Global Glucose Meters Market

Market Size in USD Billion

CAGR :

%

USD

12.71 Billion

USD

27.65 Billion

2024

2032

USD

12.71 Billion

USD

27.65 Billion

2024

2032

| 2025 –2032 | |

| USD 12.71 Billion | |

| USD 27.65 Billion | |

|

|

|

|

Glucose Meters Market Size

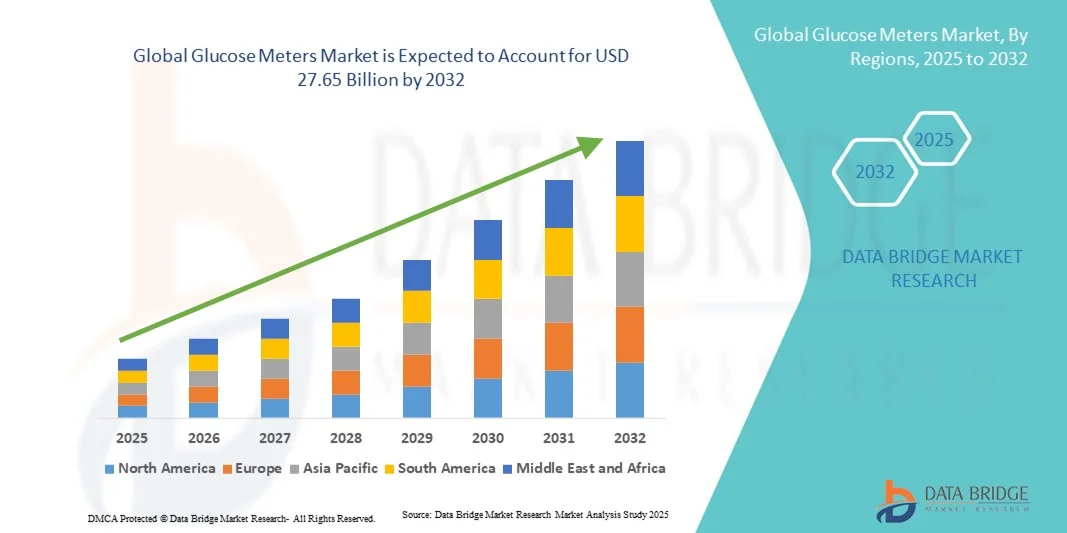

- The global glucose meters market size was valued at USD 12.71 billion in 2024 and is expected to reach USD 27.65 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of diabetes and other blood glucose-related disorders, coupled with growing awareness among patients about the importance of regular blood sugar monitoring. Technological advancements in portable, digital, and continuous glucose monitoring devices are further driving adoption across both homecare and clinical settings

- Furthermore, rising consumer demand for accurate, easy-to-use, and connected glucose monitoring devices is positioning glucose meters as a preferred solution for proactive diabetes management. These converging factors are accelerating the uptake of Glucose Meters solutions, thereby significantly boosting the industry's growth

Glucose Meters Market Analysis

- Glucose meters, providing rapid and accurate blood glucose measurement, are increasingly essential tools for diabetes management in both home and clinical settings due to their convenience, portability, and integration with digital health platforms

- The escalating demand for glucose meters is primarily fueled by the growing prevalence of diabetes worldwide, rising awareness about self-monitoring, and the adoption of connected healthcare devices that allow patients to track and manage their blood sugar levels efficiently

- North America dominated the glucose meters market with the largest revenue share of 38.5% in 2024, supported by advanced healthcare infrastructure, high prevalence of diabetes, and strong adoption of digital health solutions. The U.S. experienced substantial growth due to increased awareness of diabetes management, integration of connected glucose monitoring devices with mobile applications, and favorable reimbursement policies

- Asia-Pacific is expected to be the fastest-growing region in the glucose meters market during the forecast period, driven by rising diabetes prevalence, increasing urbanization, expanding healthcare access, and growing adoption of self-monitoring devices in countries such as China, India, and Japan

- The invasive segment dominated the glucose meters market with the largest revenue share of 63.5% in 2024, attributed to its validated accuracy and widespread clinical acceptance

Report Scope and Glucose Meters Market Segmentation

|

Attributes |

Glucose Meters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glucose Meters Market Trends

Enhanced Convenience and Accuracy in Home Glucose Monitoring

- A significant and accelerating trend in the global glucose meters market is the growing emphasis on accuracy, ease of use, and seamless integration with personal health management routines. This trend is significantly enhancing patient self-monitoring and disease management capabilities

- For instance, modern glucose meters now feature rapid test results, smaller blood sample requirements, and user-friendly interfaces, allowing individuals to efficiently monitor their blood sugar levels at home or on the go

- The integration of digital record-keeping and mobile app connectivity allows users to track trends, set reminders, and share data with healthcare providers, enhancing proactive disease management and personalized care

- Advancements in sensor technology and test strip design have improved the precision and reliability of glucose meters, making them essential tools for both Type 1 and Type 2 diabetes management

- The market is witnessing the development of compact, portable, and ergonomic designs that cater to diverse user needs, promoting regular and consistent monitoring

- Companies are also focusing on affordability and accessibility, ensuring that glucose meters are available across different regions and income groups, thereby expanding the user base

- The growing awareness of diabetes, coupled with the rise in lifestyle-related health issues, continues to drive demand for home-based glucose monitoring solution

- The market’s expansion is supported by continuous product innovations, regulatory approvals, and partnerships between device manufacturers and healthcare providers, ensuring that users have access to reliable and convenient monitoring solutions

Glucose Meters Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Diabetes and Home Monitoring

- The increasing prevalence of diabetes worldwide, coupled with rising awareness of the importance of regular blood glucose monitoring, is a significant driver for the heightened demand for home glucose meters

- For instance, in April 2024, major healthcare companies launched updated home glucose monitoring kits with enhanced accuracy, faster readings, and mobile connectivity features. Such innovations are expected to drive Glucose Meters market growth in the forecast period

- As patients seek more convenient and reliable ways to monitor their blood sugar levels, modern glucose meters provide easy-to-use interfaces, rapid test results, and integration with mobile applications, enabling proactive diabetes management at homeFurthermore, the trend of self-care and home-based healthcare has increased the adoption of these devices, as patients prefer avoiding frequent hospital visits for routine glucose checks

- The ability to track trends, set reminders, and share readings directly with healthcare providers enhances patient compliance and supports personalized treatment plans, driving market growth

- The demand for compact, portable, and user-friendly glucose meters that require minimal blood samples has further contributed to market expansion, particularly among elderly patients and individuals with limited mobility

Restraint/Challenge

Concerns Regarding Accuracy, Cost, and Regulatory Compliance

- Concerns regarding measurement accuracy and reliability of certain glucose meters can pose challenges to broader market adoption, as patients rely heavily on precise readings for insulin dosing and lifestyle adjustments

- In addition, high-quality glucose meters with advanced features such as Bluetooth connectivity, memory storage, or integration with health apps often come at a premium price, which can be a barrier for price-sensitive consumers in developing regions

- Regulatory approvals, quality certifications, and adherence to medical device standards are critical to gaining consumer trust, and any delays in these processes can slow product launches and market penetration

- Despite decreasing prices for basic glucose meters, the perceived premium for technologically advanced models can still limit widespread adoption among certain population segments

- Overcoming these challenges through enhanced accuracy, affordable pricing strategies, and regulatory compliance, along with increased awareness campaigns about the benefits of home glucose monitoring, will be vital for sustained market growth

- Integration with telehealth platforms and mobile health applications can further enhance user experience, supporting adherence, and long-term market expansion

Glucose Meters Market Scope

The market is segmented on the basis of product, type, technique, ergonomics, distribution channel, application, and end-user.

- By Product

On the basis of product, the glucose meters market is segmented into continuous glucose monitoring (CGM) devices and self-monitoring blood glucose (SMBG) Systems. The SMBG systems segment dominated the largest market revenue share of 57.3% in 2024. This dominance is attributed to its affordability, ease of use, and strong presence in emerging markets. Patients prefer SMBG devices for daily monitoring at home due to their simplicity and reliable performance. The segment is well-established, with multiple manufacturers offering calibrated, portable meters compatible with mobile health applications. Furthermore, SMBG systems benefit from robust consumer awareness, widespread distribution channels, and favorable reimbursement policies. Clinicians often recommend SMBG systems for routine glucose tracking, supporting their dominance in hospitals and home care settings. The segment’s broad adoption and proven reliability make it a cornerstone of the global glucose monitoring market.

The continuous glucose monitoring (CGM) devices segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032. The growth is fueled by rising adoption among Type 1 and Type 2 diabetes patients seeking real-time glucose data. Technological innovations, such as improved sensor accuracy, non-invasive options, and smartphone connectivity, drive CGM adoption. Increasing integration with mobile apps and telehealth platforms enhances patient engagement and disease management. Awareness campaigns highlighting the benefits of continuous monitoring over intermittent checks are boosting adoption. CGM devices are becoming more accessible due to declining prices and expanded insurance coverage. Rising prevalence of diabetes globally, combined with the need for better glycemic control, is a major growth driver. The segment is particularly popular in developed regions with higher disposable incomes, while emerging markets are gradually adopting CGM technology.

- By Type

On the basis of type, the glucose meters market is segmented into photoelectric blood glucose meters and electrode type blood glucose meters. The electrode type segment dominated with the largest market revenue share of 51.2% in 2024. This is due to its high measurement accuracy, rapid response time, and strong acceptance in clinical and home care settings. Electrode meters provide reliable readings, are easy to calibrate, and are compatible with a wide range of test strips and devices. Healthcare providers favor electrode type meters for hospital and outpatient monitoring. Consumers prefer them for consistent results, and the segment benefits from well-established supply chains and brand recognition. Educational initiatives and user-friendly manuals further enhance adoption. The long-standing reliability and accuracy of electrode meters ensure their continued dominance in the global market.

The photoelectric blood glucose meter segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032. Growth is driven by advancements in optical sensing technology, offering non-invasive or minimally invasive glucose measurement. Photoelectric devices are lightweight, portable, and often integrated with wearable or app-enabled platforms. Consumer preference for painless testing methods is increasing adoption. Continuous improvements in sensor sensitivity, along with integration with digital health tools, support market expansion. Photoelectric meters are particularly attractive for younger demographics and tech-savvy users. Rising awareness of the benefits of non-invasive monitoring and early adoption by specialty clinics are additional growth factors. The market for photoelectric meters is expected to expand rapidly in both developed and emerging regions due to convenience and innovation.

- By Technique

On the basis of technique, the glucose meters market is segmented into invasive and non-invasive. The invasive segment dominated the largest revenue share of 63.5% in 2024, attributed to its validated accuracy and widespread clinical acceptance. Hospitals and home care facilities prefer invasive methods for reliable glucose measurement. The segment benefits from established manufacturing standards, proven sensor technologies, and robust quality controls. Patients and healthcare providers alike trust invasive devices due to their consistent performance. Strong brand recognition, training support, and compatibility with existing monitoring systems further bolster adoption. Invasive meters are particularly preferred in high-risk patients requiring frequent monitoring. Their dominance is also reinforced by regulatory approvals and reimbursement support in key regions.

The non-invasive segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, driven by technological advancements in optical and sensor-based glucose detection. Patients increasingly seek painless alternatives to finger-prick testing. Non-invasive devices often integrate with mobile apps, wearables, and cloud-based platforms for real-time monitoring. Awareness campaigns highlighting the comfort and convenience of non-invasive devices are increasing adoption. Early adopters in developed markets and innovative startups are contributing to segment growth. Rising interest in telemedicine and remote patient monitoring fuels demand. Continuous R&D and regulatory approvals further support non-invasive segment expansion globally.

- By Ergonomics

On the basis of ergonomics, the glucose meters market is segmented into wearable and non-wearable devices. The non-wearable segment held the largest revenue share of 55% in 2024. Non-wearable devices are widely adopted due to their affordability, portability, and ease of use at home or in clinical settings. The segment benefits from strong consumer familiarity and established distribution channels. Home users prefer non-wearable meters for self-monitoring due to simplicity and reliability. Hospitals rely on non-wearable devices for patient monitoring in outpatient and inpatient care. Non-wearable devices often support data export to digital health platforms, enhancing usability. Continuous product innovation, such as improved displays and faster readings, ensures strong adoption. Their widespread availability in retail and online channels further solidifies market dominance.

The wearable segment is expected to witness the fastest CAGR of 25.2% from 2025 to 2032, driven by the growing integration of CGM sensors into wristbands, patches, and other wearable formats. Wearable devices offer continuous monitoring and real-time alerts, enhancing diabetes management. Integration with smartphones and cloud platforms enables remote monitoring by healthcare providers. Consumers are attracted by comfort, unobtrusive design, and data-driven insights for lifestyle management. Rising adoption of health tracking wearables contributes to market expansion. Technological innovations, such as longer battery life and miniaturized sensors, support growth. The segment is particularly expanding in tech-savvy regions with higher disposable incomes and health awareness.

- By Distribution Channel

On the basis of distribution channel, the glucose meters market is segmented into institutional sales and retail sales. Retail sales dominated the largest revenue share of 61.4% in 2024, attributed to high availability of home-use meters, e-commerce growth, and convenience for end-users. Retail channels provide easy access to SMBG and CGM devices for patients monitoring glucose at home. The segment benefits from strong marketing, promotional campaigns, and consumer awareness initiatives. Retail sales offer quick replenishment of strips and sensors, enhancing patient adherence. Established pharmacy networks and online platforms further support retail penetration. The segment is widely preferred by households seeking independent monitoring and convenience.

Institutional sales are expected to witness the fastest CAGR of 20.8% from 2025 to 2032. Growth is driven by hospitals, clinics, and diagnostic centers procuring advanced SMBG and CGM devices for patient management. Bulk procurement agreements, integration with hospital information systems, and partnerships with device manufacturers fuel expansion. Institutional adoption is supported by telehealth programs and remote patient monitoring initiatives. Hospitals increasingly demand CGM devices for intensive care and outpatient programs. Training and technical support offered by manufacturers strengthen the institutional segment. The rise in diabetes prevalence globally encourages consistent institutional purchases.

- By Application

On the basis of application, the glucose meters market is segmented into Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes. Type 2 diabetes dominated with a revenue share of 66% in 2024, driven by high prevalence, routine monitoring needs, and awareness campaigns. Increasing lifestyle-related diabetes incidence and widespread use of SMBG devices reinforce dominance. Healthcare systems encourage regular monitoring for Type 2 patients. Government programs and insurance support enhance accessibility. Type 2 monitoring accounts for the bulk of hospital and home care adoption globally.

Gestational diabetes is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by early screening initiatives, increased maternal health awareness, and adoption of portable glucose monitoring devices during pregnancy. Rising focus on prenatal care and self-monitoring encourages uptake. Awareness campaigns and integration with mobile health apps support growth. Technological improvements in small, easy-to-use meters further propel adoption. Healthcare providers recommend frequent monitoring during pregnancy, boosting device sales. Government programs promoting maternal health accelerate segment expansion.

- By End-User

On the basis of end-user, the glucose meters market is segmented into Hospitals and Home Care. The home care segment dominated the market with the largest revenue share of 58.6% in 2024. This is primarily driven by the increasing trend of self-monitoring among patients, the growing integration of mobile health technologies, and heightened awareness regarding effective diabetes management. Home care devices offer unparalleled convenience, allowing patients to track their blood glucose levels in real time through app-enabled monitoring systems. The accessibility of SMBG and CGM devices in pharmacies, online retail channels, and through health programs makes home monitoring highly feasible for long-term use. Patients benefit from easy-to-use devices that support lifestyle management, personalized alerts, and seamless data sharing with healthcare providers. The convenience, coupled with reduced dependency on hospital visits for routine glucose checks, continues to strengthen the dominance of the home care segment.

The hospital segment is projected to witness the fastest CAGR of 21.7% from 2025 to 2032. This growth is fueled by the increasing inflow of diabetes patients, the rising need for advanced continuous glucose monitoring (CGM) integration in clinical settings, and the expanding adoption of telehealth platforms. Hospitals and clinics are investing in modern glucose monitoring systems to enhance patient care, streamline outpatient monitoring, and enable remote supervision of high-risk patients. Moreover, the expansion of specialized diabetes care programs, coupled with government initiatives for chronic disease management, is driving demand in institutional settings. Hospitals also prefer devices with higher accuracy, real-time data sharing, and compatibility with electronic health records (EHRs), which further supports the rapid growth of this segment.

Glucose Meters Market Regional Analysis

- North America dominated the glucose meters market with the largest revenue share of 38.5% in 2024, supported by advanced healthcare infrastructure, high prevalence of diabetes, and strong adoption of digital health solutions

- Consumers in the region highly value the convenience, accuracy, and real-time tracking capabilities offered by connected and mobile-enabled glucose monitoring devices

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and favorable reimbursement policies, establishing home and clinical glucose monitoring as a preferred solution for proactive diabetes management

U.S. Glucose Meters Market Insight

The U.S. glucose meters market captured the largest revenue share in 2024 within North America, fueled by the swift uptake of connected devices and mobile-integrated glucose monitoring systems. Consumers are increasingly prioritizing proactive health management, with a growing preference for devices that enable real-time data tracking, telehealth integration, and remote monitoring by healthcare providers. Moreover, rising awareness of diabetes management and government healthcare initiatives are significantly contributing to the market's expansion.

Europe Glucose Meters Market Insight

The Europe glucose meters market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising diabetes prevalence, increasing urbanization, and growing awareness about chronic disease management. The adoption of home and clinical glucose monitoring solutions is increasing across countries such as Germany and the U.K., supported by technologically advanced healthcare infrastructure and the emphasis on patient-centric care.

U.K. Glucose Meters Market Insight

The U.K. glucose meters market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising trend of self-monitoring and home-based diabetes management. Consumers are increasingly adopting mobile-connected and easy-to-use devices, with the country’s robust healthcare system and retail infrastructure further promoting market growth.

Germany Glucose Meters Market Insight

The Germany glucose meters market is expected to expand at a considerable CAGR during the forecast period, supported by rising awareness of diabetes management, adoption of advanced medical technologies, and strong healthcare infrastructure. The market growth is also driven by increasing preference for reliable and accurate home and clinical glucose monitoring solutions among patients and healthcare providers.

Asia-Pacific Glucose Meters Market Insight

The Asia-Pacific glucose meters market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising diabetes prevalence, increasing urbanization, and growing healthcare access in countries such as China, Japan, and India. The affordability and accessibility of home and clinical glucose monitoring devices are expanding, while government initiatives promoting digital health solutions are further accelerating adoption.

Japan Glucose Meters Market Insight

The Japan glucose meters market is gaining momentum due to the country’s high-tech culture, aging population, and demand for convenient, accurate home-based monitoring solutions. The market growth is supported by widespread adoption of mobile-integrated and connected devices, enabling real-time tracking and better diabetes management.

China Glucose Meters Market Insight

The China glucose meters market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and high adoption of digital healthcare solutions. The growing awareness of diabetes management, coupled with affordable home and clinical monitoring devices, is driving market growth, supported by strong domestic manufacturers and increasing government initiatives for digital health.

Glucose Meters Market Share

The glucose meters industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Dexcom, Inc. (U.S.)

- Medtronic (Ireland)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Abbott (U.S.)

- DiaMonTech AG (Germany)

- ACON Laboratories, Inc. (U.S.)

- AgaMatrix (U.S.)

- ARKRAY, Inc. (Japan)

- BD (U.S.)

- Bionime Corporation (Taiwan)

Latest Developments in Global Glucose Meters Market

- In May 2022, Abbott announced that its FreeStyle Libre 3 system received U.S. FDA clearance, featuring the world’s smallest, thinnest, and most accurate 14-day glucose sensor. This advancement was aimed at enhancing diabetes management by providing continuous glucose monitoring with improved precision, convenience, and user experience

- In October 2022, Dexcom launched its G7 Continuous Glucose Monitoring System across the United Kingdom, Ireland, Germany, Austria, and Hong Kong, marking the initial phase of its global rollout. The G7 system was designed to provide real-time glucose readings every five minutes, offering superior accuracy and usability for patients managing diabetes

- In April 2023, Medtronic announced that its MiniMed780G system received FDA approval, introducing the world’s first insulin pump with meal detection technology and five-minute auto-corrections. This innovation aimed to deliver more precise insulin management and improve glycemic outcomes for patients with diabetes

- In July 2023, Senseonics received FDA approval for its Eversense E3 Continuous Glucose Monitoring System, allowing for continuous glucose monitoring for up to six months. This system was developed to reduce the frequency of sensor replacements, providing patients with enhanced convenience and long-term usability

- In September 2024, Senseonics announced FDA clearance for the Eversense 365 Continuous Glucose Monitoring System, which enables continuous glucose monitoring for up to one year. This development aimed to offer long-term convenience and reduce costs for patients using implantable sensors, representing a significant step forward in diabetes management technology

- In April 2025, Dexcom received FDA clearance for the G7 15-Day Continuous Glucose Monitoring System, extending the sensor wear period from 10 to 15 days. This advancement provided patients with greater convenience, fewer sensor replacements, and sustained accuracy for continuous glucose monitoring, further enhancing diabetes care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.