Global Gluten Free Pasta Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

2.11 Billion

2025

2033

USD

1.48 Billion

USD

2.11 Billion

2025

2033

| 2026 –2033 | |

| USD 1.48 Billion | |

| USD 2.11 Billion | |

|

|

|

|

Gluten Free Pasta Market Size

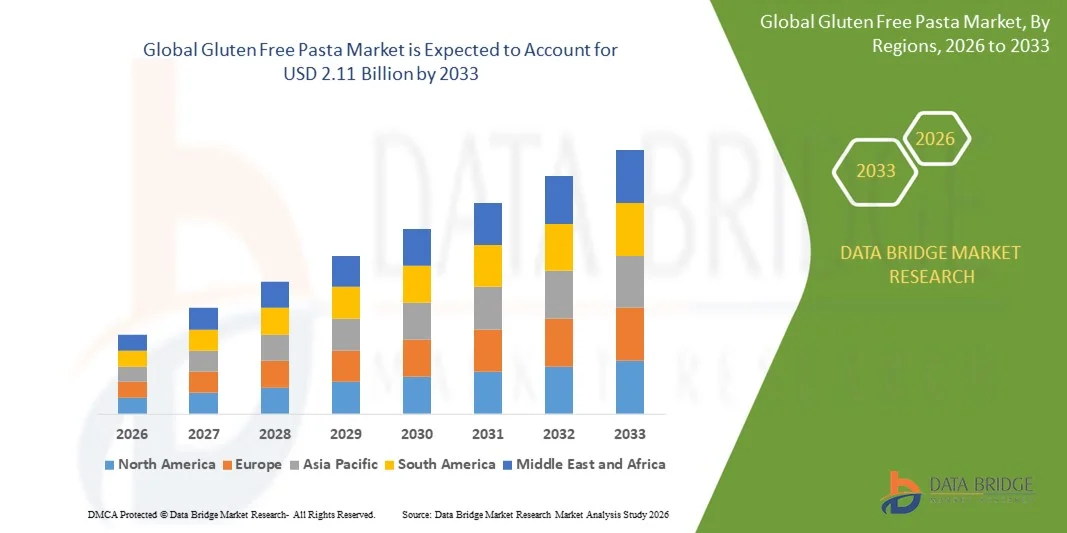

- The global gluten free pasta market size was valued at USD 1.48 billion in 2025 and is expected to reach USD 2.11 billion by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the rising consumer awareness of health and dietary needs, particularly concerning gluten intolerance, celiac disease, and wellness-focused diets, leading to increased demand for gluten free alternatives in both households and foodservice sectors

- Furthermore, growing preference for convenient, ready-to-cook, and nutrient-rich pasta options is establishing gluten free pasta as a staple in health-conscious meal planning. These converging factors are accelerating the adoption of gluten free pasta products, thereby significantly boosting the industry's growth

Gluten Free Pasta Market Analysis

- Gluten free pasta, made from alternative ingredients such as rice, quinoa, chickpea, and millet, is increasingly recognized as a healthier substitute for traditional wheat-based pasta due to its suitability for gluten-sensitive consumers and high nutritional value

- The escalating demand for gluten free pasta is primarily fueled by increasing health awareness, rising prevalence of gluten-related disorders, and growing availability of diverse product options across retail and e-commerce channels, supporting consistent market expansion

- Europe dominated the gluten free pasta market with a share of 39.34% in 2025, due to rising consumer health awareness, strong adoption of gluten-free diets, and increasing availability of premium and organic pasta options

- Asia-Pacific is expected to be the fastest growing region in the gluten free pasta market during the forecast period due to growing urbanization, rising disposable incomes, and increasing adoption of Western diets

- Dried segment dominated the market with a market share of 46.1% in 2025, due to its longer shelf life and wide availability across retail and online channels. Consumers often prefer dried gluten free pasta for its convenience, easy storage, and consistent cooking quality, making it suitable for both home kitchens and foodservice establishments. The segment also benefits from strong brand presence and extensive flavor and shape variety, enhancing consumer choice. Rising awareness regarding gluten intolerance and celiac disease further fuels demand for dried gluten free pasta as a reliable and accessible option

Report Scope and Gluten Free Pasta Market Segmentation

|

Attributes |

Gluten Free Pasta Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gluten Free Pasta Market Trends

Growing Popularity of Plant-Based and Nutrient-Rich Pasta Alternatives

- A significant trend in the gluten free pasta market is the rising consumer preference for plant-based and nutrient-dense pasta made from ingredients such as quinoa, chickpeas, and brown rice. This trend is driven by increasing health consciousness, rising prevalence of celiac disease, and the demand for functional foods that provide higher protein, fiber, and micronutrient content. Consumers are increasingly replacing traditional wheat pasta with gluten free options that offer both health benefits and versatility in meal preparation

- For instance, Barilla and Banza have expanded their gluten free pasta portfolios with quinoa and chickpea-based options that cater to health-conscious and plant-based consumers. These products enhance dietary diversity and strengthen brand presence in the functional and specialty food segment

- Rising consumer demand for premium, ready-to-cook gluten free pasta is further shaping product innovation and variety. Companies are developing new flavors, shapes, and blends to meet taste expectations and convenience requirements. The growing adoption of gluten free pasta in both home cooking and foodservice applications is positioning it as a mainstream alternative across global markets

- The trend is particularly pronounced in regions with high awareness of gluten-related health issues, where consumers actively seek certified gluten free and non-GMO products. Retailers and e-commerce platforms are expanding their offerings to cater to this increasing demand, improving accessibility and market penetration

- The integration of health and wellness trends with plant-based eating is elevating the importance of nutrient-rich gluten free pasta as a staple in modern diets. As awareness spreads, the demand for high-quality, nutritious alternatives continues to accelerate market growth

- The market is witnessing an increased presence of specialty brands and international players promoting gluten free pasta as both a healthy and convenient alternative. This rising focus on nutrition-driven innovation reinforces the transition toward plant-based and functional pasta products globally

Gluten Free Pasta Market Dynamics

Driver

Rising Consumer Awareness of Gluten Intolerance and Health Benefits

- The growing recognition of gluten intolerance, celiac disease, and general health benefits associated with gluten free diets is a primary driver for market expansion. Consumers are seeking safe, nutritious alternatives to traditional wheat pasta that support digestive health and overall wellness

- For instance, H.J. Heinz Company and Quinoa Corporation actively promote their gluten free pasta lines, emphasizing health benefits and dietary suitability. Such initiatives are increasing product adoption among health-conscious and specialty diet consumers

- Rising media coverage, nutrition campaigns, and endorsements by healthcare professionals are educating consumers on gluten-free living, further strengthening demand. This awareness is driving the inclusion of gluten free pasta in daily meal planning across households and institutional foodservice

- Urban populations with higher disposable incomes are increasingly experimenting with gluten free and functional foods, creating a consistent growth opportunity for the market. The focus on preventive healthcare and dietary management reinforces adoption rates

- The availability of certified gluten free products across supermarkets, specialty stores, and e-commerce platforms ensures wider accessibility, making gluten free pasta a preferred choice for both convenience and health benefits

Restraint/Challenge

High Price Point Compared to Traditional Pasta

- The gluten free pasta market faces challenges due to the higher cost of alternative ingredients such as quinoa, chickpeas, and brown rice, along with specialized manufacturing processes required to maintain gluten-free integrity. These factors make gluten free pasta more expensive than conventional wheat-based pasta

- For instance, Barilla’s gluten free pasta lines are priced higher than its regular pasta offerings, reflecting ingredient and production costs. The premium pricing limits adoption among price-sensitive consumers in certain markets

- Maintaining certification standards and quality assurance throughout the supply chain adds additional operational costs for manufacturers, further contributing to elevated retail prices. This creates a barrier for widespread penetration in cost-sensitive regions

- The reliance on imported or specialty ingredients exposes manufacturers to price volatility and supply chain disruptions, increasing the overall production cost. Retailers and brands face challenges in balancing affordability with product quality

- The market continues to encounter resistance from consumers accustomed to lower-priced traditional pasta. Overcoming this challenge requires targeted marketing, education on health benefits, and innovative product positioning to justify the premium cost

Gluten Free Pasta Market Scope

The market is segmented on the basis of type, product type, ingredient, and distribution channel.

- By Type

On the basis of type, the gluten free pasta market is segmented into dried, chilled/fresh, and canned/preserved. The dried segment dominated the market with the largest revenue share of 46.1% in 2025, driven by its longer shelf life and wide availability across retail and online channels. Consumers often prefer dried gluten free pasta for its convenience, easy storage, and consistent cooking quality, making it suitable for both home kitchens and foodservice establishments. The segment also benefits from strong brand presence and extensive flavor and shape variety, enhancing consumer choice. Rising awareness regarding gluten intolerance and celiac disease further fuels demand for dried gluten free pasta as a reliable and accessible option.

The chilled/fresh segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer preference for fresh, ready-to-cook meals that retain authentic texture and flavor. For instance, brands such as Barilla have launched fresh gluten free pasta lines that cater to health-conscious consumers seeking premium alternatives. Chilled/fresh pasta appeals to urban populations seeking convenience without compromising quality, and its growing presence in modern retail formats and e-commerce platforms is driving rapid adoption.

- By Product Type

On the basis of product type, the gluten free pasta market is segmented into brown rice pasta, quinoa pasta, chickpea pasta, and multigrain pasta. The brown rice pasta segment held the largest revenue share in 2025, driven by its familiar taste and texture that closely resembles traditional wheat pasta. Consumers often choose brown rice pasta as a nutrient-rich, high-fiber alternative suitable for daily consumption. Strong availability in supermarkets, specialty health stores, and online platforms further supports its market dominance. The segment also benefits from extensive marketing and brand recognition, encouraging repeat purchases and wider consumer acceptance.

The chickpea pasta segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its high protein content and functional health benefits. For instance, Banza has successfully promoted chickpea pasta as a protein-rich alternative for fitness enthusiasts and diet-conscious consumers. The segment’s growing popularity is reinforced by clean-label trends, gluten-free certifications, and innovative product launches across global markets.

- By Ingredient

On the basis of ingredient, the gluten free pasta market is segmented into rice, corn, millet, and others. The rice segment dominated the market in 2025, driven by its versatility, mild taste, and easy digestibility that make it suitable for a wide consumer base. Rice-based gluten free pasta is widely available across retail and e-commerce channels, enhancing accessibility for health-conscious consumers. Its compatibility with different cooking styles and sauces increases adoption in households and foodservice sectors. Consumer trust in rice as a natural gluten-free ingredient also reinforces its market leadership.

The millet segment is projected to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of millet’s nutritional benefits, including high fiber and micronutrient content. For instance, 24 Mantra Organic has introduced millet-based gluten free pasta targeting health-conscious urban consumers. The rising popularity of millet in wellness diets and functional foods is driving innovation and expansion in this segment.

- By Distribution Channel

On the basis of distribution channel, the gluten free pasta market is segmented into retail shops, supermarket/hypermarket, convenience stores, and e-commerce. The supermarket/hypermarket segment dominated the market in 2025, driven by the wide product assortment, competitive pricing, and in-store promotions offered to consumers. Supermarkets also provide visibility for established brands and facilitate bulk purchases, supporting high revenue generation. Urban consumers prefer supermarkets for the convenience of one-stop shopping and access to both local and international gluten free pasta options. Retailer partnerships and marketing initiatives further strengthen this segment’s leadership.

The e-commerce segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing online grocery adoption and preference for doorstep delivery. For instance, Amazon and Thrive Market have expanded their gluten free pasta portfolios, providing consumers with easy access to niche and premium products. The convenience of home delivery, subscription options, and product reviews is driving rapid growth in e-commerce channels globally.

Gluten Free Pasta Market Regional Analysis

- Europe dominated the gluten free pasta market with the largest revenue share of 39.34% in 2025, driven by rising consumer health awareness, strong adoption of gluten-free diets, and increasing availability of premium and organic pasta options

- Consumers across the region increasingly prefer gluten free pasta to manage celiac disease, gluten intolerance, and wellness-focused diets, fueling consistent market demand

- This dominance is further supported by well-developed retail and e-commerce networks, widespread product variety, and strong presence of key gluten free brands, positioning Europe as a mature and innovation-driven market

Germany Gluten Free Pasta Market Insight

The Germany gluten free pasta market accounted for the largest share within Europe in 2025, supported by high consumer awareness of health and dietary needs and a strong retail infrastructure. German consumers emphasize product quality, nutritional value, and authenticity, driving demand for brown rice and chickpea pasta. The presence of well-established gluten free brands and active government health campaigns further fuels market expansion.

U.K. Gluten Free Pasta Market Insight

The U.K. gluten free pasta market is projected to grow at a steady CAGR during the forecast period, driven by rising demand for convenient, ready-to-cook gluten free meals and increasing awareness of gluten-related disorders. Growth in online grocery shopping and modern retail formats encourages adoption of diverse pasta types. Regulatory focus on nutrition labeling and product transparency also supports consumer confidence and market growth.

North America Gluten Free Pasta Market Insight

The North America gluten free pasta market holds a substantial share, supported by rising health consciousness, increasing prevalence of celiac disease, and expanding gluten free product portfolios by major brands. Consumers in the region are shifting toward plant-based and high-protein pasta options such as quinoa and chickpea pasta. Strong e-commerce penetration and availability across supermarkets and specialty stores further strengthen market growth.

Asia-Pacific Gluten Free Pasta Market Insight

The Asia-Pacific gluten free pasta market is expected to witness the fastest CAGR from 2026 to 2033, driven by growing urbanization, rising disposable incomes, and increasing adoption of Western diets. Consumers across emerging economies are embracing gluten free alternatives for health and wellness reasons. Expansion of modern retail chains, online platforms, and awareness campaigns accelerates regional growth.

China Gluten Free Pasta Market Insight

China dominated the Asia-Pacific gluten free pasta market in 2025, supported by increasing awareness of gluten intolerance and health-conscious eating habits among urban populations. The growing presence of international and domestic gluten free brands enhances product availability and variety. Rising demand for ready-to-cook and premium pasta options further contributes to market expansion.

Gluten Free Pasta Market Share

The gluten free pasta industry is primarily led by well-established companies, including:

- Quinoa Corporation (U.S.)

- H.J. Heinz Company, L.P. (U.S.)

- Barilla (Italy)

- RPs Pasta Co. (U.S.)

- bionaturae (U.S.)

- Pastificio Lucio Garofalo S.p.A. (Italy)

- Jovial Foods Inc. (U.S.)

- Doves Farm Foods Ltd. (U.K.)

- DR SCHÄR AG/S.p.A. (Italy)

- Hain Celestial (U.S.)

- General Mills Inc. (U.S.)

- Kellogg’s Company (U.S.)

- Ebro Foods, S.A. (Spain)

- DeLallo (U.S.)

- Windmill Organics (U.K.)

- Pedon SpA (Italy)

- LIVIVA (U.S.)

- Conagra Brands, Inc. (U.S.)

- Agastya Nutri Food (India)

- LASENOR EMUL, S.L. (Spain)

Latest Developments in Global Gluten Free Pasta Market

- In November 2024, Goodles launched a gluten-free pasta product line featuring playful shapes such as Loopdy-Loos, Lucky Penne, and Twistful Thinking. Each serving offered 8 grams of protein and 3 grams of fiber, catering to health-conscious consumers seeking both nutrition and fun eating experiences. This launch strengthened Goodles’ position in the market by targeting families and younger demographics while emphasizing plant-based ingredients such as corn, brown rice, and chickpeas, aligning with the rising demand for protein-enriched and fiber-rich gluten-free options

- In September 2024, Quantum Fixes introduced a low-carbohydrate, gluten-free pasta made from resistant tapioca starch, designed to replicate the texture and taste of conventional pasta. This product expanded market offerings for consumers seeking keto-friendly and grain-free alternatives, demonstrating that gluten-free options could also meet taste and texture expectations. The innovation reinforced the brand’s appeal among health-focused consumers and contributed to diversifying the functional pasta segment

- In July 2024, Giada De Laurentiis launched a gluten-free pasta range with five varieties, including Taccole Corte, Mezzi Rigatoni, Casarecce, Stelline, and Ziti Corti. Using non-GMO corn and rice flour, the product targeted premium segments of the market, appealing to consumers seeking authentic Italian-style pasta without gluten. This launch helped elevate consumer awareness of high-quality, non-GMO gluten-free pasta, fostering greater adoption in gourmet and retail segments

- In May 2024, ZENB expanded its gluten-free pasta portfolio with products made entirely from whole yellow peas, offering 18 grams of protein and 11 grams of fiber per serving. The initiative addressed the growing demand for nutrient-dense, clean-label products and reinforced ZENB’s position in the market as a leader in protein-rich, plant-based pasta. This development also highlighted the trend of functional gluten-free foods that cater to both health and sustainability concerns

- In March 2024, Barilla introduced a gluten-free pasta line featuring penne, fusilli, and spaghetti variants made from a blend of corn and rice flour. The launch focused on providing a taste and texture experience similar to traditional pasta while ensuring high availability across global retail and e-commerce channels. This development strengthened Barilla’s presence in the mainstream gluten-free market, attracting consumers seeking convenience, reliability, and brand trust in their gluten-free choices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Free Pasta Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Free Pasta Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Free Pasta Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.