Global Glazing Gel Market

Market Size in USD Million

CAGR :

%

USD

344.74 Million

USD

509.33 Million

2024

2032

USD

344.74 Million

USD

509.33 Million

2024

2032

| 2025 –2032 | |

| USD 344.74 Million | |

| USD 509.33 Million | |

|

|

|

|

Glazing Gel Market Size

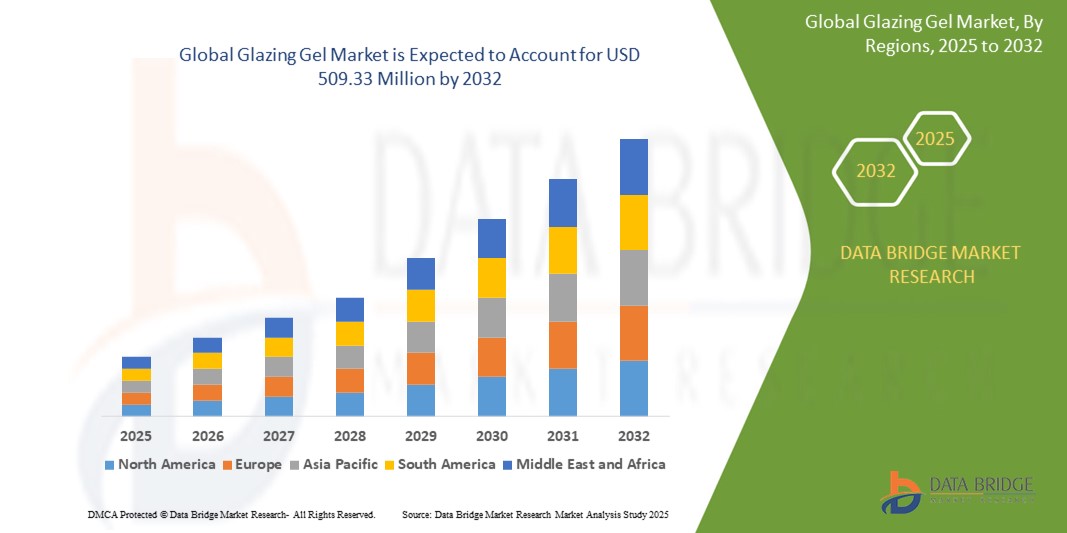

- The global glazing gel market size was valued at USD 344.74 million in 2024 and is expected to reach USD 509.33 million by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is primarily driven by the increasing demand for visually appealing and shelf-stable food products, coupled with advancements in food processing technologies that enhance the application of glazing gels across various food sectors

- The rising consumer preference for aesthetically enhanced food products, particularly in bakery and confectionary applications, and the growing trend of convenience foods are key factors propelling the adoption of glazing gels, significantly boosting the industry’s growth

Glazing Gel Market Analysis

- Glazing gels, used to enhance the appearance, texture, and shelf life of food products, are becoming essential in the food and beverage industry, particularly in bakery, confectionary, and dairy applications, due to their ability to provide a glossy finish and preserve product freshness

- The growing demand for glazing gels is fueled by the expansion of the global food and beverage industry, increasing consumer focus on visually appealing food products, and the rising popularity of ready-to-eat and packaged foods

- Europe dominated the glazing gel market with the largest revenue share of 42.15% in 2024, driven by a strong bakery and confectionary industry, high consumer demand for premium food products, and the presence of established manufacturers. Countries such as Germany, France, and Italy are key contributors, supported by innovations in food presentation and preservation techniques

- Asia-Pacific is expected to be the fastest-growing region in the glazing gel market during the forecast period due to rapid urbanization, growing disposable incomes, and increasing adoption of Western-style bakery and confectionary products

- The Plant segment dominated the largest market revenue share of 38.5% in 2024, driven by growing consumer preference for natural and clean-label products, particularly in Europe, where demand for plant-based glazing gels such as pectin and carnauba wax is strong due to their eco-friendly and sustainable attributes

Report Scope and Glazing Gel Market Segmentation

|

Attributes |

Glazing Gel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glazing Gel Market Trends

Increasing Adoption of Natural and Clean-Label Glazing Gels

- The global glazing gel market is experiencing a notable trend towards the use of natural and clean-label ingredients, driven by consumer demand for healthier and sustainable food options

- Plant-based and seaweed-derived glazing gels, such as those using pectin or carrageenan, are gaining popularity due to their natural origins and alignment with clean-label trends

- These natural formulations enhance product appeal by offering transparency in ingredient sourcing, catering to health-conscious consumers seeking minimal additives

- For instance, companies such as Cargill and Kerry Group are developing plant-based glazing gels that provide glossy finishes for bakery and confectionery products while meeting organic and vegan standards

- This trend is boosting the market's appeal, particularly in Europe, where consumer preference for natural products is strong, and is also gaining traction in Asia-Pacific due to rising awareness of sustainability

- Natural glazing gels are being increasingly used in fresh-cut fruits and vegetables to preserve natural color and texture without synthetic chemicals, enhancing shelf life and visual appeal

Glazing Gel Market Dynamics

Driver

Growing Demand for Visually Appealing Food Products and Extended Shelf Life

- Rising consumer preference for premium, visually appealing food products, such as glossy bakery items, confectioneries, and fresh produce, is a key driver for the global glazing gel market

- Glazing gels enhance product aesthetics by providing a shiny, attractive finish and extend shelf life by sealing in moisture, particularly for bakery, confectionery, and fresh-cut fruits and vegetables

- Government regulations in Europe, such as those promoting food waste reduction, are encouraging the use of glazing gels to enhance product longevity

- The proliferation of e-commerce and online food retail in Asia-Pacific is driving demand for glazing gels to maintain product quality during transportation and storage

- Manufacturers are increasingly incorporating glazing gels as standard applications in food processing to meet consumer expectations for high-quality, visually appealing products

Restraint/Challenge

High Production Costs and Regulatory Compliance Issues

- The high cost of developing and producing natural and specialty glazing gels, particularly plant-based and organic formulations, can be a barrier to adoption, especially in cost-sensitive markets such as parts of Asia-Pacific and the Middle East

- Sourcing high-quality raw materials, such as seaweed or plant-based pectin, and ensuring consistent production quality add to the overall cost

- Data privacy concerns are less relevant here, but regulatory compliance with food safety and labeling standards, such as those enforced by the European Food Safety Authority (EFSA), poses significant challenges. The fragmented regulatory landscape across regions complicates operations for global manufacturers

- Consumer concerns about synthetic glazing gels and potential health impacts are pushing manufacturers to innovate, but reformulating products to meet clean-label standards can be costly and time-intensive

- These factors may limit market expansion in regions with stringent regulations or high cost sensitivity, potentially slowing adoption in emerging markets

Glazing Gel market Scope

The market is segmented on the basis of source, application, type, and distribution channel.

- By Source

On the basis of source, the Global Glazing Gel Market is segmented into Plant, Seaweed, Animal, Microbial, and Synthetic. The Plant segment dominated the largest market revenue share of 38.5% in 2024, driven by growing consumer preference for natural and clean-label products, particularly in Europe, where demand for plant-based glazing gels such as pectin and carnauba wax is strong due to their eco-friendly and sustainable attributes. These gels are widely used for their glossy finish and moisture retention in food applications.

The Synthetic segment is expected to witness the fastest growth rate of 6.2% from 2025 to 2032, driven by its cost-effectiveness and versatility in applications such as bakery, confectionery, and cosmetics. Advancements in synthetic formulations, including improved stability and shine, further accelerate adoption in industrial settings.

- By Application

On the basis of application, the Global Glazing Gel Market is segmented into Bakery, Confectionery, Dairy, Meat and Poultry, Fresh-Cut Fruits and Vegetables, and Others. The Bakery segment dominated with a market revenue share of 65% in 2024, attributed to the widespread use of glazing gels to enhance the visual appeal, texture, and shelf life of breads, pastries, and cakes, particularly in Europe’s robust bakery sector.

The Fresh-Cut Fruits and Vegetables segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing consumer demand for visually appealing, fresh produce with extended shelf life. Glazing gels preserve natural color and texture, boosting retail appeal in rapidly urbanizing regions such as Asia-Pacific.

- By Type

On the basis of type, the Global Glazing Gel Market is segmented into Neutral, Mirror, Flavored, and Others. The Neutral segment held the largest market revenue share of 45% in 2024, owing to its versatility and compatibility with a wide range of food products, including bakery and confectionery, without altering flavor profiles. This segment is favored for its ease of application and neutral taste.

The Flavored segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for customized, premium food products. Flavored glazing gels enhance sensory appeal in confectionery and desserts, particularly in Asia-Pacific, where innovative flavor profiles are gaining traction.

- By Distribution Channel

On the basis of distribution channel, the Global Glazing Gel Market is segmented into Indirect Sales and Direct Sales. The Indirect Sales segment, encompassing supermarkets, hypermarkets, and online retail, held the largest market revenue share of 62% in 2024, driven by the expansion of retail networks and the growing popularity of online platforms for food ingredient purchases.

The Direct Sales segment is anticipated to grow rapidly from 2025 to 2032, fueled by increasing collaborations between manufacturers and food processors, particularly in Asia-Pacific. Direct sales enable customized solutions tailored to specific industrial needs, enhancing market penetration in emerging economies.

Glazing Gel Market Regional Analysis

- Europe dominated the glazing gel market with the largest revenue share of 42.15% in 2024, driven by a strong bakery and confectionary industry, high consumer demand for premium food products, and the presence of established manufacturers. Countries such as Germany, France, and Italy are key contributors, supported by innovations in food presentation and preservation techniques

- Consumers prioritize glazing gels for enhancing the aesthetic appeal, texture, and shelf life of food products, particularly in bakery, confectionery, and fresh-cut produce applications

- Growth is supported by advancements in glazing gel technology, including natural and plant-based formulations, alongside rising adoption in both industrial and retail segments.

U.K. Glazing Gel Market Insight

The U.K. market for glazing gels is expected to witness significant growth, driven by demand for visually appealing bakery and confectionery products in urban and suburban settings. Increased interest in food aesthetics and rising awareness of shelf-life extension benefits encourage adoption. Evolving food safety regulations influence consumer choices, balancing glaze application with compliance.

Germany Glazing Gel Market Insight

Germany is expected to witness significant growth in the glazing gel market, attributed to its advanced food processing sector and high consumer focus on product quality and sustainability. German consumers prefer technologically advanced glazing gels that enhance food presentation and contribute to longer shelf life. The integration of these gels in premium bakery and confectionery products, along with aftermarket applications, supports sustained market growth.

U.S. Glazing Gel Market Insight

The U.S. smart lock market is expected to witness significant growth, fueled by strong demand in the bakery and confectionery sectors and growing consumer awareness of product presentation and shelf-life benefits. The trend toward premium and artisanal food products, coupled with increasing use in fresh-cut fruits and vegetables, boosts market expansion. Manufacturers’ focus on clean-label and natural glazing gels complements consumer preferences, creating a robust market ecosystem.

Asia-Pacific Glazing Gel Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food and beverage production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of glazing gels for aesthetic enhancement, moisture retention, and shelf-life extension boosts demand. Government initiatives promoting food safety and sustainability further encourage the use of advanced glazing gels.

Japan Glazing Gel Market Insight

Japan’s glazing gel market is expected to witness rapid growth due to strong consumer preference for high-quality, visually appealing food products that enhance dining experiences. The presence of major food manufacturers and the integration of glazing gels in both industrial and retail applications accelerate market penetration. Rising interest in premium and natural glazing gels also contributes to growth.

China Glazing Gel Market Insight

China holds the largest share of the Asia-Pacific glazing gel market, propelled by rapid urbanization, rising food consumption, and increasing demand for visually appealing and longer-lasting food products. The country’s growing middle class and focus on modern food presentation support the adoption of advanced glazing gels. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Glazing Gel Market Share

The glazing gel industry is primarily led by well-established companies, including:

- AUI Fine Foods, Inc. (U.S.)

- Sprinkles & Co. (U.K.)

- Mantrose-Haeuser Co., Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Kerry Group plc. (Ireland)

- Arla Foods amba (Denmark)

- TNG Foods International (India)

- Swiss Bake Ingredients Private Limited (India)

- Vaikra Blends (India)

- Puratos (Belgium)

- Dawn Foods (U.S.)

- Bakels (Switzerland)

- Ingredion (U.S.)

- Tate & Lyle (U.K.)

- ADM (U.S.)

What are the Recent Developments in Global Glazing Gel Market?

- In November 2024, Sally Hansen formed a strategic partnership with a leading online retailer to boost the distribution of its newly launched eco-friendly glazing gel products. These biodegradable formulations are designed to appeal to environmentally conscious consumers in the cosmetics space, aligning with growing demand for sustainable beauty solutions. The collaboration enhances accessibility and visibility of Sally Hansen’s green innovations, reinforcing the brand’s commitment to clean beauty, ingredient transparency, and planet-friendly packaging

- In January 2024, OPI Products Inc. launched a new line of eco-friendly glazing gels tailored for the beauty industry. These biodegradable formulations are designed to meet rising sustainability standards while delivering durable, high-gloss finishes ideal for nail care applications. The launch targets environmentally conscious consumers who seek products that combine performance with planet-friendly ingredients. This initiative aligns with OPI’s broader commitment to clean beauty, vegan formulations, and innovative gel technologies, including their upcoming Intelli-Gel system set to revolutionize professional nail services in 2024

- In May 2023, Kerry Group, a global leader in taste and nutrition, launched a new line of organic glazing gels designed to meet the rising demand for clean-label and natural food ingredients. These gels are formulated to enhance the appearance and texture of food products—particularly in bakery and confectionery applications—while aligning with consumer preferences for healthier, sustainable, and plant-based options. The launch reflects Kerry’s commitment to innovation in food technology and its broader sustainability goals, including reducing environmental impact and promoting positive nutrition

- In January 2023, Cargill announced the expansion of its glazing gel production facility in North America to address the growing demand in the bakery and confectionery industries. This strategic move enhances Cargill’s manufacturing capabilities and supports its commitment to delivering high-quality food ingredients. The expansion is part of Cargill’s broader effort to strengthen its global market presence and meet evolving consumer preferences for visually appealing and premium baked goods. By increasing production capacity, Cargill aims to better serve food manufacturers and retailers seeking innovative glazing solutions

- In October 2022, Mantrose-Haeuser Co. Inc. introduced a novel glazing gel designed to improve the shelf-life of baked goods and confectionery items. Known for its expertise in specialty ingredients, Mantrose-Haeuser developed this formulation to meet industry demands for products that maintain freshness, visual appeal, and quality over time. The innovation supports manufacturers seeking to reduce food waste and enhance product presentation—especially in premium dessert and bakery segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glazing Gel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glazing Gel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glazing Gel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.