Global Glucose Tolerance Test Market

Market Size in USD Billion

CAGR :

%

USD

51.52 Billion

USD

110.85 Billion

2024

2032

USD

51.52 Billion

USD

110.85 Billion

2024

2032

| 2025 –2032 | |

| USD 51.52 Billion | |

| USD 110.85 Billion | |

|

|

|

|

Glucose Tolerance Test Market Size

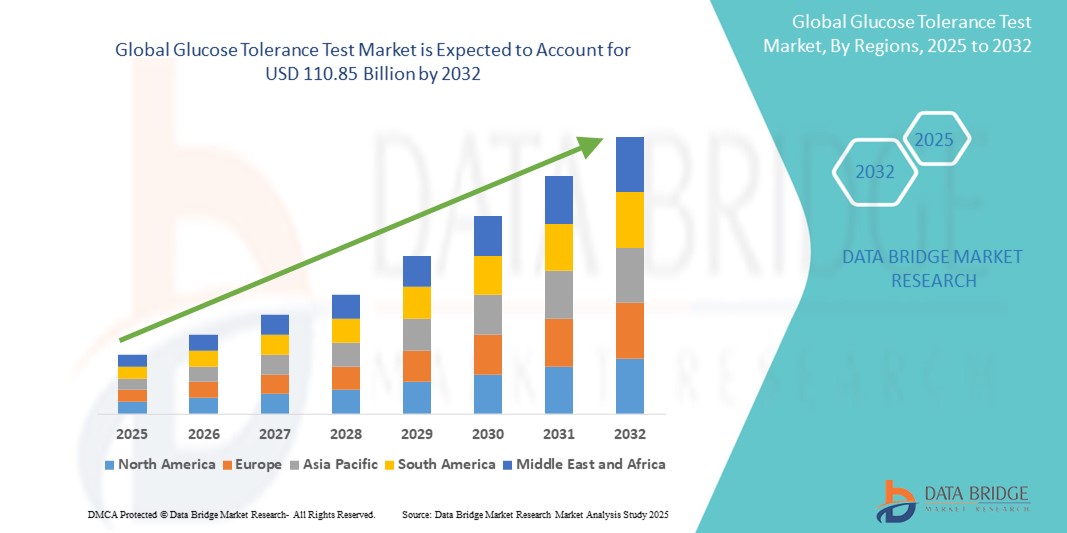

- The global glucose tolerance test market size was valued at USD 51.52 billion in 2024 and is expected to reach USD 110.85 billion by 2032, at a CAGR of 10.05% during the forecast period

- The market growth is largely fueled by the rising global prevalence of diabetes and related metabolic disorders, increasing awareness about early diagnosis and management of these conditions, and significant advancements in diagnostic technologies, including smart sensors and more user-friendly testing kits

- Furthermore, rising government initiatives and funding for preventive healthcare, combined with a growing emphasis on personalized medicine and the integration of digital health technologies for remote monitoring, are establishing glucose tolerance tests as a crucial diagnostic tool

Glucose Tolerance Test Market Analysis

- Glucose tolerance tests (GTTs), which measure the body's response to changes in sugar levels, are crucial diagnostic tools for identifying diabetes, prediabetes, gestational diabetes, and other metabolic disorders. Their enhanced accuracy, increasing accessibility, and role in early detection and management make them vital components of modern healthcare

- The escalating demand for GTTs is primarily fueled by the rising global prevalence of diabetes and related metabolic disorders, increasing public awareness about the importance of early diagnosis, and continuous technological advancements in diagnostic tools, including more accurate and user-friendly device

- North America dominates the glucose tolerance test market with the largest revenue share of 43.4% in 2024, characterized by high incidence of diabetes, advanced healthcare infrastructure, and significant investments in research and development by key industry players

- Asia-Pacific is expected to be the fastest growing region in the glucose tolerance test market during the forecast period due to increasing urbanization, rising disposable incomes, a growing diabetic population, and improving healthcare access in emerging economies

- Blood glucose testing kit segment dominates the glucose tolerance test market with a market share of 52.7% in 2024, driven by its critical role in everyday diabetes management, ease of use for self-monitoring, and continuous technological advancements improving accuracy and convenience

Report Scope and Glucose Tolerance Test Market Segmentation

|

Attributes |

Glucose Tolerance Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glucose Tolerance Test Market Trends

“Advancements in AI and Remote Monitoring for Enhanced Diabetes Management”

- A significant and accelerating trend in the global glucose tolerance test market is the deepening integration of artificial intelligence (AI) and advancements in remote monitoring technologies, including smart sensors and continuous glucose monitoring (CGM) systems. This fusion of technologies is profoundly enhancing the accuracy, convenience, and accessibility of glucose management for individuals with and without diabetes

- For instance, "Intelligent Voice Blood Glucose Meters" are emerging, featuring voice-guided instructions and real-time feedback, making diabetes management more accessible, particularly for those with visual impairments. Similarly, advanced AI and machine learning algorithms are being developed to predict blood glucose levels with high accuracy by analyzing data from CGM devices alongside physiological signals such as stress levels and activity

- AI integration in glucose monitoring enables features such as learning individual glucose patterns to predict future trends, suggesting dietary or activity adjustments, and providing more intelligent alerts for impending hypo- or hyperglycemia. For instance, some AI-powered systems can integrate data from multiple sources (CGM, activity trackers) to provide a more comprehensive and personalized approach to diabetes management. Furthermore, non-invasive screening methods using AI-powered voice analysis are being explored to detect Type 2 Diabetes with high accuracy

- The seamless integration of smart glucose monitoring devices with telemedicine platforms facilitates centralized control and proactive management of diabetes. Through a single interface, healthcare providers can remotely monitor patient glucose data, adjust treatment plans, and provide timely feedback, creating a more unified and accessible healthcare experience, especially beneficial for chronic conditions such ast diabetes

- This trend towards more intelligent, intuitive, and interconnected glucose monitoring systems is fundamentally reshaping patient expectations for diabetes care. Consequently, companies are investing in R&D to develop AI-enabled glucose monitors with features such as automatic data synchronization, predictive analytics, and seamless integration with digital health applications

- The demand for glucose tolerance test solutions that offer seamless AI and remote monitoring integration is growing rapidly across healthcare settings and home care, as both patients and providers increasingly prioritize convenience, personalized insights, and proactive management of blood glucose levels

Glucose Tolerance Test Market Dynamics

Driver

“Rising Incidence of Diabetes and Growing Awareness for Early Diagnosis”

- The escalating global prevalence of diabetes , driven by changing lifestyles, increasing obesity rates, and aging populations, coupled with a heightened awareness regarding the importance of early diagnosis and proactive management, is a significant driver for the sustained demand for glucose tolerance tests

- For instance, the International Diabetes Federation (IDF) projects that the number of adults living with diabetes will continue to rise significantly, necessitating more widespread screening and diagnostic tools such as GTTs. This growing burden of diabetes places immense pressure on healthcare systems to identify at-risk individuals and those with undiagnosed conditions

- As public health campaigns and medical communities emphasize the long-term complications of uncontrolled diabetes, there's a greater push for early detection. Glucose tolerance tests provide crucial insights into an individual's glucose metabolism, allowing for timely interventions, lifestyle modifications, or medical treatments to prevent or delay disease progression

- Furthermore, advancements in diagnostic technologies, including more accurate and patient-friendly testing kits and smart sensors, make GTTs more accessible and less cumbersome, thereby encouraging broader adoption among healthcare providers and individuals. The increasing integration of GTT data into digital health platforms also facilitates better monitoring and management, further fueling market growth.

- The expanding focus on preventive healthcare, particularly in high-risk populations, and the need for precise diagnostic tools for conditions such as gestational diabetes (which requires specific and timely screening) are key factors propelling the adoption of glucose tolerance tests across various healthcare settings, from hospitals to home care.

Restraint/Challenge

“Challenges with Test Procedures and High Costs in Certain Settings”

- While glucose tolerance tests are highly effective, challenges associated with their procedural complexity and relatively high costs in certain healthcare settings or for specific patient populations pose a significant restraint to broader market penetration. The multi-sample collection requirement for OGTTs can be time-consuming and inconvenient for patients, requiring them to stay at a clinic for several hours

- For instance, patient discomfort from fasting, potential nausea from the glucose solution, and the need for multiple blood draws can lead to poor patient compliance or reluctance to undergo the test, especially for repeat testing. The need for strict adherence to preparation protocols also makes the test susceptible to pre-analytical errors

- Addressing these procedural challenges through more patient-friendly approaches, such as integrating advanced continuous glucose monitoring (CGM) data or developing less invasive alternatives, is crucial for improving accessibility and patient experience. Companies are exploring innovations to simplify the testing process. In addition, the relatively high cost of GTTs, particularly the full OGTT with multiple blood draws and laboratory analysis, can be a barrier to adoption for price-sensitive individuals or in regions with limited healthcare funding and insurance coverage

- While some basic glucose tests are affordable, the comprehensive GTT might be considered a premium, potentially leading patients and healthcare providers to opt for less expensive screening methods such as fasting blood glucose or HbA1c tests, even if they offer less diagnostic detail

- Overcoming these challenges through the development of more streamlined, cost-effective, and less burdensome glucose tolerance test options, coupled with improved healthcare infrastructure and greater awareness of the long-term benefits of early diagnosis, will be vital for sustained market growth

Glucose Tolerance Test Market Scope

The market is segmented on the basis of product type, disease indication, and end user

- By Product Type

On the basis of product type, the glucose tolerance test market is segmented into smart sensors, blood glucose testing kit, meters, and others. The blood glucose testing kit segment held the largest market share of 52.7% in 2024, driven by its crucial role in everyday glucose monitoring for individuals with diabetes, their ease of use, quick results, and widespread adoption in both clinical and home settings. The continuous need for these consumables by a growing diabetic population underpins its leading position

The smart sensors segment is anticipated to witness significant growth during 2025 to 2032, driven by the increasing adoption of Continuous Glucose Monitoring (CGM) systems and Flash Glucose Monitoring (FGM) devices. These sensors provide real-time glucose data, enhancing diabetes management through continuous insights, reduced need for finger-pricks, and integration with digital health platforms. The demand for more convenient and less invasive monitoring solutions is fueling this segment's rapid expansion.

- By Disease Indication

On the basis of disease indication, the glucose tolerance test market is segmented into reactive hypoglycemia, diabetes hypoglycemia, gestational diabetes, and insulin resistance. The diabetes segment is expected to held the largest market share in 2024. This is primarily driven by the escalating global prevalence of both Type 1 and Type 2 diabetes, which necessitates widespread screening, diagnosis, and ongoing monitoring using glucose tolerance tests. The sheer volume of individuals affected by these conditions makes it the most significant application for GTTs

Gestational Diabetes is expected to witness the fastest CAGR from 2025 to 2032. This growth is fueled by increasing awareness of its prevalence and potential maternal and fetal complications, leading to mandatory screening protocols for pregnant women in many regions. The OGTT is the gold standard for diagnosing gestational diabetes, ensuring its continued importance in prenatal care.

- By End User

On the basis of end user, the glucose tolerance test market is segmented into hospitals, home, diagnostic clinics, and others. The home/home care settings segment is dominating the market in 2024, accounting for a significant share. This dominance is driven by the increasing trend towards self-monitoring of blood glucose (SMBG) by diabetic patients, the convenience of home testing, and the rising availability of user-friendly portable devices. Telemedicine and remote patient monitoring initiatives further contribute to the shift towards home-based care

Hospitals and Diagnostic Clinics is expected to witness a fastest growth in market during 2025 to 2032, driven by the need for initial diagnosis, confirmatory testing, and managing critically ill patients. While home use is growing, these professional settings remain crucial for comprehensive GTTs and for patients requiring supervised testing or advanced diagnostic interpretation.

Glucose Tolerance Test Market Regional Analysis

- North America dominates the glucose tolerance test market with the largest revenue share of 43.4% in 2024, driven by characterized by high incidence of diabetes, advanced healthcare infrastructure, and significant investments in research and development by key industry players

- Consumers and healthcare providers in North America highly value early diagnosis and proactive diabetes management, leading to a strong demand for accurate and convenient glucose tolerance tests

- This widespread adoption is further supported by high patient awareness, favorable reimbursement policies for diabetes testing, and the rapid uptake of technologically advanced glucose monitoring solutions, including smart sensors and continuous glucose monitoring (CGM) systems.

U.S. Glucose Tolerance Test Market Insight

The U.S. glucose tolerance test market holds a dominant position within North America, fueled by the exceptionally high prevalence of diabetes and prediabetes in the country. Consumers and healthcare providers are increasingly prioritizing rigorous screening and effective management of blood glucose levels. The robust demand for advanced diagnostic tools, including continuous glucose monitoring (CGM) and integrated digital health solutions, further propels the market. Moreover, favorable reimbursement policies and extensive public awareness campaigns about diabetes prevention and control significantly contribute to the market's expansion.

Europe Glucose Tolerance Test Market Insight

The Europe glucose tolerance test market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of diabetes across the continent and increasing public health initiatives focused on early diagnosis and management. The aging population and changing lifestyles also contribute to the growing demand for glucose monitoring and diagnostic solutions. European consumers are increasingly adopting self-monitoring blood glucose (SMBG) devices and advanced continuous glucose monitors, with a strong emphasis on improving patient outcomes and quality of life

U.K. Glucose Tolerance Test Market Insight

The U.K. glucose tolerance test market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating prevalence of diabetes and a concerted effort to enhance diabetes care and early detection. Concerns regarding the long-term health complications associated with undiagnosed or poorly managed diabetes are encouraging both individuals and healthcare providers to utilize comprehensive glucose testing solutions. The U.K.'s robust National Health Service (NHS) and its increasing focus on preventive healthcare, alongside the adoption of technologically advanced monitoring devices, are expected to continue to stimulate market growth

Germany Glucose Tolerance Test Market Insight

The Germany glucose tolerance test market is expected to expand at a considerable CAGR during the forecast period, fueled by a high incidence of diabetes, strong emphasis on preventive medicine, and a well-developed healthcare infrastructure. Germany's technologically advanced healthcare system promotes the adoption of innovative diagnostic tools, including point-of-care (POC) glucose testing and continuous glucose monitoring. The integration of GTTs with digital health platforms and a strong preference for accurate, reliable, and privacy-focused solutions align with local consumer and medical professional expectations

Asia-Pacific Glucose Tolerance Test Market Insight

The Asia-Pacific glucose tolerance test market is poised to grow at the fastest CAGR during 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and the soaring prevalence of diabetes in populous countries such as China and India. The region's growing awareness about diabetes, coupled with improving healthcare access and government initiatives promoting early detection, is driving the adoption of glucose tolerance tests. Furthermore, as APAC emerges as a significant manufacturing hub for medical devices, the affordability and accessibility of glucose testing solutions are expanding to a wider patient base.

Japan Glucose Tolerance Test Market Insight

The Japan glucose tolerance test market is gaining momentum due to the country's rapidly aging population, which is highly susceptible to diabetes, and a strong emphasis on advanced medical technology. The Japanese market places significant importance on precise diagnostics, and the adoption of glucose tolerance tests is driven by increasing awareness of diabetes management and the integration of advanced monitoring devices. The country's high-tech culture also facilitates the adoption of innovative solutions, including continuous glucose monitoring systems and connected health platforms for better patient care

India Glucose Tolerance Test Market Insight

The India glucose tolerance test market accounted for a significant market share in Asia Pacific in 2024, attributed to the country's massive diabetic population, rapid urbanization, and increasing access to healthcare facilities. India stands as one of the largest markets for diabetes care, and glucose tolerance tests are becoming increasingly crucial for diagnosis and monitoring. The push towards improved public health, the growing availability of affordable testing options, and strong domestic and international player presence are key factors propelling the market in India

Glucose Tolerance Test Market Share

The Glucose Tolerance Test industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Medtronic (U.S.)

- NIPRO (Japan)

- Trividia Health, Inc. (U.S.)

- Dexcom, Inc. (U.S.)

- Healius Limited (Australia)

- Penlan Healthcare Ltd (U.K.)

- Quest Diagnostics Incorporated (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Abbott (U.S.)

- Labcorp. (U.S.)

- ARUP Laboratories (U.S.)

- Cleveland HeartLab, Inc. (U.S.)

- Merck KGaA (Germany)

- Bayer AG (Germany)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- E-Zlab Health Services (Canada)

- F. Hoffman-La Roche Ltd (Switzerland)

- LifeScan IP Holdings, LLC (U.S.)

- Sanofi (France)

Latest Developments in Global Glucose Tolerance Test Market

- In March 2025, IDF (The International Diabetes Federation) recognized 1-hour oral glucose tolerance test (OGTT) as a more practical and sensitive option compared to a 2-hour OGTT, which requires overnight fasting followed by taking a sugar drink and waiting an additional 2 hours to undergo an additional blood sugar measurement

- In February 2025, a review published in the Journal of Clinical Endocrinology & Metabolism highlighted the exponential growth of diabetes management tools over the last decade, including continuous glucose monitors (CGM) and automated insulin delivery systems. While not directly GTTs, these advancements underscore the broader trend towards more sophisticated and continuous glucose monitoring, which can complement or even reduce the need for traditional GTTs in some contexts, offering more comprehensive insights into glucose dynamics.

- In September 2024, Midas Pharma received marketing authorization in Germany for their standardized oral glucose tolerance test (oGTT) products (50g/200ml and 75g/300ml solutions). This development signifies a focus on standardized, pharmaceutical-grade glucose solutions for GTTs, addressing concerns about consistency and quality in testing, particularly following incidents related to contaminated glucose solutions.

- In January 2022, F. Hoffmann-La Roche Ltd launched the Cobas pulse system, a revolutionary networked diagnostic device. While this occurred slightly before the requested timeframe, it's a significant indicator of the trend towards integrated, point-of-care blood glucose readings that can interact with digital health software. Such systems contribute to a more efficient and connected approach to glucose testing and management.

- In December 2022, Digostics introduced GTT@home, an oral glucose tolerance home testing solution now available in the UK via NHS Supply Chain. This innovative solution streamlines the diabetes screening workflow by allowing effective and accurate oral glucose tolerance testing directly at the patient's home. It addresses patient convenience and aims to increase patient throughput, signifying a shift towards decentralized and patient-centric diagnostic solutions in the GTT market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.