Global Gluten Free Breakfast Cereals Market

Market Size in USD Million

CAGR :

%

USD

671.10 Million

USD

1,102.38 Million

2024

2032

USD

671.10 Million

USD

1,102.38 Million

2024

2032

| 2025 –2032 | |

| USD 671.10 Million | |

| USD 1,102.38 Million | |

|

|

|

|

Gluten-Free Breakfast Cereals Market Size

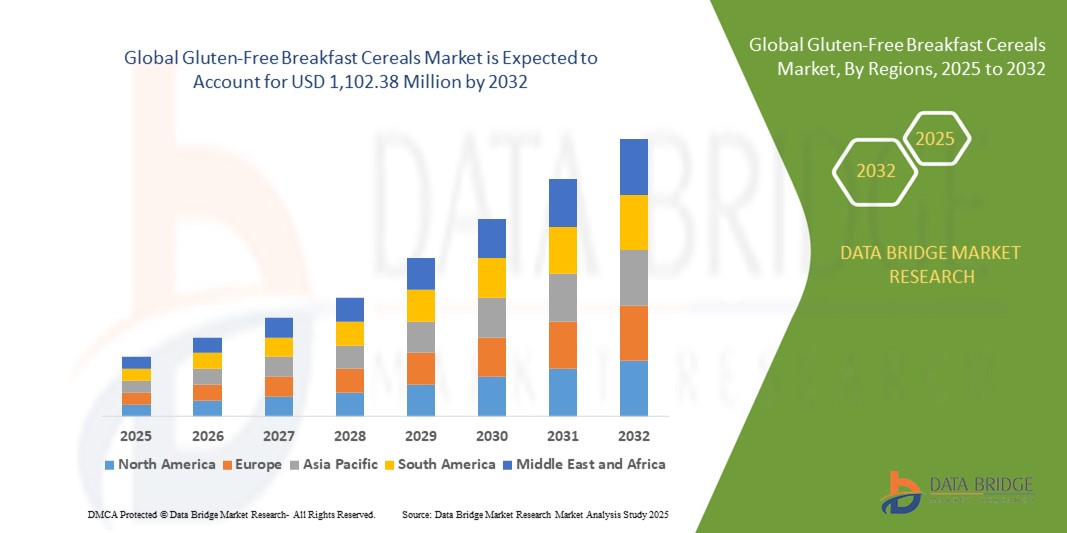

- The global gluten-free breakfast cereals market size was valued at USD 671.10 million in 2024 and is expected to reach USD 1,102.38 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing consumer awareness regarding gluten intolerance, celiac disease, and overall digestive health, driving demand for gluten-free alternatives in daily diets. As consumers across the globe adopt healthier lifestyles, gluten-free breakfast cereals are becoming a preferred choice, especially among health-conscious and allergic individuals

- Furthermore, rising product innovation and diversification—such as the introduction of high-protein, organic, and multigrain gluten-free cereal variants—are significantly enhancing the appeal of these products across all age groups. These evolving dietary preferences, combined with expanded retail distribution and strong marketing campaigns, are accelerating the uptake of gluten-free breakfast cereal solutions, thereby significantly boosting the industry’s growth

Gluten-Free Breakfast Cereals Market Analysis

- Gluten-free breakfast cereals have become an increasingly important part of the health-conscious consumer’s diet, offering alternatives for individuals with gluten intolerance, celiac disease, or those adopting gluten-free lifestyles. These products are often fortified with essential nutrients and appeal to growing demand for clean-label, allergen-free, and digestive-friendly foods

- The rising prevalence of gluten sensitivity and celiac disease, along with growing health awareness, is driving the demand for gluten-free breakfast cereals globally. Manufacturers are responding with innovative formulations using ingredients such as quinoa, rice, corn, millet, and oats (certified gluten-free), along with natural sweeteners and organic certifications

- North America dominated the gluten-free breakfast cereals market, accounting for the largest revenue share of 38.5% in 2024, due to widespread health awareness, the presence of major gluten-free brands, and robust retail infrastructure. The U.S. market continues to lead due to high rates of celiac diagnosis, consumer demand for clean-label foods, and the rapid expansion of organic and specialty food aisles in supermarkets

- Asia-Pacific is projected to be the fastest growing region in the gluten-free breakfast cereals market, expected to register a CAGR of 10.7% from 2025 to 2032. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of gluten-free diets across countries such as India, China, and Australia. Local brands and international players are actively launching region-specific gluten-free offerings to cater to dietary shifts in these markets

- The conventional cereals segment dominated the market with a major share of 69.4% in 2024, driven by their greater availability, lower prices, and well-established manufacturing processes

Report Scope and Gluten-Free Breakfast Cereals Market Segmentation

|

Attributes |

Gluten-Free Breakfast Cereals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gluten-Free Breakfast Cereals Market Trends

Rising Demand for Clean-Label and Health-Focused Products

- A key trend in the global gluten-free breakfast cereals market is the rising consumer preference for clean-label, non-GMO, and allergen-free products. Health-conscious buyers are increasingly turning to gluten-free cereals made with natural ingredients such as quinoa, millet, buckwheat, and certified gluten-free oats, reflecting a broader shift toward preventive health and better nutrition

- Major food companies and startups alike are expanding their gluten-free product lines, often fortified with added fiber, protein, vitamins, and minerals to offer enhanced functional benefits without compromising taste or texture

- For instance, brands such as Kellogg’s, General Mills, and Nature’s Path have launched gluten-free versions of traditional cereals and developed entirely new lines to cater to growing consumer demand. These innovations address not just medical needs such as celiac disease, but also lifestyle choices associated with clean eating

- Another emerging trend is the inclusion of plant-based proteins and organic ingredients in gluten-free cereals, which appeals to vegan consumers and those seeking sustainable food options

- E-commerce platforms and health-focused retail channels are also helping boost the visibility and accessibility of gluten-free breakfast cereals, allowing small and premium brands to reach a broader global audience

- As the demand for gluten-free options becomes mainstream, manufacturers are placing greater emphasis on transparent labeling, allergen testing, and certifications (e.g., USDA Organic, Non-GMO Project Verified, and Certified Gluten-Free), which serve as key decision-making factors for informed buyers

Gluten-Free Breakfast Cereals Market Dynamics

Driver

Growing Demand Driven by Health Awareness and Dietary Preferences

- The rising prevalence of gluten-related disorders such as celiac disease, gluten intolerance, and wheat allergies, combined with growing health awareness, is a significant driver fueling the demand for gluten-free breakfast cereals globally

- For instance, in February 2025, General Mills expanded its gluten-free product line with the introduction of organic quinoa and chia-based cereals, targeting both health-conscious and gluten-sensitive consumers. Such innovations highlight how major brands are tapping into the wellness trend to drive market expansion

- Consumers increasingly seek functional food products that align with clean-label, allergen-free, and plant-based diets. As a result, gluten-free cereals enriched with added fiber, protein, probiotics, or fortified vitamins are seeing higher adoption across both developed and emerging economies

- The market is also being propelled by the growing trend of plant-based eating, with manufacturers incorporating ingredients such as amaranth, millet, sorghum, and gluten-free oats to create versatile and nutritionally dense options

- Increased retail penetration, particularly through e-commerce and health-focused grocery chains, is making gluten-free cereals more accessible. Attractive packaging, clean labeling, and claims such as "non-GMO" and "organic" further appeal to lifestyle-driven consumers

Restraint/Challenge

Premium Pricing and Consumer Skepticism Over Nutritional Value

- One of the key restraints in the gluten-free breakfast cereals market is the relatively high price point compared to conventional cereals. Due to specialty ingredients, stringent production standards, and certification requirements, these products often carry a premium, limiting adoption among price-sensitive consumers

- In addition, some consumers without diagnosed gluten sensitivities may question the nutritional value or necessity of going gluten-free, leading to slower growth in some mainstream segments

- Another challenge is ensuring taste and texture parity with traditional cereals. Many early gluten-free products were criticized for being dry or bland, prompting companies to invest in improved formulations and ingredient sourcing

- Addressing these concerns through cost-effective production, consumer education, and continuous product innovation—including flavor enhancement and nutrient fortification—will be key to driving future adoption

Gluten-Free Breakfast Cereals Market Scope

The market is segmented on the basis of type, breakfast cereal product type, source, flavor, sugar content, product category, organic category, nature, packaging type, packaging size, consumer category, and distribution channel.

- By Type

On the basis of type, the gluten-free breakfast cereals market is segmented into hot cereal and ready-to-eat cereal. The ready-to-eat cereal segment dominated the largest market revenue share of 61.4% in 2024, primarily because consumers favor quick, convenient breakfast options that require minimal preparation, fitting busy lifestyles.

In contrast, the hot cereal segment is anticipated to witness the fastest growth rate of 9.6% from 2025 to 2032, driven by rising health consciousness and preference for warm, nutritious breakfasts, especially in colder climates.

- By Breakfast Cereal Product Type

On the basis of breakfast cereal product type, the market is segmented into porridge, flakes, loops, crunchies, crispies, muesli, and others. The flakes segment held the largest market revenue share of 27.8% in 2024 as flakes are widely accepted due to their taste, texture, and longstanding consumer familiarity.

The muesli segment is expected to grow fastest at a CAGR of 10.3% because it is perceived as a natural and healthy option, rich in fiber and nutrients, attracting health-conscious consumers.

- By Breakfast Cereal Source

On the basis of breakfast cereal source, the market is segmented into corn, rice, wheat, buckwheat, granola, bran, millet, multi-grains, and others. Corn accounted for the largest market share of 32.1% in 2024 due to its gluten-free nature and affordability, making it a staple ingredient in many gluten-free cereals.

Multi-grains are projected to witness the fastest CAGR of 11.1%, as consumers increasingly seek diverse grains to gain a wider nutrient profile and better taste variety.

- By Flavor

On the basis of flavor, the market is segmented into plain and flavored. The flavored segment dominated with 56.3% market revenue share in 2024 because flavored cereals appeal to children and adults looking for taste variety and indulgence.

The plain segment is expected to grow at a CAGR of 7.5% as there is a growing demand for clean-label and minimally processed foods without additives or artificial flavors.

- By Sugar Content

On the basis of sugar content, the market is segmented into with added sugar and without added sugar. The with added sugar segment held 64.2% of the market share in 2024, largely because sweeter cereals tend to attract children and satisfy taste preferences.

Meanwhile, the without added sugar segment is forecast to witness the fastest CAGR of 12.4%, propelled by increasing health concerns over sugar intake and rising demand for natural, unsweetened products.

- By Product Category

On the basis of product category, the market is segmented into plain, with nuts, with fruits, and both nuts and fruits. The with fruits category commanded the largest share of 33.6% in 2024, as fruit inclusions add natural sweetness and perceived health benefits, attracting consumers seeking nutritious breakfasts.

The both nuts and fruits segment is anticipated to grow at the highest CAGR of 10.9%, driven by consumer interest in nutrient-dense cereals that combine protein, fiber, and antioxidants.

- By Organic Category

On the basis of organic category, the market is segmented into organic and conventional. Conventional cereals held a major share of 69.4% in 2024, mainly due to their greater availability, lower prices, and established manufacturing processes.

The organic segment is expected to grow at the fastest CAGR of 11.7%, fueled by rising consumer preference for environmentally friendly, chemical-free, and sustainable food options.

- By Nature

On the basis of nature, the gluten-free breakfast cereals market is segmented into GMO and non-GMO. The non-GMO cereals segment accounted for the largest market revenue share of 58.5% in 2024, driven by increasing consumer awareness regarding food safety and a preference for natural products free from genetic modification.

The GMO cereals segment is expected to witness the fastest CAGR of 7.4% from 2025 to 2032, owing to its cost-effectiveness, higher yield potential, and scalability benefits for manufacturers aiming to meet rising global demand.

- By Packaging Type

On the basis of packaging type, the gluten-free breakfast cereals market is segmented into plastic wraps/pouches, cardboard paper boxes, plastic jars, and others. The cardboard paper boxes segment held the largest market revenue share of 46.9% in 2024, favored due to their eco-friendly appeal and better shelf visibility in retail stores.

Plastic wraps/pouches are expected to witness the fastest CAGR of 9.8% from 2025 to 2032, supported by consumer demand for lightweight, resealable, and convenient packaging solutions.

- By Packaging Size

On the basis of packaging size, the market is segmented into less than 5 OZ, 5 - 7 OZ, 8 – 10 OZ, 11 – 13 OZ, and more than 13 OZ. The 8–10 OZ packaging size dominated the market with a 31.7% revenue share in 2024, as it provides an ideal balance between portion size and value for money for most consumers.

Packaging sizes larger than 13 OZ are anticipated to register the fastest CAGR of 8.9% during the forecast period, driven by family purchases and bulk buying trends.

- By Consumer Category

On the basis of consumer category, the gluten-free breakfast cereals market is segmented into adults and kids. The adults segment accounted for the largest market revenue share of 67.8% in 2024, supported by increasing health awareness, demand for high-fiber and nutrient-rich foods, and a growing diagnosis of gluten intolerance among adults.

The kids segment is projected to grow at the fastest CAGR of 9.2% from 2025 to 2032, fueled by product innovations in flavors and shapes that appeal to children, alongside rising parental demand for healthier breakfast options.

- By Distribution Channel

On the basis of distribution channel, the gluten-free breakfast cereals market is segmented into store-based retailing and online retailing. Store-based retailing dominated with a 73.5% market revenue share in 2024, owing to consumer preference for in-store inspection, trusted shopping experiences, and broad product availability.

Online retailing is expected to witness the fastest CAGR of 13.6% during the forecast period, driven by increased internet penetration, convenience of home delivery, and the rise of direct-to-consumer brand sales.

Gluten-Free Breakfast Cereals Market Regional Analysis

- North America dominated the gluten-free breakfast cereals market with the largest revenue share of 38.5% in 2024, driven by a growing population of health-conscious consumers, increasing cases of gluten intolerance and celiac disease, and high market penetration of premium health food brands

- Consumers in the region are showing a strong preference for clean-label, organic, and allergen-free breakfast options, with gluten-free cereals gaining popularity not just among diagnosed patients but also among lifestyle-focused buyers

- This surge in demand is further supported by robust retail infrastructure, widespread availability in supermarkets and online platforms, and aggressive marketing strategies from major brands focusing on health and wellness

U.S. Gluten-Free Breakfast Cereals Market Insight

The U.S. gluten-free breakfast cereals market captured the largest revenue share of 66.8% in 2024 within North America, fueled by the rising demand for plant-based, non-GMO, and gluten-free food products. Health trends such as Paleo and Keto diets, along with increased awareness of celiac disease, have significantly boosted demand. Major players are expanding product portfolios with ancient grains such as quinoa, amaranth, and millet, while retail giants such as Whole Foods and Walmart have increased shelf space for gluten-free offerings.

Europe Gluten-Free Breakfast Cereals Market Insight

The Europe gluten-free breakfast cereals market is projected to expand at a substantial CAGR during the forecast period, driven by increasing adoption of gluten-free diets even among non-celiac individuals. Growing health awareness, the popularity of organic food, and regulatory support for allergen labeling are key enablers. Germany, the U.K., and France are witnessing strong demand in both conventional retail and e-commerce channels. Emerging brands are also targeting fitness-conscious and vegan consumers with fortified and functional gluten-free cereals.

U.K. Gluten-Free Breakfast Cereals Market Insight

The U.K. gluten-free breakfast cereals market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising demand for free-from foods and a sharp increase in gluten sensitivity awareness. Retailers such as Tesco and Sainsbury’s are expanding their gluten-free ranges, while innovations in flavors and packaging by domestic brands are attracting a broader demographic. The market also benefits from strong marketing of gut health and dietary wellness by influencers and media.

Germany Gluten-Free Breakfast Cereals Market Insight

The Germany gluten-free breakfast cereals market is expected to expand at a considerable CAGR, driven by growing demand for clean-label, non-allergenic foods. Germany’s focus on health and sustainability makes it a key market for organic, gluten-free cereals that are also free from artificial additives. Manufacturers are increasingly launching cereal products based on oats, rice, and buckwheat, enriched with vitamins and fibers to meet consumer demand for functional foods.

Asia-Pacific Gluten-Free Breakfast Cereals Market Insight

The Asia-Pacific gluten-free breakfast cereals market is poised to grow at the fastest CAGR of 10.7% during the forecast period (2025 to 2032), due to rising health consciousness, western dietary influence, and increasing incidences of gluten intolerance. Countries such as China, Japan, India, and Australia are experiencing strong growth in premium breakfast segments. Urbanization, expanding middle-class income, and rising availability of gluten-free products through online platforms and specialty health stores are contributing to the region's rapid expansion.

Japan Gluten-Free Breakfast Cereals Market Insight

The Japan gluten-free breakfast cereals market is gaining traction due to growing interest in preventive healthcare and wellness diets. Japanese consumers, traditionally favoring rice-based breakfasts, are gradually adopting Western-style gluten-free cereals enriched with soy, matcha, or marine-based nutrients. The aging population also favors high-fiber, heart-healthy, and easily digestible cereal options.

China Gluten-Free Breakfast Cereals Market Insight

The China gluten-free breakfast cereals market accounted for the largest market revenue share in Asia-Pacific in 2024, thanks to a rising health-conscious population, government promotion of dietary diversification, and growing demand for functional foods. As Chinese consumers increasingly embrace Western breakfast habits, the demand for safe, gluten-free, and fortified cereals is surging—especially among young professionals and families in urban centers. Local and international brands are investing in e-commerce and influencer-driven marketing to expand reach.

Gluten-Free Breakfast Cereals Market Share

The gluten-free breakfast cereals industry is primarily led by well-established companies, including:

- General Mills Inc. (U.S.)

- WK Kellogg Co (U.S.)

- Nestlé (Switzerland)

- Bob’s Red Mill Natural Foods (U.S.)

- Nature's Path Foods (Canada)

- Hometown Food Company (U.S.)

- The Quaker Oats Company (U.S.)

- BARBARA’S (U.S.)

- NORTHERN QUINOA PRODUCTION CORPORATION (Canada)

- GlutenFree Prairie (U.S.)

- Avena Foods, Limited (Canada)

Latest Developments in Global Gluten-Free Breakfast Cereals Market

- In March 2025, General Mills Inc. announced the expansion of its gluten-free cereal product line, introducing new flavors such as Maple Brown Sugar and Chocolate Almond, targeting health-conscious consumers seeking nutritious and tasty breakfast options. This move strengthens General Mills’ position in the gluten-free segment and addresses growing demand for clean-label and allergen-free foods

- In February 2025, Nestlé launched a new range of gluten-free breakfast cereals under its popular Cheerios brand in Europe, aiming to capture increasing consumer interest in gluten-free diets and digestive health. The launch includes organic and non-GMO options to appeal to a broader audience focused on natural ingredients

- In January 2025, Bob’s Red Mill Natural Foods expanded its distribution network in North America and Asia-Pacific, increasing availability of its gluten-free oats and cereals in major retail chains and e-commerce platforms. This expansion responds to rising gluten intolerance diagnoses and the trend toward plant-based, whole-grain breakfasts globally

- In December 2024, Nature’s Path Foods partnered with several online health food retailers to offer exclusive gluten-free breakfast cereal bundles, combining organic and non-GMO products to meet the preferences of millennials and Gen Z consumers. This strategy supports Nature’s Path’s commitment to sustainability and healthy living

- In November 2024, The Quaker Oats Company announced a reformulation of its gluten-free cereal products to reduce sugar content by 20% without compromising taste. This initiative aligns with increasing consumer demand for low-sugar and clean-label products in the breakfast segment

- In May 2022, General Mills Inc. strategically acquired TNT Crust, a notable producer of premium frozen pizza crusts. Specializing in supplying regional and national pizza chains, foodservice distributors, and retail outlets, this acquisition positions General Mills to broaden its market presence and strengthen its operations in the dynamic frozen pizza industry

- In 2020, Kellogg's Co. earned the prestigious title of America's Most Trusted Brands, as per Morning Consult. This accolade significantly bolstered Kellogg's global image, fostering increased consumer trust and loyalty. The recognition reflects the company's commitment to quality and resonates positively in the competitive global market, contributing to its enhanced reputation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Free Breakfast Cereals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Free Breakfast Cereals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Free Breakfast Cereals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.