Global Glass Syringe Market

Market Size in USD Billion

CAGR :

%

USD

10.26 Billion

USD

25.58 Billion

2024

2032

USD

10.26 Billion

USD

25.58 Billion

2024

2032

| 2025 –2032 | |

| USD 10.26 Billion | |

| USD 25.58 Billion | |

|

|

|

|

Glass Syringe Market Size

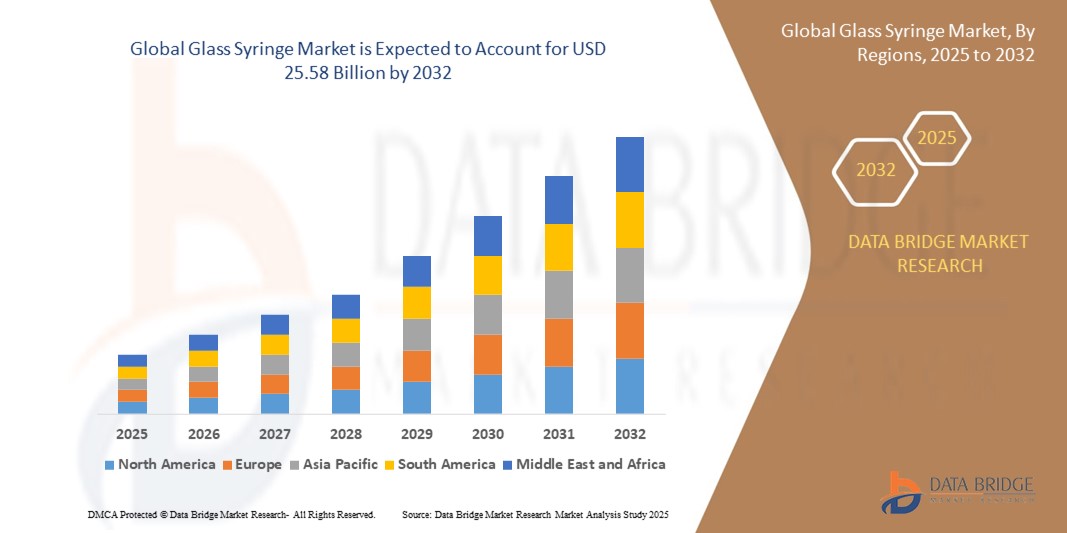

- The global glass syringe market size was valued at USD 10.26 billion in 2024 and is expected to reach USD 25.58 billion by 2032, at a CAGR of 12.1% during the forecast period

- The market growth is primarily driven by the increasing demand for safe and reliable drug delivery systems, advancements in pharmaceutical packaging, and the growing prevalence of chronic diseases requiring injectable treatments

- The rising adoption of prefilled syringes, coupled with stringent regulations for safe drug administration, is further propelling the demand for glass syringes as a preferred choice for medical applications

Glass Syringe Market Analysis

- Glass syringes are critical medical devices used for precise drug delivery in various healthcare settings, offering superior chemical resistance, durability, and compatibility with a wide range of pharmaceutical formulations

- The demand for glass syringes is fueled by their extensive use in hospitals, research laboratories, and drug manufacturing, driven by the need for sterile and contamination-free delivery systems

- Europe dominated the glass syringe market with the largest revenue share of 38.5% in 2024, attributed to advanced healthcare infrastructure, high adoption of prefilled syringes, and the presence of major pharmaceutical companies. Germany and France are key contributors to this growth

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing healthcare expenditure, and growing pharmaceutical manufacturing in countries such as China and India

- The disposable syringe segment dominated the largest market revenue share of 80% in 2024, driven by its widespread adoption in hospitals and clinics to minimize contamination risks and ensure patient safety, particularly for vaccine delivery and single-use applications

Report Scope and Glass Syringe Market Segmentation

|

Attributes |

Glass Syringe Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Syringe Market Trends

“Increasing Integration of Advanced Materials and Smart Technologies”

- The global glass syringe market is experiencing a notable trend toward the integration of advanced materials and smart technologies

- Innovations in material science, such as the development of metal-free and pre-sterilized glass syringes, enhance compatibility with biologics and reduce contamination risks, improving drug delivery precision

- Smart glass syringes with embedded sensors and connectivity features are emerging, enabling real-time monitoring of dosage accuracy and patient adherence

- For instance, some companies are developing smart syringes that track injection data and integrate with healthcare platforms to provide personalized treatment insights or optimize drug administration schedules

- This trend is increasing the appeal of glass syringes for both healthcare providers and patients, particularly in clinical and home healthcare settings

- Advanced coatings and siliconization techniques are being applied to improve plunger movement and reduce drug interaction, further enhancing the functionality of glass syringes

Glass Syringe Market Dynamics

Driver

“Rising Demand for Precise Drug Delivery and Biologics”

- The growing need for accurate and reliable drug delivery systems, particularly for biologics, vaccines, and insulin, is a key driver for the global glass syringe market

- Glass syringes enhance patient safety by offering features such as precise dosing, chemical stability, and compatibility with sensitive medications, critical for chronic disease management

- Government mandates, especially in Europe with initiatives such as eCall for emergency response, are promoting the adoption of high-quality medical devices, including glass syringes

- The expansion of biologics and biosimilars, coupled with advancements in biotechnology, is driving demand for glass syringes, particularly in hospitals and clinical research

- Manufacturers are increasingly offering prefilled glass syringes as standard solutions to meet the rising demand for convenient and sterile drug delivery systems

Restraint/Challenge

“High Production Costs and Data Privacy Concerns”

- The high initial costs associated with manufacturing advanced glass syringes, including specialized materials such as borosilicate neutral glass and smart technology integration, can be a barrier to adoption, especially in cost-sensitive emerging markets

- Incorporating smart features or pre-sterilization processes into glass syringes can increase production complexity and costs

- Data privacy and security concerns are a significant challenge, particularly for smart glass syringes that collect and transmit patient data, raising risks of breaches or non-compliance with stringent regulations such as GDPR in Europe

- The varied regulatory frameworks across regions regarding medical device standards and data handling complicate operations for global manufacturers and service providers

- These factors may deter adoption in regions with high cost sensitivity or stringent data privacy awareness, potentially limiting market growth

Glass Syringe market Scope

The market is segmented on the basis of syringe type, material type, capacity, and end use.

- By Syringe Type

On the basis of syringe type, the global glass syringe market is segmented into disposable and reusable syringes. The disposable syringe segment dominated the largest market revenue share of 80% in 2024, driven by its widespread adoption in hospitals and clinics to minimize contamination risks and ensure patient safety, particularly for vaccine delivery and single-use applications.

The reusable syringe segment is expected to witness the fastest growth rate of 14.2% from 2025 to 2032, fueled by increasing demand for sustainable and cost-effective solutions in research laboratories and clinical research settings, where sterilization and repeated use are feasible.

- By Material Type

On the basis of material type, the global glass syringe market is segmented into borosilicate neutral glass, surface-treated borosilicate glass, and soda lime glass. The borosilicate neutral glass (Type I) segment dominated with a market revenue share of 75% in 2024, owing to its superior chemical resistance, low thermal expansion, and suitability for sensitive pharmaceuticals such as biologics and vaccines.

The surface-treated borosilicate glass (Type II) segment is anticipated to experience significant growth from 2025 to 2032, driven by innovations in coatings that enhance durability and reduce protein adsorption, making it ideal for advanced biologics and high-precision applications.

- By Capacity

On the basis of capacity, the global glass syringe market is segmented into up to 1 ml, 1 ml to 5 ml, 5 ml to 20 ml, and above 20 ml. The 1 ml to 5 ml segment held the largest market revenue share of 40% in 2024, due to its extensive use in medical applications such as insulin administration, vaccinations, and cosmetic procedures, where precise dosing is critical.

The above 20 ml segment is expected to witness robust growth from 2025 to 2032, driven by increasing demand in drug manufacturing and clinical research for large-volume parenterals and infusion therapies, supported by advancements in high-capacity syringe designs.

- By End Use

On the basis of end use, the global glass syringe market is segmented into hospitals, research laboratories, drug manufacturing, and clinical research. The hospital segment dominated with a market revenue share of 45% in 2024, driven by high demand for glass syringes in vaccine administration, chronic disease treatments, and emergency care, where sterility and precision are paramount.

The drug manufacturing segment is anticipated to grow at the fastest rate of 13.8% from 2025 to 2032, fueled by the rising production of biologics and specialty pharmaceuticals that require chemically stable, non-reactive glass syringes to ensure drug integrity.

Glass Syringe Market Regional Analysis

- Europe dominated the glass syringe market with the largest revenue share of 38.5% in 2024, attributed to advanced healthcare infrastructure, high adoption of prefilled syringes, and the presence of major pharmaceutical companies. Germany and France are key contributors to this growth

- Consumers and end-users prioritize glass syringes for their chemical inertness, durability, and suitability for sensitive drug formulations, particularly in regions with stringent regulatory standards

- Growth is supported by advancements in syringe manufacturing, including enhanced borosilicate glass formulations and eco-friendly reusable options, alongside increasing adoption in hospitals, research laboratories, and drug manufacturing

U.K. Glass Syringe Market Insight

The U.K. market for glass syringes is expected to witness rapid growth, driven by increasing demand in hospitals and research laboratories for precise and safe drug administration. Growing emphasis on sustainability and reusable syringe systems, coupled with stringent safety regulations, encourages adoption. The rising focus on biologics and vaccine development further boosts demand for borosilicate glass syringes.

Germany Glass Syringe Market Insight

Germany is expected to witness significant growth in the glass syringe market, attributed to its robust pharmaceutical manufacturing sector and focus on high-quality medical devices. German end-users prefer borosilicate neutral glass syringes for their chemical stability and compatibility with advanced therapeutics. The integration of glass syringes in drug manufacturing and clinical research supports sustained market growth.

U.S. Glass Syringe Market Insight

The U.S. glass syringe market is expected to witness significant growth, fueled by strong demand in hospitals and clinical research sectors. Growing awareness of the benefits of glass syringes, such as reduced contamination risks and compatibility with biologics, drives market expansion. The trend towards sustainable, reusable syringes and stringent FDA regulations further supports growth in both disposable and reusable segments.

Asia-Pacific Glass Syringe Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global glass syringe market, driven by expanding healthcare infrastructure and rising pharmaceutical production in countries such as China, India, and Japan. Increasing awareness of the benefits of glass syringes for biologics, vaccines, and high-potency drugs is boosting demand. Government initiatives promoting healthcare access and sustainable medical devices further encourage market growth.

Japan Glass Syringe Market Insight

Japan’s glass syringe market is expected to experience rapid growth, driven by strong demand for high-quality, reusable borosilicate glass syringes in hospitals and drug manufacturing. The presence of leading pharmaceutical companies and advancements in precision syringe technology accelerate market penetration. Rising interest in eco-friendly and customizable syringe solutions also contributes to growth.

China Glass Syringe Market Insight

China holds the largest share of the Asia-Pacific glass syringe market, propelled by rapid urbanization, increasing healthcare expenditure, and growing demand for safe and reliable drug delivery systems. The country’s expanding pharmaceutical industry and focus on biologics and vaccine production drive the adoption of borosilicate neutral glass syringes. Competitive domestic manufacturing and cost-effective solutions enhance market accessibility.

Glass Syringe Market Share

The glass syringe industry is primarily led by well-established companies, including:

- BD (U.S.)

- Gerresheimer AG (Germany)

- NIPRO (Japan)

- SCHOTT (Germany)

- Ompi srl (Italy)

- Baxter (U.S.)

- Laboratorios Farmaceuticos ROVI SA (Spain)

- Terumo Corporation (Japan)

- RISCREEN GmbH (Germany)

- Frederick Furness Publishing (U.K.)

- ARTE Corporation (U.S.)

- Hindustan Syringes & Medical Devices Ltd. (India)

- Vetter Pharma International GmbH (Germany)

- Stevanato Group (Italy)

- SGD Pharma (France)

- Corning Incorporated (U.S.)

What are the Recent Developments in Global Glass Syringe Market?

- In January 2025, BD (Becton, Dickinson and Company) introduced its BD Neopak™ XtraFlow™ Glass Prefillable Syringe at Pharmapack 2025, showcasing its latest innovation for subcutaneous delivery of high-viscosity biologics. The syringe features a shorter 8mm needle and ultra-thin wall technology, reducing injection force and time by up to 57%, thereby enhancing patient comfort and minimizing intramuscular injection risks. BD also highlighted its broader Neopak™ Glass Prefillable Syringe platform and the UltraSafe Plus™ Passive Needle Guard, emphasizing their role in improving biologic drug delivery and supporting self-injection trends

- In January 2025, SCHOTT Pharma launched its next-generation SCHOTT TOPPAC® infuse polymer syringes, designed to enhance safety, efficiency, and sustainability in healthcare. Developed with Schreiner MediPharm and Körber Pharma, the system features a tamper-evident cap, functional label, and carton packaging—eliminating the need for blister packs and reducing waste by up to 58%. The syringes use cyclic olefin copolymer (COC) for improved drug stability and compatibility with existing filling lines. Though polymer-based, this innovation signals broader advancements in prefillable syringe technology, potentially influencing the glass syringe market as well

- In October 2024, Gerresheimer showcased its silicone oil-free prefillable syringe systems for ophthalmic applications at CPHI Worldwide 2024 in Milan. Designed for sensitive eye medications, these syringes—available in glass and cyclic olefin polymer (COP)—offer precise dosing, low particle load, and enhanced compatibility with advanced drug formulations. By eliminating silicone oil, the systems reduce potential medical risks and improve safety during intravitreal injections. The syringes are delivered sterile and ready-to-fill, supporting efficient drug administration. This innovation reflects Gerresheimer’s commitment to high-quality, specialized drug delivery solutions for chronic and complex eye conditions

- In October 2023, Schott AG unveiled its next-generation FIOLAX® Pro glass tubing, a Type I borosilicate glass designed to meet the evolving demands of the pharmaceutical industry. This advanced material offers enhanced chemical resistance, an improved Extractables & Leachables (E&L) profile, and is free of heavy metals, making it ideal for storing complex biologics. FIOLAX® Pro supports key industry trends including sustainability, digitalization, and the rise of biotech pharmaceuticals. Schott plans to manufacture the tubing using green energy, significantly reducing its carbon footprint and reinforcing its commitment to climate-friendly innovation

- In June 2023, Corning Inc. and SGD Pharma announced a strategic joint venture to build a pharmaceutical glass tubing facility in Telangana, India. The collaboration combines Corning’s Velocity® Vial coating technology with SGD Pharma’s vial-converting expertise to improve vial quality, boost filling-line productivity, and accelerate the global delivery of injectable medicines. This initiative addresses rising demand for critical drugs and strengthens the supply chain for glass syringes. The facility is expected to begin pharmaceutical tubing production in 2025, with Velocity Vial manufacturing starting in 2024

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glass Syringe Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glass Syringe Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glass Syringe Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.