Global Glp 1 Analogues Market

Market Size in USD Billion

CAGR :

%

USD

32.19 Billion

USD

346.06 Billion

2024

2032

USD

32.19 Billion

USD

346.06 Billion

2024

2032

| 2025 –2032 | |

| USD 32.19 Billion | |

| USD 346.06 Billion | |

|

|

|

|

GLP-1 Analogues Market Size

- The global GLP-1 analogues market size was valued at USD 32.19 billion in 2024 and is expected to reach USD 346.06 billion by 2032, at a CAGR of 34.56% during the forecast period

- This growth is driven by factors such as the rising global prevalence of obesity and type 2 diabetes, along with increasing adoption of GLP-1 analogues due to their effectiveness in glycemic control and weight management

GLP-1 Analogues Market Analysis

- GLP-1 (glucagon-like peptide-1) analogues are injectable drugs used primarily for the treatment of type 2 diabetes and obesity, improving blood sugar control and aiding in weight loss by mimicking the GLP-1 hormone

- The market growth is significantly driven by the increasing global prevalence of obesity and type 2 diabetes, along with growing awareness of the benefits of GLP-1 analogues in weight management

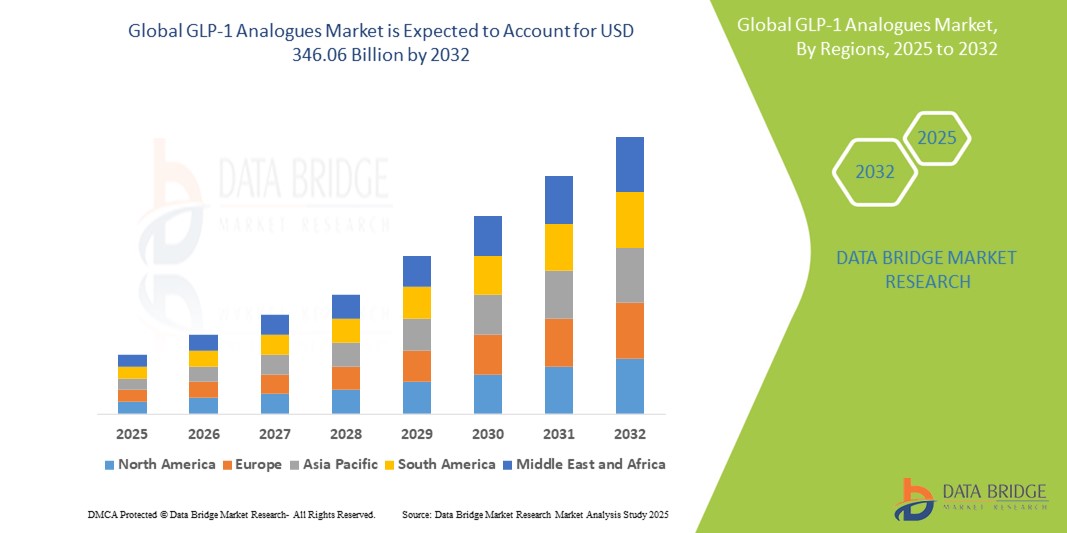

- North America is expected to lead the GLP-1 analogues market with with an estimated market share of over 76.05%, due to high obesity rates, robust healthcare systems, and early adoption of advanced therapies

- Asia-Pacific is projected to witness the fastest growth owing to rising diabetic population, healthcare access improvements, and expanding awareness of chronic disease management

- Ozempic segment is expected to dominate the market with a market share of 34.67% due to its proven efficacy in lowering HbA1c levels and promoting significant weight loss in patients with type 2 diabetes. Its once-weekly dosing improves patient adherence, while strong clinical outcomes and widespread physician adoption further support its market leadership

Report Scope and GLP-1 Analogues Market Segmentation

|

Attributes |

GLP-1 Analogues Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

GLP-1 Analogues Market Trends

“Rising Innovation in Drug Formulations & Expanding Use in Obesity Management”

- One prominent trend in the GLP-1 analogues market is the growing innovation in drug formulations, including extended-release versions and oral alternatives, enhancing patient convenience and compliance

- These innovations are expanding therapeutic applications beyond diabetes, particularly in obesity management, where GLP-1 analogues are demonstrating significant weight loss benefits in clinical trials

- For instance, the development of once-weekly and oral formulations such as Rybelsus is reshaping patient adherence, while products such as Wegovy are gaining traction specifically for chronic weight management

- These advancements are broadening the market scope, attracting interest from both healthcare providers and pharmaceutical investors, and driving robust growth in both diabetes and obesity treatment segments

GLP-1 Analogues Market Dynamics

Driver

“Rising Prevalence of Type 2 Diabetes and Obesity”

- The increasing global incidence of type 2 diabetes and obesity is a major driver fueling the demand for GLP-1 analogues, which have proven efficacy in both blood glucose regulation and weight reduction

- Modern lifestyles, poor dietary habits, and sedentary behavior are contributing to metabolic disorders, prompting a surge in demand for advanced therapeutic solutions such as GLP-1 receptor agonists

- As the burden of chronic diseases grows, healthcare providers are increasingly adopting GLP-1 analogues for their dual benefits, leading to expanded usage beyond traditional diabetic care into weight management

For instance,

- According to the World Obesity Atlas 2023, it is projected that by 2035, over 50% of the global population will be overweight or obese, underscoring the urgent need for effective obesity interventions such as GLP-1 therapies

- Consequently, the growing prevalence of metabolic diseases is driving the uptake of GLP-1 analogues, supporting their role as a key solution in both diabetes and obesity treatment strategies

Opportunity

“Expanding Therapeutic Potential Through AI-Driven Personalized Medicine”

- The integration of artificial intelligence in healthcare is opening new opportunities for personalized medicine, particularly in optimizing GLP-1 analogue therapy based on individual patient profiles and treatment responses

- AI algorithms can analyze real-world data, including electronic health records, genetic information, and lifestyle factors, to predict patient outcomes and tailor GLP-1 treatments more effectively

- This personalized approach enhances drug efficacy, minimizes adverse effects, and supports proactive patient management, particularly in complex cases involving comorbidities such as cardiovascular disease and metabolic syndrome

For instance,

- According to a 2024 report in Nature Digital Medicine, AI-based predictive models have demonstrated strong potential in identifying patients most likely to benefit from GLP-1 therapy, supporting clinicians in making evidence-based decisions for diabetes and obesity care

- By leveraging AI to personalize GLP-1 analogue use can improve adherence, optimize resource allocation, and drive better clinical outcomes, creating a compelling opportunity for healthcare providers and pharmaceutical companies alike

Restraint/Challenge

“High Treatment Costs Limiting Widespread Accessibility”

- The high cost of GLP-1 analogue therapies presents a significant barrier to widespread adoption, particularly in low- and middle-income countries where healthcare budgets are constrained

- These therapies, often priced at hundreds of dollars per month, may not be fully covered by insurance plans or public healthcare systems, making them unaffordable for many patients

- This This financial burden limits access to effective treatment for diabetes and obesity, especially among underserved populations, thereby slowing market penetration despite the drugs’ clinical benefits

For instance,

- In February 2024, according to a report by the Institute for Clinical and Economic Review (ICER), drugs such as semaglutide (Ozempic and Wegovy) were found to be cost-effective only at significantly lower price points than their current retail value, highlighting concerns about affordability and value-based pricing in chronic disease management

- Consequently, high treatment costs remain a major challenge, restricting equitable access to GLP-1 analogues and impeding the full potential of these therapies in addressing global health burdens

GLP-1 Analogues Market Scope

The market is segmented on the basis of product, application, route of administration, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Route of Application |

|

|

By Distribution Channel |

|

In 2025, the ozempic is projected to dominate the market with a largest share in product segment

The ozempic segment is expected to dominate the GLP-1 analogues market with the largest share of 34.67% in 2025 due to its proven efficacy in lowering HbA1c levels and promoting significant weight loss in patients with type 2 diabetes. Its once-weekly dosing improves patient adherence, while strong clinical outcomes and widespread physician adoption further support its market leadership

The type 2 diabetes mellitus is expected to account for the largest share during the forecast period in application market

In 2025, the type 2 diabetes mellitus segment is expected to dominate the market with the largest market share of 74.5% due to the widespread adoption of GLP-1 receptor agonists, such as Ozempic and Trulicity, for managing Type 2 diabetes. These medications have demonstrated significant efficacy in glycemic control and are widely prescribed, contributing to their leading market position.

GLP-1 Analogues Market Regional Analysis

“North America Holds the Largest Share in the GLP-1 Analogues Market”

- North America dominates the GLP-1 analogues market with an estimated market share of over 76.05%, primarily driven by high obesity and diabetes prevalence, strong healthcare infrastructure, and early adoption of innovative therapies

- U.S. holds a market share of 72.3%, due to widespread use of GLP-1 receptor agonists such as Ozempic, Wegovy, and Trulicity, along with favorable reimbursement policies and increasing focus on chronic disease management

- The presence of leading pharmaceutical companies such as Novo Nordisk and Eli Lilly, combined with high awareness among healthcare providers and patients, contributes to the region’s leadership

- In addition, the ongoing clinical trials and FDA approvals for expanded indications of GLP-1 therapies continue to stimulate growth and investment across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the GLP-1 Analogues Market”

- Asia-Pacific is expected to experience the highest compound annual growth rate, driven by the rising incidence of type 2 diabetes and obesity, growing urbanization, and dietary shifts across developing economies

- Countries such as China, India, and Japan are becoming key growth engines due to large diabetic populations, increasing healthcare spending, and efforts to improve chronic disease management

- Japan’s advanced healthcare system and regulatory support for innovative treatments make it a significant market for GLP-1 drugs, while China's expanding middle class and government initiatives on diabetes care are boosting demand

- India’s growing awareness of lifestyle diseases, coupled with rising accessibility to branded and biosimilar GLP-1 therapies, is contributing to regional expansion. Increasing involvement of global pharmaceutical companies in Asia-Pacific also supports long-term growth

GLP-1 Analogues Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- Sanofi (France)

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Amgen Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Boehringer Ingelheim International GmbH. (Germany)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Zealand Pharma (Denmark)

- Oramed (U.S.)

- Altimmune (U.S.)

- Structure Therapeutics Inc. (U.S.)

- Innovent (China)

- Sciwind Biosciences Co., Ltd. (China)

- Ascendis Pharma A/S (Denmark)

- Adocia (France)

- OPKO Health, Inc. (U.S.)

- TheracosBio, LLC (U.S.)

Latest Developments in Global GLP-1 Analogues Market

- In August 2024, Eli Lilly and Company announced that Tirzepatide (Zepbound and Mounjaro) reduced the risk of developing type 2 diabetes by 94% in adults with prediabetes and obesity or overweight, according to the SURMOUNT-1 study. The 176-week trial showed an average 22.9% weight loss with the 15 mg dose. In addition, Tirzepatide demonstrated consistent safety and tolerability

- In July 2024, Amylyx Pharmaceuticals acquired Avexitide, a GLP-1 receptor agonist, from Eiger Biopharmaceuticals, Inc., with FDA breakthrough therapy designation for treating Postbariatric Hypoglycemia (PBH) and congenital hyperinsulinism. Avexitide showed significant efficacy in reducing severe hypoglycemic events in Phase 2 trials and is set to enter Phase 3 trials for PBH in early 2025

- In February 2024, Eli Lilly and Company anticipated launching Mounjaro, its highly successful diabetic medication and obesity treatment, in India as early as next year if it passes an ongoing regulatory evaluation. This product is expected to impact Indian market growth positively

- In January 2024, Novo Nordisk A/S announced research alliances with two U.S. biotech firms. As part of its efforts to keep ahead of big pharma in discovering more medicines for cardiometabolic disorders

- In November 2023, Novo Nordisk A/S announced that it planned to introduce its immensely popular anti-obesity medicine, Wegovy, in Japan on February 22, marking its first launch in Asia, even as it struggles to keep up with demand in existing regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.