Global Glass Interposers Market

Market Size in USD Million

CAGR :

%

USD

113.35 Million

USD

308.88 Million

2025

2033

USD

113.35 Million

USD

308.88 Million

2025

2033

| 2026 –2033 | |

| USD 113.35 Million | |

| USD 308.88 Million | |

|

|

|

|

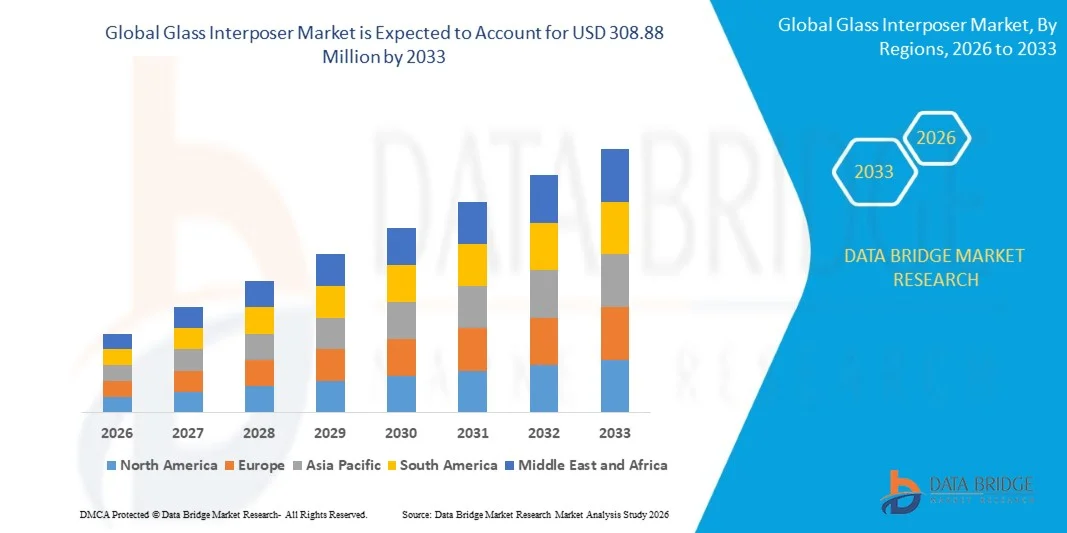

What is the Global Glass Interposer Market Size and Growth Rate?

- The global glass interposer market size was valued at USD 113.35 million in 2025 and is expected to reach USD 308.88 million by 2033, at a CAGR of13.35% during the forecast period

- Market growth is driven by rising demand for high-performance and power-efficient semiconductor devices, increasing adoption of advanced packaging technologies such as 2.5D and 3D integration, growing use of glass interposers in high-density ICs, processors, and memory devices, and the need for improved signal integrity, thermal stability, and fine-pitch interconnects. Expansion of AI, HPC, IoT, and advanced computing applications further accelerates market growth

What are the Major Takeaways of Glass Interposer Market?

- Strong growth in PCs, tablets, AI accelerators, and data center hardware, coupled with rising semiconductor R&D investments, is creating significant opportunities for glass interposer adoption across advanced packaging architectures

- However, design complexity, high initial manufacturing costs, limited skilled expertise, and integration challenges remain key restraints that may hinder large-scale commercialization, especially in cost-sensitive applications

- North America dominated the glass interposer market with a 37.95% revenue share in 2025, driven by strong growth in advanced semiconductor packaging, high-performance computing, and sustained investments in R&D across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by massive semiconductor manufacturing capacity, rapid expansion of advanced packaging facilities, and strong electronics production across China, Japan, South Korea, Taiwan, and India

- The 2.5D Glass Interposers segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread adoption in high-performance computing, networking chips, GPUs, and AI accelerators

Report Scope and Glass Interposer Market Segmentation

|

Attributes |

Glass Interposer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Glass Interposer Market?

“Increasing Shift Toward High-Density, High-Speed, and Advanced Packaging Glass Interposers”

- The glass interposer market is witnessing rising adoption of ultra-thin, high-density interposers designed to support 2.5D and 3D IC packaging, heterogeneous integration, and advanced semiconductor architectures

- Manufacturers are focusing on Through-Glass Via (TGV) technology, fine-line redistribution layers, and panel-level processing to enable higher signal integrity, lower power loss, and improved thermal performance

- Growing demand for compact, lightweight, and high-performance substrates is driving adoption across high-end computing, AI accelerators, networking, and data center applications

- For instance, leading players such as Corning, AGC, SCHOTT, TSMC, and Nippon Electric Glass are investing in next-generation glass materials, larger panel sizes, and scalable manufacturing processes

- Increasing requirements for high-speed data transmission, reduced crosstalk, and enhanced reliability are accelerating the shift from organic and silicon interposers toward glass-based solutions

- As semiconductor devices become smaller and more complex, Glass Interposers are emerging as a critical enabler for advanced packaging and next-generation electronics

What are the Key Drivers of Glass Interposer Market?

- Rising demand for high-performance computing, AI, 5G, and advanced memory packaging is driving strong adoption of glass interposers

- For instance, during 2024–2025, multiple semiconductor manufacturers expanded R&D investments in glass substrate technologies to support chiplet-based architectures

- Growing adoption of heterogeneous integration, fan-out, and 3D packaging is increasing the need for high-precision interposer solutions

- Superior properties of glass interposers, including low dielectric loss, high dimensional stability, and excellent surface flatness, enhance signal performance

- Increasing complexity of semiconductor designs and higher I/O density requirements favor glass over traditional organic substrates

- Supported by sustained investments in semiconductor manufacturing and advanced packaging infrastructure, the Glass Interposer market is expected to experience robust long-term growth

Which Factor is Challenging the Growth of the Glass Interposer Market?

- High manufacturing costs associated with TGV formation, precision processing, and yield management limit adoption, particularly among small and mid-scale players

- For instance, during 2024–2025, fluctuations in raw material prices and equipment costs increased overall production expenses for glass interposer manufacturers

- Technical challenges related to glass brittleness, handling, and large-panel scalability add complexity to mass production

- Limited availability of standardized manufacturing processes and skilled expertise slows commercialization in emerging regions

- Competition from advanced organic substrates and silicon interposers creates pricing pressure and slows rapid transition

- To overcome these challenges, companies are investing in process optimization, automation, material innovation, and collaborative ecosystem development, supporting gradual expansion of the Glass Interposer market

How is the Glass Interposer Market Segmented?

The market is segmented on the basis of product type, wafer size, substrate technology, and application.

• By Product Type

On the basis of product type, the glass interposer market is segmented into 2D Glass Interposers, 2.5D Glass Interposers, and 3D Glass Interposers. The 2.5D Glass Interposers segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread adoption in high-performance computing, networking chips, GPUs, and AI accelerators. 2.5D interposers enable high I/O density, superior signal integrity, and efficient chiplet integration while maintaining manageable manufacturing complexity. Their ability to balance performance and cost makes them the preferred choice for advanced packaging applications.

The 3D Glass Interposers segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for vertical integration, reduced footprint, and ultra-high bandwidth in next-generation processors and memory stacks. Advancements in TGV fabrication and thermal management are further accelerating adoption of 3D glass interposers in cutting-edge semiconductor designs.

• By Wafer Size

On the basis of wafer size, the glass interposer market is segmented into <200 mm, 200 mm, and 300 mm. The 200 mm wafer segment dominated the market with a 41.2% share in 2025, supported by its established manufacturing ecosystem, higher yield stability, and compatibility with existing semiconductor fabrication lines. Many glass interposer manufacturers prefer 200 mm wafers due to optimized processing costs and proven reliability for medium-to-high volume production.

The 300 mm wafer segment is projected to register the fastest CAGR from 2026 to 2033, driven by increasing demand for large-area interposers, higher throughput, and cost efficiency at scale. Growing investments in panel-level and large-wafer glass processing for advanced packaging and chiplet architectures are encouraging rapid adoption. Expansion of high-volume manufacturing for AI, data center, and advanced logic devices further supports the shift toward larger wafer sizes.

• By Substrate Technology

On the basis of substrate technology, the market is segmented into Through-Glass Vias (TGVs), Redistribution Layer (RDL) – First / Last, and Glass Panel Level Packaging (PLP). The TGV segment dominated the market with a 46.9% share in 2025, due to its critical role in enabling high-density vertical interconnections, low electrical loss, and excellent signal integrity. TGV technology is widely used in high-speed and high-frequency applications, including AI processors, RF modules, and advanced memory integration.

The Glass Panel Level Packaging (PLP) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by its potential for large-area manufacturing, reduced cost per unit, and scalability for mass production. Continuous advancements in panel handling, precision drilling, and metallization are accelerating PLP adoption across advanced semiconductor packaging applications.

• By Application

On the basis of application, the glass interposer market is segmented into 2.5D Packaging, 3D Packaging, and Fan-Out Packaging. The 2.5D Packaging segment dominated the market with a 48.3% share in 2025, supported by strong demand from high-performance computing, AI accelerators, GPUs, and networking processors. 2.5D packaging enables efficient chiplet integration with superior electrical performance while minimizing design complexity and thermal challenges.

The 3D Packaging segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of stacked memory, logic-memory integration, and space-constrained electronic systems. Rising demand for ultra-compact, high-bandwidth solutions in advanced computing and data centers is accelerating the transition toward 3D glass interposer-based packaging architectures.

Which Region Holds the Largest Share of the Glass Interposer Market?

- North America dominated the glass interposer market with a 37.95% revenue share in 2025, driven by strong growth in advanced semiconductor packaging, high-performance computing, and sustained investments in R&D across the U.S. and Canada. High adoption of AI accelerators, chiplet-based architectures, advanced ICs, and high-speed communication systems continues to fuel demand for Glass Interposers across data centers, automotive electronics, aerospace, and research institutions

- Leading companies in North America are actively investing in next-generation packaging technologies, including 2.5D and 3D integration using glass substrates, improving signal integrity, power efficiency, and thermal performance. Continuous funding for AI, cloud computing, and defense electronics further strengthens the region’s market leadership

- Strong innovation ecosystems, availability of skilled engineering talent, and close collaboration between semiconductor fabs, OSATs, and research labs reinforce North America’s dominant position

U.S. Glass Interposer Market Insight

The U.S. represents the largest share of the North American glass interposer market, driven by strong leadership in semiconductor design, advanced packaging, and high-performance computing. Rapid adoption of chiplet-based architectures, AI accelerators, and data center processors is accelerating demand for 2.5D and 3D glass interposers that offer superior signal integrity and thermal stability. The presence of leading foundries, OSATs, and technology companies, along with heavy investments in defense electronics and automotive semiconductors, supports market growth. Ongoing R&D funding and collaborations between industry and research institutions further strengthen long-term adoption.

Canada Glass Interposer Market Insight

Canada contributes steadily to the glass interposer market through its expanding microelectronics research ecosystem and growing focus on advanced materials. Universities, research labs, and innovation hubs are actively involved in semiconductor packaging research, including glass-based interposers for high-speed and low-power applications. Rising investments in telecom infrastructure, automotive electronics, and AI-driven systems are creating incremental demand for advanced packaging solutions. Government-supported innovation programs and cross-border collaboration with U.S. semiconductor companies enhance technology transfer and commercialization. While smaller in scale, Canada’s emphasis on R&D and skilled talent supports consistent market expansion.

Asia-Pacific Glass Interposer Market

Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2026 to 2033, driven by massive semiconductor manufacturing capacity, rapid expansion of advanced packaging facilities, and strong electronics production across China, Japan, South Korea, Taiwan, and India. Rising demand for AI chips, consumer electronics, and automotive semiconductors significantly boosts Glass Interposer adoption.

China Glass Interposer Market Insight

China is the largest contributor to the Asia-Pacific glass interposer market, supported by massive investments in semiconductor self-sufficiency and advanced packaging capabilities. Strong government backing, rapid expansion of foundries and OSAT facilities, and high-volume electronics manufacturing drive demand for glass interposers in AI chips, 5G infrastructure, and consumer electronics. Increasing focus on chiplet integration and heterogeneous packaging accelerates adoption of 2.5D and 3D interposer technologies. Competitive manufacturing costs and large domestic demand further support market penetration, positioning China as a key growth engine for the global Glass Interposer market.

Japan Glass Interposer Market Insight

Japan demonstrates stable growth in the glass interposer market, underpinned by its expertise in precision glass manufacturing, advanced materials, and semiconductor equipment. Japanese companies play a critical role in supplying high-quality glass substrates and processing technologies required for next-generation interposers. Growing adoption of advanced packaging in automotive electronics, robotics, and industrial systems supports market demand. Strong emphasis on reliability, miniaturization, and high-performance electronics aligns well with glass interposer advantages. Continuous investment in R&D and close collaboration between material suppliers and chip manufacturers reinforce Japan’s long-term market presence.

India Glass Interposer Market Insight

India is emerging as a high-growth market for glass interposers, driven by the rapid expansion of semiconductor design centers and government-led electronics manufacturing initiatives. Increasing focus on chip design, OSAT development, and advanced packaging under national semiconductor programs is creating new opportunities for glass interposer adoption. Demand is rising from AI, automotive electronics, telecom, and consumer electronics applications. Growing startup activity, foreign investments, and partnerships with global semiconductor players are strengthening the ecosystem. Although still at an early stage, rising R&D investments and infrastructure development are expected to accelerate market growth.

South Korea Glass Interposer Market Insight

South Korea plays a significant role in the glass interposer market due to its strong dominance in memory devices, advanced logic chips, and display technologies. Leading semiconductor manufacturers are increasingly adopting advanced packaging solutions, including glass interposers, to improve performance and power efficiency of AI processors and high-bandwidth memory. Rapid development of AI servers, automotive semiconductors, and 5G infrastructure further boosts demand. Strong manufacturing capabilities, continuous innovation, and high capital investment in semiconductor fabs position South Korea as a key contributor to the fastest-growing Asia-Pacific market.

Which are the Top Companies in Glass Interposer Market?

The glass interposer industry is primarily led by well-established companies, including:

- Corning Incorporated (U.S.)

- AGC Inc. (Asahi Glass) (Japan)

- SCHOTT AG (Germany)

- Plan Optik AG (Germany)

- Kiso Micro Co., Ltd. (Japan)

- Ushio Inc. (Japan)

- 3D Glass Solutions, Inc. (U.S.)

- Triton Microtechnologies, Inc. (U.S.)

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- Murata Manufacturing Co., Ltd. (Japan)

- Dai Nippon Printing Co., Ltd. (Japan)

- RENA (Germany)

- Samtec Inc. (U.S.)

- Workshop of Photonics (Germany)

- TECNISCO, LTD. (Japan)

- Ohara Corporation (Japan)

- Nippon Electric Glass (NEG) (Japan)

- Entegris (U.S.)

What are the Recent Developments in Global Glass Interposer Market?

- In May 2025, reports indicated that Samsung Electronics is developing a next-generation glass substrate for advanced semiconductor packaging, with a potential market introduction planned around 2028, highlighting the company’s long-term focus on next-gen chip packaging innovation and future performance scalability

- In August 2024, SCHOTT announced the launch of two environmentally friendly borosilicate glass substrates produced using low-carbon melting technology that reduces emissions by more than 25% compared to conventional methods, reinforcing sustainability while supporting high-performance semiconductor and electronics applications

- In April 2024, Nippon Electric Glass Co., Ltd. revealed the development of a lightweight, automotive-grade glass substrate with enhanced optical clarity and durability, specifically targeting head-up displays and in-vehicle infotainment systems, underscoring growing demand for advanced glass solutions in automotive electronics

- In February 2024, Corning Incorporated announced a new high-strength glass substrate optimized for AI semiconductor packaging and advanced display backplanes, offering improved heat resistance and ultra-flat surface precision, strengthening its position in high-performance and AI-driven semiconductor markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Interposers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Interposers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Interposers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.