to strong demand from construction, transportation, and wind energy sectors

- Asia-Pacific is expected to be the fastest growing region in the Glass Fiber-reinforced Plastics (GFRP) market with a share of during the forecast period due to rapid urbanization, industrial expansion, and rising investments in renewable energy, especially wind power

- Polyester segment dominated the market with a market share of 38.5% in 2024 due to its cost-effectiveness, ease of processing, and versatile applications across industries. Polyester resins offer good mechanical properties and chemical resistance, making them a preferred choice for construction and infrastructure applications

Report Scope and Glass Fiber-reinforced Plastics (GFRP) Market Segmentation

|

Attributes |

Glass Fiber-reinforced Plastics (GFRP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Fiber-reinforced Plastics (GFRP) Market Trends

“Increasing Demand for Lightweight and High-Performance Composites”

- A significant and accelerating trend in the global GFRP market is the growing emphasis on lightweight materials with superior mechanical properties for use in automotive, aerospace, and wind energy industries. This trend is reshaping manufacturing standards, focusing on performance, energy efficiency, and sustainability

- For instance, GFRP is increasingly used in automotive structural components to reduce vehicle weight, which improves fuel efficiency and lowers emissions. Likewise, wind turbine blades are commonly manufactured using GFRP due to its durability and high strength-to-weight ratio

- In aerospace, GFRP components are replacing traditional metals in interior and secondary structures to achieve weight reduction while maintaining structural integrity. In addition, the corrosion resistance and low maintenance requirements of GFRP are driving adoption in marine and construction applications

- The versatility of GFRP composites enables tailored design solutions across diverse sectors, allowing manufacturers to produce complex shapes and components that would be difficult or costly with metal alternatives

- This growing reliance on GFRP is fostering innovation in resin systems and fiber reinforcements, leading to advanced formulations that further enhance performance metrics. Manufacturers are also investing in automation and digital technologies to optimize GFRP fabrication and reduce production costs

- The trend toward lightweight, durable, and sustainable materials is fundamentally reshaping material selection strategies in various industries, positioning GFRP as a preferred composite solution for next-generation structural applications

Glass Fiber-reinforced Plastics (GFRP) Market Dynamics

Driver

“Growing Adoption in Infrastructure and Renewable Energy Sectors”

- The increasing deployment of GFRP in construction and wind energy projects is a key driver accelerating market growth, owing to its corrosion resistance, long service life, and low maintenance costs in harsh environments

- For instance, GFRP rebars are being adopted in bridges and marine structures where steel is prone to rust, significantly improving infrastructure longevity. Similarly, in wind energy, large-scale blades manufactured from GFRP enhance turbine efficiency while reducing maintenance downtime

- Government initiatives promoting renewable energy development and infrastructure modernization are further supporting the adoption of GFRP products. The material's performance benefits in terms of weight savings and durability align with regulatory and environmental goals

- In addition, the cost-effectiveness of GFRP over its lifecycle and its compatibility with a variety of manufacturing processes such as pultrusion and resin transfer molding make it attractive to producers seeking scalable, high-performance alternatives to metal

- The combination of mechanical performance, design flexibility, and environmental advantages positions GFRP as a critical material in meeting the evolving needs of global infrastructure and energy systems, fueling widespread integration across applications

Restraint/Challenge

“High Initial Production Costs and Recycling Limitations”

- The relatively high initial costs of GFRP manufacturing, coupled with limited recycling infrastructure for thermoset-based composites, present significant challenges to widespread market expansion. These factors raise concerns over material lifecycle sustainability and economic viability

- For instance, while GFRP components offer long-term performance benefits, their complex manufacturing processes and dependency on specialized equipment can increase upfront costs for producers and end users alike

- Moreover, the thermosetting resins commonly used in GFRP are not easily recyclable using traditional methods, leading to accumulation of composite waste and regulatory pressure for sustainable disposal solutions

- To address these concerns, industry stakeholders are exploring alternative resins, including thermoplastics and bio-based polymers, and advancing chemical recycling methods to enhance circularity. Several research institutions and companies are investing in pilot programs to develop scalable recycling solutions for GFRP waste

- Overcoming these obstacles through technological innovation, supportive regulations, and increased investment in recycling capabilities will be critical to ensuring sustainable growth of the GFRP industry

Glass Fiber-reinforced Plastics (GFRP) Market Scope

The market is segmented on the basis of resin type, end-user, manufacturing process, and form.

- By Resin Type

On the basis of resin type, the GFRP market is segmented into polyester, vinyl ester, epoxy, polyurethane, thermoplastic, and others. The polyester segment holds the largest market revenue share of 38.5% in 2024, driven by its cost-effectiveness, ease of processing, and versatile applications across industries. Polyester resins offer good mechanical properties and chemical resistance, making them a preferred choice for construction and infrastructure applications.

The epoxy segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its superior mechanical strength, excellent adhesion properties, and high durability. Epoxy resins are increasingly adopted in aerospace, automotive, and marine sectors where high performance and resistance to harsh environments are critical.

- By End-User

On the basis of end-user, the GFRP market is segmented into wind energy, electrical & electronics, transportation, pipes & tanks, construction & infrastructure, marine, aerospace & defense, and other end-use industries. The construction & infrastructure segment accounted for the largest market revenue share in 2024, supported by the rising demand for lightweight, corrosion-resistant materials in building projects and infrastructure development.

The wind energy segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the expanding global renewable energy initiatives and the increasing production of wind turbine blades made from GFRP composites, valued for their high strength-to-weight ratio.

- By Manufacturing Process

On the basis of manufacturing process, the GFRP market is segmented into compression & injection molding process, layup, filament winding, pultrusion, resin transfer molding (RTM), and other manufacturing processes. The compression & injection molding segment holds the largest market revenue share in 2024, owing to its high efficiency, scalability, and ability to produce complex shapes with consistent quality.

The resin transfer molding (RTM) segment is expected to witness the fastest growth rate from 2025 to 2032, favored for its low emissions, cost-effectiveness, and capacity to produce high-performance composite parts with excellent surface finish, especially in automotive and aerospace applications.

- By Form

On the basis of form, the GFRP market is segmented into rebar, powder, sheet, panel, rolls, and others. The rebar segment held the largest market revenue share in 2024, driven by the growing preference for corrosion-resistant reinforcement materials in concrete construction, particularly in infrastructure projects.

The panel segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by its increasing use in lightweight structural applications across automotive, aerospace, and marine industries, where weight reduction and durability are critical factors.

Glass Fiber-reinforced Plastics (GFRP) Market Regional Analysis

- North America dominated the Glass Fiber-reinforced Plastics (GFRP) market with the largest revenue share in 2024, driven by strong demand from construction, transportation, and wind energy sectors

- The region benefits from a well-established industrial base and advanced manufacturing capabilities. Increasing investments in infrastructure development and the push for lightweight, durable materials in automotive and aerospace industries further support market growth

- Consumers and industries in the region prioritize high-performance composites that offer strength, corrosion resistance, and sustainability, which is boosting the adoption of GFRP products

U.S. GFRP Market Insight

U.S. GFRP market leads within North America, propelled by rapid industrialization and the growing focus on renewable energy, especially wind power. The demand for corrosion-resistant materials in infrastructure projects and the transportation sector is accelerating the use of GFRP composites. In addition, advancements in manufacturing technologies and government initiatives promoting lightweight materials for fuel efficiency contribute to market expansion.

Europe GFRP Market Insight

Europe's GFRP market is poised for steady growth, supported by stringent environmental regulations and a strong emphasis on sustainable construction and automotive manufacturing. The region's focus on reducing carbon footprints encourages the use of lightweight composites such as GFRP. Growth in sectors such as aerospace, marine, and renewable energy, coupled with technological innovation, is further fostering market adoption. Increasing refurbishment and retrofitting projects also contribute to the demand for GFRP materials.

U.K. GFRP Market Insight

The U.K. market shows promising growth, fueled by rising infrastructure investments and a growing renewable energy sector. The government’s support for sustainable construction and transportation solutions is driving the demand for advanced composite materials. The U.K.’s strong R&D ecosystem and growing awareness about the benefits of corrosion-resistant, lightweight materials are key factors encouraging the adoption of GFRP.

Germany GFRP Market Insight

Germany’s GFRP market benefits from the country’s strong automotive and aerospace industries, along with significant investments in infrastructure and renewable energy projects. The focus on innovation, quality, and environmental sustainability supports the increasing use of GFRP composites. Germany's developed manufacturing infrastructure and stringent environmental standards drive demand for high-performance, eco-friendly materials.

Asia-Pacific GFRP Market Insight

The Asia-Pacific region is set to experience the fastest growth, driven by rapid urbanization, industrial expansion, and rising investments in renewable energy, especially wind power. Countries such as China, India, and Japan are leading the charge with growing demand in construction, transportation, and infrastructure sectors. The increasing adoption of GFRP is supported by government initiatives aimed at improving energy efficiency and sustainability. In addition, the region is emerging as a major manufacturing hub for composite materials, improving affordability and availability.

Japan GFRP Market Insight

Japan’s market growth is supported by its technological advancements and a strong focus on durable, lightweight materials in automotive and aerospace sectors. The country’s emphasis on quality, safety, and sustainability fosters adoption of GFRP composites. Japan's aging infrastructure and the need for maintenance and retrofitting create opportunities for corrosion-resistant materials. Integration of smart manufacturing processes also enhances the demand for GFRP.

China GFRP Market Insight

China holds a leading position in the Asia-Pacific GFRP market, driven by rapid industrialization, infrastructure development, and a growing wind energy sector. The country’s expanding manufacturing capabilities and increasing focus on sustainable materials contribute to widespread GFRP adoption. Domestic manufacturers are advancing production technologies, while government support for renewable energy and infrastructure projects fuels ongoing demand. The growth of smart city initiatives and increased urban housing also play a significant role.

Glass Fiber-reinforced Plastics (GFRP) Market Share

The Glass Fiber-reinforced Plastics (GFRP) industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- JEC (France)

- PPG Industries, Inc. (U.S.)

- Johns Manville (U.S.)

- Saint-Gobain (France)

- Nippon Sheet Glass Co., Ltd (Japan)

- AGY Holding Corp. (U.S.)

- Chongqing Polycomp International Corp. (China)

- Taishan Fiberglass Inc. (China)

- Taiwan Glass Ind. Corp. (Taiwan)

- BASF (Germany)

Latest Developments in Global Glass Fiber-reinforced Plastics (GFRP) Market

- In June 2024, Borealis launched Borcycle GD3600SY, a glass-fiber reinforced polypropylene (PP) compound containing 65% post-consumer recycled (PCR) polymer. The initial use of this material will be in center console carriers for the new Peugeot 3008, developed in collaboration with Plastivaloire and Stellantis

- In October 2021, LANXESS introduced a sustainable high-performance plastic, a polyamide 6 compound composed of 92% sustainable raw materials. This launch represents a significant advancement toward a circular economy. The content of sustainable raw materials is made transparent and traceable through independent certification using the mass balance method

- In April 2021, Bedford Reinforced Plastics introduced its FRP structure line, featuring pre-engineered and prefabricated structures such as catwalks, walkways, and fixed ladders. These components can be combined for flexible configurations and require minimal ongoing maintenance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Fiber Reinforced Plastics Gfrp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Fiber Reinforced Plastics Gfrp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Fiber Reinforced Plastics Gfrp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.