Global Glutaric Acid Market

Market Size in USD Billion

CAGR :

%

USD

5.22 Billion

USD

7.36 Billion

2024

2032

USD

5.22 Billion

USD

7.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.22 Billion | |

| USD 7.36 Billion | |

|

|

|

|

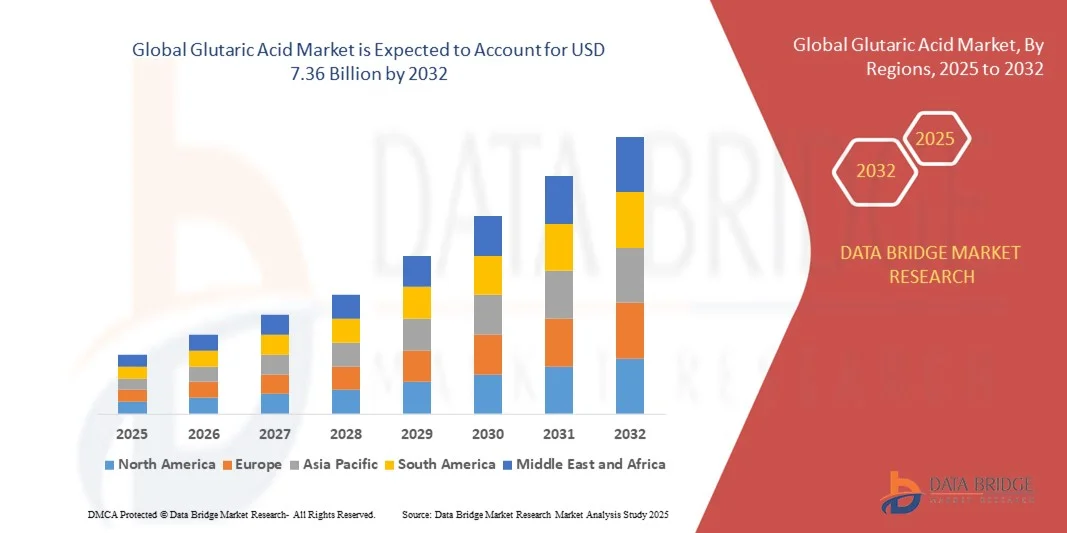

What is the Global Glutaric Acid Market Size and Growth Rate?

- The global glutaric acid market size was valued at USD 5.22 billion in 2024 and is expected to reach USD 7.36 billion by 2032, at a CAGR of 4.40% during the forecast period

- The growing usages of the product in the manufacturing of polymer material while used as an ingredient in the production of surfactants, rising demand from pharmaceutical industry as an ingredient in dietary supplements, surging volume of patients suffering from lifestyle diseases, changing work patterns along with extreme weather conditions are some of the major as well as important factors which will likely to accelerate the growth of the glutaric acid market

What are the Major Takeaways of Glutaric Acid Market?

- Growth of the chemical and healthcare sector along with rising demand for polyester polyols based coating and adhesive products which will further contribute by generating immense opportunities that will led to the growth of the glutaric acid market in the above mentioned projected timeframe

- Inflammation issues along with high consumption of product will cause health issues which will such asly to act as market restraints factor for the growth of the glutaric acid

- The Asia-Pacific Glutaric Acid market dominated the global industry with the largest revenue share of 36.58% in 2024, driven by rapid urbanization, rising disposable incomes, and increased industrial and agricultural activities

- The North America Glutaric Acid market is projected to grow at the fastest CAGR of 10.36% from 2025 to 2032, driven by rising industrial output, increased adoption of green chemicals, and technological advancements in manufacturing processes

- The Industrial Grade segment dominated the market with the largest revenue share of 61% in 2024, driven by its widespread use in large-scale chemical manufacturing, polymer production, and adhesive formulations

Report Scope and Glutaric Acid Market Segmentation

|

Attributes |

Glutaric Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Glutaric Acid Market?

Rising Adoption of Bio-Based and Sustainable Solutions

- A significant trend in the global glutaric acid market is the increasing shift toward bio-based and sustainable Glutaric Acid production methods. Manufacturers are exploring green chemistry routes using renewable feedstocks to reduce environmental impact and comply with stricter sustainability regulations

- For instance, companies such as BASF and Godavari Biorefineries have been investing in fermentation-based Glutaric Acid production, enabling eco-friendly solutions for polymer and resin applications. This shift also supports end-use industries aiming to meet their sustainability targets

- Sustainable Glutaric Acid production allows the integration of cleaner processes with lower greenhouse gas emissions, reduced energy consumption, and minimized use of hazardous chemicals. These factors improve the overall carbon footprint of downstream products such as polyesters, coatings, and adhesives

- The trend is further reinforced by growing consumer preference for eco-friendly products and regulatory mandates promoting green chemicals, driving innovations in renewable feedstock-based Glutaric Acid

- Companies such as Corbion are leveraging bio-based Glutaric Acid to develop high-performance polymers and biodegradable materials, positioning themselves at the forefront of this trend

- The rising focus on sustainable chemistry and circular economy solutions is reshaping production strategies across the Glutaric Acid value chain, increasing demand from environmentally conscious industries

What are the Key Drivers of Glutaric Acid Market?

- The growing demand for high-performance polymers, resins, and coatings is a key driver boosting Glutaric Acid consumption globally. These applications rely on Glutaric Acid for enhanced chemical resistance, flexibility, and durability

- For instance, in 2024, BASF reported expanding Glutaric Acid-based polyester production for automotive and industrial coatings, aiming to meet increasing global demand. Such initiatives strengthen market growth prospects

- Increasing industrialization in emerging economies is driving demand for adhesives, plastics, and packaging materials, where Glutaric Acid is a critical raw material

- The shift toward bio-based polymers and biodegradable products in packaging, textiles, and medical devices is further supporting Glutaric Acid adoption, as it enables greener product formulations

- Technological innovations in manufacturing processes, including catalytic oxidation and fermentation, are enhancing production efficiency and cost-effectiveness, making Glutaric Acid more accessible to a broader range of industries

- The versatility of Glutaric Acid in diverse applications, combined with global efforts toward sustainability and reduced environmental impact, is significantly boosting its market adoption across chemical, plastic, and coating industries

Which Factor is Challenging the Growth of the Glutaric Acid Market?

- The relatively high production cost of bio-based Glutaric Acid compared to conventional petrochemical routes poses a challenge to widespread adoption, especially in price-sensitive regions

- Fluctuating raw material prices for both petrochemical and renewable feedstocks can increase operational costs, affecting profitability for manufacturers and deterring smaller players from entry

- Stringent regulatory compliance requirements for chemical handling and production, particularly in North America and Europe, add complexity and investment costs for Glutaric Acid producers

- In addition, the technical challenges associated with scaling up bio-based Glutaric Acid processes, including yield optimization and product purity maintenance, can slow market growth

- Market players need to address cost barriers, ensure consistent supply, and educate end-users on the benefits of sustainable and high-purity Glutaric Acid to sustain demand

- Overcoming these challenges through innovation, process optimization, and strategic partnerships is crucial to maintaining robust growth in the Glutaric Acid market across regions and applications

How is the Glutaric Acid Market Segmented?

The market is segmented on the basis of product grade and end-use industry.

- By Product Grade

On the basis of product grade, the glutaric acid market is segmented into Industrial Grade and Reagent Grade. The Industrial Grade segment dominated the market with the largest revenue share of 61% in 2024, driven by its widespread use in large-scale chemical manufacturing, polymer production, and adhesive formulations. Industrial-grade Glutaric Acid is preferred for its cost-effectiveness and suitability for bulk applications, making it the go-to choice for manufacturers requiring high-volume inputs. It is compatible with various downstream applications, such as polyesters, resins, and coatings, which fuels its strong demand.

The Reagent Grade segment is anticipated to witness the fastest CAGR of 18.5% from 2025 to 2032, propelled by its adoption in research laboratories, high-purity chemical synthesis, and specialty formulations. Reagent-grade Glutaric Acid offers superior purity and consistency, making it ideal for pharmaceuticals, analytical testing, and specialized cosmetic applications. Increasing investment in R&D and higher standards for quality-sensitive applications are expected to drive growth in this segment.

- By End-Use Industry

On the basis of end-use industry, the glutaric acid market is segmented into Chemicals, Cosmetics and Personal Care, Healthcare, and Others. The Chemicals segment dominated the market with the largest revenue share of 55% in 2024, attributed to its extensive application in polymer synthesis, adhesives, coatings, and plasticizers. Industrial and commercial sectors rely heavily on Glutaric Acid as a key building block, which drives the strong market presence of the chemicals segment.

The Cosmetics and Personal Care segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, fueled by the increasing use of Glutaric Acid in skincare formulations, anti-aging products, and specialty personal care items. Growing consumer awareness of functional and bioactive ingredients in cosmetic products, along with rising demand for high-performance and sustainable ingredients, is accelerating adoption in this sector. In addition, emerging markets with expanding middle-class populations are contributing to the rapid growth of Glutaric Acid applications in personal care and cosmetics.

Which Region Holds the Largest Share of the Glutaric Acid Market?

- The Asia-Pacific glutaric acid market dominated the global industry with the largest revenue share of 36.58% in 2024, driven by rapid urbanization, rising disposable incomes, and increased industrial and agricultural activities

- Consumers and businesses in the region are increasingly adopting Glutaric Acid for its applications in chemical synthesis, coatings, and biodegradable polymers. The demand is further supported by government initiatives promoting industrial growth and sustainability, coupled with the presence of strong domestic manufacturers

- Widespread adoption is also fueled by the region’s focus on innovation, technology-driven processes, and expanding manufacturing infrastructure, establishing Asia-Pacific as the largest and most influential market for Glutaric Acid

China Glutaric Acid Market Insight

The China glutaric acid market captured the largest revenue share of 42% in Asia-Pacific in 2024, attributed to the country’s expanding chemical and polymer industries, growing middle-class consumption, and technological adoption. The push towards smart manufacturing and industrial automation is driving increased utilization of Glutaric Acid in coatings, resins, and specialty chemicals. Moreover, strong local production capabilities, coupled with cost-effective raw materials, are making China the dominant hub for Glutaric Acid consumption and exports in the region.

Japan Glutaric Acid Market Insight

The Japan glutaric acid market is witnessing steady growth, driven by the country’s emphasis on high-tech manufacturing, environmental sustainability, and chemical innovations. Glutaric Acid finds extensive applications in biodegradable plastics, coatings, and pharmaceuticals. Japan’s aging population and industrial modernization are increasing the demand for innovative chemical solutions, with Glutaric Acid being preferred for its versatile applications. The integration of research-driven production methods and government support for sustainable chemicals is fostering consistent market expansion across industrial and commercial sectors.

Which Region is the Fastest Growing Region in the Glutaric Acid Market?

The North America glutaric acid market is projected to grow at the fastest CAGR of 10.36% from 2025 to 2032, driven by rising industrial output, increased adoption of green chemicals, and technological advancements in manufacturing processes. The U.S. and Canada are witnessing heightened demand for Glutaric Acid in coatings, polymers, and chemical synthesis applications. Furthermore, increasing awareness about sustainable chemicals and regulatory support for eco-friendly materials is accelerating market growth, making North America the fastest-growing region globally.

U.S. Glutaric Acid Market Insight

The U.S. glutaric acid market captured the largest revenue share of 59% in North America in 2024, fueled by strong industrial demand and adoption in polymer, coating, and specialty chemical industries. Rising focus on sustainable manufacturing practices and research-driven chemical production is driving market expansion. In addition, technological innovations in chemical processing and increased investment in high-value applications are supporting growth. U.S. manufacturers are leveraging advanced production methods and supply chain efficiencies, making the country the key contributor to North America’s rapidly growing Glutaric Acid market.

Europe Glutaric Acid Market Insight

The Europe glutaric acid market is expected to grow at a steady CAGR, driven by stringent environmental regulations and the increasing adoption of bio-based and sustainable chemicals. Countries such as Germany, France, and the U.K. are focusing on greener production methods, which is boosting the demand for Glutaric Acid in biodegradable plastics, coatings, and specialty chemicals. Urbanization, industrial modernization, and research-focused initiatives in the chemical sector further enhance the adoption of Glutaric Acid across multiple European industries.

U.K. Glutaric Acid Market Insight

The U.K. glutaric acid market is projected to expand at a notable CAGR during the forecast period, supported by rising industrial demand, focus on eco-friendly chemicals, and government policies promoting green manufacturing. Increased utilization in coatings, resins, and polymer production is driving growth. Furthermore, the U.K.’s strong R&D infrastructure and integration of chemical innovations into industrial processes are contributing to the steady expansion of Glutaric Acid consumption in the region.

Germany Glutaric Acid Market Insight

The Germany glutaric acid market is expected to grow steadily, driven by advanced industrial capabilities, innovation in chemical applications, and the country’s commitment to sustainable production methods. High demand for biodegradable polymers, industrial coatings, and specialty chemical products is propelling market adoption. Germany’s strong infrastructure for chemical manufacturing, coupled with stringent environmental regulations, ensures the continued utilization of Glutaric Acid across industrial, commercial, and research-driven applications.

Which are the Top Companies in Glutaric Acid Market?

The Glutaric Acid industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Merck KGaA (Germany)

- Alfa Aesar (U.S.)

- TCI AMERICA (U.S.)

- Kowa India Pvt. Ltd (India)

- Liaoyang Hengye Chemical Co., Ltd. (China)

- Charkit Chemical Company LLC (U.S.)

- The Chemical Company (U.S.)

- Penta Manufacturer (U.S.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Biosynth Carbosynth (U.K.)

- BOC Sciences (U.S.)

- Yixing Lianyang Chemical Co., Ltd. (China)

- Witton Chemical Co. Ltd. (U.K.)

- Central Drug House. (India)

- Parchem fine & specialty chemicals. (U.S.)

- Ottokemi. (India)

- SR GROUP (India)

- SNA Healthcare Private Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Glutaric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Glutaric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Glutaric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.