Global Gluten Free Vegan Snacks Market

Market Size in USD Billion

CAGR :

%

USD

6.09 Billion

USD

8.86 Billion

2024

2032

USD

6.09 Billion

USD

8.86 Billion

2024

2032

| 2025 –2032 | |

| USD 6.09 Billion | |

| USD 8.86 Billion | |

|

|

|

|

Gluten-free Vegan Snacks Market Size

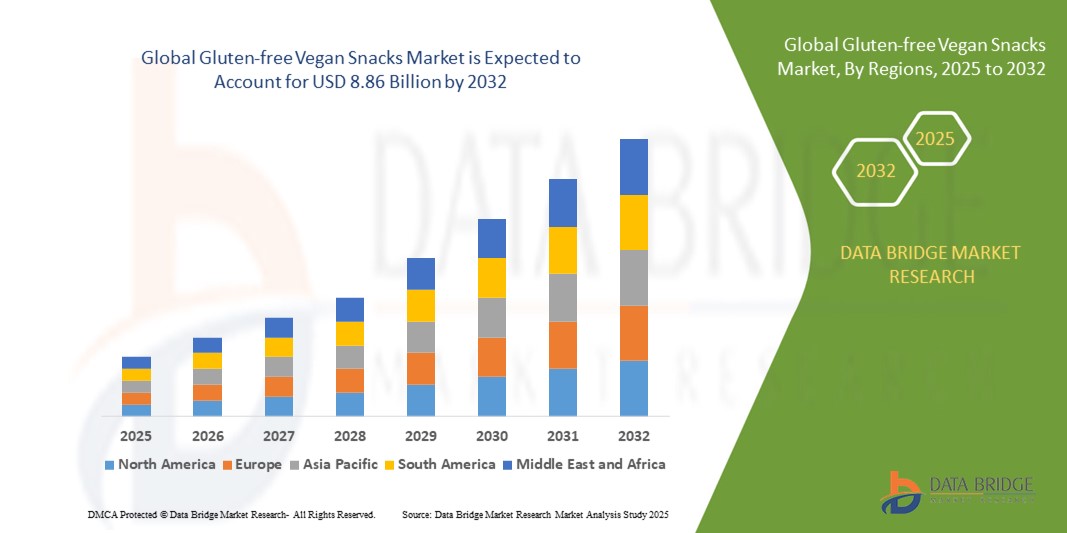

- The global gluten-free vegan snacks market size was valued at USD 6.09 billion in 2024 and is expected to reach USD 8.86 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is primarily driven by increasing consumer demand for plant-based and gluten-free diets, rising awareness of health and wellness, and growing adoption of vegan lifestyles for ethical and environmental reasons

- Growing consumer awareness of dietary restrictions, allergen-free products, and sustainable eating habits is further propelling the demand for gluten-free vegan snacks across both retail and e-commerce channels

Gluten-free Vegan Snacks Market Analysis

- The gluten-free vegan snacks market is experiencing robust growth as consumers increasingly prioritize health-conscious, allergen-free, and environmentally sustainable food options

- Growing demand from both health-conscious consumers and those with dietary restrictions, such as celiac disease or gluten sensitivity, is encouraging manufacturers to innovate with nutrient-dense, flavorful, and sustainable snack solutions

- North America dominates the gluten-free vegan snacks market with the largest revenue share of 34.3% in 2024, driven by a well-established health and wellness culture, high consumer awareness of gluten-free and vegan products, and a strong presence of key market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rising urbanization, increasing disposable incomes, growing awareness of plant-based diets, and expanding e-commerce platforms in countries such as China, India, and Southeast Asian nations

- The bars segment dominated the largest market revenue share of 35% in 2024, driven by their convenience, portability, and appeal as nutrient-dense meal replacements or on-the-go snacks. Bars are favored for their ability to incorporate plant-based proteins, superfoods, and functional ingredients, catering to health-conscious consumers seeking gluten-free and vegan options

Report Scope and Gluten-free Vegan Snacks Market Segmentation

|

Attributes |

Gluten-free Vegan Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gluten-free Vegan Snacks Market Trends

Increasing Integration of Functional Ingredients and Clean-Label Innovations

- The global gluten-free vegan snacks market is experiencing a notable trend toward the integration of functional ingredients and clean-label innovations

- These advancements enable the development of snacks with enhanced nutritional profiles, catering to health-conscious consumers seeking nutrient-dense options

- Functional ingredients, such as plant-based proteins, prebiotics, probiotics, and superfoods such as chia seeds and quinoa, are being incorporated to address specific dietary needs and wellness goals

- For instance, companies are launching gluten-free vegan snack bars fortified with omega-3 fatty acids, fiber, and antioxidants to promote gut health and overall well-being

- Clean-label trends emphasize natural, organic, and non-GMO ingredients, with brands such as GoNanas and Partake Foods introducing products free from artificial additives, enhancing consumer trust and appeal

- This trend is strengthening the market's value proposition, making gluten-free vegan snacks more appealing to both health-focused individuals and environmentally conscious consumers

Gluten-free Vegan Snacks Market Dynamics

Driver

“Rising Demand for Plant-Based and Allergen-Free Diets”

- The growing consumer preference for plant-based and allergen-free diets, driven by health, sustainability, and ethical concerns, is a key driver for the global gluten-free vegan snacks market

- Gluten-free vegan snacks offer safe and convenient options for consumers with celiac disease, gluten intolerance, or those adopting vegan lifestyles for environmental or animal welfare reasons

- Government initiatives and increased awareness of dietary restrictions in regions such as North America, where 1% of the population is affected by celiac disease, are boosting market adoption

- The rise of e-commerce and direct-to-consumer platforms, supported by improved internet access and mobile shopping, is expanding the reach of gluten-free vegan snacks, offering personalized and convenient purchasing options

- Manufacturers are increasingly offering innovative products, such as plant-based cheese-flavored crackers and fruit-based gummies, as standard or specialty items to meet consumer demand and enhance product appeal

Restraint/Challenge

“High Production Costs and Texture/Flavor Challenges”

- The high cost of sourcing gluten-free and vegan ingredients, such as alternative flours (rice, tapioca) and plant-based proteins, poses a significant barrier to market growth, particularly in cost-sensitive emerging markets

- Developing gluten-free vegan snacks with appealing textures and flavors is complex, as the absence of gluten and animal-derived ingredients can result in poor cohesiveness, shelf life, and sensory qualities

- Data privacy and supply chain transparency concerns also present challenges, as consumers demand clear information on ingredient sourcing and production processes, requiring compliance with stringent regulations

- The fragmented regulatory landscape across countries regarding allergen labeling, organic certifications, and sustainability claims complicates operations for global manufacturers and distributors

- These factors can deter cost-conscious consumers and limit market expansion, especially in regions with lower awareness of gluten-free vegan benefits or where premium pricing is a concern

Gluten-free Vegan Snacks market Scope

The market is segmented on the basis of product type, distribution channel, and consumer demographics.

- By Product Type

On the basis of product type, the global gluten-free vegan snacks market is segmented into bars, chips, cookies, crackers, fruit and vegetable snacks, and others. The bars segment dominated the largest market revenue share of 35% in 2024, driven by their convenience, portability, and appeal as nutrient-dense meal replacements or on-the-go snacks. Bars are favored for their ability to incorporate plant-based proteins, superfoods, and functional ingredients, catering to health-conscious consumers seeking gluten-free and vegan options. Their versatility in flavors and formulations, such as energy bars and protein bars, further boosts their popularity among diverse dietary preferences.

The chips segment is expected to register the fastest growth rate from 2025 to 2032, fueled by rising demand for savory, gluten-free vegan snacks that mimic traditional snack textures and flavors. Innovations in plant-based ingredients, such as vegetable-based chips and nutrient-fortified options, enhance consumer appeal. The growing popularity of snacking as a lifestyle trend and the availability of chips in diverse flavors, such as kale or beet-based varieties, support this segment’s rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the global gluten-free vegan snacks market is categorized into supermarkets and hypermarkets, convenience stores, health food stores, online retailers, and others. The supermarkets and hypermarkets segment accounted for the highest revenue share in 2024, driven by their extensive product range, dedicated shelf space for gluten-free and vegan products, and high consumer footfall. These retail formats offer a one-stop shopping experience, making them a preferred choice for consumers seeking a variety of gluten-free vegan snacks, from mainstream brands to niche offerings. Their strategic product placement and promotional activities further amplify sales.

The online retailers segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the surge in e-commerce adoption and consumer preference for convenient, home-delivered shopping. Online platforms provide access to a broader range of gluten-free vegan snacks, including specialty and organic brands, with competitive pricing and subscription models. The rise in smartphone penetration and digital marketing strategies, such as targeted ads and influencer campaigns, further accelerates this segment’s growth, particularly among younger, tech-savvy consumers.

- By Consumer Demographics

On the basis of consumer demographics, the global gluten-free vegan snacks market is segmented into age group, gender, income level, education, and health-consciousness. The millennial and Generation Z age groups held the largest revenue share in 2024, attributed to their strong inclination toward plant-based diets, ethical consumption, and health-focused lifestyles. These demographics prioritize gluten-free vegan snacks for their alignment with sustainability, animal welfare, and wellness trends, driving demand for innovative and clean-label products. Their active engagement on social media platforms also amplifies brand visibility and product adoption.

The health-conscious consumer segment is projected to grow at the fastest rate from 2025 to 2032, fueled by increasing awareness of gluten sensitivities, celiac disease, and the perceived health benefits of vegan diets. This group seeks nutrient-rich snacks with functional ingredients like fiber, antioxidants, and plant-based proteins, aligning with broader wellness trends. Rising disposable incomes and higher education levels further support this segment’s growth, as consumers are more likely to invest in premium, organic, and allergen-free snack options that cater to their dietary and ethical preferences.

Gluten-free Vegan Snacks Market Regional Analysis

- North America dominates the gluten-free vegan snacks market with the largest revenue share of 34.3% in 2024, driven by a well-established health and wellness culture, high consumer awareness of gluten-free and vegan products, and a strong presence of key market players

- Consumers prioritize gluten-free vegan snacks for health-conscious diets, ethical eating preferences, and addressing dietary restrictions, particularly in regions with high awareness of food sensitivities

- Growth is supported by advancements in snack formulations, including nutrient-dense ingredients and innovative flavors, alongside rising adoption in both mainstream and specialty markets

U.S. Gluten-free Vegan Snacks Market Insight

The U.S. gluten-free vegan snacks market captured the largest revenue share of 74.9% in 2024 within North America, fueled by strong demand in both retail and online channels and growing consumer awareness of health and sustainability benefits. The trend towards clean-label and plant-based diets further boosts market expansion. Food manufacturers’ increasing incorporation of gluten-free vegan snacks in product lines complements specialty store sales, creating a diverse product ecosystem.

Europe Gluten-free Vegan Snacks Market Insight

The Europe gluten-free vegan snacks market is expected to witness significant growth, supported by regulatory emphasis on health and sustainability in food products. Consumers seek snacks that align with vegan lifestyles and offer nutritional benefits. The growth is prominent in both mainstream retail and specialty stores, with countries such as Germany and the U.K. showing significant uptake due to rising environmental concerns and health-conscious consumer trends.

U.K. Gluten-Free Vegan Snacks Market Insight

The U.K. market for gluten-free vegan snacks is expected to witness rapid growth, driven by demand for healthy and ethical snack options in urban and suburban settings. Increased interest in plant-based diets and rising awareness of gluten sensitivities encourage adoption. Evolving food labeling regulations influence consumer choices, balancing nutritional value with dietary compliance.

Germany Gluten-Free Vegan Snacks Market Insight

Germany is expected to witness rapid growth in the gluten-free vegan snacks market, attributed to its advanced food manufacturing sector and high consumer focus on health and sustainability. German consumers prefer nutrient-rich snacks with natural ingredients that support dietary needs and ethical eating. The integration of these snacks in premium product lines and specialty stores supports sustained market growth.

Asia-Pacific Gluten-Free Vegan Snacks Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding health food markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of gluten-free and vegan diets, along with demand for innovative snack flavors, is boosting market growth. Government initiatives promoting healthy eating and sustainability further encourage the use of gluten-free vegan snacks.

Japan Gluten-Free Vegan Snacks Market Insight

Japan’s gluten-free vegan snacks market is expected to witness rapid growth due to strong consumer preference for high-quality, nutrient-dense snacks that align with health and wellness trends. The presence of major food manufacturers and the integration of gluten-free vegan snacks in retail channels accelerate market penetration. Rising interest in specialty and health-focused snacks also contributes to growth.

China Gluten-Free Vegan Snacks Market Insight

China holds the largest share of the Asia-Pacific gluten-free vegan snacks market, propelled by rapid urbanization, rising health consciousness, and increasing demand for plant-based and allergen-free snack solutions. The country’s growing middle class and focus on healthy eating support the adoption of gluten-free vegan snacks. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Gluten-free Vegan Snacks Market Share

The gluten-free vegan snacks industry is primarily led by well-established companies, including:

- Enjoy Life Foods, LLC (U.S.)

- Lundberg Family Farms (U.S.)

- Free2b Foods (U.S.)

- MadeGood (Canada)

- Kind Snacks (U.S.)

- Nature’s Path (Canada)

- Simple Mills (U.S.)

- Siete Family Foods (U.S.)

- The Gluten Free Bar (U.S.)

- Bakery on Main (U.S.)

- Rhythm Superfoods (U.S.)

- KIND Healthy Snacks (U.S.)

- Mary’s Gone Crackers (U.S.)

- Celaic Specialties (U.S.)

- Mamma Chia (U.S.)

- Primal Spirit Foods (U.S.)

- Rudi’s Gluten-free Bakery (U.S.)

- Go Raw (U.S.)

- Navitas Organics (U.S.)

- Milton’s Craft Bakers (U.S.)

What are the Recent Developments in Global Gluten-free Vegan Snacks Market?

- In July 2025, Eshbal Functional Food Inc. signed a binding letter of intent to acquire Gluten Free Nation, a Texas-based commercial baker specializing in gluten-free breads and baked goods. Operating under the name Starcall Broadcasting LLC, Gluten Free Nation distributes products across retail and foodservice channels in 49 U.S. states. The acquisition, which includes a mix of cash and stock payments, is designed to expand Eshbal’s product portfolio and leverage Gluten Free Nation’s established sales and distribution network in North America. This move supports Eshbal’s strategy of combining organic growth with strategic acquisitions to accelerate market entry

- In May 2025, New Grains Gluten Free Bakery issued an allergy alert and voluntary recall for a wide range of its products—including breads, bagels, cookies, and croutons—due to the presence of undeclared allergens: eggs, soy, milk, and tree nuts. These ingredients were not listed on product labels, posing a serious health risk to individuals with allergies or sensitivities. The affected items were distributed in Utah retail stores between April 7 and April 21, under lot numbers 90–107. The recall was conducted with the U.S. Food and Drug Administration’s knowledge, and no illnesses were reported at the time

- In October 2024, TreeHouse Foods Inc. expanded a voluntary recall to include all waffle and pancake products, including gluten-free varieties, due to the potential contamination with Listeria monocytogenes. The recall affects items manufactured at a single facility in Ontario, Canada, and distributed across the United States and Canada under multiple brand names. Listeria monocytogenes can cause serious illness, particularly in young children, the elderly, and immunocompromised individuals. This incident underscores the critical importance of food safety protocols and quality control in the packaged foods industry, especially for ready-to-eat breakfast items

- In February 2024, Grupo Bimbo, the world’s largest baking company, announced the acquisition of Amaritta Food SL, a Spanish firm specializing in the research, development, and production of gluten-free bread. Based in Córdoba, Amaritta operates a 2,000-square-meter facility capable of producing 10 million units of gluten-free products, free from 13 of the 14 major allergens. Grupo Bimbo described Amaritta as holding a leadership position in Spain’s gluten-free bakery segment. This strategic move enables Bimbo to expand its portfolio, gain technical expertise, and strengthen its presence in the high-growth gluten-free market across Europe and beyond

- In February 2024, Nestlé India partnered with the café chain SOCIAL and BOSS Burger to test launch a new plant-based range under its MAGGI Professional brand. Featured in the “New Irresistible Menu”, the offerings include plant-based burger patties and mince, designed to mimic the texture and taste of chicken while being cholesterol-free, high in protein and fiber, and suitable for vegan and flexitarian diets. Available across 41 SOCIAL and 40 BOSS Burger outlets in five major Indian cities, this initiative marks Nestlé’s strategic push into the plant-based foodservice segment, catering to evolving consumer preferences for sustainable and mindful dining

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Free Vegan Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Free Vegan Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Free Vegan Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.